UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 9, 2024

Atrion Corporation

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-32982 |

|

63-0821819 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

One Allentown Parkway

Allen, Texas 75002

(Address of principal executive offices) (Zip Code)

(972)

390-9800

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425) |

| x |

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

| Common Stock, $0.10 par value per share |

|

ATRI |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

ITEM 8.01. Other

Events.

As

previously disclosed, on May 28, 2024, Atrion Corporation, a Delaware corporation (“Atrion”), Nordson Corporation,

an Ohio corporation (“Nordson”), and Alpha Medical Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary

of Nordson (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”)

providing for the merger of Merger Sub with and into Atrion (the “Merger”), with Atrion surviving the Merger as a

wholly owned subsidiary of Nordson.

Following

the filing of the preliminary proxy statement filed by Atrion with the U.S. Securities and Exchange Commission (“SEC”)

on July 2, 2024 (the “Preliminary Proxy Statement”) and as of the date of this Current Report on Form 8-K (this “Current

Report on Form 8-K”), which amends and supplements the information in the definitive proxy statement filed by Atrion with the

SEC on July 15, 2024, and sent by Atrion to its stockholders commencing on July 15, 2024 (the “Proxy Statement”),

three (3) lawsuits have been filed, and eleven (11) demand letters have been received by Atrion, by purported stockholders of Atrion

challenging disclosures made in the Preliminary Proxy Statement or the Proxy Statement.

Atrion

and the other named defendants deny that they have violated any laws and believe that the claims asserted are without merit and that

the disclosures in the Preliminary Proxy Statement and the Proxy Statement comply fully with applicable law. However, solely to reduce

the burden and expense of litigation and to avoid any possible disruption to the Merger, Atrion is providing the supplemental information

set forth in this Current Report on Form 8-K. Atrion is also providing additional supplemental disclosures regarding certain required

consents, approvals, non-disapprovals or other authorizations applicable to the Merger under certain applicable foreign investment laws.

This

Current Report on Form 8-K is being filed to amend and supplement the information in the Proxy Statement. The information contained in

this Current Report on Form 8-K is incorporated by reference into the Proxy Statement. All page references in this Current Report on

Form 8-K are to pages in the Proxy Statement. Terms used in this Current Report on Form 8-K, but not otherwise defined herein, have the

meanings ascribed to such terms in the Proxy Statement.

To

the extent that information in this Current Report on Form 8-K differs from, or updates information contained in, the Proxy Statement,

the information in this Current Report on Form 8-K shall supersede or supplement the information in the Proxy Statement. Except as otherwise

described in this Current Report on Form 8-K or the documents referred to, contained in or incorporated by reference in this Current

Report on Form 8-K, the Proxy Statement, the annexes to the Proxy Statement and the documents referred to, contained in or incorporated

by reference in the Proxy Statement are not otherwise modified, supplemented or amended.

The

supplemental information herein should be read in conjunction with the Proxy Statement, which we urge you to read in its entirety. Nothing

in this Current Report on Form 8-K shall be deemed an admission of the legal necessity or materiality of any of the disclosures set forth

herein. For clarity, new text within restated disclosures from the Proxy Statement is highlighted with bold, underlined

text, while deleted text is bold and stricken-through.

If

you have not already submitted a proxy for use at the Special Meeting, you are urged to do so promptly. This Current Report on Form 8-K

does not affect the validity of any proxy card or voting instructions that Atrion stockholders may have previously received or delivered.

No action is required by any Atrion stockholder who has previously delivered a proxy or voting instructions and who does not wish to

revoke or change such proxy or voting instructions.

SUPPLEMENTAL DISCLOSURES

TO THE PROXY STATEMENT

1. The

second paragraph under the section captioned “Summary—Regulatory Approvals Required

for the Merger” of the Proxy Statement is hereby supplemented by amending and restating such paragraph as follows:

Atrion

and Nordson have agreed to use reasonable best efforts to obtain all regulatory approvals that may be or become necessary to consummate

the Merger and the other Transactions contemplated by the Merger Agreement, subject to certain limitations as set forth in the Merger

Agreement. Atrion and Nordson filed notification and report forms under the HSR Act with the DOJ and the FTC on June 11, 2024, and filed

requisite pre-merger notification filings, forms or submissions with other governmental authorities in Italy on June 21, 2024 and in

