UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

Information

Required in Proxy Statement

Schedule

14a Information

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☐

Filed

by a Party other than the Registrant ☒

Check

the appropriate box:

| ☒ | Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Under Rule 14a-12 |

HF

FOODS GROUP INC |

| (Name

of Registrant as Specified in Its Charter) |

| |

Irrevocable

Trust for Raymond Ni

Weihui

Kwok

Yuanyuan

Wu |

| (Name

of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment

of Filing Fee (Check the appropriate box):

| ☐ |

Fee

paid previously with preliminary materials |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY

COPY SUBJECT TO COMPLETION

DATED MAY 5, 2023

Irrevocable Trust for Raymond Ni

___________________, 2023

Dear

Fellow HF Foods Stockholders:

The

Irrevocable Trust for Raymond Ni and the other participants in this solicitation (collectively, “Raymond Ni,” “we”

or “our”) are the beneficial owners of an aggregate of 6,035,200 shares of common stock, par value $.0001 (the “Common

Stock”), of HF FOODS GROUP INC, a Delaware corporation (“HF Foods” or the “Company”), representing approximately

11.2% of the outstanding shares of Common Stock. For the reasons set forth in the attached Proxy Statement, we believe meaningful changes

to the composition of the Board of Directors of the Company (the “Board”) are necessary in order to ensure that the Company

is being run in a manner consistent with your best interests.

We

are seeking your support for the election of our five (5) nominees as directors at the 2023 annual meeting of stockholders (“Annual

Meeting”) scheduled to be held on June 1, 2023 because we believe that the Board will benefit from the addition of directors who

collectively possess the relevant skill sets, a shared objective of enhancing value for the benefit of all HF Foods stockholders and

who will be able to hold management accountable. The individuals that we have nominated are highly-qualified, capable and ready to serve

the stockholders of HF Foods.

Our

extensive due diligence has led us to believe there is significant value to be realized at HF Foods given the Company’s valuable

assets, apparent governance and cultural issues and tremendous potential. However, we are concerned that the Board is not taking the

appropriate actions to address the Company’s prolonged underperformance and actively oversee management. Given the Company’s

consistent stock price underperformance and history of poor corporate governance practices, we strongly believe that the Board must be

meaningfully refreshed to ensure that the interests of stockholders, the true owners of HF Foods, are appropriately represented in the

boardroom.

The

Board is currently composed of five (5) directors: Russell T. Libby, Xiao Mou Zhang, Valerie Chase, Hong Wang and Prudence Kuai.

We

will be proposing 5 different nominees:

Christopher

Ray McDowell, Esq. is a litigation partner in a Cincinnati law firm, responsible for civil and criminal cases at all levels. Christopher’s

practice focuses on criminal and commercial-related litigation as well as real estate transactions and regulatory compliance. This work

includes all levels and all stages of criminal and civil proceedings. In addition, he is heavily involved with commercial landlord tenant

law from leasing to evictions. He has more than 29 years of experience counseling clients across a broad-range of legal issues from commercial

disputes to employee theft and loss.

Mr.

McDowell holds a J.D. from West Virginia University College of Law and a B.A. from Marshall University in Political Science and History.

Mr.

Charles Reedy Ward is the founder of CRW Commercial Real Estate Advisors where he has worked since 2020. Between 2008 and 2020, he

was a founding member of Midland Retail. He holds a Bachelor of Business Administration from the University of Cincinnati – College

of Business Administration, with double major in Finance & Real Estate.

Mr. Josh Li is the Chief Business Officer

at Roxe, a global payment network that uses blockchain to make money smarter. Prior to Roxe, Josh was an executive at Google, where he

led strategic partnership and innovation teams in both North America and APAC. He holds a BA degree from Harvard University in East Asian

Studies, and an MBA in Marketing and High-Tech from the Anderson School of Management at UCLA.

Ms.

Xiaoyu Li has served as Co-Chief Financial Officer and director of AnPac Bio-Medical

Science Co., Ltd. (Nasdaq: ANPC) since October 2022 and as Chief Financial Officer of its subsidiary Fresh2 Technology Inc. since March

2023. She previously worked as a Financial Analyst at Apifiny Group from April 2019 to March 2023, and as an Investment Manager at Xinmoney

Technology from April 2018 to September 2019. She has extensive experience in financing, management and investor relations, especially

with respect to public companies. She was a director of Mercurity Fintech Holding Inc. (Nasdaq: MFH) from May 2018 to August 2021. She

holds a BS degree in economics from University of Minnesota and an MS degree in finance from University of Illinois.

Mr.

Yang Lin has 13 years of experience in the foodservice and restaurant industry. He has been a Board member and CEO of the Aiming

Management Group LLC since 2021. He is the Founder of the Fusabowl Chain Restaurants and the CEO since 2015. He holds a Bachelor of Business

Administration in Finance and Real Estate from the University of Cincinnati, Ohio.

Through

the attached Proxy Statement and enclosed GOLD universal proxy card, we are soliciting proxies to elect our five (5) nominees.

Stockholders should refer to the Company’s proxy statement for the names, backgrounds, qualifications and other information concerning

the Company’s nominees.

We

will be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the names of all

nominees for election to the Board. Stockholders will have the ability to vote for up to five (5) nominees on our enclosed GOLD

universal proxy card. Any stockholder who wishes to vote for any combination of our nominees and the Company nominees may do so on our

GOLD universal proxy card. There is no need to use the Company’s proxy card or voting instruction form, regardless of

how you wish to vote. We urge stockholders to use our GOLD universal proxy card to vote “FOR” our five

nominees.

We

urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating

and returning the enclosed GOLD universal proxy card today. The attached Proxy Statement and the enclosed GOLD universal

proxy card are first being furnished to stockholders on or about ____________, 2023.

If

you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning

a later dated GOLD universal proxy card or by voting in person at the Annual Meeting.

If

you have any questions or require any assistance with your vote, please contact [], which is assisting us, at its address and toll-free

numbers listed below.

Thank you for your support,

| /s/ Weihui Kwok |

|

| Weihui Kwok |

|

| |

|

| /s/ Yuanyuan Wu |

|

| Yuanyuan Wu |

|

| |

|

| /s/ Fai Lam |

|

| Irrevocable Trust for Raymond Ni |

|

| Name: Fai Lam, Trustee |

|

If

you have any questions, require assistance in voting your GOLD universal proxy card, or need additional copies of RAYMOND NI’s

proxy materials, please contact [ ] at the phone numbers or email address listed below.

