UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-40199

Greenbrook TMS Inc.

(Translation of the registrant’s name

into English)

890 Yonge Street, 7th Floor

Toronto, Ontario

Canada M4W 3P4

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F

¨

Exhibit 99.1 of this Form 6-K is incorporated by reference into

Greenbrook TMS Inc.’s registration statement on Form F-3 (File No. 333-264067).

EXHIBIT INDEX

The following document, which is attached as an exhibit hereto, is

incorporated by reference herein:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

GREENBROOK TMS INC. |

| |

|

|

| Date: December 18, 2023 |

By: |

|

/s/ Bill Leonard |

| |

|

|

Name: Bill Leonard |

| |

|

|

Title: President & CEO |

Exhibit 99.1

FORM 51-102F3

Material Change Report

| Item 1 | Name and Address of Company |

Greenbrook TMS Inc. (“Greenbrook”

or the “Company”)

890 Yonge Street, 7th Floor

Toronto, Ontario

Canada M4W 3P4

| Item 2 | Date of Material Change |

December 14, 2023.

A news release was issued by Greenbrook

on December 15, 2023 through the facilities of Cision and filed on the System for Electronic Document Analysis and Retrieval (SEDAR+).

| Item 4 | Summary of Material Change |

On December 15, 2023, Greenbrook

announced that it entered into the twenty-first amendment (the “Amendment”) to the Company’s credit facility

(the “Credit Facility”) with affiliates of Madryn Asset Management, LP (“Madryn”). As part of the

Amendment, the Company secured an additional US$4,015,548.22 in senior secured term loans from Madryn under the Credit Facility (the “New

Loan”). After giving effect to the New Loan, the Company has an aggregate amount of approximately US$76 million outstanding

under the Credit Facility (collectively, the “Loans”).

| Item 5 | Full Description of Material Change |

5.1 - Full Description of Material

Change

On December 15, 2023, Greenbrook

announced that it entered into the Amendment to the Credit Facility with Madryn. As part of the Amendment, the Company secured an additional

US$4,015,548.22 in senior secured term loans from Madryn under the Credit Facility. After giving effect to the New Loan, the Company has

an aggregate amount of approximately US$76 million outstanding under the Credit Facility.

The proceeds of the New Loan is expected

to be used by the Company to fund certain debt service obligations of the Company and for general corporate and working capital purposes.

The Company is also currently considering additional near-term financing options to address its future liquidity needs.

The Amendment also provides Madryn

with the option to convert up to approximately US$365,050 of the outstanding principal amount of the New Loan into common shares of the

Company (“Common Shares”) at a conversion price per share equal to US$1.90 (the “Conversion Price”),

subject to customary anti-dilution adjustments (the “Conversion Instrument”). This conversion feature corresponds to

the conversion provisions for the Loans previously issued under the Credit Facility, which provide Madryn with the option to convert a

portion of the outstanding principal amount of the Loans into Common Shares at the Conversion Price. After giving effect to the issuance

of the Conversion Instrument, Madryn has the option to convert up to an aggregate of approximately US$7.0 million of the outstanding principal

amount of the Loans into Common Shares at the Conversion Price.

The Amendment also extends the period

during which the Company’s minimum liquidity covenant is reduced from US$3,000,000 to US$300,000 to January 15, 2024.

MI 61-101 Disclosure

Madryn

is an insider of the Company. Accordingly, the foregoing transactions are considered “related party transactions” for purposes

of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”)

which, absent any available exemption, would require a formal valuation and minority approval under MI 61-101. The board of directors

of the Company (the “Board”) (including all independent directors) unanimously determined in good faith that

the Company may rely on the “financial hardship” exemption from the formal valuation and minority approval requirements set

out in Section 5.5(g) and Section 5.7(e) of MI 61-101 with respect to such transactions, given that the Company is

in serious financial difficulty, the transactions are designed to improve the financial position of the Company, and the exemption provided

for in Section 5.5(f) of MI 61-101 is not available, as the transactions contemplated are not subject to court approval under

bankruptcy or insolvency law. In addition, the Company has one or more independent directors who have determined that the terms and conditions

of the transactions are reasonable for the Company in the circumstances and are in its best interests.

