false

0001385818

0001385818

2024-05-15

2024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 15, 2024

Date of Report (Date of earliest event reported):

AYTU BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-38247

|

|

47-0883144

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

7900 E. Union Avenue, Suite 920

Denver, CO 80237

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (720) 437-6580

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, par value $0.0001 per share

|

|

AYTU

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 15, 2024, Aytu BioPharma, Inc. (the “Company”) issued a press release announcing its operational and financial results for the fiscal quarter ended March 31, 2024. As indicated in the press release, the Company scheduled a conference call and live audio webcast for May 15, 2024, at 4:30 p.m. Eastern time to discuss the operational and financial results and to answer questions. The conference call is publicly accessible via webcast and telephone (available live and for replay), and the press release includes instructions for accessing the webcast via the Company's website or dialing in to the call. A replay of the call will be made available after the call on the Company’s website and via a telephone replay. Availability of the call replay posted on the Company’s website and via the telephone replay is at the Company’s discretion and may be discontinued at any time. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in the press release attached as Exhibit 99.1 hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number

|

|

Exhibit Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

AYTU BIOPHARMA, INC.

|

| |

|

| |

|

|

Date: May 15, 2024

|

By:

|

/s/ Mark K. Oki

|

| |

|

Mark K. Oki

|

| |

|

Chief Financial Officer

|

Exhibit 99.1

Aytu BioPharma Reports Fiscal 2024 Third Quarter Operational and Financial Results

Q3 2024 ADHD Portfolio net revenue up 49% compared to Q3 2023

Q3 2024 adjusted EBITDA1 improved by $7.0 million compared to Q3 2023

TTM March 2024 operating income of $7.3 million for the Rx Business

TTM March 2024 companywide adjusted EBITDA of positive $15.4 million

TTM March 2024 adjusted EBITDA of positive $17.1 million for the Rx Business

$19.8 million cash balance at March 31, 2024

Company to host conference call and webcast today, May 15, 2024, at 4:30 p.m. Eastern time

DENVER, CO / May 15, 2024 / Aytu BioPharma, Inc. (the “Company” or “Aytu”) (Nasdaq: AYTU), a pharmaceutical company focused on commercializing novel therapeutics, today announced financial and operational results for the fiscal 2024 third quarter.

Q3 2024 Highlights

| |

●

|

Consolidated net revenue was $18.0 million versus $22.7 million in the prior year period and reflects the Company’s continued planned wind down of its Consumer Health Segment.

|

| |

●

|

ADHD Portfolio (Adzenys XR-ODT® and Cotempla XR-ODT®) net revenue increased 49% to $12.3 million versus $8.3 million in Q3 fiscal 2023.

|

| |

●

|

Consumer Health Segment net revenue during Q3 2024 was $4.0 million, a decrease of 56% versus Q3 2023, in line with the Company's strategy to discontinue the Consumer Health segment in mid-calendar 2024. As previously announced, the Company is ending its Consumer Health Segment’s operations with the objective of driving profitability and generating long-term stockholder value.

|

| |

●

|

Rx Segment gross margin improved to 74% in Q3 2024 compared to 61% in Q3 2023.

|

| |

●

|

Net loss during Q3 2024 was $2.9 million, or $0.52 per share, compared to a net loss of $7.2 million, or $1.93 per share, in Q3 2023.

|

| |

●

|

Consolidated adjusted EBITDA was positive $0.4 million in Q3 2024 compared to negative $6.6 million in Q3 2023.

|

| |

●

|

Cash and cash equivalents were $19.8 million at March 31, 2023, compared to $19.5 million at December 31, 2023.

|

Management Discussion

“The positive operating momentum we have experienced over the past two years continued during the third quarter of fiscal 2024, as ADHD Portfolio revenue continued its rapid growth, increasing 49%, and we improved our adjusted EBITDA by $7.0 million, compared to the year ago third quarter. This represents the first March quarter in the company’s history during which Aytu generated positive adjusted EBITDA, which is notable considering the March quarter is typically our lowest revenue quarter for the Rx Segment due largely to patients’ insurance deductible resets. Further, when considering both the current softness of our pediatric product sales coupled with the well-publicized cyberattack that impacted the entire healthcare industry, we are very encouraged by the Rx Segment’s demonstrated, year over year revenue growth.” commented Josh Disbrow, Chief Executive Officer of Aytu. “Our business is better positioned today than at any point in our history. Aytu generated TTM adjusted EBITDA of $15.4 million, while our balance sheet remains strong with $19.8 million of cash at the end of March 2024.”

