Formula Systems (1985) Ltd. (NASDAQ: FORTY), a global information

technology holding company engaged, through its subsidiaries and

affiliates, in providing software consulting services and

computer-based business solutions and developing proprietary

software products, today announced its results for the fourth

quarter and full year ended December 31, 2021.

Financial Highlights for the Fourth

Quarter Ended December 31, 2021

- Consolidated revenues for the

fourth quarter ended December 31, 2021 increased by 21.3% to a

record breaking $658.7 million, compared to $543.2 million in the

same period last year. The growth was recorded across Formula’s

entire investment portfolio.

- Consolidated operating income for

the fourth quarter ended December 31, 2021 increased by 30.2% to a

record breaking $59.6 million, compared to $45.8 million in the

same period last year.

- Consolidated net income

attributable to Formula’s shareholders for the fourth quarter ended

December 31, 2021 increased by 30.6% to $15.5 million, or $0.99 per

fully diluted share, compared to $11.9 million, or $0.76 per fully

diluted share, in the same period last year.

Financial Highlights for the Full Year

Ended December 31, 2021

- Consolidated revenues for the full

year increased by 24.4% to a record breaking $2.41 billion,

compared to $1.93 billion last year. The growth was recorded across

Formula’s entire investment portfolio.

- Consolidated operating income for

the full year increased by 21.9% to $208.0 million, compared to

$170.6 million last year.

- Consolidated net income

attributable to Formula’s shareholders for the full year 2021 was

$54.6 million, or $3.50 per fully diluted share, compared to $46.8

million, or $3.01 per fully diluted share last year, reflecting an

increase of 16.7% year over year.

- As of December 31, 2021 Formula

held 48.9%, 43.6%, 45.6%, 100%, 50%, 90.1%, 80% and 100% of the

outstanding ordinary shares of Matrix IT Ltd., Sapiens

International Corporation N.V, Magic Software Enterprises Ltd.,

Michpal Micro Computers (1983) Ltd., TSG IT Advanced Systems Ltd.,

Insync Staffing Solutions, Inc., Ofek Aerial Photography Ltd. and

ZAP Group Ltd., respectively.

- Consolidated cash and cash

equivalents, short-term bank deposits and investments in marketable

securities totaled approximately $512.5 million as of December 31,

2021, compared to $533.2 million as of December 31, 2020.

- Total equity as of December 31,

2021 was $1.18 billion (representing 43.0% of the total

consolidated balance sheet), compared to $1.11 billion

(representing 44.0% of the total consolidated balance sheet) as of

December 31, 2020.

Declaration of Dividend for the Second

Half of 2021

- Based on the Company’s results, the

Company’s board of directors approved the distribution of a cash

dividend in an amount of NIS 2.56 per share (approximately $0.78

per share) and in an aggregate amount of approximately NIS 39.2

million (approximately $12.0 million).

- The dividend is payable on April

26, 2022 to all of the Company’s shareholders of record at the

close of trading on the NASDAQ Global Select Market (or the

Tel-Aviv Stock Exchange, as appropriate) on April 12, 2022. The

dividend will be paid in New Israeli Shekels with respect to the

Company's ordinary shares traded on the Tel Aviv Stock Exchange and

American Depositary Receipts traded on the NASDAQ Global Select

Market.

In accordance with Israeli tax law, the dividend

is subject to withholding tax at source at the rate of 30% (if the

recipient of the dividend is at the time of distribution or was at

any time during the preceding 12-month period the holder of 10% or

more of the Company's share capital) or 25% (for all other dividend

recipients) of the dividend amount payable to each shareholder of

record, subject to applicable exemptions.

Debentures Covenants

As of December 31, 2021, Formula was in

compliance with all of its financial covenants under the debenture

series issued by Formula, based on the following achievements:

Covenant 1

- Target equity attributable to

Formula’s shareholders (excluding non-controlling interests): above

$215 million.

- Actual equity attributable to

Formula’s shareholders is equal to $541.0 million.

Covenant 2

- Target ratio of net financial

indebtedness to net capitalization (in each case, as defined under

the indenture for Formula’s Series A and C Secured Debentures):

below 65%.

- Actual ratio of net financial indebtedness to net

capitalization is equal to 5.9%.

Covenant 3

- Target ratio of net financial

indebtedness to EBITDA (based on the accumulated calculation for

the four recent quarters): below 5.

- Actual ratio of net financial

indebtedness to EBITDA (based on the accumulated calculation for

the four recent quarters) is equal to 0.22.