Turkey on June 24, 2024. On July 11, 2024, the Turkish Competition Authority unconditionally approved the Merger. At 11:59 p.m., Eastern

Time, on July 11, 2024, the waiting period applicable to the Merger under the HSR Act expired. Accordingly, the condition relating to

the expiration or termination of the waiting period under the HSR Act has been satisfied. On July 16, 2024, the Italian Office

of the President of the Council of Ministers declared the Merger as falling outside the scope of applicability of Italian foreign investment

laws. Accordingly, the conditions relating to the receipt of certain required consents, approvals, non-disapprovals or other authorizations

under certain applicable foreign antitrust or competition laws or foreign investment laws have been satisfied. The Merger continues

to be subject to the remaining conditions set forth in the Merger Agreement.

2. The

first and second paragraphs under the section captioned “Summary—Legal Proceedings

Regarding the Merger” of the Proxy Statement are hereby supplemented by amending and restating such paragraphs as follows:

As

of July 15August 9, 2024, Atrion has received threeeleven demand letters,

including onetwo that attaches a

draft complaints, from purported stockholders of Atrion (the “Demand Letters”), which generally allege that

the preliminary proxy statement filed by Atrion on July 2, 2024 or this proxy statement contains disclosure deficiencies in breach of fiduciary duties and in violation of Sections 14(a) and 20(a)

of the Exchange Act, and Rule 14a-9 promulgated thereunder. The Demand Letters seek corrective disclosures in respect of such alleged

deficiencies in advance of the Special Meeting.

In

addition, as of August 9, 2024, three complaints have been filed by purported Atrion stockholders related to the Merger. The first

complaint was filed on July 26, 2024 in the Supreme Court of the State of New York in Nassau County and is captioned Levy v. Athey,

et al., Case No. 613208/2024. The Levy complaint names as defendants Atrion, the members of our Board of Directors, Nordson,

and Campaign Management LLC. The Levy complaint asserts claims for negligent misrepresentation and concealment and negligence

under New York common law related to purported disclosure deficiencies in the Proxy Statement. The Levy complaint seeks, among

other relief, (i) declarations that the Proxy Statement contains misrepresentations as a result of defendants’ purported negligence,

(ii) injunctive relief requiring Atrion to issue purportedly complete disclosures, (iii) injunctive relief preventing and/or rescinding

the vote on the Merger until such disclosures are issued, (iv) attorneys’ fees and costs, and (v) such other and further relief

that the court may find just and proper.

The

second complaint was filed on August 6, 2024 in the Supreme Court of the State of New York in New York County and is captioned Stevens

v. Atrion Corporation, et al., Case No. 653966/2024. The Stevens complaint names as defendants Atrion and the members

of our Board of Directors. The Stevens complaint asserts claims for negligent misrepresentation and concealment and negligence

under New York common law related to purported disclosure deficiencies in the Proxy Statement. The Stevens complaint seeks, among

other relief, (i) injunctive relief preventing the closing of the Merger until defendants issue purportedly complete disclosures

regarding the Merger, (ii) rescission of the Merger and/or actual and punitive damages in the event the Merger is consummated prior

to such disclosures being issued, (iii) attorneys’ fees and costs, and (iv) such other and further relief that the court

may find just and proper.

The

third complaint was filed on August 7, 2024 in the Supreme Court of the State of New York in New York County and is captioned Jones

v. Atrion Corporation, et al., Case No. 653991/2024. The Jones complaint names as defendants Atrion and the members of our

Board of Directors. The Jones complaint asserts claims for negligent misrepresentation and concealment and negligence under New

York common law related to purported disclosure deficiencies in the Proxy Statement. The Jones complaint seeks, among other relief,

(i) injunctive relief preventing the closing of the Merger until defendants issue purportedly complete disclosures regarding the Merger,

(ii) rescission of the Merger and/or actual and punitive damages in the event the Merger is consummated prior to such disclosures being

issued, (iii) attorneys’ fees and costs, and (iv) such other and further relief that the court may find just and proper.

Atrion

believes that the allegations and claims asserted in the Demand Letters, the Levy complaint, the Stevens complaint

and the Jones complaint are without merit and the disclosures in this proxy statement comply fully with applicable law.

