UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

Hollysys Automation Technologies Ltd.

(Name of Issuer)

Ordinary Shares, par value $0.001 per share

(Title of Class of Securities)

G45667105

(CUSIP Number)

Mengyun Tang

c/o Advanced Technology (Cayman) Limited

Suite 3501, 35/F, Jardine House

1 Connaught Place, Central

Hong Kong, China

+852-2165-9000

With Copies To:

Marcia

Ellis Morrison &

Foerster LLP Edinburgh

Tower, 33/F The

Landmark, 15 Queen’s Road Central Hong

Kong, China +852-2585-0888 | |

Spencer

Klein Mitchell

Presser John

Owen Morrison &

Foerster LLP 250

West 55th Street New

York, NY 10019-9601 +1-212-468-8000 |

October 25, 2023

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

| * |

The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

CUSIP No. G45667105

| 1 |

|

Name of Reporting Persons

Liang Meng |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ☐

(b) ☐ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant

to Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Hong Kong Special Administrative Region of People’s Republic

of China |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain

Shares

☐ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

IN |

| |

|

| * |

Based on 62,021,930 Ordinary Shares outstanding as

of June 30, 2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission on September 20,

2023. |

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III GP Limited |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ☐

(b) ☐ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant

to Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain

Shares

☐ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

CO |

| |

|

| * |

Based on 62,021,930 Ordinary Shares outstanding as of June 30,

2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission on September 20, 2023. |

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III GP, L.P. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ☐

(b) ☐ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant

to Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain

Shares

☐ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

PN |

| |

|

| * |

Based on 62,021,930 Ordinary Shares outstanding as of June 30,

2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission on September 20, 2023. |

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III, L.P. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ☐

(b) ☐ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant

to Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain

Shares

☐ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7% |

| 14 |

|

Type of Reporting Person

PN |

| |

|

| * |

Based on 62,021,930 Ordinary Shares outstanding as of June 30,

2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission on September 20, 2023. |

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| 1 |

|

Name of Reporting Persons

Advanced Technology (Cayman) Limited |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ☐

(b) ☐ |

| 3 |

|

SEC

Use Only |

| 4 |

|

Source of Funds

WC |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant

to Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain

Shares

☐ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

CO |

| |

|

| * |

Based on 62,021,930 Ordinary Shares outstanding as of June 30,

2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission on September 20, 2023. |

| |

|

|

|

|

|

|

|

| Item 1. | Security and Issuer |

This Statement on Schedule 13D (this “Schedule 13D”)

relates to Ordinary Shares, $0.001 par value per share (the “Ordinary Shares”), of Hollysys Automation Technologies

Ltd., a company organized under the laws of the British Virgin Islands (the “Issuer”). The address of the principal

executive office of the Issuer is No. 2 Disheng Middle Road, Beijing Economic-Technological Development Area, Beijing, P. R. China

100176.

| Item 2. |

Identity and Background. |

This Schedule 13D is being filed by Mr. Liang Meng, Ascendent

Capital Partners III GP Limited (“GPGP”), Ascendent Capital Partners III GP, L.P. (“GPLP”), Ascendent

Capital Partners III, L.P. (“ACP III”) and Advanced Technology (Cayman) Limited (“Advanced Technology”

and, together with Mr. Meng, GPGP, GPLP and ACP III, the “Reporting Persons”).

GPGP and Advanced Technology are each exempt companies organized under

the laws of Cayman Islands. GPLP and ACP III are each limited partnerships organized under the laws of Cayman Islands. Mr. Meng

is a citizen of Hong Kong Special Administrative Region of People’s Republic of China. The business address for each Reporting

Person is Suite 3501, 35/F, Jardine House 1 Connaught Place, Central, Hong Kong.

Advanced Technology is the holder of the 8,491,875 Ordinary Shares

reported as beneficially owned in this Schedule 13D. ACP III holds 100% of the equity interests in Advanced Technology. GPLP is

the sole general partner of ACP III. GPGP is the sole general partner of GPLP and is exclusively responsible for making final decisions

related to the acquisition, structuring, financing and disposal of ACP III’s investments, including as held by Advanced Technology,

in each case in accordance with the investment guidelines set out in ACP III’s constitutional documents. Mr. Liang Meng holds

100% of the equity interests in and manages GPGP.

