Escalade, Inc. (NASDAQ: ESCA, or the “Company”), a leading

manufacturer and distributor of sporting goods and indoor/outdoor

recreational equipment, today announced results for the first

quarter 2022.

FIRST QUARTER 2022

HIGHLIGHTS(As compared to the first quarter 2021)

- Net Sales

increased 22.3% to $72.4 million

- Organic growth,

excluding the contribution from acquisitions was 12.2%

- Gross margin

declined 165 basis points, while Gross Profit increased 15.4%

- Operating income

increased 26.6% to $9.0 million

- Net income

increased to $6.7 million, or $0.49 per diluted share vs. $0.39 per

share for Q1 2021

- Announced $0.15

per share cash dividend to shareholders of record on May 31,

2022

For the three months ended March 19, 2022,

Escalade posted net sales of $72.4 million, net income of $6.7

million and diluted earnings per share of $0.49.

During the first quarter Escalade completed its

acquisition of Brunswick Billiards®, the largest and oldest

provider of billiards tables, game tables, and game room furniture

in the United States. The Escalade Board of Directors also approved

a 7.1% increase in the quarterly dividend from $0.14 to $0.15.

First quarter 2022 results benefited from strong

organic sales growth across the basketball, archery, pickleball,

and indoor game categories, together with contributions from the

Company’s acquisition of Brunswick Billiards®.

Gross margin declined 165 basis points due to

continued challenges related to the global supply chain, raw

materials cost inflation and labor constraints. Tight overhead cost

control led to a 26.6% increase in operating income. A marginally

higher tax rate and 2.7% smaller share base contributed to a 22.3%

increase in net income and 25.4% increase in diluted EPS.

Three Year Quarterly Comparison

| |

Three Months Ended |

| All

Amounts in Thousands |

March 19, 2022 |

|

March 20, 2021 |

|

March 21, 2020 |

|

|

|

|

|

|

|

| Net

sales |

$72,380 |

|

|

$59,191 |

|

|

$37,289 |

|

|

Cost of products sold |

|

52,261 |

|

|

|

41,757 |

|

|

|

27,074 |

|

|

Gross Profit |

|

20,119 |

|

|

|

17,434 |

|

|

|

10,215 |

|

| |

|

27.8% |

|

|

|

29.5% |

|

|

|

27.4% |

|

| |

|

|

|

|

|

| Operating Income |

|

9,023 |

|

|

|

7,129 |

|

|

|

2,424 |

|

| |

|

|

|

|

|

| Net Income |

|

6,654 |

|

|

|

5,442 |

|

|

|

1,951 |

|

| |

|

|

|

|

|

| Diluted earnings per share |

$0.49 |

|

|

$0.39 |

|

|

$0.14 |

|

| |

|

|

|

|

|

| Average Shares Outstanding |

|

13,509 |

|

|

|

13,880 |

|

|

|

14,118 |

|

“We are very pleased with the results in Q1,”

stated Walter P. Glazer, Jr., President and CEO of Escalade.

“Nearly all categories performed very well which validates the

strength of our brand portfolio and consumer acceptance of our

range of products. Our product teams continue to innovate and bring

compelling sporting goods, games, and related items to market while

our sourcing and logistics professionals navigate the challenging

global supply chain. We continue to ‘onshore’ items we can produce

in our domestic manufacturing facilities and remain focused on the

integration of the Brunswick acquisition, which we expect will be

accretive to earnings beginning in the second half of 2022.”

“The first quarter was positively impacted by

sales pulled forward from Q2 and favorable mix. In the near term,

we anticipate continued supply chain pressures, including delays

and excess logistics costs. We are also carefully monitoring point

of sale data along with consumer behavior and sentiment, given

rising interest rates, inflation, and geopolitical uncertainty,”

continued Glazer. “We have seen a slowdown in demand for fitness

products following unsustainable growth over the past two years.

Longer term, we believe consumers will continue to value the

positive experiences and memories created with the fun, healthy

activities they can enjoy with the Escalade lifestyle,” concluded

Glazer.

Net sales for the first quarter of 2022 were $72.4 million

compared to net sales of $59.2 million for the same quarter in

2021, an increase of $13.2 million or 22.3%.

Gross margin for the first quarter of 2022 was 27.8%, compared

to 29.5% for the same period in the prior year. Gross profit for

the first quarter of 2022 was $20.1 million compared to gross

profit of $17.4 million for the same quarter in 2021.

Selling, general and administrative expenses (SG&A) were

$10.5 million for the quarter compared to $9.9 million for the same

period in the prior year, an increase of $0.6 million or 6.6%.

SG&A, as a percent of sales, for the first quarter of 2022

decreased to 14.5% from 16.7% reported for the same period prior

year.

Operating income for the first quarter of 2022 was $9.0 million

compared to operating income of $7.1 million for the same period in

the prior year.