We cannot predict the outcome of, or estimate the possible loss or range of loss from, these matters. It is possible that additional

or similar demand letters may be received by Atrion, the Board of Directors, and/or Nordson and/or that additional complaints

may be filed alleging similar or additional deficiencies between the date of this proxy statement and consummation of the Merger. If

any such additional demand letters are received or any additional complaints are filed, Atrion and/or Nordson will not

necessarily disclose such demand letters or complaints.

3. The

answer to the question captioned “When do you expect the Merger to be completed?” under the section captioned “Questions

and Answers” of the Proxy Statement is hereby supplemented by amending and restating such answer as follows:

We

are working toward completing the Merger as promptly as possible. In order to complete the Merger, Atrion must obtain the Atrion Stockholder

Approval described in this proxy statement, and the other conditions to Closing under the Merger Agreement must be satisfied or waived,

including but not limited to (i) the expiration or termination of any waiting period (and any extension thereof) applicable to the consummation

of the Merger under the HSR Act and any agreement with a governmental authority not to consummate the Merger and (ii) all required consents,

approvals, non-disapprovals and other authorizations of any governmental authority under certain foreign antitrust or competition laws

or foreign investment laws must be obtained. Atrion and Nordson filed notification and report forms under the HSR Act with the DOJ and

the FTC on June 11, 2024, and filed requisite pre-merger notification filings, forms or submissions with other governmental authorities

in Italy on June 21, 2024 and in Turkey on June 24, 2024. On July 11, 2024, the Turkish Competition Authority unconditionally approved

the Merger. At 11:59 p.m., Eastern Time, on July 11, 2024, the waiting period applicable to the Merger under the HSR Act expired. Accordingly,

the condition relating to the expiration or termination of the waiting period under the HSR Act has been satisfied. On July 16,

2024, the Italian Office of the President of the Council of Ministers declared the Merger as falling outside the scope of applicability

of Italian foreign investment laws. Accordingly, the conditions relating to the receipt of certain required consents, approvals, non-disapprovals

or other authorizations under certain applicable foreign antitrust or competition laws or foreign investment laws have been satisfied.

Since the Merger remains subject to a number of conditions, the exact timing of the Merger cannot be determined at this time.

For more information, please see the section of this proxy captioned “The Merger—Regulatory Approvals Required for the

Merger.”

4. The

first paragraph under the section captioned “The Special Meeting—Anticipated

Date of Completion of the Merger” of the Proxy Statement is hereby supplemented by amending and restating such paragraph as follows:

We

are working toward completing the Merger as promptly as possible. In order to complete the Merger, Atrion must obtain the Atrion Stockholder

Approval described in this proxy statement, and the other closing conditions under the Merger Agreement must be satisfied or waived,

including but not limited to (i) the expiration or termination of any waiting period (and any extension thereof) applicable to the consummation

of the Merger under the HSR Act or any voluntary agreement with the DOJ or FTC not to consummate the Transactions and (ii) consents,

approvals, non-disapprovals and other authorizations of governmental authorities under certain foreign antitrust or competition laws

must be obtained. Atrion and Nordson filed notification and report forms under the HSR Act with the DOJ and the FTC on June 11, 2024,

and filed requisite pre-merger notification filings, forms or submissions with other governmental authorities in Italy on June 21, 2024

and in Turkey on June 24, 2024. On July 11, 2024, the Turkish Competition Authority unconditionally approved the Merger. At 11:59 p.m.,

Eastern Time, on July 11, 2024, the waiting period applicable to the Merger under the HSR Act expired. Accordingly, the condition relating

to the expiration or termination of the waiting period under the HSR Act has been satisfied. On July 16, 2024, the Italian Office

of the President of the Council of Ministers declared the Merger as falling outside the scope of applicability of Italian foreign investment

laws. Accordingly, the conditions relating to the receipt of certain required consents, approvals, non-disapprovals or other authorizations

under certain applicable foreign antitrust or competition laws or foreign investment laws have been satisfied. Since the Merger

remains subject to a number of conditions, the exact timing of the Merger cannot be determined at this time. For more information, please

see the section of this proxy captioned “The Merger—Regulatory Approvals Required for the Merger.”

