false

0001385818

0001385818

2024-02-14

2024-02-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

February 14, 2024

Date of Report (Date of earliest event reported):

AYTU BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-38247

|

|

47-0883144

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

7900 E. Union Avenue, Suite 920

Denver, CO 80237

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (720) 437-6580

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.0001 per share

|

|

AYTU

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 14, 2024, Aytu BioPharma, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended December 31, 2023. As indicated in the press release, the Company scheduled a conference call and live audio webcast for February 14, 2024, at 4:30 p.m. Eastern time to discuss the operational and financial results and to answer questions. The conference call is publicly accessible via webcast and telephone (available live and for replay), and the press release includes instructions for accessing the webcast via the Company's website or dialing in to the call. A replay of the call will be made available after the call on the Company’s website and via a telephone replay. Availability of the call replay posted on the Company’s website and via the telephone replay is at the Company’s discretion and may be discontinued at any time. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in the press release attached as Exhibit 99.1 hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number

|

|

Exhibit Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AYTU BIOPHARMA, INC.

|

| |

|

| |

|

|

Date: February 14, 2024

|

By:

|

/s/ Mark K. Oki

|

| |

|

Mark K. Oki

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

Aytu BioPharma Reports Record ADHD Revenue and Operating

Income During Fiscal 2024 Second Quarter

Q2 2024 operating income of $2.4 million

Q2 2024 net loss of $0.2 million and adjusted EBITDA1 of $5.1 million

Q2 2024 Rx Segment net revenue of $18.7 million, net income of $0.7 million, and adjusted EBITDA of $5.5 million

Q2 2024 ADHD Portfolio net revenue up 49% compared to Q2 2023

$19.5 million cash balance at December 31, 2023

Company to host conference call and webcast today, February 14, 2024, at 4:30 p.m. Eastern time

DENVER, CO / February 14, 2024 / Aytu BioPharma, Inc. (the “Company” or “Aytu”) (Nasdaq: AYTU), a pharmaceutical company focused on commercializing novel therapeutics, today announced financial and operational results for the fiscal 2024 second quarter.

Q2 2024 Highlights

| |

●

|

Consolidated net revenue was $22.9 million, compared to $26.3 million in the prior year period. The decrease is primarily due to the planned wind down of the Company's Consumer Health Segment.

|

| |

●

|

ADHD Portfolio (Adzenys XR-ODT® and Cotempla XR-ODT®) net revenue increased 49% to $16.6 million, compared to $11.1 million in the prior year period.

|

| |

●

|

Net revenue from the Company's Rx Segment was $18.7 million compared to $18.0 million in the prior year period.

|

| |

●

|

Consumer Health Segment net revenue during Q2 2024 was $4.2 million, a decrease of 49% versus the prior year period, and in line with the Company's strategy to wind down the Consumer Health Segment. As previously announced, the Company is winding down its Consumer Health Segment with the objective of discontinuing this segment in order to drive long-term stockholder value.

|

| |

●

|

Rx Segment gross margin improved to 78% in Q2 2024 compared to 72% in the prior year period.

|

| |

●

|

Consolidated operating income during Q2 2024 was $2.4 million compared to an operating loss of $6.9 million in the prior year period.

|

| |

●

|

Net loss during Q2 2024 was $0.2 million, or $0.04 per share, compared to a net loss of $6.7 million, or $2.15 per share, in Q2 2023.

|

| |

●

|

Consolidated adjusted EBITDA was $5.1 million in Q2 2024 compared to $0.7 million in the prior year period, a 599% increase.

|

| |

●

|

Cash and cash equivalents were $19.5 million at December 31, 2023, compared to $20.0 million at September 30, 2023.

|

| |

1

|

Aytu uses the term adjusted EBITDA, which is a term not defined under United States generally accepted accounting principles (“U.S. GAAP”). The Company uses this term because it is a widely accepted financial indicator utilized to analyze and compare companies on the basis of operating performance. The Company believes that presenting adjusted EBITDA by certain categories allows investors to evaluate the various performance of these categories. The Company's method of computation of adjusted EBITDA may or may not be comparable to other similarly titled measures used by other companies. We believe that net income (loss) is the performance measure calculated and presented in accordance with U.S. GAAP that is most directly comparable to adjusted EBITDA. See below for a reconciliation of net income (loss) to adjusted EBITDA.

|

Management Discussion

“I am extremely pleased with the results of the second quarter of fiscal 2024, which culminated in our first quarter of positive operating income in company history,” commented Josh Disbrow, Chairman and Chief Executive Officer of Aytu.

