Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

24 Octubre 2022 - 3:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT

OF 1934

For the month of October 2022

Commission File Number: 001-36582

Altamira Therapeutics Ltd.

(Exact name of registrant as specified in its

charter)

Clarendon House,

2 Church Street

Hamilton HM11, Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No

☒

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No

☒

On October 19, 2022, Altamira Therapeutics Ltd., an exempted company limited by shares incorporated in Bermuda (the “Company”), entered into a share purchase agreement (the “SPA”) with a European family office (the “Buyer”), pursuant to which the Buyer agreed to acquire 90% of the share capital of the Company’s subsidiary Zilentin Ltd., Zug (Switzerland) (“Zilentin”) for immediate cash consideration of $1 million. Zilentin has been active in the research for novel, second generation tinnitus treatments in

collaboration with leading academic partners (project AM-102). At the closing of such acquisition (expected on or about October 28, 2022)

(the “Initial Closing”), Zilentin has agreed to purchase from the Company, for immediate cash consideration of another $1

million, an option (the “Option”), pursuant to an option agreement dated October 19, 2022 (the “Option Agreement”)

that entitles Zilentin to acquire (such acquisition, “Transaction 2”) all (and not part) of the Company’s remaining

legacy assets in inner ear therapeutics, including AM-101 (tinnitus), AM-111 (hearing loss) and AM-125 (vertigo), for an upfront payment

of $25 million in cash upon exercise.

The Option may be exercised

for 30 days following the date of the Option Agreement. Beyond the 30 days, Zilentin will have a right of first refusal to acquire the

subject assets until December 31, 2022, with the $25 million option-exercise payment increasing by $1 million every 30-day increment following

the initial date of the Option Agreement.

After an exercise of the Option

by Zilentin (or purchase of the assets otherwise before December 31, 2022), if any, the Company will be entitled to receive milestone

payments of up to $55 million in the aggregate as well as royalties. The milestones relate to certain development or regulatory milestones,

and are as follows:

| ● | the acceptance of an investigational new drug application by the U.S. Federal Drug Administration for

AM-125 ($5 million); |

| | | |

| ● | a successful Phase 3 study for AM-125 ($10 million); |

| | | |

| ● | the regulatory approval for AM-125 in vertigo ($10 million); |

| | | |

| ● | the regulatory approval of AM-101 in acute inner ear tinnitus ($10 million); |

| | | |

| ● | the regulatory approval of AM-111 in acute inner ear hearing loss ($10 million); and |

| | | |

| ● | the grant of a license for the Company’s RNA delivery technology to Zilentin for certain targets

in inner ear disorders, on or before December 31, 2024 ($10 million upfront plus a mid-single digit percentage in royalties on future

revenues generated from the sale of drug products making use of the technology). |

Assuming the Option is exercised

(or Zilentin otherwise purchases the assets before December 31, 2022), the Option Agreement provides that prior to the closing of Transaction

2, the Company’s CEO, Thomas Meyer, will become the CEO of Zilentin within six months after such closing, while also retaining a

reasonable amount of time to continue serving as the principal executive of the Company together with the current RNA business leadership

team.

The Option Agreement may be

terminated by either party if the closing of Transaction 2 has not occurred on or before December 31, 2022.

There is no assurance that

Zilentin will exercise the Option or otherwise purchase the assets subject to the Option Agreement. The closing of Transaction 2 is subject

to the parties’ finalizing of the definitive documents related thereto, and the grant of the license to Zilentin for RNA delivery

technology for inner ear disorders is subject to the negotiation and agreement between the parties on such license.

The SPA and the Option Agreement

also contain customary representations, warranties and covenants by the parties, as well as customary provisions relating to indemnification,

confidentiality and other matters.

The foregoing description of

the terms of the SPA and the Option Agreement is qualified in its entirety by reference to the full text of such documents, which are

furnished as Exhibits 99.1 and 99.2, respectively, to this Report on Form 6-K, and incorporated by reference herein.

INCORPORATION BY REFERENCE

This Report on Form 6-K shall

be deemed to be incorporated by reference into the registration statements on Form F-3 (Registration Numbers 333-228121,

333-249347, 333-261127

and 333-264298) and Form

S-8 (Registration Numbers 333-232735

and 333-252141) of Altamira

Therapeutics Ltd. (formerly Auris Medical Holding Ltd.) and to be a part thereof from the date on which this report is filed, to the extent

not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

| * | Certain identified information has been excluded from this Exhibit

because it is not material and is the type that the Company treats as private or confidential. The omissions have been indicated by “[**]”. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Altamira Therapeutics Ltd. |

| |

|

|

|

| |

By: |

/s/ Marcel Gremaud |

| |

|

Name: |

Marcel Gremaud |

| |

|

Title: |

Chief Financial Officer |

| |

|

|

|

| Date: October 24, 2022 |

|

|

|

4

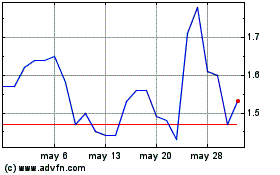

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025