Aterian, Inc. (Nasdaq: ATER) (“Aterian” or the “Company”) today

announced results for the second quarter ended June 30, 2023.

Second Quarter Highlights

- Second quarter 2023 net revenue

declined 39.5% to $35.3 million, compared to $58.3 million in the

second quarter of 2022.

- Second quarter 2023 gross margin

declined to 42.2%, compared to 53.8% in the second quarter of 2022,

primarily reflecting the impact of our strategy of liquidating

high-cost inventory.

- Second quarter 2023 contribution

margin declined to (3.6)% from 9.7% in the second quarter of 2022,

primarily reflecting consumer softness and higher competitive

pricing pressure in cooling and air quality product categories and

an increased inventory obsolescence reserve.

- Second quarter 2023 operating loss

of ($36.4) million increased compared to a loss of ($10.1) million

in the second quarter of 2022. Second quarter 2023 operating loss

includes ($3.2) million of non-cash stock compensation, a non-cash

loss on impairment of intangibles of ($22.8) million, and

restructuring costs of $(1.2) million, while second quarter 2022

operating loss included a gain of $1.7 million from the change in

fair value of earn-out liabilities and ($6.0) million of non-cash

stock compensation.

- Second quarter 2023 net loss of

($34.8) million increased from ($6.3) million loss in the second

quarter of 2022. Second quarter 2023 net loss includes ($3.2)

million of non-cash stock compensation, a non-cash loss on

impairment of intangibles of ($22.8) million, restructuring costs

of ($1.2) million, and a gain on fair value of warrant liability of

$2.2 million, while second quarter 2022 net loss included ($6.0)

million in net charges from the changes in fair value of warrants,

($6.0) million of non-cash stock compensation and a gain of $1.7

million from the net change in fair value of earn-out

liabilities.

- Second quarter 2023 adjusted EBITDA

loss of ($8.0) million increased from ($3.7) million in the second

quarter of 2022.

- Total cash balance at June 30, 2023

was $28.9 million.

Third Quarter 2023 Outlook

For the third quarter, taking into account the

current global environment and inflation, we believe that net

revenue will be between $32.5 million and $37.5 million and expect

an adjusted EBITDA loss of between ($4.5) million to ($5.5)

million.

The Company’s third quarter 2023 guidance is

based on a number of assumptions that are subject to change, many

of which are outside the Company’s control. If actual results vary

from these assumptions, the Company’s expectations may change.

There can be no assurance that the Company will achieve these

results.

Non-GAAP Financial Measures

For more information on our non-GAAP financial

measures and a reconciliation of GAAP to non-GAAP measures, please

see the “Non-GAAP Financial Measures” section below. The most

directly comparable GAAP financial measure for EBITDA and adjusted

EBITDA is net loss and we expect to report a net loss for the three

months ending September 30, 2023, due primarily to our operating

losses, which includes stock-based compensation expense, and

interest expense. We are unable to reconcile the forward-looking

statements of EBITDA and adjusted EBITDA in this press release to

their nearest GAAP measures because the nearest GAAP financial

measures are not accessible on a forward-looking basis and

reconciling information is not available without unreasonable

effort.

Webcast and Conference Call

Information

Aterian will host a live conference call to

discuss financial results today, August 8, 2023, at 5:00 p.m.

Eastern Time, which will be accessible by telephone and the

internet. To access the call, participants from within the U.S.

should dial (833) 636-1351 and participants from outside the U.S.

should dial (412) 902-4267 and ask to be joined into the Aterian,

Inc. call. Participants may also access the call through a live

webcast at https://ir.aterian.io. The archived online replay will

be available for a limited time after the call in the Investors

Relations section of the Aterian website.

About Aterian, Inc.

Aterian, Inc. (Nasdaq: ATER) is a leading

technology-enabled consumer product company that builds, acquires,

and partners with leading e-commerce brands by harnessing

proprietary software and an agile supply chain to create top

selling consumer products. The Company’s cloud-based platform,

Artificial Intelligence Marketplace Ecommerce Engine (AIMEE™),

leverages machine learning, natural language processing and data

analytics to streamline the management of products at scale across

the world's largest online marketplaces with a focus on Amazon,

Shopify and Walmart. Aterian owns and operates a number of brands

and sells its products in multiple categories, including home and

kitchen appliances, health and wellness, beauty and consumer

electronics.

