Cumulus Media Inc. (NASDAQ: CMLS) (the "Company," "Cumulus Media,"

"we," "us," or "our") today announced operating results for the

three and six months ended June 30, 2024.

Mary G. Berner, President and Chief Executive

Officer of Cumulus Media, said, "In the context of a challenging

advertising environment, second quarter total revenue finished in

line with our pacing guidance, down 2.5% year-over-year. However,

our unrelenting focus on areas of the business that are in our

control helped us to mitigate the impact of soft demand while also

driving tangible progress in key priority areas. During the

quarter, we grew our digital marketing services business by 24%;

reduced fixed costs by $4 million; and continued to strengthen our

balance sheet through the successful completion of our exchange

offer, ABL upsizing, and the buyback of a portion of our remaining

2026 maturity debt."

Berner continued, "Looking ahead, while the

advertising outlook remains uncertain, our advertisers continue to

be focused on when – not if – they’re going to return to more

typical spending levels. Fortunately, thanks to our success at

extending our debt maturities, we have time on our side and the

flexibility to pursue multiple paths to create shareholder

value."

Q2 Key Highlights:

- Posted total net revenue of $204.8

million, a decline of 2.5% year-over-year

- Generated digital revenue of $39.4

million, up 5.0% year-over-year

- Digital marketing services grew 24% driven by an increase in

new customers, improved customer retention and higher average order

size

- Radio-only customers adding digital marketing services

increased by 25% year-over-year

- Digital revenue increased to 19% of total company revenue

- Recorded net loss of $27.7 million

compared to net loss of $1.1 million in Q2 2023 and Adjusted

EBITDA(1) of $25.2 million compared to $30.7 million in Q2

2023

- Continued to improve operating

leverage by reducing fixed costs by approximately $4 million

year-over-year

- Used $7.9 million of cash in

operations, or generated $8.3 million of cash from operations when

excluding execution costs related to the completed exchange offer

of $16.3 million(1)

- Completed the exchange offer for

our Senior Notes due 2026 and Term Loan due 2026 with favorable

terms and aggregate participation of approximately 96% of debt

outstanding

- Debt obligations under our debt instruments reduced by

approximately $33 million

- Debt maturities extended from 2026 to 2029

- Amended ABL Facility, increasing

capacity to $125 million from $100 million and extending maturity

to 2029

- Retired $0.5 million face value of

Senior Notes due 2026

- Reported total debt(2)(3) of $674.4

million, total debt at maturity(1)(2)(3) of $642.1 million, and net

debt less total unamortized discount(1)(2)(3) of $588.6 million at

June 30, 2024, including total debt due in 2026(3) of $23.9

million

Operating Summary (dollars in thousands, except

percentages and per share data):

For the three months

ended June 30, 2024, the Company reported net revenue

of $204.8 million, a decrease of 2.5% from the three

months ended June 30, 2023, net loss of $27.7

million and Adjusted EBITDA of $25.2 million.

For the six months ended June 30,

2024, the Company reported net revenue of $404.9 million, a

decrease of 2.6% from the six months

ended June 30, 2023, net loss of $41.9 million and

Adjusted EBITDA of $33.6 million.

