UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE

13D

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)*

| Whole Earth Brands, Inc. |

| (Name of Issuer) |

| Common Stock, par value $0.0001 per share |

| (Title of Class of Securities) |

|

Keith Goodman

c/o Notch View Capital Management, LLC

360 NW 27th Street, 8th Floor

Miami, Florida 33127

Telephone Number: (212) 796-4954 |

|

(Name, Address and Telephone Number of Person Authorized

to Receive

Notices and Communications) |

| January 3, 2024 |

| (Date of Event Which Requires Filing of this Statement) |

| If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of ss.240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [X]. |

| |

|

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Notch View Capital Management, LLC |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) [_] |

| |

|

(b) [_] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

[_] |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

2,510,898 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

| |

|

|

| |

2,510,898 |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

2,510,898 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

[_] |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

5.9% |

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

IA, OO |

|

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Notch View Capital, LP |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) [_] |

| |

|

(b) [_] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

[_] |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

2,193,684 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

| |

|

|

| |

2,193,684 |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

2,193,684 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

[_] |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

5.1% |

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

PN |

|

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Notch View Capital Long Only, LP |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) [_] |

| |

|

(b) [_] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

[_] |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

317,214 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

| |

|

|

| |

317,214 |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

317,214 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

[_] |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

0.7% |

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

PN |

|

| |

|

|

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Notch View Capital GP, LLC |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) [_] |

| |

|

(b) [_] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

[_] |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

2,510,898 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

| |

|

|

| |

2,510,898 |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

2,510,898 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

[_] |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

5.9% |

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

OO |

|

| |

|

|

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Keith Goodman |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) [_] |

| |

|

(b) [_] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

[_] |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

United States of America |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

2,510,898 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

| |

|

|

| |

2,510,898 |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

2,510,898 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

[_] |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

5.9% |

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

HC, IN |

|

| |

|

|

| Item 1. |

Security and Issuer. |

|

| |

The name of the issuer is Whole Earth Brands, Inc., a Delaware corporation (the "Issuer"). The address of the Issuer's principal executive offices is 125 S. Wacker Drive, Suite 1250, Chicago, Illinois 60606. This Schedule 13D amendment relates to the Issuer's Common Stock, par value $0.0001 per share (the "Shares"). |

|

| |

|

|

| |

|

|

| Item 2. |

Identity and Background. |

|

| |

(a), (f) |

This Schedule 13D amendment is being filed jointly by Notch View Capital Management, LLC, a Delaware limited liability company (“Notch View”), Notch View Capital, LP, a Delaware limited partnership (“Capital”), Notch View Capital Long Only, LP, a Delaware limited partnership (“Long Only”), Notch View Capital GP, LLC, a Delaware limited liability company (the “GP”), and Keith Goodman (“Goodman”), a United States citizen (collectively, the "Reporting Persons"). |

|

| |

|

|

|

| |

(b) |

The principal business address for each of the Reporting Persons is 360 NW 27th Street, 8th Floor, Miami, Florida 33127. |

|

| |

|

|

|

| |

(c) |

Goodman is the managing member of Notch View. The principal business of Notch View is serving as an investment adviser to its clients. The principal business of the GP is serving as the general partner to certain private funds. Notch View is the investment manager to Capital and Long Only and the GP is the general partner of Capital and Long Only. The principal business of Capital and Long Only is purchasing, holding and selling securities for investment purposes. |

|

| |

|

|

|

| |

(d), (e) |

During the last five years, none of the Reporting Persons has been (a) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. The Reporting Persons disclaim membership in a group. |

|

| |

|

|

|

| |

|

|

| Item 3. |

Source and Amount of Funds or Other Consideration. |

|

| |

|

|

| |

The funds for the purchase of the Shares came from the working capital of Capital and Long Only, over which the Reporting Persons, through their roles described above in Item 2(c), exercise investment discretion. No borrowed funds were used to purchase the Shares, other than borrowed funds used for working capital purposes in the ordinary course of business. |

|

| |

|

|

| Item 4. |

Purpose of Transaction. |

|

| |

|

|

| |

The Reporting Persons have acquired their Shares of

the Issuer for investment.