“The key drivers to achieving these critical milestones of positive $15.4 million in TTM companywide adjusted EBITDA and positive $17.1 million in Rx Business TTM adjusted EBITDA, have been a combination of redefining our corporate strategic mandate to focus our business solely on the Rx Segment while instituting a number of operational improvements. These improvements include strong sales force execution, the leveraging of our innovative Aytu RxConnect platform, and continued effective expense management. Additionally, once we have fully transitioned manufacturing of our ADHD brands out of our Grand Prairie, Texas facility, we expect to gain additional expense and margin improvements beyond what we’re currently generating. While there is still work to be done to mitigate the negative impact of the payor changes within our Pediatric Portfolio, which we believe we will be successful in addressing, we are excited about the overall trajectory of the business as we finish fiscal 2024,” Mr. Disbrow concluded.

Non-Core Business Update

In June 2023, the Company announced that it had instituted a strategic mandate focusing its business solely on its Rx Segment, in an effort to drive long-term stockholder value. The Company has generated positive adjusted EBITDA for fiscal 2023 and for seven of the last reported eight quarters for Rx, excluding the Consumer Health Segment and pipeline R&D (the “Rx Business”). This concentration on the Rx Segment will result in discontinuing the Consumer Health Segment altogether.

This goal of emphasizing profitability was initially started with the indefinite suspension of all pipeline clinical development programs announced in October 2022 to minimize research and development expense until such time that the Company can fund those efforts with internally generated cash flows or through partnerships. During fiscal 2023, the Consumer Health Segment contributed adjusted EBITDA of negative $3.6 million and pipeline programs contributed adjusted EBITDA of negative $2.6 million, while the Company's Rx Business contributed adjusted EBITDA of positive $9.7 million. Over the Trailing Twelve-Month (“TTM”) period ending March 31, 2024, the Company’s Rx Business contributed operating income of $7.3 million and adjusted EBITDA of positive $17.1 million.

Segment Reporting

|

|

|

Three Months Ended

|

|

|

|

|

March 31,

|

|

|

|

|

2024

|

|

|

2023

|

|

|

|

|

(in thousands)

|

|

|

Consolidated net revenue:

|

|

|

|

|

|

|

|

Rx Segment

|

|

$ |

14,025 |

|

|

$ |

13,805 |

|

|

Consumer Health Segment

|

|

|

3,968 |

|

|

|

8,928 |

|

|

Total consolidated net revenue

|

|

$ |

17,993 |

|

|

$ |

22,733 |

|

|

|

|

|

|

|

|

|

|

Rx Segment net revenue:

|

|

|

|

|

|

|

|

ADHD Portfolio

|

|

$ |

12,326 |

|

|

$ |

8,272 |

|

|

Pediatric Portfolio

|

|

|

1,729 |

|

|

|

5,266 |

|

|

Other*

|

|

|

(30 |

) |

|

|

267 |

|

|

Total Rx Segment net revenue

|

|

$ |

14,025 |

|

|

$ |

13,805 |

|

*Other includes discontinued or deprioritized products.

Q3 2024 Financial Results

Net revenue for the third quarter of fiscal 2024 was $18.0 million, compared to $22.7 million for the prior year period.

Net revenue from the Rx Segment in the third quarter of fiscal 2024 was $14.0 million compared to $13.8 million in the prior year period. The ADHD Portfolio (Adzenys XR-ODT® and Cotempla XR-ODT®) experienced a 49% increase in net revenue to $12.3 million in the third quarter of fiscal 2024, compared to the prior year period. The Pediatric Portfolio (Poly-Vi-Flor®, Tri-Vi-Flor®, and Karbinal® ER) net revenue decreased to $1.7 million due to customer ordering timing as a result of payor changes that impacted scripts.

Net revenue from the Consumer Health Segment was $4.0 million in the third quarter of fiscal 2024, a decrease of 56% over the same quarter last year. As previously announced, the Company is winding down its Consumer Health Segment with the objective of discontinuing this segment to improve operating cash flows to drive long-term stockholder value.

Consolidated gross profit was $11.7 million, or 65% of net revenue, in the third quarter of fiscal 2024, compared to $12.7 million, or 56% of net revenue, in the same quarter last year. Gross profit margin for the Rx Segment was 74% in the third quarter of fiscal 2024, compared with 61% in the prior year period.

