CB Financial Services, Inc. (“CB” or the “Company”) (NASDAQGM:

CBFV), the holding company of Community Bank (the “Bank”) and

Exchange Underwriters, Inc. (“EU”), a wholly-owned insurance

subsidiary of the Bank, today announced its fourth quarter and 2022

financial results.

Three Months Ended

Year Ended

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

12/31/22

12/31/21

(Dollars in thousands, except per share

data) (Unaudited)

Net Income (GAAP)

$

4,152

$

3,929

$

118

$

3,047

$

6,965

$

11,247

$

11,570

Non-Recurring Items

(66

)

(310

)

157

12

(4,122

)

(208

)

(1,053

)

Adjusted Net Income (Non-GAAP) (1)

$

4,086

$

3,619

$

275

$

3,059

$

2,843

$

11,039

$

10,517

Earnings per Common Share - Diluted

(GAAP)

$

0.81

$

0.77

$

0.02

$

0.58

$

1.31

$

2.18

$

2.15

Adjusted Earnings per Common Share -

Diluted (Non-GAAP) (1)

$

0.80

$

0.71

$

0.05

$

0.59

$

0.53

$

2.14

$

1.95

(1) Refer to Explanation of Use of

Non-GAAP Financial Measures and reconciliation of adjusted net

income and adjusted earnings per common share - diluted in this

Press Release.

2022 Fourth Quarter Financial

Highlights

(Comparisons to three months ended December 31, 2021 unless

otherwise noted)

- Net income was $4.2 million, compared to net income of $7.0

million. Current period results were driven by net interest margin

expansion coupled with a reduction of noninterest expense of

$974,000 for the three months ended December 31, 2022 compared to

the three months ended December 31, 2021, which benefited from a

gain on sale of $5.2 million resulting from the sale of branch

locations.

- Adjusted net income (Non-GAAP) was $4.1 million, compared to

$2.8 million.

- Earnings per diluted common share (EPS) decreased to $0.81 from

$1.31.

- Adjusted earnings per common share - diluted (Non-GAAP) was

$0.80, compared to $0.53.

- Return on average assets (annualized) of 1.16%, compared to

1.87%.

- Adjusted return on average assets (annualized) (Non-GAAP) of

1.15%, compared to 0.76%.

- Return on average equity (annualized) of 15.26%, compared to

20.95% (annualized).

- Adjusted return on average equity (annualized) (Non-GAAP) of

15.01%, compared to 8.55%.

- Net interest margin (NIM) improved to 3.45% from 2.95%.

- Net interest and dividend income was $11.9 million, compared to

$10.2 million.

- Noninterest income decreased to $2.4 million, compared to $8.7

million. The prior year period benefited from the recognition of

$5.2 million in gain on sales of branches of two branch locations

as part of branch optimization initiatives while the current year

period included a decrease of income from net gain on sale of loans

of $977,000 primarily the result of the sale of a nonperforming

commercial real estate loan in the hotel portfolio. In addition, a

decrease of $219,000 in insurance commissions was primarily driven

by contingency income which resulted from the timing of lock-in

amounts recorded and was partially offset by an increase in core

business for commercial insurance lines.

(Amounts at December 31, 2022; comparisons to December 31,

2021, unless otherwise noted)

- Total loans, including Payroll Protection Program (“PPP”)

loans, were $1.05 billion, an increase of $29.1 million from $1.02

billion.

- Total loans held for investment, excluding PPP loans, increased

$53.5 million, or 5.4%, to $1.05 billion compared to $996.3

million, and included increases of $24.8 million, or 27.1%, in

consumer loans, and $44.7 million, or 15.2%, growth in commercial

real estate loans, partially offset by decreases of $40.1 million

in construction real estate and $19.0 million in commercial and

industrial loans. Total loans held for investment, excluding PPP

loans, as of December 31, 2022, increased $7.6 million, or 0.7%, as

compared to September 30, 2022. This included increases of $8.5

million, or 13.8%, in commercial and industrial loans, $4.3

million, or 1.0%, in commercial real estate loans, and $2.5

million, or 0.8%, in residential loans, partially offset by

decreases of $4.6 million, or 9.2%, in construction loans, and $3.7

million, or 2.4%, in consumer loans.

- Nonperforming loans to total loans was 0.55%, a decrease of 16

basis points (“bps”), compared to 0.71%.

- Total deposits were $1.27 billion, an increase of $41.9

million, compared to $1.23 billion.

- Total assets remained level at $1.43 billion.

- Book value per share was $21.60, compared to $20.94 as of

September 30, 2022 and $25.31 as of December 31, 2021.

- Tangible book value per share (Non-GAAP) was $19.00, compared

to $18.25 as of September 30, 2022 and $22.45 as of December 31,

2021, reflecting impact to Accumulated Other Comprehensive Income

from unrealized losses on securities portfolios.

Management Commentary

President and CEO John H. Montgomery stated, “In closing out

what was a successful 2022, our fourth quarter results continued to

benefit from margin expansion on top of consistent loan growth. Two

years ago we undertook a long term strategy that consisted of first

driving down our expenses in a durable manner by rationalizing our

physical branch footprint while also working to make sure our

operations were optimized and efficient. This effort set the stage

for the reduced the non-interest expenses we enjoyed throughout

2022. With our branch optimization largely completed, in 2022 we

turned our attention to driving growth through smart additions of

key leadership on both the retail and commercial sides of our

business. Those investments helped drive growth in our loan

portfolio through 2022 which coupled with rising interest rates to

yield growth in our net interest income.”

Mr. Montgomery continued, “We remain watchful with respect to

the overall economic climate as the Federal Reserve continues to

work to rein in inflation while not tipping the country into a

recession. As I have noted in the past, our credit team possesses a

wealth of experience, including demonstrated success during the

Great Financial Crisis just over a dozen years ago. With that

experience, we are confident in our ability to navigate whatever

macroeconomic headwinds we face.”

Mr. Montgomery concluded, “Continuing our commitment to CB

shareholders, we increased our regular quarterly dividend to $0.25

per share. In addition, we repurchased 4,620 shares during the

fourth quarter under the current $10.0 million share repurchase

program announced earlier in 2022. We remain well-capitalized with

the ability to support growth along with these shareholder-friendly

actions.”

Dividend Information

The Company’s Board of Directors has approved a 4.2% increase in

the regular quarterly cash dividend by declaring a $0.25 quarterly

cash dividend per outstanding share of common stock, payable on or

about February 28, 2023, to stockholders of record as of the close

of business on February 15, 2023.

