0001584831

false

0001584831

2023-04-05

2023-04-05

0001584831

OXBR:OrdinarySharesParValue0.001Member

2023-04-05

2023-04-05

0001584831

OXBR:WarrantsToPurchaseOrdinarySharesMember

2023-04-05

2023-04-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 5, 2023

OXBRIDGE

RE HOLDINGS LIMITED

(Exact

Name of Registrant as Specified in Charter)

| Cayman

Islands |

|

001-36346 |

|

98-1150254 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

Suite

201,

42

Edward Street, Georgetown

P.O. Box 469

Grand

Cayman, Cayman

Islands |

|

KY1-9006 |

| (Address of Principal Executive Office) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (345) 749-7570

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class: |

|

Trading

symbol |

|

Name

of each exchange on which registered |

| Ordinary

Shares (par value $0.001) |

|

OXBR |

|

The

Nasdaq Stock Market LLC |

| Warrants

to Purchase Ordinary Shares |

|

OXBRW |

|

The

Nasdaq Stock Market LLC

(The

Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

3.02. Unregistered Sales of Equity Securities

On

June 27, 2023, SurancePlus Inc. (“SurancePlus”), a wholly owned subsidiary of Oxbridge Re Holdings Limited (“Oxbridge”),

completed its private placement (the “Private Placement”) of Series DeltaCat Re Preferred Shares represented by DeltaCat

Re Tokens (the “Securities”). On June 27, 2023, SurancePlus entered into subscription agreements with accredited investors

and non-U.S. persons in the Private Placement with respect to 229,766 of the Securities at a purchase price of $10.00 per token for aggregate

gross proceeds of $2,297,660. SurancePlus also previously entered into subscription agreements for and sold 15,010 of the Securities

between April 5, 2023 and May 18, 2023 for gross proceeds of $150,100, also at a purchase price of $10.00 per token. The aggregate amount

raised in the Private Placement was $2,447,760 for the issuance of 244,776 Securities.

The

Securities were issued pursuant to the exemptions from registration contained in Rule 506(c) of Regulation D and Regulation S of the

Securities Act of 1933, as amended (the “Securities Act”). SurancePlus relied, in part, upon representations made in the

subscription agreements by each subscriber that the subscriber was an accredited investor as defined in Regulation D under the Securities

Act or was not a U.S. Person as defined under Rule 902 of Regulation S. The issuance involved general solicitation in connection with

the offering as permitted by Rule 506(c) of Regulation D. No underwriting discounts or commissions were or will be paid with respect

to such sales.

Item 7.01. Regulation FD Disclosure.

On

June 28, 2023, Oxbridge issued a press release announcing the completion of the Private Placement. Such press release is attached as

Exhibit 99.1 hereto.

The

information in this Item 7.01, including the press release attached as Exhibit 99.1, is being furnished and shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section,

and shall not be incorporated by reference into any filing under the Securities Exchange Act of 1934 or the Securities Act, as amended,

except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d)

Exhibits

This

Current Report on Form 8-K does not constitute an offer to sell nor a solicitation of an offer to buy the Securities. The Securities

are not required to be, and have not been, registered under the United States Securities Act of 1933, as amended, in reliance on the

exemptions provided by Regulation S and SEC Rule 506(c) thereunder. Offers and sales of the Securities are made only by, and pursuant

to, the terms set forth in the Confidential Private Placement Memorandum relating to the Securities. The offering of the Securities is

not being made to persons in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities,

blue sky, or other laws of such jurisdiction.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

OXBRIDGE

RE HOLDINGS LIMITED |

| |

|

| |

/s/

Wrendon Timothy |

| Date: June 28, 2023 |

Wrendon Timothy |

| |

Chief Financial Officer

and Secretary |

| |

(Principal Accounting Officer

and |

| |

Principal Financial Officer) |

Exhibit

99.1

Oxbridge

Re’s Web3-Focused Subsidiary SurancePlus Announces Closing of its

Private

Offering of Tokenized Reinsurance Securities

GRAND

CAYMAN, Cayman Islands — (June 28th, 2023) — Oxbridge Re Holdings Limited (Nasdaq: OXBR) (“Oxbridge

Re”), a provider of reinsurance solutions to property and casualty insurers in the Gulf Coast region of the United States,

announced that its Web3-focused, wholly-owned subsidiary, SurancePlus Inc. (“SurancePlus”), closed a $2.4 million (USD) private

capital raise through the sale of 244,776 of its tokenized reinsurance security, DeltaCat Re. The tokens will be issued on the Avalanche

blockchain.

Ownership

of DeltaCat Re tokenized reinsurance securities indirectly confers fractionalized interests in reinsurance contracts underwritten by

Oxbridge Re’s reinsurance subsidiary, Oxbridge Re NS, for the 2023-2024 treaty year. Each digital security represents one preferred

share of SurancePlus.

The

DeltaCat Re digital security was offered to United States (“US”) accredited investors under Rule 506(c) of US Securities

and Exchange Commission (SEC) Regulation D and to non-US investors pursuant to Regulation S of the US Securities Act 1933, as amended.

Commenting

on the completion of the SurancePlus offering, Oxbridge Re’s President and Chief Executive Officer Jay Madhu said, “SurancePlus

innovated upon Oxbridge Re’s existing special purpose vehicle for raising reinsurance capital, Oxbridge Re NS Limited, by applying

digital innovations and insights from the Web3 space and democratizing access to reinsurance as an alternative investment. In doing so,

we believe that we are the first publicly traded company to successfully raise capital for catastrophe reinsurance risks through the

sale of tokenized reinsurance securities.”

Disclaimer:

This press release does not constitute an offer to sell nor a solicitation of an offer to buy the DeltaCat Re tokens or the Series DeltaCat

Re Preferred Shares underlying the tokens (the “Securities”). The Securities are not required to be, and have not been, registered

under the United States Securities Act of 1933, as amended, in reliance on the exemptions provided by Regulation S and Regulation D (SEC

Rule 506(c)) thereunder. Offers and sales of the Securities are made only by, and pursuant to, the terms set forth in the Confidential

Private Placement Memorandum relating to the Securities. The offering of the Securities is not being made to persons in any jurisdiction

in which the making or acceptance thereof would not be in compliance with the securities, blue sky, or other laws of such jurisdiction.

About

Oxbridge Re Holdings Limited

Oxbridge

Re Holdings Limited (NASDAQ: OXBR, OXBRW) (“Oxbridge Re”) is a Cayman Islands exempted company that was

established in 2013. Its primary subsidiaries are Oxbridge Reinsurance Limited, a licensed reinsurance subsidiary that provides reinsurance

business solutions primarily to property and casualty insurers in the Gulf Coast region of the United States; Oxbridge Re NS, a licensed

reinsurance SPV/side car that provides third-party investors with access to reinsurance contracts with returns uncorrelated to the financial

markets; and SurancePlus, a Web3-focused subsidiary that currently leverages blockchain technology to democratize access to high-return

reinsurance contracts via digital securities. Oxbridge Re is also the founding and lead investor of Oxbridge Acquisition Corp. (NASDAQ:

OXAC), a special purpose acquisition company (“SPAC”).

About

SurancePlus Inc.

SurancePlus

Inc. (www.SurancePlus.com) is a wholly owned subsidiary of Oxbridge Re Holdings Limited, incorporated in the British Virgin Islands.

SurancePlus was organized to serve as a special-purpose vehicle to make tokenized side-car investments in reinsurance contracts entered

into by Oxbridge Re’s licensed reinsurance subsidiaries.

Company

Contact:

Oxbridge

Re Holdings Limited

Jay

Madhu, CEO

+1

345-749-7570

jmadhu@oxbridgere.com

Forward-Looking

Statements

This

press release, together with other statements and information publicly disseminated by Oxbridge Re Holdings Limited (the “Company”),

contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. The Company intends such forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with these safe harbor provisions. Any statements made in this press release that are not statements

of historical fact, including statements about our beliefs and expectations, are forward-looking statements and should be evaluated as

such. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions

of our business plan and strategies. These statements often include words such as “anticipate,” “expect,” “suggests,”

“plan,” “believe,” “intend,” “estimates,” “targets,” “projects,”

“should,” “could,” “would,” “may,” “profitable,” “will,” “forecast”

and other similar expressions. We base these forward-looking statements on our current expectations, plans and assumptions that we have

made in light of our experience in the industry, as well as our perceptions of historical trends, current conditions, expected future

developments and other factors we believe are appropriate under the circumstances at such time. Although we believe that these forward-looking

statements are based on reasonable assumptions at the time they are made, you should be aware that many factors could affect our business,

results of operations and financial condition and could cause actual results to differ materially from those expressed in the forward-looking

statements. These statements are not guarantees of future performance or results. The forward-looking statements are subject to and involve

risks, uncertainties and assumptions, and you should not place undue reliance on these forward-looking statements. These forward-looking

statements include, but are not limited to, the prospects of our subsidiary SurancePlus subsidiary and the DeltaCat tokens and the other

important factors discussed under the caption “Risk Factors” in our Form 10-K filed with the U.S. Securities and Exchange

Commission on March 30, 2023, as may be updated from time to time in subsequent filings. These cautionary statements should not be construed

by you to be exhaustive and are made only as of the date of this press release. We undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

v3.23.2

Cover

|

Apr. 05, 2023 |

| Statement [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Apr. 05, 2023

|

| Entity File Number |

001-36346

|

| Entity Registrant Name |

OXBRIDGE

RE HOLDINGS LIMITED

|

| Entity Central Index Key |

0001584831

|

| Entity Tax Identification Number |

98-1150254

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

Suite

201

|

| Entity Address, Address Line Two |

42

Edward Street, Georgetown

|

| Entity Address, Address Line Three |

P.O. Box 469

|

| Entity Address, City or Town |

Grand

Cayman

|

| Entity Address, Country |

KY

|

| Entity Address, Postal Zip Code |

KY1-9006

|

| City Area Code |

(345)

|

| Local Phone Number |

749-7570

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Ordinary Shares (par value $0.001) |

|

| Statement [Line Items] |

|

| Title of 12(b) Security |

Ordinary

Shares (par value $0.001)

|

| Trading Symbol |

OXBR

|

| Security Exchange Name |

NASDAQ

|

| Warrants to Purchase Ordinary Shares |

|

| Statement [Line Items] |

|

| Title of 12(b) Security |

Warrants

to Purchase Ordinary Shares

|

| Trading Symbol |

OXBRW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

us-gaap_StatementLineItems |

| Namespace Prefix: |

us-gaap_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=OXBR_OrdinarySharesParValue0.001Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=OXBR_WarrantsToPurchaseOrdinarySharesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

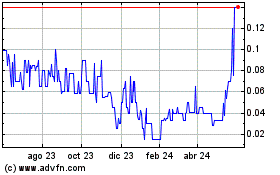

Oxbridge Re (NASDAQ:OXBRW)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

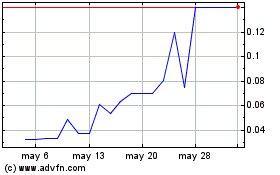

Oxbridge Re (NASDAQ:OXBRW)

Gráfica de Acción Histórica

De May 2023 a May 2024