5. The

third full paragraph under the section captioned “The Merger—Background of the

Merger” on page 41 of the Proxy Statement is hereby supplemented by amending and restating such paragraph as follows:

Also

on that date, Mr. David Battat spoke with Mr. Lovass regarding the importance to the Board of Directors of Atrion of entering into retention

arrangements with its key employees as quickly as practicable after the execution of the Merger Agreement, given the need for Atrion

to retain these key employees if the Merger was announced and not completed. Mr. David Battat and Mr. Lovass also had a high-level discussion

regarding whether Mr. David Battat would have a role at Atrion following the completion of the Merger. During this discussion, Mr. Lovass

raised the possibility of Mr. David Battat being retained by Nordson or Atrion in a consulting capacity for up to 90 days following the

completion of the Merger for aggregate compensation in the range of $225,000. Since that initial discussion through the

date of this proxy statementJuly 17, 2024, there has beenwere no discussions

between Mr. David Battat and Mr. Lovass (or any other representative of Nordson) regarding Mr. David Battat’s role, if any, with

Atrion or Nordson following the completion of the Merger.

6. The

disclosure under the section captioned “The Merger—Background of the Merger”

is hereby supplemented and amended by adding the following as a new paragraph following the last paragraph thereunder on page 43 of the

Proxy Statement.

On

July 18, 2024, a representative of Nordson informed Mr. David Battat that none of Nordson, Atrion, the Surviving Corporation or their

respective subsidiaries or affiliates would retain Mr. David Battat in any capacity, including short-term consulting, following completion

of the Merger.

7. The

third paragraph under the section captioned “The Merger—Opinion of Atrion’s

Financial Advisor—Financial Analyses—Selected Public

Companies Analysis” of the Proxy Statement is hereby supplemented by amending and restating such paragraph as follows:

The overall low to high

calendar year 2024 estimated EBITDA multiples observed for the selected companies were 13.9x to 23.9x (with a mean of 17.7x and a median

of 17.8x). Truist Securities applied a selected range of calendar year 2024 estimated EBITDA multiples derived from the selected companies

of 16.5x to 18.5x (with particular focus on the overall mean calendar year 2024 estimated EBITDA multiple observed for the selected

companies) to corresponding data of Atrion based on financial projections and other estimates of Atrion’s management. This

analysis indicated the following implied per Share equity value reference range for Atrion, compared to the Merger Consideration:

Implied Per Share

Equity Value Reference Range |

|

Merger Consideration |

| $402.60 - $449.90 |

|

$460.00 |

8. The

fourth paragraph under the section captioned “The Merger—Opinion of Atrion’s

Financial Advisor—Financial Analyses—Selected Public

Companies Analysis” of the Proxy Statement is hereby supplemented by amending and restating such paragraph as follows:

No

company or business used in these analyses is identical to Atrion nor, except as otherwise disclosed, were individual multiples

derived from the selected companies independently determinative of the results of such analyses. Accordingly, an evaluation of

the results of these analyses is not entirely mathematical. Rather, these analyses involve complex considerations and judgments concerning

differences in financial and operating characteristics and other factors that could affect the public trading or other values of the

companies or businesses to which Atrion was compared.

9. The

third paragraph under the section captioned “The Merger—Opinion of Atrion’s

Financial Advisor—Financial Analyses—Selected Precedent

M&A Transactions Analysis” of the Proxy Statement is hereby supplemented by amending and restating such paragraph as follows:

The overall low to high

LTM EBITDA multiples observed for the selected transactions were 14.7x to 24.0x (with a mean of 17.3x and median of 15.6x). Truist Securities

applied a selected range of LTM EBITDA multiples derived from the selected transactions of 16.0x to 18.0x (with particular focus

on the overall mean LTM EBITDA multiple observed for the selected transactions) to Atrion’s latest 12 months EBITDA

(as of March 31, 2024) based on financial projections and other estimates of Atrion’s management. This analysis indicated

the following implied per Share equity value reference range for Atrion, as compared to the Merger Consideration:

Implied Per Share

Equity Value Reference Range |

|

Merger Consideration |

| $377.30 - $423.00 |

|

$460.00 |

10. The

fourth paragraph under the section captioned “The Merger—Opinion of Atrion’s

Financial Advisor—Financial Analyses—Selected Precedent

M&A Transactions Analysis” of the Proxy Statement is hereby supplemented by amending and restating such paragraph as follows:

No

company, business or transaction used in this analysis is identical to Atrion or the Merger nor, except as otherwise disclosed,

were individual multiples derived from the selected transactions independently determinative of the results of such analyses.

