UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 001-33107

CANADIAN

SOLAR INC.

545 Speedvale Avenue West, Guelph,

Ontario, Canada N1K 1E6

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

CANADIAN SOLAR INC.

Form 6-K

TABLE OF CONTENTS

Explanatory

Note

CSI Solar Co., Ltd. (“CSI Solar”), a majority-owned

subsidiary of Canadian Solar Inc. (“Canadian Solar”) with its shares listed on the Shanghai Stock Exchange (“SSE”)’s

Sci-Tech Innovation Board, has filed with the SSE a voluntary disclosure announcement on performance for the first half of 2024

(the “Announcement”). Currently, Canadian Solar owns approximately 62% of CSI Solar.

Exhibit 99.1 provides an English translation of the Announcement

for CSI Solar.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CANADIAN SOLAR INC. |

| |

|

| |

By: |

/s/ Shawn (Xiaohua)

Qu |

| |

Name: |

Shawn (Xiaohua) Qu |

| |

Title: |

Chairman and Chief |

| |

|

Executive Officer |

| |

|

| Date: July 17, 2024 |

|

EXHIBIT INDEX

Exhibit 99.1 — CSI Solar Co., Ltd. Voluntary Disclosure Announcement on Performance for the First Half of 2024

Exhibit 99.1

| SSE Stock Code: 688472 |

SSE Stock Abbreviation: CSI Solar |

SSE Announcement Number: 2024-037 |

CSI Solar Co., Ltd.

Voluntary Disclosure Announcement on Performance

for the First Half of 2024

The

board of directors of CSI Solar Co., Ltd. (the “Company” or “CSI Solar”) and all members of the board of

directors guarantee that the information of this public announcement contains no misrepresentations, misleading statements or material

omissions, and they are legally responsible for the truthfulness, accuracy and completeness of the information contained herein.

I. Performance for the First Half of 2024

In

the first half of 2024, by leveraging its strengths, adopting a rational strategy, adjusting tactics, and balancing with the

development of its second primary business – battery energy storage solutions, CSI Solar maintained relatively good

profitability. The Company expects the net profit attributable to the shareholders of the Company in the first half of 2024

to range from RMB1.20 billion to RMB1.40 billion. Similarly, the net profit attributable to the shareholders of the Company,

excluding non-recurring gains and losses, is expected to be between RMB1.20 billion and RMB1.40 billion in the first half of 2024.

The Company also expects the net profit in the second quarter of 2024 to continue increasing from that in the first quarter of 2024,

with a quarter-over-quarter (“qoq”) increase ranging from 7% to 42%. The Company has now achieved qoq net profit growth

for two consecutive quarters. Details are as follows:

1. Photovoltaic Business:

Total

module shipments in the first quarter of 2024 were 6.3 GW, up 3.28% year-over-year (“yoy”), with over 20% delivered to the

North America market. The Company expects total module shipments in the second quarter of 2024 to be approximately 8.0 GW, up 27% qoq.

Under current market conditions, CSI Solar will strike a balance between pricing and shipment volumes by forgoing certain loss-making

orders and proactively reducing the shipment volume of photovoltaic products. The Company will prioritize maintaining its profitability,

operational stability, and financial health. Additionally, it will leverage its industry-leading capabilities and global brand reputation

to secure high-margin orders worldwide, ensuring profitability. Through continuous investment in R&D, technological innovation, and

systematic patent deployment, CSI Solar strives to maintain its technological leadership in the industry. Furthermore, the Company strengthens

cost management through technological innovation and lean production management, thereby achieving long-term sustainable development.

2. Battery Energy Storage Business:

CSI Solar’s utility-scale battery energy storage business has

made significant progress, its second primary business continuing to grow steadily. The Company is beginning to make large-scale deliveries

this year on its large base of battery energy storage pipeline and contracted orders. In the first quarter of this year, the delivery

volume of CSI Solar’s utility-scale battery energy storage products nearly totaled that of 2023 in its entirety. The delivery volume

of utility-scale battery energy storage products in the second quarter is expected to grow by more than 50% qoq. For the full year 2024,

CSI Solar expects to ship between 6.0 GWh and 6.5 GWh of utility-scale battery energy storage solutions, approximately 500% more than

2023 volumes.