Forward Looking Statements

All statements other than statements of

historical facts included in this press release that address

activities, events or developments that we expect, believe or

anticipate will or may occur in the future are forward-looking

statements including, in particular, the statements regarding our

projected third quarter revenue and adjusted EBITDA, the current

global environment and inflation. These forward-looking statements

are based on management’s current expectations and beliefs and are

subject to a number of risks and uncertainties and other factors,

all of which are difficult to predict and many of which are beyond

our control and could cause actual results to differ materially and

adversely from those described in the forward-looking statements.

These risks include, but are not limited to, those related to our

ability to continue as a going concern, our ability to meet

financial covenants with our lenders, our ability to create

operating leverage and efficiency when integrating companies that

we acquire, including through the use of our team’s expertise, the

economies of scale of our supply chain and automation driven by our

platform; those related to our ability to grow internationally and

through the launch of products under our brands and the acquisition

of additional brands; those related to consumer demand, our cash

flows, financial condition, forecasting and revenue growth rate;

our supply chain including sourcing, manufacturing, warehousing and

fulfillment; our ability to manage expenses, working capital and

capital expenditures efficiently; our business model and our

technology platform; our ability to disrupt the consumer products

industry; our ability to maintain and to grow market share in

existing and new product categories; our ability to continue to

profitably sell the SKUs we operate; our ability to generate

profitability and stockholder value; international tariffs and

trade measures; inventory management, product liability claims,

recalls or other safety and regulatory concerns; reliance on third

party online marketplaces; seasonal and quarterly variations in our

revenue; acquisitions of other companies and technologies and our

ability to integrate such companies and technologies with our

business; our ability to continue to access debt and equity capital

(including on terms advantageous to the Company) and the extent of

our leverage; and other factors discussed in the “Risk Factors”

section of our most recent periodic reports filed with the

Securities and Exchange Commission (“SEC”), all of which you may

obtain for free on the SEC’s website at www.sec.gov.

Although we believe that the expectations

reflected in our forward-looking statements are reasonable, we do

not know whether our expectations will prove correct. You are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof, even if

subsequently made available by us on our website or otherwise. We

do not undertake any obligation to update, amend or clarify these

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

|

|

|

|

|

ATERIAN, INC. |

|

Consolidated Balance Sheets |

|

(in thousands, except share and per share

data) |

|

|

| |

|

December 31,2022 |

|

June 30,2023 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash |

|

$ |

43,574 |

|

|

$ |

28,867 |

|

| Accounts receivable, net |

|

|

4,515 |

|

|

|

4,782 |

|

| Inventory |

|

|

43,666 |

|

|

|

36,683 |

|

| Prepaid and other current

assets |

|

|

8,261 |

|

|

|

5,326 |

|

| Total current assets |

|

|

100,016 |

|

|

|

75,658 |

|

| Property and equipment, net |

|

|

853 |

|

|

|

839 |

|

| Other intangibles, net |

|

|

54,757 |

|

|

|

12,429 |

|

| Other non-current assets |

|

|

813 |

|

|

|

543 |

|

| Total assets |

|

$ |

156,439 |

|

|

$ |

89,469 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current Liabilities: |