Accordingly, an evaluation of the results of this analysis is not entirely mathematical. Rather, this analysis involved complex considerations

and judgments concerning differences in financial and operating characteristics and other factors that could affect the acquisition or

other values of the companies, businesses or transactions to which Atrion and the Merger were compared.

11. The

paragraph of the section captioned “The Merger—Opinion of Atrion’s Financial

Advisor—Financial Analyses—Discounted Cash Flow

Analysis” of the Proxy Statement is hereby supplemented by amending and restating such paragraph as follows:

Truist Securities performed

a discounted cash flow analysis of Atrion by calculating the estimated present value of the standalone unlevered, after-tax free cash

flows that Atrion was forecasted to generate during the fiscal years ending December 31, 2024 through December 31, 2028 based on financial

projections and other estimates and data of Atrion’s management. Truist Securities calculated terminal values for Atrion by applying

to Atrion’s terminal year unlevered free cash flow a selected

range of perpetuity growth rates of 5.0% to 6.0% selected based on Truist Securities’ professional judgment.

The unlevered free cash flows and terminal values were then discounted to present value (as of May 24, 2024) using a selected range of

discount rates of 11.0% to 12.0% derived from a weighted average cost of capital calculation. This analysis indicated the

following implied per Share equity value reference range for Atrion, as compared to the Merger Consideration:

Implied Per Share

Equity Value Reference Range |

|

Merger Consideration |

| $321.40 - $433.90 |

|

$460.00 |

12. The

first paragraph under the section captioned “The Merger—Opinion of Atrion’s

Financial Advisor—Miscellaneous” of the Proxy Statement is hereby supplemented by amending

and restating such paragraph as follows:

Atrion

has agreed to pay Truist Securities for its services as financial advisor to Atrion in connection with the Merger an aggregate fee currently

estimated to be approximately $14.3 million, of which a portion $2 million was payable upon delivery

of Truist Securities’ opinion and approximately $12.3 million is contingent upon consummation of the Merger. Atrion also has

agreed to reimburse certain of Truist Securities’ expenses and to indemnify Truist Securities and certain related persons for certain

liabilities, including liabilities under federal securities laws, arising out of Truist Securities’ engagement.

13. The

second paragraph under the section captioned “The Merger—Opinion of Atrion’s

Financial Advisor—Miscellaneous” of the Proxy Statement is hereby supplemented by amending

and restating such paragraph as follows:

Although

Truist Securities and its affiliates currently are not providing, and during the two-year period prior to the date of Truist Securities’

opinion have not provided, investment banking and other financial services to Atrion unrelated to the Merger for which Truist Securities

or its affiliates have received or expect to receive compensation, Truist Securities and its affiliates in the future may provide such

services to Atrion and/or its affiliates for which Truist Securities and its affiliates would expect to receive compensation. As the

Board of Directors was aware, Truist Securities and its affiliates (including Truist Bank) in the past have provided, currently are providing

and in the future may provide investment banking and other financial services to Nordson and/or its affiliates, including, during the

approximately two-year period prior to the date of Truist Securities’ opinion, having acted or acting as a lender under certain

credit facilities of, and having provided or providing certain corporate banking services to, Nordson and/or certain of its subsidiaries,

for which services Truist Securities and/or its affiliates have received or expect to receive compensation. During such approximately

two-year period, Truist Securities and its affiliates received aggregate fees for such investment banking and/or other financial services

of approximately $600,000 from Nordson and/or its affiliates. Truist Securities is a full service securities firm engaged in securities

trading and brokerage activities as well as providing investment banking and other financial services. In the ordinary course of business,

Truist Securities and its affiliates acquire, hold or sell, or may acquire, hold or sell, for its and its

affiliates’ own accounts and/or the accounts of customers, equity, debt and other securities and financial instruments

(including bank loans and other obligations) of Atrion, Nordson, their respective affiliates and any other party that may be involved

in the Merger, as well as provide investment banking and other financial services to such parties. Truist Securities and/or its

affiliates held for the account of customers approximately 61,765 Nordson common shares as of March 31, 2024 (with an implied aggregate

value of approximately $17 million based on the closing price of Nordson common shares on March 28, 2024), representing approximately

0.1% of the outstanding Nordson common shares at February 20, 2024 based on certain public filings of Nordson.

