Compugen Ltd. (NASDAQ:CGEN) today reported financial results for

the second quarter ended June 30, 2007. �During the past quarter we

saw significant progress, particularly in the areas of product

candidate development, negotiations for new licensing agreements,

new engine creation and discovery validation. In addition, our

recent announcement regarding the development and first discoveries

from a new proprietary discovery engine targeted at identifying

existing drug molecules predicted to have important, but currently

unknown, therapeutic indications, is another example of the

uniqueness and power of the Compugen approach,� said Alex Kotzer,

President and Chief Executive Officer of Compugen. Martin Gerstel,

Chairman of Compugen, added, �Many companies are attempting to find

new indications for specific drugs of interest because of the

potential for much quicker time to market for successful

discoveries of this type. However, unlike high throughput � and

largely random � experimentally-based efforts focused on a single

drug, Compugen has used its exceptional computational biology

skills and platforms to develop an engine that, in addition to

finding new uses for specific drugs, has been designed for the in

silico identification of those drugs predicted to have new

indications from amongst all drugs either in commercial use or

undergoing clinical trials. This in silico phase is then followed

by experimental validation of the predicted product candidates.�

Mr. Gerstel continued, �Similar to our recently announced

achievements in discovering new ligands for GPCRs and large scale

genetic variations, this hypothesis-driven discovery process is

proving to provide unparalleled breadth, power and efficiency.� As

previously projected, current revenues continued to be

insignificant. No revenues were reported for the second quarter of

2007 or for the six months ended June 30, 2007, compared to

revenues of $5,000 for the second quarter of 2006 and $205,000 for

six months ended June 30, 2006. The net loss from continuing

operations for the most recent quarter was $2.7 million (including

a non-cash expense of $436,000 related to stock based compensation)

or $0.09 per share, compared with a net loss from continuing

operations of $3.3 million (including a non-cash expense of

$459,000 related to stock based compensation), or $0.12 per share,

for the corresponding quarter of 2006. The net loss from continuing

operations for the first six months of 2007 was $5.6 million

(including a non-cash expense of $1.2 million related to stock

based compensation), or $0.20 per share, compared with a net loss

from continuing operations of $6.0 million (including a non-cash

expense of $1 million related to stock based compensation), or

$0.22 per share, for the same period in 2006. The net loss for the

most recent quarter was $3.2 million (including a non-cash expense

of $342,000 related to stock based compensation) or $0.11 per

share, compared with a net loss of $3.6 million (including a

non-cash expense of $472,000 related to stock based compensation),

or $0.13 per share, for the corresponding quarter of 2006. The net

loss for the first six months of 2007 was $6.3 million (including a

non-cash expense of $1.2 million related to stock based

compensation), or $0.22 per share, compared with a net loss of $6.7

million (including a non-cash expense of $1 million related to

stock based compensation), or $0.24 per share, for the same period

in 2006. Research and development expenses of $2.3 million for the

second quarter of 2007, compared to $2.7 million for the second

quarter of 2006, remain the Company�s largest expense. These

amounts are before the deduction of governmental and other grants,

which totaled $293,000 for the second quarter ended June 30, 2007,

compared with $105,000 for the corresponding quarter in 2006. As of

June 30, 2007, Compugen had $20.8 million in cash, cash

equivalents, deposits and marketable securities, a decrease of $5.6

million for the six months from December 31, 2006. Affiliated

Companies: As previously disclosed, Compugen is currently not

making additional cash investments in its affiliated companies.