The Reporting Persons have had conversations with

members of the Issuer's management and board of directors regarding possible ways to enhance shareholder value. The Reporting Persons

intend to have additional conversations with the Issuer's management and board of directors. The topics of these conversations will cover

a range of issues, potentially including those relating to the business of the Issuer, capital allocation, mergers, acquisition and disposals,

balance sheet management, board composition, investor communication, and corporate governance. In connection with the foregoing, Notch

View sent the letter attached hereto as Exhibit C to the Issuer’s board of directors on January 3, 2024. The Reporting Persons may

also have similar conversations with other stockholders of the Issuer and other interested parties, such as industry analysts, existing

or potential strategic partners or competitors, investment professionals, and other investors. The Reporting Persons may at any time reconsider

and change their intentions relating to the foregoing.

No Reporting Person has any present plan or proposal

which would relate to or would result in any of the matters set forth in subparagraphs (a)- (j) of Item 4 of Schedule 13D except as set

forth herein or such as would occur upon completion of any of the actions discussed herein. The Reporting Persons may in the future take

one or more of the actions described in subsections (a) through (j) of Item 4 of Schedule 13D and may discuss such actions with the Issuer's

management and the board of directors, other stockholders of the Issuer, and other interested parties, such as those set out above.

The Reporting Persons intend to review their investments

in the Issuer on a continuing basis. Depending on various factors, including, without limitation, the Issuer's financial position and

strategic direction, the outcome of the discussions and actions referenced above, actions taken by the Issuer's board of directors, price

levels of the Shares, other investment opportunities available to the Reporting Persons, conditions in the securities market and general

economic and industry conditions, the Reporting Persons may in the future take actions with respect to its investment position in the

Issuer as it deems appropriate, including, without limitation, purchasing additional Shares or selling some or all of its Shares, and/or

engaging in hedging or similar transactions with respect to the Shares.

|

|

| |

|

|

| Item 5. |

Interest in Securities of the Issuer. |

|

| |

|

|

| |

(a) - (e) |

Notch View:

As of the date hereof, Notch View may be deemed to

be the beneficial owner of 2,510,898 Shares, constituting 5.9% of the Shares*.

Notch View has the sole power to vote or direct the

vote of 0 Shares; has the shared power to vote or direct the vote of 2,510,898 Shares; has the sole power to dispose or direct the disposition

of 0 Shares; and has the shared power to dispose or direct the disposition of 2,510,898 Shares.

Capital:

As of the date hereof, Capital may be deemed to be

the beneficial owner of 2,193,684 Shares, constituting 5.1% of the Shares*.

Capital has the sole power to vote or direct the vote

of 0 Shares; has the shared power to vote or direct the vote of 2,193,684 Shares; has the sole power to dispose or direct the disposition

of 0 Shares; and has the shared power to dispose or direct the disposition of 2,193,684 Shares.

Long Only:

As of the date hereof, Long Only may be deemed to

be the beneficial owner of 317,214 Shares, constituting 0.7% of the Shares*.

Long Only has the sole power to vote or direct the

vote of 0 Shares; has the shared power to vote or direct the vote of 317,214 Shares; has the sole power to dispose or direct the disposition

of 0 Shares; and has the shared power to dispose or direct the disposition of 317,214 Shares.

GP:

As of the date hereof, the GP may be deemed to be

the beneficial owner of 2,510,898 Shares, constituting 5.9% of the Shares*.

The GP has the sole power to vote or direct the vote

of 0 Shares; has the shared power to vote or direct the vote of 2,510,898 Shares; has the sole power to dispose or direct the disposition

of 0 Shares; and has the shared power to dispose or direct the disposition of 2,510,898 Shares.

Goodman:

As of the date hereof, Goodman may be deemed to be

the beneficial owner of 2,510,898 Shares, constituting 5.9% of the Shares*.

Goodman has the sole power to vote or direct the vote

of 0 Shares; has the shared power to vote or direct the vote of 2,510,898 Shares; has the sole power to dispose or direct the disposition

of 0 Shares; and has the shared power to dispose or direct the disposition of 2,510,898 Shares.

The transactions by the Reporting Persons in the Shares

during the past sixty days are set forth in Exhibit B.