The Company

did not file a material change report related to the foregoing transactions more than 21 days before the closing of the foregoing transactions,

as the shorter period was necessary in order to permit the Company to complete the transactions in a timeframe consistent with usual market

practice for transactions of this nature and in order to expeditiously address the Company’s immediate liquidity needs.

The following supplementary information

is provided in accordance with section 5.2 of MI 61-101 in respect of the transactions described herein:

| (a) | Description of the transaction and its material terms |

| | | |

| | | See Item 5.1 above. |

| (b) | Purpose and business reasons for the transaction |

| | | |

| | | In the view of the Board, the Amendment

was approved in order to mitigate the risk of covenant breaches by the Company under the Credit Facility and to provide the Company with

additional capital to satisfy the Company’s ongoing payment and contractual obligations and to operate its business. |

| (c) | Anticipated effect of the transaction on the issuer’s business and affairs |

| | | |

| | | See Item 5.1(b) above. |

| (i) | the interest in the transaction of every interested party and of the related parties and associated

entities of the interested parties |

| | | |

| | | See Item 5.1 above. |

| (ii) | the anticipated effect of the transaction on the percentage of securities of the issuer, or of an affiliated

entity of the issuer, beneficially owned or controlled by each person or company referred to in subparagraph (i) for which there

would be a material change in that percentage |

| | | |

| | | The transactions described herein will not have a material impact on the percentage of Common Shares held by Madryn. |

| (e) | Unless this information will be included in another disclosure document for the transaction, a discussion

of the review and approval process adopted by the board of directors and the special committee, if any, of the issuer for the transaction,

including a discussion of any materially contrary view or abstention by a director and any material disagreement between the board and

the special committee |

The Board (including all independent directors) unanimously determined that the Company was in serious financial difficulty and unanimously determined that the transaction described herein were reasonable and in the best interests of the Company in the circumstances. No materially contrary view or abstention was expressed or made by any director of the Company. See Item 5.1 above for further details.

| (f) | A summary in accordance with section 6.5 of MI 61-101 of the formal valuation, if any, obtained for

the transaction, unless the formal valuation is included in its entirety in the material change report or will be included in its entirety

in another disclosure document for the transaction |

Not Applicable.

| (g) | Disclosure, in accordance with section 6.8 of MI 61-101 of every prior valuation in respect of the

issuer that relates to the subject matter of or is otherwise relevant to the transaction (i) that has been made in the 24 months

before the date of the material change report, and (ii) the existence of which is known, after reasonable inquiry, to the issuer

or to any director or senior officer of the issuer |

In the 24 months immediately preceding

the date of this material change report, there has not been any prior valuation, the existence of which is known after reasonable inquiry

to the Company or any director or senior officer thereof, in respect of the Company.

| (h) | The general nature and material terms of any agreement entered into by the issuer, or a related party

of the issuer, with an interested party or a joint actor with an interested party, in connection with the transaction |

See the description of the Amendment,

the New Loan and the Conversion Instrument as well as their material terms found in Item 5.1 above.

| (i) | Disclosure of the formal valuation and minority approval exemptions, if any, on which the issuer is

relying under sections 5.5 and 5.7 of MI 61-101 respectively, and the facts supporting reliance on the exemptions |

See Item 5.1 above.

5.2 - Disclosure for Restructuring

Transactions

Not applicable.

| Item 6 | Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

| Item 7 | Omitted Information |

No information has been omitted from

this report on the basis that it is confidential information.

For further information, please contact

William Leonard, President and Chief Executive Officer, at (855) 797-4867.

December 18, 2023.

Cautionary Note Regarding

Forward-Looking Information

Certain statements contained in this material

change report, including statements relating to the New Loan and the expected use of proceeds therefrom, may constitute “forward-looking

information” within the meaning of applicable securities laws in Canada and “forward-looking statements” within the

meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking information”).