During the past quarter, Evogene, an agricultural biotechnology

company which Compugen established in 2002, completed an initial

public offering on the Tel Aviv Stock Exchange (TASE). In addition,

Keddem, a small molecule drug discovery company which Compugen

established in 2004, is limiting its activities to corporate

development and intellectual property protection until third party

funding, currently under discussion with various potential sources,

is achieved. Pursuant to the relevant accounting rules and

regulations, each of the above events is reflected in the Company�s

quarterly financial statements for the most recent quarter. Prior

to Evogene�s IPO, Compugen�s investment in Evogene was accounted

for under the Cost Method of Accounting. Following the IPO, as of

the end of each reporting period, those Evogene shares owned by

Compugen which are either then unrestricted or will become

unrestricted within one year of such date, are recorded on the

Company�s Balance Sheet as an asset based on the market price of

such shares at such time. With respect to Keddem, in view of the

fact that there can be no assurance that additional financing will

be achieved, Keddem�s assets are presented as a one line item in

the Company�s balance sheet as �Assets related to discontinued

operations� and Keddem�s expenses are shown as a separate one line

item as �Loss from discontinued operations� in the Company�s

statement of operations. Conference Call and Web Cast Information

Compugen will hold a conference call to discuss its first quarter

results on August 2, 2007 at 10:00 a.m. EST. To access the

conference call, please dial 1-888-281-1167 from the US or

+972-3-918-0610 internationally. The call will also be available

via live webcast through Compugen�s website, located at

www.cgen.com. A replay of the conference call will be available

approximately two hours after the completion of the live conference

call. To access the replay, please dial 1-888-782-4291 from the US

or +972-3�925-5901. The replay will be available until 12 noon EST

on August 6, 2007. About Compugen Compugen�s mission is to be the

world leader in the discovery and licensing of product candidates

to the drug and diagnostic industry. The Company�s powerful

discovery engines enable the predictive discovery of numerous

potential therapeutics and diagnostic biomarkers. This capability

results from the Company�s decade-long pioneering efforts in the

deeper understanding of important biological phenomena at the

molecular level through the incorporation of ideas and methods from

mathematics, computer science and physics into biology, chemistry

and medicine. To date, Compugen�s diagnostic and therapeutic

product discovery efforts and its initial discovery engines have

focused mainly within the areas of cancer, immune-related and

cardiovascular diseases. The Company's primary commercialization

pathway for its product candidates is to enter into milestone and

revenue sharing out-licensing and joint development agreements with

leading therapeutic and diagnostic companies. Compugen has

established an agricultural biotechnology affiliate � Evogene, and

a small-molecule drug discovery affiliate � Keddem Bioscience. For

additional information, please visit Compugen's corporate Website

at www.cgen.com. This press release contains "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. These statements include words like "may,"

"expects," "believes," and "intends," and describe opinions about

future events. These forward-looking statements involve known and

unknown risks and uncertainties that may cause the actual results,

performance or achievements of Compugen to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking statements. Some of these risks

are: changes in relationships with collaborators; the impact of

competitive products and technological changes; risks relating to

the development of new products; the ability to implement

technological improvements; the ability of Compugen to obtain and

retain customers. These and other factors are identified and more

fully explained under the heading "Risk Factors" in Compugen's

annual reports filed with the Securities and Exchange Commission.

COMPUGEN LTD. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (U.S.

dollars in thousands, except for share and per-share amounts) �

Three Months Ended June 30, Six Months Ended June 30, 2007

Unaudited 2006 Unaudited 2007 Unaudited 2006 Unaudited � Revenues -

5 - 205 Cost and Expenses Cost of revenues - - - 6 Research and

development expenses 2,324 2,743 4,662 5,204 Less: governmental and

other grants (293 ) (105 ) (590 ) (522 ) Research and development

expenses, net 2,031 2,638 4,072 4,682 Sales and marketing expenses

272 360 866 770 General and administrative expenses 623 497 1,176

1,062 Total operating expenses (a) 2,926 3,495 6,114 6,520 �

Operating loss (2,926 ) (3,490 ) (6,114 ) (6,315 ) Financing

income, net 227 167 503 277 Other income 5 6 14 6 Net loss from

continuing operations (2,694 ) (3,317 ) (5,597 ) (6,032 ) Loss from

discontinued operations (464 ) (303 ) (668 ) (676 ) Net loss (3,158

) (3,620 ) (6,265 ) (6,708 ) Basic and diluted loss per ordinary

share from continuing operations (0.09 ) (0.12 ) (0.20 ) (0.22 )

Basic and diluted loss per ordinary share from discontinued

operations (0.02 ) (0.01 ) (0.02 ) (0.02 ) Basic and diluted net

loss per ordinary share (0.11 ) (0.13 ) (0.22 ) (0.24 ) Weighted

average number of ordinary shares outstanding 28,242,570 27,938,110

28,220,723 27,920,170 � (a) Includes stock based compensation

COMPUGEN LTD. CONDENSED CONSOLIDATED BALANCE SHEETS DATA (U.S.

dollars, in thousands) � June 31, 2007 Unaudited December 31, 2006

Audited � ASSETS Current assets Cash, cash equivalents, short term

deposits and marketable securities 18,804 25,403 Trade receivables

- 10 Receivables and prepaid expenses 995 824 Assets related to

discontinued operations 108 401 Total current assets 19,907 26,638

� Long-term investments Long term deposits and marketable

securities 2,000 1,000 Investment in Evogene 124 - Other assets

1,406 1,370 Property and equipment, net 1,570 1,848 Total assets

25,007 30,856 � LIABILITIES AND SHAREHOLDERS� EQUITY Current

liabilities Accounts payable and accrued expenses 1,636 2,794

Deferred revenues 100 75 Liabilities related to discontinued

operations 254 287 Total current liabilities 1,990 3,156 �

Long-term liabilities Accrued severance pay 1,481 1,436 Other

long-term liabilities 60 60 Excess of losses over investment in

Evogene - 466 Total long-term liabilities 1,541 1,962 � Total

shareholders� equity 21,476 25,738 Total liabilities and

shareholders� equity 25,007 30,856

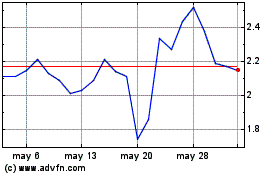

Compugen (NASDAQ:CGEN)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Compugen (NASDAQ:CGEN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024