*The outstanding Shares figure reflects 42,850,915

Shares outstanding as reported in the Issuer’s 10-Q filed by the Issuer on November 9, 2023. |

|

| |

|

|

|

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

|

| |

|

|

| |

Not applicable.

|

|

| |

|

|

| Item 7. |

Material to be Filed as Exhibits. |

|

| |

Exhibit A: Joint Filing Agreement

Exhibit B: Schedule of Transactions in Shares

Exhibit C: Letter to Issuer’s Board of Directors, dated January 3,

2024 |

| |

|

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

Notch View Capital Management, LLC * |

| |

|

|

| |

By: |

/s/ Keith Goodman |

| |

|

Name: Keith Goodman |

| |

|

Title: Managing Member |

| |

|

|

| |

|

|

| |

Notch View Capital, LP* |

| |

|

|

| |

By: |

/s/ Keith Goodman |

| |

|

Name: Keith Goodman |

| |

|

Title: Managing Member

|

| |

Notch View Capital Long Only, LP* |

| |

|

|

| |

By: |

/s/ Keith Goodman |

| |

|

Name: Keith Goodman |

| |

|

Title: Managing Member |

| |

|

|

| |

|

|

| |

Keith Goodman* |

| |

|

|

| |

By: |

/s/ Keith Goodman |

| |

|

|

| |

|

|

| |

Notch View Capital GP, LLC* |

| |

|

|

| |

By: |

/s/ Keith Goodman |

| |

|

Name: Keith Goodman |

| |

|

Title: Managing Member |

| |

|

|

* This reporting person disclaims beneficial ownership

of these reported securities except to the extent of its pecuniary interest therein, and this report shall not be deemed an admission

that any such person is the beneficial owner of these securities for purposes of Section 16 of the U.S. Securities Exchange Act of 1934,

as amended, or for any other purpose.

Attention: Intentional misstatements or omissions of fact constitute Federal

criminal violations (see 18 U.S.C. 10001).

Exhibit A

AGREEMENT

The undersigned agree that this

Schedule 13D amendment, dated January 3, 2024, relating to the Common Stock, par value $0.0001 per share, of Whole Earth Brands, Inc.

shall be filed on behalf of the undersigned.

| |

Notch View Capital Management, LLC |

| |

|

|

| |

By: |

/s/ Keith Goodman |

| |

|

Name: Keith Goodman |

| |

|

Title: Managing Member |

| |

|

|

| |

|

|

| |

Notch View Capital, LP |

| |

|

|

| |

By: |

/s/ Keith Goodman |

| |

|

Name: Keith Goodman |

| |

|

Title: Managing Member

|

| |

Notch View Capital Long Only, LP |

| |

|

|

| |

By: |

/s/ Keith Goodman |

| |

|

Name: Keith Goodman |

| |

|

Title: Managing Member |

| |

|

|

| |

|

|

| |

Keith Goodman |

| |

|

|

| |

By: |

/s/ Keith Goodman |

| |

|

|

| |

|

|

| |

Notch View Capital GP, LLC |

| |

|

|

| |

By: |

/s/ Keith Goodman |

| |

|

Name: Keith Goodman |

| |

|

Title: Managing Member |

| |

|

|

| |

|

|

| |

|

|

Exhibit B

Schedule of Transactions in Shares

|

Date of Transaction |

Title of Class |

Number of Shares Acquired |

Number of Shares Disposed |

Price Per Share |

| |

|

|

|

|

| 11/9/2023 |

Common Stock, par value $0.0001 per share |

60,000 |

|

$2.84 |

| 11/9/2023 |

Common Stock, par value $0.0001 per share |

260,000 |

|

$2.84 |

| 11/13/2023 |

Common Stock, par value $0.0001 per share |

|

30,000 |

$3.00 |

| 11/16/2023 |

Common Stock, par value $0.0001 per share |

68,000 |

|

$3.31 |

| 12/1/2023 |

Common Stock, par value $0.0001 per share |

350,000 |

|

$3.30 |

| 12/22/2023 |

Common Stock, par value $0.0001 per share |

|

9,500 |

$3.46 |

| 12/26/2023 |

Common Stock, par value $0.0001 per share |

|

40,000 |

$3.46 |

| |

|

|

|

|

Exhibit C

January 3, 2024

Whole Earth Brands, Inc.

