BTCS Inc. (Nasdaq: BTCS) (“BTCS” or the “Company”), a blockchain

technology-focused company, announced its results for the fiscal

year ended December 31, 2022.

2022 Financial

Highlights

Revenue for fiscal year 2022 rose 39% to $1.7

million compared to $1.2 million in 2021.

Gross margins were 75% for fiscal year 2022,

compared to 78% during 2021.

In 2022, net loss decreased to $15.9 million

($1.25 per share) compared to $21.1 million ($3.09 per share) net

loss for 2021. BTCS’s net loss is primarily driven by non-cash

charges related to the impairment of crypto assets, because U.S.

Generally Accepted Accounting Principles requires BTCS to impair

its crypto assets to their lowest price since acquisition, with no

ability to mark-to-market if crypto prices rebound. Crypto asset

impairment charges during the fourth quarter of 2022 amounted to

$1.0 million, compared to $145,000 in the third quarter of 2022 and

$12.2 million in the first six months of 2022, highlighting the

impact of the crypto market’s decline throughout the year on our

financial statements. Crypto asset impairment for fiscal year 2022

totaled $13.3 million compared to $3.8 million in 2021.

The fair value of BTCS’s crypto assets totaled

$12.5 million as of December 31, 2022, however, crypto prices have

since rebounded and the fair value of our crypto assets was $18.8

million and together with our cash equate to approximately $1.37

per share as of March 28, 2023.

As of December 31, 2022, the Company had $2.1

million in cash.

Management Commentary

“Building on the momentum of staking our own

crypto assets over the past several years and through extensive

research and development in the necessary technology to create and

run validator nodes on a growing number of proof-of-stake

blockchains, we successfully completed the beta launch of our

innovative StakeSeeker platform in early January 2023,” said

Charles Allen, Chief Executive Officer of BTCS. “The launch of this

proprietary digital asset analytics and non-custodial

staking-as-a-service platform represents a significant step forward

for our organization.”

StakeSeeker is a comprehensive crypto dashboard

and education center for crypto asset holders to learn how to earn

crypto rewards by staking through its non-custodial Stake Hub and

evaluate their crypto portfolios across exchanges and wallets in a

single analytics platform. StakeSeeker sets itself apart by solving

the common problem of central tracking for crypto holdings stored

on various crypto exchanges and digital wallets, providing crypto

holders with an improved user experience and the ability to easily

track and analyze the performance of their entire portfolio. The

platform was developed to empower crypto holders, to self-custody

their crypto, and to better understand and grow their crypto asset

holdings with innovative portfolio analytics and a non-custodial

process to earn staking rewards through the direct participation in

blockchain consensus algorithms.

“Since launching StakeSeeker, we have continued

to expand its features and functionality, with a particular focus

on integrating new blockchain networks and improving user

experience,” added Michael Prevoznik, Chief Financial Officer of

BTCS. “We remain committed to growing StakeSeeker's user base and

building a strong delegator base on our validator nodes to provide

an attractive non-custodial staking option for crypto asset

holders. Our team is passionate about empowering users to keep

control of their crypto assets and make informed decisions with

respect to their crypto assets. We have developed in-depth

educational materials that emphasize the benefits of non-custodial

staking and the importance of self-custody of assets.”

“At BTCS, we recognize that blockchain

technologies are still emerging, and we remain committed to being

at the forefront of the industry’s ongoing evolution,” continued

Allen, “As such, we continue to invest time and resources into

educating the public on emerging blockchain technologies, the

benefits of self-custody of crypto assets, and the importance of

secure staking practices. We firmly believe in the transformational

potential of blockchain technologies and passionately advocate for

its increasing use in both the private and public sectors. We are

optimistic about the future and excited to continue driving new

innovations that strengthen long-term shareholder value.”

Industry and

Business Highlights

The recent failures of Silicon Valley Bank,

Silvergate, and Signature Bank have had a significant impact on

both the crypto and financial markets, sparking a shift in capital

flows as people look for alternative places to store their wealth.

BTC and ETH in particular have shone brightly in this market

environment, providing signs of optimism in the sector following

FTX's recent collapse.

BTCS believes the failure of FTX as well as

recent actions taken by the SEC against Kraken and ongoing

investigations into crypto's classification as securities

underscore the need for greater regulatory clarity and transparency

in the crypto market. Importantly, the Company's StakeSeeker

platform, a non-custodial staking-as-a-service solution, differs

materially from other industry staking programs such as Kraken's

custodial model.