Operating expenses, excluding amortization of intangible assets, restructurings costs, and gain from contingent consideration, were $12.6 million in the third quarter of fiscal 2024 compared to $20.8 million in the prior year period. The decrease was a result of reduced Consumer Health spending and improved operational efficiencies.

Loss from operations during the third quarter of fiscal 2024 was $2.5 million compared to $8.6 million in the prior year period.

Net loss during the third quarter of fiscal 2024 was $2.9 million, or $0.52 per share, compared to a $7.2 million net loss, or $1.93 per share, in the prior year period. The fiscal 2024 third quarter results were impacted by $0.2

million of costs associated with the previously announced winding down of the manufacturing facility.

Adjusted EBITDA was positive $0.4 million in the third quarter of fiscal 2024, compared to negative $6.5 million in the prior year period, a $7.0 million improvement. Adjusted EBITDA for the Rx Business was positive $0.9 million in the third quarter of fiscal 2024, compared to negative $4.7 million in the prior year period, a $5.6 million improvement.

Cash and cash equivalents at March 31, 2023, were $19.8 million compared to $19.5 million at December 31, 2023.

Conference Call Details

Date and Time: Wednesday, May 15, 2024, at 4:30 p.m. Eastern time.

Call-in Information: Interested parties can access the conference call by dialing (888) 506-0062 for U.S. callers or +1 (973) 528-0011 for international callers and using the participant access code 300411.

Webcast Information: The webcast will be accessible live and archived at https://www.webcaster4.com/Webcast/Page/2142/50379, and accessible on the Investors section of the Company’s website at https://investors.aytubio.com/ under Events & Presentations.

Replay: A teleconference replay of the call will be available until May 29, 2024 at (877) 481-4010 for U.S. callers or +1 (919) 882-2331 for international callers and using replay access code 50379.

About Aytu BioPharma, Inc.

Aytu is a pharmaceutical company focused on commercializing novel therapeutics. The Company's prescription products include Adzenys XR-ODT® (amphetamine) extended-release orally disintegrating tablets (see Full Prescribing Information, including Boxed WARNING) and Cotempla XR-ODT® (methylphenidate) extended-release orally disintegrating tablets (see Full Prescribing Information, including Boxed WARNING) for the treatment of attention deficit hyperactivity disorder (ADHD), Karbinal® ER (carbinoxamine maleate), an extended-release antihistamine suspension indicated to treat numerous allergic conditions, and Poly-Vi-Flor® and Tri-Vi-Flor®, two complementary fluoride-based prescription vitamin product lines available in various formulations for infants and children with fluoride deficiency. To learn more, please visit aytubio.com.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). All statements other than statements of historical facts contained in this press release, are forward-looking statements. Forward-looking statements are generally written in the future tense and/or are preceded by words such as “may,” “will,” “should,” “forecast,” “could,” “expect,” “suggest,” “believe,” “estimate,” “continue,” “anticipate,” “intend,” “plan,” or similar words, or the negatives of such terms or other variations on such terms or comparable terminology. All statements other than statements of historical facts contained in this presentation, are forward-looking statements. These statements are predictions and are subject to risks and uncertainties that could cause the actual events or results to differ materially. These risks and uncertainties include, among others, risks associated with: the Company's plans relating to the Company's ability to efficiently wind down the Consumer Health Segment, the Company's ability to complete the manufacturing transfer of Adzenys XR-ODT® and Cotempla XR-ODT®, the Company's overall financial and operational performance, potential adverse changes to the Company's financial position or our business, the results of operations, strategy and plans, changes in capital markets and the ability of the Company to finance operations in the manner expected, risks relating to gaining market acceptance of our products, our partners performing their required activities, our anticipated future cash position, regulatory and compliance challenges and future events under current and potential future collaborations. We also refer you to (i) the risks described in “Risk Factors” in Part I, Item 1A of our most recent Annual Report on Form 10‑K and in the other reports and documents it files with the Securities and Exchange Commission.

Footnote 1

Aytu uses the term adjusted EBITDA, which is a term not defined under United States generally accepted accounting principles (“U.S. GAAP”). The Company uses this term because it is a widely accepted financial indicator utilized to analyze and compare companies on the basis of operating performance. The Company believes that presenting adjusted EBITDA by certain categories allows investors to evaluate the various performance of these categories. The Company's method of computation of adjusted EBITDA may or may not be comparable to other similarly titled measures used by other companies. We believe that net income (loss) is the performance measure calculated and presented in accordance with U.S. GAAP that is most directly comparable to adjusted EBITDA. See below for a reconciliation of net income (loss) to adjusted EBITDA.

