As filed with the Securities and Exchange

Commission on February 23, 2021

Registration No. 333-[●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

POWERBRIDGE TECHNOLOGIES CO., LTD.

(Exact name of registrant as specified in

its charter)

|

Cayman Islands

|

|

N/A

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

1st Floor, Building D2, Southern Software

Park

Tangjia Bay, Zhuhai, Guangdong 519080,

China

Tel: +86-756-339-5666

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue

Suite 204

Newark, Delaware 19711

(Name, address including

zip code, and telephone number, including area code, of agent for service)

With copies to:

Joan Wu Esq.

Hunter Taubman Fischer & Li, LLC

800 Third Avenue, Suite 2800

New York, NY 10022

Tel: (212) 530-2210

Facsimile: (212) 202-6380

Approximate date of commencement of

proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than

securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth

company ☒

If an emerging

growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has

elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount to be Registered

|

|

|

Proposed Maximum Offering Price Per Share

|

|

|

Proposed Maximum Aggregate Offering Price

|

|

|

Amount of Registration Fee

|

|

|

Primary Offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Share, par value $0.00166667 per share (1)

|

|

|

|

(2)

|

|

|

|

(3)

|

|

|

|

|

|

|

|

|

|

Debt Securities (1)

|

|

|

|

(2)

|

|

|

|

(3)

|

|

|

|

|

|

|

|

|

|

Warrants (1)

|

|

|

|

(2)

|

|

|

|

(3)

|

|

|

|

|

|

|

|

|

|

Rights (1)

|

|

|

|

(2)

|

|

|

|

(3)

|

|

|

|

|

|

|

|

|

|

Units (1)

|

|

|

|

(2)

|

|

|

|

(3)

|

|

|

|

|

|

|

|

|

|

Total Primary Offering (4)

|

|

|

|

|

|

|

|

|

|

$

|

200,000,000

|

|

|

$

|

21,820

|

|

|

Secondary Offering

|

|

|

|

(6)

|

|

|

|

(7)

|

|

|

|

|

|

|

|

|

|

Ordinary Share, par value $0.00166667 per share (5)(8)

|

|

|

8,800,000

|

|

|

$

|

4.075

|

|

|

$

|

35,860,000

|

|

|

$

|

3,913

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

$

|

235,860,000

|

|

|

$

|

25,733

|

|

|

(1)

|

With respect to the securities issuable in the primary offering, the securities being registered consist of such indeterminate number of ordinary shares, par value $0.00166667 per share (“Ordinary Shares”), as may be determined from time to time at indeterminate prices. The securities registered for the primary offering also include such indeterminate number of Ordinary Share. In no event will the aggregate maximum offering price of all securities issued in the primary offering pursuant to this registration statement exceed $200,000,000.

|

|

(2)

|

Not required to be included in accordance with General Instruction II.D. of Form F-3 under the Securities Act.

|

|

(3)

|

With respect to the primary offering, the proposed maximum offering price per security and the proposed maximum aggregate offering price will be determined from time to time by the Registrant in connection with the issuance by the Registrant of the securities registered hereunder and is not specified as to each class of security pursuant to General Instruction II.D. of Form F-3 under the Securities Act.

|

|

(4)

|

Calculated pursuant to Rule 457(o) under the Securities act of 1933, as amended.

|

|

(5)

|

As described in greater detail in the prospectus contained in this registration statement, the Ordinary Shares to be offered for resale by selling shareholders include an aggregate of 8,800,000 Ordinary Shares issued to the selling shareholders in connection with private transactions.

|

|

(6)

|

All shares registered pursuant to the Secondary Offering of this registration statement are to be offered for resale by the Selling Shareholders (defined below). Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers such indeterminate number of additional shares of the registrant’s Ordinary Shares, issued to prevent dilution resulting from share splits, share dividends or similar events. No additional consideration will be received for such additional number of shares of common share, and therefore no registration fee is required pursuant to Rule 457(i) under the Securities Act.

|

|

(7)

|

Calculated pursuant to Rule 457(g) under the Securities Act.

|

|

(8)

|

The offering price has been estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) of the Securities Act with respect to the Ordinary Shares registered hereunder, based on the price of $4.07, which was the average of the high and low prices reported on the Nasdaq Capital Market February 16, 2021.

|

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant

to said Section 8(a), may determine.

EXPLANATORY NOTE

This registration statement contains:

|

|

●

|

a base prospectus, which covers the offering, issuance and sales by us of up to $200,000,000 in the aggregate of the securities identified above from time to time in one or more offerings;

|

|

|

|

|

|

|

●

|

A resale prospectus which covers offer and resale of up to an aggregate of 8,800,000 ordinary shares, par value $$0.00166667 held by certain Selling Shareholders; and

|

|

|

●

|

a sales agreement prospectus covering the offer, issuance and sale by us of up to a maximum aggregate offering price of up to $30 million of our ordinary shares that may be issued and sold from time to time under a sales agreement with A.G.P / Alliance Global Partners (the “Sales Agreement”).

|

The base prospectus

immediately follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus will

be specified in a prospectus supplement to the base prospectus. The sales agreement prospectus immediately follows the base prospectus.

The $30 million of ordinary shares that may be offered, issued and sold under the sales agreement prospectus is included in the

$200,000,000 of securities that may be offered, issued and sold by us under the base prospectus. Upon termination of the Sales

Agreement, any portion of the $30 million included in the sales agreement prospectus that is not sold pursuant to the Sales Agreement

will be available for sale in other offerings pursuant to the base prospectus, and if no shares are sold under the Sales Agreement,

the full $30 million of securities may be sold in other offerings pursuant to the base prospectus.

The information

in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed

with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

|

SUBJECT

TO COMPLETION

|

DATED

FEBRUARY 23, 2021

|

PROSPECTUS

POWERBRIDGE TECHNOLOGIES CO., LTD.

$200,000,000

Ordinary Share

Preferred share

Debt Securities

Warrants

Rights

Units

8,800,000 Ordinary Shares Offered by

Selling Shareholders

We may offer to the

public from time to time in one or more series or issuances of our ordinary shares, par value $$0.00166667, debt securities, warrants

to purchase our Ordinary Shares, debt securities consisting of debentures, notes or other evidences of indebtedness, units consisting

of a combination of the foregoing securities, or any combination of these securities

Selling Shareholders

(defined as below) may also offer up to an aggregate of 8,800,000 Ordinary Shares, par value $$0.00166667 (“Shares”)

currently held by such Selling Shareholders acquired pursuant to certain securities purchase agreement (the “SPA”)

dated August 24, 2020, by and among the Company and such Selling Shareholders, where the Company sold the Shares at a per share

purchase price of $2.00 to the Selling Shareholders. The holders of the Shares are each referred to herein as a “Selling

Shareholder” and collectively as the “Selling Shareholders.” We have agreed to bear all of the expenses incurred

in connection with the registration of the Shares. The Selling Shareholders will pay or assume discounts, commissions, fees of

underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the resale the Shares.