“The strategic initiatives we have undertaken to re-position Aytu as a growing, and now operating profitable, specialty pharmaceutical company focused on commercializing novel prescription therapeutics are clearly working. Our ADHD Portfolio experienced a 49% year over year increase in net revenue during the second quarter to an Aytu record of $16.6 million driven by strong sales force execution and an enhanced commercial approach, along with continuing to leverage our innovative Aytu RxConnect platform, which we believe is a best-in-class patient support program. This growth in the ADHD Portfolio net revenue has been matched by an improvement in our Rx Segment gross margin, increasing from 72% a year ago to 78% this quarter, as well as efficiencies within operating expenses. Importantly, we believe we will see further operational improvements throughout calendar year 2024.”

“The strength within ADHD, which represents approximately 88% of our Rx Segment revenues, was partially offset by the continuing effect of payor changes within our Pediatric Portfolio, which have impacted both net revenues and scripts. We made progress during the quarter expanding our customer base, having recently implemented multiple commercial initiatives, and we have seen some unslacking of the distribution channel, which has resulted in Poly-Vi-Flor units up significantly for the month of January 2024 versus December 2023. There is still work to be done, but we believe the trend in the Pediatrics Portfolio is heading back in a positive direction.”

“As we have stated for the past few quarters, it has been our objective to transition Aytu from a multi-pronged approach, which included not only our Rx Segment, but also our Consumer Health Segment and pipeline development programs—both of which have been a drain on cash flows—to a specialty pharmaceutical company that can grow and achieve profitability. While we have been Rx Segment adjusted EBITDA positive for six of the last seven quarters, the ability to transition this business to operating income profitability is a tremendous accomplishment that was made possible by the hard-working individuals at Aytu. We remain focused on maximizing the potential of our Rx brands going forward with a focus on continuing to drive improvement in long-term stockholder value.”

Consumer Health Segment Update

In June 2023, the Company announced that it had instituted a strategic mandate focusing its business solely on its Rx Segment, in an effort to drive long-term stockholder value. The Rx Segment has generated positive adjusted EBITDA for the 2023 fiscal year and for six of the last reported seven quarters. This concentration on the Rx Segment will result in discontinuing the Consumer Health Segment altogether. The Company expects to sell through the remaining Consumer Health Segment inventory resulting in approximately neutral adjusted EBITDA for the Consumer Health Segment in fiscal 2024.

This goal of emphasizing profitability was initially started with the indefinite suspension of all pipeline clinical development programs announced in October 2022 to minimize research and development expense until such time that the Company can fund those efforts with internally generated cash flow or through partnerships. During fiscal 2023, the Consumer Health Segment contributed negative adjusted EBITDA of $3.6 million and pipeline programs contributed a negative adjusted EBITDA of $2.6 million, while the Company's Rx Segment contributed positive adjusted EBITDA of $9.4 million.

Segment Reporting

|

|

|

Three Months Ended

|

|

|

|

|

December 31,

|

|

|

|

|

2023

|

|

|

2022

|

|

|

|

|

(in thousands)

|

|

|

Consolidated net revenue:

|

|

|

|

|

|

|

|

Rx Segment

|

|

$ |

18,748 |

|

|

$ |

18,029 |

|

|

Consumer Health Segment

|

|

|

4,186 |

|

|

|

8,250 |

|

|

Total consolidated net revenue

|

|

$ |

22,934 |

|

|

$ |

26,279 |

|

|

|

|

|

|

|

|

|

|

Rx Segment net revenue:

|

|

|

|

|

|

|

|

ADHD Portfolio

|

|

$ |

16,572 |

|

|

$ |

11,120 |

|

|

Pediatric Portfolio

|

|

|

2,145 |

|

|

|

6,328 |

|

|

Other*

|

|

|

31 |

|

|

|

581 |

|

|

Total Rx Segment net revenue

|

|

$ |

18,748 |

|

|

$ |

18,029 |

|

*Other includes discontinued or deprioritized products.

Q2 2024 Financial Results

Net revenue for the second quarter of fiscal 2024 was $22.9 million, compared to $26.3 million for the prior year period.

Net revenue from the Rx Segment in the second quarter of fiscal 2024 was $18.7 million compared to $18.0 million in the prior year period. The ADHD Portfolio (Adzenys XR-ODT® and Cotempla XR-ODT®) experienced a 49% increase in net revenue to $16.6 million in the second quarter of fiscal 2024, compared to the prior year period. The Pediatric Portfolio (Poly-Vi-Flor®, Tri-Vi-Flor®, and Karbinal® ER) net revenue decreased to $2.1 million due to customer ordering timing as a result of payor changes that impacted scripts.