The principal business of Advanced Technology and ACP III is investment

management. The principal business of GPLP is to serve as the general partner of ACP III. The principal business of GPGP is to serve

as the general partner of GPLP. Mr. Liang Meng is Ascendent Capital Partners’ Founding Managing Partner and Chief Executive

Officer.

In accordance with the provisions of General Instruction C to Schedule

13D, information concerning the name, business address, principal occupation and citizenship of the respective executive officers and

directors of GPGP and Advanced Technology, required by Item 2 of Schedule 13D, is provided on Appendix A and is incorporated by reference

herein.

During the last five years, none of the Reporting Persons or the persons

listed on Appendix A have been (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or

(ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding

was or is subject to a judgment, decree, or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws, or finding any violation with respect to such laws.

| Item 3. | Source and Amount of Funds or Other Consideration |

Advanced Technology purchased an aggregate amount 8,491,875

Ordinary Shares for an aggregate purchase price of approximately US$177 million.

The funds used by Advanced Technology to purchase the Ordinary Shares

came from its working capital.

The Reporting Persons anticipate that an aggregate amount of approximately

US$1.39 billion will be expended in acquiring all of the outstanding Ordinary Shares not currently

held by the Reporting Person (“Publicly Held Shares”) at US$26 per

Ordinary Share in cash.

It is anticipated that the funding for the purchase of the Publicly

Held Shares will be provided by a combination of debt and equity financing. It is anticipated that equity financing will be provided

by one or more limited partnerships for which GPLP serves as the sole general partner and is responsible for making recommendations related

to the acquisition, structuring, financing and disposal of such limited partnership’s investments, in accordance with the investment

guidelines set out in such limited partnership’s constitutional documents. It is anticipated that debt financing will be provided

by a bank.

| Item 4. |

Purpose of Transaction. |

The information set forth in Item 3 of this Schedule 13D is incorporated

herein by reference.

On November 6, 2023, the Reporting Persons submitted a

letter to the Special Committee of the Board of Directors of the Issuer (a copy of which is attached hereto as Exhibit 99.1 and

incorporated by reference herein) and expressed their intention to actively pursue an acquisition of the Issuer. The Reporting

Persons have proposed a non-binding, all-cash offer of US$26 per share, which values the Issuer at approximately US$1.61 billion.

The Reporting Persons may also acquire additional Ordinary Shares through open market purchases and private agreements.

The Reporting Persons support the efforts by other shareholders to

cause a special meeting of the shareholders (a “Special Meeting”) to be held. The Reporting Persons request that the

Special Meeting be held no later than December 1, 2023.

The Reporting Persons intend to continuously review their investment

in the Issuer, and, notwithstanding anything contained herein, the Reporting Persons specifically reserve the right to change their intention

with respect to any or all of such matters. In reaching any decision as to their course of action (as well as to the specific elements

thereof), the Reporting Persons currently expect that they would take into consideration a variety of factors, including, but not limited

to, the following: the Issuer’s business and prospects; other developments concerning the Issuer and its businesses generally;

other business opportunities available to the Reporting Persons; changes in law and government regulations; general economic conditions;

and money and stock market conditions, including the market price of the securities of the Issuer. The Reporting Persons may in the future

determine to dispose of all or a portion of the securities of the Issuer owned by the Reporting Persons or to take any other available

course of action, which could involve one or more of the types of transactions or have one or more of the results described in clauses

(a)−(j) of Item 4 of Schedule 13D, including a merger or other extraordinary corporate transaction involving the Issuer, the

delisting of the Issuer’s securities from the NASDAQ Global Select Market, and a class of equity securities of the Issuer becoming

eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934.

| Item 5. | Interest in Securities of the Issuer. |

The information set forth in Items 2 and 3 of this Schedule 13D is incorporated herein by reference.

| (a)-(b) |

The information on Items 7 to 11 and 13 on the cover pages of

this Schedule 13D is incorporated by reference herein. The percentage set forth in row 13 is based on 62,021,930 Ordinary Shares

outstanding as of June 30, 2023, as provided in the Issuer’s Form 20-F filed with the Securities and Exchange Commission

on September 20, 2023.