Stock Repurchase Program

On April 21, 2022, CB announced a program to repurchase up to

$10.0 million of the Company’s outstanding shares of common stock.

Based on the Company’s closing stock price at January 23, 2023, the

repurchase program, if fully completed, would encompass 430,906

shares, or approximately 8.4% of the shares currently

outstanding.

2022 Fourth Quarter Financial

Review

Net Interest and Dividend

Income

Net interest and dividend income increased $1.6 million, or

16.0%, to $11.9 million for the three months ended December 31,

2022 compared to $10.2 million for the three months ended December

31, 2021.

- Net interest margin (GAAP) increased to 3.45% for the three

months ended December 31, 2022 compared to 2.95% for the three

months ended December 31, 2021. Fully Tax Equivalent (“FTE”) Net

interest margin (Non-GAAP) increased 50 bps to 3.46% for the three

months ended December 31, 2022 compared to 2.96% for the three

months ended December 31, 2021.

- Interest and dividend income increased $2.9 million, or 26.4%,

to $13.9 million for the three months ended December 31, 2022

compared to $11.0 million for the three months ended December 31,

2021.

- Interest income on loans increased $1.9 million, or 19.5%, to

$11.8 million for the three months ended December 31, 2022 compared

to $9.9 million for the three months ended December 31, 2021. The

average balance of loans increased $29.9 million to $1.03 billion

from $1.00 billion and the average yield increased 62 bps to 4.54%

compared to 3.92%. Interest and fee income on PPP loans was $22,000

for the three months ended December 31, 2022 and didn’t impact loan

yield, compared to $391,000 for the three months ended December 31,

2021, which contributed 4 bps to loan yield. The impact of the

accretion of the credit mark on acquired loan portfolios was

$61,000 for the three months ended December 31, 2022 compared to

$83,000 for the three months ended December 31, 2021, or 2 bps in

the current period compared to 3 bps in the prior period.

- Interest income on taxable investment securities increased

$108,000, or 12.5%, to $974,000 for the three months ended December

31, 2022 compared to $866,000 for the three months ended December

31, 2021 driven by a $11.6 million increase in average balance

partially coupled with a 11 bps increase in average yield.

- Interest expense increased $1.3 million, or 171.7%, to $2.0

million for the three months ended December 31, 2022 compared to

$732,000 for the three months ended December 31, 2021.

- Interest expense on deposits increased $1.2 million, or 184.7%,

to $1.8 million for the three months ended December 31, 2022

compared to $636,000 for the three months ended December 31, 2021.

While average interest-earning deposit balances decreased $7.2

million, or 0.8%, to $887.7 million as of December 31, 2022

compared to $894.8 million as of December 31, 2021, rising interest

rates led to the repricing of higher-cost demand and money market

deposits and resulted in a 53 bps, or 188.0%, increase in average

cost compared to the three months ended December 31, 2021. In

addition, the average balance of time deposits and the related

average cost decreased $38.2 million and 5 bps, respectively. These

decreases are partially offset by an increase in average other

borrowings of $8.1 million or 85.8% to $17.6 million as of December

31, 2022 compared to $9.5 million as of December 31, 2021, which

was driven by the issuance of subordinate debt of $15.0 million in

late December of 2021, and outstanding for the entire quarter ended

December 31, 2022.

Provision for Loan Losses

There was no provision for loan losses for the three months

ended December 31, 2022 or for the three months ended December 31,

2021.

Noninterest income

Noninterest income decreased $6.3 million, or 72.8%, to $2.4

million for the three months ended December 31, 2022, compared to

$8.7 million for the three months ended December 31, 2021. The

decrease was primarily related to non-recurring prior period

recognition of $5.2 million gain on sale of branches as a result of

branch optimization initiatives and $897,000 due to the sale of a

nonperforming commercial real estate loan in the hotel portfolio.

During the quarter, there was a $219,000 decrease in insurance

commissions. The decrease in insurance commissions was primarily

driven by contingency income which resulted from the timing of

lock-in amounts received and core business including commercial and

personal insurance lines.

Noninterest Expense

Noninterest expense decreased $974,000, or 9.8%, to $9.0 million

for the three months ended December 31, 2022 compared to $10.0

million for the three months ended December 31, 2021. Salaries and

benefits decreased $556,000 to $4.6 million and contracted services

decreased $728,000 to $405,000 for the three months ended December

31, 2022 compared to $1.1 million for the three months ended

December 31, 2021. This was a result of branch optimization

initiatives completed in the prior year. These decreases were

partially offset by an increase in occupancy expenses of

$198,000.

Statement of Financial Condition

Review

Assets

Total assets decreased $16.5 million, or 1.16%, to $1.41 billion

at both December 31, 2022, and December 31, 2021.

- Cash and due from banks decreased $16.0 million, or 13.3%, to

$103.7 million at December 31, 2022, compared to $119.7 million at

December 31, 2021.

- Securities decreased $34.9 million, or 15.5%, to $190.1 million

at December 31, 2022, compared to $225.0 million at December 31,

2021. The Securities balance was primarily impacted by a $32.3

million decrease in the market value of the debt securities

portfolio, primarily due to the increase in market interest rates.

The current year included $26.8 million of purchases, and $29.2

million of pay downs. The purchases were made to earn a higher

yield on excess cash. In addition, there was $168,000 decrease in

the market value in the equity securities portfolio, which is

primarily comprised of bank stocks.

Payroll Protection Program

Update

- PPP loans decreased $24.4 million to $126,000 at December 31,

2022 compared to $24.5 million at December 31, 2021.

- $5,000 of net PPP loan origination fees were unearned at

December 31, 2022 compared to $678,000 at December 31, 2021.

$22,000 of net PPP loan origination fees were earned in the three

months ended December 31, 2022 compared to $117,000 for the three

months ended September 30, 2022.

Loans and Credit Quality

- Total loans held for investment increased $29.1 million, or

2.85%, to $1.05 billion at December 31, 2022 compared to $1.02

billion at December 31, 2021. Excluding the net decline of $24.4

million in PPP loans in the current period, loans increased $53.5

million or 5.4%.

- The allowance for loan losses was $12.8 million at December 31,

2022 and $11.6 million at December 31, 2021. As a result, the

allowance for loan losses to total loans was 1.22% at December 31,

2022 compared to 1.13% at December 31, 2021. The allowance for loan

losses to total loans, excluding PPP loans, was 1.22% at December

31, 2022 compared to 1.16% at December 31, 2021. The change in the

allowance for loan losses was primarily due to adjustments to

historical loss factors and changes in qualitative factors in

particular economic and industry conditions since December 31,

2021.