Net revenue from the Consumer Health Segment was $4.2 million in the second quarter of fiscal 2024, a decrease of 49% over the same quarter last year. As previously announced, the Company is winding down its Consumer Health Segment with the objective of discontinuing this segment to drive long-term stockholder value.

Consolidated gross profit was $16.2 million, or 71% of net revenue, in the second quarter of fiscal 2024, compared to $17.3 million, or 66% of net revenue, in the same quarter last year. Gross profit margin for the Rx Segment was 78% in the second quarter of fiscal 2024, compared with 72% in the prior year period.

Operating expenses, excluding amortization of intangible assets, impairment expense, and loss from contingent consideration, were $12.5 million in the second quarter of fiscal 2024 compared to $20.3 million in the prior year period.

Operating income during the second quarter of fiscal 2024 was $2.4 million compared to an operating loss of $6.9 million in the prior year period.

Net loss during the second quarter of fiscal 2024 was $0.2 million, or $0.04 per share, compared to a $6.7 million net loss, or $2.15 per share, in the prior year period. The prior year period was negatively impacted by impairment expense of $2.6 million.

Adjusted EBITDA was $5.1 million in the second quarter of fiscal 2024, compared to $0.7 million in the prior year period, a $4.4 million improvement. Adjusted EBITDA for the Rx Segment was $5.5 million in the second quarter of fiscal 2024, compared to $3.1 million in the prior year period, a $2.4 million improvement.

Cash and cash equivalents at December 31, 2023, were $19.5 million compared to $20.0 million at September 30, 2023.

Conference Call Details

Aytu will host a conference call today, February 14, 2024, at 4:30 p.m. Eastern time to discuss financial results for the second quarter of fiscal 2024 for the period ended December 31, 2023.

The conference call will be available via telephone by dialing toll free 888‑506‑0062 for U.S. callers or +1 973‑528‑0011 for international callers and using entry code 566278. A webcast of the call may be accessed at https://www.webcaster4.com/Webcast/Page/2142/49729.

A webcast replay will be available on the Investors News/Events section of the Company's website and may be discontinued at any time. A telephone replay of the call will be available approximately one hour following the call, through February 28, 2024, and can be accessed by dialing 877‑481‑4010 for U.S. callers or +1 919‑882‑2331 for international callers and entering replay access code 49729.

About Aytu BioPharma, Inc.

Aytu is a pharmaceutical company focused on commercializing novel therapeutics. The Company's prescription products include Adzenys XR-ODT® (amphetamine) extended-release orally disintegrating tablets (see Full Prescribing Information, including Boxed WARNING) and Cotempla XR-ODT® (methylphenidate) extended-release orally disintegrating tablets (see Full Prescribing Information, including Boxed WARNING) for the treatment of attention deficit hyperactivity disorder (ADHD), Karbinal® ER (carbinoxamine maleate), an extended-release antihistamine suspension indicated to treat numerous allergic conditions, and Poly-Vi-Flor® and Tri-Vi-Flor®, two complementary fluoride-based prescription vitamin product lines available in various formulations for infants and children with fluoride deficiency. To learn more, please visit aytubio.com.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). All statements other than statements of historical facts contained in this press release, are forward-looking statements. Forward-looking statements are generally written in the future tense and/or are preceded by words such as “may,” “will,” “should,” “forecast,” “could,” “expect,” “suggest,” “believe,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” or similar words, or the negatives of such terms or other variations on such terms or comparable terminology. All statements other than statements of historical facts contained in this presentation, are forward-looking statements. These statements are predictions and are subject to risks and uncertainties that could cause the actual events or results to differ materially. These risks and uncertainties include, among others, risks associated with: the Company's plans relating to the Company's ability to efficiently wind down the Consumer Health Segment, the Company's ability to complete the manufacturing transfer of Adzenys XR-ODT® and Cotempla XR-ODT®, the Company's overall financial and operational performance, potential adverse changes to the Company's financial position or our business, the results of operations, strategy and plans, changes in capital markets and the ability of the Company to finance operations in the manner expected, risks relating to gaining market acceptance of our products, our partners performing their required activities, our anticipated future cash position, regulatory and compliance challenges and future events under current and potential future collaborations. We also refer you to (i) the risks described in “Risk Factors” in Part I, Item 1A of our most recent Annual Report on Form 10‑K and in the other reports and documents it files with the Securities and Exchange Commission.

