As filed with the Securities and Exchange Commission

on , 2021.

Registration No. 333 -_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Powerbridge Technologies

Co., Ltd.

|

Cayman Islands

|

|

7371

|

|

Not applicable

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

1st Floor, Building D2, Southern

Software Park

Tangjia Bay, Zhuhai, Guangdong 519080, China

Tel: +86-756-339-5666

(Address, including zip code, and telephone number, including

area code, of principal executive offices)

Copies to:

Yu Wang Esq.

King & Wood Mallesons

13/F Gloucester Tower, The Landmark, 15 Queen's

Road Central

Central, Hong Kong

+1-852-34431150

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Approximate date of commencement of proposed

sale to the public: Promptly after the effective date of this registration statement.

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following

box: ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

† The term “new or revised financial

accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification

after April 5, 2012.

CALCULATION OF REGISTRATION FEE

|

Title of Class of Securities to

be Registered

|

|

Amount

to

be

Registered

|

|

|

Proposed

Maximum

Aggregate

Price

Per Share(2)

|

|

|

Proposed

Maximum

Aggregate

offering

Price

|

|

|

Amount

of

Registration

Fee(1)

|

|

|

convertible notes(3)(4)

|

|

|

4,000,000

|

|

|

$

|

1.00

|

|

|

$

|

4,000,000

|

|

|

$

|

436.4

|

|

|

warrants(3)(4)

|

|

|

653,061

|

|

|

$

|

3.675

|

|

|

$

|

2,399,999

|

|

|

$

|

261.8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

4,653,061

|

|

|

$

|

-

|

|

|

$

|

6,399,999

|

|

|

$

|

698.2

|

|

|

|

(1)

|

The

registration fee for securities is based on an estimate of the Proposed Maximum Aggregate

Offering Price of the securities, assuming the sale of the maximum number of shares at the

highest expected offering price, and such estimate is solely for the purpose of calculating

the registration fee pursuant to Rule 457(o).

|

|

|

(2)

|

Estimated solely for the

purpose of calculating the registration fee in accordance with Rule 457(c) under the Securities

Act.

|

|

|

(3)

|

Please

refer to “The Offering” in this prospectus for more details.

|

|

|

(4)

|

Pursuant

to Rule 416 of the Securities Act, the securities being registered hereunder include such

additional securities as may be issued after the date hereof as a result of share splits,

share dividends or similar transactions.

|

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this registration statement shall become effective in accordance with Section 8(a) of the Securities Act of

1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to such Section 8(a), may determine.

The information in

this prospectus is not complete and may be changed. We and the selling shareholder may not sell the securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

we are not soliciting any offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

SUBJECT TO COMPLETION

PROSPECTUS DATED ,

2021

Powerbridge Technologies Co., Ltd.

$4,000,000 Convertible Notes

653,061 Warrants

Pursuant to this prospectus, we are offering (the “Offering”)

(i) US$2,000,000 aggregate principal amount of the 6% convertible note due August 5, 2022 (the “First Note”); (ii)

US$2,000,000 aggregate principal amount of the 6% convertible note to be issued upon or shortly after the effectiveness of this Prospectus

and due on the one-year anniversary of the issuance date (the “Second Note”, and together with the First Note, the

“Notes”); and (iii) warrants to purchase 653,061 Ordinary Share (the “Warrants”), to YA II PN, Ltd.

(the “Investor”).

The Notes have a conversion price of the lower of (1) US$3.675 per

Ordinary Shares; or (2) 90% of the lowest daily VWAP (the dollar volume-weighted average price for ordinary shares on the Nasdaq Capital

Market) during the ten consecutive trading days immediately preceding the conversion date or other date of determination, but not lower

than US$1.00 per Ordinary Share or any reset lowest price as applicable (the “Conversion Price”). The Conversion Price

is subject to adjustment in the case of a subdivision, combination or re-classification, and future issuance of Ordinary Shares. The Principal

and the interest payable under the First Note and the Second Note will mature on August 5, 2022 and the one year anniversary of the issuance

date, respectively, (each, the “Maturity Date”), unless earlier converted or redeemed by us. At any time before the

Maturity Date, the Investor may convert the Notes at their option into our Ordinary Shares at the Conversion Price.

We have the right, but not

the obligation, to redeem (“Optional Redemption”) a portion or all amounts outstanding under the Note prior to the

Maturity Date at a cash redemption price equal to the outstanding Principal balance to be redeemed, plus the application redemption premium

and plus accrued and unpaid interest, if any; provided that the trading price of the Ordinary Shares is less than US3.675 per Ordinary

Shares, and we provide the holder of the Note at least 15 business days’ prior written notice of our desire to exercise an Optional

Redemption. The holder shall have the right to elect to convert all or any part of the Notes after receiving a redemption notice, in which

case the redemption amount shall be reduced by the amount so converted.

The Warrants grant the holder

the right to purchase an aggregate of 653,061 Ordinary Shares. Each Warrant will have an exercise price of US$3.675 per ordinary share,

exercisable commencing on the date of issuance and will expire in five years from the date of issuance.

This prospectus also covers

the sale of ordinary shares issuable to the Investor upon (i) the conversion or redemption of the Notes; and (ii) the exercise of the

Warrants. For additional information on the methods of sale that may be used by the Investor, see the section entitled “Plan of

Distribution” on page 17.

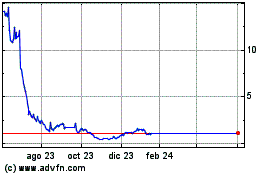

Our ordinary shares are listed

on the Nasdaq Capital Market under the symbol “PBTS”. On September 27, 2021, the closing price for our ordinary share on the

Nasdaq Capital Market was $1.33 per ordinary share.

We are a holding company incorporated

in the Cayman Islands. As a holding company with no material operations of our own, we conduct a substantial majority of our operations

through our operating entities established in the People’s Republic of China, which are our indirect subsidiaries. Unless otherwise

stated, as used in this prospectus supplement, “we”, “us”, “our company”, “our”, or “PBTS”

refers to Powerbridge Technologies Co., Ltd., and its subsidiaries. Because of our corporate structure, we are subject to risks due to

the uncertainty of the interpretation and the application of the PRC laws and regulations, including but not limited to the risks of uncertainty

about any future actions of the PRC government on U.S. listed companies. We may also subject to sanctions imposed by PRC regulatory agencies,

including Chinese Securities Regulatory Commission (“CSRC”), if we fail to comply with their rules and regulations,

which will result in a material change in our financial performance and our results of operations and/or the value of our ordinary shares,

and could cause the value of such securities to significantly decline or become worthless.