- Net charge-offs for the three months ended December 31, 2022

were $35,000, or 0.01% of average loans on an annualized basis. Net

charge-offs for the three months ended December 31, 2021 were

$74,000, or 0.03% of average loans on an annualized basis. Net

charge-offs for the year ended December 31, 2022 were $2.5 million,

or 0.25% of average loans on an annualized basis. Net charge-offs

for the year ended December 31, 2021 were $64,000, and had an

immaterial and one hundredth effect on ratios for the period.

- Nonperforming loans, which includes nonaccrual loans, accruing

loans past due 90 days or more, and accruing loans that are

considered troubled debt restructurings, were $5.8 million at

December 31, 2022 compared to $7.3 million at December 31, 2021.

Current nonperforming loans to total loans ratio was 0.55% compared

to 0.71% at December 31, 2021.

Other

- Intangible assets decreased $1.8 million, or 34.0%, to $3.5

million at December 31, 2022 compared to $5.3 million at December

31, 2021 due to amortization expense recognized during the

period.

- Accrued interest receivable and other assets increased $8.3

million, or 64.5% to $21.1 million at December 31, 2022, compared

to $12.9 million at December 31, 2021. This change was primarily

driven by the increase in market interest rate conditions and an

increase in deferred tax assets of $7.5 million.

Liabilities

Total liabilities increased $6.4 million, or 0.5%, to $1.30

billion at December 31, 2022 compared to $1.29 billion at December

31, 2021.

Deposits

- Total deposits increased $41.9 million to $1.27 billion as of

December 31, 2022 compared to $1.23 billion at December 31, 2021,

an increase of 3.4%. Interest-bearing and non interest-bearing

demand deposits increased $39.3 million and $4.6 million,

respectively, partially offset by a decrease in time deposits of

$27.6 million. Average total deposits increased $45.9 million,

primarily in both interest-bearing and non interest-bearing demand

deposits for the three months ended December 31, 2022. The increase

in interest-bearing demand deposits is primarily the result of the

transition of customer deposits from securities sold under

agreements to repurchase product, which are related to business

deposit customers whose funds, above designated target balances,

are transferred into an overnight interest-earning investment

account by purchasing securities from the Bank’s investment

portfolio under an agreement to repurchase.

Borrowed Funds

- Short-term borrowings decreased $31.2 million, or 79.5%, to

$8.1 million at December 31, 2022, compared to $39.3 million at

December 31, 2021. At December 31, 2022 and December 31, 2021,

short-term borrowings were comprised entirely of securities sold

under agreements to repurchase as noted in the above-mentioned

deposit section. A portion of this decrease is due to accounts that

were transitioned into other deposit products and account for most

of the interest-bearing demand deposit increase.

Stockholders’ Equity

Stockholders’ equity decreased $23.0 million, or 17.3%, to

$110.2 million at December 31, 2022, compared to $133.1 million at

December 31, 2021. Key factors impacting stockholders’ equity

included accumulated other comprehensive loss, which increased

$25.3 million primarily due to the effect of rising market interest

rates on the Company’s investment securities; the payment of $4.9

million in dividends since December 31, 2021; and activity under

share repurchase programs, offset by the positive impact of $11.2

million of net income. On February 15, 2022, the Company completed

its stock repurchase program that was implemented on June 10, 2021.

On April 21, 2022, a new $10 million repurchase program was

authorized, with the Company repurchasing 62,178 shares at an

average price of $22.47 per share since the inception of the plan.

In total, the Company has repurchased $4.8 million since December

31, 2021.

Book value per share

Book value per common share was $21.60 at December 31, 2022

compared to $25.31 at December 31, 2021, a decrease of $3.71.

Tangible book value per common share (Non-GAAP) was $19.00 at

December 31, 2022, compared to $22.45 at December 31, 2021, a

decrease of $3.45.

Refer to “Explanation of Use of Non-GAAP Financial Measures” at

the end of this Press Release.

About CB Financial Services,

Inc.

CB Financial Services, Inc. is the bank holding company for

Community Bank, a Pennsylvania-chartered commercial bank. Community

Bank operates its branch network in southwestern Pennsylvania and

West Virginia. Community Bank offers a broad array of retail and

commercial lending and deposit services and provides commercial and

personal insurance brokerage services through Exchange

Underwriters, Inc., its wholly owned subsidiary.

For more information about CB Financial Services, Inc. and

Community Bank, visit our website at www.communitybank.tv.

Statement About Forward-Looking

Statements

Statements contained in this press release that are not

historical facts may constitute forward-looking statements as that

term is defined in the Private Securities Litigation Reform Act of

1995 and such forward-looking statements are subject to significant

risks and uncertainties. The Company intends such forward-looking

statements to be covered by the safe harbor provisions contained in

the Act. The Company’s ability to predict results or the actual

effect of future plans or strategies is inherently uncertain.

Factors which could have a material adverse effect on the

operations and future prospects of the Company and its subsidiaries

include, but are not limited to, general and local economic

conditions, the scope and duration of economic contraction as a

result of the COVID-19 pandemic and its effects on the Company’s

business and that of the Company’s customers, changes in market

interest rates, deposit flows, demand for loans, real estate values

and competition, competitive products and pricing, the ability of

our customers to make scheduled loan payments, loan delinquency

rates and trends, our ability to manage the risks involved in our

business, our ability to control costs and expenses, inflation,

market and monetary fluctuations, changes in federal and state

legislation and regulation applicable to our business, actions by

our competitors, and other factors that may be disclosed in the

Company’s periodic reports as filed with the Securities and

Exchange Commission. These risks and uncertainties should be

considered in evaluating forward-looking statements and undue

reliance should not be placed on such statements. The Company

assumes no obligation to update any forward-looking statements

except as may be required by applicable law or regulation.

CB FINANCIAL SERVICES,

INC.