Comments of Management

Commenting on the results, Guy Bernstein, CEO of

Formula Systems, said: “We are proud of our outstanding performance

in the fourth quarter and throughout 2021 as we reported another

record quarter of revenues, operating income and net income in the

Company’s history. Our revenue of $658.7 million in the fourth

quarter of 2021 was up 12.4% on a sequential basis and 21.3% on a

year over year basis, growing our annual revenue to $2.4 billion.

That record breaking performance also flowed through to our bottom

line, as we realized exceptional annual net income of $54.6 million

($3.50 per fully diluted share). Such a high-level of execution is

a testament to our strong fundamentals and our pivotal role in

influencing our customers’ growth strategies in all of the areas in

which we operate. We have seen an acceleration in growth of digital

transformation, and we expect this trend to continue in 2022. We

continue our efforts across our entire portfolio to adhere to our

core values of innovation, professionalism, agility and

transparency which allow us to continue our growth and deliver

exceptional value to our clients and shareholders in 2022 and

beyond.”

“In 2021 we distributed a $22.0 million cash

dividend to our shareholders, compared to $7.9 million in 2020.

With the release of our fourth quarter and full year 2021 financial

results we have announced a cash dividend of approximately $12.0

million. Over the last five years (2017-2021) we have distributed

an aggregate amount of approximately $60.0 million to our

shareholders.

“Matrix, celebrating two decades of activity,

reported its best fourth quarter in history with record-breaking

results recorded across all its key financial indices with 72% of

its growth deriving from organic growth. We are pleased with

Matrix’s continued recognition as a market leader in the

implementation of fastest-growing technologies, such as cloud,

cyber, digital, data, DevOps and AI, which enable Matrix to create

significant value for its customers in managing, streamlining,

accelerating and making their businesses thrive. There is a strong

demand in Israel for software services in digital, cloud, cyber,

data, and core operating systems—areas where Matrix significantly

increased its strength during the COVID-19 period, and which are at

the center of demand in the IT market.”

“Sapiens finished the year strong, with fourth

quarter revenue growing 17.3% to $119.2 million and non-GAAP

operating profit margin of 18%, reflecting Sapiens’ ability to

maintain profitability despite the cost increases that our industry

and many sectors are facing. Sapiens’ 2021 results demonstrate how

well it is executing its proven “Land and Expand” strategy, which

enables it to grow in the highly regulated and regionally-diverse

global insurance markets and validate its operating leverage. This

unique value proposition enables insurers to benefit from Sapiens’

pre-integrated, cloud-first, low-code “insurance-in-a-box” approach

across the majority of its products, empowering them to choose

between deploying Sapiens end-to-end solution, or any combination

of its components, to meet their evolving needs. Sapiens introduced

2022 guidance for revenue in a range of $495 million to $500

million, reflecting annual growth of 7.3% to 8.5%.”

“Magic Software finished the year strong, with

record-breaking fourth quarter revenue of $133.0 million, growing

27.2% year over year, exceeding market expectations, and with

non-GAAP operating margin of 14.9%, reflecting its ability to

maintain profitability despite the costs increase that our industry

and many sectors are facing. I am very proud of what Magic Software

accomplished during 2021, with Digital Transformation programs at

enterprises becoming increasingly important. Magic Software

continues to witness healthy demand and has been developing a

growing pipeline to deliver continued growth in 2022, as its

customers increasingly engage it as a preferred partner for their

Digital Transformation initiatives. Magic Software has introduced

2022 guidance for revenue in a range of $535 million to $545

million, reflecting annual growth of 11.5% to 13.5%.”

“Since its acquisition by Formula Systems at the

beginning of 2017, Michpal’s consolidated revenue has increased

fivefold and crossed the NIS 100 million threshold for the first

time in 2021, with operating profitability of over 30%. Michpal

continued to realize synergies and monetize on its business model

while investing in expanding its product offering with the launch

of a new cloud-based employer-employee payroll portal. In addition,

Michpal recently concluded the acquisition of a 70% share interest

in Formally Smart Form System Ltd., creator of Formally Smart Form

platform – a central server platform for managing knowledge and

work processes, and for producing digital forms combined with a

legally-binding eSignature technology allowing customers to create

impressive documents in minutes and get them signed in a snap.

Formally offers a variety of proprietary computerized and advanced

tools for managing business processes trusted by Israel’s largest

financial, banking, and insurance enterprises. This acquisition of

Formally is an additional strategic step, supporting the expansion

of Michpal’s product offering in the fields of payroll, human

resources and financial management and compliance.”

“TSG (held jointly by Formula and Israel

Aerospace Industries) finished the year with a solid performance.

TSG decided to expand into new lines of business such as products

and services for municipalities, in which TSG has a very strong

presence. As part of its strategy TSG keeps looking to enter into

M&As for new businesses that are synergetic with its

offering.”