As a result of the relationships described in Item 2, each of

the Reporting Persons may be deemed to share beneficial ownership of and the power to vote or direct the vote of and to dispose or

direct the disposition of the securities reported herein.

|

| (c) |

The transactions in Ordinary Shares by Advanced Technology during

the past sixty days are set forth in Schedule A and are incorporated herein by reference.

Each of the transactions set forth in Schedule A were effected

on the open market. The Reporting Persons hereby undertake to provide upon request to the staff of the Securities and Exchange Commission,

the Issuer or a security holder of the Issuer full information regarding the number of shares and prices at which the transactions

were effected.

Other than the transactions disclosed above, there were no transactions

in Ordinary Shares effected during the sixty days prior to the date hereof by the Reporting Persons. |

| |

|

|

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect

to Securities of the Issuer. |

None.

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true, complete and correct.

Dated: November 6, 2023

| |

Liang Meng |

| |

|

|

| |

/s/

Liang Meng |

| |

|

|

| |

Ascendent Capital Partners III

GP Limited |

| |

|

|

| |

By: |

/s/

Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

|

| |

Ascendent Capital Partners III

GP, L.P. |

| |

By: Ascendent Capital Partners III GP Limited, its

General Partner |

| |

|

|

| |

By: |

/s/ Liang

Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

|

| |

Ascendent Capital Partners III,

L.P. |

| |

By: Ascendent Capital Partners III GP, L.P., its

General Partner |

| |

By: Ascendent Capital Partners III GP Limited, its

General Partner |

| |

|

|

| |

By: |

/s/ Liang

Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

|

| |

Advanced Technology (Cayman) Limited |

| |

|

|

| |

By: |

/s/ Liang

Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

APPENDIX A

Set forth below is a list of each executive officer

and director of Ascendent Capital Partners III GP Limited and Advanced Technology (Cayman) Limited, including the name, citizenship,

business address and present principal occupation or employment (and the name and address of any corporation or organization in which

such employment is conducted) of each individual.

