Oxford Lane Capital Corp. Announces Increase in Monthly Common Stock Distributions and Announces Net Asset Value and Selected Financial Results for the Fourth Fiscal Quarter

14 Mayo 2024 - 3:00PM

Oxford Lane Capital Corp. (NasdaqGS: OXLC) (NasdaqGS: OXLCM)

(NasdaqGS: OXLCP) (NasdaqGS: OXLCL) (NasdaqGS: OXLCO) (NasdaqGS:

OXLCZ) (NasdaqGS: OXLCN) (“Oxford Lane,” the “Company,” “we,” “us”

or “our”) announced today the following financial results and

related information:

- Today, our Board of Directors declared the following

distributions on our common stock, representing an increase of

12.5% from our previous monthly distribution rate:

|

Month Ending |

Record Date |

Payment Date |

Amount Per Share |

|

July 31, 2024 |

July 17, 2024 |

July 31, 2024 |

$0.09 |

|

August 31, 2024 |

August 16, 2024 |

August 30, 2024 |

$0.09 |

|

September 30, 2024 |

September 16, 2024 |

September 30, 2024 |

$0.09 |

|

|

- Net asset value (“NAV”) per share as of March 31, 2024 stood at

$4.90, compared with a NAV per share on December 31, 2023 of

$4.82.

- Net investment income (“NII”), calculated in accordance with

U.S. generally accepted accounting principles (“GAAP”), was

approximately $51.0 million, or $0.22 per share, for the quarter

ended March 31, 2024.

- Our core net investment income (“Core NII”) was approximately

$79.9 million, or $0.35 per share, for the quarter ended March 31,

2024.

- Core NII incorporates all applicable cash distributions

received, or entitled to be received (if any, in either case), on

our collateralized loan obligation (“CLO”) equity investments.

See additional information under “Supplemental Information

Regarding Core Net Investment Income” below.

- We emphasize that our taxable income may differ materially from

our GAAP NII and/or our Core NII, and that neither GAAP NII nor

Core NII should be relied upon as indicators of our taxable

income.

- Total investment

income for the quarter ended March 31, 2024 amounted to

approximately $82.6 million, which represented an increase of

approximately $3.4 million from the quarter ended December 31,

2023.

- For the quarter

ended March 31, 2024 we recorded investment income as follows:

- Approximately $76.3

million from our CLO equity and CLO warehouse investments, and

- Approximately $6.3

million from our CLO debt investments and other income.

- Our total

expenses for the quarter ended March 31, 2024 were approximately

$31.7 million, compared with total expenses of approximately $30.5

million for the quarter ended December 31, 2023.

- As of March 31, 2024, the following metrics applied (note that

none of these metrics represented a total return to shareholders):

- The weighted average yield of our CLO debt investments at

current cost was 17.1%, up from 16.6% as of December 31, 2023.

- The weighted average effective yield of our CLO equity

investments at current cost was 16.9%, up from 16.5% as of December

31, 2023.

- The weighted average cash distribution yield of our CLO equity

investments at current cost was 23.5%, down from 24.0% as of

December 31, 2023.

- For the quarter ended March 31, 2024, we recorded a net

increase in net assets resulting from operations of approximately

$67.5 million, or $0.30 per share, comprised of:

- NII of approximately $51.0 million;

- Net realized losses of approximately $1.2 million; and

- Net unrealized appreciation of approximately $17.7

million.

- During the quarter ended March 31, 2024, we made additional

investments of approximately $225.2 million, and received

approximately $19.0 million from sales and repayments of our CLO

investments.

- For the quarter ended March 31, 2024, we issued a total of

approximately 18.6 million shares of common stock pursuant to an

“at-the-market” offering. After deducting the sales agent’s

commissions and offering expenses, this resulted in net proceeds of

approximately $94.7 million. As of March 31, 2024, we had

approximately 239.1 million shares of common stock

outstanding.

- On May 14, 2024,

our Board of Directors declared the required monthly dividends on

our 6.75% Series 2024 Term Preferred Shares, 6.25% Series 2027 Term

Preferred Shares, 6.00% Series 2029 Term Preferred Shares, and

7.125% Series 2029 Term Preferred Shares as follows:

|

PreferredShares Type |

Per ShareDividendAmountDeclared |

Record Dates |

Payment Dates |

|

6.75% - Series 2024(1) |

$ |

0.14062500 |

June 14, 2024 |

June 28, 2024 |

|

6.25% - Series 2027 |

$ |

0.13020833 |

June 14, 2024, July 17, 2024,August 16, 2024 |

June 28, 2024, July 31, 2024, August 30, 2024 |

|

6.00% - Series 2029 |

$ |

0.12500000 |

June 14, 2024, July 17, 2024,August 16, 2024 |

June 28, 2024, July 31, 2024, August 30, 2024 |

|

7.125% - Series 2029 |

$ |

0.14843750 |

June 14, 2024, July 17, 2024,August 16, 2024 |

June 28, 2024, July 31, 2024, August 30, 2024 |

(1) The 6.75% Series 2024 Term Preferred Shares have a term

redemption date of June 30, 2024.