In non-custodial staking, users retain control

over their crypto assets and directly participate in the network’s

consensus mechanism by staking their crypto and earning rewards. In

contrast, centralized staking, such as that employed by Kraken and

other exchanges, involves entrusting a third-party with your crypto

assets. While centralized staking may seem convenient, they often

come with significant undisclosed risks, such as hacking, theft,

and going bankrupt.

“As the crypto industry continues to grow and

mature, it is vital that we maintain a clear understanding of the

differences between non-custodial and centralized staking,”

continued Allen. “By doing so, we can ensure the general public is

informed and make wise decisions about how they participate in

consensus mechanisms and earn rewards.”

About BTCS:

BTCS Inc. is a Nasdaq listed company operating

in the blockchain technology space since 2014 and is one of the

first U.S. publicly traded companies with a primary focus on

blockchain infrastructure and staking. BTCS secures and operates

validator nodes on disruptive next-generation blockchain networks

that power Web 3, earning native token rewards by staking our

proof-of-stake crypto assets. “StakeSeeker” is BTCS’ newly

introduced proprietary Cryptocurrency Dashboard and

Staking-as-a-Service platform, developed to empower users to better

understand and grow their crypto holdings with innovative portfolio

analytics and a non-custodial process to earn staking rewards on

crypto asset holdings. Users can easily link and monitor their

cryptocurrency portfolios across exchanges, wallets, validator

nodes, and other sources; and have access to a suite of data

analytic tools such as performance and reward tracking.

StakeSeeker’s Staking Hub allows users to earn rewards by directly

participating in network consensus mechanisms by staking and

delegating their cryptocurrencies to company-operated validator

nodes for a growing number of supported blockchains. As a

non-custodial validator operator, BTCS receives a percentage of

token holders staking rewards generated as a validator node fee,

creating the potential opportunity for a highly scalable business

with limited additional costs. For more information visit:

www.btcs.com.

Forward-Looking Statements:

Certain statements in this press release,

constitute “forward-looking statements” within the meaning of the

federal securities laws including statements regarding the growth

of our StakeSeeker use base, our beliefs regarding the

transformational potential of blockchain technologies and the

optimism regarding delivering shareholder value. Words such as

“may,” “might,” “will,” “should,” “believe,” “expect,”

“anticipate,” “estimate,” “continue,” “predict,” “forecast,”

“project,” “plan,” “intend” or similar expressions, or statements

regarding intent, belief, or current expectations, are

forward-looking statements. While the Company believes these

forward-looking statements are reasonable, undue reliance should

not be placed on any such forward-looking statements, which are

based on information available to us on the date of this release.

These forward-looking statements are based upon current estimates

and assumptions and are subject to various risks and uncertainties,

including without limitation regulatory issues unexpected issues

with our proprietary Digital Asset Analytic and

Staking-as-a-Service Platform: StakeSeeker, regulatory issues, and

the reluctance of users to try or accept our product, as well as

risks set forth in the Company’s filings with the Securities and

Exchange Commission including its Form 10-K for the year ended

December 31, 2022 which was filed on March 31, 2023. Thus, actual

results could be materially different. The Company expressly

disclaims any obligation to update or alter statements, whether as

a result of new information, future events or otherwise, except as

required by law.

Investor Relations:ir@btcs.com

Public Relations: Mercy Chikoworem.chikowore@btcs.com

Financials

The tables below are derived from the Company’s

financial statements included in its Form 10-K filed on March 31,

2023, with the Securities and Exchange Commission. Please refer to

the Form 10-K for complete financial statements and further

information regarding the Company’s results of operations and

financial condition relating to the fiscal quarter and fiscal year

ended December 31, 2022 and 2021. The Company’s Form 10-K also

includes a discussion of risk factors applicable to the Company and

its business.