The securities may

be sold by us or the Selling Shareholders to or through underwriters or dealers, directly to purchasers or through agents designated

from time to time. The Selling Shareholders identified in this prospectus, or their respective transferees, pledgees, donees or

other successors-in-interest, may offer the Shares through public or private transactions at prevailing market prices, at prices

related to prevailing market prices or at privately negotiated prices. For additional information on the methods of sale, see the

section entitled “Plan of Distribution” on page 15. For a list of the Selling Shareholders, see the section

entitled “Selling Shareholders” on page 13.

The Selling Shareholders

may sell any, all or none of the securities offered by this prospectus, and we do not know when or in what amount the Selling Shareholders

may sell their Shares hereunder following the effective date of this registration statement.

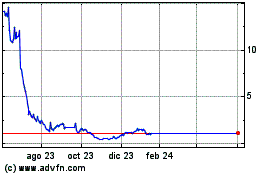

Our Ordinary Share

is currently listed on the Nasdaq Capital Market under the symbol “PBTS.” On February 22, 2021, the last reported sale

price of our Ordinary Share on the Nasdaq Capital Market was $4.37 per share. The applicable prospectus supplement will contain

information, where applicable, as to other listings, if any, on the Nasdaq Capital Market or other securities exchange of the securities

covered by the prospectus supplement.

If any underwriters

are involved in the sale of the securities with respect to which this prospectus is being delivered, the names of such underwriters

and any applicable discounts or commissions and over-allotment options will be set forth in the applicable prospectus supplement.

This prospectus also describes the general manner in which the Shares may be offered and sold. If necessary, the specific manner

in which the Shares may be offered and sold will be described in a supplement to this prospectus.

Investing in our

Ordinary Share involves risks. You should carefully review the risks described under the heading “Risk Factors” beginning

on page 5 and in the documents which are incorporated

by reference herein before you invest in our securities.

Neither the Securities and

Exchange Commission, Cayman Islands, nor any state securities commission has approved or disapproved of these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is February

23, 2021.

TABLE OF CONTENTS

You should rely only on the information

contained or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized any person to provide

you with different or additional information. If anyone provides you with different or inconsistent information, you should not

rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy securities in any jurisdiction

where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any prospectus

supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate as of the date

on the front of those documents only. Our business, financial condition, results of operations and prospects may have changed since

those dates.

ABOUT THIS PROSPECTUS

This prospectus is

a part of a registration statement that we filed with the Securities and Exchange Commission, or the Commission, using a “shelf”

registration process. Under this shelf registration process, we may offer to sell any of the securities, or any combination of

the securities, described in this prospectus, in each case in one or more offerings, up to a total amount of $200,000,000 and the

Selling Shareholders may offer from time to time up to an aggregate of 8,800,000 Ordinary Shares, par value $$0.00166667. You should

rely only on the information contained in this prospectus and the related exhibits, any prospectus supplement or amendment thereto

and the documents incorporated by reference, or to which we have referred you, before making your investment decision. Neither

we nor the Selling Shareholders have authorized anyone to provide you with different information. If anyone provides you with different

or inconsistent information, you should not rely on it. This prospectus, any prospectus supplement or amendments thereto do not

constitute an offer to sell, or a solicitation of an offer to purchase, the Ordinary Share offered by this prospectus, any prospectus

supplement or amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer

or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus, any

prospectus supplement or amendments thereto, as well as information we have previously filed with the U.S. Securities and Exchange

Commission (the “SEC”), is accurate as of any date other than the date on the front cover of the applicable document.

If necessary, the specific

manner in which the securities may be offered and sold will be described in a supplement to this prospectus, which supplement may

also add, update or change any of the information contained in this prospectus. To the extent there is a conflict between the information

contained in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement, provided

that if any statement in one of these documents is inconsistent with a statement in another document having a later date-for example,

a document incorporated by reference in this prospectus or any prospectus supplement-the statement in the document having the later

date modifies or supersedes the earlier statement.

Neither the delivery

of this prospectus nor any distribution of Ordinary Share pursuant to this prospectus shall, under any circumstances, create any

implication that there has been no change in the information set forth or incorporated by reference into this prospectus or in

our affairs since the date of this prospectus. Our business, financial condition, results of operations and prospects may have

changed since such date.

When used herein, unless

the context requires otherwise, references to the “Powerbridge,” “Company,” “we,” “our”

and “us” refer to Powerbridge Technologies Co., Ltd., a Cayman Islands exempted company.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, the

applicable prospectus supplement or amendment and the information incorporated by reference in this prospectus contain various

forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities and Exchange

Act of 1934, as amended (the “Exchange Act”), which represent our expectations or beliefs concerning future events.

Forward-looking statements include statements that are predictive in nature, which depend upon or refer to future events or conditions,

and/or which include words such as “believes,” “plans,” “intends,” “anticipates,”

“estimates,” “expects,” “may,” “will” or similar expressions. In addition, any

statements concerning future financial performance, ongoing strategies or prospects, and possible future actions, which may be

provided by our management, are also forward-looking statements. Forward-looking statements are based on current expectations and

projections about future events and are subject to risks, uncertainties, and assumptions about our company, economic and market

factors, and the industry in which we do business, among other things. These statements are not guarantees of future performance,

and we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future

events, or otherwise, except as required by law. Actual events and results may differ materially from those expressed or forecasted

in forward-looking statements due to a number of factors. Factors that could cause our actual performance, future results and actions

to differ materially from any forward-looking statements include, but are not limited to, those discussed under the heading “Risk

Factors” in any of our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act. The forward-looking

statements in this prospectus, the applicable prospectus supplement or any amendments thereto and the information incorporated

by reference in this prospectus represent our views as of the date such statements are made. These forward-looking statements should

not be relied upon as representing our views as of any date subsequent to the date such statements are made.