|

|

|

|

| Credit facility |

|

$ |

21,053 |

|

|

$ |

15,748 |

|

| Accounts payable |

|

|

16,035 |

|

|

|

11,821 |

|

| Seller notes |

|

|

1,693 |

|

|

|

1,206 |

|

| Accrued and other current

liabilities |

|

|

14,254 |

|

|

|

11,978 |

|

| Total current liabilities |

|

|

53,035 |

|

|

|

40,753 |

|

| Other liabilities |

|

|

1,452 |

|

|

|

1,556 |

|

| Total liabilities |

|

|

54,487 |

|

|

|

42,309 |

|

| Commitments and contingencies

(Note 9) |

|

|

|

|

| Stockholders' equity: |

|

|

|

|

| Common stock, $0.0001 par value,

500,000,000 shares authorized and 80,752,290 and 88,014,844 shares

outstanding at December 31, 2022 and June 30, 2023,

respectively |

|

|

8 |

|

|

|

9 |

|

| Additional paid-in capital |

|

|

728,339 |

|

|

|

733,878 |

|

| Accumulated deficit |

|

|

(625,251 |

) |

|

|

(685,838 |

) |

| Accumulated other comprehensive

loss |

|

|

(1,144 |

) |

|

|

(889 |

) |

| Total stockholders’ equity |

|

|

101,952 |

|

|

|

47,160 |

|

| Total liabilities and

stockholders' equity |

|

$ |

156,439 |

|

|

$ |

89,469 |

|

|

|

|

ATERIAN, INC. |

|

Consolidated Statements of Operations |

|

(in thousands, except share and per share

data) |

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

| Net revenue |

|

$ |

58,268 |

|

|

$ |

35,264 |

|

|

$ |

99,941 |

|

|

$ |

70,143 |

|

| Cost of good sold |

|

|

26,917 |

|

|

|

20,368 |

|

|

|

44,982 |

|

|

|

36,151 |

|

| Gross profit |

|

|

31,351 |

|

|

|

14,896 |

|

|

|

54,959 |

|

|

|

33,992 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Sales and distribution |