125 S. Wacker Drive, Suite 1250

Chicago, IL 60606

| Attn: | Board of Directors of Whole Earth Brands, Inc. |

Irwin Simon, Chairman

Rajnish Ohri, Co-Chief Executive Officer

Jeffrey Robinson, Co-Chief Executive Officer

Bernardo Fiaux, Chief Financial Officer

Dear Ladies and Gentlemen,

We are writing on behalf of funds managed by Notch View Capital

Management, LLC (“Notch View” or “we”), which currently own 5.9% of the outstanding shares of Whole Earth Brands

Inc. (“Whole Earth” or “the Company”), making Notch View the second largest owner of the Company’s stock.

Notch View seeks to identify attractive mid-cap businesses that have been undervalued by the public markets and will often partner with

management teams to enhance long-term shareholder value creation. We have been shareholders of Whole Earth since August of 2021 and appreciate

the dialogue we have had with the management team and the Board of Directors (the “Board”) over the last two years.

As we all know, Whole Earth was approached by its largest shareholder

in June of 2023 with a preliminary offer to acquire the Company for $4.00 per share1,

representing a 28% premium to the prior-day’s share price. We applauded the Company for taking this offer seriously and subsequently

hiring Jefferies to conduct a comprehensive strategic review.

Unfortunately, it has now been more than six months since the Company

received this bid and since then, Whole Earth’s shares have declined 13%, remaining below the June 2023 bid and meaningfully underperforming

major market indices2.

We believe six months should be more than enough time to evaluate this bid, negotiate with the bidder or seek out a more attractive alternative.

Dragging this process out any longer is unreasonable and value destructive to shareholders.

Moreover, we strongly believe this strategic review should

result in a sale of the Company. We do not think a standalone plan for Whole Earth in its current form is a feasible option and believe

this would likely result in significant shareholder value destruction and a long road ahead to rebuild it. Whole Earth has a buyer who

is ready, willing, and able to acquire the Company in its entirety. We strongly encourage the Board to negotiate in good faith with the

potential acquirer and agree on a price that is suitable for all parties involved.

Whole Earth came public through a transaction with a Special

Purpose Acquisition Company (“SPAC”), known as Act II Global Acquisition Corp. (“Act II Global”), in June 2020.

Act II Global acquired Merisant Company (“Merisant”), a leading branded sugar replacement business, and MAFCO Worldwide LLC

(“MAFCO”), a leading flavors & ingredients supplier. These two businesses were subsidiaries of Flavors Holdings Inc.

(“Flavors Holdings”), a company owned by MacAndrews & Forbes Incorporated.

1 Schedule 13D/A filed with the SEC on 6/26/2023.

2 Bloomberg market data as of 12/29/2023.

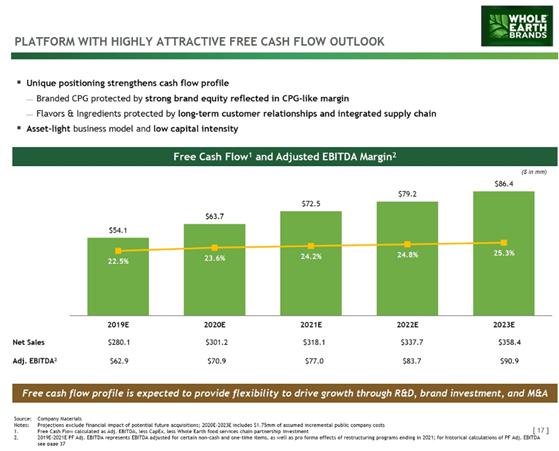

In the original SPAC presentation filed with the Securities

and Exchange Commission on December 19, 2019 (“the original SPAC presentation”), the Company furnished a five-year forecast

for revenue, gross profit, adjusted EBITDA and free cash flow. As can be seen below in slide 17 of the presentation, the forecasted targets

called for 2023 estimated revenue of approximately $358 million, adjusted EBITDA of approximately $91 million and company-defined free

cash flow of approximately $86 million.