[ ]

PRELIMINARY

COPY SUBJECT TO COMPLETION

DATED MAY 5, 2023

2023 ANNUAL MEETING OF STOCKHOLDERS

OF

HF FOODS, INC.

_________________________

PROXY STATEMENT

OF

The Irrevocable Trust for Raymond Ni

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD UNIVERSAL PROXY CARD TODAY

The

Irrevocable Trust for Raymond Ni, and the other participants in this solicitation (collectively, “Raymond Ni,” “we”

or “our”) are significant stockholders of HF Foods, Inc., a Delaware corporation (“HF Foods” or the “Company”),

who beneficially own an aggregate of 6,035,200 shares of common stock, par value $0.0001 per share (the “Common Stock”),

of HF Foods, representing approximately 11.2% of the outstanding shares of Common Stock. We believe that the Board of Directors of the

Company (the “Board”) must be meaningfully refreshed to ensure that the Board takes the necessary steps for the Company’s

stockholders to realize the maximum value of their investments and hold management accountable. We have nominated directors who have

strong, relevant backgrounds and who are committed to fully exploring all opportunities to unlock stockholder value. Accordingly, we

are seeking your support at the annual meeting of stockholders scheduled to be held virtually on Thursday, June 1, 2023, at

12:00 p.m., Eastern Time (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the

“Annual Meeting”), for the following:

| 1. | To

elect Raymond Ni’s five (5) director nominees, namely Christopher Ray McDowell, Esq., Charles Reedy Ward, Josh Li, Xiaoyu Li and

Yang Lin (each aa “Raymond Ni Nominee” and collectively, the “Raymond Ni Nominees”), as members of the Board,

to serve until the 2024 annual meeting of stockholders (the “2024 Annual Meeting”); |

| | | |

| 2. | To

ratify the selection of BDO USA, LLP as the Company’s independent registered public accounting firm for the year ending December 31,

2023; |

| 3. | To

consider a non-binding advisory vote on compensation of our named executive officers; and |

| 4. | To

transact such other business as may properly come before the meeting or any continuation, adjournment or postponement thereof. |

This

Proxy Statement and the enclosed GOLD universal proxy card are first being mailed to stockholders on or about [____________],

2023.

The

Board is currently composed of five (5) directors.

Through

the attached Proxy Statement and enclosed GOLD universal proxy card, we are soliciting proxies to elect our nominees.

Any

stockholder who wishes to vote for any combination of the RAYMOND NI Nominees and the Company’s nominees may do so on RAYMOND NI’s

enclosed GOLD universal proxy card. There is no need to use the Company’s proxy card or voting instruction form, regardless

of how you wish to vote.

Your

vote to elect the RAYMOND NI Nominees will have the legal effect of replacing five (5) incumbent directors with the RAYMOND NI Nominees.

There is no assurance that any of the Company’s nominees will serve as directors if all or some of the RAYMOND NI Nominees are

elected.

Stockholders

are permitted to vote for less than five (5) nominees or for any combination (up to five (5) total) of the RAYMOND NI Nominees and the

Company’s nominees on the GOLD universal proxy card. However, if stockholders choose to vote for any of the Company’s

nominees, we recommend that stockholders vote in favor of only the Company’s nominees. We recommend that stockholders do not vote

for any of the Company’s nominees.

IF

YOU MARK FEWER THAN FIVE (5) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, OUR GOLD UNIVERSAL PROXY CARD, WHEN DULY

EXECUTED, WILL BE VOTED ONLY AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO HOW YOU WISH TO VOTE YOUR SHARES, THE PROXIES

NAMED THEREIN WILL VOTE SUCH SHARES “FOR” THE FIVE (5) RAYMOND NI NOMINEES. IMPORTANTLY, IF YOU MARK MORE THAN FIVE (5) “FOR”

BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

As

of the date hereof, Raymond Ni and each of the RAYMOND NI Nominees (each a “Participant” and collectively, the “Participants”),

collectively own 6,035,200 shares of Common Stock (the “RAYMOND NI Shares”), We intend to vote the RAYMOND NI Shares FOR

the election of the RAYMOND NI Nominees, FOR the ratification of the appointment of BDO USA, LLP as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2023, and AGAINST approval of the advisory

vote on the compensation of the Company’s named executive officers.

The

Company has set the close of business on April 6, 2023 as the record date for determining stockholders entitled to notice of and

to vote at the Annual Meeting (the “Record Date”). Stockholders of record at the close of business on the Record Date will

be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were [_______] shares of Common Stock

outstanding and entitled to vote at the Annual Meeting.

We

urge you to carefully consider the information contained in this Proxy Statement and then support our efforts by signing, dating and

returning the enclosed GOLD universal proxy card today.

THIS

SOLICITATION IS BEING MADE BY RAYMOND NI AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS

TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH RAYMOND NI IS NOT

AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED

GOLD UNIVERSAL PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

RAYMOND

NI URGES YOU TO SIGN, DATE AND RETURN THE GOLD UNIVERSAL PROXY CARD VOTING “FOR” THE ELECTION OF THE RAYMOND

NI NOMINEES.

IF

YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS

DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD UNIVERSAL PROXY CARD. THE LATEST DATED PROXY

IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION

OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important

Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our GOLD universal

proxy card are available at

www.[_____________________].com

IMPORTANT

Your

vote is important, no matter how few shares of Common Stock you own. RAYMOND NI urges you to sign, date, and return the enclosed GOLD

universal proxy card today to vote FOR the election of the RAYMOND NI Nominees and in accordance with RAYMOND NI’s recommendations

on the other proposals on the agenda for the Annual Meeting.

| ● | If

your shares of Common Stock are registered in your own name, please sign and date the enclosed GOLD universal proxy card and return

it to RAYMOND NI, c/o [] (“[]”), in the enclosed postage-paid envelope today. Stockholders also have the following two options

for authorizing a proxy to vote shares registered in their name: |

| ● | Via

the Internet at [] at any time prior to 11:59 p.m. (Eastern Time) on the day before the Annual Meeting, and follow the instructions provided

on the GOLD universal proxy card; or |

| ● | By

telephone, by calling [] at any time prior to 11:59 p.m. (Eastern Time) on the day before the Annual Meeting, and follow the instructions

provided on the GOLD universal proxy card. |

| ● | If

your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common

Stock, and these proxy materials, together with a GOLD voting instruction form, are being forwarded to you by your broker or bank.