Recent developments in the utility-scale battery energy storage business

are as follows:

| (1) | e-STORAGE, the Company's battery energy storage subsidiary, will deliver 220 MWh DC of energy storage solutions to a standalone energy

storage project owned by Epic Energy in Mannum, South Australia. Epic Energy is one of Australia's leading energy infrastructure companies, with a gas pipeline

network spanning over 1,200 kilometres and an expanding renewable energy portfolio. |

| (2) | The Company assisted in the construction of Gansu's largest standalone shared energy storage power station project (500 MW/1000 MWh).

This 500 MW/1000 MWh energy storage power station using the Company’s SolBank battery energy storage system is Gansu’s first

shared energy storage system and first liquid-cooled energy storage system, as well as the world's highest voltage (330 kV) energy storage

power station. The first phase (150 MW/300 MWh) was fully connected to the grid on May 30, 2023, and the second phase of the project

is currently progressing steadily. |

| (3) | e-STORAGE secured a contract with Nova Scotia Power to develop flagship energy storage projects across three locations in Nova Scotia,

Canada: Bridgewater, Waverley, and White Rock, totaling 150 MW/705 MWh DC. |

| (4) | e-STORAGE secured a contract with Aypa Power (“Aypa”), a member of Blackstone Group, to deliver a 498 MWh DC standalone

battery energy storage system for Aypa's Bypass Project. The Bypass Project is scheduled for completion in the third quarter of 2025 and

is the Company’s third project with Aypa, bringing the Company’s total energy storage capacity commitment to Aypa to 1.3 GWh. |

| (5) | As of March 31, 2024, the Company had approximately 56 GWh of energy storage pipeline, including long-term service agreements,

with contracted backlog totaling USD2.5 billion (approximately RMB18.1 billion converted according to the recent USD exchange rate). |

| (6) | In the “BNEF Energy Storage Tier 1 List 2Q 2024” released by Bloomberg New Energy Finance (BNEF) (a list of global Tier

1 energy storage manufacturers in the second quarter of 2024), e-STORAGE ranked as a Tier 1 energy storage manufacturer, recognized for

its highly efficient and reliable products, outstanding global projects, and strong bankability. |

The Company has successfully delivered over 5 GWh of battery energy

storage solutions to markets in North America, Europe, and the Asia-Pacific region. With growing global demand for advanced energy solutions,

the Company is expanding its production capacity to meet the needs of its customers and partners.

3. New Businesses Including Residential Battery Energy Storage and

Power Electronics:

CSI

Solar has established distribution networks across key residential battery energy storage markets such as North America,

Europe, and Japan, while expanding into new business areas such as power electronics to broaden application boundaries and diversify

value creation. The Company is also working on establishing a third, and possibly more, profit streams. For example, in

June 2024, the Company entered into an agreement with U.S. largest homebuilder D.R. Horton to offer its solar and energy

storage products across communities in California, which include both its high-efficiency solar panels and fully integrated

residential energy storage system, EP Cube.

4. Cash Flow and Financing:

As of March 31, 2024, the Company had monetary funds of RMB18.714

billion. As of June 30, 2024, the Company had various types of bank credit facilities totaling approximately RMB40.4 billion, of

which approximately RMB14.9 billion has been drawn, representing a credit utilization rate of only 37%. Based on its cash needs for operations

and debt repayments amidst the current financing environment, the Company continuously optimizes its financial leverage, reduces financial

costs, and safeguards liquidity throughout the industry cycle.

5. Performance Outlook:

Based on the Company’s photovoltaic performance trends and results

in the first and second quarter of 2024, as well as the current order and delivery status of the battery energy storage business, the

Company anticipates better performance in the second half of the year compared to the first half (This performance outlook does not guarantee

performance for the second half of the year. The actual performance of 2024 will be disclosed in the Company’s 2024 annual report,

prevailing as final.)

As a distinguished pioneer in the solar PV and battery energy storage

industry, CSI Solar remains committed to its mission of contributing to carbon neutrality amidst an increasingly complex and challenging

ecosystem and social environment. The Company will focus on strengthening its operational performance, actively responding and adapting

to new external developments. Guided by the requirements of “new quality productivity,” the Company will adhere to an “investor-oriented”

development philosophy. By striving to enhance its operational quality and investment value, CSI Solar aims to deliver compelling shareholder

returns.