14. The

paragraph under the section captioned “The Merger—Interests of Atrion’s

Directors and Executive Officers in the Merger—Arrangements with Nordson” of the Proxy

Statement is hereby supplemented by amending and restating such paragraph as follows:

As

of the date of this proxy statement, none of our executive officers has entered into any agreement with Nordson or any of its affiliates

regarding employment with, or the right to purchase or participate in the equity of, the Surviving Corporation or one or more of its

affiliates. Prior to and following the Closing, however, certain of our executive officers, including Mr. David Battat and Ms. Cindy

Ferguson, may have discussions and may enter into agreements with Nordson, the Surviving Corporation or their respective subsidiaries

or affiliates regarding service with the Surviving Corporation or one or more of its affiliates on and after the Closing Date. Nordson

anticipates that any such agreement with Mr. David Battat will be short-term in nature. On July 18, 2024, a representative

of Nordson informed Mr. David Battat that none of Nordson, Atrion, the Surviving Corporation or their respective subsidiaries or affiliates

would retain Mr. David Battat in any capacity, including short-term consulting, following completion of the Merger.

15. The

second paragraph under the section captioned “The Merger—Regulatory Approvals

Required for the Merger” of the Proxy Statement is hereby supplemented by amending and restating such paragraph as follows:

The

completion of the Transactions is also subject to certain required consents, approvals, non-disapprovals or other authorizations under

certain applicable foreign antitrust or competition laws or foreign investment laws, including in Italy and Turkey. Atrion and Nordson

have filed requisite pre-merger notification filings, forms or submissions with other governmental authorities in Italy on June 21, 2024

and in Turkey on June 24, 2024. On July 11, 2024, the Turkish Competition Authority unconditionally approved the Merger. On July

16, 2024, the Italian Office of the President of the Council of Ministers declared the Merger as falling outside the scope of applicability

of Italian foreign investment laws. Accordingly, the conditions relating to the receipt of certain required consents, approvals, non-disapprovals

or other authorizations under certain applicable foreign antitrust or competition laws or foreign investment laws have been satisfied.

16. The

first and second paragraphs under the section captioned “The Merger—Legal Proceedings Regarding the Merger” of the

Proxy Statement are hereby supplemented by amending and restating such paragraphs as follows:

As

of July 15August 9, 2024, Atrion has received the Demand Letters, which generally allege that the preliminary

proxy statement filed by Atrion on July 2, 2024 or this proxy statement contains disclosure deficiencies in breach of fiduciary duties and in violation of Sections 14(a) and 20(a)

of the Exchange Act, and Rule 14a-9 promulgated thereunder. The Demand Letters seek corrective disclosures in respect of such alleged

deficiencies in advance of the Special Meeting.

In

addition, as of August 9, 2024, three complaints have been filed by purported Atrion stockholders related to the Merger. The first

complaint was filed on July 26, 2024 in the Supreme Court of the State of New York in Nassau County and is captioned Levy v. Athey,

et al., Case No. 613208/2024. The Levy complaint names as defendants Atrion, the members of our Board of Directors, Nordson,

and Campaign Management LLC. The Levy complaint asserts claims for negligent misrepresentation and concealment and negligence

under New York common law related to purported disclosure deficiencies in the Proxy Statement. The Levy complaint seeks, among

other relief, (i) declarations that the Proxy Statement contains misrepresentations as a result of defendants’ purported negligence,

(ii) injunctive relief requiring Atrion to issue purportedly complete disclosures, (iii) injunctive relief preventing and/or rescinding

the vote on the Merger until such disclosures are issued, (iv) attorneys’ fees and costs, and (v) such other and further relief

that the court may find just and proper.

The

second complaint was filed on August 6, 2024 in the Supreme Court of the State of New York in New York County and is captioned Stevens

v. Atrion Corporation, et al., Case No. 653966/2024. The Stevens complaint names as defendants Atrion and the members

of our Board of Directors. The Stevens complaint asserts claims for negligent misrepresentation and concealment and negligence

under New York common law related to purported disclosure deficiencies in the Proxy Statement. The Stevens complaint seeks, among

other relief, (i) injunctive relief preventing the closing of the Merger until defendants issue purportedly complete disclosures

regarding the Merger, (ii) rescission of the Merger and/or actual and punitive damages in the event the Merger is consummated prior

to such disclosures being issued, (iii) attorneys’ fees and costs, and (iv) such other and further relief that the court

may find just and proper.

