Cyclacel Pharmaceuticals, Inc. (NASDAQ: CYCC, NASDAQ: CYCCP;

"Cyclacel" or the "Company"), a biopharmaceutical company

developing innovative medicines based on cancer cell biology,

announced today first quarter financial results and provided a

business update.

“We are excited to report that we have begun

enrolling patients in the Phase 2, proof of concept (PoC) stage of

our 065-101 study of fadraciclib, our oral CDK2/9 inhibitor, and

are on track to deliver key readouts this year,” said Spiro

Rombotis, President and Chief Executive Officer. “Receipt of $8.0

million gross proceeds in a private placement together with

existing resources support our ongoing clinical program.

Pharmacokinetic, pharmacodynamic, safety and anticancer activity

data from the Phase 1, dose escalation stage of 065-101 in patients

with advanced solid tumors and lymphoma will be presented at the

upcoming American Society of Clinical Oncology (ASCO) Annual

Meeting. Data to date suggest that fadraciclib is differentiated

from other next generation CDK inhibitors.”

“Having determined the recommended Phase 2 dose

for fadraciclib we are now enrolling patients in the Phase 2 PoC

stage of 065-101” said Brian Schwartz, M.D., interim Chief Medical

Officer. “We are initially concentrating on the biomarker cohort

which is enrolling patients prospectively selected for

CDKN2A/CDKN2B alterations to be followed by patients with T-cell

lymphoma. There are no approved medicines for patients with

CDKN2A/CDKN2B alterations. Including currently opened trial sites,

we expect a total of up to seven sites will participate with the

majority in the United States. We are encouraged about fadra’s

prospects and look forward to presenting emerging data from the

065-101 study later in the year.“

Key Upcoming Milestones for

2024

- Report final data from dose escalation

stage and RP2D determination from the 065-101 study of oral

fadraciclib in patients with advanced solid tumors and lymphoma at

the ASCO 2024 Annual Meeting

- Report interim data from initial

cohorts in Phase 2 proof-of-concept stage of 065-101 study with

oral fadraciclib in patients with advanced solid tumors and

lymphoma

Financial Highlights

As of March 31, 2024, pro forma cash and cash

equivalents totalled $9.9 million, including proceeds from this

month’s private placement and $0.8 million received for the United

Kingdom research & development tax credit. Cash and cash

equivalents as of March 31, 2024, totalled $2.8 million, compared

to $3.4 million as of December 31, 2023.

Net cash used in operating activities was $0.5

million for the three months ended March 31, 2024, which includes

$2.9 million received in March in respect of the United Kingdom

research & development tax credit, compared to $6.9 million for

the same period of 2023. The Company estimates that its current

cash resources will fund planned programs into the fourth quarter

of 2024.

Research and development (R&D) expenses were

$2.8 million for the three months ended March 31, 2024, as compared

to $5.7 million for the same period in 2023. R&D expenses

relating to fadraciclib were $1.8 million for the three months

ended March 31, 2024, as compared to $4.1 million for the same

period in 2023 due to a decrease in clinical trial and other

non-clinical expenditures. R&D expenses related to plogosertib

were $1.0 million for the three months ended March 31, 2024, as

compared to $1.4 million for the same period in 2023 due to a

decrease in manufacturing and other non-clinical

expenditures.

General and administrative expenses remained

relatively flat at approximately $1.6 million for each of the three

months ended March 31, 2024 and 2023.

Total other expenses, net, for the three months and

year ended March 31, 2024, were $0.1 million, compared to $0.2

million for the same period of the previous year.

United Kingdom research & development tax

credits for the three months March 31, 2024, were $1.4 million,

which includes $0.8 million related to the 2023 claim which was

received in May 2024, compared to $1.3 million for the same period

of the previous year and are directly correlated to qualifying

research and development expenditure.

Net loss for the three months March 31, 2024, was

$2.9 million (including non-cash stock-based compensation expense

of $0.2 million), compared to $5.8 million (including non-cash

stock-based compensation expense of $0.4 million) for the same

period in 2023.

Conference call information:

Call: (888) 632-3384 / international call: (785)

424-1794

Archive: (800) 938-1584 / international archive:

(402) 220-1542

Code for live and archived conference call is

CYCCQ124. Webcast link

For the live and archived webcast, please visit the

Corporate Presentations page on the Cyclacel website

at www.cyclacel.com. The webcast will be archived for 90 days

and the audio replay for 7 days.

About Cyclacel Pharmaceuticals,

Inc. Cyclacel is a clinical-stage, biopharmaceutical

company developing innovative cancer medicines based on cell cycle,

transcriptional regulation and mitosis biology. The transcriptional

regulation program is evaluating fadraciclib, a CDK2/9 inhibitor,

and the anti-mitotic program CYC140, a PLK1 inhibitor, in patients

with both solid tumors and hematological

malignancies. Cyclacel's strategy is to build a

diversified biopharmaceutical business based on a pipeline of novel

drug candidates addressing oncology and hematology indications. For

additional information, please

visit www.cyclacel.com.