OUR COMPANY

This summary highlights information

contained in the documents incorporated herein by reference. Before making an investment decision, you should read the entire prospectus,

and our other filings with the SEC, including those filings incorporated herein by reference, carefully, including the sections

entitled “Risk Factors” and “Special Note Regarding Forward-Looking Statements.” Unless otherwise indicated

or the context otherwise requires, references in this prospectus to “we,” “our,” “us,” and

other similar terms refer to Powerbridge Technologies Co., Ltd. and its consolidated subsidiaries.

Overview

We are a provider of

software application and technology solutions and services to corporate and government customers primarily located in China. We

introduced global trade software applications when we launched our operations in 1997 with a vision to make global trade operations

easier for our customers. Since our inception, we have continued to innovate by developing technologies that enable us to successfully

deliver a series of solutions and services that address the evolving and changing needs of our corporate and government customers.

Our mission is to make global trade easier by empowering all players in the ecosystem.

With the rapid growth

of advertisement and media industrial in recent years, we believe that there is a substantial market opportunity to operate an

out-of-home digital display advertising and media technology platform in the Greater Bay Area of China. We also see the potential

to further expand our business into such industry, which could be supported by the success of our own Big Data platforms/products.

As a result, we started to implement our plan to build a network of digital display and operate an advertisement platform since

October 2020 by using our Big Data platform and services.

Our customers

are corporate and government organizations engaged in global trade. Our corporate customers are import and export companies, manufacturers

engaged in international trade, as well as logistics and other service providers. Our government customers include customs and

other government agencies that oversee the flow of goods and services across borders, as well as government authorities and organizations

that manage and operate free trade and bonded trade zones, ports and terminals, and other international trade facilities.

Global trade involves

complicated and cumbersome processing, manual handling of voluminous documents, extended and complex cross-organization workflows

as well as a great number of business and government players in the global trade ecosystem. Our customers are facing increasing

challenges as the world’s trade ecosystems continue to grow in size and complexity. Costs associated with global trade, such

as logistics performance, border control and international connectivity remain high. Potential savings from more collaborative

and efficient trade processes could reduce the costs of global trade significantly. The need for greater efficiency and cost savings

are driving the transformative shift for participants in global trade to become more connected and collaborative.

Our comprehensive and

robust solutions and services include Powerbridge System Solutions and Powerbridge SaaS Services with

more than 50 solutions and services deployable on premise and in the cloud. Leveraging our deep domain knowledge and strong industry

experience, we provide a series of differentiated and robust solutions and services that address the mission critical needs of

our corporate and government customers, enabling them to handle and simplify the complexities of global trade operations, logistics

and compliance.

We provide Powerbridge

System Solutions to our corporate and government customers engaged in global trade, including businesses and manufacturers

across a broad range of industries, government agencies and regulatory authorities, as well as global trade logistics and other

service providers. Powerbridge System Solutions enable our customers to streamline their trade operations, trade logistics

and regulatory compliance, consisting of Trade Enterprise Solutions and Trade Compliance Solutions which have been

in service since our first introduction twenty years ago and Import & Export Loan and Insurance Processing which have

recently been introduced to a selected group of customers.

We began offering our

Powerbridge SaaS Services (software-as-a-service) in 2016 and are continually developing and expanding our SaaS services

that provide our corporate and government customers with significant benefits, including better use of resources, a lower cost

of operations, easier document handling, faster processing time as well as higher logistics and compliance connectivity and efficiency.

Powerbridge SaaS Services include Logistics Service Cloud and Trade Zone Operations Cloud which are in service,

and Inward Processed Manufacturing Cloud, Cross-Border eCommerce Cloud and Import & Export Loan and Insurance Processing

Service Cloud which are in development.

We have begun offering

our cloud-based Powerbridge BaaS Services (blockchain-as-a-service) with designated use case for limited government

customers since June 2019 and we have not generated any revenue from it. We continue developing our BaaS Services for

market commercialization. Blockchain technology is emerging as a major disruptive force across many industries including those

involved in global trade. We believe that blockchain technology could allow our customers to conduct business in more synchronized

and collaborative ways to substantially increase operational efficiency and reduce trade costs across the global trade supply chain. Powerbridge

BaaS Service includes Compliance Blockchain Services and Supply Chain Blockchain Services.

Our solutions and services

are built from our multiple proprietary technology platforms which are developed based on industry leading open source infrastructure

technologies. Our technology platforms include Powerbridge System Platform and Powerbridge SaaS Platform,

which are designed for high-performance reliability, flexibility and scalability, allowing us to expand our solutions and services

rapidly and efficiently to consistently address the needs of our corporate and government customers. Our Powerbridge BaaS

Platform is in development and our BaaS services will be built on top of our Powerbridge Blockchain Platform that

is designed to provide high scalability and performance characteristics, consisting of multiple technology engines that support

the various business component models specific for trade transaction, trade logistics and regulatory compliance in global trade.

We intend to continue

leveraging our industry expertise and product knowledge with the best use of emerging and disruptive technologies such as big data,

artificial intelligence and Internet of Things to enhance our core technology capabilities and continually increase the scope of

our solutions and services to our customers.

Expansion Into Out-Of-Home Advertising

and Media

Since October 2020,

we started to implement our plan to build a network of digital display such as LCD screens and operate an advertisement platform

in Shenzhen initially, and then expand to the Greater Bay Area of China. We believe that there is a substantial market opportunity

to operate an out-of-home digital display advertising and media technology platform in the Greater Bay Area of China. We will focus

on display advertising in various high traffic advertising locations such as residential and office buildings, commercial parking

garages, and elevators in residential and office buildings.

We closed on a $50

million Note financing on October 27, 2020, which is in addition to the $17.5 million raised on August 24, 2020 in a private placement

of ordinary shares, par value $0.00166667. The funds raised are being used as prepayment for acquiring the right to operate and

publish advertisements at certain advertising space, as an efficient way of accelerating the Company’s entrance into the

out-of-home digital display advertising and media business.

On September 25, 2020,

Shenzhen Honghao Internet Technology Co. Ltd. (“Honghao”), a wholly-owned subsidiary of the Company, entered into a

leasing agreement (the “Original Leasing Agreement”) with Shenzhen Kezhi Technology Co., Ltd., a company incorporated

under the PRC laws (“Kezhi”), pursuant to which, Kezhi agreed to transfer the right to operate and publish advertisements

at certain advertising space it leases or controls in certain shopping centers in Shenzhen, Guangdong, to Honghao. No less than

75% of the advertising space as provided in the Original Leasing Agreement shall be delivered within 6 months and the remainder

shall be delivered within 12 months following the date of the Original Leasing Agreement. The Original Leasing Agreement became

effective on October 1, 2020 and shall expire on September 30, 2032.