SELECTED CONSOLIDATED

FINANCIAL INFORMATION

(Dollars in thousands, except share and

per share data) (Unaudited)

Selected Financial Condition

Data

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

Assets

Cash and Due From Banks

$

103,700

$

122,801

$

81,121

$

123,588

$

119,674

Securities

190,058

193,846

213,505

231,097

224,974

Loans

Real Estate:

Residential

330,725

328,248

325,138

317,254

320,798

Commercial

436,805

432,516

426,105

427,227

392,124

Construction

44,923

49,502

41,277

54,227

85,028

Commercial and Industrial

Commercial and Industrial

69,918

61,428

62,054

59,601

64,487

PPP

126

768

3,853

8,242

24,523

Consumer

146,927

150,615

148,921

143,422

122,152

Other

20,449

19,865

20,621

10,669

11,684

Total Loans

1,049,873

1,042,942

1,027,969

1,020,642

1,020,796

Allowance for Loan Losses

(12,819

)

(12,854

)

(12,833

)

(11,595

)

(11,582

)

Loans, Net

1,037,054

1,030,088

1,015,136

1,009,047

1,009,214

Premises and Equipment, Net

17,844

18,064

18,196

18,349

18,399

Bank-Owned Life Insurance

25,893

25,750

25,610

25,468

25,332

Goodwill

9,732

9,732

9,732

9,732

9,732

Intangible Assets, Net

3,513

3,959

4,404

4,850

5,295

Accrued Interest and Other Assets

21,144

21,680

18,757

16,539

12,859

Total Assets

$

1,408,938

$

1,425,920

$

1,386,461

$

1,438,670

$

1,425,479

Liabilities

Deposits

Non-Interest Bearing Demand Deposits

$

390,405

$

407,107

$

389,127

$

400,105

$

385,775

Interest Bearing Demand Accounts

311,825

298,755

265,347

280,455

272,518

Money Market Accounts

209,125

198,715

185,308

192,929

192,125

Savings Accounts

248,022

250,378

250,226

247,589

239,482

Time Deposits

109,126

120,879

125,182

129,235

136,713

Total Deposits

1,268,503

1,275,834

1,215,190

1,250,313

1,226,613

Short-Term Borrowings

8,060

18,108

32,178

39,219

39,266

Other Borrowings

14,638

17,627

17,618

17,607

17,601

Accrued Interest Payable and Other

Liabilities

7,582

7,645

7,703

9,375

8,875

Total Liabilities

1,298,783

1,319,214

1,272,689

1,316,514

1,292,355

Stockholders’ Equity

$

110,155

$

106,706

$

113,772

$

122,156

$

133,124

Total Liabilities and Stockholders’

Equity

$

1,408,938

$

1,425,920

$

1,386,461

$

1,438,670

$

1,425,479

(Dollars in thousands, except share and

per share data) (Unaudited)

Three Months Ended

Year Ended

Selected Operating Data

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

12/31/22

12/31/21

Interest and Dividend Income

Loans, Including Fees

$

11,835

$

10,815

$

9,733

$

9,551

$

9,904

$

41,933

$

39,704

Securities:

Taxable

974

985

988

905

866

3,852

2,990

Tax-Exempt

40

49

57

66

66

213

289

Dividends

28

21

20

22

21

91

84

Other Interest and Dividend Income

978

417

160

72

106

1,627

490

Total Interest and Dividend Income

13,855

12,287

10,958

10,616

10,963

47,716

43,557

Interest Expense

Deposits

1,811

1,079

604

530

636

4,025

3,125

Short-Term Borrowings

7

19

18

19

26

63

98

Other Borrowings

171

174

173

174

70

693

182

Total Interest Expense

1,989

1,272

795

723

732

4,781

3,405

Net Interest and Dividend Income

11,866

11,015

10,163

9,893

10,231

42,935

40,152

Provision (Recovery) for Loan Losses

—

—

3,784

—

75

3,784

(1,125

)

Net Interest and Dividend Income After

Provision (Recovery) for Loan Losses

11,866

11,015

6,379

9,893

10,156

39,151

41,277

Noninterest Income:

Service Fees

530

544

559

526

569

2,160

2,331

Insurance Commissions

1,399

1,368

1,369

1,798

1,618

5,934

5,616

Other Commissions

157

244

179

89

90

669

521

Net Gain on Sales of Loans

—

—

—

—

977

—

1,143

Net Gain (Loss) on Securities

83

(46

)

(199

)

(7

)

44

(168

)

526

Net Gain on Purchased Tax Credits

14

14

14

14

17

57

70

Gain on Sale of Branches

—

—

—

—

5,203

—

5,203

Net Gain (Loss) on Disposal of Fixed

Assets

—

439

—

(8

)

—

431

(3

)

Income from Bank-Owned Life Insurance

143

140

142

136

142

561

553

Other Income

34

36

41

65

29

176

320

Total Noninterest Income

2,360

2,739

2,105

2,613

8,689

9,820

16,280

Noninterest Expense:

Salaries and Employee Benefits

4,625

4,739

4,539

4,565

5,181

18,469

19,938

Occupancy

817

768

776

686

619

3,047

2,968

Equipment

178

170

182

210

252

739

1,034

Data Processing

681

540

446

485

488

2,152

2,154

FDIC Assessment

154

147

128

209

222

638

1,014

PA Shares Tax

258

240

240

240

173

979

887

Contracted Services

405

288

348

587

1,133

1,628

4,011

Legal and Professional Fees

362

334

389

152

206

1,237

994

Advertising

165

131

115

116

191

527

749

Other Real Estate Owned (Income)

(38

)

(38

)

(37

)

(38

)

(30

)

(151

)

(183

)

Amortization of Intangible Assets

446

445

446

445

445

1,782

1,926

Intangible Assets and Goodwill

Impairment

—

—

—

—

—

—

1,178

Writedown of Fixed Assets

—

—

—

—

23

—

2,293

Other

945

1,063

838

999

1,069

3,844

3,899

Total Noninterest Expense

8,998

8,827

8,410

8,656

9,972

34,891

42,862

Income Before Income Tax Expense

(Benefit)

5,228

4,927

74

3,850

8,873

14,080

14,695

Income Tax Expense (Benefit)

1,076

998

(44

)

803

1,908

2,833

3,125

Net Income

$

4,152

$

3,929

$

118

$

3,047

$

6,965

$

11,247

$

11,570

Three Months Ended

Year Ended

Per Common Share Data

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

12/31/22

12/31/21

Dividends Per Common Share

$

0.24

$

0.24

$

0.24

$

0.24

$

0.24

$

0.96

$

0.96

Earnings Per Common Share - Basic

0.81

0.77

0.02

0.59

1.32

2.19

2.15

Earnings Per Common Share - Diluted

0.81

0.77

0.02

0.58

1.31

2.18

2.15

Adjusted Earnings Per Common Share -

Diluted (Non-GAAP) (1)

0.80

0.71

0.05

0.59

0.53

2.14

1.95

Weighted Average Common Shares Outstanding

- Basic

5,095,237

5,106,861

5,147,846

5,198,194

5,291,795

5,136,670

5,382,441

Weighted Average Common Shares Outstanding

- Diluted

5,104,254

5,118,627

5,156,975

5,220,887

5,314,537

5,149,312

5,392,729

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

Common Shares Outstanding

5,100,189

5,096,672

5,128,333

5,156,897

5,260,672

Book Value Per Common Share

$

21.60

$

20.94

$

22.18

$

23.69

$

25.31

Tangible Book Value per Common Share

(1)