|

|

31,866 |

|

|

|

20,557 |

|

|

|

54,840 |

|

|

|

40,783 |

|

| Research and development |

|

|

1,730 |

|

|

|

1,709 |

|

|

|

2,877 |

|

|

|

2,956 |

|

| General and administrative |

|

|

9,571 |

|

|

|

6,281 |

|

|

|

19,112 |

|

|

|

12,240 |

|

| Impairment loss on goodwill |

|

|

— |

|

|

|

— |

|

|

|

29,020 |

|

|

|

— |

|

| Impairment loss on

intangibles |

|

|

— |

|

|

|

22,785 |

|

|

|

— |

|

|

|

39,445 |

|

| Change in fair value of

contingent earn-out liabilities |

|

|

(1,691 |

) |

|

|

— |

|

|

|

(4,466 |

) |

|

|

— |

|

| Total operating expenses |

|

|

41,476 |

|

|

|

51,332 |

|

|

|

101,383 |

|

|

|

95,424 |

|

| Operating loss |

|

|

(10,125 |

) |

|

|

(36,436 |

) |

|

|

(46,424 |

) |

|

|

(61,432 |

) |

| Interest expense, net |

|

|

338 |

|

|

|

346 |

|

|

|

1,138 |

|

|

|

717 |

|

| Gain on extinguishment of seller

note |

|

|

— |

|

|

|

— |

|

|

|

(2,012 |

) |

|

|

— |

|

| Loss on initial issuance of

equity |

|

|

— |

|

|

|

— |

|

|

|

5,835 |

|

|

|

— |

|

| Change in fair value of warrant

liability |

|

|

6,014 |

|

|

|

(2,197 |

) |

|

|

7,893 |

|

|

|

(1,843 |

) |

| Other (income) expense, net |

|

|

— |

|

|

|

176 |

|

|

|

(25 |

) |

|

|

229 |

|

| Loss before income taxes |

|

|

(16,477 |

) |

|

|

(34,761 |

) |

|

|

(59,253 |

) |

|

|

(60,535 |

) |

| Provision (benefit) for income

taxes |

|

|

(168 |

) |

|

|

26 |

|

|

|

(168 |

) |

|

|

52 |

|

| Net loss |

|

$ |

(16,309 |

) |

|

$ |

(34,787 |

) |

|

$ |

(59,085 |

) |

|

$ |

(60,587 |

) |

| Net loss per share, basic and

diluted |

|

$ |

(0.26 |

) |

|

$ |

(0.45 |

) |

|

$ |

(0.94 |

) |

|

$ |

(0.78 |

) |

| Weighted-average number of shares

outstanding, basic and diluted |

|

|

63,947,069 |

|

|

|

77,625,304 |

|

|

|

62,749,520 |

|

|

|

77,181,388 |

|

|

|

|

ATERIAN, INC. |

|

Consolidated Statements of Cash Flows |

|

(in thousands) |

|

|

| |

|

Six Months Ended June 30, |

|

|

|

|

2022 |

|

|

|

2023 |

|

| OPERATING ACTIVITIES: |

|

|

|

|

| Net loss |

|

$ |

(59,085 |

) |

|

$ |

(60,587 |

) |

| Adjustments to reconcile net loss

to net cash used by operating activities: |

|

|

|

|

| Depreciation and

amortization |

|

|

3,894 |

|

|

|

2,964 |

|

| Provision for sales returns |

|

|

226 |

|

|

|

(170 |

) |

| Amortization of deferred

financing cost and debt discounts |

|

|

213 |

|

|

|

213 |

|

| Stock-based compensation |

|

|

8,913 |

|

|

|

5,539 |

|

| Gain from decrease of contingent

earn-out liability fair value |

|

|

(4,466 |

) |

|

|

— |

|

| Change in inventory

provisions |

|

|

— |

|

|

|

262 |

|

| Loss in connection with the

change in warrant fair value |

|

|

7,893 |

|

|

|

(1,843 |

) |

| Gain in connection with

settlement of note payable |

|

|

(2,012 |

) |

|

|

— |

|

| Loss on initial issuance of

equity |

|

|

5,835 |

|

|

|

— |

|

| Impairment loss on goodwill |

|

|

29,020 |

|

|

|

— |

|

| Impairment loss on

intangibles |

|

|

— |

|

|

|

39,445 |

|

| Allowance for doubtful accounts

and other |

|

|

127 |

|

|

|

— |

|

| Changes in assets and

liabilities: |

|

|

|

|

| Accounts receivable |

|

|

3,304 |

|

|

|

(267 |

) |

| Inventory |

|

|

(13,071 |

) |

|

|

6,721 |

|

| Prepaid and other current

assets |

|

|

2,108 |

|

|

|

2,469 |

|

| Accounts payable, accrued and

other liabilities |

|

|

(5,010 |

) |

|

|

(3,603 |

) |

| Cash used in operating

activities |

|

|

(22,111 |

) |

|

|

(8,857 |

) |

| INVESTING ACTIVITIES: |

|

|

|

|

| Purchase of fixed assets |

|

|

(16 |

) |

|

|

(66 |

) |

| Purchase of Step and Go

assets |

|

|

— |

|

|

|

(125 |

) |

| Cash used in investing

activities |

|

|

(16 |

) |

|

|

(191 |

) |

| FINANCING ACTIVITIES: |

|

|

|

|

| Proceeds from equity offering,

net of issuance costs |

|

|

27,007 |

|

|

|

— |

|

| Repayments on note payable to

Smash |

|

|

(1,778 |

) |

|

|

(501 |

) |

| Payment of Squatty Potty

earn-out |

|

|

(3,983 |

) |

|

|

— |

|

| Borrowings from MidCap credit

facilities |

|

|

71,914 |

|

|

|

38,060 |

|

| Repayments for MidCap credit

facilities |

|

|

(70,972 |

) |

|

|

(43,572 |

) |

| Insurance obligation

payments |

|

|

(719 |

) |

|

|

(534 |

) |

| Cash provided (used) by financing

activities |

|

|

21,469 |

|

|

|

(6,547 |

) |

| Foreign currency effect on cash,

cash equivalents, and restricted cash |

|

|

(602 |

) |

|

|

255 |

|

| Net change in cash and restricted

cash for the year |

|

|

(1,260 |

) |

|

|

(15,340 |

) |

| Cash and restricted cash at

beginning of year |

|

|

38,315 |

|

|

|

46,629 |

|

| Cash and restricted cash at end

of year |

|

$ |

37,055 |

|

|

$ |

31,289 |

|

| RECONCILIATION OF CASH AND

RESTRICTED CASH: |

|

|

|

|

| Cash |

|

|

34,781 |

|

|

|

28,867 |

|

| Restricted Cash—Prepaid and other

current assets |

|

|

2,145 |

|

|

|

2,293 |

|

| Restricted cash—Other non-current

assets |

|

|

129 |

|

|

|

129 |

|

| TOTAL CASH AND RESTRICTED

CASH |

|

$ |

37,055 |

|

|

$ |

31,289 |

|

| |

|

|

|

|

| SUPPLEMENTAL DISCLOSURES OF CASH

FLOW INFORMATION |

|

|

|

|

| Cash paid for interest |

|

$ |

828 |

|

|

$ |

1,038 |

|

| Cash paid for taxes |

|

$ |

58 |

|

|

$ |

80 |

|

| NON-CASH INVESTING AND FINANCING

ACTIVITIES: |

|

|

|

|

| Non-cash consideration paid to

contractors |

|

$ |

1,137 |

|

|

$ |

321 |

|

| Fair value of warrants issued in

connection with equity offering |

|

$ |

18,982 |

|

|

$ |

— |

|

| Issuance of common stock related

to exercise of warrants |

|

$ |

767 |

|

|

$ |

— |

|

| Exercise of prefunded

warrants |

|

$ |

15,039 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

We believe that our financial statements and the

other financial data included in this Quarterly Report have been

prepared in a manner that complies, in all material respects, with

generally accepted accounting principles in the U.S. (“GAAP”).