As a beneficial owner, if you wish to vote, you must instruct your broker, trustee or other representative how to vote. Your broker cannot

vote your shares of Common Stock on your behalf without your instructions. |

| ● | Depending

upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed

voting instruction form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed

voting instruction form. |

| ● | You

may vote your shares in person at the Annual Meeting. Even if you plan to attend the Annual Meeting in person, we recommend that you

submit your GOLD proxy card by mail, internet or telephone by the applicable deadline so that your vote will be counted if you

later decide not to attend the Annual Meeting. |

As

we are using a “universal” proxy card, which includes our RAYMOND NI Nominees as well as the Company’s nominees, there

is no need to use any other proxy card regardless of how you intend to vote. We strongly urge you NOT to sign or return any Company

proxy cards or voting instruction forms that you may receive from the Company. Even if you return the Company’s white proxy

card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously

sent to us.

[ ]

BACKGROUND

TO THE SOLICITATION

The

following is a chronology of material events leading up to this proxy solicitation:

On

August 22, 2018, pursuant to the merger agreement dated as of March 28, 2018, or the “Acquisition Agreement,” by and among

Atlantic Acquisition Corp. (“Atlantic”), HF Group Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of

Atlantic, or “Merger Sub,” HF Group Holding Corporation, a North Carolina corporation, or “HF Group,” the stockholders

of HF Group, and Zhou Min Ni, as representative of the stockholders, the Irrevocable Trust for Raymond Ni received 5,591,553 shares of

the Common Stock of the Company in exchange for its equity interest in HF Group. Prior to the completion of the transaction, HF Group

was a privately-owned company. The HF Group stockholders, including the Reporting Person, exchanged their equity ownership in HF Group

for shares of Common Stock in Atlantic.

As

part of the acquisition, and as contemplated under the Acquisition Agreement, Atlantic changed its name to HF Foods Group Inc.

In

connection with the Acquisition Agreement, Atlantic, HF Group, Zhou Min Ni, as representative of the stockholders of HF Group, and Loeb

& Loeb LLP, as escrow agent, entered into an Escrow Agreement at closing, pursuant to which Atlantic deposited shares of Common Stock,

representing 15% of the aggregate amount of shares (2,995,475 shares) to be issued to the stockholders of HF Group pursuant to the Business

Combination, to secure the indemnification obligations of the stockholders of HF Group as contemplated by the Acquisition Agreement.

Furthermore,

Atlantic and each of the HF Group shareholders entered into a Lock-Up Agreement at closing, pursuant to which the stockholders of HF

Group agreed, for a period of 365 days from the closing of the Acquisition, not to offer, sell, contract to sell, pledge or otherwise

dispose of, directly or indirectly, any shares of Common Stock (including any securities convertible into, or exchangeable for, or representing

the rights to receive, shares of Common Stock), enter into a transaction that would have the same effect, or enter into any swap, hedge

or other arrangement that transfers, in whole or in part, any of the economic consequences of ownership of such shares, or to enter into

any transaction, swap, hedge or other arrangement, or engage in any short sales with respect to any security of Atlantic.

In

addition, Atlantic and the HF Group shareholders entered into a Registration Rights Agreement at closing to provide for the registration

of the Common Stock being issued to the HF Group shareholders in connection with the Business Combination. The HF Group shareholders

are entitled to “piggy-back” registration rights with respect to registration statements filed following the consummation

of the Business Combination. Atlantic will bear the expenses incurred in connection with the filing of any such registration statements.

On

March 31, 2023, the Company announced by Form 8-K that it has established June 1, 2023 as the date for its combined 2022-2023 annual

meeting of stockholders (the “Annual Meeting”). Due to the fact that the Company did not hold an annual meeting of

stockholders in 2022, the Company said that it was providing the due date for submission of any qualified stockholder proposal or qualified

stockholder nominations. According to the Company, a stockholder proposal not included in the proxy statement for the Annual Meeting

would be ineligible for presentation at the meeting unless the stockholder gives timely notice of the proposal in writing to the Company’s

Secretary at its principal executive offices and otherwise complies with the provisions of the Company’s Amended and Restated Bylaws

(the “Bylaws”). To be timely, according to the Company, the Bylaws provide that if no annual meeting was held in the

preceding year and the first public announcement of the date of such annual meeting is less than 100 days prior to the date of such annual

meeting then notice by the stockholder to be timely must be so delivered on or before the 10th day following the day on which public

announcement of the date of such meeting is first made by the Company. In accordance with the foregoing requirements of the Bylaws, the

Company said that stockholders must submit such written notice to the Secretary no later than the close of business on April 10, 2023,

the 10th day following the day on which public announcement of the date of the Annual Meeting has first been made by the Company. The

Company has also set a deadline of April 10, 2023 for the receipt of any stockholder proposals for inclusion in the proxy materials to

be distributed in connection with the Annual Meeting pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended, which

the Company said that it believed to be a reasonable time before it expects to begin to print and distribute its proxy materials for

the Annual Meeting. In addition to complying with the April 10, 2023 deadline, stockholder director nominations and proposals intended

to be considered for inclusion in the Company’s proxy materials for the Annual Meeting must also, wrote the Company, comply with

all applicable Securities and Exchange Commission rules, including Rule 14a-8 and Rule 14a-19, Delaware corporate law, and the Bylaws

in order to be eligible for inclusion in the proxy materials for the Annual Meeting.

According

to the tight deadline, we complied with all the Company’s requests and pursuant to Section 2.7 and 2.8 of Article II of the Bylaws,

legally notified the Company (the “Notice”) of our intent to nominate five persons as directors for election to the

Board at the 2022-2023 Annual Meeting.

The

persons we intended to nominate for election to the Board at the Annual Meeting are Christopher Ray McDowell, Charles Reedy Ward, Michael

K. Brooks, Haohan Xu, and Xiaoyu Li (each a “Nominee” and collectively, the “Nominees”). Note that

since then, we replaced two of the nominees.

Information

regarding each Nominee required to be disclosed pursuant to Section 2.7 of Article II of the Bylaws was set forth in the exhibits to

the Notice. Pursuant to Section 2.7 and Section 2.8 of Article II of the Bylaws, each Nominee’s written consent to his nomination

and a written representation and agreement according to Section 2.8(a)(ii) was included as well. Pursuant to Section 2.8 of Article II

of the Bylaws, each Nominee’s completed questionnaire with respect to the background, independence and qualifications of such person

and the background of any other person or entity on whose behalf the nomination is being made, was included as well.