II. Risk Alert

The aforementioned data has not been audited by certified public

accountants, could differ from the data disclosed in periodic reports, and is for investors’ interim reference only. The

specific and accurate financial data to be disclosed in the Company’s periodic reports shall prevail as final. Investors are

hereby advised to be mindful of investment risks.

We hereby announce the above.

Board of Directors of CSI

Solar Co., Ltd.

July 18, 2024

Safe Harbor/Forward-Looking Statements

Certain statements in this announcement, including those regarding

Canadian Solar Inc. (“Canadian Solar”)’s expected future shipment volumes, revenues, gross margins, and project sales

are forward-looking statements that involve a number of risks and uncertainties that could cause actual results to differ materially.

These statements are made under the “Safe Harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

In some cases, you can identify forward-looking statements by such terms as “believes,” “expects,” “anticipates,”

“intends,” “estimates,” the negative of these terms, or other comparable terminology. Factors that could cause

actual results to differ include general business, regulatory and economic conditions and the state of the solar power and battery energy storage

market and industry; geopolitical tensions and conflicts, including impasses, sanctions and export controls; volatility, uncertainty,

delays and disruptions related to global pandemics; supply chain disruptions; governmental support for the deployment of solar

power and battery energy storage; future available supplies of silicon, solar wafers and lithium cells; demand for end-use products

by consumers and inventory levels of such products in the supply chain; changes in demand from significant customers; changes in demand

from major markets such as China, the U.S., Europe, Brazil and Japan; changes in effective tax rates; changes in customer

order patterns; changes in product mix; changes in corporate responsibility, especially environmental, social and governance (“ESG”)

requirements; capacity utilization; level of competition; pricing pressure and declines in or failure to timely adjust average selling

prices; delays in new product introduction; delays in utility-scale project approval process; delays in utility-scale project construction;

delays in the completion of project sales; the pipeline of projects and timelines related to them; the ability of the parties to

optimize value of that pipeline; continued success in technological innovations and delivery of products with the features that customers

demand; shortage in supply of materials or capacity requirements; availability of financing; exchange and inflation rate fluctuations;

litigation and other risks as described in Canadian Solar’s filings with the Securities and Exchange Commission, including its annual

report on Form 20-F filed on April 26, 2024. Although Canadian Solar believes that the expectations reflected in the forward-looking

statements are reasonable, it cannot guarantee future results, level of activity, performance, or achievements. Investors should not place

undue reliance on these forward-looking statements. All information provided in this press release is as of today's date, unless otherwise

stated, and Canadian Solar undertakes no duty to update such information, except as required under applicable law.

Chinese GAAP

The Company’s aforementioned data was prepared in accordance

with Chinese GAAP, whereas Canadian Solar’s financial statements are prepared in accordance with generally accepted accounting

principles in the United States (“U.S. GAAP”). Chinese GAAP differs materially from U.S. GAAP. The Company has not prepared

a reconciliation of the aforementioned data between Chinese GAAP and U.S. GAAP and has not quantified such differences. In addition, Canadian Solar’s

financial statements eliminate all intercompany transactions between Canadian Solar, the Company and Recurrent Energy (formerly Global

Energy) subsidiaries. As a result, the Company’s aforementioned data is not directly comparable to the corresponding consolidated financial performance

of Canadian Solar. Investors should consult their own professional advisors for an understanding of the differences between Chinese GAAP

and U.S. GAAP and how those differences might affect the information contained in the aforementioned data.

Some of the applicable differences between Chinese GAAP and U.S. GAAP

include the presentation of the income statement, recognition of share-based compensation, the intraperiod income taxes, the accumulated

and unappropriated profits, and the specific standard on assets held for sale.

No Audit or Review

The aforementioned data has not been audited or reviewed by the

independent public accountants of Canadian Solar or the Company. The aforementioned data should not be relied upon by investors to

provide the same type or quality of information as information that has been subject to an audit or review by independent

auditors.

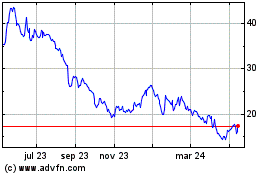

Canadian Solar (NASDAQ:CSIQ)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

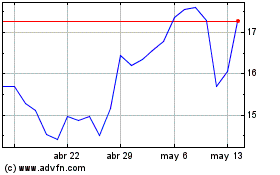

Canadian Solar (NASDAQ:CSIQ)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024