Jamf Announces Launch of Secondary Offering of Common Stock by Selling Stockholders and Related Common Stock Repurchase

13 Mayo 2024 - 3:42PM

Jamf (Nasdaq: JAMF), the standard in managing and securing Apple at

work, today announced the commencement of an underwritten public

offering (the “Offering”) of its common stock by investment funds

affiliated with Vista Equity Partners (the “Selling Stockholders”).

The Selling Stockholders are offering 8,956,522 shares of Jamf’s

common stock pursuant to a registration statement on Form S-3 (the

“Registration Statement”) filed with the Securities and Exchange

Commission (the “SEC”) on June 24, 2022. The Selling Stockholders

intend to grant the underwriters a 30-day option to purchase up to

an additional 1,043,478 shares of Jamf’s common stock from the

Selling Stockholders.

Jamf is not selling any shares of common stock in this offering

and will not receive any proceeds from the sale of shares by the

Selling Stockholders, but will bear the costs associated with the

sale of such shares, other than any underwriting discounts and

commissions.

In addition, Jamf has authorized the purchase from the

underwriters of 2,000,000 shares of Jamf’s common stock that are

the subject of the proposed Offering at the same per share price to

be paid by the underwriters to the Selling Stockholders in the

Offering (the “Stock Repurchase”). Jamf intends to fund the

concurrent Stock Repurchase with existing cash on hand. The Stock

Repurchase is conditioned upon the completion of the Offering and

therefore there can be no assurance that the Stock Repurchase will

be completed. The Offering is not conditioned upon the completion

of the Stock Repurchase.

Morgan Stanley & Co. LLC, Goldman Sachs & Co. LLC and

J.P. Morgan Securities LLC are acting as joint underwriters of the

offering.

The Registration Statement on Form S-3 relating to these

securities has been filed with the SEC and became effective upon

such filing. The offering will be made only by means of a

prospectus and an accompanying prospectus supplement. Before

investing, prospective investors should read the prospectus, any

accompanying prospectus supplement and the documents incorporated

by reference therein for more complete information. A copy of the

prospectus and any prospectus supplement relating to this offering

may be obtained, when available, by visiting the SEC’s website at

www.sec.gov. Alternatively, copies of the prospectus and prospectus

supplement relating to the offering may be obtained if you request

it by contacting: Morgan Stanley & Co. LLC, Attn: Prospectus

Department, 180 Varick Street, 2nd Floor, New York, NY 10014;

Goldman Sachs & Co. LLC, Prospectus Department, 200 West

Street, New York, NY 10282, telephone: 1-866-471-2526, facsimile:

212-902-9316, or email: prospectus-ny@ny.email.gs.com; or J.P.

Morgan Securities LLC, c/o Broadridge Financial Solutions,

1155 Long Island Avenue, Edgewood, NY 11717 or by email at

prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any offer or sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or jurisdiction.

Note Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of federal securities laws, which statements involve

substantial risks and uncertainties. Forward-looking statements

generally relate to future events or our future financial or

operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“may,” “can,” “will,” “would,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “forecasts,”

“potential,” or “continue,” or other similar terms or expressions

that concern our expectations, strategy, plans, or intentions.

Forward-looking statements may involve known and unknown risks,

uncertainties, and other factors that may cause our actual results,

performance, or achievements to be materially different from those

expressed or implied by the forward-looking statements. These

statements include, but are not limited to, statements regarding

the Offering and the Stock Repurchase.

The forward-looking statements contained in this press release

are also subject to additional risks, uncertainties, and factors,

including those more fully described in our Annual Report on Form

10-K for the fiscal year ended December 31, 2023 and our other

filings with the SEC. Moreover, we operate in a very competitive

and rapidly changing environment, and new risks and uncertainties

may emerge that could have an impact on the forward-looking

statements contained in this press release.

Given these factors, as well as other variables that may affect

our operating results, you should not rely on forward-looking

statements, assume that past financial performance will be a

reliable indicator of future performance, or use historical trends

to anticipate results or trends in future periods. The

forward-looking statements included in this press release relate

only to events as of the date hereof. We undertake no obligation to

update or revise any forward-looking statement as a result of new

information, future events, or otherwise, except as otherwise

required by law.

About Jamf

Jamf’s purpose is to simplify work by helping organizations

manage and secure an Apple experience that end users love and

organizations trust. Jamf is the only company in the world that

provides a complete management and security solution for an

Apple-first environment that is enterprise secure, consumer simple

and protects personal privacy.

Investor Contact:

Jennifer Gaumondir@jamf.com

Media Contact:

Rachel Nauenmedia@jamf.com

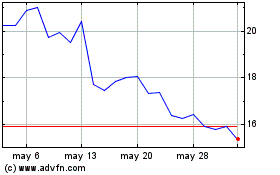

Jamf (NASDAQ:JAMF)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Jamf (NASDAQ:JAMF)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025