Net income for the first quarter of 2022 was $6.7 million, or

$0.49 diluted earnings per share compared to net income of $5.4

million, or $0.39 diluted earnings per share for the same quarter

in 2021.

The Company announced a quarterly dividend of $0.15 per share to

be paid to all shareholders of record on May 31, 2022 and disbursed

on June 7, 2022.

CONFERENCE CALL

A conference call will be held Thursday, April

14, 2022, at 11:00 a.m. ET to review the Company’s financial

results, discuss recent events and conduct a question-and-answer

session.

A webcast of the conference call and

accompanying presentation materials will be available in the

Investor Relations section of Escalade’s website at

www.escaladeinc.com. To listen to a live broadcast, go to the site

at least 15 minutes prior to the scheduled start time in order to

register, download, and install any necessary audio software.

To participate in the live teleconference:

|

Domestic Live: |

877-407-0792 |

| International Live: |

201-689-8263 |

To listen to a replay of the teleconference,

which subsequently will be available through April 28, 2022:

|

Domestic Replay: |

844-512-2921 |

| International Replay: |

412-317-6671 |

| Conference ID: |

13728194 |

ABOUT ESCALADE, INC

Founded in 1922, and headquartered in Evansville, Indiana,

Escalade designs, manufactures, and sells sporting goods, fitness,

and indoor/outdoor recreation equipment. Our mission is to

connect family and friends creating lasting memories. Leaders in

our respective categories, Escalade’s brands include Brunswick

Billiards®; STIGA® table tennis; Accudart®; RAVE Sports® water

recreation; Victory Tailgate® custom games; Onix® pickleball;

Goalrilla™ basketball; Lifeline® fitness; Woodplay® playsets; and

Bear® Archery. Escalade’s products are available online and at

leading retailers nationwide. For more information about Escalade’s

many brands, history, financials, and governance please visit

www.escaladeinc.com.

INVESTOR RELATIONS CONTACTPatrick GriffinVice

President - Corporate Development & Investor

Relations812-467-1358

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements relating to

present or future trends or factors that are subject to risks and

uncertainties. These risks include, but are not limited to:

specific and overall impacts of the COVID-19 global pandemic on

Escalade’s financial condition and results of operations; the

impact of competitive products and pricing; product demand and

market acceptance; new product development; Escalade’s ability to

achieve its business objectives, especially with respect to its

Sporting Goods business on which it has chosen to focus; Escalade’s

ability to successfully achieve the anticipated results of

strategic transactions, including the integration of the operations

of acquired assets and businesses and of divestitures or

discontinuances of certain operations, assets, brands, and

products; the continuation and development of key customer,

supplier, licensing and other business relationships; Escalade’s

ability to develop and implement our own direct to consumer

e-commerce distribution channel; Escalade’s ability to successfully

negotiate the shifting retail environment and changes in consumer

buying habits; the financial health of our customers; disruptions

or delays in our business operations, including without limitation

disruptions or delays in our supply chain, arising from political

unrest, war, labor strikes, natural disasters, public health crises

such as the coronavirus pandemic, and other events and

circumstances beyond our control; Escalade’s ability to control

costs; Escalade’s ability to successfully implement actions to

lessen the potential impacts of tariffs and other trade

restrictions applicable to our products and raw materials,

including impacts on the costs of producing our goods, importing

products and materials into our markets for sale, and on the

pricing of our products; general economic conditions; fluctuation

in operating results; changes in foreign currency exchange rates;

changes in the securities markets; continued listing of the

Company’s common stock on the NASDAQ Global Market and/or inclusion

in market indices such as the Russell 2000; Escalade’s ability to

obtain financing and to maintain compliance with the terms of such

financing; the availability, integration and effective operation of

information systems and other technology, and the potential

interruption of such systems or technology; risks related to data

security of privacy breaches; and other risks detailed from time to

time in Escalade’s filings with the Securities and Exchange

Commission. Escalade’s future financial performance could differ

materially from the expectations of management contained herein.

Escalade undertakes no obligation to release revisions to these

forward-looking statements after the date of this report.

Escalade, Incorporated and

SubsidiariesConsolidated Statements of

Operations(Unaudited, In Thousands Except Per Share

Data)