Honghao agreed to pay

an aggregate rent of RMB150 million (approximately $22 million) within 3 months of the date of the Original Leasing Agreement.

Additionally, Honghao agreed to pay RMB10 million (approximately $1.67 million) as security deposit within 3 business days after

the date of the Original Leasing Agreement. Kezhi agreed to pledge certain Hainan Huanghua pear furniture it owns and currently

valued for RMB150 million (the “Collateral”) as guarantee for the rent payment made by Honghao pursuant to a separate

guarantee agreement to be agreed upon by and between Honghao and Kezhi. The parties agreed the Collateral shall be pledged for

the entire term of the lease and in the event the value of the Collateral is determined less than RMB150 million anytime during

the term of the guaranty, Kezhi shall provide additional collateral within three months of such determination to make sure that

aggregate value of the Collateral maintains at RMB150 million.

On November 20, 2020,

Honghao and Kezhi entered into a supplemental agreement to the Leasing Agreement (the “Supplemental Agreement”, together

with the Original Leasing Agreement, the “Leasing Agreement”), pursuant to which, Kezhi agreed to transfer the right

to operate and publish advertisements at certain additional advertising space it leased or controls in several urban villages in

Shenzhen, Guangdong, to Honghao.

Given that there was

no transfer of the right to operate and publish advertisements between October 1, 2020, the effective date of the Original Leasing

Agreement, and the date of the Supplemental Agreement, both parties agreed to change the effective date of the Original Leasing

Agreement from October 1, 2020 to January 1, 2021, which shall expire on December 31, 2040.

Honghao and Kezhi also

agreed to increase the rent from RMB150 million (approximately $22 million) to RMB 470 million (approximately $71 million) as consideration

for all the advertising space, the payment of which shall be made within 3 months of the date of the Supplemental Agreement. Accordingly,

Kezhi agreed to increase the value of the original collateral as provided in the Original Leasing Agreement from RMB150 million

to RMB 470 million. Additionally, both parties agreed to change the original payment schedule of the security deposit in an amount

of RMB10 million (approximately $1.67 million) as set forth in the Original Leasing Agreement from 3 business days after the date

of the Original Leasing Agreement to 3 business days after the date of the Supplemental Agreement.

Additionally, the Supplemental

Agreement provided the advertising space delivery schedule with at least 50% of the total advertising space to be delivered by

December 31, 2021 and the remainder to be delivered by December 31, 2022 (the “Delivery Schedule”). In the event Kezhi

fails to deliver the advertising space according to the Delivery Schedule, Honghao shall have the right to terminate the Leasing

Agreement and have the rent returned in full as well as demand damages due to Kezhi’s default. Furthermore, both parties

agreed that Honghao shall not be liable for any disputes, conflicts or lawsuits arising between Kezhi and any third party concerning

the advertising space provided thereof (the “Third Party Disputes”). In the event Kezhi is unable to continue to perform

all or part of its obligations under the Leasing Agreement due to third party disputes, Kezhi shall manage to locate similar replacement

of advertising space for Honghao within one month. The parties also agreed on the parties’ obligations to seek regulatory

approval to publish the advertisements, safe operation of the advertisement space, force majeure and other matters

customary to lease agreement of such nature.

As of the date of this

prospectus, we have not started the management of digital displays and have not generated any revenue under the outdoor advertising

business. We plan to initiate our outdoor advertising business in the second quarter of 2021, and expect to manage a network of

30,000 digital displays such as LCD screens as well as operate an advertisement platform in Guangdong province, China. We are partnered

with Kezhi, an advertising company in Shenzhen, to install and provide maintenance service for the digital displays while we will

operate the advertisement system by using our big data platform. We expect to generate our revenue from the monthly advertisement

fees charged to the advertisers. Supported by our big data platform, we are able to identify the most popular advertisements at

a given time and location. With such analysis result, we can help our customers to identify the place and time which attract the

most attention to their advertisements.

The following diagram

illustrates our current corporate structure:

As of the date of this

prospectus, Ningbo Powerbridge Pet Products Cross-border E-commerce Service Co., Ltd is dormant and has no operation.

Corporate Information

Our principal executive

office is located at 1st Floor, Building D2, Southern Software Park, Tangjia Bay, Zhuhai, Guangdong 519080, China. Our telephone

number is +86-756-339-5666. We maintain a website at www.powerbridge.com that contains information about our Company, though no

information contained on our website is part of this prospectus.

ABOUT

THE SECONDARY OFFERING

The secondary offering of this prospectus

relates to the offer and resale by the Selling Shareholders of an aggregate of 8,800,000 Ordinary Shares. All of the Ordinary Shares

will be sold by the Selling Shareholders. The Selling Shareholders may sell the Ordinary Shares from time to time at prevailing

market prices or at privately negotiated prices.

|

Ordinary Share Offered by the Selling Shareholders:

|

|

8,800,000 Ordinary Shares.

|

|

|

|

|

|

Ordinary Share Outstanding on February 22, 2021:

|

|

45,777,318 Ordinary Shares

|

|

|

|

|

|

Use of Proceeds:

|

|

We will not receive any proceeds from the sale of shares by the Selling Shareholders. See the “Use of Proceeds” section beginning on page 14.

|

|

|

|

|

|

Risk Factors:

|

|

An investment in the Ordinary Shares offered under this prospectus is highly speculative and involves substantial risk. Please carefully consider the “Risk Factors” section on page 5 and other information in this prospectus for a discussion of risks. Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and operations.

|

|

|

|

|

|

Nasdaq Symbol:

|

|

PBTS

|

RISK FACTORS

An investment in our

Ordinary Share involves significant risks. You should carefully consider the risk factors contained in any prospectus supplement

and in our filings with the SEC, as well as all of the information contained in this prospectus and the related exhibits, any prospectus

supplement or amendments thereto, and the documents incorporated by reference herein or therein, before you decide to invest in

our Ordinary Share. Our business, prospects, financial condition and results of operations may be materially and adversely affected

as a result of any of such risks. The value of our Ordinary Share could decline as a result of any of these risks. You could lose

all or part of your investment in our Ordinary Share. Some of our statements in sections entitled “Risk Factors”

are forward-looking statements. The risks and uncertainties that we have described are not the only ones that we face. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, prospects,

financial condition and results of operations.