In

addition to the foregoing, information regarding the qualifications of each Nominee responsive to the criteria and attributes was

set forth in the exhibits to the Notice. We also declared that each Nominee is prepared to commit sufficient time to attend to his

duties and responsibilities as a member of the Board.

Also certified in the Notice was that (i) during the past ten (10)

years, no Nominee has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no Nominee

directly or indirectly beneficially owns any securities of the Company; (iii) no Nominee owns any securities of the Company; (iv) no Nominee

has purchased or sold any securities of the Company during the past two (2) years; (v) no Nominee is, or within the past year was, a party

to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited

to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or

profits, or the giving or withholding of proxies; (vi) no associate of any Nominee owns beneficially, directly or indirectly, any securities

of the Company; (vii) no Nominee owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company;

(viii) no Nominee or any of his or her associates had any direct or indirect interest in any transaction, or series of similar transactions,

since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar

transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000 (with

the possible exceptions of Mr. Michael K. Brooks and Mr. Charles Reedy Ward); (ix) no Nominee or any of his or her associates has any

arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, nor with respect

to any future transactions to which the Company or any of its affiliates will or may be a party; (x) no Nominee has a substantial interest,

direct or indirect, by securities holdings or otherwise, in any matter to be acted on at the Annual Meeting; (xi) no Nominee holds any

positions or offices with the Company; (xii) no Nominee has a family relationship with any director, executive officer, or person nominated

or chosen by the Company to become a director or executive officer (with the possible exceptions of then-nominee Haohan Xu and the Nominee

Ms. Xiaoyu Li who are cousins); and (xiii) no companies or organizations, with which any of the Nominees has been employed in the past

five (5) years, is a parent, subsidiary or other affiliate of the Company.

Except

as set forth in the Notice (i) there are no material proceedings to which any Nominee or any of his or her associates is a party adverse

to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries and (ii) none

of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K occurred during the past ten (10) years.

We

declared that we intend to solicit the holders of shares representing at least 67% of the voting power of shares entitled to vote on

the election of directors in support of director nominees other than the Company’s nominees within the timelines and instructions

of Section 2.7 of the Bylaws. If any change occurs with respect to our intent to solicit the holders of shares representing at least

67% of the voting power of shares entitled to vote on the election of directors in support of director nominees other than the Company’s

nominees or with respect to the names of such person’s nominees, we said that we would notify the Company’s promptly, all

as the Bylaws required.

We

complied in all respects with the Bylaws and applicable law, and asked the Company that if it for whatever reasons it believes the Notice

was incomplete or otherwise deficient in any respect, to please notify us in writing immediately of such alleged deficiencies. We reserved

the right, following receipt of any such notice, to either challenge, or attempt to cure, any alleged deficiencies.

In spite of complying with all the Company’s requests, and with

the Bylaws and applicable law, the Company responded cryptically that “the proposal is materially non-compliant with Section 2.7

and, among other things, fails to satisfy key goals of that Bylaw provision, namely certainty and transparency to stockholders concerning

the nominating stockholders and the Board nominees.” Even though we asked for clarifications and to understand what this meant,

they were given no further explanations. We decided to consider their further actions at that point and all the legal tools remained at

their disposal, and now may proceed with filing their own materials, e.g., using a universal proxy card according to the rules, that the

Company shall have used, and did not when it filed on April 28, 2023 a proxy statement ignoring our timely Notice.

REASONS

FOR THE SOLICITATION

WE

BELIEVE THAT CHANGE TO THE HF FOODS BOARD IS NEEDED NOW

We

believe that HF Foods has failed to create stockholder value and has lost credibility with investors because it is unwilling to hold

its current management to account. In our opinion, HF Foods neither has a credible plan nor the capital allocation discipline required

to turn its underperformance around and unlock stockholder value, as indicated by the Company’s long history of total shareholder

return (“TSR”) underperformance relative to benchmark indices. Additionally, it has failed to create any operating leverage

and achieve the desired profitability.

We

believe that urgent change is needed on the Board to solidify the Company’s long-term strategy, enhance the Company’s operational

performance, add rigor and discipline to capital allocation, and ensure better accountability at both the Board and management levels.

HF

Foods is at a critical crossroads and in order to ensure that the Company finds the right path forward and that the will of stockholders

will no longer be ignored, further change is needed from the boardroom. Given the Board’s seeming disregard for the concerns of

its stockholders, its unwillingness to hold the Company’s management accountable for consistently poor performance and failed strategies,

we felt obligated to nominate our five highly qualified Raymond Ni Nominees for election at the Annual Meeting.

We

believe Raymond Ni nominees would add fresh and independent perspectives, relevant and significant expertise, and an enduring commitment

to the long-term success of the Company on behalf of all stockholders.

PROPOSAL

NO. 1

ELECTION

OF DIRECTORS

The

Board is currently composed of five (5) directors and, according to the Company’s proxy statement. Your vote to elect the RAYMOND

NI Nominees will have the legal effect of replacing five (5) directors of the Company with the RAYMOND NI Nominees.

This

Proxy Statement is soliciting proxies to elect not only the five (5) RAYMOND NI Nominees. This proxy statement includes the notice information

required to be provided to the Company pursuant to the Universal Proxy Rules, including Rule 14a-19(a)(1) under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). This proxy statement includes the names of all nominees for whom we intend

to solicit proxies. Further, we intend to solicit the holders of Common Stock representing at least 67% of the voting power of the Common

Stock entitled to vote on the election of directors in support of director nominees other than the Company’s nominees.

THE

NOMINEES

The

following information sets forth the name, age, business address, present principal occupation, and employment and material occupations,

positions, offices, or employments for the past five (5) years of each of the RAYMOND NI Nominees. The nominations were made in a timely

manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications,

attributes and skills that led us to conclude that the RAYMOND NI Nominees should serve as directors of the Company are set forth above

in the section entitled “Reasons for the Solicitation” and below. This information has been furnished to us by the RAYMOND

NI Nominees.

Christopher

Ray McDowell, Esq. is a litigation partner in a Cincinnati law firm, responsible for civil and criminal cases at all levels. Christopher’s

practice focuses on criminal and commercial-related litigation as well as real estate transactions and regulatory compliance. This work

includes all levels and all stages of criminal and civil proceedings. In addition, he is heavily involved with commercial landlord tenant

law from leasing to evictions. He has more than 29 years of experience counseling clients across a broad-range of legal issues from commercial

disputes to employee theft and loss.

Mr.