However, for the reasons discussed below, we have presented certain

non-GAAP measures herein.

We have presented the following non-GAAP

measures to assist investors in understanding our core net

operating results on an on-going basis: (i) Contribution Margin;

(ii) Contribution margin as a percentage of net revenue; (iii)

EBITDA (iv) Adjusted EBITDA; and (v) Adjusted EBITDA as a

percentage of net revenue. These non-GAAP financial measures may

also assist investors in making comparisons of our core operating

results with those of other companies.

As used herein, Contribution margin represents

gross profit less e-commerce platform commissions, online

advertising, selling and logistics expenses (included in sales and

distribution expenses). As used herein, Contribution margin as a

percentage of net revenue represents Contribution margin divided by

net revenue. As used herein, EBITDA represents net loss plus

depreciation and amortization, interest expense, net and provision

for income taxes. As used herein, Adjusted EBITDA represents EBITDA

plus stock-based compensation expense, changes in fair-market value

of earn-outs, profit and loss impacts from the issuance of common

stock and/or warrants, changes in fair-market value of warrant

liability, litigation settlements, impairment on goodwill and

intangibles, gain from extinguishment of debt, restructuring

expenses and other expenses, net. As used herein, Adjusted EBITDA

as a percentage of net revenue represents Adjusted EBITDA divided

by net revenue. Contribution margin, EBITDA and Adjusted EBITDA do

not represent and should not be considered as alternatives to loss

from operations or net loss, as determined under GAAP.

We present Contribution margin and Contribution

margin as a percentage of net revenue, as we believe each of these

measures provides an additional metric to evaluate our operations

and, when considered with both our GAAP results and the

reconciliation to gross profit, provides useful supplemental

information for investors. Specifically, Contribution margin and

Contribution margin as a Non-GAAP Financial Measure percentage of

net revenue are two of our key metrics in running our business. All

product decisions made by us, from the approval of launching a new

product and to the liquidation of a product at the end of its life

cycle, are measured primarily from Contribution margin and/or

Contribution margin as a percentage of net revenue. Further, we

believe these measures provide improved transparency to our

stockholders to determine the performance of our products prior to

fixed costs as opposed to referencing gross profit alone.

In the reconciliation to calculate contribution

margin, we add e-commerce platform commissions, online advertising,

selling and logistics expenses (“sales and distribution variable

expense”) to gross profit to inform users of our financial

statements of what our product profitability is at each period

prior to fixed costs (such as sales and distribution expenses such

as salaries as well as research and development expenses and

general administrative expenses). By excluding these fixed costs,

we believe this allows users of our financial statements to

understand our products performance and allows them to measure our

products performance over time.

We present EBITDA, Adjusted EBITDA and Adjusted

EBITDA as a percentage of net revenue because we believe each of

these measures provides an additional metric to evaluate our

operations and, when considered with both our GAAP results and the

reconciliation to net loss, provide useful supplemental information

for investors. We use these measures with financial measures

prepared in accordance with GAAP, such as sales and gross margins,

to assess our historical and prospective operating performance, to

provide meaningful comparisons of operating performance across

periods, to enhance our understanding of our operating performance

and to compare our performance to that of our peers and

competitors. We believe EBITDA, Adjusted EBITDA and Adjusted EBITDA

as a percentage of net revenue are useful to investors in assessing

the operating performance of our business without the effect of

non-cash items.

Contribution margin, Contribution margin as a

percentage of net revenue, EBITDA, Adjusted EBITDA and Adjusted

EBITDA as a percentage of net revenue should not be considered in

isolation or as alternatives to net loss, loss from operations or

any other measure of financial performance calculated and

prescribed in accordance with GAAP. Neither EBITDA, Adjusted EBITDA

or Adjusted EBITDA as a percentage of net revenue should be

considered a measure of discretionary cash available to us to

invest in the growth of our business. Our Contribution margin,

Contribution margin as a percentage of net revenue, EBITDA,

Adjusted EBITDA and Adjusted EBITDA as a percentage of net revenue

may not be comparable to similar titled measures in other

organizations because other organizations may not calculate

Contribution margin, Contribution margin as a percentage of net

revenue, EBITDA, Adjusted EBITDA or Adjusted EBITDA as a percentage

of net revenue in the same manner as we do. Our presentation of

Contribution margin and Adjusted EBITDA should not be construed as

an inference that our future results will be unaffected by the

expenses that are excluded from such terms or by unusual or

non-recurring items.