The

third complaint was filed on August 7, 2024 in the Supreme Court of the State of New York in New York County and is captioned Jones

v. Atrion Corporation, et al., Case No. 653991/2024. The Jones complaint names as defendants Atrion and the members of our

Board of Directors. The Jones complaint asserts claims for negligent misrepresentation and concealment and negligence under New

York common law related to purported disclosure deficiencies in the Proxy Statement. The Jones complaint seeks, among other relief,

(i) injunctive relief preventing the closing of the Merger until defendants issue purportedly complete disclosures regarding the Merger,

(ii) rescission of the Merger and/or actual and punitive damages in the event the Merger is consummated prior to such disclosures being

issued, (iii) attorneys’ fees and costs, and (iv) such other and further relief that the court may find just and proper.

Atrion

believes that the allegations and claims asserted in the Demand Letters, the Levy complaint, the Stevens complaint

and the Jones complaint are without merit and the disclosures in this proxy statement comply fully with applicable law.

We cannot predict the outcome of, or estimate the possible loss or range of loss from, these matters. It is possible that additional

or similar demand letters may be received by Atrion, the Board of Directors, and/or Nordson and/or that additional complaints

may be filed alleging similar or additional deficiencies between the date of this proxy statement and consummation of the Merger. If

any such additional demand letters are received or any additional complaints are filed, Atrion and/or Nordson will not

necessarily disclose such demand letters or complaints.

Cautionary Statement Regarding

Forward-Looking Statements

Statements in this Current Report on Form 8-K

that are forward looking are based upon current expectations, and actual results or future events may differ materially. Therefore, the

inclusion of such forward-looking information should not be regarded as a representation by us that our objectives or plans will be achieved.

Such statements include, but are not limited to, statements regarding the financial and business impact and anticipated benefits of the

transaction, the closing of the transaction and the timing thereof, business plans and strategy, product launches and product performance

and impact. Words such as “expects,” “believes,” “anticipates,” “intends,” “should,”

“plans,” and variations of such words and similar expressions are intended to identify such forward-looking statements.

Forward-looking statements contained herein involve

numerous risks and uncertainties, including the risk factors described in Part I, Item 1A. Risk Factors in our most recent Annual Report

on Form 10-K and the specific risk factors discussed herein and in connection with forward-looking statements throughout this Current

Report on Form 8-K, and there are a number of factors that could cause actual results or future events to differ materially, including,

but not limited to, the following: the risk that the COVID-19 pandemic may again lead to material delays and cancellations of, or reduced

demand for, procedures in which our products are utilized; curtailed or delayed capital spending by hospitals and other healthcare providers;

disruption to our supply chain; closures of our facilities; delays in training; delays in gathering clinical evidence; diversion of management

and other resources to respond to the pandemic; the impact of global and regional economic and credit market conditions on healthcare

spending; the risk that the COVID-19 virus will again disrupt global economies and may cause economies in our key markets to enter prolonged

recessions; changing economic, market and business conditions; acts of war or terrorism; the effects of governmental regulation; the

impact of competition and new technologies; slower-than-anticipated introduction of new products or implementation of marketing strategies;

implementation of new manufacturing processes or implementation of new information systems; our ability to protect our intellectual property;

changes in the prices of raw materials; changes in product mix; intellectual property and product liability claims and product recalls;

the ability to attract and retain qualified personnel; the loss of, or any material reduction in sales to any significant customers;

business disruptions (including disruptions in relationships with employees, customers or suppliers) following the announcement and/or

closing of the contemplated Merger; and the conditions to the completion of the contemplated Merger, including the fact that the receipt

of the required regulatory approvals and clearances, may not be satisfied at all or in a timely manner; the fact that the closing of

the contemplated Merger may not occur or may be delayed. In addition, assumptions relating to budgeting, marketing, product development

and other management decisions are subjective in many respects and thus susceptible to interpretations and periodic review which may

cause us to alter our marketing, capital expenditures or other budgets, which in turn may affect our results of operations and financial

condition. These risks and uncertainties, in some cases, have affected and in the future could affect our ability to implement our business

strategy and may cause actual results to differ materially from those contemplated by the statements expressed in this Current Report

on Form 8-K. New risks and uncertainties may arise from time to time and are difficult to predict. All of these factors are difficult

or impossible to predict accurately and many of them are beyond our control. As a result, readers are cautioned not to place undue reliance

on any of our forward-looking statements.

