Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

10 Agosto 2023 - 7:34AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING

| | | | | | | | | | | | | | |

| (Check one): | ☐ Form 10-K | ☐ Form 20-F | ☐ Form 11-K | ☒ Form 10-Q |

| ☐ Form 10-D | ☐ Form N-SAR | ☐ Form N-CSR | |

| | |

For Period Ended: June 30, 2023 |

| | |

☐ Transition Report on Form 10-K |

☐ Transition Report on Form 20-F |

☐ Transition Report on Form 11-K |

☐ Transition Report on Form 10-Q |

☐ Transition Report on Form N-SAR |

| | |

| For the Transition Period Ended: _______________________ |

Read Instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I - REGISTRANT INFORMATION

| | |

| AMYRIS, INC. |

| (Full Name of Registrant) |

(Former Name if Applicable)

5885 Hollis Street, Suite 100

Address of Principal Executive Office (Street and Number)

Emeryville, CA 94608

City, State and Zip Code

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

| | | | | | | | | | | |

| | | (a) | The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| | ☐ | (b) | The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| | | (c) | The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III - NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

As disclosed in the Current Report on Form 8-K filed on August 10, 2023 by Amyris, Inc. (“we,” “us,” “our,” or the “Company”), together with certain of its subsidiaries, commenced the filing of voluntary petitions (the “Chapter 11 Cases”) under Chapter 11 of Title 11 of the United States Code in the United States Bankruptcy Court for the District of Delaware beginning on August 9, 2023.

The Company’s financial, accounting and other administrative personnel have devoted substantially all of their time to address matters related to the Chapter 11 Cases, including, among other things, the maintenance of the Company’s ongoing operations, the development of the Company’s post-petition strategy and the Company’s recent 30% reduction in force. The commencement of the Chapter 11 Cases and these other matters have accordingly diverted the attention of the Company’s personnel and resources from the completion of the Company’s quarterly close procedures and the review of other financial and accounting matters required for the preparation of the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023 (the “Q2 10-Q”). In addition, the Chapter 11 Cases involve various complex accounting implications on multiple aspects of the Company’s financial reporting and the Company’s accounting and financial reporting requirements in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) and United States Securities and Exchange Commission (the “SEC”) regulations. Accordingly, the Company is unable to file its Q2 10-Q by the prescribed date without unreasonable effort or expense due to a lack of sufficient personnel.

At this time, the Company cannot estimate when it will be able to file the Q2 10-Q.

The Company cautions that trading in the Company’s securities during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s securities in the Chapter 11 Cases. The Company cannot be certain that holders of the Company’s common stock will receive any payment or other distribution on account of those shares following the Chapter 11 Cases.

PART IV - OTHER INFORMATION

| | | | | |

| (1) | Name and telephone number of person to contact in regard to this notification |

| | | | | | | | | | | | | | |

| Han Kieftenbeld | | (510) | | 450-0761 |

| (Name) | | (Area Code) | | (Telephone Number) |

| | | | | |

| (2) | Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). |

| | Yes ☒ No ☐ |

| | |

| (3) | Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? |

| | Yes ☒ No ☐ |

The Company’s results of operations for the quarter ended June 30, 2023 differed significantly from its results of operations for the quarter ended June 30, 2022 due to adverse developments that occurred with respect to the Company’s business and liquidity, including events precipitating the Company commencing the Chapter 11 Cases.

Cautionary Note Regarding Forward-Looking Statements

This Form 12b-25 includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements contained in this Form 12b-25 include, but are not limited to, statements regarding the process and potential outcomes of the Company’s Chapter 11 Cases and the Company’s ability to file its Q2 10-Q. These statements are based on management’s current expectations, and actual results and future events may differ materially due to risks and uncertainties, including, without limitation, risks inherent in the bankruptcy process, including the outcome of the Chapter 11 Cases; the Company’s financial projections and cost estimates; the Company’s ability to raise additional funds during the Chapter 11 Cases; the Company’s ability to sell any of its assets; the impact of the Chapter 11 Cases on the listing of the Company’s common stock on the Nasdaq Stock Market; and the effect of the Chapter 11 Cases on the Company’s business prospects, financial results and business operations. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. These and other factors that may affect the Company’s future business prospects, results and operations are identified and described in more detail in the Company’s filings with the SEC, including the Company’s most recent Annual Report filed on Form 10-K and the subsequently filed Quarterly Report(s) on Form 10-Q. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Form 12b-25. Except as required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

| | | | | |

| AMYRIS, INC. |

| (Name of Registrant as Specified in Charter) |

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: August 10, 2023 | | Amyris, Inc. | |

| By: | /s/ Han Kieftenbeld | |

| | Han Kieftenbeld

Interim Chief Executive Officer and Chief Financial Officer | |

| | | |

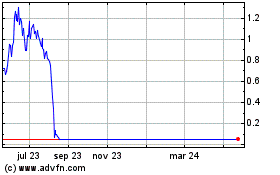

Amyris (NASDAQ:AMRS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Amyris (NASDAQ:AMRS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024