In addition, we are subject to certain legal and operational risks

associated with our operations in China. PRC laws and regulations governing our current business operations are sometimes subject to interpretation

of the competent authorities, which may result in a material change in our subsidiaries’ operations, significant depreciation of

the value of our ordinary shares, or a complete hinderance of our ability to offer or continue to offer our securities to investors and

cause the value of such securities to significantly decline or be worthless. Recently, the PRC government initiated a series of regulatory

actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities

in the securities market, enhancing supervision over China-based companies listed overseas, adopting new measures to extend the scope

of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. We do not expect to be subject to cybersecurity review

with the Cyberspace Administration of China (“CAC”) if the draft Measures for Cybersecurity Censorship become effective

as they are published, since: (i) our products and services are offered not directly to individual consumers; (ii) we do not possess a

large amount of personal information in our business operations; and (iii) data processed in our business does not have a bearing on national

security and thus may not be classified as core or important data by the authorities. Since these statements and regulatory actions are

new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws

or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact such

modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on

an U.S. or other foreign exchange. Please refer to “Risk Factors – Risks Related to Doing Business in China” of the

Annual Report on Form 20-F for the fiscal year ended December 31, 2020, as filed with the Securities and Exchange Commission (the “SEC”)

dated July 13, 2021 for more details.

The Notes and Warrants

offered in this prospectus are those of Powerbridge Technologies Co., Ltd., our Cayman Islands holding company.

Investing in our securities

involves a high degree of risk. Before making an investment decision, please read “Risk Factors” and any other risk

factors included in this prospectus and our Annual Report on Form 20-F for the fiscal year ended December 31, 2020, as filed with the

SEC and any accompanying prospectus supplements and in the documents incorporated by reference into this prospectus or any prospectus

supplement.

Neither the SEC nor any

state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

This prospectus does not

constitute, and there will not be, an offering of securities to the public in the Cayman Islands.

|

|

|

The Notes

|

|

|

Offering Price

|

|

$

|

4,000,000

|

|

|

Original Issue Discount

|

|

$

|

120,000

|

|

|

Placement Agent’s Fee

|

|

$

|

360,000

|

|

|

Proceeds, before expense, to us

|

|

$

|

3,520,000

|

|

The date of this prospectus is _____________,

2021.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus may constitute “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”)

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements relate to

future events concerning our business and to our future revenues, operating results and financial condition. In some cases, you can identify

forward-looking statements by terminology such as “may”, “will”, “could”, “would”, “should”,

“expect”, “plan”, “anticipate”, “intend”, “believe”, “estimate”

“forecast”, “predict”, “propose”, “potential” or “continue” or the negative

of those terms or other comparable terminology.

Any forward-looking statements

contained in this prospectus are only estimates or predictions of future events based on information currently available to our management

and management’s current beliefs about the potential outcome of the future events. Whether these future events will occur as management

anticipates, whether we will achieve our business objectives, and whether our revenues, operating results or financial condition will

improve in future periods are subject to numerous risks. There are a number of important factors that could cause actual results to differ

materially from the results anticipated by these forward-looking statements. These important factors include those that we discuss under

the heading “Risk Factors” and in other sections of our Annual Report on Form 20-F for the year ended December 31, 2020,

including all amendments thereto, as filed with the SEC, as well as in our other reports filed from time to time with the SEC that are

incorporated by reference into this prospectus. You should read these factors and the other cautionary statements made in this prospectus

and in the documents we incorporate by reference into this prospectus as being applicable to all related forward-looking statements wherever

they appear in this prospectus or the documents we incorporate by reference into this prospectus. If one or more of these factors materialize,

or if any underlying assumptions prove to be incorrect, our actual results, performance or achievements may vary materially from any

future results, performance or achievements expressed or implied by these forward-looking statements. We undertake no obligation to publicly

update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 that

we filed with the SEC.

You should read this prospectus,

exhibits filed as part of the registration statement and the information and documents incorporated by reference carefully. Such documents

contain important information that you should consider when making your investment decision. See “Where You Can Find Additional

Information” and “Incorporation of Information by Reference” in this prospectus.

You should rely only on the information provided in this prospectus,

exhibits filed as part of the registration statement or documents incorporated by reference into this prospectus. We have not authorized

anyone to provide you with different information. This prospectus covers offers and sales of our securities only in jurisdictions in which

such offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus,

regardless of the time of delivery of this prospectus or of any sale of our ordinary shares. You should not assume that the information

contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, or that the information

contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference,

regardless of the time of delivery of this prospectus or any sale of a security.

In this prospectus, we refer

to Powerbridge Technologies Co., Ltd. as “we”, “us”, “our”, the “Company” or “Powerbridge”.

You should rely only on the information which we have provided or incorporated by reference in this prospectus, exhibits filed as part

of the registration statement, any applicable prospectus supplements and any related free writing prospectus. We have not authorized

anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information or to

represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus.

PROSPECTUS SUMMARY

Our Company

We are a provider of software

application and technology solutions and services to corporate and government customers primarily located in China. We introduced global

trade software applications when we launched our operations in 1997 with a vision to make global trade operations easier for our customers.

Since our inception, we have continued to innovate by developing technologies that enable us to successfully deliver a series of solutions

and services that address the evolving and changing needs of our corporate and government customers. Our mission is to make global trade

easier by empowering all players in the ecosystem.

Our customers are corporate

and government organizations engaged in global trade. Our corporate customers are import and export companies, manufacturers engaged

in international trade, as well as logistics and other service providers. Our government customers include customs and other government

agencies that oversee the flow of goods and services across borders, as well as government authorities and organizations that manage

and operate free trade and bonded trade zones, ports and terminals, and other international trade facilities.

Global trade involves complicated

and cumbersome processing, manual handling of voluminous documents, extended and complex cross-organization workflows as well as a great

number of business and government players in the global trade ecosystem. We estimated that a typical process for an export shipment in

China may involve one exporter, eight government agencies and authorities as well as 12 various logistics and financial service providers

with more than 60 people engaged in 13 different work processes that generate more than 55 regulatory compliance and trade logistics

documents and 150 information or message exchanges.