ASCENDENT CAPITAL PARTNERS III GP LIMITED

| Name

and Citizenship | |

Present

Principal Occupation (principal

business of employer) | |

Business

Address |

| Liang Meng, a citizen of Hong Kong Special Administrative Region

of People’s Republic of China | |

Investment management

Founding

Managing Partner and Chief Executive Officer, Ascendent Capital Partners

Director, Ascendent Capital Partners III

GP Limited

Director, Advanced Technology (Cayman) Limited | |

Suite 3501, 35/F, Jardine House

1 Connaught Place, Central, Hong Kong, China |

| | |

| |

|

| Ellen Janet Christian, a citizen of Cayman Islands | |

Investment

management

Director, Ascendent Capital Partners III GP Limited | |

One Nexus Way, Camana Bay, Grand Cayman KY1-9005, Cayman Islands |

| | |

| |

|

| Samit Ghosh, a citizen of Cayman Islands | |

Investment management

Director,

Ascendent Capital Partners III GP Limited | |

One Nexus Way, Camana Bay, Grand Cayman KY1-9005, Cayman Islands |

ADVANCED TECHNOLOGY (CAYMAN) LIMITED

| Name and Citizenship | |

Present

Principal Occupation (principal

business of employer) | |

Business Address |

| Liang Meng, a citizen of Hong Kong Special Administrative Region

of People’s Republic of China | |

Investment management

Founding

Managing Partner and Chief Executive Officer, Ascendent Capital Partners

Director, Ascendent Capital Partners III

GP Limited

Director, Advanced Technology (Cayman) Limited | |

Suite 3501, 35/F, Jardine House

1 Connaught Place, Central, Hong Kong, China |

SCHEDULE A

Transactions in Ordinary Shares During the

Past Sixty Days

Name of Reporting

Person | |

Nature of Transaction | |

Date of Transaction | |

Amount of Securities

Purchased/(Sold) | | |

Weighted Average

Price Per

Share ($) | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

9/28/2023 | |

| 22,351 | | |

$ | 19.14 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

9/29/2023 | |

| 532,192 | | |

$ | 20.01 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/3/2023 | |

| 16,283 | | |

$ | 20.45 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/4/2023 | |

| 24,357 | | |

$ | 20.91 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/5/2023 | |

| 19,336 | | |

$ | 20.90 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/6/2023 | |

| 16,189 | | |

$ | 20.72 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/10/2023 | |

| 10,385 | | |

$ | 20.83 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/11/2023 | |

| 2,110,000 | | |

$ | 22.03 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/25/2023 | |

| 2,000,000 | | |

$ | 21.03 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/26/2023 | |

| 1,688,675 | | |

$ | 20.76 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/27/2023 | |

| 1,050,000 | | |

$ | 21.02 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/30/2023 | |

| 29,517 | | |

$ | 20.72 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

10/31/2023 | |

| 278,325 | | |

$ | 20.93 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

11/1/2023 | |

| 15,386 | | |

$ | 20.74 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

11/2/2023 | |

| 16,449 | | |

$ | 20.76 | |

| Advanced Technology (Cayman) Limited | |

Purchase of Ordinary Shares | |

11/3/2023 | |

| 320,793 | | |

$ | 21.01 | |

Exhibit 99.1

November 6, 2023

The Special Committee of the Board of Directors

Hollysys Automation Technologies Ltd.

No. 2 Disheng Middle Road

Beijing Economic-Technological Development Area

Beijing, People’s Republic of China, 100176

Dear Dr. Kok Peng Teh, Dr. Jianyun Chai, and Ms. Khiaw

Ngoh Tan,

Ascendent Capital Partners (“Ascendent”

or “we”) is filing a Schedule 13D with the U.S. Securities and Exchange Commission today disclosing that we have become the

single largest shareholder in Hollysys Automation Technologies Ltd. (“Hollysys” or the “Company”) with a 13.7%

stake in the Company. We are interested in acquiring all of the issued and outstanding shares of the Company not currently owned by us

with a non-binding, all-cash offer of US$26 per share.

We are pleased to see that the Company has formed

a special committee of the board of directors (the “Special Committee”) to conduct a formal sale process to maximize shareholder

value. We believe our proposal offers compelling value with certainty of closing to all shareholders. We are ready to meet and discuss

our bid with you immediately, and to work with you to complete the transaction in a constructive and expeditious manner that would serve

shareholders’ interests.

Our proposal

Price: We

are proposing a non-binding, all-cash offer of US$26 per share to acquire all of the issued and outstanding shares of the Company

not currently owned by us. Our offer represents a 26.2% premium to the closing share price of US$20.6 on November 3, 2023,

and a 36.9% premium to the volume-weighted average share price of US$18.99 during the 180-day period ending on November 3, 2023.

Speed:

We are prepared to execute a transaction in an expeditious manner. Specifically, we are ready to discuss and execute definitive

transaction documents while we conduct final confirmatory due diligence, leveraging our existing understanding of the business and industry

landscape.

Certainty:

Our all-cash bid is offered at an attractive premium, supported by our ability to secure offshore funding sources. Coupled

with the fact we own the largest stake in the Company, our proposal presents the clearest and the most certain path to closing for all

shareholders.

Partnership:

Ascendent has a strong decade-long track record in owning and operating businesses in multiple sectors in partnership with

management teams to unlock value and drive business growth. At the same time, we aim to be a responsible steward of businesses, and dedicate

resources to strengthen corporate governance, enhance interest alignment with management, provide better products and services to customers,

and improve employee satisfaction. We look forward to discussing with you and key managers about the opportunities ahead.