“Lastly, Zap Group, a leading group of consumer

sites in Israel and a well-reputable brand in the Israeli market,

offering a wide range of solutions in the field of advertising,

website promotion and targeted mailing, was consolidated into our

financial results beginning on April 5, 2021. During these past

months, we’ve been focusing together with Zap’s management on the

integration of Zap Group and on building a long-term strategy plan

to accelerate its growth, including the formation of potential

business partnerships in order to expand Zap Group’s products and

services offerings, as well as reaching new customers. We will

remain focused on the successful integration of Zap Group and

continue to carefully explore additional M&As

opportunities.”

Stand-Alone Financial

Measures

This press release presents, further below,

certain stand-alone financial measures to reflect Formula’s

stand-alone financial position in reference to its assets and

liabilities as the parent company of the group. These financial

measures are prepared consistent with the accounting principles

applied in the consolidated financial statements of the group. Such

measures include investments in subsidiaries and a jointly

controlled entity measured at cost adjusted by Formula’s share in

the investees’ accumulated undistributed earnings and other

comprehensive income or loss.

Formula believes that these financial measures

provide useful information to management and investors regarding

Formula’s stand-alone financial position. Formula’s management uses

these measures to compare the Company’s performance to that of

prior periods for trend analyses. These measures are also used in

financial reports prepared for management and in quarterly

financial reports presented to the Company’s board of directors.

The Company believes that the use of these stand-alone financial

measures provides an additional tool for investors to use in

evaluating Formula’s financial position.

Management of the Company does not consider

these stand-alone measures in isolation or as an alternative to

financial measures determined in accordance with GAAP. Formula

urges investors to review the consolidated financial statements

which it includes in press releases announcing quarterly financial

results, including this press release, and not to rely on any

single financial measure to evaluate the Company’s business or

financial position.

About Formula

Formula Systems, whose ordinary shares are

traded on the Tel-Aviv Stock Exchange and ADSs are traded on the

NASDAQ Global Select Market, is a global information technology

holding company engaged, through its subsidiaries and affiliates,

in providing software consulting services and computer-based

business solutions and developing proprietary software

products.

For more information, visit

www.formulasystems.com.

Press Contact:

Formula Systems (1985) Ltd. +972-3-5389487

ir@formula.co.il

Forward Looking Statements

Certain matters discussed in this press release that are

incorporated herein and therein by reference are forward-looking

statements within the meaning of Section 27A of the Securities Act,

Section 21E of the Exchange Act and the safe harbor provisions of

the U.S. Private Securities Litigation Reform Act of 1995, that are

based on our beliefs, assumptions and expectations, as well as

information currently available to us. Such forward-looking

statements may be identified by the use of the words “anticipate,”

“believe,” “estimate,” “expect,” “may,” “will,” “plan” and similar

expressions. Such statements reflect our current views with respect

to future events and are subject to certain risks and

uncertainties. There are important factors that could cause our

actual results, levels of activity, performance or achievements to

differ materially from the results, levels of activity, performance

or achievements expressed or implied by the forward-looking

statements, including, but not limited to: the COVID-19

(coronavirus) pandemic, which may last longer than expected and

materially adversely affect our results of operations; the degree

of our success in our plans to leverage our global footprint to

grow our sales; the degree of our success in integrating the

companies that we have acquired through the implementation of our

M&A growth strategy; the lengthy development cycles for our

solutions, which may frustrate our ability to realize revenues

and/or profits from our potential new solutions; our lengthy and

complex sales cycles, which do not always result in the realization

of revenues; the degree of our success in retaining our existing

customers or competing effectively for greater market share;

difficulties in successfully planning and managing changes in the

size of our operations; the frequency of the long-term, large,

complex projects that we perform that involve complex estimates of

project costs and profit margins, which sometimes change

mid-stream; the challenges and potential liability that heightened

privacy laws and regulations pose to our business; occasional

disputes with clients, which may adversely impact our results of

operations and our reputation; various intellectual property issues

related to our business; potential unanticipated product

vulnerabilities or cybersecurity breaches of our or our customers’

systems; risks related to the insurance industry in which our

clients operate; risks associated with our global sales and

operations, such as changes in regulatory requirements, wide-spread

viruses and epidemics like the recent novel coronavirus outbreak,

or fluctuations in currency exchange rates; and risks related to

our principal location in Israel.

While we believe such forward-looking statements

are based on reasonable assumptions, should one or more of the

underlying assumptions prove incorrect, or these risks or

uncertainties materialize, our actual results may differ materially

from those expressed or implied by the forward-looking statements.