Forward-looking Statements

This news release contains certain

forward-looking statements that involve risks and uncertainties

that could cause actual results to be materially different from

historical results or from any future results expressed or implied

by such forward-looking statements. Such forward-looking statements

include, among other things, statements related to the intended use

of proceeds from the private placement, the efficacy, safety and

intended utilization of Cyclacel’s product candidates, the conduct

and results of future clinical trials, plans regarding regulatory

filings, future research and clinical trials and plans regarding

partnering activities. Factors that may cause actual results to

differ materially include market and other conditions, the risk

that product candidates that appeared promising in early research

and clinical trials do not demonstrate safety and/or efficacy in

larger-scale or later clinical trials, trials may have difficulty

enrolling, Cyclacel may not obtain approval to market its

product candidates, the risks associated with reliance on outside

financing to meet capital requirements, the risks associated with

reliance on collaborative partners for further clinical trials,

development and commercialization of product candidates and

Cyclacel’s ability to regain and maintain compliance with Nasdaq’s

continued listing requirements. You are urged to consider

statements that include the words "may," "will," "would," "could,"

"should," "believes," "estimates," "projects," "potential,"

"expects," "plans," "anticipates," "intends," "continues,"

"forecast," "designed," "goal," or the negative of those words or

other comparable words to be uncertain and forward-looking. For a

further list and description of the risks and uncertainties the

Company faces, please refer to our most recent Annual Report on

Form 10-K and other periodic and other filings we file with

the Securities and Exchange Commission and are available

at www.sec.gov. Such forward-looking statements are current

only as of the date they are made, and we assume no obligation to

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

Contacts

|

Company: |

Paul McBarron, (908) 517-7330, pmcbarron@cyclacel.com |

|

Investor Relations: |

Grace Kim, IR@cyclacel.com |

|

|

|

© Copyright 2024 Cyclacel Pharmaceuticals, Inc. All

Rights Reserved. The Cyclacel logo and Cyclacel® are trademarks of

Cyclacel Pharmaceuticals, Inc.

SOURCE: Cyclacel Pharmaceuticals, Inc.

| |

| CYCLACEL

PHARMACEUTICALS, INC. CONSOLIDATED STATEMENTS

OF OPERATIONS (LOSS)(In $000s, except share and per share

amounts) |

| |

| |

|

Three Months

Ended |

| |

|

March

31, |

| |

|

2024 |

|

2023 |

| |

|

|

|

|

|

Revenues |

|

$ |

29 |

|

|

$ |

- |

|

| |

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

Research and development |

|

|

2,802 |

|

|

|

5,674 |

|

|

General and administrative |

|

|

1,582 |

|

|

|

1,645 |

|

|

Total operating expenses |

|

|

4,384 |

|

|

|

7,319 |

|

|

Operating loss |

|

|

(4,355 |

) |

|

|

(7,319 |

) |

|

Other income (expense): |

|

|

|

|

|

Foreign exchange gains (losses) |

|

|

1 |

|

|

|

(87 |

) |

|

Interest income |

|

|

2 |

|

|

|

116 |

|

|

Other income, net |

|

|

52 |

|

|

|

166 |

|

|

Total other income (expense), net |

|

|

55 |

|

|

|

195 |

|

|

Loss before taxes |

|

|

(4,300 |

) |

|

|

(7,124 |

) |

|

Income tax benefit |

|

|

1,354 |

|

|

|

1,320 |

|

|

Net loss |

|

|

(2,946 |

) |

|

|

(5,804 |

) |

|

Dividend on convertible exchangeable preferred shares |

|

|

- |

|

|

|

(50 |

) |

|

Net loss applicable to common shareholders |

|

$ |

(2,946 |

) |

|

$ |

(5,854 |

) |

|

Basic and diluted earnings per common share: |

|

|

|

|

|

Net loss per share – basic and diluted (common shareholders) |

|

$ |

(2.27 |

) |

|

$ |

(7.00 |

) |

|

Net loss per share – basic and diluted (redeemable common

shareholders) |

|

$ |

- |

|

|

$ |

(7.00 |

) |

| |

|

|

|

|

|

Weighted average common shares outstanding |

|

|

1,296,547 |

|

|

|

835,946 |

|

|

|

|

|

|

|

| |

| CYCLACEL

PHARMACEUTICALS, INC. CONSOLIDATED BALANCE

SHEET (In $000s, except share, per share, and

liquidation preference amounts) |

| |

|

|

|

|

|

|

|

|

| |

|

March

31, |

|

December

31, |

| |

|

2024 |

|

2023 |

| |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2,798 |

|

|

$ |

3,378 |

|

|

Prepaid expenses and other current assets |

|

|

2,037 |

|

|

|

4,066 |

|

|

Total current assets |

|

|

4,835 |

|

|

|

7,444 |

|

| |

|

|

|

|

|

|

Property and equipment, net |

|

|

7 |

|

|

|

9 |

|

|

Right-of-use lease asset |

|

|

79 |

|

|

|

93 |

|

|

Non-current deposits |

|

|

1,244 |

|

|

|

1,259 |

|

|

Total assets |

|

$ |

6,165 |

|

|

$ |

8,805 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

5,200 |

|

|

$ |

3,543 |

|

|

Accrued and other current liabilities |

|

|

3,150 |

|

|

|

4,618 |

|

|

Total current liabilities |

|

|

8,350 |

|

|

|

8,161 |

|

|

Lease liability |

|

|

21 |

|

|

|

37 |

|

|

Total liabilities |

|

|

8,371 |

|

|

|

8,198 |

|

|

|

|

|

|

|

|

|

Stockholders’ equity |

|

|

(2,206 |

) |

|

|

607 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

6,165 |

|

|

$ |

8,805 |

|

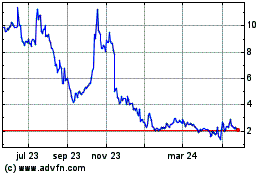

Cyclacel Pharmaceuticals (NASDAQ:CYCC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

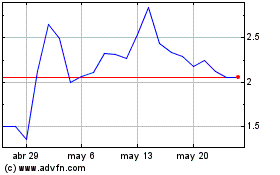

Cyclacel Pharmaceuticals (NASDAQ:CYCC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025