McDowell holds a J.D. from West Virginia University College of Law and a B.A. from Marshall University in Political Science and History.

Mr.

Charles Reedy Ward is the founder of CRW Commercial Real Estate Advisors where he has worked since 2020. Between 2008 and 2020, he

was a founding member of Midland Retail. He holds a Bachelor of Business Administration from the University of Cincinnati – College

of Business Administration, with double major in Finance & Real Estate.

Mr.

Josh Li is the Chief Business Officer at Roxe, a global payment network that uses blockchain to make money smarter. Prior to Roxe,

Josh was an executive at Google, where he led strategic partnership and innovation teams in both North America and APAC. He holds a BA

degree from Harvard University in East Asian Studies, and an MBA in Marketing from the Anderson School of Management at UCLA.

Ms.

Xiaoyu Li has served as Co-Chief Financial Officer and director of AnPac Bio-Medical Science Co., Ltd. (Nasdaq: ANPC) since October

2022 and as Chief Financial Officer of its subsidiary Fresh2 Technology Inc. since March 2023. She previously worked as a Financial Analyst

at Apifiny Group from April 2019 to March 2023, and as an Investment Manager at Xinmoney Technology from April 2018 to September 2019.

She has extensive experience in financing, management and investor relations, especially with respect to public companies. She was a

director of Mercurity Fintech Holding Inc. (Nasdaq: MFH) from May 2018 to August 2021.

Mr.

Yang Lin has 13 years of experience in the foodservice and restaurant industry. He has been a Board member and CEO of the Aiming

Management Group LLC since 2021. He is the Founder of the Fusabowl Chain Restaurants and the CEO since 2015. He holds a Bachelor of Business

Administration in Finance and Real Estate from the University of Cincinnati, Ohio.

Except

as otherwise set forth in this Proxy Statement (including the Schedule hereto), (i) during the past 10 years, no RAYMOND NI Nominee has

been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no RAYMOND NI Nominee directly or

indirectly beneficially owns any securities of the Company; (iii) no RAYMOND NI Nominee owns any securities of the Company which are

owned of record but not beneficially; (iv) no RAYMOND NI Nominee has purchased or sold any securities of the Company during the past

two years; (v) no part of the purchase price or market value of the securities of the Company owned by any RAYMOND NI Nominee is represented

by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no RAYMOND NI Nominee is, or within

the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company,

including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit,

division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any RAYMOND NI Nominee owns beneficially,

directly or indirectly, any securities of the Company; (viii) no RAYMOND NI Nominee owns beneficially, directly or indirectly, any securities

of any parent or subsidiary of the Company; (ix) no RAYMOND NI Nominee or any of his or her associates or immediate family members was

a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party

to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to

be a party, in which the amount involved exceeds $120,000; (x) no RAYMOND NI Nominee or any of his or her associates has any arrangement

or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future

transactions to which the Company or any of its affiliates will or may be a party; (xi) no RAYMOND NI Nominee has a substantial interest,

direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting; (xii) no RAYMOND NI Nominee

holds any positions or offices with the Company; (xiii) no RAYMOND NI Nominee has a family relationship with any director, executive

officer, or person nominated or chosen by the Company to become a director or executive officer, (xiv) no companies or organizations,

with which any of the RAYMOND NI Nominees has been employed in the past five years, is a parent, subsidiary or other affiliate of the

Company and (xv) there are no material proceedings to which any RAYMOND NI Nominee or any of his associates is a party adverse to the

Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. Except as disclosed

herein, with respect to each of the RAYMOND NI Nominees, (a) none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of

the Exchange Act (“Regulation S-K”) occurred during the past 10 years, (b) there are no relationships involving any RAYMOND

NI Nominee or any of such RAYMOND NI Nominee’s associates that would have required disclosure under Item 407(e)(4) of Regulation

S-K had such RAYMOND NI Nominee been a director of the Company, and (c) none of the RAYMOND NI Nominees nor any of their associates has

received any fees earned or paid in cash, stock awards, option awards, non-equity incentive plan compensation, changes in pension value

or nonqualified deferred compensation earnings or any other compensation from the Company during the Company’s last completed fiscal

year, or was subject to any other compensation arrangement described in Item 402 of Regulation S-K.

Other

than as stated herein, there are no arrangements or understandings between RAYMOND NI Capital, the RAYMOND NI Nominees, or any other

person or persons pursuant to which the nomination of the RAYMOND NI Nominees described herein is to be made. Other than as stated herein,

none of the RAYMOND NI Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the

Company or any of its subsidiaries in any material pending legal proceeding.

We

do not expect that any of the RAYMOND NI Nominees will be unable to stand for election, but, in the event any RAYMOND NI Nominee is unable

to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed GOLD universal proxy card will

be voted for substitute nominee(s), to the extent this is not prohibited under the Company’s By-laws

(the “Bylaws”) and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes

or announces any changes to the Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying

any RAYMOND NI Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, we would identify

and properly nominate such substitute nominee(s) in accordance with the Bylaws and shares of Common Stock represented by the enclosed

GOLD universal proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s),

to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing

size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding

sentence are without prejudice to any potential position of RAYMOND NI that any attempt to increase the size of the current Board or

to reconstitute or reconfigure the classes on which the current directors serve, may constitute an unlawful manipulation of the Company’s

corporate machinery.

Stockholders

will have the ability to vote for up to five (5) nominees on RAYMOND NI’s enclosed GOLD universal proxy card. Any stockholder

who wishes to vote for any combination of the RAYMOND NI Nominees and the Company’s nominees may do so on RAYMOND NI’s enclosed

GOLD universal proxy card. There is no need to use the Company’s white proxy card or voting instruction form, regardless

of how you wish to vote. RAYMOND NI urges stockholders to vote using our GOLD universal proxy card “FOR” the

RAYMOND NI Nominees.

Stockholders

are permitted to vote for less than five (5) nominees or for any combination (up to five (5) total) of the RAYMOND NI Nominees and

the Company’s nominees on the GOLD universal proxy card. Certain information about the Company Nominees is set forth in

the Company’s proxy statement. RAYMOND NI is not responsible for the accuracy of any information provided by or relating to

Company nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, the Company or

any other statements that the Company or its representatives have made or may otherwise make.