Please read the risks discussed under the heading “Risk Factors” in

our most recent Annual Report on Form 20-F, in order to review

conditions that we believe could cause actual results to differ

materially from those contemplated by the forward-looking

statements. You should not rely upon forward-looking statements as

predictions of future events. Although we believe that the

expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee that future results, levels of

activity, performance and events and circumstances reflected in the

forward-looking statements will be achieved or will occur. Except

as required by law, we undertake no obligation to update publicly

any forward-looking statements for any reason, to conform these

statements to actual results or to changes in our expectations.

|

FORMULA SYSTEMS (1985) LTD. |

|

|

|

|

|

|

|

|

CONSOLIDATED CONDENSED STATEMENTS OF PROFIT OR

LOSS |

|

|

|

|

| U.S.

dollars in thousands (except per share data) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three months

ended |

|

Year

ended |

| |

December 31, |

|

December 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

Unaudited |

|

Unaudited |

|

|

|

Revenues |

658,735 |

|

543,240 |

|

2,405,510 |

|

1,933,918 |

| Cost of

revenues |

503,015 |

|

418,264 |

|

1,841,651 |

|

1,486,485 |

|

Gross profit |

155,720 |

|

124,976 |

|

563,859 |

|

447,433 |

| Research and

development costs, net |

16,737 |

|

14,220 |

|

65,858 |

|

52,604 |

| Selling,

marketing and general and administrative expenses |

79,410 |

|

64,989 |

|

289,986 |

|

224,188 |

|

Operating income |

59,573 |

|

45,767 |

|

208,015 |

|

170,641 |

| Financial

expenses, net |

7,382 |

|

10,723 |

|

24,005 |

|

26,885 |

|

Income before taxes on income |

52,191 |

|

35,044 |

|

184,010 |

|

143,756 |

| Taxes on

income |

12,600 |

|

6,755 |

|

42,614 |

|

31,269 |

|

Income after taxes |

39,591 |

|

28,289 |

|

141,396 |

|

112,487 |

| Share of

profit (loss) of companies accounted for at equity, net |

152 |

|

1,200 |

|

505 |

|

1,535 |

| Net

income |

39,743 |

|

29,489 |

|

141,901 |

|

114,022 |

| Net income

attributable to non-controlling interests |

24,206 |

|

17,596 |

|

87,317 |

|

67,246 |

| Net

income attributable to Formula Systems' shareholders |

15,537 |

|

11,893 |

|

54,584 |

|

46,776 |

| |

|

|

|

|

|

|

|

| Earnings per

share (basic) |

1.02 |

|

0.77 |

|

3.57 |

|

3.05 |

| Earnings per

share (diluted) |

0.99 |

|

0.76 |

|

3.50 |

|

3.01 |

| |

|

|

|

|

|

|

|

| Number of

shares used in computing earnings per share (basic) |

15,290,517 |

|

15,288,017 |

|

15,289,580 |

|

15,286,142 |

| Number of

shares used in computing earnings per share (diluted) |

15,498,375 |

|

15,293,138 |

|

15,403,543 |

|

15,292,450 |

| |

|

|

|

|

|

|

|

|

FORMULA SYSTEMS (1985) LTD. |

|

|

|

|

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION |

|

|

| U.S.