Contacts for Investors

Mark Oki, Chief Financial Officer

Aytu BioPharma, Inc.

moki@aytubio.com

Robert Blum or Roger Weiss

Lytham Partners

aytu@lythampartners.com

Source: Aytu BioPharma, Inc.

Aytu BioPharma, Inc.

Unaudited Consolidated Statements of Operations

(in thousands, except per share data)

|

|

|

Three Months Ended

|

|

|

|

|

December 31,

|

|

|

|

|

2023

|

|

|

2022

|

|

|

Product revenue, net

|

|

$ |

22,934 |

|

|

$ |

26,279 |

|

|

Cost of sales

|

|

|

6,731 |

|

|

|

8,986 |

|

|

Gross profit

|

|

|

16,203 |

|

|

|

17,293 |

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Selling and marketing

|

|

|

6,576 |

|

|

|

10,560 |

|

|

General and administrative

|

|

|

5,439 |

|

|

|

8,018 |

|

|

Research and development

|

|

|

524 |

|

|

|

1,710 |

|

|

Amortization of intangible assets

|

|

|

1,300 |

|

|

|

1,198 |

|

|

Impairment expense

|

|

|

— |

|

|

|

2,600 |

|

|

Loss from contingent consideration

|

|

|

— |

|

|

|

75 |

|

|

Total operating expenses

|

|

|

13,839 |

|

|

|

24,161 |

|

|

Income (loss) from operations

|

|

|

2,364 |

|

|

|

(6,868 |

) |

|

Other expense, net

|

|

|

(1,179 |

) |

|

|

(1,228 |

) |

|

(Loss) gain on derivative warrant liabilities

|

|

|

(577 |

) |

|

|

1,403 |

|

|

Income (loss) before income tax

|

|

|

608 |

|

|

|

(6,693 |

) |

|

Income tax expense

|

|

|

828 |

|

|

|

— |

|

|

Net loss

|

|

$ |

(220 |

) |

|

$ |

(6,693 |

) |

|

|

|

|

|

|

|

|

|

Basic and diluted weighted-average common shares outstanding

|

|

|

5,517,670 |

|

|

|

3,110,304 |

|

|

Basic and diluted net loss per common share

|

|

$ |

(0.04 |

) |

|

$ |

(2.15 |

) |

Aytu BioPharma, Inc.

Unaudited Consolidated Balance Sheets

(in thousands, except share data)

|

|

|

December 31,

|

|

|

June 30,

|

|

|

|

|

2023

|

|

|

2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

19,529 |

|

|

$ |

22,985 |

|

|

Accounts receivable, net

|

|

|

29,403 |

|

|

|

28,937 |

|

|

Inventories

|

|

|

13,001 |

|

|

|

11,995 |

|

|

Prepaid expenses

|

|

|

8,105 |

|

|

|

8,047 |

|

|

Other current assets

|

|

|

1,333 |

|

|

|

868 |

|

|

Total current assets

|

|

|

71,371 |

|

|

|

72,832 |

|

|

Non-current assets:

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

1,127 |

|

|

|

1,815 |

|

|

Operating lease right-of-use assets

|

|

|

2,133 |

|

|

|

2,054 |

|

|

Intangible assets, net

|

|

|

55,711 |

|

|

|

58,970 |

|

|

Other non-current assets

|

|

|

907 |

|

|

|

792 |

|

|

Total non-current assets

|

|

|

59,878 |

|

|

|

63,631 |

|

|

Total assets

|

|

$ |

131,249 |

|

|

$ |

136,463 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

10,473 |

|

|

$ |

13,478 |

|

|

Accrued liabilities

|

|

|

43,413 |

|

|

|

46,799 |

|

|

Short-term line of credit

|

|

|

1,026 |

|

|

|

1,563 |

|

|

Current portion of debt

|

|

|

39 |

|

|

|

85 |

|

|

Other current liabilities

|

|

|

9,236 |

|

|

|

7,090 |

|

|

Total current liabilities

|

|

|

64,187 |

|

|

|

69,015 |

|

|

Non-current liabilities:

|

|

|

|

|

|

|

|

Debt, net of current portion

|

|

|

14,978 |

|

|

|

14,713 |

|

|

Derivative warrant liabilities

|

|

|

12,887 |

|

|

|

6,403 |

|

|

Other non-current liabilities

|

|

|

6,344 |

|

|

|

6,975 |

|

|

Total non-current liabilities

|

|

|

34,209 |

|

|

|

28,091 |

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, par value $.0001; 50,000,000 shares authorized; no shares issued or outstanding