Our customers are facing

more challenges as the world’s trade ecosystems continue to grow in size and complexity. Costs associated with global trade, such

as logistics performance, border control and international connectivity remain high. Potential savings from more collaborative and efficient

trade processes could reduce the costs of global trade significantly. The need for greater efficiency and cost savings are driving the

transformative shift for participants in global trade to become more connected and collaborative.

Our comprehensive and robust

solutions and services include Powerbridge System Solutions and Powerbridge SaaS Services with more than 40 solutions and

services deployable on premise and in the cloud. Leveraging our deep domain knowledge and strong industry experience, we provide a series

of differentiated and robust solutions and services that address the mission critical needs of our corporate and government customers,

enabling them to handle and simplify the complexities of global trade operations, logistics and compliance.

We provide Powerbridge

System Solutions to our corporate and government customers who engaged in global trade, including businesses and manufacturers across

a broad range of industries, government agencies and regulatory authorities, as well as global trade logistics and other service providers.

Powerbridge System Solutions enable our customers to streamline their trade operations, trade logistics and regulatory compliance,

consisting of Trade Enterprise Solutions and Trade Compliance Solutions which have been in service since our first introduction

twenty years ago and Import & Export Loan and Insurance Processing which have recently been introduced to a selected group

of customers. We believe Powerbridge System Solutions provide the following core benefits to our customers:

|

|

●

|

Import and export businesses and manufacturers in diverse vertical

industries use our Trade Enterprise Solutions to manage business operations, simplify trade processes, reduce document

handling, minimize operational cost and increase overall productivity.

|

|

|

●

|

Our Trade Compliance Solutions enable government agencies

and regulatory authorities greater control and security, better use of resources, higher duty collection, faster processing time

and higher compliance efficiency in servicing global trade businesses and logistics service providers.

|

|

|

●

|

Our newly introduced Import &

Export Loan and Insurance Processing is designed to facilitate and streamline global trade related loan and insurance

processes. It enables businesses, financial and insurance service involved in global trade to reduce workflow complexity, processing

time and operational cost while increase processing efficiency.

|

We began offering our Powerbridge

SaaS Services (software-as-a-service) in 2016 and are continually developing and expanding our SaaS services that provide our corporate

and government customers with significant benefits, including better use of resources, a lower cost of operations, easier document handling,

faster processing time as well as higher logistics and compliance connectivity and efficiency. Powerbridge SaaS Services include

Logistics Service Cloud and Trade Zone Operations Cloud which are in service, and Inward Processed Manufacturing Cloud,

Cross-Border eCommerce Cloud and Import & Export Loan and Insurance Processing Service Cloud which are in development.

We believe Powerbridge SaaS Services encompass the following core advantages:

|

|

●

|

Lower total cost of ownership. Unlike the traditional software

model, our on-demand services enable our customers to have access anytime and anywhere without the upfront spending in software and

hardware.

|

|

|

●

|

Rapid deployment and configuration. Our services are designed

to be deployed and configured rapidly through our application programming interfaces.

|

|

|

●

|

Flexible and scalable. Our flexible and extensible architecture

enables us to offer services that are scalable and adjustable to quickly address the different needs of our diverse group of customers.

|

|

|

●

|

Reliable and secure. Our multi-tenant and microservice technology

architectures allow us to design our services to provide our customers with a high level of performance, reliability and security.

|

|

|

●

|

Intuitive and ease of use. Our

services are designed to be intuitive and easy to use with interfaces that are simple and user friendly. Our users are able to

learn and use our services without specialized trainings.

|

We have begun offering our

cloud-based Powerbridge BaaS Services (blockchain-as-a-service) with designated use case for limited government customer

in June 2019 and we have generated limited revenue from it. We continue to develop our BaaS Services for market commercialization. Blockchain

technology is emerging as a major disruptive force across many industries including those involved in global trade. We believe that blockchain

technology could allow our customers to conduct business in more synchronized and collaborative ways to substantially increase operational

efficiency and reduce trade costs across the global trade supply chain.

Our solutions and services

are built from our multiple proprietary technology platforms which are developed based on industry leading open source infrastructure

technologies. Our technology platforms include Powerbridge System Platform and Powerbridge SaaS Platform, which are designed

for high-performance reliability, flexibility and scalability, allowing us to expand our solutions and services rapidly and efficiently

to consistently address the needs of our corporate and government customers. Our Powerbridge BaaS Platform became available in

June 2019.

We currently derive our revenues

from three sources: (i) revenue from application development services generated from Powerbridge System Solutions, which require

us to perform services including project planning, project design, application development and system integration based on customers’

specific needs. These services also require significant production and customization; (ii) revenue from consulting and technical support

services primarily generated from Powerbridge System Solutions; and (iii) revenue from subscription services generated from Powerbridge

SaaS Services. We currently generate most of our revenues from application development services, which represented 78.2% and 82.5%

of the total revenue for the fiscal years ended December 31, 2019 and 2020, respectively. Revenue from consulting and technical support

services represented 16.5% and 14.2% of the total revenue for the fiscal years ended December 31, 2019 and 2020, respectively. Revenue

from subscription services represented 5.3% and 3.3% of the total revenue for the fiscal years ended December 31, 2019 and 2020, respectively.

For the fiscal years ended December 31, 2019 and 2020, our revenues were US$20.1 million and US$26.7 million, respectively.

Our customers include: (i)

international trade businesses and manufacturers; (ii) government agencies and authorities; and (iii) logistics and other various service

providers. During the fiscal year ended December 31, 2020, we generated revenue from a total of 602 customers, of which 373 are international

trade businesses and manufacturers, 33 are government agencies and authorities, and 196 are logistics and other service providers. During

the fiscal year ended December 31, 2019, we generated revenue from a total of 488 customers, of which 312 are international trade businesses

and manufacturers, 29 are government agencies and authorities, and 147 are logistics and other service providers.

We generate a significant

portion of our revenues from a relatively small number of major customers. For the year ended December 31, 2020, one customer accounted

for 25.7% of the Company’s total revenues. For the year ended December 31, 2019, two customers accounted for 21.8% and 10.7% of

the Company’s total revenues, respectively.

As of the date of this prospectus,

we had a total of 236 full-time employees, of which 106 are in research and development, 39 are in sales and marketing, 52 are

in technical and customer services, and 39 are in general and administration.