dollars in thousands |

|

|

|

| |

December 31, |

|

December 31, |

| |

2021 |

|

2020 |

| |

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

485,391 |

|

501,650 |

|

Short-term deposits |

25,924 |

|

30,289 |

|

Marketable securities |

1,142 |

|

1,238 |

|

Trade receivables |

696,449 |

|

519,885 |

|

Other accounts receivable and prepaid expenses |

72,203 |

|

83,820 |

|

Inventories |

20,119 |

|

23,988 |

|

Total current assets |

1,301,228 |

|

1,160,870 |

| |

|

|

|

|

LONG-TERM ASSETS: |

|

|

|

|

Deferred taxes |

46,364 |

|

39,750 |

|

Other long-term accounts receivable and prepaid expenses |

23,676 |

|

22,872 |

|

Total long-term assets |

70,040 |

|

62,622 |

| |

|

|

|

|

INVESTMENTS IN COMPANIES ACCOUNTED FOR AT EQUITY

METHOD |

28,900 |

|

28,311 |

| |

|

|

|

|

PROPERTY, PLANTS AND EQUIPMENT, NET |

56,886 |

|

59,176 |

| |

|

|

|

|

RIGHT-OF-USE ASSETS |

115,833 |

|

114,414 |

| |

|

|

|

| NET

INTANGIBLE ASSETS AND GOODWILL |

1,174,790 |

|

1,094,687 |

| |

|

|

|

|

TOTAL ASSETS |

2,747,677 |

|

2,520,080 |

| |

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

Loans and credit from banks and others |

173,682 |

|

120,444 |

|

Debentures |

48,455 |

|

41,454 |

|

Current maturities of lease liabilities |

41,655 |

|

32,065 |

|

Trade payables |

205,988 |

|

153,322 |

|

Deferred revenues |

140,660 |

|

128,898 |

|

Employees and payroll accrual |

207,553 |

|

190,247 |

|

Other accounts payable |

79,048 |

|

68,976 |

|

Liabilities in respect of business combinations |

8,094 |

|

8,654 |

|

Put options of non-controlling interests |

39,558 |

|

35,843 |

|

Total current liabilities |

944,693 |

|

779,903 |

| |

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

Loans from banks and others |

159,243 |

|

180,316 |

|

Debentures |

205,035 |

|

203,070 |

|

Lease liabilities |

84,839 |

|

91,188 |

|

Other long-term liabilities |

12,183 |

|

12,191 |

|

Deferred taxes |

78,135 |

|

68,367 |

|

Deferred revenues |

17,757 |

|

16,626 |

|

Liabilities in respect of business combinations |

21,644 |

|

16,582 |

|

Put options of non-controlling interests |

31,720 |

|

28,175 |

|

Employees benefit liabilities |

12,641 |

|

15,119 |

|

Total long-term liabilities |

623,197 |

|

631,634 |

| |

|

|

|

|

EQUITY |

|

|

|

|

Equity attributable to Formula Systems' shareholders |

540,960 |

|

503,201 |

|

Non-controlling interests |

638,827 |

|

605,342 |

|

Total equity |

1,179,787 |

|

1,108,543 |

| |

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

2,747,677 |

|

2,520,080 |

| |

|

|

|

|

FORMULA SYSTEMS (1985) LTD. |

|

|

|

|

STAND-ALONE STATEMENTS OF FINANCIAL POSITION |

|

|

|

| U.S.

dollars in thousands |

|

|

|

| |

December 31, |

|

December 31, |

| |

2021 |

|

2020 |

| |

(Unaudited) |

|

(Unaudited) |

| ASSETS |

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

Cash and cash equivalents |

14,163 |

|

47,852 |

|

Other accounts receivable and prepaid expenses |

4,513 |

|

4,977 |

|

Total current assets |

18,676 |

|

52,829 |

| |

|

|

|

|

INVESTMENTS IN SUBSIDIARIES AND A JOINTLY CONTROLLED ENTITY

(*) |

|

|

|

|

Matrix IT Ltd. |

154,391 |

|

142,194 |

|

Sapiens International Corporation N.V. |

231,130 |

|

227,771 |

|

Magic Software Enterprises Ltd. |

76,864 |

|

118,105 |

|

Other |

219,975 |

|

90,359 |

|

Total Investments in subsidiaries and a jointly controlled

entity |

682,360 |

|

578,429 |

| |

|

|

|

|

OTHER LONG TERM RECEIVABLES |

2,547 |

|

1,707 |

| |

|

|

|

|

PROPERTY, PLANTS AND EQUIPMENT, NET |

10 |

|

2 |

| |

|

|

|

|

TOTAL ASSETS |

703,593 |

|

632,967 |

| |

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

Debentures |

28,654 |

|

21,652 |

|

Trade payables |

192 |

|

349 |

|

Other accounts payable |

5,339 |

|

2,329 |

|

Total current liabilities |

34,185 |

|

24,330 |

| |

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

Debentures |

126,049 |

|

104,394 |

|

Put options of non-controlling interests |

1,249 |

|

1,042 |

|

Liability in respect of a business combination |

1,150 |

|

- |

|

Total long-term liabilities |

128,448 |

|

105,436 |

| |

|

|

|

|

EQUITY |

540,960 |

|

503,201 |

| |

|

|

|

|

TOTAL LIABILITIES AND EQUITY |

703,593 |

|

632,967 |

| |

|

|

|

(*) The investments' carrying amounts are measured

consistent with the accounting principles applied in

the consolidated financial statements of the group and

representing the investments’ cost adjusted by Formula's share

in the investees' accumulated undistributed earnings and other

comprehensive income or loss.

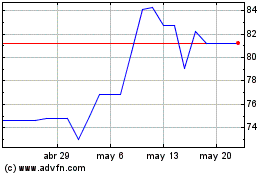

Formula Systems 1985 (NASDAQ:FORTY)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Formula Systems 1985 (NASDAQ:FORTY)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025