In addition to the

risk factors referenced above, as described in our most recent annual report on Form 20-F, we want to disclose the additional risk

factors below.

Risks Relating

to Our Advertising and Media Business

We have

a limited operating history in our advertising and media business, which may make it difficult for you to evaluate our business

and prospects.

Since October 2020,

we started to implement our plan to build a network of digital display such as LCD screens and operate an advertisement platform

in Shenzhen initially, and then expand to the Greater Bay Area of China. On September 25, 2020, Shenzhen Honghao Internet Technology

Co. Ltd. (“Honghao”), the wholly-owned subsidiary of the Company, entered into a leasing agreement (the “Original

Leasing Agreement”) with Shenzhen Kezhi Technology Co., Ltd., a company incorporated under the PRC laws (“Kezhi”),

pursuant to which, Kezhi agreed to transfer the right to operate and publish advertisements at certain advertising space it leases

or controls in certain shopping centers in Shenzhen, Guangdong, to Honghao. On November 20, 2020, Honghao and Kezhi entered into

a supplemental agreement to the Leasing Agreement (the “Supplemental Agreement”), pursuant to which, Kezhi agreed to

transfer the right to operate and publish advertisements at certain additional advertising space it leased or controls in several

urban villages in Shenzhen, Guangdong, to Honghao.

Accordingly,

we have a very limited operating history for our current operations of our advertising and media business upon which you can evaluate

the viability and sustainability of our business and its acceptance by advertisers and consumers. It is also difficult to evaluate

the viability of our use of advertising displays and our use of advertising poster frames in residential complexes because we do

not have sufficient experience to address the risks frequently encountered by early stage companies using new forms of advertising

media and entering new and rapidly evolving markets. These circumstances may make it difficult for you to evaluate our business

and future operation.

Advertising

is particularly sensitive to changes in economic conditions and advertising trends.

Demand

for advertising time slots and advertising frame space on our networks, and the resulting advertising spending by our clients,

is particularly sensitive to changes in general economic conditions and advertising spending typically decreases during periods

of economic downturn. Advertisers may reduce the money they spend to advertise on our networks for a number of reasons, including:

|

|

●

|

a

general decline in economic conditions;

|

|

|

●

|

a

decline in economic conditions in the particular cities where we conduct business;

|

|

|

●

|

a

decision to shift advertising expenditures to other available advertising media; or

|

|

|

●

|

a

decline in advertising spending in general.

|

A

decrease in demand for advertising media in general and for our advertising services in particular would materially and adversely

affect our ability to generate revenue from our advertising services, and our financial condition and results of operations.

Our operating

results of our advertising and media business are difficult to predict and may fluctuate significantly from period to period in

the future.

Our

operating results of our advertising and media business are difficult to predict and may fluctuate significantly from period to

period based on the seasonality of consumer spending and corresponding advertising trends in China. As a result, you may not be

able to rely on period to period comparisons of our operating results as an indication of our future performance. Factors that

are likely to cause our operating results to fluctuate include the seasonality of advertising spending in China, a deterioration

of economic conditions in China and potential changes to the regulation of the advertising industries in China. If our revenues

generated from our advertising and media business for a particular quarter are lower than we expect, we may be unable to reduce

our operating expenses for that quarter by a corresponding amount, which would harm our overall operating results for that quarter

relative to our operating results from other quarters.

The out-of-home

advertising market is intensely competitive. In addition, we might face competitive pressure from well-established internet companies,

marketing agencies and traditional media.

With

the introduction of new technologies and the influx of new entrants, we expect competition to continue and intensify, which could

harm our ability to increase revenue and attain or sustain profitability. We believe the principal competitive factors in this

industry include:

|

|

●

|

ability

to deliver return on marketing expenditure at scale;

|

|

|

●

|

breadth

and depth of cooperation with publishers, ad exchanges, ad networks and other participants in the online marketing ecosystem;

|

|

|

●

|

comprehensiveness

of solutions and service offerings;

|

|

|

●

|

pricing

structure and competitiveness;

|

|

|

●

|

cross-channel

capabilities;

|

|

|

●

|

accessibility

and user-friendliness of solutions; and

|

In

addition, independent online marketing technology platforms face competitive pressure from large and well-established internet

companies which have established stronger and broader presence across the online marketing ecosystem and have significantly more

financial, technical, marketing and other resources, more extensive client base, and longer operating histories and greater brand

recognition than we do. These companies may also leverage their positions to make changes to their systems, platforms, exchanges,

networks or other products or services that could be harmful to our business and results of operations. In addition, these large

and well-established companies control content distribution channels and would directly compete with us should we vertically expand

our business to own or operate content distribution channels in the future. Further, some of these companies are, or may also become,

our content distribution channels and may enter into other types of strategic arrangements with us. We also face competition from

marketing agencies, who may have their own relationships with content distribution channels and can directly connect marketers

with such channels. Furthermore, we continue to compete with traditional media including direct marketing, television, radio, cable

and print advertising companies.

New

technologies and methods of online marketing present an evolving competitive challenge, as market participants upgrade or expand

their service offerings to capture more marketing spend from marketers. In addition to existing competitors and their existing

service offerings, we expect to face competition from new entrants to the online marketing technology industry and new service

offerings from existing competitors. If existing or new companies develop, market or resell competitive high-value marketing technology

solutions, acquire one of our competitors or strategic partners, form a strategic alliance or enter into exclusivity arrangement

with one of our competitors or strategic partners, our ability to compete effectively could be significantly compromised and our

business, results of operations and prospects could be materially and adversely affected.

If our

advertising business do not achieve widespread market acceptance, our business, growth prospects and results of operations would

be materially and adversely affected.

The

market for out-of-home advertising is evolving in China and may not achieve or sustain high levels of demand and market acceptance

as we expect because we may face competition from mobile and social media. While marketing via search engines or display channels

has been established for several years, marketing via new digital channels such as mobile and social media is not as well established

and under quick development. The future growth of our out-of-home advertising business could be constrained by our competitors

in out-of-home digital display business and competitors from emerging online marketing channels and social media.

Expansion

of our outdoor advertising business depends on a number of factors, including the growth of new digital advertising channels such

as mobile and social media and the cost, as well as the performance and perceived value associated with online marketing technology

solutions. If we do not achieve widespread acceptance, or there is a reduction in demand for out-of-home advertising caused by

weakening economic conditions, decreases in corporate spending, technological challenges, data security or privacy concerns, governmental

regulation, competing technologies and solutions or otherwise, our business, growth prospects and results of operations will be

materially and adversely affected.