THE OFFERING

|

Notes

|

US$4,000,000

aggregate principal amount of 6% convertible notes, including US$2,000,000 principal amount for the First Note

and US$2,000,000 principal amount for the Second Note.

|

|

Warrants

|

Warrants to purchase 653,061

ordinary shares. Each Warrant will have an exercise price of US$3.675 per Ordinary Share, exercisable commencing on the date of issuance

and will expire in five years from the date of issuance. For additional information regarding the Warrants, see “Description of

Share Capital”.

|

|

Investor

|

YA II PN, Ltd.

|

|

Conversion Price

|

The Notes are convertible into Ordinary Shares at the lower of (1)

US$3.675 per ordinary shares, or (2) 90% of the lowest daily VWAP during ten consecutive trading days immediately preceding the conversion

date or other date of determination, but not lower than US$1.00 per ordinary share. The Conversion Price is subject to adjustment in the

case of a subdivision, combination or re-classification, and future issuance of ordinary shares.

|

|

Maximum number of ordinary shares issuable

|

4,653,061 ordinary shares, including (i) 4,000,000 ordinary shares

upon the conversion of the Notes and (ii) 653,061 ordinary shares upon the exercise of the Warrants.

|

|

Interest

|

6% per annum payable on August 5, 2022 for the First Note and the one-year

anniversary of the issuance date for the Second Note.

|

|

Ranking

|

The Notes will be our general unsecured

obligation and will be equal in right of payment to any of our unsecured indebtedness that is not so subordinated and effectively

junior in right of payment to any of our secured indebtedness.

|

|

Maturity

|

August 5, 2022 for the First Note and

on the one-year anniversary of the issuance date for the Second Note, unless converted or redeemed prior to such dates

|

|

Proceeds, before expenses, to us

|

US$4,000,000

|

|

Net Proceeds to us

|

US$3,520,000

|

|

Optional Redemption

|

We have the right, but not the obligation, to redeem a portion or all

amounts outstanding under the Notes prior to the respective Maturity Dates at a cash redemption price equal to the outstanding principal

balance to be redeemed, plus the application redemption premium and plus accrued and unpaid interest, if any; provided that the trading

price of the ordinary shares is less than US$3.675 per ordinary share, and we provide the holder of the Notes at least fifteen business

days’ prior written notice of our desire to exercise an Optional Redemption. The holder shall have rights to elect to convert all

or any part of the Notes prior to the redemption date, in which case the redemption amount shall be reduced by the amount so converted.

|

|

Use of Proceeds

|

We estimate that we will receive net

proceeds of approximately US$3,520,000 from this offering, after deducting estimated offering expenses payable by us.

We anticipate using the net proceeds of this

offering primarily for the general corporate purposes and working capital.

|

|

Transfer agent and registrar

|

Transhare Corporation

|

|

Listing

|

Our Ordinary Shares are listed on the Nasdaq Capital Market under the

symbol “PBTS.” There is no established public trading market for the Notes or the Warrants and we do not expect a market to

develop. We do not intend to apply for listing of the Notes or the Warrants on any securities exchange or other nationally recognized

trading system. Without an active trading market, the liquidity of the Note will be limited.

|

|

Risk Factors

|

Investing in our securities involves a high

degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our securities, see the

information contained in or incorporated by reference under the heading “Risk Factors” beginning on page 4 of this

prospectus, and in the other documents incorporated by reference into this prospectus.

|

RISK FACTORS

An investment in our ordinary

shares involves risks. Prior to making a decision about investing in our ordinary shares, you should consider carefully all of the information

contained or incorporated by reference in this prospectus, including any risks in the section entitled “Risk Factors” contained

in any supplements to this prospectus and in our Annual Report on Form 20-F for the fiscal year ended December 31, 2020, as amended to

date, and in our subsequent filings with the SEC. Each of the referenced risks and uncertainties could adversely affect our business,

operating results and financial condition, as well as adversely affect the value of an investment in our securities. Additional risks

not known to us or that we believe are immaterial may also adversely affect our business, operating results and financial condition and

the value of an investment in our securities.

Save as the risk factors

disclosed in our Annual Report on Form 20-F for the fiscal year ended December 31, 2020 filed with the SEC on July 13, 2022, we are also

subject to additional risk factors in relation to our corporate structure and business operations as set forth below:

Risks Related to Doing Business in China

Substantial uncertainties exist with respect

to the interpretation and implementation of PRC Foreign Investment Law and how it may impact the viability of our current corporate structure,

corporate governance and business operations.

On March 15, 2019, the

National People’s Congress approved the Foreign Investment Law, which took effect on January 1, 2020 and replaced three existing

laws on foreign investments in China, namely, the PRC Equity Joint Venture Law, the PRC Cooperative Joint Venture Law and the Wholly

Foreign-owned Enterprise Law, together with their implementation rules and ancillary regulations. The Foreign Investment Law embodies

an expected PRC regulatory trend to rationalize its foreign investment regulatory regime in line with prevailing international practice

and the legislative efforts to unify the corporate legal requirements for both foreign and domestic invested enterprises in China. The

Foreign Investment Law establishes the basic framework for the access to, and the promotion, protection and administration of foreign

investments in view of investment protection and fair competition.

According to the Foreign

Investment Law, “foreign investment” refers to investment activities directly or indirectly conducted by one or more natural

persons, business entities, or otherwise organizations of a foreign country (collectively referred to as “foreign investor”)

within China, and the investment activities include the following situations: (i) a foreign investor, individually or collectively with

other investors, establishes a foreign-invested enterprise within China; (ii) a foreign investor acquires stock shares, equity shares,

shares in assets, or other like rights and interests of an enterprise within China; (iii) a foreign investor, individually or collectively

with other investors, invests in a new project within China; and (iv) investments in other means as provided by laws, administrative

regulations, or the State Council.

According to the Foreign

Investment Law, the State Council will publish or approve to publish the “negative list” for special administrative measures

concerning foreign investment. The Foreign Investment Law grants national treatment to foreign-invested entities, (“FIEs”),

except for those FIEs that operate in industries deemed to be either “restricted” or “prohibited” in the “negative

list”. Because the “negative list” has yet to be published, it is unclear whether it will differ from the current Special

Administrative Measures for Market Access of Foreign Investment (Negative List). The Foreign Investment Law provides that FIEs operating

in foreign restricted or prohibited industries will require market entry clearance and other approvals from relevant PRC governmental

authorities. If a foreign investor is found to invest in any prohibited industry in the “negative list”, such foreign investor

may be required to, among other aspects, cease its investment activities, dispose of its equity interests or assets within a prescribed

time limit and have its income confiscated. If the investment activity of a foreign investor is in breach of any special administrative

measure for restrictive access provided for in the “negative list”, the relevant competent department shall order the foreign

investor to make corrections and take necessary measures to meet the requirements of the special administrative measure for restrictive

access.