| |

|

|

|

|

|

Three Months Ended |

| All

Amounts in Thousands Except Per Share Data |

|

|

|

|

March 19, 2022 |

|

March 20, 2021 |

| |

|

|

|

|

|

|

|

| Net

sales |

|

|

|

|

$72,380 |

|

|

$59,191 |

|

| |

|

|

|

|

|

|

|

| Costs and

Expenses |

|

|

|

|

|

|

|

|

Cost of products sold |

|

|

|

|

|

52,261 |

|

|

|

41,757 |

|

|

Selling, administrative and general expenses |

|

|

|

|

|

10,526 |

|

|

|

9,876 |

|

|

Amortization |

|

|

|

|

|

570 |

|

|

|

429 |

|

| |

|

|

|

|

|

|

|

| Operating Income |

|

|

|

|

|

9,023 |

|

|

|

7,129 |

|

| |

|

|

|

|

|

|

|

| Other Income

(Expense) |

|

|

|

|

|

|

|

|

Interest expense |

|

|

|

|

|

(560) |

|

|

|

(234) |

|

|

Other income |

|

|

|

|

|

43 |

|

|

|

35 |

|

| |

|

|

|

|

|

|

|

| Income Before Income

Taxes |

|

|

|

|

|

8,506 |

|

|

|

6,930 |

|

| |

|

|

|

|

|

|

|

| Provision for Income

Taxes |

|

|

|

|

|

1,852 |

|

|

|

1,488 |

|

| |

|

|

|

|

|

|

|

| Net Income |

|

|

|

|

$6,654 |

|

|

$5,442 |

|

| |

|

|

|

|

|

|

|

| Earnings Per Share

Data: |

|

|

|

|

|

|

|

|

Basic earnings per share |

|

|

|

|

$0.49 |

|

|

$0.39 |

|

|

Diluted earnings per share |

|

|

|

|

$0.49 |

|

|

$0.39 |

|

|

|

|

|

|

|

|

|

|

|

Dividends declared |

|

|

|

|

$0.15 |

|

|

$0.14 |

|

| |

|

|

|

|

|

|

|

Consolidated Balance

Sheets(Unaudited, In Thousands)

| All

Amounts in Thousands Except Share Information |

March 19, 2022 |

December 25, 2021 |

March 20, 2021 |

|

|

(Unaudited) |

(Audited) |

(Unaudited) |

| ASSETS |

|

|

|

| Current Assets: |

|

|

|

|

Cash and cash equivalents |

$6,392 |

$4,374 |

$5,879 |

|

Receivables, less allowance of $566; $457; and $954;

respectively |

|

67,301 |

|

65,991 |

|

54,475 |

|

Inventories |

|

114,605 |

|

92,382 |

|

91,425 |

|

Prepaid expenses |

|

12,716 |

|

7,569 |

|

4,044 |

|

Prepaid income tax |

|

-- |

|

739 |

|

-- |

| TOTAL CURRENT ASSETS |

|

201,014 |

|

171,055 |

|

155,823 |

|

|

|

|

|

| Property, plant and equipment,

net |

|

28,812 |

|

24,936 |

|

18,962 |

| Operating lease right-of-use

assets |

|

1,896 |

|

2,210 |

|

2,147 |

| Intangible assets, net |

|

36,208 |

|

20,778 |

|

22,216 |

| Goodwill |

|

38,837 |

|

32,695 |

|

32,695 |

| Other assets |

|

294 |

|

124 |

|

117 |

| TOTAL ASSETS |

$307,061 |

$251,798 |

$231,960 |

| |

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

| Current Liabilities: |

|

|

|

|

Current portion of long-term debt |

$7,143 |

$7,143 |

$ |

-- |

|

Trade accounts payable |

|

27,378 |

|

15,847 |

|

22,708 |

|

Accrued liabilities |

|

19,875 |

|

24,385 |

|

12,194 |

|

Income tax payable |

|

1,087 |

|

-- |

|

1,456 |

|

Current operating lease liabilities |

|

604 |

|

818 |

|

1,310 |

| TOTAL CURRENT LIABILITIES |

|

56,087 |

|

48,193 |

|

37,668 |

| |

|

|

|

| Other Liabilities: |

|

|

|

|

Long-term debt |

|

92,850 |

|

50,396 |

|

46,907 |

|

Deferred income tax liability |

|

4,759 |

|

4,759 |

|

4,193 |

|

Operating lease liabilities |

|

1,298 |

|

1,387 |

|

844 |

|

Other liabilities |

|

448 |

|

448 |

|

448 |

|

TOTAL LIABILITIES |

|

155,442 |

|

105,183 |

|

90,060 |

| |

|

|

|

| Stockholders' Equity: |

|

|

|

| Preferred stock: |

|

|

|

|

Authorized 1,000,000 shares; no par value, none issued |

|

|

|

| Common stock: |

|

|

|

|

Authorized 30,000,000 shares; no par value, issued and outstanding

– 13,585,096; 13,493,332; and 13,924,754; shares respectively |

|

13,585 |

|

13,493 |

|

13,925 |

| Retained earnings |

|

138,034 |

|

133,122 |

|

127,975 |

| TOTAL STOCKHOLDERS' EQUITY |

|

151,619 |

|

146,615 |

|

141,900 |

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

$307,061 |

$251,798 |

$231,960 |

| |

|

|

|

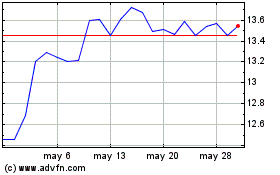

Escalade (NASDAQ:ESCA)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Escalade (NASDAQ:ESCA)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024