Emerson Electric to Buy National Instruments in $8.2 Billion Deal

12 Abril 2023 - 7:59AM

Noticias Dow Jones

By Dean Seal

Emerson Electric Co. will acquire National Instruments Corp. for

$60 a share in cash.

The St. Louis-based technology and engineering company said

Wednesday that it has reached a deal that gives National

Instruments an equity value of $8.2 billion.

Emerson already owns about 2% of the company's shares and had

been trying for nearly a year to buy all of National Instruments'

outstanding equity.

In January, Emerson publicized a $53-per-share acquisition offer

that the Austin-based company's board had rejected in an effort to

entice National Instruments' shareholders. The public proposal came

eight months after the board of National Instruments declined

Emerson's offer for an acquisition at $48 a share.

The latest $60-a-share offer received approval from both

companies' boards.

Emerson said it expects to finance the deal with available cash

and liquidity, including about $8 billion of post-tax proceeds from

the sale of its majority stake in its Climate Technologies business

to private equity funds managed by Blackstone, which is expected to

close in the second quarter of this calendar year.

The transaction is expected to close in the first half of

Emerson's fiscal 2024.

Emerson's existing 2.3 million shares of the company were

acquired at a weighted average price of $36.84, making Emerson's

effective per-share purchase price $59.61.

National Instruments' shares were halted at $52.58 in premarket

trading. Shares of Emerson fell 1.7% to $83.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

April 12, 2023 08:44 ET (12:44 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

National Instruments (NASDAQ:NATI)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

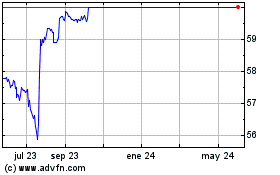

National Instruments (NASDAQ:NATI)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024