The PRC government will

establish a foreign investment information reporting system, according to which foreign investors or foreign-invested enterprises shall

submit investment information to the competent department for commerce concerned through the enterprise registration system and the enterprise

credit information publicity system, and a security review system under which the security review shall be conducted for foreign investment

affecting or likely affecting the state security.

Furthermore, the Foreign

Investment Law provides that foreign invested enterprises established according to the existing laws regulating foreign investment may

maintain their structure and corporate governance within five years after the implementing of the Foreign Investment Law.

In addition, the Foreign

Investment Law also provides several protective rules and principles for foreign investors and their investments in the PRC, including,

among others, that a foreign investor may freely transfer into or out of China, in Renminbi or a foreign currency, its contributions,

profits, capital gains, income from disposition of assets, royalties of intellectual property rights, indemnity or compensation lawfully

acquired, and income from liquidation, among others, within China; local governments shall abide by their commitments to the foreign

investors; governments at all levels and their departments shall enact local normative documents concerning foreign investment in compliance

with laws and regulations and shall not impair legitimate rights and interests, impose additional obligations onto FIEs, set market access

restrictions and exit conditions, or intervene with the normal production and operation activities of FIEs; except for special circumstances,

in which case statutory procedures shall be followed and fair and reasonable compensation shall be made in a timely manner, expropriation

or requisition of the investment of foreign investors is prohibited; and mandatory technology transfer is prohibited.

The Chinese government exerts substantial

influence over the manner in which we must conduct our business activities. We are currently not required to obtain approval from

Chinese authorities to list on U.S exchanges, however, if our holding company were required to obtain approval in the future and were

denied permission from Chinese authorities to list on U.S. exchange, we will not be able to continue listing on any U.S. exchange, which

would materially affect the interest of the investors.

The Chinese government has

exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state

ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation,

environmental regulations, land use rights, properties and other matters. The central or local governments of these jurisdictions may

impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on

our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including

any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local

variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular

regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties.

As such, our business

segments may be subject to various government and regulatory oversight in the provinces in which we operate. We could

be subject to regulation by various political and regulatory entities, including various local and municipal agencies and government

sub-divisions. We may incur increased costs necessary to comply with existing and newly adopted laws and regulations or

penalties for any failure to comply.

Furthermore, it is

uncertain when and whether the Company will be required to obtain permission from the PRC government to make registered offering on

a U.S. exchange in the future, and even when such permission is obtained, whether it will be denied or rescinded. Although we are

currently not required to obtain permission from the PRC government or any local government to obtain such permission and have not

received any denial to make registered offering on a U.S. exchange, our operations could be adversely affected, directly or

indirectly, by existing or future laws and regulations relating to our business or industry. Such risk could result in significant

depreciation of the value of our ordinary shares, or a complete hinderance of our ability to offer or continue to offer our

securities to investors and cause the value of such securities to significantly decline or be worthless.

Recent regulatory

initiatives implemented by the PRC competent government authorities on cyberspace data security may have introduced uncertainty in our

business operations and compliance status.

Recently,

the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued

the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the Opinions, which was made

available to the public on July 6, 2021. The Opinions emphasized the need to strengthen the administration over illegal securities activities,

and the need to strengthen the supervision over overseas listings by Chinese companies. Effective measures, such as promoting the construction

of relevant regulatory systems will be taken to deal with the risks and incidents of China-concept overseas listed companies, and cybersecurity

and data privacy protection requirements and similar matters. On July 10, 2021, the Cyberspace Administration of China issued a revised

draft of the Measures for Cybersecurity Review for public comments, which required that, any data processing operators controlling personal

information of no less than one million users which seeks to list in a foreign stock exchange should also be subject to cybersecurity

review, and further elaborated the factors to be considered when assessing the national security risks of the relevant activities. However,

the revised draft of the Measures for Cybersecurity Review is in the process of being formulated and the Opinions remain unclear on how

it will be interpreted, amended and implemented by the relevant PRC governmental authorities. Thus, it is still uncertain how PRC governmental

authorities will regulate overseas listing in general and whether we are required to obtain any specific regulatory approvals. Furthermore,

if the China Securities Regulatory Commission, or the CSRC or other regulatory agencies later promulgate new rules or explanations requiring

that we obtain their approvals for this offering and any follow-on offering, we may be unable to obtain such approvals which could significantly

limit or completely hinder our ability to offer or continue to offer securities to our investors.

The recent joint statement by the SEC and

the Public Company Accounting Oversight Board (United States), or the “PCAOB,” proposed rule changes submitted by Nasdaq

and the Holding Foreign Companies Accountable Act all call for additional and more stringent criteria to be applied to emerging market

companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These

developments could add uncertainties to our offering.

The lack of access to the

PCAOB inspection in China prevents the PCAOB from fully evaluating audits and quality control procedures of the auditors based in China.

As a result, the investors may be deprived of the benefits of such PCAOB inspections. The inability of the PCAOB to conduct inspections

of auditors in China makes it more difficult to evaluate the effectiveness of these accounting firms’ audit procedures or quality

control procedures as compared to auditors outside of China that are subject to the PCAOB inspections, which could cause existing and

potential investors in our stock to lose confidence in our audit procedures and reported financial information and the quality of our

financial statements.

On April 21, 2020, SEC Chairman

Jay Clayton and PCAOB Chairman William D. Duhnke III, along with other senior SEC staff, released a joint statement highlighting the

risks associated with investing in companies based in or have substantial operations in emerging markets including China. The joint statement

emphasized the risks associated with lack of access for the PCAOB to inspect auditors and audit work papers in China and higher risks

of fraud in emerging markets.

On May 18, 2020, Nasdaq filed

three proposals with the SEC to (i) apply minimum offering size requirement for companies primarily operating in “Restrictive Market”;

(ii) adopt a new requirement relating to the qualification of management or board of director for Restrictive Market companies; and (iii)

apply additional and more stringent criteria to an applicant or listed company based on the qualifications of the company’s auditors.

