NuCana Reports Second Quarter 2023 Financial Results and Provides Business Update

16 Agosto 2023 - 3:01PM

NuCana plc (NASDAQ: NCNA) announced financial results for

the second quarter ended June 30, 2023 and provided an update

on its broad clinical development program with its transformative

ProTide therapeutics.

As of June 30, 2023, NuCana had cash and cash equivalents of

£24.6 million compared to £31.0 million at March 31, 2023 and £41.9

million at December 31, 2022. NuCana continues to advance its

various clinical programs and reported a net loss of £5.4 million

for the quarter ended June 30, 2023, as compared to a net loss of

£3.9 million for the quarter ended June 30, 2022. Basic and diluted

loss per share was £0.10 for the quarter ended June 30, 2023, as

compared to £0.07 per share for the comparable quarter ended June

30, 2022.

“During the first half of 2023, we focused on advancing our

ProTides through clinical development and look forward to providing

data updates from these studies in the second half of this year,”

said Hugh S. Griffith, NuCana’s Founder and Chief Executive

Officer. “We anticipate data updates from the three ongoing studies

of NUC-3373, a ProTide that has the potential to replace 5-FU

across multiple tumor types. These studies include: the Phase 2

part of the NuTide:302 study evaluating NUC-3373 combined with

leucovorin and either irinotecan (NUFIRI) or oxaliplatin (NUFOX)

plus bevacizumab in second-line patients with colorectal cancer;

the randomized Phase 2 NuTide:323 study of NUFIRI plus bevacizumab

compared to the standard of care FOLFIRI plus bevacizumab in

patients with second-line colorectal cancer; and the Phase 1b/2

NuTide:303 modular study of NUC-3373 in combination with

pembrolizumab in patients with solid tumors and in combination with

docetaxel in patients with lung cancer.”

Mr. Griffith continued: “NUC-7738, our ProTide transformation of

3’-deoxyadenosine continues to progress well. We anticipate sharing

data later this year from the Phase 2 part of the NuTide:701 study

investigating NUC-7738 as monotherapy in patients with solid tumors

and in combination with pembrolizumab in patients with

melanoma.”

Mr. Griffith concluded, “With a cash runway expected to extend

into 2025 and through many key milestones for both NUC-3373 and

NUC-7738, we look forward to a busy and exciting rest of the year

as we progress towards our goal of significantly improving

treatment outcomes for patients with cancer.”

2023 Anticipated

Milestones

- NUC-3373 (a ProTide transformation of 5-FU) In

2023, NuCana expects to:

- Announce data from the Phase 2 (NuTide:302) study of NUC-3373

combined with irinotecan and bevacizumab (NUFIRI-bevacizumab) and

in combination with oxaliplatin and bevacizumab (NUFOX-bevacizumab)

in second-line patients with colorectal cancer;

- Announce preliminary data from the randomized Phase 2

(NuTide:323) study of NUFIRI-bevacizumab versus the standard of

care FOLFIRI-bevacizumab for the second-line treatment of patients

with colorectal cancer; and

- Announce data from the Phase 1b (NuTide:303) modular study of

NUC-3373 in combination with pembrolizumab in patients with solid

tumors and in combination with docetaxel in patients with lung

cancer to identify additional indications for development.

- NUC-7738 (a ProTide transformation of 3’-deoxyadenosine)

In 2023, NuCana expects to:

- Announce data from the Phase 1 part of the NuTide:701 study of

NUC-7738 in patients with solid tumors; and

- Announce data from the Phase 2 part of the NuTide:701 study of

NUC-7738 as monotherapy in patients with solid tumors and in

combination with pembrolizumab in patients with melanoma.

About NuCanaNuCana is a

clinical-stage biopharmaceutical company focused on significantly

improving treatment outcomes for patients with cancer by applying

our ProTide technology to transform some of the most widely

prescribed chemotherapy agents, nucleoside analogs, into more

effective and safer medicines. While these conventional agents

remain part of the standard of care for the treatment of many solid

and hematological tumors, they have significant shortcomings that

limit their efficacy and they are often poorly tolerated. Utilizing

our proprietary technology, we are developing new medicines,

ProTides, designed to overcome the key limitations of nucleoside

analogs and generate much higher concentrations of anti-cancer

metabolites in cancer cells. NuCana’s pipeline includes NUC-3373

and NUC-7738. NUC-3373 is a new chemical entity derived from the

nucleoside analog 5-fluorouracil, a widely used chemotherapy agent.

NUC-3373 is currently being evaluated in three ongoing clinical

studies: a Phase 1b/2 study (NuTide:302) in combination with

leucovorin, irinotecan or oxaliplatin, and bevacizumab in patients

with metastatic colorectal cancer; a randomized Phase 2 study

(NuTide:323) in combination with leucovorin, irinotecan, and

bevacizumab for the second-line treatment of patients with advanced

colorectal cancer; and a Phase 1b/2 modular study (NuTide:303) of

NUC-3373 in combination with the PD-1 inhibitor pembrolizumab for

patients with advanced solid tumors and in combination with

docetaxel for patients with lung cancer. NUC-7738 is a

transformation of 3’-deoxyadenosine, a novel anti-cancer nucleoside

analog. NUC-7738 is in the Phase 2 part of a Phase 1/2 study in

patients with advanced solid tumors which is evaluating NUC-7738 as

a monotherapy and in combination with pembrolizumab.

Forward-Looking Statements This press release

may contain “forward-looking” statements within the meaning of the

Private Securities Litigation Reform Act of 1995 that are based on

the beliefs and assumptions and on information currently available

to management of NuCana plc (the “Company”). All statements other

than statements of historical fact contained in this press release

are forward-looking statements, including statements concerning the

Company’s planned and ongoing clinical studies for the Company’s

product candidates and the potential advantages of those product

candidates, including NUC-3373 and NUC-7738; the initiation,

enrollment, timing, progress, release of data from and results of

those planned and ongoing clinical studies; the Company’s goals

with respect to the development, regulatory pathway and potential

use, if approved, of each of its product candidates; the utility of

prior non-clinical and clinical data in determining future clinical

results; and the sufficiency of the Company’s current cash, cash

equivalents and marketable securities to fund its planned

operations into 2025. In some cases, you can identify

forward-looking statements by terminology such as “may,” “will,”

“should,” “expects,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” “potential” or “continue” or the negative

of these terms or other comparable terminology. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the Company’s actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. These risks and uncertainties include,

but are not limited to, the risks and uncertainties set forth in

the “Risk Factors” section of the Company’s Annual Report on Form

20-F for the year ended December 31, 2022 filed with the Securities

and Exchange Commission (“SEC”) on April 4, 2023, and subsequent

reports that the Company files with the SEC. Forward-looking

statements represent the Company’s beliefs and assumptions only as

of the date of this press release. Although the Company believes

that the expectations reflected in the forward-looking statements

are reasonable, it cannot guarantee future results, levels of

activity, performance or achievements. Except as required by law,

the Company assumes no obligation to publicly update any

forward-looking statements for any reason after the date of this

press release to conform any of the forward-looking statements to

actual results or to changes in its expectations.

Unaudited Condensed Consolidated

Statements of Operations

| |

|

For the Three Months EndedJune

30, |

|

For the Six Months EndedJune

30, |

| |

|

|

| |

|

2023 |

2022 |

|

2023 |

2022 |

| |

|

(in thousands, except per share data) |

|

|

|

£ |

|

£ |

|

|

£ |

|

£ |

|

| |

|

|

|

|

|

|

|

|

|

|

| Research and development

expenses |

|

(3,959 |

) |

(6,406 |

) |

|

(10,764 |

) |

(15,852 |

) |

| Administrative expenses |

|

(1,754 |

) |

(1,889 |

) |

|

(3,402 |

) |

(4,040 |

) |

| Net foreign exchange (losses)

gains |

|

(564 |

) |

3,077 |

|

|

(1,259 |

) |

4,208 |

|

| Operating

loss |

|

(6,277 |

) |

(5,218 |

) |

|

(15,425 |

) |

(15,684 |

) |

| Finance income |

|

178 |

|

132 |

|

|

465 |

|

163 |

|

| Loss before

tax |

|

(6,099 |

) |

(5,086 |

) |

|

(14,960 |

) |

(15,521 |

) |

| Income tax credit |

|

685 |

|

1,194 |

|

|

1,679 |

|

3,226 |

|

| Loss for the

period |

|

(5,414 |

) |

(3,892 |

) |

|

(13,281 |

) |

(12,295 |

) |

| |

|

|

|

|

|

|

| Basic and diluted loss per

share |

|

(0.10 |

) |

(0.07 |

) |

|

(0.25 |

) |

(0.24 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unaudited Condensed Consolidated

Statements of Financial Position as

at

|

|

|

June 30,

2023 |

|

December 31, 2022 |

|

|

|

|

(in thousands) |

|

|

|

£ |

|

£ |

|

| Assets |

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

Intangible assets |

|

2,553 |

|

2,365 |

|

| Property, plant and

equipment |

|

701 |

|

866 |

|

| Deferred tax asset |

|

113 |

|

103 |

|

|

|

|

3,367 |

|

3,334 |

|

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

| Prepayments, accrued income and

other

receivables |

|

2,617 |

|

3,957 |

|

| Current income tax

receivable |

|

8,033 |

|

6,367 |

|

| Other assets |

|

2,596 |

|

2,684 |

|

| Cash and cash

equivalents |

|

24,644 |

|

41,912 |

|

|

|

|

37,890 |

|

54,920 |

|

| Total

assets |

|

41,257 |

|

58,254 |

|

|

|

|

|

|

|

|

| Equity and

liabilities |

|

|

|

|

|

| Capital and

reserves |

|

|

|

|

|

| Share capital and share

premium |

|

143,213 |

|

143,203 |

|

| Other

reserves |

|

77,709 |

|

75,872 |

|

| Accumulated

deficit |

|

(193,540 |

) |

(180,573 |

) |

| Total equity

attributable to equity holders of the

Company |

|

27,382 |

|

38,502 |

|

|

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

Provisions |

|

58 |

|

46 |

|

| Lease

liabilities |

|

279 |

|

396 |

|

|

|

|

337 |

|

442 |

|

| Current

liabilities |

|

|

|

|

|

| Trade

payables |

|

4,679 |

|

4,803 |

|

| Payroll taxes and social

security |

|

189 |

|

162 |

|

| Accrued expenditure |

|

5,384 |

|

10,002 |

|

| Lease

liabilities |

|

286 |

|

243 |

|

| Provisions |

|

3,000 |

|

4,100 |

|

|

|

|

13,538 |

|

19,310 |

|

| Total

liabilities |

|

13,875 |

|

19,752 |

|

| Total equity and

liabilities |

|

41,257 |

|

58,254 |

|

|

|

|

|

|

|

|

|

|

|

Unaudited Condensed

Consolidated Statements of Cash

Flows

|

|

|

For the Six Months EndedJune

30, |

|

|

|

2023 |

|

2022 |

|

|

|

|

(in thousands) |

|

|

|

|

£ |

|

£ |

|

| Cash flows from operating

activities |

|

|

|

|

|

| Loss for the

period |

|

(13,281 |

) |

(12,295 |

) |

| Adjustments for: |

|

|

|

|

|

| Income tax

credit |

|

(1,679 |

) |

(3,226 |

) |

| Amortization and

depreciation |

|

288 |

|

470 |

|

| Movement in provisions |

|

(1,109 |

) |

- |

|

| Finance

income |

|

(465 |

) |

(163 |

) |

| Interest expense on lease

liabilities |

|

16 |

|

5 |

|

| Share-based

payments |

|

2,195 |

|

2,741 |

|

| Net foreign exchange losses

(gains) |

|

1,285 |

|

(4,283 |

) |

|

|

|

(12,750 |

) |

(16,751 |

) |

| Movements in working

capital: |

|

|

|

|

|

| Decrease in prepayments, accrued

income and other

receivables |

|

1,288 |

|

295 |

|

| (Decrease) increase in trade

payables |

|

(124 |

) |

312 |

|

| Decrease in payroll taxes, social

security and accrued

expenditure |

|

(4,598 |

) |

(1,524 |

) |

| Movements in working

capital |

|

(3,434 |

) |

(917 |

) |

| Cash used in

operations |

|

(16,184 |

) |

(17,668 |

) |

| Net income tax

paid |

|

(2 |

) |

- |

|

| Net cash used in

operating

activities |

|

(16,186 |

) |

(17,668 |

) |

| Cash flows from

investing activities |

|

|

|

|

|

| Interest

received |

|

482 |

|

161 |

|

| Payments for property, plant and

equipment |

|

(5 |

) |

(10 |

) |

| Payments for intangible

assets |

|

(291 |

) |

(276 |

) |

| Net cash from (used

in) investing

activities |

|

186 |

|

(125 |

) |

| Cash flows from financing

activities |

|

|

|

|

|

| Payments for lease

liabilities |

|

(84 |

) |

(148 |

) |

| Proceeds from issue of share

capital – exercise of share

options |

|

1 |

|

1 |

|

| Proceeds from issue of share

capital |

|

11 |

|

- |

|

| Share issue

expense |

|

(2 |

) |

- |

|

| Net cash used in

financing

activities |

|

(74 |

) |

(147 |

) |

| Net decrease in cash and cash

equivalents |

|

(16,074 |

) |

(17,940 |

) |

| Cash and cash

equivalents at beginning of

period |

|

41,912 |

|

60,264 |

|

| Effect of exchange rate changes

on cash and cash

equivalents |

|

(1,194 |

) |

4,204 |

|

| Cash and cash

equivalents at end of

period |

|

24,644 |

|

46,528 |

|

|

|

|

|

|

|

|

For more information, please contact:

NuCana plcHugh S. GriffithChief Executive Officer +44

131-357-1111 info@nucana.com

ICR WestwickeChris Brinzey+1

339-970-2843chris.brinzey@westwicke.com

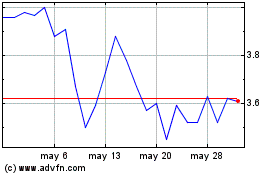

NuCana (NASDAQ:NCNA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

NuCana (NASDAQ:NCNA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025