19.00

18.25

19.43

20.86

22.45

Stockholders’ Equity to Assets

7.8

%

7.5

%

8.2

%

8.5

%

9.3

%

Tangible Common Equity to Tangible Assets

(1)

6.9

6.6

7.3

7.6

8.4

Three Months Ended

Year Ended

Selected Financial Ratios (2)

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

12/31/22

12/31/21

Return on Average Assets

1.16

%

1.12

%

0.03

%

0.87

%

1.87

%

0.80

%

0.79

%

Adjusted Return on Average Assets (1)

1.15

1.03

0.08

0.87

0.76

0.78

0.72

Return on Average Equity

15.26

13.60

0.40

9.50

20.95

9.56

8.66

Adjusted Return on Average Equity (1)

15.01

12.53

0.93

9.54

8.55

9.39

7.87

Average Interest-Earning Assets to Average

Interest-Bearing Liabilities

149.04

149.41

149.03

144.48

145.09

148.00

145.44

Average Equity to Average Assets

7.63

8.20

8.49

9.14

8.93

8.36

9.12

Net Interest Rate Spread

3.17

3.10

3.00

2.98

2.85

3.07

2.81

Net Interest Rate Spread (FTE) (1)

3.18

3.11

3.01

2.99

2.86

3.08

2.82

Net Interest Margin

3.45

3.29

3.12

3.08

2.95

3.24

2.92

Net Interest Margin (FTE) (1)

3.46

3.30

3.13

3.10

2.96

3.25

2.94

Net Charge-offs and (Recoveries) to

Average Loans

0.01

(0.01

)

1.01

(0.01

)

0.03

0.25

0.01

Efficiency Ratio

63.25

64.18

68.55

69.21

52.71

66.14

75.95

Adjusted Efficiency Ratio (1)

60.74

63.02

64.18

65.88

69.73

63.36

74.25

Asset Quality Ratios

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

Allowance for Loan Losses to Total

Loans

1.22

%

1.23

%

1.25

%

1.14

%

1.13

%

Allowance for Loan Losses to Total Loans,

Excluding PPP Loans(1)

1.22

1.23

1.25

1.15

1.16

Allowance for Loan Losses to Nonperforming

Loans (3)

221.06

218.61

219.89

158.88

159.40

Allowance for Loan Losses to Noncurrent

Loans (4)

320.64

318.96

329.47

218.28

233.37

Delinquent and Nonaccrual Loans to Total

Loans (4) (5)

0.81

0.46

0.45

0.79

0.78

Nonperforming Loans to Total Loans (3)

0.55

0.56

0.57

0.72

0.71

Noncurrent Loans to Total Loans (4)

0.38

0.39

0.38

0.52

0.49

Nonperforming Assets to Total Assets

(6)

0.41

0.41

0.42

0.51

0.51

Capital Ratios (7)

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

Common Equity Tier 1 Capital (to Risk

Weighted Assets)

12.33

%

12.02

%

11.83

%

11.99

%

11.95

%

Tier 1 Capital (to Risk Weighted

Assets)

12.33

12.02

11.83

11.99

11.95

Total Capital (to Risk Weighted

Assets)

13.58

13.27

13.08

13.20

13.18

Tier 1 Leverage (to Adjusted Total

Assets)

8.66

8.51

8.33

8.19

7.76

(1)

Refer to Explanation of Use of

Non-GAAP Financial Measures in this Press Release for the

calculation of the measure and reconciliation to the most

comparable GAAP measure.

(2)

Interim period ratios are

calculated on an annualized basis.

(3)

Nonperforming loans consist of

nonaccrual loans, accruing loans that are 90 days or more past due,

and troubled debt restructured loans.

(4)

Noncurrent loans consist of

nonaccrual loans and accruing loans that are 90 days or more past

due.

(5)

Delinquent loans consist of

accruing loans that are 30 days or more past due.

(6)

Nonperforming assets consist of

nonperforming loans and other real estate owned.

(7)

Capital ratios are for Community

Bank only.

Certain items previously reported

may have been reclassified to conform with the current reporting

period’s format.

AVERAGE BALANCES AND

YIELDS

Three Months Ended

December 31, 2022

September 30, 2022

June 30, 2022

March 31, 2022

December 31, 2021

Average

Balance

Interest

and

Dividends

Yield/

Cost (1)

Average

Balance

Interest

and

Dividends

Yield/

Cost (1)

Average

Balance

Interest

and

Dividends

Yield/

Cost (1)

Average

Balance

Interest

and

Dividends

Yield/

Cost (1)

Average

Balance

Interest

and

Dividends

Yield/

Cost (1)

(Dollars in thousands) (Unaudited)

Assets:

Interest-Earning Assets:

Loans, Net (2)

$

1,034,714

$

11,853

4.54

%

$

1,024,363

$

10,833

4.20

%

$

1,007,874

$

9,751

3.88

%

$

1,009,210

$

9,573

3.85

%

$

1,004,827

$

9,927

3.92

%

Debt Securities

Taxable

216,915

974

1.80

222,110

985

1.77

228,315

988

1.73

215,906

905

1.68

205,328

866

1.69

Exempt From Federal Tax

6,277

51

3.25

7,998

62

3.10

9,109

73

3.21

10,195

84

3.30

10,477

84

3.21

Equity Securities

2,693

28

4.16

2,693

21

3.12

2,693

20

2.97

2,693

22

3.27

2,693

21

3.12

Interest Bearing Deposits at Banks

99,108

939

3.79

67,870

378

2.23

56,379

122

0.87

59,296

33

0.22

150,102

61

0.16

Other Interest-Earning Assets

2,875

39

5.38

2,784

39

5.56

3,235

38

4.71

3,483

39

4.54

3,475

45

5.14

Total Interest-Earning Assets

1,362,582

13,884

4.04

1,327,818

12,318

3.68

1,307,605

10,992

3.37

1,300,783

10,656

3.32

1,376,902

11,004

3.17

Noninterest-Earning Assets

51,718

68,796

84,323

122,288

100,607

Total Assets

$

1,414,300

$

1,396,614

$

1,391,928

$

1,423,071

$

1,477,509

Liabilities and Stockholders'

Equity

Interest-Bearing Liabilities:

Interest-Bearing Demand Deposits (3)