If our operating

platforms are flawed or ineffective, or if our platform fails to otherwise function properly, our reputation and market share would

be materially and adversely affected.

Our

ability to attract marketers to, and build trust in, our platform is significantly dependent on our ability to interact with relevant

marketing content. The data we collect may not be relevant to all industries, and for certain industries, we may not have sufficient

user data to ensure that our platforms would work effectively. Furthermore, we generally do not verify the data we gather, which

may be subject to fraud or are otherwise inaccurate. Even if such data are accurate, they may become irrelevant or outdated and

thus may not reflect a user’s genuine interest or accurately predict his or her interaction with a given marketing message.

For example, following the date we obtain the relevant data, a user’s interest and behavior pattern may change or he or she

may have already completed a transaction and is no longer interested in the marketing message.

In

addition, we expect to experience significant growth in the amount of data we process as we continue to develop new solutions and

features to meet evolving and growing marketer demands. As the amount of data and variables we process increases, the calculations

that our algorithms and data engines must process become increasingly complex and the likelihood of any defect or error increases.

To the extent our operating platforms fail to accurately assess or predict a user’s interest in and interaction with, the

relevant marketing content, or experience significant errors or defects, marketers may not achieve their marketing goals in a cost-effective

manner or at all, which could make our platform less attractive to them, result in damages to our reputation and a decline of our

market share and adversely affect our business and results of operations.

We plan

to use big data platform to run and manage our out-of-home advertising digital displays. However, our ability to collect and use

data from various sources could be restricted, and therefore, it may affect our management and operation of our out-of-home advertising

digital displays.

We

plan to use big data platform to run and manage our out-of-home advertising digital displays. With data collected by and analysis

ran by big data platform, we may better identify the target audience of our out-of-home advertising digital displays. The optimal

performance and analysis of our big data platform depends on the data that we collect from multiple sources, which we use to build

user profiles, develop and refine preferences of our target audience. Our ability to collect and use these types of data is limited

by a number of factors including:

|

|

●

|

decisions

by marketers, content distribution channels, or selected third party that we may have data collaboration arrangement with, to

restrict our ability to collect data from them, to refuse to implement mechanisms that we may request to ensure compliance with

our legal obligations;

|

|

|

●

|

new

developments in law, regulations and industry standards on privacy and data protection regimes, including increased visibility

of consent mechanisms as a result of these legal, regulatory or industry developments;

|

|

|

●

|

the

failure of our network or software systems, or the network or software systems of marketers;

|

|

|

●

|

our

inability to grow client base in new industries and geographic markets in order to obtain the critical mass of data necessary

for our algorithms and data engines to perform optimally in these new industries and geographies;

|

|

|

●

|

our

relationship with our data partners or certain key data sources, including major internet companies in China, which may stop providing

or be unable to provide us data on terms acceptable to us; and

|

|

|

●

|

interruptions,

failures or defects in our data collection, mining, analysis and storage systems.

|

Any

of the above described limitations on our ability to successfully collect and use data could materially impair the optimal performance

of our big data platform as well as the efficiency of our solutions for our clients, which could make our platform less attractive

to marketers and result in damages to our reputation, a decline of our market share and adversely affect our business and results

of operations.

Our failure

to maintain existing relationships or obtain new relationships with businesses that allow us to access to desirable locations and

platforms on which we operate our network could harm or reverse our growth potential and our ability to increase our revenues.

Our

ability to generate revenues from advertising sales depends largely upon our ability to provide large networks of flat-panel displays

placed in desirable building, commercial and store locations, of advertising poster frames placed in residential complexes, to

secure desirable locations of large outdoor LED digital billboards, throughout major urban areas in China. We also depend on the

ability of our third-party location provider to secure desirable LED digital billboard locations for our outdoor LED network. This,

in turn, requires that we develop and maintain business relationships with real estate developers, landlords, property managers,

hypermarkets, retailers and other businesses and locations in which we rent space for our displays and digital billboards. Although

our advertising space leasing agreements have terms of 19 years, we may not be able to maintain our relationships with them on

satisfactory terms, or at all. If we fail to maintain our relationships with landlords and property managers, or if our leasing

agreement is terminated or not renewed or if we fail to maintain our relationship with our location provider of LED billboard space,

advertisers may find advertising on our networks unattractive and may not wish to purchase advertising time slots or advertising

frame space on our networks, which would cause our revenues to decline and our business and prospects to deteriorate.

In

accordance with PRC real estate laws and regulations, prior consent of landlords and property managers is required for any commercial

use of the public areas or facilities of residential properties. With regard to our network of advertising poster frames and some

of our LED screen placed in the elevators and public areas of residential complexes, we have entered/plan to enter into frame or

display placement agreements with property managers and landlords. For those frame or display placement agreements entered into

with property managers, we intend to obtain or urge property managers to obtain consents from landlords. However, if the landlords

of a residential complex object to our placing advertising displays in the elevators and public areas of the complex, we may be

required to remove our advertising displays from the complex and may be subject to fines. We may not be able to successfully expand

our out-of-home advertising network into new regions or diversify our network into new advertising networks or media platforms,

which could harm or reverse our growth potential and our ability to increase our revenues.

If we are

unable to obtain or retain desirable placement locations for our outdoor digital displays on commercially advantageous terms or

if the supply of desirable locations diminishes or ceases to expand, we could have difficulty in maintaining or expanding our network,

our operating margins and earnings could decrease and our results of operations could be materially and adversely affected.

Our

location costs, which include lease payments to landlords and property managers under our advertising space leasing agreement,

maintenance and monitoring fees and other associated costs, could comprise a significant portion of our cost of revenues. We may

also need to increase our expenditures on our advertising space leasing agreements to obtain new and desirable locations, to renew

existing locations, and to secure favorable exclusivity and renewal terms. In addition, lessors of space for our outdoor digital

displays may charge increasingly higher display location lease fees, or demand other compensation arrangements, such as profit

sharing. If we are unable to pass increased location costs on to our advertising clients through rate increases, our operating

margins and earnings could decrease and our results of operations could be materially and adversely affected.