Contacts for Investors

Mark Oki, Chief Financial Officer

Aytu BioPharma, Inc.

moki@aytubio.com

Robert Blum or Roger Weiss

Lytham Partners

aytu@lythampartners.com

Aytu BioPharma, Inc.

Unaudited Consolidated Statements of Operations

(in thousands, except per share data)

|

|

|

Three Months Ended

|

|

|

|

|

March 31,

|

|

|

|

|

2024

|

|

|

2023

|

|

|

Net revenue

|

|

$ |

17,993 |

|

|

$ |

22,733 |

|

|

Cost of sales

|

|

|

6,300 |

|

|

|

9,990 |

|

|

Gross profit

|

|

|

11,693 |

|

|

|

12,743 |

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Selling and marketing

|

|

|

6,549 |

|

|

|

12,804 |

|

|

General and administrative

|

|

|

5,442 |

|

|

|

7,177 |

|

|

Research and development

|

|

|

619 |

|

|

|

856 |

|

|

Amortization of intangible assets

|

|

|

1,303 |

|

|

|

1,198 |

|

|

Restructuring costs

|

|

|

244 |

|

|

|

— |

|

|

Gain from contingent consideration

|

|

|

— |

|

|

|

(734 |

) |

|

Total operating expenses

|

|

|

14,157 |

|

|

|

21,301 |

|

|

Loss from operations

|

|

|

(2,464 |

) |

|

|

(8,558 |

) |

|

Other expense, net

|

|

|

(1,195 |

) |

|

|

(1,215 |

) |

|

Gain on derivative warrant liabilities

|

|

|

1,017 |

|

|

|

2,573 |

|

|

Loss before income tax

|

|

|

(2,642 |

) |

|

|

(7,200 |

) |

|

Income tax expense

|

|

|

(245 |

) |

|

|

— |

|

|

Net loss

|

|

$ |

(2,887 |

) |

|

$ |

(7,200 |

) |

|

|

|

|

|

|

|

|

|

Basic and diluted weighted-average common shares outstanding

|

|

|

5,533,555 |

|

|

|

3,726,779 |

|

|

Basic and diluted net loss per common share

|

|

$ |

(0.52 |

) |

|

$ |

(1.93 |

) |

Aytu BioPharma, Inc.

Unaudited Consolidated Balance Sheets

(in thousands, except share data)

|

|

|

March 31,

|

|

|

June 30,

|

|

|

|

|

2024

|

|

|

2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

19,760 |

|

|

$ |

22,985 |

|

|

Accounts receivable, net

|

|

|

29,925 |

|

|

|

28,937 |

|

|

Inventories

|

|

|

13,193 |

|

|

|

11,995 |

|

|

Prepaid expenses

|

|

|

7,249 |

|

|

|

8,047 |

|

|

Other current assets

|

|

|

1,003 |

|

|

|

868 |

|

|

Total current assets

|

|

|

71,130 |

|

|

|

72,832 |

|

|

Non-current assets:

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

967 |

|

|

|

1,815 |

|

|

Operating lease right-of-use assets

|

|

|

1,795 |

|

|

|

2,054 |

|

|

Intangible assets, net

|

|

|

54,082 |

|

|

|

58,970 |

|

|

Other non-current assets

|

|

|

889 |

|

|

|

792 |

|

|

Total non-current assets

|

|

|

57,733 |

|

|

|

63,631 |

|

|

Total assets

|

|

$ |

128,863 |

|

|

$ |

136,463 |

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

10,475 |

|

|

$ |

13,478 |

|

|

Accrued liabilities

|

|

|

44,091 |

|

|

|

46,799 |

|

|

Short-term line of credit

|

|

|

1,581 |

|

|

|

1,563 |

|

|

Current portion of debt

|

|

|

15,135 |

|

|

|

85 |

|

|

Current portion of derivative warrant liabilities

|

|

|

3,261 |

|

|

|

— |

|

|

Other current liabilities

|

|

|

9,146 |

|

|

|

7,090 |

|

|

Total current liabilities

|

|

|

83,689 |

|

|

|

69,015 |

|

|

Non-current liabilities:

|

|

|

|

|

|

|

|

Debt, net of current portion

|

|

|

— |

|

|

|

14,713 |

|

|

Derivative warrant liabilities

|

|

|

8,609 |

|

|

|

6,403 |

|

|

Other non-current liabilities

|

|

|

5,788 |

|

|

|

6,975 |

|

|

Total non-current liabilities

|

|

|

14,397 |

|

|

|

28,091 |

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, par value $.0001; 50,000,000 shares authorized; no shares issued or outstanding

|

|

|

— |

|

|

|

— |

|

|

Common stock, par value $.0001; 200,000,000 shares authorized; 5,567,909 and 5,517,174 shares issued and outstanding, respectively

|

|

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital

|

|

|

346,132 |

|

|

|

343,485 |

|

|

Accumulated deficit

|

|

|

(315,356 |

) |

|

|

(304,129 |

) |

|

Total stockholders' equity

|

|

|

30,777 |

|

|

|

39,357 |

|

|

Total liabilities and stockholders' equity

|

|

$ |

128,863 |

|

|

$ |

136,463 |

|

Aytu BioPharma, Inc.

Unaudited Reconciliation of Net Loss to Adjusted EBITDA

(in thousands)

|

|

|

For the Three Months Ended March 31, 2024

|

|

| |

|

Rx Business

|

|

|

Consumer Health

|

|

|

Pipeline R&D

|

|

|

Consolidated

|

|

|

Net loss - GAAP

|

|

$ |

(1,876 |

) |

|

$ |

(875 |

) |

|

$ |

(136 |

) |

|

$ |

(2,887 |

) |

|

Depreciation and amortization

|

|

|

1,449 |

|

|

|

385 |

|

|

|

— |

|

|

|

1,834 |

|

|

Stock-based compensation expense

|

|

|

699 |

|

|

|

112 |

|

|

|

— |

|

|

|

811 |

|

|

Other expense, net

|

|

|

1,187 |

|

|

|

8 |

|

|

|

— |

|

|

|

1,195 |

|

|

Gain on derivative warrant liabilities

|

|

|

(1,017 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1,017 |

) |

|

Income tax expense

|

|

|

245 |

|

|

|

— |

|

|

|

— |

|

|

|

245 |

|

|

Restructuring costs

|

|

|

244 |

|

|

|

— |

|

|

|

— |

|

|

|

244 |

|

|

Adjusted EBITDA - non-GAAP

|

|

$ |

931 |

|

|

$ |

(370 |

) |

|

$ |

(136 |

) |

|

$ |

425 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended March 31, 2023

|

|

| |

|

Rx Business

|

|

|

Consumer Health

|

|

|

Pipeline R&D

|

|

|

Consolidated

|

|

|

Net loss - GAAP

|

|

$ |

(5,376 |

) |

|

$ |

(1,423 |

) |

|

$ |

(401 |

) |

|

$ |

(7,200 |

) |

|

Depreciation and amortization

|

|

|

1,563 |

|

|

|

280 |

|

|

|

— |

|

|

|

1,843 |

|

|

Stock-based compensation expense

|

|

|

788 |

|

|

|

114 |

|

|

|

13 |

|

|

|

915 |

|

|

Gain from contingent consideration

|

|

|

(345 |

) |

|

|

(389 |

) |

|

|

— |

|

|

|

(734 |

) |

|

Other expense (income), net

|

|

|

1,229 |

|

|

|

(14 |

) |

|

|

— |

|

|

|

1,215 |

|

|

Gain on derivative warrant liabilities

|

|

|

(2,573 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,573 |

) |

|

Adjusted EBITDA - non-GAAP

|

|

$ |

(4,714 |

) |

|

$ |

(1,432 |

) |

|

$ |

(388 |

) |

|

$ |

(6,534 |

) |

Aytu BioPharma, Inc.