$

315,352

$

810

1.02

%

$

278,412

$

393

0.56

%

$

260,655

$

111

0.17

$

276,603

$

48

0.07

$

278,546

$

51

0.07

%

Savings (3)

249,948

29

0.05

251,148

20

0.03

248,356

20

0.03

243,786

19

0.03

252,387

20

0.03

Money Market (3)

206,192

604

1.16

189,371

269

0.56

188,804

61

0.13

192,425

41

0.09

209,572

57

0.11

Time Deposits (3)

116,172

368

1.26

123,438

397

1.28

127,832

412

1.29

132,015

422

1.30

154,342

508

1.31

Total Interest-Bearing Deposits (3)

887,664

1,811

0.81

842,369

1,079

0.51

825,647

604

0.29

844,829

530

0.25

894,847

636

0.28

Short-Term Borrowings

Securities Sold Under Agreements to

Repurchase

8,985

7

0.31

28,738

19

0.26

34,135

18

0.21

37,884

19

0.20

44,709

26

0.23

Other Borrowings

17,598

171

3.86

17,621

174

3.92

17,611

173

3.94

17,604

174

4.01

9,474

70

2.93

Total Interest-Bearing Liabilities

914,247

1,989

0.86

888,728

1,272

0.57

877,393

795

0.36

900,317

723

0.33

949,030

732

0.31

Noninterest-Bearing Demand Deposits

391,300

390,658

391,975

384,188

388,787

Other Liabilities

788

2,636

4,415

8,554

7,800

Total Liabilities

1,306,335

1,282,022

1,273,783

1,293,059

1,345,617

Stockholders' Equity

107,965

114,592

118,145

130,012

131,892

Total Liabilities and Stockholders'

Equity

$

1,414,300

$

1,396,614

$

1,391,928

$

1,423,071

$

1,477,509

Net Interest Income (FTE)

(Non-GAAP) (4)

$

11,895

$

11,046

$

10,197

$

9,933

$

10,272

Net Interest-Earning Assets (5)

448,335

439,090

430,212

400,466

427,872

Net Interest Rate Spread (FTE)

(Non-GAAP) (4) (6)

3.18

%

3.11

%

3.01

%

2.99

%

2.86

%

Net Interest Margin (FTE)

(Non-GAAP) (4)(7)

3.46

3.30

3.13

3.10

2.96

PPP Loans

216

22

40.41

2,424

123

20.13

5,546

144

10.41

14,673

445

12.30

29,067

391

5.34

(1)

Annualized based on three months

ended results.

(2)

Net of the allowance for loan

losses and includes nonaccrual loans with a zero yield and Loans

Held for Sale if applicable.

(3)

Includes Deposits Held for Sale

that were sold in December 2021.

(4)

Refer to Explanation and Use of

Non-GAAP Financial Measures in this Press Release for the

calculation of the measure and reconciliation to the most

comparable GAAP measure.

(5)

Net interest-earning assets

represent total interest-earning assets less total interest-bearing

liabilities.

(6)

Net interest rate spread

represents the difference between the weighted average yield on

interest-earning assets and the weighted average cost of

interest-bearing liabilities.

(7)

Net interest margin represents

annualized net interest income divided by average total

interest-earning assets.

AVERAGE BALANCES AND

YIELDS

Year Ended

December 31, 2022

December 31, 2021

Average

Balance

Interest

and

Dividends

Yield

/Cost

Average

Balance

Interest

and

Dividends

Yield

/Cost

(Dollars in thousands) (Unaudited)

Assets:

Interest-Earning Assets:

Loans, Net (1)

$

1,019,124

$

42,010

4.12

%

$

1,014,405

$

39,799

3.92

%

Debt Securities

Taxable

220,818

3,852

1.74

162,987

2,990

1.83

Exempt From Federal Tax

8,383

270

3.22

11,829

366

3.09

Marketable Equity Securities

2,693

91

3.38

2,657

84

3.16

Interest Bearing Deposits at Banks

70,765

1,473

2.08

177,768

304

0.17

Other Interest-Earning Assets

3,092

154

4.98

3,733

186

4.98

Total Interest-Earning Assets

1,324,875

47,850

3.61

1,373,379

43,729

3.18

Noninterest-Earning Assets

81,553

91,075

Total Assets

$

1,406,428

$

1,464,454

Liabilities and Stockholders'

Equity

Interest-Bearing Liabilities:

Interest-Bearing Demand Deposits (2)

$

282,850

$

1,362

0.48

%

$

272,256

$

232

0.09

%

Savings (2)

248,334

88

0.04

247,864

98

0.04

Money Market (2)

194,223

976

0.50

201,222

281

0.14

Time Deposits (2)

124,817

1,599

1.28

171,805

2,514

1.46

Total Interest-Bearing Deposits (2)

850,224

4,025

0.47

893,147

3,125

0.35

Short-Term Borrowings

Securities Sold Under Agreements to

Repurchase

27,360

63

0.23

43,988

98

0.22

Other Borrowings

17,609

693

3.94

7,172

182

2.54

Total Interest-Bearing Liabilities

895,193

4,781

0.53

944,307

3,405

0.36

Noninterest-Bearing Demand Deposits

389,553

378,374

Other Liabilities

4,072

8,168

Total Liabilities

1,288,818

1,330,849

Stockholders' Equity

117,610

133,605

Total Liabilities and Stockholders'

Equity

$

1,406,428

$

1,464,454

Net Interest Income (FTE) (Non-GAAP)

(3)

43,069

40,324

Net Interest-Earning Assets (4)

429,682

429,072

Net Interest Rate Spread (FTE) (Non-GAAP)

(3)(5)

3.08

%

2.82

%

Net Interest Margin (FTE) (Non-GAAP)

(3)(6)

3.25

2.94

PPP Loans

5,666

734

12.95

45,905

2,189

4.77

(1)

Net of the allowance for loan

losses and includes nonaccrual loans with a zero yield and Loans

Held for Sale if applicable.

(2)

Includes Deposits Held for Sale

that were sold in December 2021.

(3)

Refer to Explanation and Use of

Non-GAAP Financial Measures in this Press Release for the

calculation of the measure and reconciliation to the most

comparable GAAP measure.

(4)

Net interest-earning assets

represent total interest-earning assets less total interest-bearing

liabilities.

(5)

Net interest rate spread

represents the difference between the weighted average yield on

interest-earning assets and the weighted average cost of

interest-bearing liabilities.

(6)

Net interest margin represents

annualized net interest income divided by average total

interest-earning assets.