In

addition, in some developed cities of the Greater Bay Area of China, it may be difficult to increase the number of desirable locations

in our network because most such locations have already been occupied either by us or by our competitors, or in the case of outdoor

LED billboards, the placement of outdoor installments may be limited by municipal zoning and planning policies. In recently developing

cities, the supply of desirable locations may be small and the pace of economic development and construction levels may not provide

a steadily increasing supply of desirable commercial and residential locations. If, as a result of these possibilities, we are

unable to increase the placement of our out-of-home digital displays into commercial and residential locations that advertisers

find desirable, we may be unable to expand our client base, sell advertising time slots and poster frame space on our network or

increase the rates we charge for time slots and poster frame space, which could decrease the value of our network to advertisers.

If we are

unable to attract advertisers to advertise on our networks, we will be unable to maintain or increase our advertising fees and

the demand for time on our networks, which could negatively affect our ability to grow revenues.

The

amounts of fees we can charge advertisers for time slots on our out-of-home digital display advertising and media technology networks

depend on the size and quality of our out-of-home digital display advertising and media technology networks and the demand by advertisers

for advertising time on our out-of-home digital display advertising and media technology networks. Advertisers choose to advertise

on our out-of-home digital display advertising and media technology networks in part based on the size of the networks and the

desirability of the locations where we have placed our flat-panel displays and where we lease LED digital billboards as well as

the quality of the services we offer. If we fail to maintain or increase the number of locations, displays and billboards in our

networks, diversify advertising channels in our networks, or solidify our brand name and reputation as a quality provider of advertising

services, advertisers may be unwilling to purchase time on our networks or to pay the levels of advertising fees we require to

remain profitable.

In

addition, the fees we can charge advertisers for frame space on our poster frame network depends on the quality of the locations

in which we place advertising poster frames, demand by advertisers for frame space and the quality of our service. If we are unable

to continue to secure the most desirable residential locations for deployment of our advertising poster frames, we may be unable

to attract advertisers to purchase frame space on our poster frame network.

Our

failure to attract advertisers to purchase time slots and frame space on our networks will reduce demand for time slots and frame

space on our networks and the number of time slots and amount of frame space we are able to sell, which could necessitate lowering

the fees we charge for advertising time on our network and could negatively affect our ability to increase revenues in the future.

Failure

to manage our growth could strain our management, operational and other resources and we may not be able to achieve anticipated

levels of growth in the new networks and media platforms we are beginning to operate, either of which could materially and adversely

affect our business and growth potential.

We

have been rapidly expanding, and plan to continue to rapidly expand, our advertising and media operations in China. We must continue

to expand our advertising and media operations to meet the potential demands of advertisers for larger and more diverse network

coverage and the demands of current and future landlords and property managers for installing and configuring outdoor digital displays

in our existing and future commercial, store, residential and urban locations. This expansion has resulted, and will continue to

result, in substantial demands on our management resources. To manage our growth, we must develop and improve our existing administrative

and operational systems and, our financial and management controls and further expand, train and manage our work force. As we continue

this effort, we may incur substantial costs and expend substantial resources in connection with any such expansion due to, among

other things, different technology standards, and legal considerations. We may not be able to manage our operations effectively

and efficiently or compete effectively in such markets. We cannot assure you that we will be able to efficiently or effectively

manage the growth of our operations, recruit top talent and train our personnel. Any failure to efficiently manage our expansion

may materially and adversely affect our business and future growth.

We

may expand into new networks and new media platforms, however, the new advertising networks and media platforms we pursue in the

future may not present the same opportunities for growth of outdoor digital displays as expected. Accordingly, we cannot assure

you that the level of growth of our networks will not decline over time. Moreover, we expect the level of growth of our commercial

location network to decrease as many of the more desirable locations have already been leased by us or our competitors.

If advertisers

or the viewing public do not accept, or lose interest in, our out-of-home advertising network, our revenues may be negatively affected

and our business may not expand or be successful.

We

compete for advertising spending with many forms of more established advertising media. Our success depends on the acceptance of

our out-of-home advertising network by advertisers and their continuing interest in these mediums as components of their advertising

strategies. Our success also depends on the viewing public continuing to be receptive towards our advertising network. Advertisers

may elect not to use our services if they believe that consumers are not receptive to our networks or that our networks do not

provide sufficient value as effective advertising mediums. Likewise, if consumers find some element of our networks, such as the

strong light from the billboard, to be disruptive or intrusive, advertisers may decide not to place advertisements on our advertising

network and may deem our outdoor billboards as a less attractive advertising medium compared to other alternatives. In that event,

advertisers may determine to reduce their spending on our advertising network. If a substantial number of advertisers lose interest

in advertising on our advertising network for these or other reasons, we will be unable to generate sufficient revenues and cash

flow to operate our business, and our advertising service revenue, liquidity and results of operations could be negatively affected.

We may need

additional capital and we may not be able to obtain it, which could adversely affect our liquidity and financial position.

We

believe that our current cash and cash equivalents and cash flow from operations will be sufficient to meet our anticipated cash

needs including for working capital and capital expenditures, for the foreseeable future. We may, however, require additional cash

resources due to changed business conditions or other future developments. If these sources are insufficient to satisfy our cash

requirements, we may seek to sell additional equity or debt securities or obtain a credit facility. The sale of convertible debt

securities or additional equity securities, could result in additional dilution to our shareholders. The incurrence of indebtedness

would result in increased debt service obligations and could result in operating and financing covenants that would restrict our

operations and liquidity.

Our ability to

obtain additional capital on acceptable terms is subject to a variety of uncertainties, including:

|

|

●

|

investors’

perception of, and demand for, securities of alternative advertising media companies;

|

|

|

●

|

conditions

of the U.S. and other capital markets in which we may seek to raise funds;

|

|

|

●

|

our

future results of operations, financial condition and cash flows;

|

|

|

●

|

PRC

governmental regulation of foreign investment in advertising services companies in China;

|

|

|

●

|

economic,

political and other conditions in China; and

|

|

|

●

|

PRC

governmental policies relating to foreign currency borrowings.

|

We

cannot assure you that financing will be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise

additional funds on terms favorable to us could have a material adverse effect on our liquidity and financial condition.

If we are

unable to adapt to changing advertising trends and the technology needs of advertisers and consumers, we will not be able to compete

effectively and we will be unable to increase or maintain our revenues which may materially and adversely affect our business prospects

and revenues.