|

As Reported |

|

Three Months Ended June 30, 2024 |

|

Three Months Ended June 30, 2023 |

|

% Change |

|

|

Net revenue |

|

$ |

204,849 |

|

|

$ |

210,136 |

|

|

(2.5 |

)% |

| Net loss |

|

$ |

(27,699 |

) |

|

$ |

(1,068 |

) |

|

(2,493.5 |

)% |

| Adjusted EBITDA |

|

$ |

25,213 |

|

|

$ |

30,676 |

|

|

(17.8 |

)% |

| Basic loss per share |

|

$ |

(1.64 |

) |

|

$ |

(0.06 |

) |

|

(2,633.3 |

)% |

| Diluted loss per share |

|

$ |

(1.64 |

) |

|

$ |

(0.06 |

) |

|

(2,633.3 |

)% |

|

As Reported |

|

Six Months Ended June 30, 2024 |

|

Six Months Ended June 30, 2023 |

|

% Change |

|

|

Net revenue |

|

$ |

404,902 |

|

|

$ |

415,828 |

|

|

(2.6 |

)% |

| Net loss |

|

$ |

(41,853 |

) |

|

$ |

(22,535 |

) |

|

(85.7 |

)% |

| Adjusted EBITDA |

|

$ |

33,618 |

|

|

$ |

41,005 |

|

|

(18.0 |

)% |

| Basic loss per share |

|

$ |

(2.49 |

) |

|

$ |

(1.25 |

) |

|

(99.2 |

)% |

| Diluted loss per share |

|

$ |

(2.49 |

) |

|

$ |

(1.25 |

) |

|

(99.2 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

Revenue Detail Summary (dollars in

thousands):

|

As Reported |

|

Three Months Ended June 30, 2024 |

|

Three Months Ended June 30, 2023 |

|

% Change |

| Broadcast radio revenue: |

|

|

|

|

|

|

|

Spot |

|

$ |

101,806 |

|

$ |

107,065 |

|

(4.9 |

)% |

|

Network |

|

|

34,306 |

|

|

39,698 |

|

(13.6 |

)% |

| Total broadcast radio

revenue |

|

|

136,112 |

|

|

146,763 |

|

(7.3 |

)% |

| Digital |

|

|

39,397 |

|

|

37,538 |

|

5.0 |

% |

| Other |

|

|

29,340 |

|

|

25,835 |

|

13.6 |

% |

| Net revenue |

|

$ |

204,849 |

|

$ |

210,136 |

|

(2.5 |

)% |

|

As Reported |

|

Six Months Ended June 30, 2024 |

|

Six Months Ended June 30, 2023 |

|

% Change |

| Broadcast radio revenue: |

|

|

|

|

|

|

|

Spot |

|

$ |

192,379 |

|

$ |

204,778 |

|

(6.1 |

)% |

|

Network |

|

|

83,468 |

|

|

89,995 |

|

(7.3 |

)% |

| Total broadcast radio

revenue |

|

|

275,847 |

|

|

294,773 |

|

(6.4 |

)% |

| Digital |

|

|

73,844 |

|

|

69,627 |

|

6.1 |

% |

| Other |

|

|

55,211 |

|

|

51,428 |

|

7.4 |

% |

| Net revenue |

|

$ |

404,902 |

|

$ |

415,828 |

|

(2.6 |

)% |

| |

Balance Sheet Summary (dollars in

thousands):

|

|

|

June 30, 2024 |

|

December 31, 2023 |

| Cash and cash equivalents |

|

$ |

53,492 |

|

$ |

80,660 |

| Term Loan due 2026 (3) |

|

$ |

1,203 |

|

$ |

329,510 |

| Senior Notes due 2026 (3) |

|

$ |

22,697 |

|

$ |

346,245 |

| Term Loan due 2029 (2)

(3) |

|

$ |

327,873 |

|

$ |

— |

| Senior Notes due 2029 (2)

(3) |

|

$ |

322,591 |

|

$ |

— |

| |

|

|

|

|

|

|

| |

|

|

Three Months Ended June 30, 2024 |

|

|

Three Months Ended June 30, 2023 |

| Capital expenditures |

|

$ |

4,387 |

|

$ |

6,603 |

| |

|

|

|

|

|

|

| |

|

|

Six Months Ended June 30, 2024 |

|

|

Six Months Ended June 30, 2023 |

| Capital expenditures |

|

$ |

12,553 |

|

$ |

13,975 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

(1) Adjusted EBITDA, operating cash flow

excluding execution costs related to the completed exchange offer,

total debt at maturity and net debt less total unamortized discount

are not financial measures calculated or presented in accordance

with accounting principles generally accepted in the United States

of America (“GAAP”). For additional information, see "Non-GAAP

Financial Measures."

(2) The exchange offer was accounted for as a

debt modification resulting in a prospective yield adjustment and

the carrying value was not changed. The $33.1 million difference

between the principal amounts exchanged and the resulting principal

amounts will be amortized to interest expense (thereby reducing

interest expense) over the life of the debt. As of June 30, 2024,

$16.0 million and $16.2 million of unamortized difference for the

Term Loan due 2029 and the Senior Notes due 2029, respectively,

remain.

(3) Excludes any debt issuance costs.

Earnings Conference Call

Details The Company will host a conference call today

at 8:30 AM ET to discuss its second quarter 2024 operating results.

NetRoadshow (NRS) is the service provider for this call. They will

require email address verification (one-time only) and will provide

registration confirmation. To participate in the conference call,

please register in advance using the link on the Company's investor

relations website at www.cumulusmedia.com/investors. Upon

completing registration, a calendar invitation will follow with

call access details, including a unique PIN, and replay

details.

To join by phone with operator-assisted dial-in,

domestic callers should dial 833-470-1428 and international callers

should dial 404-975-4839. If prompted, the participant access code

is 044716. Please call five to ten minutes in advance to ensure

that you are connected prior to the call.

The conference call will also be broadcast live

in listen-only mode through a link on the Company’s investor

relations website at www.cumulusmedia.com/investors. This link can

also be used to access a recording of the call, which will be

available shortly following its completion.

Please see an update to the Company’s investor

presentation on the Company's investor relations website at

www.cumulusmedia.com/investors, which may be referenced on the

conference call. Unless otherwise specified, information contained

in the investor presentation or on our website is not incorporated

into this press release or other documents we file with, or furnish

to, the SEC.

Forward-Looking

Statements Certain statements in this release may

constitute “forward-looking” statements within the meaning of the

Private Securities Litigation Reform Act of 1995 and other federal

securities laws. Such statements are statements other than

historical fact and relate to our intent, belief or current

expectations primarily with respect to our future operating,

financial, and strategic performance and our plans and objectives.

Any such forward-looking statements are not guarantees of future

performance and involve risks, uncertainties and other factors that

may cause actual results, performance or achievements to differ

from those contained in or implied by the forward-looking

statements as a result of various factors. Such factors include,

among others, risks and uncertainties related to the implementation

of our strategic operating plans, the continued uncertain financial

and economic conditions, the rapidly changing and competitive media

industry, and the economy in general. We are subject to additional

risks and uncertainties described in our quarterly and annual

reports filed with the Securities and Exchange Commission from time

to time, including in the "Risk Factors," and "Management’s

Discussion and Analysis of Financial Condition and Results of

Operations" sections contained therein. You should not rely on

forward-looking statements since they involve known and unknown

risks, uncertainties and other factors that are, in some cases,

beyond the Company’s control, and the unexpected occurrence or

failure to occur of any such events or matters could cause our

actual results, performance, financial condition or achievements to

differ materially from those expressed or implied by such

forward-looking statements. Cumulus Media assumes no responsibility

to update any forward-looking statements, which are based upon

expectations as of the date hereof, as a result of new information,

future events or otherwise.

About Cumulus

Media Cumulus Media (NASDAQ: CMLS) is an audio-first

media company delivering premium content to over a quarter billion

people every month — wherever and whenever they want it. Cumulus

Media engages listeners with high-quality local programming through

401 owned-and-operated radio stations across 85 markets; delivers

nationally-syndicated sports, news, talk, and entertainment

programming from iconic brands including the NFL, the NCAA, the

Masters, CNN, AP News, the Academy of Country Music Awards, and

many other world-class partners across more than 9,800 affiliated

stations through Westwood One, the largest audio network in

America; and inspires listeners through the Cumulus Podcast

Network, its rapidly growing network of original podcasts that are

smart, entertaining and thought-provoking. Cumulus Media provides

advertisers with personal connections, local impact and national

reach through broadcast and on-demand digital, mobile, social, and

voice-activated platforms, as well as integrated digital marketing

services, powerful influencers, full-service audio solutions,

industry-leading research and insights, and live event experiences.

For more information visit www.cumulusmedia.com.

Non-GAAP Financial Measures

From time to time, we utilize certain financial

measures that are not prepared or calculated in accordance with

GAAP to assess our financial performance and profitability.

Consolidated adjusted earnings before interest, taxes,

depreciation, and amortization ("Adjusted EBITDA") is the financial

metric by which management and the chief operating decision maker

allocate resources of the Company and analyze the performance of

the Company as a whole. Management also uses this measure to

determine the contribution of our core operations to the funding of

our corporate resources utilized to manage our operations and the

funding of our non-operating expenses including debt service and

acquisitions. In addition, consolidated Adjusted EBITDA is a key

metric for purposes of calculating and determining our compliance

with certain covenants contained in our credit agreements.

In determining Adjusted EBITDA, we exclude the

following from net loss: interest, taxes, depreciation,

amortization, stock-based compensation expense, gain or loss on the

exchange, sale, or disposal of any assets or stations or early

extinguishment of debt, restructuring costs, expenses relating to

acquisitions and divestitures, non-routine legal expenses incurred

in connection with certain litigation matters, and non-cash

impairments of assets, if any.

Management believes that Adjusted EBITDA, with

and excluding impact of political advertising, although not a

measure that is calculated in accordance with GAAP, is commonly

employed by the investment community as a measure for determining

the market value of a media company and comparing the operational

and financial performance among media companies. Management has

also observed that Adjusted EBITDA, with and excluding impact of

political advertising, is routinely utilized to evaluate and

negotiate the potential purchase price for media companies. Given

the relevance to our overall value, management believes that

investors consider these metrics to be extremely useful.

The Company presents revenue, excluding impact

of political revenue. As a result of the cyclical nature of the

electoral system and the seasonality of the related political

revenue, management believes presenting net revenue, excluding

impact of political revenue, provides useful information to

investors about the Company’s revenue growth comparable from period

to period.

The Company presents the non-GAAP financial

measure total debt at maturity which is total debt principal,

gross, less total unamortized debt discount. In addition, the

Company presents the non-GAAP financial measure net debt less total

unamortized discount which is total debt at maturity less cash and

cash equivalents. Management believes that total debt at maturity

and net debt less total unamortized discount are important measures

to monitor leverage and evaluate the balance sheet.

The Company also presents operating cash flow

excluding execution costs related to the completed exchange offer.

Management believes that operating cash flow excluding execution

costs related to the completed exchange offer is an important

measure to evaluate the Company’s operating performance in light of

the cost of the execution of the exchange offer that management

deems one time or non-operational in nature.

We refer to Adjusted EBITDA, with and excluding

the impact of political advertising, net revenue, excluding the

impact of political revenue, total debt at maturity, net debt less

total unamortized discount and operating cash flow excluding the

execution costs related to the completed exchange offer as the

"Non-GAAP Financial Measures." Non-GAAP Financial Measures should

not be considered in isolation or as a substitute for net income,

net revenue, operating income, cash flows from operating activities

or any other measure for determining the Company’s operating

performance or liquidity that is calculated in accordance with

GAAP. In addition, Non-GAAP Financial Measures may be defined or

calculated differently by other companies and, therefore,

comparability may be limited.

For further information, please

contact:Cumulus Media Inc.Investor

Relations DepartmentIR@cumulus.com404-260-6600

Supplemental Financial Data and

Reconciliations

|

Cumulus Media Inc.Unaudited Condensed

Consolidated Statements of Operations(Dollars in

thousands) |

|

|

|

|

|

Three Months EndedJune 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net revenue |

|

$ |

204,849 |

|

|

$ |

210,136 |

|

|

$ |

404,902 |

|

|

$ |

415,828 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Content costs |

|

|

73,631 |

|

|

|

73,533 |

|

|

|

158,688 |

|

|

|

162,199 |

|

|

Selling, general & administrative expenses |

|

|

94,359 |

|

|

|

94,401 |

|

|

|

189,119 |

|

|

|

188,702 |

|

|

Depreciation and amortization |

|

|

14,680 |

|

|

|

15,146 |

|

|

|

29,549 |

|

|

|

29,830 |

|

|

Corporate expenses |

|

|

12,122 |

|

|

|

11,899 |

|

|

|

24,752 |

|

|

|

24,497 |

|

|

Stock-based compensation expense |

|

|

1,336 |

|

|

|

1,492 |

|

|

|

2,408 |

|

|

|

2,618 |

|

|

Restructuring costs |

|

|

1,988 |

|

|

|

10,716 |

|

|

|

4,118 |

|

|

|

11,007 |

|

|

Debt exchange costs |

|

|

16,271 |

|

|

|

— |

|

|

|

16,271 |

|

|

|

— |

|

|

Loss (gain) on sale of assets or stations |

|

|

45 |

|

|

|

(272 |

) |

|

|

54 |

|

|

|

(7,281 |

) |

|

Total operating expenses |

|

|

214,432 |

|

|

|

206,915 |

|

|

|

424,959 |

|

|

|

411,572 |

|

|

Operating (loss) income |

|

|

(9,583 |

) |

|

|

3,221 |

|

|

|

(20,057 |

) |

|

|

4,256 |

|

| Non-operating expense: |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(17,626 |

) |

|

|

(17,940 |

) |

|

|

(34,986 |

) |

|

|

(35,606 |

) |

|

Interest income |

|

|

146 |

|

|

|

712 |

|

|

|

492 |

|

|

|

1,081 |

|

|

Gain on early extinguishment of debt |

|

|

170 |

|

|

|

8,389 |

|

|

|

170 |

|

|

|

9,006 |

|

|

Other (expense) income, net |

|

|

(27 |

) |

|

|

(268 |

) |

|

|

14,806 |

|

|

|

(286 |

) |

|

Total non-operating expense, net |

|

|

(17,337 |

) |

|

|

(9,107 |

) |

|

|

(19,518 |

) |

|

|

(25,805 |

) |

|

Loss before income taxes |

|

|

(26,920 |

) |

|

|

(5,886 |

) |

|

|

(39,575 |

) |

|

|

(21,549 |

) |

| Income tax (expense)

benefit |

|

|

(779 |

) |

|

|

4,818 |

|

|

|

(2,278 |

) |

|

|

(986 |

) |

|

Net loss |

|

$ |

(27,699 |

) |

|

$ |

(1,068 |

) |

|

$ |

(41,853 |

) |

|

$ |

(22,535 |

) |

|

|

The following tables reconcile net loss, the

most directly comparable financial measure calculated and presented

in accordance with GAAP, to Adjusted EBITDA for the periods

presented herein (dollars in thousands):

|

As Reported |

|

Three Months Ended June 30, 2024 |

|

Three Months Ended June 30, 2023 |

|

GAAP net loss |

|

$ |

(27,699 |

) |

|

$ |

(1,068 |

) |

|

Income tax expense (benefit) |

|

|

779 |

|

|

|

(4,818 |

) |

|

Non-operating expense, including net interest expense |

|

|

17,507 |

|

|

|

17,496 |

|

|

Depreciation and amortization |

|

|

14,680 |

|

|

|

15,146 |

|

|

Stock-based compensation expense |

|

|

1,336 |

|

|

|

1,492 |

|

|

Loss (gain) on sale or disposal of assets or stations |

|

|

45 |

|

|

|

(272 |

) |

|

Gain on early extinguishment of debt |

|

|

(170 |

) |

|

|

(8,389 |

) |

|

Restructuring costs |

|

|

1,988 |

|

|

|

10,716 |

|

|

Debt exchange costs |

|

|

16,271 |

|

|

|

— |

|

|

Non-routine legal expenses |

|

|

280 |

|

|

|

173 |

|

|

Franchise taxes |

|

|

196 |

|

|

|

200 |

|

| Adjusted EBITDA |

|

$ |

25,213 |

|

|

$ |

30,676 |

|

|

As Reported |

|

Six Months Ended June 30, 2024 |

|

Six Months Ended June 30, 2023 |

|

GAAP net loss |

|

$ |

(41,853 |

) |

|

$ |

(22,535 |

) |

|

Income tax expense |

|

|

2,278 |

|

|

|

986 |

|

|

Non-operating expense, including net interest expense |

|

|

19,688 |

|

|

|

34,811 |

|

|

Depreciation and amortization |

|

|

29,549 |

|

|

|

29,830 |

|

|

Stock-based compensation expense |

|

|

2,408 |

|

|

|

2,618 |

|

|

Loss (gain) on sale or disposal of assets or stations |

|

|

54 |

|

|

|

(7,281 |

) |

|

Gain on early extinguishment of debt |

|

|

(170 |

) |

|

|

(9,006 |

) |

|

Restructuring costs |

|

|

4,118 |

|

|

|

11,007 |

|

|

Debt exchange costs |

|

|

16,271 |

|

|

|

— |

|

|

Non-routine legal expenses |

|

|

888 |

|

|

|

176 |

|

|

Franchise taxes |

|

|

387 |

|

|

|

399 |

|

| Adjusted EBITDA |

|

$ |

33,618 |

|

|

$ |

41,005 |

|

| |

The following tables reconcile the as reported

net revenue and as reported Adjusted EBITDA, both including and

excluding the impact of political, for the periods presented herein

(dollars in thousands):

| |

|

Three Months Ended June 30, 2024 |

|

Three Months Ended June 30, 2023 |

|

As reported net revenue |

|

$ |

204,849 |

|

|

$ |

210,136 |

|

|

Political revenue |

|

|

(1,909 |

) |

|

|

(502 |

) |

| As reported net revenue,

excluding impact of political revenue |

|

$ |

202,940 |

|

|

$ |

209,634 |

|

| |

|

Three Months Ended June 30, 2024 |

|

Three Months Ended June 30, 2023 |

|

As reported Adjusted EBITDA |

|

$ |

25,213 |

|

|

$ |

30,676 |

|

|

Political EBITDA |

|

|

(1,718 |

) |

|

|

(451 |

) |

| As reported Adjusted EBITDA,

excluding impact of political EBITDA |

|

$ |

23,495 |

|

|

$ |

30,225 |

|

| |

|

Six Months Ended June 30, 2024 |

|

Six Months Ended June 30, 2023 |

|

As reported net revenue |

|

$ |

404,902 |

|

|

$ |

415,828 |

|

|

Political revenue |

|

|

(4,108 |

) |

|

|

(907 |

) |

| As reported net revenue,

excluding impact of political revenue |

|

$ |

400,794 |

|

|

$ |

414,921 |

|

| |

|

Six Months Ended June 30, 2024 |

|

Six Months Ended June 30, 2023 |

|

As reported Adjusted EBITDA |

|

$ |

33,618 |

|

|

$ |

41,005 |

|

|

Political EBITDA |

|

|

(3,697 |

) |

|

|

(816 |

) |

| As reported Adjusted EBITDA,

excluding impact of political EBITDA |

|

$ |

29,921 |

|

|

$ |

40,189 |

|

| |

The following table reconciles total debt

principal, gross, the most directly comparable financial measure

calculated and presented in accordance with GAAP, to total debt at

maturity and net debt less total unamortized discount (dollars in

thousands):

| |

|

As of June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

| Total debt principal,

gross |

|

$ |

674,364 |

|

|

$ |

680,947 |

|

| Less: Total unamortized

discount |

|

|

(32,242 |

) |

|

|

— |

|

| Total debt at maturity |

|

|

642,122 |

|

|

|

680,947 |

|

| Less: Cash and cash

equivalents |

|

|

(53,492 |

) |

|

|

(92,420 |

) |

| Net debt less total

unamortized discount |

|

$ |

588,630 |

|

|

$ |

588,527 |

|

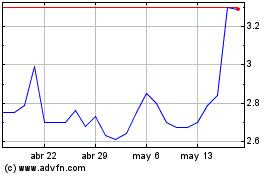

Cumulus Media (NASDAQ:CMLS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Cumulus Media (NASDAQ:CMLS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024