IMPORTANTLY,

IF YOU MARK FEWER THAN five (5) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, OUR GOLD UNIVERSAL PROXY CARD, WHEN

DULY EXECUTED, WILL BE VOTED ONLY AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO HOW YOU WISH TO VOTE YOUR SHARES, THE PROXIES

NAMED THEREIN WILL VOTE SUCH SHARES “FOR” THE FIVE (5) RAYMOND NI NOMINEES. IMPORTANTLY, IF YOU MARK MORE THAN FIVE (5) “FOR”

BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

WE

STRONGLY URGE YOU TO VOTE “FOR” THE ELECTION OF THE RAYMOND NI NOMINEES ON THE ENCLOSED GOLD UNIVERSAL PROXY CARD.

PROPOSAL

NO. 2

RATIFICATION

OF THE SELECTION OF BDO USA, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING DECEMBER 31,

2023.

U

As

disclosed in the Company’s proxy statement, the Board of Directors is submitting the selection of BDO USA, LLP for ratification

at the Annual Meeting.

According

to the Company’s proxy statement, approval of Proposal 2 requires the affirmative vote of a majority of the shares of common stock

present in person, virtually or by proxy at the Annual Meeting and entitled to vote on this proposal. As a result, abstentions will have

the same effect as votes against this proposal. We do not expect any broker non-votes in connection with this proposal.

WE

MAKE NO RECOMMENDATION WITH RESPECT TO THE RATIFICATION OF THE APPOINTMENT OF BDO USA, LLP AS THE COMPANY’S INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

PROPOSAL

NO. 3

ADVISORY

VOTE ON EXECUTIVE COMPENSATION

As

discussed in further detail in the Company’s proxy statement, in accordance with Section 14A of the Exchange Act and Rule 14a-21(a)

promulgated thereunder, stockholders are entitled to vote at the Annual Meeting to approve the compensation of our named executive officers,

commonly known as a “Say-on-Pay”, as disclosed in this proxy statement in accordance with the standards established under

Item 402 of Regulation S-K under the Exchange Act. However, the stockholder vote on executive compensation is an advisory vote only,

and it is not binding.

The

following resolution is the subject of the vote:

“RESOLVED

that the Company’s stockholders hereby approve the compensation paid to the Company’s executive officers named in the Summary

Compensation Table of this proxy statement, as that compensation is disclosed pursuant to the compensation disclosure rules of the Securities

and Exchange Commission, including the various compensation tables and the accompanying narrative discussion included in this proxy statement.”

The

vote on this resolution is not intended to address any specific element of compensation; rather the vote relates to the compensation

of our named executive officers, as described in this proxy statement in accordance with the compensation disclosure rules of the SEC.

According to the Company’s proxy statement, approval of Proposal

3 requires the affirmative vote of a majority of the shares of common stock present in person, virtually or by proxy at the Annual Meeting

and entitled to vote on this proposal. As a result, abstentions will have the same effect as votes against this proposal. Broker non-votes

will not be treated as entitled to vote on this proposal, and accordingly will have no effect on this proposal.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE

ADVISORY VOTE ON EXECUTIVE COMPENSATION AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

VOTING AND PROXY PROCEDURES

Only stockholders of record

on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock

before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares. Stockholders of record

on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares after the Record

Date. Based on publicly available information, RAYMOND NI believes that the only outstanding class of securities of the Company entitled

to vote at the Annual Meeting is the Common Stock.

Shares of Common Stock represented

by properly executed GOLD universal proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions,

will be voted FOR the election of the RAYMOND NI Nominees, FOR the ratification of the appointment of BDO USA, LLP as the

Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023, and AGAINST the advisory

resolution to approve the compensation of the Company’s named executive officers

We believe that voting on

the GOLD universal proxy card provides the best opportunity for stockholders to elect all of the RAYMOND NI Nominees and achieve

the best Board composition overall. RAYMOND NI therefore urges stockholders to use our GOLD universal proxy card to vote “FOR”

the five (5) RAYMOND NI Nominees.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number

of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business

at the meeting. For the Annual Meeting, the presence, in person or by proxy, of holders of at least a majority of the total number of

outstanding shares entitled to vote at the Annual Meeting is necessary to constitute a quorum for the transaction of business at the Annual

Meeting.

| ● | Directors will be elected by a majority of shares present

or represented at the meeting in person or by proxy and entitled to vote on this matter. For each director nominee, you may vote “FOR,”

“AGAINST” or “ABSTAIN”. Abstentions will have the same effect as a vote against the applicable director nominee

in Proposal No. 1, and broker non-votes will have no effect on Proposal No. 1. |

| ● | Ratification of the selection of BDO USA, LLP as our independent

registered public accounting firm will require the affirmative vote of a majority of the shares present in person, virtually or represented

by proxy at the Annual Meeting and entitled to vote on this matter. You may vote “FOR,” “AGAINST” or “ABSTAIN”

on the proposal to ratify the selection of BDO USA, LLP as independent registered public accounting firm. Abstentions will have the same

effect as a vote against Proposal No. 2. We do not expect any broker non-votes in connection with respect to Proposal No. 2. |

| ● | Approval, on an advisory basis, of our executive compensation

will require the affirmative vote of a majority of the shares present in person, virtually or represented by proxy at the Annual Meeting

and entitled to vote on this matter. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the proposal to

approve, on an advisory basis, our executive compensation. Abstentions will have the same effect as a vote against Proposal No. 3 and

broker non-votes will have no effect on Proposal No. 3. |

An “ABSTAIN” vote represents a stockholder’s

affirmative choice to decline to vote on a proposal. Given the requirement in our bylaws that a majority of the shares present in person,

virtually or represented by proxy at the Annual Meeting and entitled to vote on a proposal vote in favor of such proposal, an abstention

on any proposal will have the same effect as a vote against that proposal.

Generally, “broker non-votes” occur

when shares held by a broker in street name for a beneficial owner are not voted with respect to a particular proposal because the broker

(1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker

is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of our independent

registered public accounting firm, without instructions from the beneficial owner of those shares. As a result, we do not expect any broker

non-votes in connection with the ratification of our independent registered public accounting firm. However, a broker is not entitled

to vote shares held for a beneficial owner on proposals such as director elections, executive compensation, and other significant matters

absent instructions from the beneficial owner. Accordingly, while broker non-votes are counted for purposes of determining whether a quorum

is present at the Annual Meeting, broker non-votes will not be treated as shares entitled to vote on any such non-routine proposal and

therefor will have no effect on the outcome of such proposal.