The

market for out-of-home advertising requires us to continuously identify new advertising trends and the technology needs of advertisers

and consumers, which may require us to develop new features and enhancements for our advertising network. In the future, subject

to relevant PRC laws and regulations, we may use other technology, such as cable or broadband networking, advanced audio technologies

and high-definition panel technology. We may be required to incur development and acquisition costs in order to keep pace with

new technology needs but we may not have the financial resources necessary to fund and implement future technological innovations

or to replace obsolete technology. Furthermore, we may fail to respond to these changing technology needs. For example, if the

use of wireless or broadband networking capabilities on our advertising network becomes a commercially viable alternative and meets

all applicable PRC legal and regulatory requirements, and we fail to implement such changes on our commercial location network

and in-store network or fail to do so in a timely manner, our competitors or future entrants into the market who do take advantage

of such initiatives could gain a competitive advantage over us. If we cannot succeed in developing and introducing new features

on a timely and cost-effective basis, advertiser demand for our advertising networks may decrease and we may not be able to compete

effectively or attract advertising clients, which would have a material and adverse effect on our business prospects and revenues.

We may be

subject to intellectual property infringement claims, which may force us to incur substantial legal expenses and, if determined

adversely against us, may materially disrupt our business.

We

cannot be certain that our advertising displays or other aspects of our business do not or will not infringe upon patents, copyrights

or other intellectual property rights held by third parties. Although we are not aware of any such claims, we may become subject

to legal proceedings and claims from time to time relating to the intellectual property of others in the ordinary course of our

business. If we are found to have violated the intellectual property rights of others, we may be enjoined from using such intellectual

property, and we may incur licensing fees or be forced to develop alternatives. In addition, we may incur substantial expenses

in defending against these third party infringement claims, regardless of their merit. Successful infringement or licensing claims

against us may result in substantial monetary liabilities, which may materially and adversely disrupt our business.

We face

significant competition, and if we do not compete successfully against new and existing competitors, we may lose our market share,

and our profitability may be adversely affected.

We

compete with other advertising companies in China. We compete for advertising clients primarily on the basis of network size and

coverage, location, price, the range of services that we offer and our brand name. We also face competition from other out-of-home

television advertising network operators for access to the most desirable locations in cities in China. Individual buildings, hotels,

restaurants and other commercial locations and hypermarket, supermarket and convenience store chains may also decide to independently,

or through third-party technology providers, install and operate their own flat-panel television advertising screens.

Our

out-of-home advertising network faces competition with similar networks operated by domestic out-of-home advertising companies,

including but not limited to Shanghai Xicheng Cultural Dissemination Co., Ltd., Focus Media Information Technology, and iClick

Interactive Asia Group Limited. We also compete for overall advertising spending with other alternative advertising media companies,

such as Internet, wireless communications, street furniture, billboard, frame and public transport advertising companies, and with

traditional advertising media, such as newspapers, television, magazines and radio.

In

the future, we may also face competition from new entrants into the out-of-home television advertising sector. Our sector is characterized

by relatively low fixed costs and, as is customary in the advertising industry. In addition, since December 10, 2005, wholly foreign-owned

advertising companies are allowed to operate in China, which may expose us to increased competition from international advertising

media companies attracted to opportunities in China.

Increased

competition could reduce our operating margins and profitability and result in a loss of market share. Some of our existing and

potential competitors may have competitive advantages, such as significantly greater financial, marketing or other resources, or

exclusive arrangements with desirable locations, and others may successfully mimic and adopt our business model. Moreover, increased

competition will provide advertisers with a wider range of media and advertising service alternatives, which could lead to lower

prices and decreased revenues, gross margins and profits. We cannot assure you that we will be able to successfully compete against

new or existing competitors.

We do not

maintain any business liability disruption or litigation insurance coverage for our operations, and any business liability, disruption

or litigation we experience might result in our incurring substantial costs and the diversion of resources.

While

business disruption insurance is available to a limited extent in China, we have determined that the risks of disruption, cost

of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical

for us to have such insurance. As a result, we do not have any business liability, disruption or litigation insurance coverage

for our operations of advertising and media business in China. Any business disruption or litigation may result in our incurring

substantial costs and the diversion of resources.

Any negative

publicity with respect to us in general or our partners may materially and adversely affect our reputation, business and results

of operations.

Complaints,

litigation, regulatory actions or other negative publicity that arise about the advertising industry in general or our company

in particular, including on the quality, effectiveness and reliability of privacy and security practices, and advertising content,

even if inaccurate, could adversely affect our reputation and client confidence in, and the use of, our solutions. Harm to our

reputation and client confidence can also arise for many other reasons, including employee misconduct, misconduct of our data and

content distribution channel partners, data center providers or other counterparties, failure by these persons or entities to meet

minimum quality standards or otherwise fulfill their contractual obligations or to comply with applicable laws and regulations.

Additionally, negative publicity with respect to our data or content distribution channel partners could also affect our business

and results of operation to the extent that we rely on these partners or if marketers or marketing agencies associate our company

with such partners.

If we fail

to promote or maintain our brand in a cost-efficient manner, our business and results of operations may be harmed.

We

believe that developing and maintaining awareness of our brand in a cost-effective manner is critical to achieving widespread acceptance

of our platforms, and is an important element in attracting new clients and partners. Furthermore, we believe that the importance

of brand recognition will increase as competition in our market increases. Successful promotion of our brand will depend largely

on our ability to deliver value propositions to marketers and on the effectiveness of our marketing efforts If we fail to successfully

promote and maintain our brand, or incur substantial expenses in an unsuccessful attempt to promote and maintain our brand, we

may fail to attract enough new clients or retain our existing clients and our business and results of operations can be materially

and adversely affected.

Risks Relating

to Regulations of Our Adverting and Media Business

Our business

operations may be affected by legislative or regulatory changes.

There

are no existing PRC laws, rules or regulations that specifically define or regulate advertising on billboards. Moreover, we cannot

assure you that any new laws, rules or regulations governing advertising on billboards, or out-of-home advertising generally, would

not be burdensome to us or otherwise increase compliance and other costs or have a material adverse effect on our business and

operations. We also cannot predict the timing and effects of any such new laws, rules or regulations. Changes in laws, rules and

regulations governing advertising services, our business licenses or any other aspects of our business and operations may result

in substantial additional costs as well as diversion of resources, and could have a material adverse effect on our financial condition,

results of operations and prospects.

Adverse

changes in the political and economic policies of the PRC government could significantly decrease the overall economic growth of

the PRC, which could lead to a reduction in demand for our services and materially and adversely affect our business, financial

conditions, results of operations and prospects.

Substantially

all of our assets are located in the PRC and substantially all of our revenues are derived from our operations in the PRC. Accordingly,

our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal