0001690080

false

0001690080

2023-12-04

2023-12-04

0001690080

ATNF:CommonStockParValue0.0001PerShareMember

2023-12-04

2023-12-04

0001690080

ATNF:WarrantsToPurchaseSharesOfCommonStockMember

2023-12-04

2023-12-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date of

earliest event reported): December 4, 2023

180 LIFE SCIENCES

CORP.

(Exact Name of Registrant

as Specified in Charter)

| Delaware |

|

001-38105 |

|

90-1890354 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

3000 El Camino Real, Bldg. 4, Suite

200

Palo Alto, CA |

|

94306 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone

number, including area code: (650) 507-0669

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e 4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

ATNF |

|

The NASDAQ Stock Market LLC |

| Warrants to purchase shares of Common Stock |

|

ATNFW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On December 4, 2023, 180 Life

Sciences Corp. (the “Company”) issued a press release announcing that it had engaged A.G.P./Alliance Global Partners

as financial advisor to explore and evaluate strategic alternatives to enhance shareholder value. A copy of the press release is attached

hereto as Exhibit 99.1, and is incorporated into this Item 8.01 by reference.

Item 9.01 Financial Statements and Exhibits.

Forward-Looking Statements

This Current Report on Form

8-K, including the press release filed as Exhibit 99.1, to this Current Report

on Form 8-K, contains forward-looking statements within the meaning

of the federal securities laws, including the Private Securities Litigation Reform Act of 1995,

and, as such, may involve known and unknown risks, uncertainties and assumptions. You can identify these forward-looking statements

by words such as “may,” “should,” “expect,” “anticipate,”

“believe,” “estimate,” “intend,” “plan” and other similar

expressions. These forward-looking statements relate to the Company’s current expectations

and are subject to the limitations and qualifications set forth in the press release, as well as in the Company’s other filings

with the Securities and Exchange Commission, including, without limitation, that actual events and/or results may differ materially from

those projected in such forward-looking statements. These statements also involve known and unknown risks, which may cause the results

of the Company, its divisions and concepts to be materially different than those expressed or implied in such statements,

including those referenced in the press release. Accordingly, readers should not place undue

reliance on any forward-looking statements. Forward-looking statements may include comments as to the Company’s beliefs and expectations

as to future financial performance, events and trends affecting its business and are necessarily subject to uncertainties, many of which

are outside the Company’s control. More information on potential factors that could affect the Company’s financial results

is included from time to time in the “Cautionary Note Regarding Forward-Looking Statements,” “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s

most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings with the SEC and available at www.sec.gov and

in the “Investors”, “SEC Filings”, “All SEC Filings” page of our website at www.180lifesciences.com. Forward-looking

statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise that occur after that date, except as otherwise provided

by law.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Date: December 4, 2023

| |

180 LIFE SCIENCES CORP. |

| |

|

| |

By: |

/s/ James N. Woody, M.D., Ph.D. |

| |

|

Name: |

James N. Woody, M.D., Ph.D. |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit 99.1

180 Life Sciences

Engages Financial Advisor to Explore Strategic Alternatives

PALO ALTO, Calif., December

4, 2023 -- 180 Life Sciences Corp. (NASDAQ: ATNF) (“180 Life Sciences” or the “Company”), today announced it has

engaged A.G.P./Alliance Global Partners as financial advisor to explore and evaluate strategic alternatives to enhance shareholder value.

Potential strategic alternatives

that may be explored or evaluated by the Company as part of this process include, but are not limited to, an acquisition, merger, reverse

merger, other business combination, sale of assets, licensing or other strategic transactions involving the Company. The Company does

not intend to discuss or disclose further developments during this process unless and until its Board of Directors has approved a specific

action or otherwise determined that further disclosure is appropriate.

There is no assurance

that the strategic review process will result in the approval or completion of any specific transaction or outcome.

About 180 Life Sciences Corp.

180 Life Sciences Corp. is a clinical stage biotechnology

company focused on the development of therapeutics for unmet medical needs in chronic pain, inflammation and fibrosis by employing innovative

research, and, where appropriate, combination therapy. The Company’s current primary focus is a novel program to treat several

inflammatory disorders using anti-TNF (tumor necrosis factor).

Forward-Looking Statements

This press release includes “forward-looking

statements”, including information about management’s view of the Company’s future expectations, plans and prospects,

within the safe harbor provisions provided under federal securities laws, including under The Private Securities Litigation Reform Act

of 1995 (the “Act”). Words such as “expect,” “estimate,” “project,” “budget,”

“forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,”

“should,” “believes,” “predicts,” “potential,” “continue” and similar expressions

are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties

that could cause the actual results to differ materially from the expected results and, consequently, you should not rely on these forward-looking

statements as predictions of future events. These forward-looking statements and factors that may cause such differences include, without

limitation, the review and evaluation of strategic transactions and their impact on shareholder value; the process by which the Company

engages in evaluation of strategic transactions; the outcome of potential future strategic transactions and the terms thereof; the ability

of the Company to raise funding, the terms of such funding, and dilution caused thereby; the ability of the Company to maintain the continued

listing of the Company’s securities on The Nasdaq Stock Market, including that the Company is not currently in compliance with Nasdaq’s

continued listing standards; risks regarding the outcome of pharmaceutical studies, the timing and costs thereof, and the ability to obtain

sufficient participants; our ability to commercialize drug candidates, if proven successful for treatment in trials; risks regarding whether

the administrative processes required for the issuance of patents will be completed in a timely manner or at all, whether patents, if

issued, will provide sufficient protection and market exclusivity for the Company; whether any patents held by the Company may be challenged,

invalidated, infringed or circumvented by third parties; events that could interfere with the continued validity or enforceability of

a patent; the Company’s ability generally to maintain adequate patent protection and successfully enforce patent claims against

third parties; the timing of, outcome of, and results of, clinical trials statements regarding the timing of marketing authorization application

(MAA) submissions to the UK Medicines and Healthcare products Regulatory Agency (MHRA) and New Drug Application submissions (NDA) to the

U.S. Food and Drug Administration (FDA), our ability to obtain approval and acceptance thereof, the willingness of MHRA to review such

MAA and the FDA to review such NDA, and our ability to address outstanding comments and questions from the MHRA and FDA; statements about

the ability of our clinical trials to demonstrate safety and efficacy of our product candidates, and other positive results; the uncertainties

associated with the clinical development and regulatory approval of 180 Life Sciences’ drug candidates, including potential delays

in the enrollment and completion of clinical trials, the costs thereof, closures of such trials prior to enrolling sufficient participants

in connection therewith, issues raised by the FDA, the MHRA and the European Medicines Agency (EMA); the ability of the Company to persuade

regulators that chosen endpoints do not require further validation; timing and costs to complete required studies and trials, and timing

to obtain governmental approvals; the accuracy of simulations and the ability to reproduce the outcome of such simulations in real world

trials; 180 Life Sciences’ reliance on third parties to conduct its clinical trials, enroll patients, and manufacture its preclinical

and clinical drug supplies; the ability to come to mutually agreeable terms with such third parties and partners, and the terms of such

agreements; estimates of patient populations for 180 Life Sciences planned products; 180 Life Sciences’ ability to fully comply

with numerous federal, state and local laws and regulatory requirements, as well as rules and regulations outside the United States, that

apply to its product development activities; current negative operating cash flows and a need for additional funding to finance our operating

plans; the terms of any further financing, which may be highly dilutive and may include onerous terms, increases in interest rates which

may make borrowing more expensive and increased inflation which may negatively affect costs, expenses and returns; statements relating

to expectations regarding future agreements relating to the supply of materials and license and commercialization of products; the availability

and cost of materials required for trials; the risk that initial drug results are not predictive of future results or will not be able

to be replicated in clinical trials or that such drugs selected for clinical development will not be successful; challenges and uncertainties

inherent in product research and development, including the uncertainty of clinical success and of obtaining regulatory approvals; uncertainty

of commercial success; the inherent risks in early stage drug development including demonstrating efficacy; development time/cost and

the regulatory approval process; the progress of our clinical trials; our ability to find and enter into agreements with potential partners;

our ability to attract and retain key personnel; changing market and economic conditions; competition, including technological advances,

new products and patents attained by competitors; challenges to patents; changes to applicable laws and regulations, including global

health care reforms; expectations with respect to future performance, growth and anticipated acquisitions; expectations regarding the

capitalization, resources and ownership structure of the Company; the ability of the Company to execute its plans to develop and market

new drug products and the timing and costs of these development programs; estimates of the size of the markets for the Company’s

potential drug products; the outcome of current litigation involving the Company; potential future litigation involving the Company or

the validity or enforceability of the intellectual property of the Company; global economic conditions; geopolitical events and regulatory

changes; the expectations, development plans and anticipated timelines for the Company’s drug candidates, pipeline and programs,

including collaborations with third parties; and the effect of rising interest rates and inflation, economic downturns and recessions,

declines in economic activity or global conflicts. These risk factors and others are included from time to time in documents the Company

files with the Securities and Exchange Commission, including, but not limited to, its Form 10-Ks, Form 10-Qs and Form 8-Ks, and including

the Annual Report on Form 10-K for the year ended December 31, 2022, and Quarterly Report on Form 10-Q for the quarter ended September

30, 2023, and future SEC filings. These reports and filings are available at www.sec.gov and are available for download, free of charge,

soon after such reports are filed with or furnished to the SEC, on the “Investors”, “SEC Filings”, “All

SEC Filings” page of our website at www.180lifesciences.com. All subsequent written and oral forward-looking statements concerning

the Company, the results of the Company’s clinical trial results and studies or other matters and attributable to the Company or

any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. Readers are cautioned not

to place undue reliance upon any forward-looking statements, which speak only as of the date made, including the forward-looking statements

included in this press release, which are made only as of the date hereof. The Company cannot guarantee future results, levels of activity,

performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. The Company does not

undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect

any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based, except as otherwise

provided by law.

Investors:

Jason Assad

Director of IR

180 Life Sciences Corp

Jassad@180lifesciences.com

v3.23.3

Cover

|

Dec. 04, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 04, 2023

|

| Entity File Number |

001-38105

|

| Entity Registrant Name |

180 LIFE SCIENCES

CORP.

|

| Entity Central Index Key |

0001690080

|

| Entity Tax Identification Number |

90-1890354

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3000 El Camino Real

|

| Entity Address, Address Line Two |

Bldg. 4

|

| Entity Address, Address Line Three |

Suite

200

|

| Entity Address, City or Town |

Palo Alto

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94306

|

| City Area Code |

650

|

| Local Phone Number |

507-0669

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ATNF

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase shares of Common Stock |

|

| Title of 12(b) Security |

Warrants to purchase shares of Common Stock

|

| Trading Symbol |

ATNFW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATNF_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ATNF_WarrantsToPurchaseSharesOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

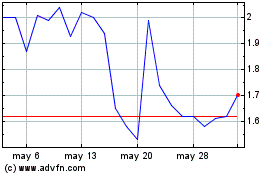

180 Life Sciences (NASDAQ:ATNF)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

180 Life Sciences (NASDAQ:ATNF)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025