Explanation of Use of Non-GAAP Financial Measures

In addition to financial measures presented in accordance with

generally accepted accounting principles (“GAAP”), we use, and this

Press Release contains or references, certain Non-GAAP financial

measures. We believe these Non-GAAP financial measures provide

useful information in understanding our underlying results of

operations or financial position and our business and performance

trends as they facilitate comparisons with the performance of other

companies in the financial services industry. Non-GAAP adjusted

items impacting the Company's financial performance are identified

to assist investors in providing a complete understanding of

factors and trends affecting the Company’s business and in

analyzing the Company’s operating results on the same basis as that

applied by management. Although we believe that these Non-GAAP

financial measures enhance the understanding of our business and

performance, they should not be considered an alternative to GAAP

or considered to be more important than financial results

determined in accordance with GAAP, nor are they necessarily

comparable with Non-GAAP measures which may be presented by other

companies. Where Non-GAAP financial measures are used, the

comparable GAAP financial measure, as well as the reconciliation to

the comparable GAAP financial measure, can be found herein.

Three Months Ended

Year Ended

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

12/31/22

12/31/21

(Dollars in thousands, except share and

per share data) (Unaudited)

Net Income (GAAP)

$

4,152

$

3,929

$

118

$

3,047

$

6,965

$

11,247

$

11,570

Adjustments

(Gain) Loss on Securities

(83

)

46

199

7

(44

)

168

(526

)

Gain on Sale of Branches

—

—

—

—

(5,203

)

—

(5,203

)

(Gain) Loss on Disposal of Fixed

Assets

—

(439

)

—

8

—

(431

)

3

Tax effect

17

83

(42

)

(3

)

1,102

55

1,202

Non-Cash Charges:

Intangible Assets and Goodwill

Impairment

—

—

—

—

—

—

1,178

Writedown on Fixed Assets

—

—

—

—

23

—

2,293

Tax Effect

—

—

—

—

—

—

Adjusted Net Income (Non-GAAP)

$

4,086

$

3,619

$

275

$

3,059

$

2,843

$

11,039

$

10,517

Weighted-Average Diluted Common Shares and

Common Stock Equivalents Outstanding

5,104,254

5,118,627

5,156,975

5,220,887

5,314,537

5,149,312

5,392,729

Earnings per Common Share - Diluted

(GAAP)

$

0.81

$

0.77

$

0.02

$

0.58

$

1.31

$

2.18

$

2.15

Adjusted Earnings per Common Share -

Diluted (Non-GAAP)

$

0.80

$

0.71

$

0.05

$

0.59

$

0.53

$

2.15

$

1.95

Net Income (GAAP) (Numerator)

$

4,152

$

3,929

$

118

$

3,047

$

6,965

$

11,247

$

11,570

Annualization Factor

3.97

3.97

4.01

4.06

3.97

1.00

1.00

Average Assets (Denominator)

1,414,300

1,396,614

1,391,928

1,423,071

1,477,509

1,406,428

1,464,454

Return on Average Assets (GAAP)

1.16

%

1.12

%

0.03

%

0.87

%

1.87

%

0.80

%

0.79

%

Adjusted Net Income (Non-GAAP)

(Numerator)

$

4,086

$

3,619

$

275

$

3,059

$

2,843

$

11,039

$

10,517

Annualization Factor

3.97

3.97

4.01

4.06

3.97

1.00

1.00

Average Assets (Denominator)

1,414,300

1,396,614

1,391,928

1,423,071

1,477,509

1,407,413

1,455,368

Adjusted Return on Average Assets

(Non-GAAP)

1.15

%

1.03

%

0.08

%

0.87

%

0.76

%

0.78

%

0.72

%

Three Months Ended

Year Ended

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

12/31/22

12/31/21

(Dollars in thousands) (Unaudited)

Net Income (GAAP) (Numerator)

$

4,152

$

3,929

$

118

$

3,047

$

6,965

$

11,247

$

11,570

Annualization Factor

3.97

3.97

4.01

4.06

3.97

1.00

1.00

Average Equity (GAAP) (Denominator)

107,965

114,592

118,145

130,012

131,892

117,610

133,605

Return on Average Equity (GAAP)

15.26

%

13.60

%

0.40

%

9.50

%

20.95

%

9.56

%

8.66

%

Adjusted Net Income (Non-GAAP)

(Numerator)

$

4,086

$

3,619

$

275

$

3,059

$

2,843

$

11,039

$

10,517

Annualization Factor

3.97

3.97

4.01

4.06

3.97

1.00

1.00

Average Equity (GAAP) (Denominator)

107,965

114,592

118,145

130,012

131,892

117,610

133,605

Adjusted Return on Average Equity

(Non-GAAP)

15.01

%

12.53

%

0.93

%

9.54

%

8.55

%

9.39

%

7.87

%

Tangible book value per common share is a Non-GAAP measure and

is calculated based on tangible common equity divided by period-end

common shares outstanding. Tangible common equity to tangible

assets is a Non-GAAP measure and is calculated based on tangible

common equity divided by tangible assets. We believe these Non-GAAP

measures serve as useful tools to help evaluate the strength and

discipline of the Company's capital management strategies and as an

additional, conservative measure of the Company’s total value.

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

(Dollars in thousands, except share and

per share data) (Unaudited)

Assets (GAAP)

$

1,408,938

$

1,425,920

$

1,386,461

$

1,438,670

$

1,425,479

Goodwill and Intangible Assets, Net

(13,245

)

(13,691

)

(14,136

)

(14,582

)

(15,027

)

Tangible Assets (Non-GAAP) (Numerator)

$

1,395,693

$

1,412,229

$

1,372,325

$

1,424,088

$

1,410,452

Stockholders' Equity (GAAP)

$

110,155

$

106,706

$

113,772

$

122,156

$

133,124

Goodwill and Intangible Assets, Net

(13,245

)

(13,691

)

(14,136

)

(14,582

)

(15,027

)

Tangible Common Equity or Tangible Book

Value (Non-GAAP) (Denominator)

$

96,910

$

93,015

$

99,636

$

107,574

$

118,097

Stockholders’ Equity to Assets (GAAP)

7.8

%

7.5

%

8.2

%

8.5

%

9.3

%

Tangible Common Equity to Tangible Assets

(Non-GAAP)

6.9

%

6.6

%

7.3

%

7.6

%

8.4

%

Common Shares Outstanding

(Denominator)

5,100,189

5,096,672

5,128,333

5,156,897

5,260,672

Book Value per Common Share (GAAP)

