SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or

13(e)(1)

of the Securities Exchange Act of 1934

INTERCEPT PHARMACEUTICALS, INC.

(Name of Subject Company (Issuer))

INTERSTELLAR ACQUISITION INC.

a wholly owned subsidiary of

ALFASIGMA S.P.A.

(Names of Filing Persons (Offerors))

Common Stock, par value $0.001 per share

(Title of Class of Securities)

45845P108

(CUSIP Number of Class of Securities)

Michele A. Cera

Corporate General Counsel

Alfasigma S.p.A.

Via Ragazzi del ’99,

5

40133 Bologna, Italy

+39 051 648 9521

(Name, address and telephone number of person authorized

to receive notices and communications on behalf of the filing person)

Copies to:

Matthew G. Hurd

Oderisio de Vito Piscicelli

Sullivan & Cromwell LLP

125 Broad Street

New York, NY 10004

| x |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| x |

third-party tender offer subject to Rule 14d-1. |

| ¨ |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check

the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third Party Tender Offer) |

This filing relates solely to preliminary communications made before

the commencement of a tender offer for the outstanding shares of Common Stock, par value $0.001 per share, of Intercept Pharmaceutials, Inc.

(“Intercept”) by Interstellar Acquisition Inc. (“Purchaser”), a wholly owned subsidiary of Alfasigma S.p.A. (“Parent”).

Additional Information

The tender offer described in this communication (the “Offer”)

has not yet commenced, and this communication is neither an offer to purchase nor a solicitation of an offer to sell any shares of the

common stock of Intercept or any other securities. On the commencement date of the Offer, a tender offer statement on Schedule TO, including

an offer to purchase, a letter of transmittal and related documents, will be filed with the United States Securities and Exchange Commission

(the “SEC”) by Parent and a Solicitation/Recommendation Statement on Schedule 14D-9 will be filed with the SEC by Intercept.

The offer to purchase shares of Intercept common stock will only be made pursuant to the offer to purchase, the letter of transmittal

and related documents filed as a part of the Schedule TO. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ BOTH THE TENDER OFFER STATEMENT

AND THE SOLICITATION/RECOMMENDATION STATEMENT REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM TIME TO TIME, WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The tender offer statement will be filed with the SEC by Purchaser, a wholly owned

subsidiary of Parent, and the solicitation/recommendation statement will be filed with the SEC by Intercept. Investors and security holders

may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC

at www.sec.gov or by directing such requests to the Information Agent for the Offer, which will be named in the tender offer statement.

Item 12. Exhibits

Exhibit 99.1

Date: October 9, 2023

Subject: Letter from Alfasigma CEO Francesco Balestrieri

It was a pleasure to meet with all of you during the All-Employee

Update and in the Morristown offices. The Alfasigma leadership team and I appreciated the warm welcome, the thoughtful dialogue and transparent

questions.

We believe that Intercept is a perfect match with Alfasigma’s

core business area and an enabler of our strategic path to become a specialty company focused on GI/gut disorders. This intended acquisition

is about seeking to expand our presence in the U.S. market and building on it as a platform for growth. As such, we will depend on you

to drive the continued success of Ocaliva® and sustained progress of the pipeline programs.

Please know that during the transaction closing period and ensuing

integration, we are committed to maintaining business continuity, minimizing disruption to daily activities, and communicating progress

in a clear and timely manner.

Thank you for your continued dedication to Intercept’s business

and commitment to the patients that you serve.

I look forward to talking with you again soon.

Kind regards,

Francesco

Additional Information and Where to Find It

The tender offer described in this communication has not yet commenced.