Unaudited Reconciliation of Trailing Twelve-Month Net Income (Loss) to Adjusted EBITDA

(in thousands)

|

Companywide:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

|

|

|

|

|

|

| |

|

March 31,

2024

|

|

|

December 31,

2023

|

|

|

September 30,

2023

|

|

|

June 30,

2023

|

|

|

Total TTM

|

|

|

Net loss - GAAP

|

|

$ |

(2,887 |

) |

|

$ |

(220 |

) |

|

$ |

(8,120 |

) |

|

$ |

(2,457 |

) |

|

$ |

(13,684 |

) |

|

Depreciation and amortization

|

|

|

1,834 |

|

|

|

1,899 |

|

|

|

1,941 |

|

|

|

1,836 |

|

|

|

7,510 |

|

|

Stock-based compensation expense

|

|

|

811 |

|

|

|

820 |

|

|

|

930 |

|

|

|

899 |

|

|

|

3,460 |

|

|

Other expense, net

|

|

|

1,195 |

|

|

|

1,179 |

|

|

|

709 |

|

|

|

1,252 |

|

|

|

4,335 |

|

|

(Gain) loss on derivative warrant liabilities

|

|

|

(1,017 |

) |

|

|

577 |

|

|

|

5,907 |

|

|

|

1,374 |

|

|

|

6,841 |

|

|

Income tax expense

|

|

|

245 |

|

|

|

828 |

|

|

|

— |

|

|

|

— |

|

|

|

1,073 |

|

|

Restructuring costs

|

|

|

244 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

244 |

|

|

One-time transactions

|

|

|

— |

|

|

|

— |

|

|

|

851 |

|

|

|

— |

|

|

|

851 |

|

|

Gain from contingent consideration

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(465 |

) |

|

|

(465 |

) |

|

Impairment expense

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5,224 |

|

|

|

5,224 |

|

|

Adjusted EBITDA - non-GAAP

|

|

$ |

425 |

|

|

$ |

5,083 |

|

|

$ |

2,218 |

|

|

$ |

7,663 |

|

|

$ |

15,389 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rx Business:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the Three Months Ended

|

|

|

|

|

|

| |

|

March 31,

2024

|

|

|

December 31,

2023

|

|

|

September 30,

2023

|

|

|

June 30,

2023

|

|

|

Total TTM

|

|

|

Net (loss) income - GAAP

|

|

$ |

(1,876 |

) |

|

$ |

667 |

|

|

$ |

(7,321 |

) |

|

$ |

3,677 |

|

|

$ |

(4,853 |

) |

|

Depreciation and amortization

|

|

|

1,449 |

|

|

|

1,510 |

|

|

|

1,554 |

|

|

|

1,562 |

|

|

|

6,075 |

|

|

Stock-based compensation expense

|

|

|

699 |

|

|

|

707 |

|

|

|

725 |

|

|

|

784 |

|

|

|

2,915 |

|

|

Other expense, net

|

|

|

1,187 |

|

|

|

1,170 |

|

|

|

699 |

|

|

|

1,205 |

|

|

|

4,261 |

|

|

(Gain) loss on derivative warrant liabilities

|

|

|

(1,017 |

) |

|

|

577 |

|

|

|

5,907 |

|

|

|

(465 |

) |

|

|

5,002 |

|

|

Income tax expense

|

|

|

245 |

|

|

|

828 |

|

|

|

— |

|

|

|

— |

|

|

|

1,073 |

|

|

Restructuring costs

|

|

|

244 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

244 |

|

|

One-time transactions

|

|

|

— |

|

|

|

— |

|

|

|

851 |

|

|

|

— |

|

|

|

851 |

|

|

Loss from contingent consideration

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,374 |

|

|

|

1,374 |

|

|

Impairment expense

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

130 |

|

|

|

130 |

|

|

Adjusted EBITDA - non-GAAP

|

|

$ |

931 |

|

|

$ |

5,459 |

|

|

$ |

2,415 |

|

|

$ |

8,267 |

|

|

$ |

17,072 |

|

v3.24.1.1.u2

Document And Entity Information

|

May 15, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

AYTU BIOPHARMA, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 15, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38247

|

| Entity, Tax Identification Number |

47-0883144

|

| Entity, Address, Address Line One |

7900 E. Union Avenue

|

| Entity, Address, Address Line Two |

Suite 920

|

| Entity, Address, City or Town |

Denver

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

80237

|

| City Area Code |

720

|

| Local Phone Number |

437-6580

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AYTU

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001385818

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

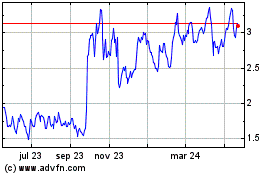

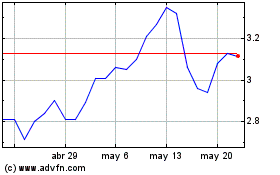

AYTU BioPharma (NASDAQ:AYTU)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

AYTU BioPharma (NASDAQ:AYTU)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024