In accordance with their terms, each of the 6.75% Series 2024

Term Preferred Shares, 6.25% Series 2027 Term Preferred Shares,

6.00% Series 2029 Term Preferred Shares, and 7.125% Series 2029

Term Preferred Shares will pay a monthly dividend at a fixed rate

of 6.75%, 6.25%, 6.00% and 7.125%, respectively, of the $25.00 per

share liquidation preference, or $1.6875, $1.5625, $1.5000 and

$1.78125 per share per year, respectively. This fixed annual

dividend rate is subject to adjustment under certain circumstances,

but will not, in any case, be lower than 6.75%, 6.25%, 6.00% and

7.125% per year, respectively, for each of the 6.75% Series 2024

Term Preferred Shares, 6.25% Series 2027 Term Preferred Shares,

6.00% Series 2029 Term Preferred Shares and 7.125% Series 2029 Term

Preferred Shares.

Supplemental Information Regarding Core Net Investment

Income

We provide information relating to Core NII (a non-GAAP measure)

on a supplemental basis. This measure is not provided as a

substitute for GAAP NII, but in addition to it. Our non-GAAP

measures may differ from similar measures by other companies, even

in the event of similar terms being utilized to identify such

measures. Core NII represents GAAP NII adjusted for additional

applicable cash distributions received, or entitled to be received

(if any, in either case), on our CLO equity investments. Oxford

Lane’s management uses this information in its internal analysis of

results and believes that this information may be informative in

assessing the quality of Oxford Lane’s financial performance,

identifying trends in its results and providing meaningful

period-to-period comparisons.

Income from investments in the “equity” class securities of CLO

vehicles, for GAAP purposes, is recorded using the effective

interest method; this is based on an effective yield to the

expected redemption utilizing estimated cash flows, at current

cost, including those CLO equity investments that have not made

their inaugural distribution for the relevant period end. The

result is an effective yield for the investment in which the

respective investment’s cost basis is adjusted quarterly based on

the difference between the actual cash received, or distributions

entitled to be received, and the effective yield calculation.

Accordingly, investment income recognized on CLO equity securities

in the GAAP statement of operations differs from the cash

distributions actually received by the Company during the period

(referred to below as “CLO equity adjustments”).

Furthermore, in order for the Company to continue qualifying as

a regulated investment company for tax purposes, we are required,

among other things, to distribute at least 90% of our investment

company taxable income annually. While Core NII may provide a

better indication of our estimated taxable income than GAAP NII

during certain periods, we can offer no assurance that will be the

case, however, as the ultimate tax character of our earnings cannot

be determined until after tax returns are prepared at the close of

a fiscal year. We note that this non-GAAP measure may not serve as

a useful indicator of taxable earnings, particularly during periods

of market disruption and volatility, and, as such, our taxable

income may differ materially from our Core NII.

The following table provides a reconciliation of GAAP NII to

Core NII for the three months ended March 31, 2024:

|

|

Three Months Ended |

|

|

March 31, 2024 |

|

|

|

Amount |

|

Per Share |

|

|

Amount |

|

|

GAAP net investment income………………………………………… |

$ |

50,956,435 |

|

$ |

0.22 |

|

|

CLO equity adjustments……………………………………….……… |

|

28,944,761 |

|

|

0.13 |

|

|

Core net investment income…………………………………………… |

$ |

79,901,196 |

|

$ |

0.35 |

|

We will host a conference call to discuss our fourth quarter

results today, Tuesday, May 14, 2024 at 4:00 PM ET. Please call

1-833-470-1428, access code number 548622 to participate. A

recording of the conference call will be available for replay for

approximately 30 days following the call. The replay number is

1-866-813-9403, and the replay passcode is 178097.

A presentation containing additional details regarding our

quarterly results of operations has been posted under the Investor

Relations section of our website

at www.oxfordlanecapital.com.

About Oxford Lane Capital Corp.

Oxford Lane Capital Corp. is a publicly-traded registered

closed-end management investment company principally investing in

debt and equity tranches of CLO vehicles. CLO investments may also

include warehouse facilities, which are financing structures

intended to aggregate loans that may be used to form the basis of a

CLO vehicle.

Forward-Looking Statements

This press release contains forward-looking statements subject

to the inherent uncertainties in predicting future results and

conditions. Any statements that are not statements of historical

fact (including statements containing the words “believes,”

“plans,” “anticipates,” “expects,” “estimates” and similar

expressions) should also be considered to be forward-looking

statements. These statements are not guarantees of future

performance, conditions or results and involve a number of risks

and uncertainties. Certain factors could cause actual results

and conditions to differ materially from those projected in these

forward-looking statements. These factors are identified from time

to time in our filings with the Securities and Exchange Commission.

We undertake no obligation to update such statements to reflect

subsequent events, except as may be required by law.

Contact:Bruce Rubin203-983-5280

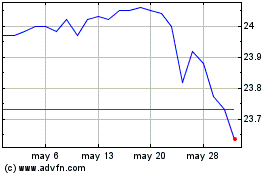

Oxford Lane Capital (NASDAQ:OXLCL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Oxford Lane Capital (NASDAQ:OXLCL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024