On May 20, 2020, the U.S.

Senate passed the Holding Foreign Companies Accountable Act requiring a foreign company to certify it is not owned or controlled by a

foreign government if the PCAOB is unable to audit specified reports because the company uses a foreign auditor not subject to PCAOB

inspection. If the PCAOB is unable to inspect the company’s auditors for three consecutive years, the issuer’s securities

are prohibited to trade on a national exchange. On December 2, 2020, the U.S. House of Representatives approved the Holding Foreign Companies

Accountable Act. On December 18, 2020, the Holding Foreign Companies Accountable Act was signed into law.

On March 24, 2021, the SEC

announced that it had adopted interim final amendments to implement congressionally mandated submission and disclosure requirements of

the Act. The interim final amendments will apply to registrants that the SEC identifies as having filed an annual report on Forms 10-K,

20-F, 40-F or N-CSR with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and

that the PCAOB has determined it is unable to inspect or investigate completely because of a position taken by an authority in that jurisdiction.

The SEC will implement a process for identifying such a registrant and any such identified registrant will be required to submit documentation

to the SEC establishing that it is not owned or controlled by a governmental entity in that foreign jurisdiction, and will also require

disclosure in the registrant’s annual report regarding the audit arrangements of, and governmental influence on, such a registrant.

On June 22, 2021, the U.S.

Senate passed a bill which, if passed by the U.S. House of Representatives and signed into law, would reduce the number of consecutive

non-inspection years required for triggering the prohibitions under the Holding Foreign Companies Accountable Act from three years to

two.

Our current auditor, Onestop Assurance PAC, the independent registered

public accounting firm that issues the audit report incorporated by reference in the Annual Report on Form 20-F for the fiscal year ended

December 31, 2020, is an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, and

subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable

professional standards. Onestop Assurance PAC is headquartered in the Singapore and is subject to inspection by the PCAOB on a regular

basis.

The recent developments

would add uncertainties to our offering and we cannot assure you whether Nasdaq or regulatory authorities would apply additional and

more stringent criteria to us after considering the effectiveness of our auditor’s audit procedures and quality control procedures,

adequacy of personnel and training, or sufficiency of resources, geographic reach or experience as it relates to the audit of our financial

statements. It remains unclear what the SEC’s implementation process related to the March 2021 interim final amendments will entail

or what further actions the SEC, the PCAOB or Nasdaq will take to address these issues and what impact those actions will have on U.S.

companies that have significant operations in the PRC and have securities listed on a U.S. stock exchange. In addition, the March 2021

interim final amendments and any additional actions, proceedings, or new rules resulting from these efforts to increase U.S. regulatory

access to audit information could create some uncertainty for investors, the market price of our ordinary shares could be adversely affected.

Trading of our securities may be prohibited and, as a result, we could be delisted. If we and our auditor are unable to meet the PCAOB

inspection requirements or we are required to engage a new audit firm, any such determination would require significant expenses and

management time.

The approval of the China Securities Regulatory

Commission may be required in connection with this offering, and, if required, we cannot predict whether we will be able to obtain such

approval.

The Regulations on Mergers

and Acquisitions of Domestic Companies by Foreign Investors, or the M&A Rules, adopted by six PRC regulatory agencies requires an

overseas special purpose vehicle formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies

or individuals to obtain the approval of the China Securities Regulatory Commission (“CSRC”) , prior to the listing

and trading of such special purpose vehicle’s securities on an overseas stock exchange.

Our PRC counsel has advised

us that, based on our understanding of the current PRC laws, rules and regulations, the CSRC’s approval is not required for the

listing and trading of our ordinary shares on Nasdaq in the context of this offering, given that: (i) our PRC subsidiaries were incorporated

as a wholly foreign-owned enterprise by means of direct investment rather than by merger or acquisition of equity interest or assets

of a PRC domestic company owned by PRC companies or individuals, as defined under the M&A Rules, that are our beneficial owners;

(ii) the CSRC currently has not issued any definitive rule or interpretation concerning whether offerings like ours under this prospectus

are subject to the M&A Rules; and (iii) no provision in the M&A Rules clearly classifies contractual arrangements as a type of

transaction subject to the M&A Rules.

However, our PRC counsel

has further advised us that there remain some uncertainties as to how the M&A Rules will be interpreted or implemented in the context

of an overseas offering and its opinions summarized above are subject to any new laws, rules and regulations or detailed implementations

and interpretations in any form relating to the M&A Rules. We cannot assure you that relevant PRC government agencies, including

the CSRC, would reach the same conclusion as we do. If it is determined that CSRC approval is required for this offering, we may face

sanctions by the CSRC or other PRC regulatory agencies for failure to seek CSRC approval for this offering. These sanctions may include

fines and penalties on our operations in the PRC, limitations on our operating privileges in the PRC, delays in or restrictions on the

repatriation of the proceeds from this offering into the PRC, restrictions on, or prohibition of, the payments or remittance of dividends

by our PRC subsidiary, or other actions that could have a material and adverse effect on our business, financial condition, results of

operations, reputation and prospects, as well as the trading price of our ordinary shares. Furthermore, the CSRC or other PRC regulatory

agencies may also take actions requiring us, or making it advisable for us, to halt this offering before the settlement and delivery

of the ordinary shares that we are offering. Consequently, if you engage in market trading or other activities in anticipation of, and

prior to the settlement and delivery of, the ordinary shares we are offering, you would be doing so at the risk that the settlement and

delivery may not occur.

It may be difficult for overseas shareholders

and/or regulators to conduct investigation or collect evidence within China.

Shareholder claims or regulatory

investigation that are common in the United States generally are difficult to pursue as a matter of law or practicality in China. For

example, in China, there are significant legal and other obstacles to providing information needed for regulatory investigations or litigation

initiated outside China. Although the authorities in China may establish a regulatory cooperation mechanism with the securities regulatory

authorities of another country or region to implement cross-border supervision and administration, such cooperation with the securities

regulatory authorities in the Unities States may not be efficient in the absence of mutual and practical cooperation mechanism. Furthermore,

according to Article 177 of the PRC Securities Law, or Article 177, which became effective in March 2020, no overseas securities regulator

is allowed to directly conduct investigation or evidence collection activities within the territory of the PRC. Accordingly, without

governmental approval in China, no entity or individual in China may provide documents and information relating to securities business

activities to overseas regulators when it is under direct investigation or evidence discovery conducted by overseas regulators. While

detailed interpretation of or implementation rules under Article 177 have yet to be promulgated, the inability for an overseas securities

regulator to directly conduct investigation or evidence collection activities within China may further increase difficulties faced by

you in protecting your interests.

REGULATIONS

A

summary of the current major PRC laws and regulations that are relevant to our business and operation is included in “Item 3. Key

Information—Regulation” in our annual report on Form 20-F for the fiscal year ended December 31, 2020, that are incorporated

herein by reference into this prospectus and any applicable prospectus supplement. In addition, set forth below are certain recent major

PRC laws and regulations that are relevant to our business and operation.

Regulation under

the PRC Securities Law

The PRC Securities Law was

promulgated in December 1998 and was subsequently revised in August 2004, October 2005, June 2013, August 2014 and December 2019. According

to Article 177 of the PRC Securities Law, or Article 177, which became effective in March 2020, no overseas securities regulator is allowed

to directly conduct investigation or evidence collection activities within the territory of the PRC. While there is no detailed interpretation

regarding the rule implementation under Article 177, it will be difficult for an overseas securities regulator to conduct investigation

or evidence collection activities in China.

Regulations on Internet Privacy

In recent years, the PRC

governmental authorities have enacted legislation on internet use to protect personal information from any unauthorized disclosure. The

PRC law does not prohibit ICP operators from collecting and analyzing personal information of their users. However, the Administrative

Measures on Internet Information Services prohibit an ICP operator from insulting or slandering a third party or infringing the lawful

rights and interests of a third party. Pursuant to the Decision on Strengthening Network Information Protection promulgated by the Standing

Committee of the National People’s Congress in 2012, ICP operators that provide electronic messaging services must keep users’

personal information confidential and must not disclose such personal information to any third parties without the users’ consent

or unless required by law. The regulations further authorize the relevant telecommunications authorities to order ICP operators to rectify

unauthorized disclosure. ICP operators are subject to legal liabilities if the unauthorized disclosure results in damages or losses to

users. When relevant competent departments perform their duties to prevent, stop, investigate and deal with the illegal and criminal

acts of stealing or illegally obtaining, selling or illegally providing citizens' personal electronic information to others, as well

as other illegal and criminal acts of network information according to law, ICP operators shall cooperate and provide technical support.

In December 2011, the MIIT promulgated the Several Provisions on Regulating the Market Order of Internet Information Services, which

became effective in March 2012. Without obtaining the consent from the users, telecommunication business operators and ICP operators

may not collect or use the users’ personal information. The personal information collected or used in the course of provision of

services by the telecommunication business operators or ICP operators must be kept in strict confidence, and may not be divulged, tampered

with or damaged, and may not be sold or illegally provided to others. The ICP operators are required to take certain measures to prevent

any divulge, damage, tamper or loss of users’ personal information.

In December 2012, the Standing

Committee of the National People’s Congress of the PRC issued the Decision on Strengthening the Protection of Online Information.

Under this decision, ICP operators are required to take such technical and other measures necessary to safeguard information against

inappropriate disclosure. To further implement this decision and the relevant rules, MIIT issued the Regulation of Protection of Telecommunication

and Internet User Information in 2013.

In November 2016, the Standing

Committee of the National People’s Congress issued the Cyber Security Law, which came into effect on June 1, 2017. The Cyber Security

Law imposes certain data protection obligations on network operators, including that network operators may not disclose, tamper with,

or damage users’ personal information that they have collected, and that they are obligated to delete unlawfully collected information

and to amend incorrect information. Moreover, internet operators may not provide users’ personal information to others without

consent. Exempted from these rules is information irreversibly processed to preclude identification of specific individuals. Also, the

Cyber Security Law imposes breach notification requirements that will apply to breaches involving personal information.

On April 10, 2019, the Cyber

Security and Protection Bureau of the Ministry of Public Security, the Beijing Internet Industry Association and the Third Research Institute

of the Ministry of Public Security jointly issued the Internet Personal Information Security Protection Guide, or the Guide. The Guide

is applicable to enterprises that provide services through the internet, as well as organizations or individuals who use a private or

non-networked environment to control and process personal information. This indicates that in addition to the traditional internet companies,

companies or individuals in other fields, as long as they involve the control and processing of personal information, are all in the

scope of the Guide. The Guide imposes higher requirements on the collection of personal information by personal information holders.

For example, the Guide states that personal information that is not related to the services provided by personal information holders

should not be collected, and personal information should not be forced to be collected by bundling products or various business functions

of the service.

In November 2019, the Secretary

Bureau of the Cyberspace Administration of China, the General Office of the MIIT, the General Office of the Ministry of Public Security

and the General Office of the State Administration for Market Regulation issued the Notice on the Measures for the Determination of the

Collection and Use of Personal Information by Apps in Violation of Laws and Regulations, or the Notice, which came into effect on November

28, 2019. According to the Notice, if the personal information solicited by an app for a new service function is beyond the scope of

a user’s original consent, it is a violation of law for the app to refuse to provide the original service function if the user

disagrees with the new scope, unless the new service function is a replacement of the original service function.

In April 2020, the Cyberspace

Administration of China and certain other PRC regulatory authorities promulgated the Cybersecurity Review Measures, which became effective

in June 2020. Pursuant to the Cybersecurity Review Measures, operators of critical information infrastructure must pass a cybersecurity

review when purchasing network products and services which do or may affect national security. On July 10, 2021, the Cyberspace Administration

of China issued a revised draft of the Measures for Cybersecurity Review for public comments, which required that, any data processing

operators carrying out data processing activities that affect or may affect national security should also be subject to cybersecurity

review, and further elaborated the factors to be considered when assessing the national security risks of the relevant activities, including,

among others, (i) the risk of core data, important data or a large amount of personal information being stolen, leaked, destroyed, and

illegally used or exited the country; and (ii) the risk of critical information infrastructure, core data, important data or a large

amount of personal information being affected, controlled, or maliciously used by foreign governments after listing abroad. The Cyberspace

Administration of China has said that under the proposed rules companies holding data on more than 1,000,000 users must now apply for

cybersecurity approval when seeking listings in other nations because of the risk that such data and personal information could be “affected,

controlled, and maliciously exploited by foreign governments,” The cybersecurity review will also look into the potential national

security risks from overseas IPOs. We do not know what regulations will be adopted or how such regulations will affect us and our listing

on Nasdaq. In the event that the Cyberspace Administration of China determines that we are subject to these regulations, we may be required

to delist from Nasdaq and we may be subject to fines and penalties. On June 10, 2021, the Standing Committee of the NPC promulgated the