BTCS Inc.Balance

Sheets

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

| Assets: |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

2,146,783 |

|

|

$ |

1,400,867 |

|

| Crypto assets |

|

|

982 |

|

|

|

3,117,360 |

|

| Investments, at value (Cost

$100,000) |

|

|

100,000 |

|

|

|

- |

|

| Staked crypto assets |

|

|

1,826,307 |

|

|

|

623,754 |

|

| Prepaid expense |

|

|

123,727 |

|

|

|

324,551 |

|

| Total current assets |

|

|

4,197,799 |

|

|

|

5,466,532 |

|

| |

|

|

|

|

|

|

|

|

| Other assets: |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

11,152 |

|

|

|

9,783 |

|

| Staked crypto assets |

|

|

5,708,624 |

|

|

|

8,625,678 |

|

| Total other assets |

|

|

5,719,776 |

|

|

|

8,635,461 |

|

| |

|

|

|

|

|

|

|

|

| Total

Assets |

|

$ |

9,917,575 |

|

|

$ |

14,101,993 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued

expense |

|

$ |

76,727 |

|

|

$ |

138,716 |

|

| Accrued compensation |

|

|

295,935 |

|

|

|

7,334 |

|

| Warrant liabilities |

|

|

213,750 |

|

|

|

1,852,500 |

|

| Total current liabilities |

|

|

586,412 |

|

|

|

1,998,550 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

| Common stock, 97,500,000

shares authorized at $0.001 par value, 13,107,149 and 10,528,212

shares issued and outstanding at December 31, 2022 and 2021,

respectively |

|

|

13,108 |

|

|

|

10,529 |

|

| Additional paid in

capital |

|

|

160,800,263 |

|

|

|

147,682,384 |

|

| Accumulated deficit |

|

|

(151,482,208 |

) |

|

|

(135,589,470 |

) |

| Total stockholders'

equity |

|

|

9,331,163 |

|

|

|

12,103,443 |

|

| |

|

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders' Equity |

|

$ |

9,917,575 |

|

|

$ |

14,101,993 |

|

BTCS Inc.Statements of

Operations

| |

|

For the Year Ended |

|

| |

|

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

| Revenues |

|

|

|

|

|

|

|

|

|

Validator revenue (net of fees) |

|

$ |

1,692,454 |

|

|

$ |

1,213,284 |

|

|

Total revenues |

|

|

1,692,454 |

|

|

|

1,213,284 |

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

|

|

|

|

|

|

|

Validator expense |

|

|

426,440 |

|

|

$ |

268,346 |

|

|

Gross profit |

|

|

1,266,014 |

|

|

|

944,938 |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

General and administrative |

|

$ |

1,916,193 |

|

|

$ |

1,590,707 |

|

|

Research and development |

|

|

611,758 |

|

|

|

712,736 |

|

|

Compensation and related expenses |

|

|

3,313,638 |

|

|

|

15,583,258 |

|

|

Marketing |

|

|

78,171 |

|

|

|

180,290 |

|

|

Impairment loss on crypto assets |

|

|

13,348,874 |

|

|

|

3,845,899 |

|

|

Realized gains on crypto asset transactions |

|

|

(506,757 |

) |

|

|

(3,054,418 |

) |

|

Total operating expenses |

|

|

18,761,877 |

|

|

|

18,858,472 |

|

| |

|

|

|

|

|

|

|

|

| Other income (expenses): |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

- |

|

|

|

(186,740 |

) |

|

Amortization on debt discount |

|

|

- |

|

|

|

(1,868,059 |

) |

|

Change in fair value of warrant liabilities |

|

|

1,638,750 |

|

|

|

3,918,750 |

|

|

Distributions to warrant holders |

|

|

(35,625 |

) |

|

|

- |

|

|

Total other income (expenses) |

|

|

1,603,125 |

|

|

|

1,863,951 |

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(15,892,738 |

) |

|

$ |

(16,049,583 |

) |

| Deemed dividends related to

amortization of beneficial conversion feature of Series C-2

convertible preferred stock |

|

|

- |

|

|

|

(45,541 |

) |

| Deemed dividends related to

recognition of downround adjustment to conversion amount for Series

C-2 convertible preferred stock |

|

|

- |

|

|

|

(5,020,883 |

) |

| Net loss attributable

to common stockholders |

|

$ |

(15,892,738 |

) |

|

$ |

(21,116,007 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders, basic and

diluted |

|

$ |

(1.25 |

) |

|

$ |

(3.09 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average

number of common shares outstanding, basic and

diluted |

|

|

12,732,914 |

|

|

|

6,840,665 |

|

BTCS Inc.Statements of

Cash Flows

| |

|

For the Year Ended |

|

| |

|

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

| Net Cash flows used

from operating activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(15,892,738 |