We support the request for an EGM

We are aware that a significant group of shareholders,

representing more than 32% of the Company’s shareholder base, has requested that the Board convene a Special Meeting of Shareholders

(an “EGM”) with a view to strengthening corporate governance and increasing the number of independent directors on the Board.

Ascendent is a strong supporter of best-in-class governance, and it is our view that the Hollysys Board would benefit from a greater

number of independent directors. This recent shareholder action is an important consideration in the current situation and is instrumental

in informing our decision to submit this bid. We support the request for an EGM to be convened and request that it be held no later than

December 1, 2023.

We look forward to speedy and constructive discussions

with the Special Committee to ensure that value is maximized for all shareholders.

Sincerely,

Ascendent Capital Partners

About Ascendent Capital Partners

Ascendent Capital Partners, headquartered in

Hong Kong, is a private equity investment management firm managing assets for global institutional investors, including sovereign wealth

funds, endowments, pensions and foundations.

ACP

has successfully led and executed a large number of innovative and ground-breaking private equity investments, generating strong

risk-adjusted returns for investors and business growth for our portfolio companies. ACP has established a consistent track record

in providing advice and solution capital to entrepreneurs, business owners and management teams, building long-lasting relationships through in-depth

collaboration. For additional information about ACP, please visit ACP’s website at www.ascendentcp.com.

Exhibit 99.2

Execution version

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k)(1) promulgated

under the Securities Exchange Act of 1934, as amended, the undersigned hereby agree that they are jointly filing this statement on Schedule

13D. Each of them is responsible for the timely filing of such statement and any amendments thereto, and for the completeness and accuracy

of the information concerning such person contained therein; but none of them is responsible for the completeness or accuracy of the

information concerning the other persons making the filing, unless such person knows or has reason to believe that such information is

inaccurate.

[Signature pages to

follow]

Execution version

IN WITNESS WHEREOF, the undersigned hereby

execute this Joint Filing Agreement as of the 6th day of November, 2023.

| |

Liang Meng |

| |

|

| |

/s/ Liang

Meng |

Signature Page to the 13D Joint Filing Agreement

Execution version

IN WITNESS WHEREOF, the undersigned hereby execute this Joint Filing

Agreement as of the 6th day of November, 2023.

| |

Ascendent Capital Partners III

GP Limited |

| |

|

| |

By: |

/s/

Liang Meng |

| |

Name: Liang Meng |

| |

Title: Director |

Signature Page to the 13D Joint Filing Agreement

Execution version

IN WITNESS WHEREOF, the undersigned hereby execute this Joint Filing

Agreement as of the 6th day of November, 2023.

| |

Ascendent Capital Partners III GP, L.P. |

| |

By: Ascendent Capital Partners III GP Limited, its General Partner |

| |

|

| |

By: |

/s/

Liang Meng |

| |

Name: Liang Meng |

| |

Title: Director |

Signature Page to the 13D Joint Filing Agreement

Execution version

IN WITNESS WHEREOF, the undersigned hereby execute this Joint Filing

Agreement as of the 6th day of November, 2023.

| |

Ascendent Capital Partners III,

L.P. |

| |

By: Ascendent Capital Partners III GP, L.P., its

General Partner |

| |

By: Ascendent Capital Partners III GP Limited, its

General Partner |

| |

|

| |

By: |

/s/ Liang Meng |

| |

Name: Liang Meng |

| |

Title: Director |

Signature Page to the 13D Joint Filing Agreement

Execution version

IN WITNESS WHEREOF, the undersigned hereby execute this Joint Filing

Agreement as of the 6th day of November, 2023.

| |

Advanced Technology (Cayman) Limited |

| |

|

| |

By: |

/s/ Liang Meng |

| |

Name: Liang Meng |

| |

Title: Director |

Signature Page to the 13D Joint Filing Agreement

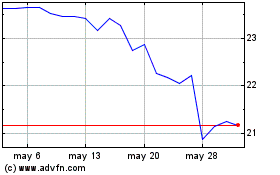

Hollysys Automation Tech... (NASDAQ:HOLI)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Hollysys Automation Tech... (NASDAQ:HOLI)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025