How to Revoke Your Proxy

Any person giving a proxy in the form accompanying

this proxy statement has the power to revoke it at any time before its exercise. The mere presence at the Annual Meeting of the person

appointing a proxy does not, however, revoke the appointment. If your shares are held in “street name” through a bank, broker

or other nominee, any changes need to be made through them. Your last vote will be the vote that is counted.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE

RAYMOND NI NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED GOLD UNIVERSAL PROXY CARD IN THE POSTAGE-PAID

ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies

pursuant to this Proxy Statement is being made by RAYMOND NI. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet,

in person and by advertisements.

RAYMOND NI has entered into

an agreement with [] for solicitation and advisory services in connection with this solicitation, for which [] will receive a fee not

to exceed $[_____], together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities

and expenses, including certain liabilities under the federal securities laws. [] will solicit proxies from individuals, brokers, banks,

bank nominees and other institutional holders. We have requested banks, brokerage houses and other custodians, nominees and fiduciaries

to forward all solicitation materials to the beneficial owners of the shares of Common Stock they hold of record. RAYMOND NI will reimburse

these record holders for their reasonable out-of-pocket expenses in so doing. In addition, directors, officers, members and certain other

employees of RAYMOND NI may solicit proxies as part of their duties in the normal course of their employment without any additional compensation.

The RAYMOND NI Nominees may make solicitations of proxies but, except as described herein, will not receive compensation for acting as

director nominees. It is anticipated that [] will employ approximately [____] persons to solicit stockholders for the Annual Meeting.

The entire expense of soliciting

proxies is being borne by RAYMOND NI Capital. Costs of this solicitation of proxies are currently estimated to be approximately $[___________]

(including, but not limited to, fees for attorneys, solicitors and other advisors, and other costs incidental to the solicitation). RAYMOND

NI Capital estimates that through the date hereof its expenses in connection with this solicitation are approximately $[___________].

To the extent legally permissible, if RAYMOND NI Capital is successful in its proxy solicitation, RAYMOND NI Capital intends to seek reimbursement

from the Company for the expenses it incurs in connection with this solicitation. RAYMOND NI Capital does not intend to submit the question

of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

Except as set forth in this

Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no Participant has been convicted in a criminal proceeding

(excluding traffic violations or similar misdemeanors); (ii) no Participant directly or indirectly beneficially owns any securities of

the Company; (iii) no Participant owns any securities of the Company which are owned of record but not beneficially; (iv) no Participant

has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the

securities of the Company owned by any Participant is represented by funds borrowed or otherwise obtained for the purpose of acquiring

or holding such securities; (vi) no Participant is, or within the past year was, a party to any contract, arrangements or understandings

with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements,

puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies;

(vii) no associate of any Participant owns beneficially, directly or indirectly, any securities of the Company; (viii) no Participant

owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no Participant or any of his,

her or its associates or immediate family members was a party to any transaction, or series of similar transactions, since the beginning

of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which

the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no Participant or any

of his, her or its associates has any arrangement or understanding with any person with respect to any future employment by the Company

or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; (xi)

no Participant has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the

Annual Meeting; (xii) no Participant holds any positions or offices with the Company; (xiii) no Participant has a family relationship

with any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer and (xiv)

no companies or organizations, with which any of the Participants has been employed in the past five years, is a parent, subsidiary or

other affiliate of the Company.

There are no material proceedings

to which any Participant or any of his, her or its associates is a party adverse to the Company or any of its subsidiaries or has a material

interest adverse to the Company or any of its subsidiaries. With respect to each of the RAYMOND NI Nominees, none of the events enumerated

in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten (10) years.

OTHER MATTERS AND ADDITIONAL INFORMATION

RAYMOND NI is unaware of any

other matters to be considered at the Annual Meeting. However, should other matters, which RAYMOND NI is not aware of at a reasonable

time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed GOLD universal

proxy card will vote on such matters in their discretion.

Some banks, brokers and other

nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means

that only one copy of this Proxy Statement may have been sent to multiple stockholders in your household. We will promptly deliver a separate

copy of the document to you if you write to our proxy solicitor, [], at the address set forth on the back cover of this Proxy Statement,

or call toll free at []. If you want to receive separate copies of our proxy materials in the future, or if you are receiving multiple

copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holder,

or you may contact our proxy solicitor at the above address and phone number.

The information concerning

the Company and the proposals in the Company’s proxy statement contained in this Proxy Statement has been taken from, or is based

upon, publicly available documents on file with the SEC and other publicly available information. Although we have no knowledge that would

indicate that statements relating to the Company contained in this Proxy Statement, in reliance upon publicly available information, are

inaccurate or incomplete, to date we have not had access to the books and records of the Company, were not involved in the preparation

of such information and statements and are not in a position to verify such information and statements. All information relating to any

person other than the Participants is given only to our knowledge.

This Proxy Statement is dated

[________], 2023. You should not assume that the information contained in this Proxy Statement is accurate as of any date other than such

date, and the mailing of this Proxy Statement to stockholders shall not create any implication to the contrary.

STOCKHOLDER PROPOSALS

According to the Company’s proxy statement,

the Board of Directors has established a process for stockholders to send communications to it. Stockholders who wish to communicate with

the Board of Directors, or specific individual directors, may do so by directing correspondence addressed to such directors or director

in care of Carlos Rodriguez, our Chief Financial Officer, at the principal executive offices of the Company at 6325 South Rainbow Boulevard

Suite 420, Las Vegas, Nevada, 89118. Such correspondence shall prominently display the fact that it is a stockholder-board communication

and whether the intended recipients are all or individual members of the Board of Directors. The Chief Financial Officer has been authorized

to screen commercial solicitations and materials that pose security risks, are unrelated to the business or governance of the Company,

or are otherwise inappropriate. The Chief Financial Officer shall promptly forward any and all such stockholder communications to the

entire Board of Directors or the individual director as appropriate.

CERTAIN ADDITIONAL INFORMATION

WE HAVE OMITTED FROM THIS

PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING

TO THE ANNUAL MEETING BASED ON OUR RELIANCE ON RULE 14A-5(C) UNDER THE EXCHANGE ACT. THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER

THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS AND EXECUTIVE OFFICERS, INFORMATION CONCERNING EXECUTIVE COMPENSATION

AND DIRECTOR COMPENSATION, INFORMATION CONCERNING THE COMMITTEES OF THE BOARD AND OTHER INFORMATION CONCERNING THE BOARD, INFORMATION

CONCERNING CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS, INFORMATION ABOUT THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM AND OTHER IMPORTANT INFORMATION. STOCKHOLDERS ARE DIRECTED TO REFER TO THE COMPANY’S PROXY STATEMENT FOR THE FOREGOING INFORMATION,

INCLUDING INFORMATION REQUIRED BY ITEM 7 OF SCHEDULE 14A WITH REGARD TO THE COMPANY’S NOMINEES. STOCKHOLDERS CAN ACCESS THE COMPANY’S

PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS DISCLOSING THIS INFORMATION, WITHOUT COST, ON THE SEC’S WEBSITE AT WWW.SEC.GOV.