For a further list and description of these and

other important risks and uncertainties that may affect our future operations, refer to Part I, Item 1A. Risk Factors in our most

recent Annual Report on Form 10-K filed with the SEC, as updated in Part II, Item 1A. Risk Factors in our Quarterly Report on

Form 10-Q filed with the SEC on May 10, 2024, which we may update in Part II, Item 1A. Risk Factors in subsequent Quarterly Reports

on Form 10-Q that we will file hereafter. The forward-looking statements in this Current Report on Form 8-K are made as of the date hereof,

and we do not undertake any obligation, and disclaim any duty, to supplement, update or revise such statements, whether as a result of

subsequent events, changed expectations or otherwise, except as required by applicable law. This cautionary statement is applicable to

all forward-looking statements contained in this Current Report on Form 8-K.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

This Current Report on Form 8-K does not constitute

an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with

the contemplated Merger, the Company filed the Proxy Statement with the SEC. STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY

STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN) AND OTHER RELEVANT DOCUMENTS

IN CONNECTION WITH THE contemplated Merger BECAUSE THEY CONTAIN IMPORTANT INFORMATION

ABOUT THE contemplated Merger AND THE PARTIES TO THE contemplated

Merger. Stockholders and investors may obtain free copies of the Proxy Statement, this Current Report on Form 8-K and other relevant

materials and other documents filed by the Company at the SEC’s website at www.sec.gov.

PARTICIPANTS IN THE SOLICITATION

The Company, Parent and certain of their respective

directors and executive officers may be deemed to be participants in the solicitation of proxies from the Company’s stockholders

in connection with the contemplated Merger. Information regarding the Company’s directors and executive officers, including a description

of their respective direct or indirect interests, by security holdings or otherwise, are included in the Proxy Statement described above.

These documents may be obtained free of charge from the SEC’s website at www.sec.gov or by accessing the Investor Relations section

of the Company’s website at www.atrioncorp.com. Information regarding the Company’s directors and executive officers is contained

in the sections entitled “Election of Directors” and “Securities Ownership” included in the Company’s

proxy statement for the 2024 annual meeting of stockholders, which was filed with the SEC on April 9, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/701288/000110465924044922/tm242747d4_def14a.htm)

and in the section entitled “Directors, Executive Officers and Corporate Governance” included in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 29, 2024 (and which is available

at https://www.sec.gov/ix?doc=/Archives/edgar/data/701288/000165495424002411/atri_10k.htm). Information regarding Parent’s

directors and executive officers is contained in the sections entitled “Election of Directors” and “Security

Ownership of Nordson Common Shares by Certain Beneficial Owners and Management” included in Parent’s proxy statement

for its 2024 annual meeting of stockholders, filed with the SEC on January 19, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/72331/000119312524010767/d482491ddef14a.htm),

in the section entitled “Information About Our Executive Officers” included in Parent’s Annual Report on Form

10-K for the year ended October 31, 2023, which was filed with the SEC on December 20, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/72331/000007233123000242/ndsn-20231031.htm),

in Parent’s Form 8-K filed on August 24, 2023 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233123000150/ndsn-20230823.htm),

in Parent’s Form 8-K filed on January 16, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000019/ndsn-20240116.htm),

in Parent’s Form 8-K filed on February 14, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000030/ndsn-20240214.htm),

and in Parent’s Form 8-K filed on April 23, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/0000072331/000007233124000057/ndsn-20240423.htm).

To the extent holdings of Parent securities by the directors and executive officers of Parent have changed from the amounts of securities

of Parent held by such persons as reflected therein, such changes have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

Exhibit

No. |

|

Description |

| 104 |

|

Cover Page Interactive Data File

- the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

|

|

| |

|

ATRION CORPORATION |

| |

|

|

| Date: August 9, 2024 |

By: |

/s/ David A. Battat |

| |

|

David A. Battat |

| |

|

President and Chief Executive Officer |

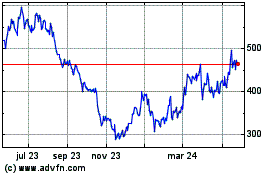

ATRION (NASDAQ:ATRI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

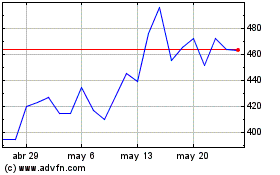

ATRION (NASDAQ:ATRI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025