UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT

OF 1934

For the month of December, 2022.

Commission File Number 001-36582

Altamira Therapeutics Ltd.

(Translation of registrant’s name into English)

Clarendon House

2 Church Street

Hamilton HM 11, Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Purchase Agreement and Registration Rights Agreement

On December 5, 2022, Altamira

Therapeutics Ltd., an exempted company limited by shares incorporated in Bermuda (“we” or the “Company”), entered

into a purchase agreement (the “Purchase Agreement”) and a registration rights agreement (the “Registration Rights Agreement”)

with Lincoln Park Capital Fund, LLC (“Lincoln Park”), pursuant to which Lincoln Park has agreed to purchase from us, from

time to time, up to $10,000,000 of our common shares, par value CHF 0.20 per share (the “Common Shares”), subject to certain

limitations set forth in the Purchase Agreement, during the 24-month term of the Purchase Agreement following the Commencement Date (defined

below). As consideration for Lincoln Park’s irrevocable commitment to purchase shares of the Company’s Common Stock upon the

terms of and subject to satisfaction of the conditions set forth in the Purchase Agreement, the Company agreed to issue 50,000 shares

of its Common Stock immediately to Lincoln Park as commitment shares. Pursuant to the terms of the Registration Rights Agreement, we will

file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F-1 (the “Registration

Statement”) to register for resale under the Securities Act of 1933, as amended (the “Securities Act”), Common Shares

that we may elect to sell to Lincoln Park from time to time from and after the Commencement Date under the Purchase Agreement.

We do not have the right to

commence any sales to Lincoln Park under the Purchase Agreement until all of the conditions thereto that are set forth in the Purchase

Agreement, all of which are outside of Lincoln Park’s control, have been satisfied, including, among other things, the Registration

Statement being declared effective by the SEC (the date on which all such conditions are satisfied, the “Commencement Date”).

From and after the Commencement Date, under the Purchase Agreement, on any business day selected by us on which the closing sale price

of our Common Shares exceeds the Floor Price (as defined in the Purchase Agreement) and all purchased Common Shares subject to all prior

Regular Purchases (as defined in the Purchase Agreement) have theretofore been received by Lincoln Park as DWAC Shares (as defined in

the Purchase Agreement), we may direct Lincoln Park to purchase up to 15,000 Common Shares on the applicable purchase date (a “Regular

Purchase”), which maximum number of shares may be increased to certain higher amounts up to a maximum of 30,000 Common Shares, if

the market price of our Common Shares at the time of the Regular Purchase equals or exceeds $10.00 (such share and dollar amounts subject

to proportionate adjustments for share splits, reverse share splits, recapitalizations and other similar transactions as set forth in

the Purchase Agreement), provided that Lincoln Park’s purchase obligation under any single Regular Purchase shall not exceed $1,500,000.

The purchase price of Common Shares we may elect to sell to Lincoln Park under the Purchase Agreement in a Regular Purchase, if any, will

be based on prevailing market prices of our Common Shares immediately preceding the time of sale as set forth in the Purchase Agreement.

In addition to Regular Purchases,

the Company may also direct Lincoln Park to purchase other amounts of our Common Shares in “accelerated purchases” and in

“additional accelerated purchases” under the terms set forth in the Purchase Agreement.

Lincoln Park has no right

to require us to sell any Common Shares to Lincoln Park, but Lincoln Park is obligated to make purchases as the Company directs, subject

to certain conditions. There are no upper limits on the price per share that Lincoln Park must pay for our Common Shares that we may elect

to sell to Lincoln Park pursuant to the Purchase Agreement. In all instances, the Company may not sell Common Shares to Lincoln Park under

the Purchase Agreement to the extent that the sale of shares would result in Lincoln Park beneficially owning more than 4.99% of our Common

Shares.

There are no restrictions

on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement or Registration

Rights Agreement, other than our agreement not to enter into any “variable rate” transactions (as defined in the Purchase

Agreement) with any third party, subject to certain exceptions set forth in the Purchase Agreement, for the period set forth in the Purchase

Agreement. Lincoln Park has covenanted not to cause or engage in any direct or indirect short selling or hedging of our Common Shares.

Actual sales of Common Shares,

if any, to Lincoln Park under the Purchase Agreement will depend on a variety of factors to be determined by the Company from time to

time, including, among others, market conditions, the trading price of the Common Shares and determinations by the Company as to the appropriate

sources of funding for the Company and its operations. The net proceeds to us from sales of Common Shares to Lincoln Park under the Purchase

Agreement, if any, will depend on the frequency and prices at which we sell shares to Lincoln Park under the Purchase Agreement. We expect

that any net proceeds received by us from such sales to Lincoln Park, if any, will be used for working capital and general corporate purposes.

The Purchase Agreement

and the Registration Rights Agreement contain customary representations, warranties, conditions and indemnification obligations of

the parties. During any “event of default” under the Purchase Agreement, all of which are outside of Lincoln

Park’s control, Lincoln Park does not have the right to terminate the Purchase Agreement; however, the Company may not

initiate any Regular Purchase or any other purchase of Common Shares by Lincoln Park, until such event of default is cured. The

Company has the right to terminate the Purchase Agreement at any time, at no cost or penalty. In addition, in the event of

bankruptcy proceedings by or against the Company that is not discharged within 90 days, the Purchase Agreement will automatically terminate. The representations,

warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were

solely for the benefit of the parties to such agreements, and may be subject to limitations agreed upon by the contracting

parties.

The Common Shares are being

sold by the Company to Lincoln Park under the Purchase Agreement in reliance upon an exemption from the registration requirements of the

Securities Act afforded by Section 4(a)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated thereunder.

The foregoing descriptions

of the Purchase Agreement and the Registration Rights Agreement are qualified in their entirety by reference to the full text of such

agreements, copies of which are attached hereto as Exhibit 10.1 and 10.2, respectively, and each of which is incorporated herein in its

entirety by reference.

INCORPORATION BY REFERENCE

This Report on Form 6-K,

including Exhibits 10.1 and 10.2 to this Report on Form 6-K, shall be deemed to be incorporated by reference into the registration

statements on Form F-3 (Registration Numbers 333-228121, 333-249347, 333-261127 and 333-264298)

and Form S-8 (Registration Numbers 333-232735 and

333-252141) of Altamira Therapeutics Ltd. (formerly Auris Medical Holding Ltd.) and to be a part thereof from the date on which this

report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Altamira Therapeutics Ltd. |

| |

|

| |

By: |

/s/ Thomas Meyer |

| |

|

Name: |

Thomas Meyer |

| |

|

Title: |

Chief Executive Officer |

Date: December 5, 2022

4

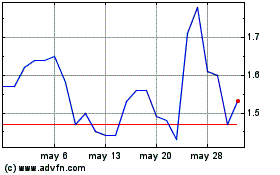

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025