|

|

|

— |

|

|

|

— |

|

|

Common stock, par value $.0001; 200,000,000 shares authorized; 5,567,347 and 5,517,174 shares issued and outstanding, respectively

|

|

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital

|

|

|

345,321 |

|

|

|

343,485 |

|

|

Accumulated deficit

|

|

|

(312,469 |

) |

|

|

(304,129 |

) |

|

Total stockholders' equity

|

|

|

32,853 |

|

|

|

39,357 |

|

|

Total liabilities and stockholders' equity

|

|

$ |

131,249 |

|

|

$ |

136,463 |

|

Aytu BioPharma, Inc.

Unaudited Reconciliation of Net Income (Loss) to Adjusted EBITDA

(in thousands)

|

|

|

For the Three Months Ended December 31, 2023

|

|

| |

|

Rx

|

|

|

Consumer Health

|

|

|

Pipeline R&D

|

|

|

Consolidated

|

|

|

Net income (loss) - GAAP

|

|

$ |

667 |

|

|

$ |

(791 |

) |

|

$ |

(96 |

) |

|

$ |

(220 |

) |

|

Depreciation and amortization

|

|

|

1,510 |

|

|

|

389 |

|

|

|

— |

|

|

|

1,899 |

|

|

Stock-based compensation expense

|

|

|

707 |

|

|

|

113 |

|

|

|

— |

|

|

|

820 |

|

|

Other expense, net

|

|

|

1,170 |

|

|

|

9 |

|

|

|

— |

|

|

|

1,179 |

|

|

Loss on derivative warrant liabilities

|

|

|

577 |

|

|

|

— |

|

|

|

— |

|

|

|

577 |

|

|

Income tax expense

|

|

|

828 |

|

|

|

— |

|

|

|

— |

|

|

|

828 |

|

|

Adjusted EBITDA - non-GAAP

|

|

$ |

5,459 |

|

|

$ |

(280 |

) |

|

$ |

(96 |

) |

|

$ |

5,083 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended December 31, 2022

|

|

| |

|

Rx

|

|

|

Consumer Health

|

|

|

Pipeline R&D

|

|

|

Consolidated

|

|

|

Net loss - GAAP

|

|

$ |

(3,996 |

) |

|

$ |

(1,413 |

) |

|

$ |

(1,284 |

) |

|

$ |

(6,693 |

) |

|

Depreciation and amortization

|

|

|

1,572 |

|

|

|

281 |

|

|

|

— |

|

|

|

1,853 |

|

|

Impairment expense

|

|

|

2,600 |

|

|

|

— |

|

|

|

— |

|

|

|

2,600 |

|

|

Stock-based compensation expense

|

|

|

2,974 |

|

|

|

80 |

|

|

|

13 |

|

|

|

3,067 |

|

|

Loss (gain) from contingent consideration

|

|

|

104 |

|

|

|

(29 |

) |

|

|

— |

|

|

|

75 |

|

|

Other expense, net

|

|

|

1,217 |

|

|

|

11 |

|

|

|

— |

|

|

|

1,228 |

|

|

Gain on derivative warrant liabilities

|

|

|

(1,403 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1,403 |

) |

|

Adjusted EBITDA - non-GAAP

|

|

$ |

3,068 |

|

|

$ |

(1,070 |

) |

|

$ |

(1,271 |

) |

|

$ |

727 |

|

v3.24.0.1

Document And Entity Information

|

Feb. 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

AYTU BIOPHARMA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 14, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38247

|

| Entity, Tax Identification Number |

47-0883144

|

| Entity, Address, Address Line One |

7900 E. Union Avenue

|

| Entity, Address, Address Line Two |

Suite 920

|

| Entity, Address, City or Town |

Denver

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

80237

|

| City Area Code |

720

|

| Local Phone Number |

437-6580

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AYTU

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001385818

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

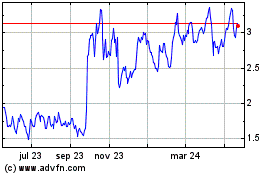

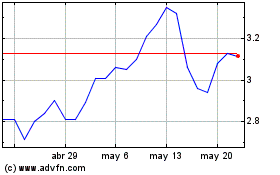

AYTU BioPharma (NASDAQ:AYTU)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

AYTU BioPharma (NASDAQ:AYTU)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024