In the two years following the publication of the above forecasts,

Whole Earth spent over $300 million on two major acquisitions345.

The company acquired Swerve, L.L.C. (“Swerve”), a manufacturer of sugar-free plant-based sweeteners and WSO Investments,

Inc., the holding company for Wholesome Sweeteners Incorporated (“Wholesome”), North America’s leading organic sweetener

brand. At the time these acquisitions were announced, the Company anticipated that Swerve would generate approximately $5 million of

adjusted EBITDA in 20203 and Wholesome would generate approximately $23 million of adjusted EBITDA in 20204.

3 Company press release dated 11/10/2020: “Whole Earth Brands, Inc. Acquires Swerve®, a Rapidly Growing Keto-Friendly & Plant-based Sweeteners & Baking Brand”.

4 Company press release dated 12/17/2020: “Whole Earth Brands, Inc. Enters Into Definitive Agreement to Acquire Wholesome Sweeteners, North America’s #1 Organic Sweetener Brand”.

5 Whole Earth Brands 2022 10-K filed on 3/13/2023.

Assuming no growth in both acquired companies’ adjusted

EBITDA through 2023, these acquisitions should have added $28 million to the approximately $91 million forecast in the original SPAC presentation,

resulting in 2023 adjusted EBITDA of approximately $119 million. The Wholesome transaction also included an earn-out of $55 million which

would only be triggered if Wholesome reached approximately $30 million of adjusted EBITDA between August 29, 2020, and December 31, 20216.

As this earn-out was paid in full during the first quarter of 20227,

we assume that 2023 EBITDA adjusted for these two acquisitions should have been even higher than $119 million had the Company met its

targets for the remaining business.

Instead, as of the end of the third quarter of 2023, Whole

Earth’s guidance for 2023 adjusted EBITDA is a range of $77 million to $79 million, leaving the Company on track to miss their

2023 EBITDA forecast adjusted for acquisitions by more than 33%. In addition to materially underperforming its long-term plan, the

Company also issued mid-year downward revisions to its full-year forecast for adjusted EBITDA in 2022 and revenue in 20238,

adding to a pattern of consistently missing financial targets.

While profitability has fallen short of expectations, the

Company’s debt balance has increased meaningfully following the acquisitions of Swerve and Wholesome. Prior to the announcement

of these transactions, the Company had approximately $84 million of net debt or 1.6x the Company’s trailing twelve month adjusted

EBITDA9. Including the

Wholesome earn-out, these acquisitions resulted in a cash outflow of $290 million. As of the latest quarter ending September 30, 2023,

Whole Earth had over $411 million of net debt or approximately 5.4x trailing twelve month adjusted EBITDA10.

Whole Earth has expressed in corporate presentations that the

Company has a long-term leverage target of less than 3.0x but will retain flexibility to go above this level for M&A as long as they

can utilize free cash flow to de-leverage back to less than 3.0x “within a reasonable period of time”11.

On the Company’s fourth quarter 2020 earnings call, following the acquisitions of Swerve and Wholesome, management reiterated that

reducing balance sheet leverage was a corporate priority and targeted a ratio of net debt to EBITDA of approximately 4.0x by the end of

2021. Instead, the Company’s leverage ratio has increased each year since the announcement of these acquisitions, reaching 4.4x

by the end of 2021, 5.1x by the end of 2022 and 5.4x in the most recently reported quarterly results12.

We believe part of the reason leverage has been moving in the

wrong direction is because the Wholesome and Swerve acquisitions were both funded primarily by floating-rate bank debt during a period

when interest rates were materially below current levels. The rapid rise in interest rates and the Company’s exposure to variable

rate debt resulted in cash flows being diverted away from reducing the principal amount of debt, to instead servicing the debt through

higher interest payments. Unlike many other companies, Whole Earth failed to fix their floating rate debt with interest rate swaps during

the low-rate environment that persisted throughout 2020 and 2021.

