2024 Second Quarter Highlights compared with 2024 First

Quarter:

- Financial Results:

- Net income of $5.4 million, a 4.0% increase compared to $5.2

million

- Diluted earnings per share of $0.36, a 5.9% increase compared

to $0.34

- Net interest income of $16.2 million, compared to $16.0

million

- Net interest margin of 2.96%, compared to 3.06%

- Provision for credit losses of $617 thousand, compared to $145

thousand

- Total assets of $2.29 billion, a 2.5% increase compared to

$2.23 billion

- Gross loans of $1.87 billion, a 3.6% increase compared to $1.80

billion

- Total deposits of $1.94 billion, a 2.4% increase compared to

$1.90 billion

- Credit Quality:

- Allowance for credit losses to gross loans of 1.22%, compared

to 1.23%

- Net charge-offs(1) to average gross loans(2) of (0.00)%,

compared to 0.01%

- Loans past due 30-89 days to gross loans of

0.36%, compared to 0.22%

- Nonperforming loans to gross loans of 0.23%, compared to

0.24%

- Criticized loans(3) to gross loans of 0.88%, compared to

0.64%

- Capital Levels:

- Remained well-capitalized with a Common Equity Tier 1 (“CET1”)

ratio of 12.01%

- Book value per common share increased to $13.22, compared to

$13.00

- Repurchased 224,321 shares of common stock at an average price

of $9.64 per share

- Paid quarterly cash dividend of $0.12 per share for the

periods

__________________________________________________________

(1) Annualized. (2) Includes loans held for sale. (3) Includes

special mention, substandard, doubtful, and loss categories.

OP Bancorp (the “Company”) (NASDAQ: OPBK), the holding company

of Open Bank (the “Bank”), today reported its financial results for

the second quarter of 2024. Net income for the second quarter of

2024 was $5.4 million, or $0.36 per diluted common share, compared

with $5.2 million, or $0.34 per diluted common share, for the first

quarter of 2024, and $6.1 million, or $0.39 per diluted common

share, for the second quarter of 2023.

Min Kim, President and Chief Executive Officer:

“Even with the extended pressure on the business and banking

environment, we continued to grow our loans and deposits while

improving net income and earnings per share over the last quarter.

Our net interest margin was controlled with a slight decline while

our credit quality remained strong. We remain optimistic about our

future growth and performance and will continue to focus on

executing our strategic goals while maintaining an optimal risk

profile,” said Min Kim, President and Chief Executive.

SELECTED FINANCIAL HIGHLIGHTS

($ in thousands, except per share

data)

As of and For the Three Months

Ended

% Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

Selected Income Statement Data:

Net interest income

$

16,194

$

15,979

$

17,252

1.3

%

(6.1

)%

Provision for credit losses

617

145

—

325.5

n/m

Noninterest income

4,184

3,586

3,605

16.7

16.1

Noninterest expense

12,189

12,157

12,300

0.3

(0.9

)

Income tax expense

2,136

2,037

2,466

4.9

(13.4

)

Net income

5,436

5,226

6,091

4.0

(10.8

)

Diluted earnings per share

0.36

0.34

0.39

5.9

(7.7

)

Selected Balance Sheet Data:

Gross loans

$

1,870,106

$

1,804,987

$

1,716,197

3.6

%

9.0

%

Total deposits

1,940,821

1,895,411

1,859,639

2.4

4.4

Total assets

2,290,680

2,234,520

2,151,701

2.5

6.5

Average loans(1)

1,843,284

1,808,932

1,725,764

1.9

6.8

Average deposits

1,970,320

1,836,331

1,817,101

7.3

8.4

Credit Quality:

Nonperforming loans

$

4,389

$

4,343

$

3,447

1.1

%

27.3

%

Nonperforming loans to gross loans

0.23

%

0.24

%

0.20

%

(0.01

)

0.03

Criticized loans(2) to gross loans

0.88

0.64

0.44

0.24

0.44

Net charge-offs (recoveries)(3) to average

gross loans(1)

(0.00

)

0.01

0.00

(0.01

)

(0.00

)

Allowance for credit losses to gross

loans

1.22

1.23

1.21

(0.01

)

0.01

Allowance for credit losses to

nonperforming loans

519

510

603

9.00

(84.00

)

Financial Ratios:

Return on average assets(3)

0.95

%

0.96

%

1.15

%

(0.01

)%

(0.20

)%

Return on average equity(3)

11.23

10.83

13.27

0.40

(2.04

)

Net interest margin(3)

2.96

3.06

3.40

(0.10

)

(0.44

)

Efficiency ratio(4)

59.81

62.14

58.97

(2.33

)

0.84

Common equity tier 1 capital ratio

12.01

12.34

11.92

(0.33

)

0.09

Leverage ratio

9.28

9.65

9.50

(0.37

)

(0.22

)

Book value per common share

$

13.22

$

13.00

$

12.16

1.7

8.7

(1)

Includes loans held for sale.

(2)

Includes special mention, substandard,

doubtful, and loss categories.

(3)

Annualized.

(4)

Represents noninterest expense divided by

the sum of net interest income and noninterest income.

INCOME STATEMENT HIGHLIGHTS

Net Interest Income and Net Interest Margin

($ in thousands)

For the Three Months

Ended

% Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

Interest Income

Interest income

$

34,357

$

32,913

$

30,102

4.4

%

14.1

%

Interest expense

18,163

16,934

12,850

7.3

41.3

Net interest income

$

16,194

$

15,979

$

17,252

1.3

%

(6.1

)%

($ in thousands)

For the Three Months

Ended

Yield Change 2Q2024

vs.

2Q2024

1Q2024

2Q2023

Interest

and Fees

Yield/Rate(1)

Interest

and Fees

Yield/Rate(1)

Interest

and Fees

Yield/Rate(1)

1Q2024

2Q2023

Interest-earning Assets:

Loans

$

30,605

6.67

%

$

30,142

6.69

%

$

27,288

6.34

%

(0.02

)%

0.33

%

Total interest-earning assets

34,357

6.29

32,913

6.32

30,102

5.94

(0.03

)

0.35

Interest-bearing Liabilities:

Interest-bearing deposits

17,343

4.84

15,675

4.77

11,920

3.98

0.07

0.86

Total interest-bearing liabilities

18,163

4.81

16,934

4.76

12,850

4.01

0.05

0.80

Ratios:

Net interest income / interest rate

spreads

16,194

1.48

15,979

1.56

17,252

1.93

(0.08

)

(0.45

)

Net interest margin

2.96

3.06

3.40

(0.10

)

(0.44

)

Total deposits / cost of deposits

17,343

3.54

15,675

3.43

11,920

2.63

0.11

0.91

Total funding liabilities / cost of

funds

18,163

3.57

16,934

3.50

12,850

2.71

0.07

0.86

(1)

Annualized.

($ in thousands)

For the Three Months

Ended

Yield Change 2Q2024

vs.

2Q2024

1Q2024

2Q2023

Interest

& Fees

Yield(1)

Interest

& Fees

Yield(1)

Interest

& Fees

Yield(1)

1Q2024

2Q2023

Loan Yield Component:

Contractual interest rate

$

29,719

6.48

%

$

28,877

6.41

%

$

26,411

6.13

%

0.07

%

0.35

%

SBA loan discount accretion(2)

1,087

0.24

881

0.20

1,078

0.25

0.04

(0.01

)

Amortization of net deferred fees

(44

)

(0.01

)

54

0.01

16

0.01

(0.02

)

(0.02

)

Amortization of premium

(396

)

(0.09

)

(428

)

(0.10

)

(452

)

(0.11

)

0.01

0.02

Net interest recognized on nonaccrual

loans

(3

)

—

492

0.11

40

0.01

(0.11

)

(0.01

)

Prepayment penalties and other fees(3)

242

0.05

266

0.06

195

0.05

(0.01

)

—

Yield on loans

$

30,605

6.67

%

$

30,142

6.69

%

$

27,288

6.34

%

(0.02

)%

0.33

%

(1)

Annualized.

(2)

Includes discount accretion from SBA loan payoffs of $564

thousand, $345 thousand and $459 thousand for the three months

ended June 30, 2024, March 31, 2024 and June 30, 2023,

respectively.

(3)

Includes prepayment penalty income of $26 thousand, $115

thousand and $110 thousand for the three months ended June 30,

2024, March 31, 2024 and June 30, 2023, respectively, from

Commercial Real Estate (“CRE”) and Commercial and Industrial

(“C&I”) loans.

Second Quarter 2024 vs. First Quarter

2024

Net interest income increased $215 thousand, or 1.3%, primarily

due to higher interest income on deposits in other banks and loans,

coupled with lower interest expense on borrowings, but partially

offset by higher interest expense on interest-bearing deposits. Net

interest margin was 2.96%, a decrease of 10 basis points from

3.06%.

- An $858 thousand increase in interest income on

interest-bearing deposits in other banks was primarily due to a

$62.9 million, or 86.2%, increase in average balance.

- A $463 thousand increase in interest income on loans was

primarily due to a $34.4 million, or 1.9%, increase in average

balance.

- A $439 thousand decrease in interest expense on borrowings was

primarily due to a $31.4 million, or 28.9%, decrease in average

balance.

- A $1.7 million increase in interest expense on interest-bearing

deposits was primarily due to a $119.3 million, or 9.0%, increase

in average balance.

Second Quarter 2024 vs. Second Quarter

2023

Net interest income decreased $1.1 million, or 6.1%, primarily

due to higher interest expense on interest-bearing deposits,

partially offset by higher interest income on loans and deposits in

other banks as our deposit costs repriced quicker than our

interest-earning asset yields following the Federal Reserve’s rate

increases. Net interest margin was 2.96%, a decrease of 44 basis

points from 3.40%.

- A $5.4 million increase in interest expense on interest-bearing

deposits was primarily due to a $239.8 million, or 20.0%, increase

in average balance and a 86 basis point increase in average

cost.

- A $3.3 million increase in interest income on loans was

primarily due to a $117.5 million, or 6.8%, increase in average

balance and a 33 basis point increase in average yield.

- An $844 thousand increase in interest income on

interest-bearing deposits in other banks was primarily due to a

$56.8 million, or 71.7%, increase in average balance and a 36 basis

point increase in average yield.

Provision for Credit Losses

($ in thousands)

For the Three Months

Ended

2Q2024

1Q2024

2Q2023

Provision for credit losses on loans

$

627

$

193

$

—

Reversal of credit losses on off-balance

sheet exposure

(10

)

(48

)

—

Total provision for credit losses

$

617

$

145

$

—

Second Quarter 2024 vs. First Quarter

2024

The Company recorded a $617 thousand provision for credit

losses, an increase of $472 thousand, compared with a $145 thousand

provision for credit losses. Provision for credit losses on loans

of $627 thousand was partially offset by a $10 thousand reversal of

credit losses on off-balance sheet exposure.

Provision for credit losses on loans of $627 thousand was

primarily due to a $634 thousand increase in the qualitative

reserve. The quantitative reserve was unchanged from the prior

quarter. The increase in the qualitative reserve was primarily due

to weakening economic and business conditions, increasing

criticized loans, and declining collateral values for collateral

dependent CRE loans.

Second Quarter 2024 vs. Second Quarter

2023

The Company recorded a $617 thousand provision for credit

losses, an increase of $617 thousand, compared with no provision

for credit losses.

Noninterest Income

($ in thousands)

For the Three Months

Ended

% Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

Noninterest Income

Service charges on deposits

$

793

$

612

$

573

29.6

%

38.4

%

Loan servicing fees, net of

amortization

575

772

595

(25.5

)

(3.4

)

Gain on sale of loans

2,325

1,703

2,098

36.5

10.8

Other income

491

499

339

(1.6

)

44.8

Total noninterest income

$

4,184

$

3,586

$

3,605

16.7

%

16.1

%

Second Quarter 2024 vs. First Quarter

2024

Noninterest income increased $598 thousand, or 16.7%, primarily

due to higher gain on sale of loans and higher service charges on

deposits, offset by lower loan servicing fee.

- Gain on sale of loans was $2.3 million, an increase of $622

thousand from $1.7 million, primarily due to a higher Small

Business Administration (“SBA”) loan sold amount and a higher

average premium on sales. The Bank sold $32.1 million in SBA loans

at an average premium rate of 8.58%, compared to the sale of $24.8

million at an average premium rate of 8.33%.

- Service charges on deposits was $793 thousand, an increase of

$181 thousand from $612 thousand, primarily due to an increase in

deposit analysis fees from an increase in the number of analysis

accounts.

- Loan servicing fees, net of amortization, was $575 thousand, a

decrease of $197 thousand from $772 thousand, primarily due to an

increase in servicing fee amortization driven by higher loan

payoffs in loan servicing portfolio.

Second Quarter 2024 vs. Second Quarter

2023

Noninterest income increased $579 thousand, or 16.1%, primarily

due to higher gain on sale of loans, higher service charges on

deposits and higher other income.

- Gain on sale of loans was $2.3 million, an increase of $227

thousand from $2.1 million, primarily due to a higher average

premium rate. The Bank sold $32.1 million in SBA loans at an

average premium rate of 8.58%, compared to the sale of $36.8

million at an average premium rate of 6.64%.

- Service charges on deposits was $793 thousand, an increase of

$220 thousand from $573 thousand, primarily due to an increase in

deposit analysis fees from an increase in the number of analysis

accounts.

- Other income was $491 thousand, an increase of $152 thousand

from $339 thousand, primarily due to an increase of $98 thousand in

credit related fee income.

Noninterest Expense

($ in thousands)

For the Three Months

Ended

% Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

Noninterest Expense

Salaries and employee benefits

$

7,568

$

7,841

$

7,681

(3.5

)%

(1.5

)%

Occupancy and equipment

1,660

1,655

1,598

0.3

3.9

Data processing and communication

530

487

546

8.8

(2.9

)

Professional fees

406

395

381

2.8

6.6

FDIC insurance and regulatory

assessments

378

374

420

1.1

(10.0

)

Promotion and advertising

151

149

159

1.3

(5.0

)

Directors’ fees

178

157

210

13.4

(15.2

)

Foundation donation and other

contributions

539

540

594

(0.2

)

(9.3

)

Other expenses

779

559

711

39.4

9.6

Total noninterest expense

$

12,189

$

12,157

$

12,300

0.3

%

(0.9

)%

Second Quarter 2024 vs. First Quarter

2024

Noninterest expense increased $32 thousand, or 0.3%, primarily

due to higher other expenses and data processing and communication,

partially offset by lower salaries and employee benefits.

- Other expenses increased $220 thousand, primarily due to an

increase of $147 thousand in business development expense related

to the addition of deposit analysis accounts and an increase of $84

thousand in Other Real Estate Owned (“OREO”) expense.

- Data processing and communication increased $43 thousand,

primarily due to an accrual adjustment made in the prior quarter

for credits received on data processing fees.

- Salaries and employee benefits decreased $273 thousand,

primarily due to decreases in employer payroll taxes, employee

incentive accruals, and employee vacation accruals.

Second Quarter 2024 vs. Second Quarter

2023

Noninterest expense decreased $111 thousand, or 0.9%, primarily

due to lower salaries and employee benefits and foundation donation

and other contributions, partially offset by higher other

expenses.

- Salaries and employee benefits decreased $113 thousand,

primarily due to decreases in employee incentive accruals and

employee vacation accruals.

- Foundation donations and other contributions decreased $55

thousand, primarily due to a lower donation accrual for Open

Stewardship as a result of lower net income.

- Other expenses increased $68 thousand, primarily due to an

increase of $84 thousand in OREO expense.

Income Tax Expense

Second Quarter 2024 vs. First Quarter

2024

Income tax expense was $2.1 million and the effective tax rate

was 28.2%, compared to income tax expense of $2.0 million and the

effective rate of 28.0%. The increase in income tax expense was in

line with the increase in income before income taxes.

Second Quarter 2024 vs. Second Quarter

2023

Income tax expense was $2.1 million and the effective tax rate

was 28.2%, compared to income tax expense of $2.5 million and an

effective rate of 28.8%. The decrease in the effective tax rate was

primarily due to an increased tax benefits from an increase in low

income housing tax credit investments.

BALANCE SHEET HIGHLIGHTS

Loans

($ in thousands)

As of

% Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

CRE loans

$

931,284

$

905,534

$

847,863

2.8

%

9.8

%

SBA loans

242,395

247,550

238,785

(2.1

)

1.5

C&I loans

188,557

147,508

112,160

27.8

68.1

Home mortgage loans

506,873

502,995

516,226

0.8

(1.8

)

Consumer & other loans

997

1,400

1,163

(28.8

)

(14.3

)

Gross loans

$

1,870,106

$

1,804,987

$

1,716,197

3.6

%

9.0

%

The following table presents new loan originations based on loan

commitment amounts for the periods indicated:

($ in thousands)

For the Three Months

Ended

% Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

CRE loans

$

41,990

$

44,595

$

29,976

(5.8

)%

40.1

%

SBA loans

24,142

52,379

34,312

(53.9

)

(29.6

)

C&I loans

21,271

22,124

25,650

(3.9

)

(17.1

)

Home mortgage loans

13,720

2,478

22,788

453.7

(39.8

)

Gross loans

$

101,123

$

121,576

$

112,726

(16.8

)%

(10.3

)%

The following table presents changes in gross loans by loan

activity for the periods indicated:

($ in thousands)

For the Three Months

Ended

2Q2024

1Q2024

2Q2023

Loan Activities:

Gross loans, beginning

$

1,804,987

$

1,765,845

$

1,692,485

New originations

101,123

121,576

112,726

Net line advances

43,488

16,965

(25,961

)

Purchases

—

—

6,359

Sales

(32,102

)

(32,106

)

(36,791

)

Paydowns

(19,710

)

(24,557

)

(17,210

)

Payoffs

(36,902

)

(28,539

)

(25,969

)

Decrease (increase) in loans held for

sale

9,590

(14,280

)

7,534

Other

(368

)

83

3,024

Total

65,119

39,142

23,712

Gross loans, ending

$

1,870,106

$

1,804,987

$

1,716,197

As of June 30, 2024 vs. March 31,

2024

Gross loans were $1.87 billion as of June 30, 2024, up $65.1

million, from March 31, 2024, primarily due to new loan

originations, partially offset by loan sales, payoffs and paydowns.

New loan originations, loan sales, and loan payoffs and paydowns

were $101.1 million $32.1 million and $56.6 million, respectively,

for the second quarter of 2024, compared with $121.6 million, $32.1

million and $53.1 million, respectively, for the first quarter of

2024.

As of June 30, 2024 vs. June 30,

2023

Gross loans were $1.87 billion as of June 30, 2024, up $153.9

million, from June 30, 2023, primarily due to new loan originations

of $415.7 million, primarily offset by loan sales of $127.7 million

and loan payoffs and paydowns of $211.6 million.

The following table presents the composition of gross loans by

interest rate type accompanied with the weighted average

contractual rates as of the periods indicated:

($ in thousands)

As of

2Q2024

1Q2024

2Q2023

%

Rate

%

Rate

%

Rate

Fixed rate

36.2

%

5.39

%

35.1

%

5.17

%

36.2

%

4.82

%

Hybrid rate

33.9

5.42

32.8

5.22

34.7

4.99

Variable rate

29.9

9.19

32.1

9.16

29.1

9.05

Gross loans

100.0

%

6.54

%

100.0

%

6.47

%

100.0

%

6.11

%

The following table presents the maturity of gross loans by

interest rate type accompanied with the weighted average

contractual rates for the periods indicated:

($ in thousands)

As of June 30, 2024

Within One Year

One Year Through Five

Years

After Five Years

Total

Amount

Rate

Amount

Rate

Amount

Rate

Amount

Rate

Fixed rate

$

155,421

6.17

%

$

292,706

5.11

%

$

229,174

5.21

%

$

677,301

5.39

%

Hybrid rate

5,032

8.38

173,341

4.21

454,749

5.84

633,122

5.42

Variable rate

93,103

9.03

128,778

9.04

337,802

9.29

559,683

9.19

Gross loans

$

253,556

7.26

%

$

594,825

5.70

%

$

1,021,725

6.84

%

$

1,870,106

6.54

%

Allowance for Credit Losses

The following table presents allowance for credit losses and

provision for credit losses as of and for the periods

presented:

($ in thousands)

As of and For the Three Months

Ended

Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

Allowance for credit losses on loans,

beginning

$

22,129

$

21,993

$

20,814

$

136

$

1,315

Provision for credit losses

627

193

—

434

627

Gross charge-offs

—

(68

)

(20

)

68

20

Gross recoveries

4

11

8

(7

)

(4

)

Net (charge-offs) recoveries

4

(57

)

(12

)

61

16

Allowance for credit losses on loans,

ending

$

22,760

$

22,129

$

20,802

$

631

$

1,958

Allowance for credit losses on off-balance

sheet exposure, beginning

$

468

$

516

$

367

$

(48

)

$

101

Reversal of credit losses

(10

)

(48

)

—

38

(10

)

Allowance for credit losses on off-balance

sheet exposure, ending

$

458

$

468

$

367

$

(10

)

$

91

Asset Quality

($ in thousands)

As of and For the Three Months

Ended

Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

Loans 30-89 days past due and still

accruing

$

6,652

$

3,904

$

5,215

70.4

%

27.6

%

As a % of gross loans

0.36

%

0.22

%

0.30

%

0.14

0.06

Nonperforming loans(1)

$

4,389

$

4,343

$

3,447

1.1

%

27.3

%

Nonperforming assets(1)

5,626

5,580

3,447

0.8

63.2

Nonperforming loans to gross loans

0.23

%

0.24

%

0.20

%

(0.01

)

0.03

Nonperforming assets to total assets

0.25

0.25

0.16

0.00

0.09

Criticized loans(1)(2)

$

16,428

$

11,564

$

7,538

42.1

%

117.9

%

Criticized loans to gross loans

0.88

%

0.64

%

0.44

%

0.24

0.44

Allowance for credit losses ratios:

As a % of gross loans

1.22

%

1.23

%

1.21

%

(0.01

)%

0.01

%

As a % of nonperforming loans

519

510

603

9

(84

)

As a % of nonperforming assets

405

397

603

8

(198

)

As a % of criticized loans

139

191

276

(52

)

(137

)

Net charge-offs (recoveries)(3) to average

gross loans(4)

(0.00

)

0.01

0.00

(0.01

)

(0.00

)

(1)

Excludes the guaranteed portion

of SBA loans that are in liquidation totaling $3.5 million, $3.1

million and $5.4 million as of June 30, 2024, March 31, 2024 and

June 30, 2023, respectively.

(2)

Consists of special mention,

substandard, doubtful and loss categories.

(3)

Annualized.

(4)

Includes loans held for sale.

Overall, the Bank continued to maintain low levels of

nonperforming loans and net charge-offs. Our allowance remained

strong with an allowance to gross loans ratio of 1.22%.

- Loans 30-89 days past due and still accruing were $6.7 million

or 0.36% of gross loans as of June 30, 2024, compared with $3.9

million or 0.22% as of March 31, 2024. The increase was due to two

home mortgage loans totaling $2.2 million, one of which was paid

current after the quarter, and one SBA relationship totaling $0.9

million.

- Nonperforming loans were $4.4 million or 0.23% of gross loans

as of June 30, 2024, compared with $4.3 million or 0.24% as of

March 31, 2024.

- Nonperforming assets were $5.6 million or 0.25% of total assets

as of June 30, 2024, compared with $5.6 million or 0.25% as of

March 31, 2024. OREO was $1.2 million as of June 30, 2024, which is

secured by a mix-use property in Los Angeles Koreatown with 90%

guaranteed by SBA.

- Criticized loans were $16.4 million or 0.88% of gross loans as

of June 30, 2024, compared with $11.6 million or 0.64% as of March

31, 2024. The increase was due to three Special Mention downgrades

totaling $2.1 million and five Substandard downgrades totaling $3.2

million.

- Net recoveries were $4 thousand or 0.00% of average loans in

the second quarter of 2024, compared to net charge-offs of $57

thousand, or 0.01% of average loans in the first quarter of 2024

and of $12 thousand, or 0.00% of average loans in the second

quarter of 2023.

Deposits

($ in thousands)

As of

% Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

Amount

%

Amount

%

Amount

%

1Q2024

2Q2023

Noninterest-bearing deposits

$

518,456

26.7

%

$

539,396

28.5

%

$

634,745

34.1

%

(3.9

)%

(18.3

)%

Money market deposits and others

332,137

17.1

327,718

17.3

344,162

18.5

1.3

(3.5

)

Time deposits

1,090,228

56.2

1,028,297

54.2

880,732

47.4

6.0

23.8

Total deposits

$

1,940,821

100.0

%

$

1,895,411

100.0

%

$

1,859,639

100.0

%

2.4

%

4.4

%

Estimated uninsured deposits

$

860,419

44.3

%

$

805,523

42.5

%

$

805,070

43.3

%

6.8

%

6.9

%

As of June 30, 2024 vs. March 31,

2024

Total deposits were $1.94 billion as of June 30, 2024, up $45.4

million from March 31, 2024, primarily due to increases of $61.9

million in time deposits and $4.4 million in money market deposits,

offset by a $20.9 million decrease in noninterest-bearing deposit.

Noninterest-bearing deposits, as a percentage of total deposits,

decreased to 26.7% from 28.5%. The composition shift to time

deposits driven by customers’ preference for high-rate deposit

products continued but slowed to a lesser extent.

As of June 30, 2024 vs. June 30,

2023

Total deposits were $1.94 billion as of June 30, 2024, up $81.2

million from June 30, 2023, primarily driven by a $209.5 million

increase in time deposits, offset by decreases of $116.3 million in

noninterest-bearing deposits and $12.0 million in money market

deposits. Noninterest-bearing deposits, as a percentage of total

deposits, decreased to 26.7% from 34.1%. The composition shift to

time deposits was primarily due to customers’ preference for

high-rate deposit products driven by market rate increases as a

result of the Federal Reserve’s rate increases.

The following table sets forth the maturity of time deposits as

of June 30, 2024:

As of June 30, 2024

($ in thousands)

Within Three

Months

Three to

Six Months

Six to Nine Months

Nine to Twelve

Months

After

Twelve Months

Total

Time deposits (greater than $250)

$

96,968

$

201,334

$

145,549

$

85,958

$

4,048

$

533,857

Time deposits ($250 or less)

155,311

188,367

102,834

77,680

32,179

556,371

Total time deposits

$

252,279

$

389,701

$

248,383

$

163,638

$

36,227

$

1,090,228

Weighted average rate

5.09

%

5.18

%

5.07

%

5.16

%

4.17

%

5.10

%

OTHER HIGHLIGHTS

Liquidity

The Company maintains ample access to liquidity, including

highly liquid assets on our balance sheet and available unused

borrowings from other financial institutions. The following table

presents the Company's liquid assets and available borrowings as of

dates presented:

($ in thousands)

2Q2024

1Q2024

2Q2023

Liquidity Assets:

Cash and cash equivalents

$

127,676

$

139,246

$

143,761

Available-for-sale debt securities

199,205

187,225

202,250

Liquid assets

$

326,881

$

326,471

$

346,011

Liquid assets to total assets

14.3

%

14.6

%

16.1

%

Available borrowings:

Federal Home Loan Bank—San Francisco

$

343,600

$

331,917

$

400,543

Federal Reserve Bank

191,421

185,913

172,316

Pacific Coast Bankers Bank

50,000

50,000

50,000

Zions Bank

25,000

25,000

25,000

First Horizon Bank

25,000

25,000

25,000

Total available borrowings

$

635,021

$

617,830

$

672,859

Total available borrowings to total

assets

27.7

%

27.6

%

31.3

%

Liquid assets and available borrowings to

total deposits

49.6

%

49.8

%

54.8

%

Capital and Capital Ratios

On July 25, 2024, the Company’s Board of Directors declared a

quarterly cash dividend of $0.12 per share of its common stock. The

cash dividend is payable on or about August 22, 2024 to all

shareholders of record as of the close of business on August 8,

2024. The payment of the dividend is based primarily on dividends

from the Bank to the Company, and future dividends will depend on

the Board’s assessment of the availability of capital levels to

support the ongoing operating capital needs of both the Company and

the Bank.

The Company also repurchased 224,321 shares of its common stock

at an average price of $9.64 per share during the second quarter of

2024 under the stock repurchase program announced in August 2023.

Since the announcement of the stock repurchase program in August

2023, the Company repurchased a total of 424,018 shares of its

common stock at an average repurchase price of $9.36 per share

through June 30, 2024.

OP Bancorp(1)

Open Bank

Minimum Well

Capitalized

Ratio

Minimum

Capital Ratio+

Conservation

Buffer(2)

Risk-Based Capital Ratios:

Total risk-based capital ratio

13.26

%

13.24

%

10.00

%

10.50

%

Tier 1 risk-based capital ratio

12.01

11.99

8.00

8.50

Common equity tier 1 ratio

12.01

11.99

6.50

7.00

Leverage ratio

9.28

9.27

5.00

4.00

(1)

The capital requirements are only applicable to the Bank, and

the Company's ratios are included for comparison purpose.

(2)

An additional 2.5% capital conservation buffer above the minimum

capital ratios are required in order to avoid limitations on

distributions, including dividend payments and certain

discretionary bonuses to executive officers.

OP Bancorp

Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

Risk-Based Capital Ratios:

Total risk-based capital ratio

13.26

%

13.59

%

13.10

%

(0.33

)%

0.16

%

Tier 1 risk-based capital ratio

12.01

12.34

11.92

(0.33

)

0.09

Common equity tier 1 ratio

12.01

12.34

11.92

(0.33

)

0.09

Leverage ratio

9.28

9.65

9.50

(0.37

)

(0.22

)

Risk-weighted Assets ($ in thousands)

$

1,776,771

$

1,715,186

$

1,700,205

3.59

4.50

ABOUT OP BANCORP

OP Bancorp, the holding company for Open Bank (the “Bank”), is a

California corporation whose common stock is quoted on the Nasdaq

Global Market under the ticker symbol, “OPBK.” The Bank is engaged

in the general commercial banking business in Los Angeles, Orange,

and Santa Clara Counties in California, the Dallas metropolitan

area in Texas, and Clark County in Nevada and is focused on serving

the banking needs of small- and medium-sized businesses,

professionals, and residents with a particular emphasis on Korean

and other ethnic minority communities. The Bank currently operates

eleven full-service branch offices in Downtown Los Angeles, Los

Angeles Fashion District, Los Angeles Koreatown, Cerritos, Gardena,

Buena Park, and Santa Clara, California, Carrollton, Texas and Las

Vegas, Nevada. The Bank also has four loan production offices in

Pleasanton, California, Atlanta, Georgia, Aurora, Colorado, and

Lynnwood, Washington. The Bank commenced its operations on June 10,

2005 as First Standard Bank and changed its name to Open Bank in

October 2010. Its headquarters is located at 1000 Wilshire Blvd.,

Suite 500, Los Angeles, California 90017. Phone 213.892.9999;

www.myopenbank.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters set forth herein constitute “forward-looking

statements” within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, including forward-looking

statements relating to the Company’s current business plans and

expectations regarding future operating results. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results, performance or achievements to

differ materially from those projected. These risks and

uncertainties, some of which are beyond our control, include, but

are not limited to: the effects of substantial fluctuations in, and

continuing elevated levels of, interest rates on our borrowers’

ability to perform in accordance with the terms of their loans and

on our deposit customers’ expectation for higher rates on deposit

products; cybersecurity risks, including the potential for the

occurrence of successful cyberattacks and our ability to prevent

and to mitigate the harms resulting from any such attacks;

infrastructure risks and similar circumstances that affect our and

our customers’ ability to communicate and to engage in routine

online banking activities; business and economic conditions,

particularly those affecting the financial services industry and

our primary market areas; risks of international conflict,

terrorism, civil unrest and domestic instability; the continuing

effects of inflation and monetary policies, particularly those

relating to the decisions and indicators of intent expressed by the

Federal Reserve Open Markets Committee, as those circumstances

impact our operations and our current and prospective borrowers and

depositors; our ability to balance deposit liabilities and

liquidity sources (including our ability to reprice those

instruments and balancing our borrowings and investments to keep

pace with changing market conditions) so as to meet current and

expected withdrawals while promoting strong earning capacity; our

ability to manage our credit risk successfully and to assess,

adjust and monitor the sufficiency of our allowance for credit

losses; factors that can impact the performance of our loan

portfolio, including real estate values and liquidity in our

primary market areas, the financial health of our commercial

borrowers, the success of construction projects that we finance,

including any loans acquired in acquisition transactions; the

impacts of credit quality on our earnings and the related effects

of increases to the reserve on our net income; our ability

effectively to execute our strategic plan and manage our growth;

interest rate fluctuations, which could have an adverse effect on

our profitability; external economic and/or market factors, such as

changes in monetary and fiscal policies and laws, including

inflation or deflation, changes in the demand for loans, and

fluctuations in consumer spending, borrowing and savings habits,

which may have an adverse impact on our financial condition;

continued or increasing competition from other banks and from

credit unions and non-bank financial services companies, many of

which are subject to less restrictive or less costly regulations

than we are; challenges arising from unsuccessful attempts to

expand into new geographic markets, products, or services;

practical and regulatory constraints on the ability of Open Bank to

pay dividends to us; increased capital requirements imposed by

banking regulators, which may require us to raise capital at a time

when capital is not available on favorable terms or at all; a

failure in the internal controls we have implemented to address the

risks inherent to the business of banking; including internal

controls that affect the reliability of our publicly reported

financial statements; inaccuracies in our assumptions about future

events, which could result in material differences between our

financial projections and actual financial performance,

particularly with respect to the effects of predictions of future

economic conditions as those circumstances affect our estimates for

the adequacy of our allowance for credit losses and the related

provision expense; changes in our management personnel or our

inability to retain motivate and hire qualified management

personnel; disruptions, security breaches, or other adverse events,

failures or interruptions in, or attacks on, our information

technology systems; disruptions, security breaches, or other

adverse events affecting the third-party vendors who perform

several of our critical processing functions; an inability to keep

pace with the rate of technological advances due to a lack of

resources to invest in new technologies; risks related to potential

acquisitions; political developments, uncertainties or instability,

catastrophic events, or natural disasters, such as earthquakes,

fires, drought, pandemic diseases (such as the coronavirus) or

extreme weather events, any of which may affect services we use or

affect our customers, employees or third parties with which we

conduct business; incremental costs and obligations associated with

operating as a public company; the impact of any claims or legal

actions to which we may be subject, including any effect on our

reputation; compliance with governmental and regulatory

requirements, including the Dodd-Frank Act and others relating to

banking, consumer protection, securities and tax matters, and our

ability to maintain licenses required in connection with commercial

mortgage origination, sale and servicing operations; changes in

federal tax law or policy; and our ability the manage the foregoing

and other factors set forth in the Company’s public reports. We

describe these and other risks that could affect our results in

Item 1A. “Risk Factors,” of our latest Annual Report on Form 10-K

for the year ended December 31, 2023 and in our subsequent filings

with the Securities and Exchange Commission.

CONSOLIDATED BALANCE SHEETS (unaudited)

($ in thousands)

As of

% Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

Assets

Cash and due from banks

$

21,771

$

20,513

$

21,295

6.1

%

2.2

%

Interest-bearing deposits in other

banks

105,905

118,733

122,466

(10.8

)

(13.5

)

Cash and cash equivalents

127,676

139,246

143,761

(8.3

)

(11.2

)

Available-for-sale debt securities, at

fair value

199,205

187,225

202,250

6.4

(1.5

)

Other investments

16,367

16,264

16,183

0.6

1.1

Loans held for sale

6,485

16,075

—

(59.7

)

n/m

CRE loans

931,284

905,534

847,863

2.8

9.8

SBA loans

242,395

247,550

238,785

(2.1

)

1.5

C&I loans

188,557

147,508

112,160

27.8

68.1

Home mortgage loans

506,873

502,995

516,226

0.8

(1.8

)

Consumer loans

997

1,400

1,163

(28.8

)

(14.3

)

Gross loans receivable

1,870,106

1,804,987

1,716,197

3.6

9.0

Allowance for credit losses

(22,760

)

(22,129

)

(20,802

)

2.9

9.4

Net loans receivable

1,847,346

1,782,858

1,695,395

3.6

9.0

Premises and equipment, net

4,716

4,971

5,093

(5.1

)

(7.4

)

Accrued interest receivable, net

8,555

8,370

7,703

2.2

11.1

Servicing assets

11,043

11,405

12,654

(3.2

)

(12.7

)

Company owned life insurance

22,566

22,399

21,913

0.7

3.0

Deferred tax assets, net

14,117

13,802

13,360

2.3

5.7

Other real estate owned

1,237

1,237

—

—

n/m

Operating right-of-use assets

8,348

8,864

9,487

(5.8

)

(12.0

)

Other assets

23,019

21,804

23,902

5.6

(3.7

)

Total assets

$

2,290,680

$

2,234,520

$

2,151,701

2.5

%

6.5

%

Liabilities and Shareholders'

Equity

Liabilities:

Noninterest-bearing

$

518,456

$

539,396

$

634,745

(3.9

)%

(18.3

)%

Money market and others

332,137

327,718

344,162

1.3

(3.5

)

Time deposits greater than $250

533,857

451,497

416,208

18.2

28.3

Other time deposits

556,371

576,800

464,524

(3.5

)

19.8

Total deposits

1,940,821

1,895,411

1,859,639

2.4

4.4

Federal Home Loan Bank advances

115,000

105,000

75,000

9.5

53.3

Accrued interest payable

15,504

12,270

9,354

26.4

65.7

Operating lease liabilities

9,000

9,614

10,486

(6.4

)

(14.2

)

Other liabilities

14,449

17,500

13,452

(17.4

)

7.4

Total liabilities

2,094,774

2,039,795

1,967,931

2.7

6.4

Shareholders' equity:

Common stock

73,749

75,957

77,464

(2.9

)

(4.8

)

Additional paid-in capital

11,441

11,240

10,297

1.8

11.1

Retained earnings

127,929

124,280

114,177

2.9

12.0

Accumulated other comprehensive loss

(17,213

)

(16,752

)

(18,168

)

2.8

(5.3

)

Total shareholders’ equity

195,906

194,725

183,770

0.6

6.6

Total liabilities and shareholders'

equity

$

2,290,680

$

2,234,520

$

2,151,701

2.5

%

6.5

%

CONSOLIDATED STATEMENTS OF INCOME (unaudited)

($ in thousands, except share and per

share data)

For the Three Months

Ended

% Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

Interest income

Interest and fees on loans

$

30,605

$

30,142

$

27,288

1.5

%

12.2

%

Interest on available-for-sale debt

securities

1,590

1,460

1,562

8.9

1.8

Other interest income

2,162

1,311

1,252

64.9

72.7

Total interest income

34,357

32,913

30,102

4.4

14.1

Interest expense

Interest on deposits

17,343

15,675

11,920

10.6

45.5

Interest on borrowings

820

1,259

930

(34.9

)

(11.8

)%

Total interest expense

18,163

16,934

12,850

7.3

41.3

Net interest income

16,194

15,979

17,252

1.3

(6.1

)

Provision for credit losses

617

145

—

325.5

n/m

Net interest income after provision for

credit losses

15,577

15,834

17,252

(1.6

)

(9.7

)

Noninterest income

Service charges on deposits

793

612

573

29.6

38.4

Loan servicing fees, net of

amortization

575

772

595

(25.5

)

(3.4

)

Gain on sale of loans

2,325

1,703

2,098

36.5

10.8

Other income

491

499

339

(1.6

)

44.8

Total noninterest income

4,184

3,586

3,605

16.7

16.1

Noninterest expense

Salaries and employee benefits

7,568

7,841

7,681

(3.5

)

(1.5

)

Occupancy and equipment

1,660

1,655

1,598

0.3

3.9

Data processing and communication

530

487

546

8.8

(2.9

)

Professional fees

406

395

381

2.8

6.6

FDIC insurance and regulatory

assessments

378

374

420

1.1

(10.0

)

Promotion and advertising

151

149

159

1.3

(5.0

)

Directors’ fees

178

157

210

13.4

(15.2

)

Foundation donation and other

contributions

539

540

594

(0.2

)

(9.3

)

Other expenses

779

559

711

39.4

9.6

Total noninterest expense

12,189

12,157

12,300

0.3

(0.9

)

Income before income tax expense

7,572

7,263

8,557

4.3

(11.5

)

Income tax expense

2,136

2,037

2,466

4.9

(13.4

)

Net income

$

5,436

$

5,226

$

6,091

4.0

%

(10.8

)%

Book value per share

$

13.22

$

13.00

$

12.16

1.7

%

8.7

%

Earnings per share - basic

0.36

0.34

0.39

5.9

(7.7

)

Earnings per share - diluted

0.36

0.34

0.39

5.9

(7.7

)

Shares of common stock outstanding, at

period end

14,816,281

14,982,555

15,118,268

(1.1

)%

(2.0

)%

Weighted average shares:

- Basic

14,868,344

14,991,835

15,158,365

(0.8

)%

(1.9

)%

- Diluted

14,868,344

14,991,835

15,169,794

(0.8

)

(2.0

)

KEY RATIOS

For the Three Months

Ended

% Change 2Q2024 vs.

2Q2024

1Q2024

2Q2023

1Q2024

2Q2023

Return on average assets (ROA)(1)

0.95

%

0.96

%

1.15

%

—

%

(0.2

)%

Return on average equity (ROE)(1)

11.23

10.83

13.27

0.4

(2.0

)

Net interest margin(1)

2.96

3.06

3.40

(0.1

)

(0.4

)

Efficiency ratio

59.81

62.14

58.97

(2.3

)

0.8

Total risk-based capital ratio

13.26

%

13.59

%

13.10

%

(0.3

)%

0.2

%

Tier 1 risk-based capital ratio

12.01

12.34

11.92

(0.3

)

0.1

Common equity tier 1 ratio

12.01

12.34

11.92

(0.3

)

0.1

Leverage ratio

9.28

9.65

9.50

(0.4

)

(0.2

)

(1)

Annualized.

CONSOLIDATED STATEMENTS OF INCOME (unaudited)

($ in thousands, except share and per

share data)

For the Six Months

Ended

2Q2024

2Q2023

% Change

Interest income

Interest and fees on loans

$

60,747

$

53,299

14.0

%

Interest on available-for-sale debt

securities

3,050

3,128

(2.5

)

Other interest income

3,473

2,269

53.1

Total interest income

67,270

58,696

14.6

Interest expense

Interest on deposits

33,018

22,302

48.0

Interest on borrowings

2,079

1,250

66.3

Total interest expense

35,097

23,552

49.0

Net interest income

32,173

35,144

(8.5

)

Provision for (reversal of) credit

losses

762

(338

)

n/m

Net interest income after provision for

credit losses

31,411

35,482

(11.5

)

Noninterest income

Service charges on deposits

1,405

991

41.8

%

Loan servicing fees, net of

amortization

1,347

1,441

(6.5

)

Gain on sale of loans

4,028

4,668

(13.7

)

Other income

990

800

23.8

Total noninterest income

7,770

7,900

(1.6

)

Noninterest expense

Salaries and employee benefits

15,409

14,933

3.2

Occupancy and equipment

3,315

3,168

4.6

Data processing and communication

1,017

1,096

(7.2

)

Professional fees

801

740

8.2

FDIC insurance and regulatory

assessments

752

887

(15.2

)

Promotion and advertising

300

321

(6.5

)

Directors’ fees

335

371

(9.7

)

Foundation donation and other

contributions

1,079

1,347

(19.9

)

Other expenses

1,338

1,345

(0.5

)

Total noninterest expense

24,346

24,208

0.6

Income before income tax expense

14,835

19,174

(22.6

)

Income tax expense

4,173

5,549

(24.8

)

Net income

$

10,662

$

13,625

(21.7

)%

Book value per share

$

13.22

$

12.16

8.7

%

Earnings per share - basic

0.70

0.88

(20.5

)

Earnings per share - diluted

0.70

0.88

(20.5

)

Shares of common stock outstanding, at

period end

14,816,281

15,118,268

(2.0

)%

Weighted average shares:

- Basic

14,930,090

15,221,010

(1.9

)%

- Diluted

14,930,090

15,241,903

(2.0

)

KEY RATIOS

For the Six Months

Ended

2Q2024

2Q2023

% Change

Return on average assets (ROA)(1)

0.96

%

1.29

%

(0.3

)%

Return on average equity (ROE)(1)

11.03

15.02

(4.0

)

Net interest margin(1)

3.01

3.48

(0.5

)

Efficiency ratio

60.95

56.24

4.7

Total risk-based capital ratio

13.26

%

13.10

%

0.2

%

Tier 1 risk-based capital ratio

12.01

11.92

0.1

Common equity tier 1 ratio

12.01

11.92

0.1

Leverage ratio

9.28

9.50

(0.2

)

(1)

Annualized.

ASSET QUALITY

($ in thousands)

As of and For the Three Months

Ended

2Q2024

1Q2024

2Q2023

Nonaccrual loans(1)

$

4,389

$

4,343

$

3,447

Loans 90 days or more past due,

accruing(2)

—

—

—

Nonperforming loans

4,389

4,343

3,447

OREO

1,237

1,237

—

Nonperforming assets

$

5,626

$

5,580

$

3,447

Criticized loans by risk categories:

Special mention loans

$

3,339

$

1,415

$

2,909

Classified loans(1)(3)

13,089

10,149

4,629

Total criticized loans

$

16,428

$

11,564

$

7,538

Criticized loans by loan type:

CRE loans

$

5,896

$

5,292

$

—

SBA loans

9,771

6,055

4,784

C&I loans

550

—

200

Home mortgage loans

211

217

2,554

Total criticized loans

$

16,428

$

11,564

$

7,538

Nonperforming loans / gross loans

0.23

%

0.24

%

0.20

%

Nonperforming assets / gross loans plus

OREO

0.30

0.31

0.20

Nonperforming assets / total assets

0.25

0.25

0.16

Classified loans / gross loans

0.70

0.56

0.27

Criticized loans / gross loans

0.88

0.64

0.44

Allowance for credit losses ratios:

As a % of gross loans

1.22

%

1.23

%

1.21

%

As a % of nonperforming loans

519

510

603

As a % of nonperforming assets

405

397

603

As a % of classified loans

174

218

449

As a % of criticized loans

139

191

276

Net charge-offs (recoveries)

$

(4

)

$

57

$

12

Net charge-offs (recoveries)(4) to average

gross loans(5)

(0.00

)%

0.01

%

0.00

%

(1)

Excludes the guaranteed portion

of SBA loans that are in liquidation totaling $3.5 million, $3.1

million and $5.1 million as of June 30, 2024, March 31, 2024 and

June 30, 2023, respectively.

(2)

Excludes the guaranteed portion

of SBA loans that are in liquidation totaling $246 thousand as of

June 30, 2023.

(3)

Consists of substandard, doubtful

and loss categories.

(4)

Annualized.

(5)

Includes loans held for sale.

($ in thousands)

2Q2024

1Q2024

2Q2023

Accruing delinquent loans 30-89 days past

due

30-59 days

$

3,774

$

801

$

3,647

60-89 days

2,878

3,103

1,568

Total

$

6,652

$

3,904

$

5,215

AVERAGE BALANCE SHEET, INTEREST AND YIELD/RATE

ANALYSIS

For the Three Months

Ended

2Q2024

1Q2024

2Q2023

($ in thousands)

Average

Balance

Interest

and Fees

Yield/

Rate(1)

Average

Balance

Interest

and Fees

Yield/

Rate(1)

Average

Balance

Interest

and Fees

Yield/

Rate(1)

Interest-earning assets:

Interest-bearing deposits in other

banks

$

135,984

$

1,847

5.37

%

$

73,047

$

989

5.35

%

$

79,200

$

1,003

5.01

%

Federal funds sold and other

investments

16,307

315

7.72

16,265

322

7.92

15,374

249

6.46

Available-for-sale debt securities, at

fair value

195,512

1,590

3.25

191,383

1,460

3.05

209,801

1,562

2.98

CRE loans

908,073

13,742

6.09

901,262

13,729

6.13

838,526

11,823

5.66

SBA loans

259,649

7,116

11.02

259,368

7,213

11.19

262,825

7,174

10.95

C&I loans

172,481

3,367

7.85

134,893

2,670

7.96

114,103

2,232

7.85

Home mortgage loans

501,862

6,348

5.06

512,023

6,495

5.07

508,976

6,043

4.75

Consumer loans

1,219

32

10.44

1,386

35

10.10

1,334

16

4.77

Loans(2)

1,843,284

30,605

6.67

1,808,932

30,142

6.69

1,725,764

27,288

6.34

Total interest-earning assets

2,191,087

34,357

6.29

2,089,627

32,913

6.32

2,030,139

30,102

5.94

Noninterest-earning assets

89,446

87,586

84,991

Total assets

$

2,280,533

$

2,177,213

$

2,115,130

Interest-bearing liabilities:

Money market deposits and others

$

338,554

$

3,494

4.15

%

$

367,386

$

3,940

4.31

%

$

357,517

$

3,201

3.59

%

Time deposits

1,102,587

13,849

5.05

954,442

11,735

4.94

843,836

8,719

4.14

Total interest-bearing deposits

1,441,141

17,343

4.84

1,321,828

15,675

4.77

1,201,353

11,920

3.98

Borrowings

77,314

820

4.27

108,681

1,259

4.66

82,586

930

4.52

Total interest-bearing liabilities

1,518,455

18,163

4.81

1,430,509

16,934

4.76

1,283,939

12,850

4.01

Noninterest-bearing liabilities:

Noninterest-bearing deposits

529,179

514,503

615,748

Other noninterest-bearing liabilities

39,301

39,207

31,810

Total noninterest-bearing liabilities

568,480

553,710

647,558

Shareholders’ equity

193,598

192,994

183,633

Total liabilities and shareholders’

equity

$

2,280,533

2,177,213

2,115,130

Net interest income / interest rate

spreads

$

16,194

1.48

%

$

15,979

1.56

%

$

17,252

1.93

%

Net interest margin

2.96

%

3.06

%

3.40

%

Cost of deposits & cost of funds:

Total deposits / cost of deposits

$

1,970,320

$

17,343

3.54

%

$

1,836,331

$

15,675

3.43

%

$

1,817,101

$

11,920

2.63

%

Total funding liabilities / cost of

funds

2,047,634

18,163

3.57

1,945,012

16,934

3.50

1,899,687

12,850

2.71

(1)

Annualized.

(2)

Includes loans held for sale.

For the Six Months

Ended

2Q2024

2Q2023

($ in thousands)

Average

Balance

Interest

and Fees

Yield/

Rate(1)

Average

Balance

Interest

and Fees

Yield/

Rate(1)

Interest-earning assets:

Interest-bearing deposits in other

banks

$

104,515

$

2,836

5.37

%

$

76,695

$

1,849

4.79

%

Federal funds sold and other

investments

16,286

637

7.82

13,761

420

6.10

Available-for-sale debt securities, at

fair value

193,448

3,050

3.15

210,130

3,128

2.98

CRE loans

904,667

27,471

6.11

839,459

23,002

5.53

SBA loans

259,508

14,329

11.10

268,823

14,156

10.62

C&I loans

153,687

6,037

7.90

117,988

4,432

7.58

Home mortgage loans

506,943

12,843

5.07

497,949

11,676

4.69

Consumer & other loans

1,303

67

10.26

1,360

33

4.92

Loans(2)

1,826,108

60,747

6.68

1,725,579

53,299

6.22

Total interest-earning assets

2,140,357

67,270

6.31

2,026,165

58,696

5.83

Noninterest-earning assets

88,516

83,771

Total assets

$

2,228,873

$

2,109,936

Interest-bearing liabilities:

Money market deposits and others

$

352,970

$

7,434

4.24

%

$

383,521

$

6,351

3.34

%

Time deposits

1,028,515

25,584

5.00

815,267

15,952

3.95

Total interest-bearing deposits

1,381,485

33,018

4.81

1,198,788

22,303

3.75

Borrowings

92,998

2,079

4.50

54,533

1,249

4.62

Total interest-bearing liabilities

1,474,483

35,097

4.79

1,253,321

23,552

3.79

Noninterest-bearing liabilities:

Noninterest-bearing deposits

521,841

643,465

Other noninterest-bearing liabilities

39,253

31,729

Total noninterest-bearing liabilities

561,094

675,194

Shareholders’ equity

193,296

181,421

Total liabilities and shareholders’

equity

$

2,228,873

2,109,936

Net interest income / interest rate

spreads

$

32,173

1.52

%

$

35,144

2.04

%

Net interest margin

3.01

%

3.48

%

Cost of deposits & cost of funds:

Total deposits / cost of deposits

$

1,903,326

$

33,018

3.49

%

1,842,253

$

22,303

2.44

%

Total funding liabilities / cost of

funds

1,996,324

35,097

3.54

1,896,786

23,552

2.50

(1)

Annualized.

(2)

Includes loans held for sale.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725607933/en/

Investor Relations OP Bancorp Christine Oh EVP & CFO

213.892.1192 Christine.oh@myopenbank.com

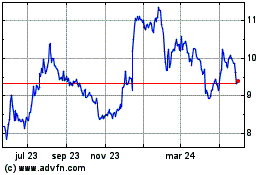

OP Bancorp (NASDAQ:OPBK)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

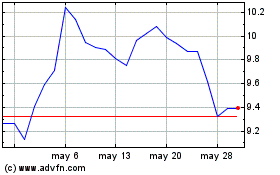

OP Bancorp (NASDAQ:OPBK)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024