) |

|

$ |

(16,049,583 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation expense |

|

|

4,039 |

|

|

|

939 |

|

|

Amortization on debt discount |

|

|

- |

|

|

|

1,868,059 |

|

|

Stock-based compensation |

|

|

2,625,270 |

|

|

|

15,490,555 |

|

|

Stock-based compensation in connection with issuance of Series C-2

convertible preferred stock |

|

|

- |

|

|

|

179,277 |

|

|

Validator revenue |

|

|

(1,692,454 |

) |

|

|

(1,213,284 |

) |

|

Blockchain network fees (non-cash) |

|

|

1,321 |

|

|

|

- |

|

|

Change in fair value of warrant liabilities |

|

|

(1,638,750 |

) |

|

|

(3,918,750 |

) |

|

Purchase of non-productive crypto assets |

|

|

- |

|

|

|

(5,761,550 |

) |

|

Sale of non-productive crypto assets |

|

|

2,547,325 |

|

|

|

4,274,491 |

|

|

Realized gain on crypto asset transactions |

|

|

(506,757 |

) |

|

|

(3,054,418 |

) |

|

Impairment loss on crypto assets |

|

|

13,348,874 |

|

|

|

3,845,899 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets |

|

|

200,824 |

|

|

|

(292,676 |

) |

|

Accounts payable and accrued expenses |

|

|

(62,332 |

) |

|

|

112,428 |

|

|

Accrued compensation |

|

|

288,601 |

|

|

|

(343,042 |

) |

| Net cash used in operating

activities |

|

|

(776,777 |

) |

|

|

(4,861,655 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash used in

investing activities: |

|

|

|

|

|

|

|

|

|

Purchase of productive crypto assets for validating |

|

|

(9,453,024 |

) |

|

|

(9,462,279 |

) |

|

Sale of productive crypto assets |

|

|

585,595 |

|

|

|

- |

|

|

Purchase of investments |

|

|

(100,000 |

) |

|

|

- |

|

|

Purchase of property and equipment |

|

|

(5,408 |

) |

|

|

(10,491 |

) |

| Net cash used in investing

activities |

|

|

(8,972,837 |

) |

|

|

(9,472,770 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash provided by

financing activities: |

|

|

|

|

|

|

|

|

|

Dividend distributions |

|

|

(630,801 |

) |

|

|

- |

|

|

Proceeds from exercise of warrants |

|

|

- |

|

|

|

400,000 |

|

|

Proceeds from issuance of Series C-2 convertible preferred

stock |

|

|

- |

|

|

|

1,100,000 |

|

|

Net proceeds from issuance of convertible notes |

|

|

- |

|

|

|

1,000,000 |

|

|

Net proceeds from issuance of common stock and warrants for

cash |

|

|

- |

|

|

|

8,865,000 |

|

|

Net proceeds from issuance of common stock |

|

|

- |

|

|

|

3,014,005 |

|

|

Net proceeds from issuance common stock/ At-the-market

offering |

|

|

11,126,331 |

|

|

|

2,832,152 |

|

|

Payment to convertible notes principle |

|

|

- |

|

|

|

(2,000,000 |

) |

| Net cash provided by financing

activities |

|

|

10,495,530 |

|

|

|

15,211,157 |

|

| |

|

|

|

|

|

|

|

|

| Net increase in cash |

|

|

745,916 |

|

|

|

876,732 |

|

| Cash, beginning of period |

|

|

1,400,867 |

|

|

|

524,135 |

|

| Cash, end of period |

|

$ |

2,146,783 |

|

|

$ |

1,400,867 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Supplemental

disclosure of non-cash financing and investing

activities: |

|

|

|

|

|

|

|

|

|

Deemed dividends related to amortization of beneficial conversion

feature of Series C-2 convertible preferred stock |

|

$ |

- |

|

|

$ |

45,541 |

|

|

Deemed dividends related to recognition of downround adjustment to

conversion amount for Series C-2 convertible preferred stock |

|

$ |

- |

|

|

$ |

5,020,883 |

|

|

Conversion of Series C-1 Preferred Stock |

|

$ |

- |

|

|

$ |

20 |

|

|

Conversion of Series C-2 Preferred Stock |

|

$ |

- |

|

|

$ |

6,216,289 |

|

|

Beneficial conversion feature of Series C-2 convertible preferred

stock |

|

$ |

- |

|

|

$ |

129,412 |

|

|

Beneficial conversion features associated with convertible notes

payable |

|

$ |

- |

|

|

$ |

1,000,000 |

|

|

Dividends payable |

|

$ |

- |

|

|

$ |

- |

|

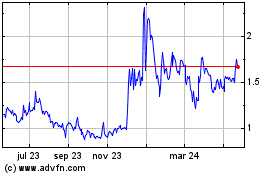

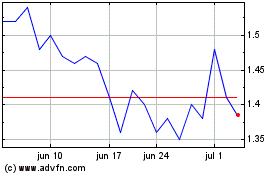

BTCS (NASDAQ:BTCS)

Gráfica de Acción Histórica

De Oct 2024 a Oct 2024

BTCS (NASDAQ:BTCS)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024