Forward-looking information may relate to the Company’s future financial and liquidity outlook and anticipated events or results

and may include information regarding the Company’s business, financial position, results of operations, business strategy, growth

plans and strategies, technological development and implementation, budgets, operations, financial results, taxes, dividend policy, plans

and objectives. Particularly, information regarding the New Loan and the expected use of proceeds therefrom may be forward-looking information.

In some cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”,

“expects” or “does not expect”, “is expected”, “an opportunity exists”, “budget”,

“scheduled”, “estimates”, “outlook”, “forecasts”, “projection”, “prospects”,

“strategy”, “intends”, “anticipates”, “does not anticipate”, “believes”, or

variations of such words and phrases or statements that certain actions, events or results “may”, “should”, “could”,

“would”, “might”, “will”, “will be taken”, “occur” or “be achieved”.

In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances

contain forward-looking information. Statements containing forward-looking information are not facts but instead represent management’s

expectations, estimates and projections regarding future events or circumstances.

Forward-looking information is necessarily based

on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date of this material change

report, are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause the actual results, level

of activity, performance or achievements or future events or developments to differ materially from those expressed or implied by the

forward-looking statements, including, without limitation: macroeconomic factors such as inflation and recessionary conditions, substantial

doubt regarding the Company’s ability to continue as a going concern due to recurring losses from operations; inability to increase

cash flow and/or raise sufficient capital to support the Company’s operating activities and fund its cash obligations, repay indebtedness

and satisfy the Company’s working capital needs and debt obligations; prolonged decline in the price of the Common Shares reducing

the Company’s ability to raise capital; inability to satisfy debt covenants under the Credit Facility and the potential acceleration

of indebtedness; risks related to the resolution of the Company’s ongoing litigation with Benjamin Klein and compliance with the

terms of their settlement agreement; risks related to the ability to continue to negotiate amendments to the Credit Facility to prevent

a default; risks relating to the Company’s ability to deliver and execute on the previously-announced restructuring plan (the “Restructuring

Plan”) and the possible failure to complete the Restructuring Plan on terms acceptable to the Company or its suppliers (including

Neuronetics, Inc.), or at all; risks relating to maintaining an active, liquid and orderly trading market for Common Shares as a

result of the Company’s recent delisting notification and potential inability to regain compliance with the Nasdaq Stock Market’s

listing rules; risks relating to the Company’s ability to realize expected cost-savings and other anticipated benefits from the

Restructuring Plan; risks related to the Company’s negative cash flows, liquidity and its ability to secure additional financing;

increases in indebtedness levels causing a reduction in financial flexibility; inability to achieve or sustain profitability in the future;

inability to secure additional financing to fund losses from operations and satisfy the Company’s debt obligations; risks relating

to strategic alternatives, including restructuring or refinancing of the Company’s debt, seeking additional debt or equity capital,

reducing or delaying the Company’s business activities and strategic initiatives, or selling assets, other strategic transactions

and/or other measures, including obtaining bankruptcy protection, and the terms, value and timing of any transaction resulting from that

process; claims made by or against the Company, which may be resolved unfavorably to us; risks relating to the Company’s dependence

on Neuronetics, Inc. as its exclusive supplier of TMS devices. Additional risks and uncertainties are discussed in the Company’s

materials filed with the Canadian securities regulatory authorities and the United States Securities and Exchange Commission from time

to time, available at www.sedarplus.com and www.sec.gov, respectively. These factors are not intended to represent a complete list of

the factors that could affect the Company; however, these factors should be considered carefully. There can be no assurance that such

estimates and assumptions will prove to be correct. The forward-looking statements contained in this material change report are made as

of the date of this material change report, and the Company expressly disclaims any obligation to update or alter statements containing

any forward-looking information, or the factors or assumptions underlying them, whether as a result of new information, future events

or otherwise, except as required by law.

Greenbrook TMS (NASDAQ:GBNH)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

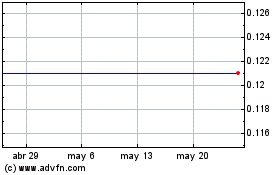

Greenbrook TMS (NASDAQ:GBNH)

Gráfica de Acción Histórica

De May 2023 a May 2024