This communication is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares

of Intercept Pharmaceuticals, Inc. (the “Company”), nor is it a substitute for any tender offer materials that the Company

or Alfasigma S.p.A. (together with its subsidiaries, “Alfasigma”) will file with the SEC. A solicitation and an offer to

buy shares of the Company will be made only pursuant to an offer to purchase and related materials that Alfasigma intends to file with

the SEC. At the time the tender offer is commenced, Alfasigma will file a Tender Offer Statement on Schedule TO with the SEC, and the

Company will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. THE COMPANY’S

STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL

AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

WHICH SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. The Offer to Purchase, the related Letter

of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, will be sent to all stockholders

of the Company at no expense to them. The Tender Offer Statement and the Solicitation/Recommendation Statement will be made available

for free at the SEC’s website at www.sec.gov. Additional copies may be obtained for free by contacting Alfasigma or the

Company. Free copies of these materials and certain other offering documents will be made available by the Company by mail to Intercept

Pharmaceuticals, Inc., 305 Madison Avenue, Morristown, NJ 07960, Attention: Corporate Secretary, by email at investors@interceptpharma.com,

or by directing requests for such materials to the information agent for the offer, which will be named in the tender offer materials.

Copies of the documents filed with the SEC by the Company will be available free of charge under the “Investors & Media”

section of the Company’s internet website at https://ir.interceptpharma.com/investor-relations.

In addition to the Offer to Purchase, the related Letter of Transmittal

and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, the Company files periodic reports and

other information with the SEC. The Company’s filings with the SEC are also available for free to the public from commercial document-retrieval

services and at the website maintained by the SEC at www.sec.gov.

Forward Looking Statements

This communication contains forward-looking statements related to

the Company, Alfasigma and the proposed acquisition of the Company by Alfasigma (the “Transaction”) that involve substantial

risks and uncertainties. Forward-looking statements include any statements containing the words “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “goal,” “may,” “might,” “plan,”

“predict,” “project,” “seek,” “target,” “potential,” “will,”

“would,” “could,” “should,” “continue” and similar expressions. In this communication,

the Company’s forward-looking statements include statements about the parties’ ability to satisfy the conditions to the consummation

of the tender offer and the other conditions to the consummation of the Transaction; statements about the expected timetable for completing

the Transaction; the Company’s plans, objectives, expectations and intentions; the financial condition, results of operations and

business of the Company and Alfasigma; the ability to successfully commercialize the Company’s product and product candidates and

generate future revenues with respect to the Company’s product candidates; and the anticipated timing of the closing of the Transaction.

Forward-looking statements are subject to certain risks, uncertainties,

or other factors that are difficult to predict and could cause actual events or results to differ materially from those indicated in

any such statements due to a number of risks and uncertainties. Those risks and uncertainties that could cause the actual results to

differ from expectations contemplated by forward-looking statements include, among other things: uncertainties as to the timing of the

tender offer and merger; uncertainties as to how many of the Company’s stockholders will tender their stock in the offer; the possibility

that competing offers will be made; the possibility that various closing conditions for the Transaction may not be satisfied or waived,

including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the Transaction; the effects

of the Transaction on relationships with employees, other business partners or governmental entities; the difficulty of predicting the

timing or outcome of FDA approvals or actions, if any; the impact of competitive products and pricing; that Alfasigma may not realize

the potential benefits of the Transaction; other business effects, including the effects of industry, economic or political conditions

outside of the companies’ control; Transaction costs; actual or contingent liabilities; and other risks listed under the heading

“Risk Factors” in the Company’s periodic reports filed with the U.S. Securities and Exchange Commission, including

current reports on Form 8-K, quarterly reports on Form 10-Q, annual reports on Form 10-K, as well as the Schedule 14D-9

to be filed by the Company and the Schedule TO and related tender offer documents to be filed by Alfasigma and Interstellar Acquisition

Inc., a wholly owned subsidiary of Alfasigma. You should not place undue reliance on these statements. All forward-looking statements

are based on information currently available to the Company and Alfasigma, and the Company and Alfasigma disclaim any obligation to update

the information contained in this communication as new information becomes available.

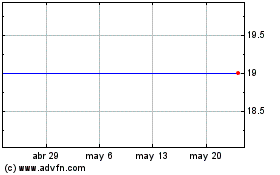

Intercept Pharmaceuticals (NASDAQ:ICPT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

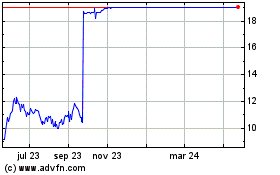

Intercept Pharmaceuticals (NASDAQ:ICPT)

Gráfica de Acción Histórica

De May 2023 a May 2024