We recognize that EBITDA, Adjusted EBITDA and

Adjusted EBITDA as a percentage of net revenue, have limitations as

analytical financial measures. For example, neither EBITDA nor

Adjusted EBITDA reflects:

• our capital expenditures or future

requirements for capital expenditures or mergers and

acquisitions;

• the interest expense or the cash requirements

necessary to service interest expense or principal payments,

associated with indebtedness;

• depreciation and amortization, which are

non-cash charges, although the assets being depreciated and

amortized will likely have to be replaced in the future, or any

cash requirements for the replacement of assets;

• changes in cash requirements for our working

capital needs; or

• changes in fair value of contingent earn-out

liabilities, warrant liabilities, and amortization of inventory

step-up from acquisitions (included in cost of goods sold).

Additionally, Adjusted EBITDA excludes non-cash

expense for stock-based compensation, which is and is expected to

remain a key element of our overall long-term incentive

compensation package.

We also recognize that Contribution margin and

Contribution margin as a percentage of net revenue have limitations

as analytical financial measures. For example, Contribution margin

does not reflect:

• general and administrative expense necessary

to operate our business; •research and development expenses

necessary for the development, operation and support of our

software platform;

• the fixed costs portion of our sales and

distribution expenses including stock-based compensation expense;

or

• changes in fair value of contingent earn-out

liabilities, warrant liabilities, and amortization of inventory

step-up from acquisitions (included in cost of goods sold).

Contribution Margin

The following table provides a reconciliation of

Contribution margin to gross profit and Contribution margin as a

percentage of net revenue to gross profit as a percentage of net

revenue, which are the most directly comparable financial measures

presented in accordance with GAAP:

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

| |

(in thousands, except percentages) |

|

| Gross Profit |

$ |

31,351 |

|

|

$ |

14,896 |

|

|

$ |

54,959 |

|

|

$ |

33,992 |

|

|

| Less: |

|

|

|

|

|

|

|

|

| E-commerce platform commissions,

online advertising, selling and logistics expenses |

|

(25,703 |

) |

|

|

(16,164 |

) |

|

|

(45,479 |

) |

|

|

(33,193 |

) |

|

| Contribution margin |

$ |

5,648 |

|

|

$ |

(1,268 |

) |

|

$ |

9,480 |

|

|

$ |

799 |

|

|

| Gross Profit as a percentage of

net revenue |

|

53.8 |

% |

|

|

42.2 |

% |

|

|

55.0 |

% |

|

|

48.5 |

% |

|

| Contribution margin as a

percentage of net revenue |

|

9.7 |

% |

|

|

(3.6 |

)% |

|

|

9.5 |

% |

|

|

1.1 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

The following table provides a reconciliation of

EBITDA and Adjusted EBITDA to net loss, which is the most directly

comparable financial measure presented in accordance with GAAP:

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

| |

(in thousands, except percentages) |

|

| Net loss |

$ |

(16,309 |

) |

|

$ |

(34,787 |

) |

|

$ |

(59,085 |

) |

|

$ |

(60,587 |

) |

|

| Add: |

|

|

|

|

|

|

|

|

| Provision (benefit) for income

taxes |

|

(168 |

) |

|

|

26 |

|

|

|

(168 |

) |

|

|

52 |

|

|

| Interest expense, net |

|

338 |

|

|

|

346 |

|

|

|

1,138 |

|

|

|

717 |

|

|

| Depreciation and

amortization |

|

2,048 |

|

|

|

1,202 |

|

|

|

3,894 |

|

|

|

2,964 |

|

|

| EBITDA |

|

(14,091 |

) |

|

|

(33,213 |

) |

|

|

(54,221 |

) |

|

|

(56,854 |

) |

|

| Other (income) expense, net |

|

— |

|

|

|

176 |

|

|

|

(25 |

) |

|

|

229 |

|

|

| Change in fair value of

contingent earn-out liabilities |

|

(1,691 |

) |

|

|

— |

|

|

|

(4,466 |

) |

|

|

— |

|

|

| Impairment loss on goodwill |

|

— |

|

|

|

— |

|

|

|

29,020 |

|

|

|

— |

|

|

| Impairment loss on

intangibles |

|

— |

|

|

|

22,785 |

|

|

|

— |

|

|

|

39,445 |

|

|

| Gain on extinguishment of seller

note |

|

— |

|

|

|

— |

|

|

|

(2,012 |

) |

|

|

— |

|

|

| Change in fair market value of

warrant liability |

|

6,014 |

|

|

|

(2,197 |

) |

|

|

7,893 |

|

|

|

(1,843 |

) |

|

| Loss on original issuance of

equity |

|

— |

|

|

|

— |

|

|

|

5,835 |

|

|

|

— |

|

|

| Litigation reserve |

|

— |

|

|

|

— |

|

|

|

800 |

|

|

|

— |

|

|

| Restructuring expense |

|

— |

|

|

|

1,216 |

|

|

|

— |

|

|

|

1,216 |

|

|

| Stock-based compensation

expense |

|

6,048 |

|

|

|

3,223 |

|

|

|

8,913 |

|

|

|

5,539 |

|

|

| Adjusted EBITDA |

$ |

(3,720 |

) |

|

$ |

(8,010 |

) |

|

$ |

(8,263 |

) |

|

$ |

(12,268 |

) |

|

| Net loss as a percentage of net

revenue |

|

(28.0 |

)% |

|

|

(98.6 |

)% |

|

|

(59.1 |

)% |

|

|

(86.4 |

)% |

|

| Adjusted EBITDA as a percentage

of net revenue |

|

(6.4 |

)% |

|

|

(22.7 |

)% |

|

|

(8.3 |

)% |

|

|

(17.5 |

)% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Each of our products typically goes through the

Launch phase and depending on its level of success is moved to one

of the other phases as further described below:

i. Launch phase: During this phase,

we leverage our technology to target opportunities identified using

AIMEE (Artificial Intelligence Marketplace e-Commerce Engine) and

other sources. This phase also includes revenue from new product

variations and relaunches. During this period of time, due to the

combination of discounts and investment in marketing, our net

margin for a product could be as low as approximately negative 35%.

Net margin is calculated by taking net revenue less the cost of

goods sold, less fulfillment, online advertising and selling

expenses. These primarily reflect the estimated variable costs

related to the sale of a product.

ii. Sustain phase: Our goal is for

every product we launch to enter the sustain phase and become

profitable, with a target of positive 15% net margin for most

products, within approximately three months of launch on average.

Net margin primarily reflects a combination of manual and automated

adjustments in price and marketing spend.

iii. Liquidate phase: If a product does

not enter the sustain phase or if the customer satisfaction of the

product (i.e., ratings) is not satisfactory, then it will go to the

liquidate phase and we will sell through the remaining inventory.

Products can also be liquidated as part of inventory normalization

especially when steep discounts are required.

The following tables break out our second

quarter of 2022 and 2023 results of operations by our product

phases (in thousands):