$

21.60

$

20.94

$

22.18

$

23.69

$

25.31

Tangible Book Value per Common Share

(Non-GAAP)

$

19.00

$

18.25

$

19.43

$

20.86

$

22.45

Interest income on interest-earning assets, net interest rate

spread and net interest margin are presented on a fully

tax-equivalent (“FTE”) basis. The FTE basis adjusts for the tax

benefit of income on certain tax-exempt loans and securities using

the federal statutory income tax rate of 21 percent. We believe the

presentation of net interest income on a FTE basis ensures

comparability of net interest income arising from both taxable and

tax-exempt sources and is consistent with industry practice. The

following table reconciles net interest income, net interest spread

and net interest margin on a FTE basis for the periods

indicated:

Three Months Ended

Year Ended

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

12/31/22

12/31/21

(Dollars in thousands) (Unaudited)

Interest Income (GAAP)

$

13,855

$

12,287

$

10,958

$

10,616

$

10,963

$

47,716

$

43,557

Adjustment to FTE Basis

29

31

34

40

41

134

172

Interest Income (FTE) (Non-GAAP)

13,884

12,318

10,992

10,656

11,004

47,850

43,729

Interest Expense (GAAP)

1,989

1,272

795

723

732

4,781

3,405

Net Interest Income (FTE) (Non-GAAP)

$

11,895

$

11,046

$

10,197

$

9,933

$

10,272

$

43,069

$

40,324

Net Interest Rate Spread (GAAP)

3.17

%

3.10

%

3.00

%

2.98

%

2.85

%

3.07

%

2.81

%

Adjustment to FTE Basis

0.01

0.01

0.01

0.01

0.01

0.01

0.01

Net Interest Rate Spread (FTE)

(Non-GAAP)

3.18

3.11

3.01

2.99

2.86

3.08

2.82

Net Interest Margin (GAAP)

3.45

%

3.29

%

3.12

%

3.08

%

2.95

%

3.24

%

2.92

%

Adjustment to FTE Basis

0.01

0.01

0.01

0.02

0.01

0.01

0.02

Net Interest Margin (FTE) (Non-GAAP)

3.46

3.30

3.13

3.10

2.96

3.25

2.94

Adjusted efficiency ratio excludes the effect of certain

non-recurring or non-cash items and represents adjusted noninterest

expense divided by adjusted operating revenue. The Company

evaluates its operational efficiency based on its adjusted

efficiency ratio and believes it provides additional perspective on

its ongoing performance as well as peer comparability.

Three Months Ended

Year Ended

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

12/31/22

12/31/21

(Dollars in thousands) (Unaudited)

Noninterest Expense (GAAP) (Numerator)

$

8,998

$

8,827

$

8,410

$

8,656

$

9,972

$

34,891

$

42,862

Net Interest and Dividend Income

(GAAP)

$

11,866

$

11,015

$

10,163

$

9,893

$

10,231

$

42,935

$

40,152

Noninterest Income (GAAP)

2,360

2,739

2,105

2,613

8,689

9,820

16,280

Operating Revenue (GAAP) (Denominator)

$

14,226

$

13,754

$

12,268

$

12,506

$

18,920

$

52,755

$

56,432

Efficiency Ratio (GAAP)

63.25

%

64.18

%

68.55

%

69.21

%

52.71

%

66.14

%

75.95

%

Noninterest Expense (GAAP)

$

8,998

$

8,827

$

8,410

$

8,656

$

9,972

$

34,891

$

42,862

Less:

Other Real Estate Owned (Income)

(38

)

(38

)

(37

)

(38

)

(30

)

(151

)

(183

)

Amortization of Intangible Assets

446

445

446

445

445

1,782

1,926

Intangible Assets and Goodwill

Impairment

—

—

—

—

—

—

1,178

Writedown on Fixed Assets

—

—

—

—

23

—

2,293

Adjusted Noninterest Expense (Non-GAAP)

(Numerator)

$

8,590

$

8,420

$

8,001

$

8,249

$

9,534

$

33,260

$

37,648

Net Interest and Dividend Income

(GAAP)

$

11,866

$

11,015

$

10,163

$

9,893

$

10,231

$

42,935

$

40,152

Noninterest Income (GAAP)

2,360

2,739

2,105

2,613

8,689

9,820

16,280

Less:

Net Gain (Loss) on Securities

83

(46

)

(199

)

(7

)

44

(168

)

526

Gain on Sale of Branches

—

—

—

—

5,203

—

5,203

Net Gain (Loss) on Disposal of Fixed

Assets

—

439

—

(8

)

—

431

(3

)

Adjusted Noninterest Income (Non-GAAP)

$

2,277

$

2,346

$

2,304

$

2,628

$

3,442

$

9,557

$

10,554

Adjusted Operating Revenue (Non-GAAP)

(Denominator)

$

14,143

$

13,361

$

12,467

$

12,521

$

13,673

$

52,492

$

50,706

Adjusted Efficiency Ratio (Non-GAAP)

60.74

%

63.02

%

64.18

%

65.88

%

69.73

%

63.36

%

74.25

%

Allowance for loan losses to total loans, excluding PPP loans,

is a Non-GAAP measure that serves as a useful measurement to

evaluate the allowance for loan losses without the impact of SBA

guaranteed loans.

12/31/22

9/30/22

6/30/22

3/31/22

12/31/21

(Dollars in thousands) (Unaudited)

Allowance for Loan Losses (Numerator)

$

12,819

$

12,854

$

12,833

$

11,595

$

11,582

Total Loans

1,049,873

$

1,042,942

1,027,969

$

1,020,642

$

1,020,796

PPP Loans

(126

)

(768

)

(3,853

)

(8,242

)

(24,523

)

Total Loans, Excluding PPP Loans

(Non-GAAP) (Denominator)

$

1,049,747

$

1,042,174

$

1,024,116

$

1,012,400

$

996,273

Allowance for Loan Losses to Total Loans,

Excluding

PPP Loans (Non-GAAP)

1.22

%

1.23

%

1.25

%

1.15

%

1.16

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230126005788/en/

Company Contact: John H. Montgomery

President and Chief Executive Officer Phone: (724) 225-2400

Investor Relations: Jeremy Hellman,

Vice President The Equity Group Inc. Phone: (212) 836-9626 Email:

jhellman@equityny.com

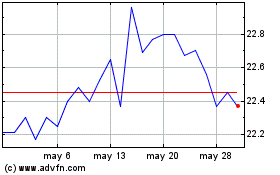

CB Financial Services (NASDAQ:CBFV)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

CB Financial Services (NASDAQ:CBFV)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025