Form 425 - Prospectuses and communications, business combinations

16 Noviembre 2023 - 4:07PM

Edgar (US Regulatory)

Filed by Calumet Specialty Products Partners, L.P.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Calumet Specialty Products Partners, L.P.

Commission File No.: 000-51734

November 16, 2023 Corporate Transition

Overview

Cautionary Statements Forward-Looking

Statements This Presentation has been prepared by Calumet Specialty Products Partners, L.P. (the “Company,” “Calumet,” “CLMT,” "we," "our" or like terms) as of November 16, 2023. The information in this

Presentation includes certain “forward-looking statements.” These statements can be identified by the use of forward-looking terminology including “may,” “intend,” “believe,” “expect,”

“anticipate,” “estimate,” “forecast,” “outlook,” “continue” or other similar words. The statements discussed in this Presentation that are not purely historical data are forward-looking

statements. These forward-looking statements discuss future expectations or state other “forward-looking” information and involve risks and uncertainties. When considering forward-looking statements, you should keep in mind the risk

factors and other cautionary statements included in our most recent Annual Report on Form 10-K and other filings with the SEC. The risk factors and other factors noted in our most recent Annual Report on Form 10-K and other filings with the SEC

could cause our actual results to differ materially from those contained in any forward-looking statement. Our forward-looking statements are not guarantees of future performance, and actual results and future performance may differ materially from

those suggested in any forward-looking statement. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the foregoing. Existing and prospective

investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this Presentation. We undertake no obligation to publicly update or revise any forward-looking statements after the date they

are made, whether as a result of new information, future events or otherwise. Additional Information and Where to Find It This Presentation relates to the proposed corporate reorganization (the “Transaction”) between Calumet and a new

Delaware corporation to be formed in connection with the Transaction (“New Calumet” or “New CLMT”). This Presentation may be deemed to be solicitation material in respect of the proposed Transaction. The proposed Transaction

will be submitted to Calumet’s unitholders for their consideration. In connection with the proposed Transaction, New Calumet is expected to file with the SEC a registration statement on Form S-4 (the “Form S 4”) containing a proxy

statement/prospectus (the “Proxy Statement/Prospectus”) to be distributed to Calumet’s unitholders in connection with Calumet’s solicitation of proxies for the vote of Calumet’s unitholders in connection with the

proposed Transaction and other matters as described in such Proxy Statement/Prospectus. The Proxy Statement/Prospectus will also serve as the prospectus relating to the offer of the securities to be issued to Calumet’s equityholders in

connection with the completion of the proposed Transaction. Calumet and New Calumet may file other relevant documents with the SEC regarding the proposed Transaction. The definitive Proxy Statement/Prospectus will be mailed to Calumet’s

unitholders when available. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND UNITHOLDERS AND OTHER INTERESTED PERSONS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS REGARDING THE

PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. This

Presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of

1933, as amended. The Proxy Statement/Prospectus, any amendments or supplements thereto and other relevant materials, and any other documents filed by Calumet or New Calumet with the SEC, may be obtained once such documents are filed with the SEC

free of charge at the SEC’s website at www.sec.gov or free of charge from Calumet at www.calumet.com or by directing a written request to Calumet at 2780 Waterfront Parkway East Drive, Indianapolis, Indiana 46214. Participants in the

Solicitation Calumet, Calumet GP, LLC, the general partner of Calumet (the “General Partner”), and certain of the General Partner’s executive officers, directors, other members of management and employees may, under the rules of

the SEC, be deemed to be “participants” in the solicitation of proxies in connection with the proposed Transaction. Information regarding the General Partner’s directors and executive officers is available in Calumet’s Annual

Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 15, 2023 (the “Annual Report”). To the extent that holdings of Calumet’s securities have changed from the amounts reported in the

Annual Report, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC. These documents may be obtained free of charge from the sources indicated above. Information regarding the

participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Form S-4, the Proxy Statement/Prospectus and other relevant materials relating to the

proposed Transaction to be filed with the SEC when they become available. Unitholders and other investors should read the Proxy Statement/Prospectus carefully when it becomes available before making any voting or investment decisions.

Transaction Overview: C-Corp Transition

On November 9, 2023, Calumet announced plans to transition to a C-Corp to maximize future opportunities, access a broader base of investors and unlock shareholder value Transaction highlights: C-Corp transition will eliminate Incentive Distribution

Rights (“IDRs”), align all shareholder interests, and is expected to substantially increase trading volume and institutional investment in the company Calumet expects to close C-Corp transition in mid-2024 and cancellation of IDRs will

occur simultaneously with closing Upon closing, the C-Corp will acquire the General Partner (effectively constituting the indirect acquisition of the existing IDRs and 2% General Partner interest (~1.6 million GP units)) in exchange for 5.5 million

shares of common stock and 2.0 million warrants Warrants will have a strike price of $20/share and will expire three years from the date of issuance 4.5% shareholder dilution (excluding warrants) at closing of transaction (see “Dilution

Calculation” on slide 6) Governance: The board of directors will consist of 9 members who will serve staggered three-year terms; a majority of the directors will be independent For so long as The Heritage Group and its affiliates

(“THG”) own at least 15% of the outstanding common stock, they will have the right to nominate three directors, which reduces to two directors so long as THG owns at least 10% and less than 15% of the outstanding common stock Until the

earlier of THG no longer owning at least 5% of the outstanding common stock and the third anniversary of the closing date, THG will maintain certain consent rights, including with respect to: any amendment of the organizational documents, any

increase or decrease in the size of the Board and any appointment or removal of the Chairman of the Board or Chief Executive Officer THG will receive customary registration rights covering its shares and warrants

Corporate Transition CLMT unitholders to

exchange all existing CLMT units in a 1-1 ratio for New CLMT common stock structured as a nontaxable “Reverse-Merger” transaction Reverse Merger CLMT Units New CLMT Stock CLMT Unitholders CLMT MLP New CLMT (C-Corp)

Tax Benefits Unlike many other public MLP

simplification or conversions, CLMT is pursuing a Nontaxable Corporate Conversion Transaction Post-Closing, sales of New CLMT common stock are expected to be characterized as capital gains/losses: Maximum federal tax rate for long-term capital gains

is currently 20.0% If characterized as a long-term capital gain, a sale of New CLMT common stock results in a lower tax rate compared to ordinary income arising from sale of partnership interest Holding, purchasing or selling New CLMT common stock

is not expected to generate Unrelated Business Taxable Income (UBTI) for tax-exempt and tax preferenced Investors (IRA Accounts, Roth IRA Accounts, 401(k) Accounts, etc.) CLMT unitholders with negative net tax capital balances may recognize

taxable gain subject to ordinary gain recapture upon Transaction Closing For public CLMT unitholders with negative net tax capital balances, Passive Loss Carryforwards and Excess Business Interest Expense Carryforwards (EBIE) are expected to

be available to reduce tax owed from the Transaction Non-U.S. and foreign investors should consult with their own tax advisors for potential tax implications from the proposed Transaction CLMT unitholders tax basis in the CLMT units

roll into New CLMT stock basis with certain adjustments (i.e., gains recognized by unitholders). Investors should contact their tax advisor to determine tax basis in the New CLMT stock Corporate Transition Tax Impact Transaction Closing

Subject to CLMT unitholder approval, the Nontaxable Corporate Conversion Transaction is anticipated to close in mid-2024 (“Transaction Closing”) If current CLMT unitholders hold CLMT units through Transaction Closing, no taxable

gain/income is anticipated upon nontaxable exchange transaction for all CLMT unitholders with positive net tax capital CLMT unitholders that sell CLMT units prior to Transaction Closing may recognize a taxable capital gain/(loss) subject to

ordinary gain recapture (this is the status quo condition and will change post-conversion) Upon Transaction Closing, CLMT investors will own New CLMT common stock tradeable publicly on the Nasdaq Global Select Market Tax Reporting Tax Considerations

Current CLMT unitholders will receive 2023 Schedule K-1 tax reporting by March 8, 2024 Subject to CLMT unitholder approval and the timing of the Transaction Closing, CLMT unitholders that acquire CLMT units prior to Transaction Closing will receive

stub-period 2024 Schedule K-1 tax reporting in early-March 2025 Post-Transaction Closing tax reporting for New CLMT common stock provided through broker Form 1099 tax reporting New CLMT and its investors will no longer be subject to future

Post-Transaction Closing Schedule K-1 tax reporting requirements

Dilution Calculation Warrants: 2.0

million Strike Price $20 / share Term: 3 Years Illustrative Share Price $20 $25 $30 $35 $40 $45 $50 Net New Shares From Warrants Conversion (Millions) 0.00 0.40 0.67 0.86 1.00 1.11 1.20 Dilution Including Warrants 4.5% 5.0% 5.3% 5.5% 5.6% 5.8% 5.8%

Unit/Share Count Summary Now Post-Conversion Existing LP Units / Common Stock 80.0 80.0 Existing GP Units 1.6 - New Shares Issued at Closing - 5.5 Total Economic Shares Outstanding 81.6 85.5 *4.5% Dilution (Excluding Warrants)

Tax Disclosures No Advice This

Presentation has been prepared by Calumet as of November 16, 2023. This Presentation has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Calumet

unitholders should consult their own tax and other advisors before making any decisions regarding the proposed transaction Important Notice The information reflects the application of various assumptions and conventions, as disclosed by Calumet to

you in various SEC filings and other offering documents. Calumet may provide disclosures of certain of these assumptions and conventions in the preparation of Calumet’s tax return as warranted to the Internal Revenue Service and/or other

taxing authorities. We suggest that you refer to the appropriate federal and state income tax laws, instructions, SEC filings, and other offering documents, and that you consult with your personal tax advisor with any questions. You should discuss

with your tax advisor whether the treatment of any items in this Presentation may subject you and/or your tax advisor to a penalty by a taxing authority and the need to adequately disclose any items in order to avoid such penalty. This Presentation

is provided for your general guidance. The information herein is not intended to be, nor should it be construed as the basis of tax advice. The tax information discussed in this Presentation is based on existing federal and state laws and

regulations as interpreted by Calumet. Before undertaking any tax filing, we strongly suggest that you refer to the appropriate federal and state income tax laws and consult with your personal tax advisor. Qualified Notice Notice Pursuant to

Treasury Regulation Section 1.1446-4(b)(4) by Calumet. This statement is intended to serve as qualified notice to nominees under Treasury Regulation Section 1.1446-4(b). Brokers and nominees should treat 100% of Calumet’s distributions to

foreign investors as being attributable to income that is effectively connected with a United States trade or business. Therefore, distributions to foreign investors are subject to federal income tax withholding at the highest applicable effective

tax rate. Nominees, not Calumet, are treated as the withholding agents responsible for withholding on the distributions received by them on behalf of foreign investors.

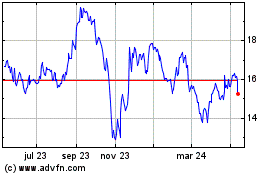

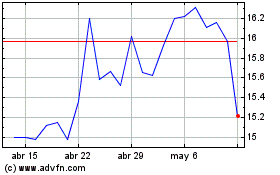

Calumet Specialty Produc... (NASDAQ:CLMT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Calumet Specialty Produc... (NASDAQ:CLMT)

Gráfica de Acción Histórica

De May 2023 a May 2024