6 Whole Earth Brands 2020 10-K filed on 3/16/2021.

7 Whole Earth Brands 2022 10-K filed on 3/13/2023.

8 Q3 2022 earnings release dated 11/9/2022 and Q3 2023 earnings release dated 11/9/2023.

9 Q3 2020 earnings release dated 11/16/2020 and Q4 2020 earnings release dated 3/16/2021.

10 Q3 2023 supplemental earnings presentation dated 11/9/2023.

11 Barclays Global Consumer Staples Conference Investor Presentation dated 9/8/2020, slide 28.

12 Q4 2021 supplemental earnings presentation dated 3/14/2022, Q4 2022 supplemental earnings presentation dated 3/13/2023 and Q3 2023 supplemental earnings presentation dated 11/9/2023.

In addition to materially higher interest payments required

to service the Company’s debt, missteps related to the Company’s supply chain have also diverted cash flows away from de-leveraging

the balance sheet. The Company began having issues with its supply chain in the fourth quarter of 2021 and has since spent nearly $37

million on non-recurring cash expenses related to its Supply Chain Reinvention Program13.

While this issue is now mostly behind the Company, it has still resulted in less free cash flow available for debt reduction.

We believe Whole Earth's current financial leverage of 5.4x

net debt to EBITDA is at a level that is hardly acceptable in this higher interest rate environment. We agree with the Company’s

messaging over the last several years that the appropriate amount of financial leverage for Whole Earth remains below 3.0x net debt to

EBITDA. Based on our expectations and consensus estimates14

for growth and free cash flow generation, a target of roughly 3.0x net debt to EBITDA will not be achieved until sometime in 2027. This

means that not only did the Company carry a level of financial leverage materially higher than its long-term target of less than 3.0x

net debt to EBITDA in 2021, 2022, and 2023, but will likely remain above that level for at least the next three years as well. Operating

with a level of financial leverage well above the Company’s long-term target for six years is completely unacceptable in our view.

13 Q4 2021 earnings release dated 3/14/2022, Q4 2022 earnings release dated 3/13/2023 and the Q3 2023 earnings release dated 11/9/2023.

14 Bloomberg consensus estimates as of 12/29/2023.

We originally invested in Whole Earth as we believed the Company

would be able to grow revenues, improve margins and generate a substantial amount of free cash flow, allowing the Company to quickly de-leverage

the balance sheet and increase shareholder value. However, the combination of consistently poor financial performance relative to Company

targets and increasing leverage during a period of rising interest rates has contributed to stagnant adjusted EBITDA, poor free cash flow

generation, and an overly indebted balance sheet. The result is a share price that is down nearly 66% since the announcement of the SPAC

transaction15.

We understand management’s goal is to improve financial

performance and free cash flow generation over the coming years. While we acknowledge that if achieved, this should improve shareholder

value over time, we also know that a standalone plan is not risk-free and, as discussed in this letter, the Company has a consistent track

record of missing financial forecasts. Even with a material change in operating trajectory and solid execution against consensus expectations,

Whole Earth will continue to have an overly indebted balance sheet for many years to come, making this a difficult investment for many

prospective shareholders in this higher interest rate environment.

We believe the consequence of inaction by the Board as it relates

to the strategic review will be Whole Earth remains an illiquid, small market capitalization company with an over-leveraged balance sheet

for the foreseeable future. We believe this represents an extraordinarily uphill battle for Whole Earth as a public company and would

be an inferior outcome for the Company’s shareholders relative to a sale.

An immediate sale of the Company is a risk-free alternative

that gives shareholders an exit at a premium to the current share price. We urge the Board of Directors to negotiate in good faith with

potential acquirers and agree on a sale price that is satisfactory for all shareholders.

We have had significant dialogue with the Company since the

strategic review process was initiated and have supported the Company’s comprehensive review of alternatives to maximize shareholder

value. We are surprised by the lack of updates on the progress of the review despite a significant amount of time passing since the Company

received the initial bid. We believe that anything but a sale of the Company in its entirety is not an acceptable outcome of the strategic

review process, and we look forward to engaging with the Board in a more influential role to assist in enhancing shareholder value.

Sincerely,

Keith Goodman

Managing Partner

Notch View Capital

15

Bloomberg market data based on Whole Earth’s share price as of 12/29/2023 compared to 12/19/2019 (last day of trading prior to the

announcement of the SPAC transaction).

Whole Earth Brands (NASDAQ:FREE)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Whole Earth Brands (NASDAQ:FREE)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025