| |

|

Three months ended June 30, 2022 |

| |

|

Sustain |

|

Launch |

|

Liquidation/ Other |

|

Fixed Costs |

|

Stock Based Compensation |

|

Total |

|

Net revenue |

|

$ |

54,080 |

|

$ |

1,342 |

|

$ |

2,846 |

|

$ |

— |

|

|

$ |

— |

|

$ |

58,268 |

|

| Cost of goods sold |

|

|

24,259 |

|

|

742 |

|

|

1,916 |

|

|

— |

|

|

|

— |

|

|

26,917 |

|

| Gross profit |

|

|

29,821 |

|

|

600 |

|

|

930 |

|

|

— |

|

|

|

— |

|

|

31,351 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and distribution

expenses |

|

|

22,635 |

|

|

632 |

|

|

2,435 |

|

|

3,281 |

|

|

|

2,883 |

|

|

31,866 |

|

| Research and development |

|

|

— |

|

|

— |

|

|

— |

|

|

1,097 |

|

|

|

633 |

|

|

1,730 |

|

| General and

administrative |

|

|

— |

|

|

— |

|

|

— |

|

|

7,038 |

|

|

|

2,533 |

|

|

9,571 |

|

| Change in earn-out

liability |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,691 |

) |

|

|

— |

|

|

(1,691 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended June 30,

2023 |

| |

|

Sustain |

|

Launch |

|

Liquidation/ Other |

|

Fixed Costs |

|

Stock Based Compensation |

|

Total |

| Net revenue |

|

$ |

30,985 |

|

$ |

42 |

|

$ |

4,237 |

|

$ |

— |

|

|

$ |

— |

|

$ |

35,264 |

|

| Cost of goods sold |

|

|

16,505 |

|

|

20 |

|

|

3,843 |

|

|

— |

|

|

|

— |

|

|

20,368 |

|

| Gross profit |

|

|

14,480 |

|

|

22 |

|

|

394 |

|

|

— |

|

|

|

— |

|

|

14,896 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and distribution

expenses |

|

|

13,841 |

|

|

33 |

|

|

2,290 |

|

|

3,302 |

|

|

|

1,091 |

|

|

20,557 |

|

| Research and development |

|

|

— |

|

|

— |

|

|

— |

|

|

1,286 |

|

|

|

423 |

|

|

1,709 |

|

| General and

administrative |

|

|

— |

|

|

— |

|

|

— |

|

|

4,572 |

|

|

|

1,709 |

|

|

6,281 |

|

| Impairment loss on

intangibles |

|

|

— |

|

|

— |

|

|

— |

|

|

22,785 |

|

|

|

— |

|

|

22,785 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six months ended June 30,

2022 |

| |

|

Sustain |

|

Launch |

|

Liquidation/Other |

|

Fixed Costs |

|

Stock BasedCompensation |

|

Total |

|

Net revenue |

|

$ |

92,044 |

|

$ |

2,179 |

|

$ |

5,718 |

|

$ |

— |

|

|

$ |

— |

|

$ |

99,941 |

|

| Cost of goods sold |

|

|

40,008 |

|

|

1,153 |

|

|

3,821 |

|

|

— |

|

|

|

— |

|

|

44,982 |

|

| Gross profit |

|

|

52,036 |

|

|

1,026 |

|

|

1,897 |

|

|

— |

|

|

|

— |

|

|

54,959 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and distribution

expenses |

|

|

40,114 |

|

|

1,167 |

|

|

4,197 |

|

|

6,133 |

|

|

|

3,229 |

|

|

54,840 |

|

| Research and development |

|

|

— |

|

|

— |

|

|

— |

|

|

1,970 |

|

|

|

907 |

|

|

2,877 |

|

| General and

administrative |

|

|

— |

|

|

— |

|

|

— |

|

|

14,335 |

|

|

|

4,777 |

|

|

19,112 |

|

| Impairment loss on

goodwill |

|

|

— |

|

|

— |

|

|

— |

|

|

29,020 |

|

|

|

— |

|

|

29,020 |

|

| Change in earn-out

liability |

|

|

— |

|

|

— |

|

|

— |

|

|

(4,466 |

) |

|

|

— |

|

|

(4,466 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six months ended June 30, 2023 |

| |

|

Sustain |

|

Launch |

|

Liquidation/Other |

|

Fixed Costs |

|

Stock BasedCompensation |

|

Total |

| Net revenue |

|

$ |

59,616 |

|

$ |

200 |

|

$ |

10,327 |

|

$ |

— |

|

|

$ |

— |

|

$ |

70,143 |

|

| Cost of goods sold |

|

|

28,183 |

|

|

111 |

|

|

7,857 |

|

|

— |

|

|

|

— |

|

|

36,151 |

|

| Gross profit |

|

|

31,433 |

|

|

89 |

|

|

2,470 |

|

|

— |

|

|

|

— |

|

|

33,992 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and distribution

expenses |

|

|

27,194 |

|

|

152 |

|

|

5,847 |

|

|

5,829 |

|

|

|

1,761 |

|

|

40,783 |

|

| Research and development |

|

|

— |

|

|

— |

|

|

— |

|

|

2,099 |

|

|

|

857 |

|

|

2,956 |

|

| General and

administrative |

|

|

— |

|

|

— |

|

|

— |

|

|

9,319 |

|

|

|

2,921 |

|

|

12,240 |

|

| Impairment loss on

intangibles |

|

|

— |

|

|

— |

|

|

— |

|

|

39,445 |

|

|

|

— |

|

|

39,445 |

|

Investor Contact:

Ilya Grozovsky

Director of Investor Relations & Corp. Development

Aterian, Inc.

ilya@aterian.io

917-905-1699

aterian.io

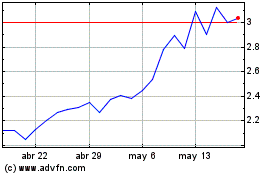

Aterian (NASDAQ:ATER)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Aterian (NASDAQ:ATER)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025