The information concerning

the Company contained in this Proxy Statement and the Schedule attached hereto has been taken from, or is based upon, publicly available

documents on file with the SEC and other publicly available information. Although we have no knowledge that would indicate that statements

relating to the Company contained in this Proxy Statement, in reliance upon publicly available information, are inaccurate or incomplete,

to date we have not had access to the books and records of the Company, were not involved in the preparation of such information and statements

and are not in a position to verify such information and statements.

________________

Your vote is important. No matter how many or

how few shares of Common Stock you own, please vote to elect the RAYMOND NI Nominees by marking, signing, dating and mailing the enclosed

GOLD universal proxy card promptly.

| |

Irrevocable Trust for Raymond Ni |

| |

|

| |

_________________, 2023 |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED May 5, 2023

HF FOODS, INC.

2023 ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF IRREVOCABLE

TRUST FOR RAYMOND NI

AND THE OTHER PARTICIPANTS IN ITS PROXY SOLICITATION

THE BOARD OF DIRECTORS OF HF FOODS, INC.

IS NOT SOLICITING THIS PROXY

P R O X Y

The undersigned appoints [],

[], [] and each of them, attorneys and agents with full power of substitution to vote all shares of common stock of HF Foods, Inc. (the

“Company”) which the undersigned would be entitled to vote if personally present at the 2023 annual meeting of stockholders

of the Company scheduled to be held virtually on Thursday, June 1, 2023, at 12:00 p.m., Eastern Time (including any adjournments

or postponements thereof and any meeting called in lieu thereof, the “Annual Meeting”).

The undersigned hereby revokes any other proxy or proxies heretofore

given to vote or act with respect to the shares of common stock of the Company held by the undersigned, and hereby ratifies and confirms

all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take by virtue hereof. If properly executed,

this Proxy will be voted as directed on the reverse and in the discretion of the herein named attorneys and proxies or their substitutes

with respect to any other matters as may properly come before the Annual Meeting that are unknown to the Irrevocable Trust for Raymond

Ni (together with the other participants in its solicitation, “RAYMOND NI”) a reasonable time before this solicitation.

THIS PROXY WILL BE VOTED

AS DIRECTED. IF NO DIRECTION IS INDICATED WITH RESPECT TO THE PROPOSALS ON THE REVERSE, THIS PROXY WILL BE VOTED “FOR” THE

FIVE (5) RAYMOND NI NOMINEES, “FOR” PROPOSAL 2, AND “AGAINST” PROPOSAL 3.

This Proxy will be valid until

the completion of the Annual Meeting. This Proxy will only be valid in connection with RAYMOND NI’s solicitation of proxies for

the Annual Meeting.

IMPORTANT: PLEASE SIGN, DATE AND MAIL THIS PROXY

CARD PROMPTLY!

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

☒ Please mark vote as in

this example

Raymond

Ni STRONGLY RECOMMENDS THAT STOCKHOLDERS VOTE “for” THE FIVE

(5) RAYMOND NI NOMINEES AND NOT TO VOTE “FOR” ANY COMPANY NOMINEES LISTED BELOW

IN PROPOSAL 1.

YOU MAY SUBMIT VOTES FOR UP TO FIVE (5) NOMINEES.

IMPORTANTLY, IF YOU MARK MORE THAN FIVE (5) “FOR” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR

THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID. IF YOU MARK FEWER THAN FIVE (5) “FOR” BOXES WITH RESPECT TO THE ELECTION

OF DIRECTORS, THIS PROXY CARD, WHEN DULY EXECUTED, WILL BE VOTED ONLY AS DIRECTED.

| 1. |

Election of Directors to hold office until the 2024 annual general meeting of stockholders. |

| Nominees |

FOR |

WITHHOLD |

| 1. Christopher Ray McDowell, Esq. |

☐ |

☐ |

| 2. Charles Reedy Ward |

☐ |

☐ |

| 3. Josh Li |

☐ |

☐ |

| 4. Xiaoyu Li |

☐ |

☐ |

| 5. Yang Lin |

☐ |

☐ |

| COMPANY Nominees OPPOSED BY Raymond Ni |

FOR |

WITHHOLD |

| 1. [______] |

☐ |

☐ |

| 2. [______] |

☐ |

☐ |

| 3. [______] |

☐ |

☐ |

| 4. [______] |

☐ |

☐ |

| 5. [______] |

☐ |

☐ |

RAYMOND NI MAKES NO RECOMMENDATION WITH RESPECT

TO PROPOSAL 2.

| 2. |

To vote on the Company’s proposal to ratify the appointment of BDO USA, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023. |

| |

☐ FOR |

|

☐ AGAINST |

|

☐ ABSTAIN |

RAYMOND NI MAKES NO RECOMMENDATION WITH RESPECT

TO PROPOSAL 3.

| 3. |

To vote on the Company’s advisory resolution to approve the compensation of the Company’s named executive officers. |

| |

☐ FOR |

|

☐ AGAINST |

|

☐ ABSTAIN |

DATED: ____________________________

____________________________________

(Signature)

____________________________________

(Signature, if held jointly)

____________________________________

(Title)

WHEN SHARES ARE HELD JOINTLY, JOINT OWNERS SHOULD

EACH SIGN. EXECUTORS, ADMINISTRATORS, TRUSTEES, ETC., SHOULD INDICATE THE CAPACITY IN WHICH SIGNING. PLEASE SIGN EXACTLY AS NAME APPEARS

ON THIS PROXY.

18

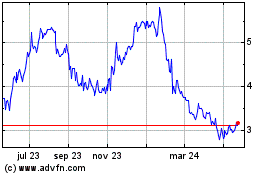

HF Foods (NASDAQ:HFFG)

Gráfica de Acción Histórica

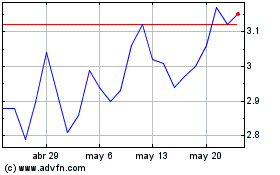

De May 2024 a Jun 2024

HF Foods (NASDAQ:HFFG)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024