PRC Data Security Law, which became effective on September 1, 2021. The Data Security Law also sets forth the data security protection

obligations for entities and individuals handling personal data, including that no entity or individual may acquire such data by stealing

or other illegal means, and the collection and use of such data should not exceed the necessary limits. The costs of compliance with,

and other burdens imposed by, CSL and any other cybersecurity and related laws may limit the use and adoption of our products and services

and could have an adverse impact on our business. Further, if the enacted version of the Measures for Cybersecurity Review mandates clearance

of cybersecurity review and other specific actions to be completed by companies like us, we face uncertainties as to whether such clearance

can be timely obtained, or at all.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to incorporate

by reference the information we file with them. This means that we can disclose important information to you by referring you to those

documents. Each document incorporated by reference is current only as of the date of such document, and the incorporation by reference

of such documents should not create any implication that there has been no change in our affairs since such date. The information incorporated

by reference is considered to be a part of this prospectus and should be read with the same care. When we update the information contained

in documents that have been incorporated by reference by making future filings with the SEC, the information incorporated by reference

in this prospectus is considered to be automatically updated and superseded. In other words, in the case of a conflict or inconsistency

between information contained in this prospectus and information incorporated by reference into this prospectus, you should rely on the

information contained in the document that was filed later.

We incorporate by reference

the documents listed below:

|

|

●

|

Form

6-K filed with the SEC on August 13, 2021 and September 26, 2021; and

|

|

|

●

|

Our

annual report on Form 20-F for the fiscal year ended December 31, 2020 filed with the SEC

on July 13, 2021.

|

Unless expressly

incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to, but not filed

with, the SEC. We will also provide to you, upon your written or oral request, without charge, a copy of any or all of the documents

we refer to above which we have incorporated in this prospectus by reference, other than exhibits to those documents unless such exhibits

are specifically incorporated by reference in the documents. You should direct your requests to Stewart Lor, our President, at 1st

Floor, Building D2, Southern Software Park, Tangjia Bay, Zhuhai, Guangdong 519080, China. Our telephone number is +86-756-339-5666.

CAPITALIZATION

The

following table sets forth our capitalization as of December 31, 2020 presented on:

|

|

●

|

an unaudited actual basis; and

|

|

|

●

|

on an unaudited as adjusted basis to give effect to

the sale of the Notes and Warrants, after deducting the estimated offering expenses payable by us.

|

You

should read this table together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

and our consolidated financial statements and note included in the information incorporated by reference into this prospectus.

|

|

|

As of December 31, 2020

|

|

|

|

|

Actual

|

|

|

As adjusted

|

|

|

|

|

US$

|

|

|

US$

|

|

|

Convertible Notes

|

|

|

-

|

|

|

|

4,000,000

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

Equity

|

|

|

|

|

|

|

|

|

|

Ordinary Shares

|

|

|

76,296

|

|

|

|

76,296

|

|

|

Additional paid-in capital

|

|

|

100,149,397

|

|

|

|

100,149,397

|

|

|

Accumulated deficit

|

|

|

(28,234,492

|

)

|

|

|

(28,234,492

|

)

|

|

Accumulated other comprehensive loss

|

|

|

814,343

|

|

|

|

814,343

|

|

|

Total equity

|

|

|

72,805,544

|

|

|

|

72,805,544

|

|

|

Total capitalization

|

|

|

72,805,544

|

|

|

|

76,805,544

|

|

USE OF PROCEEDS

We estimate that we will

receive cash net proceeds from this offering, after deducting offering expenses payable by us, of $3,520,000.

We intend to use the net

proceeds from this offering for working capital and general corporate purposes.

The foregoing represents

our current intentions based upon our present plans and business conditions to use and allocate the net proceeds of this offering. Our

management, however, will have significant flexibility and discretion to apply the net proceeds of this offering. If an unforeseen event

occurs or business conditions change, we may use the proceeds of this offering differently than as described in this prospectus supplement.

Unforeseen events or changed business conditions may result in application of the proceeds of this offering in a manner other than as

described in this prospectus supplement.

To the extent that the net

proceeds we receive from this offering are not immediately applied for the above purposes, we plan to invest the net proceeds in bank

deposits.

DIVIDEND POLICY

We have never declared or

paid any cash dividends on our Ordinary Shares. We anticipate that we will retain any earnings to support operations and to finance the

growth and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future. Any future determination

relating to our dividend policy will be made at the discretion of our board of directors and will depend on a number of factors, including

future earnings, capital requirements, financial conditions, and future prospects and other factors the board of directors may deem relevant.

DESCRIPTION OF OUR

SHARE CAPITAL

Ordinary Shares

Powerbridge was established

under the laws of Cayman Islands on July 27, 2018. The original authorized number of ordinary shares was 500,000,000 shares with a par

value of $0.0001 per share. On August 18, 2018, in order to optimize the Company’s share capital structure, the board of directors

approved a reverse share split of the Company’s authorized number of ordinary shares at a ratio of 10-1. After the reverse share

split, the Company’s authorized number of ordinary shares became 50,000,000 shares with par value of $0.001 per share and 11,508,747

shares were issued on August 27, 2018 at par value to the original shareholders of Zhuhai Powerbridge Technology Co., Ltd. (“Powerbridge

Zhuhai”), the equivalent to share capital of $11,509. On February 10, 2019, the board of directors further approved a reverse

share split of the Company’s authorized number of ordinary shares at a ratio of 1-0.6. After the reverse share split, the Company’s

authorized number of ordinary shares was 30,000,000 shares with par value of $0.00166667 per share and 6,905,248 shares were issued and

outstanding immediately after the reserve share split. The Company believes it is appropriate to reflect these share issuances as nominal

share issuance on a retroactive basis similar to share split pursuant to ASC 260. The Company has retroactively adjusted all shares and

per share data for all the periods presented.

On September 30, 2020, the

Company held its 2020 special general meeting of shareholders (the “Meeting”). At the Meeting, the Company’s

shareholders approved the Company’s amended and restated Memorandum and Articles of Association (“A&R M&A”)

to increase the authorized share capital. As a result, the Company’s authorized share capital is US$500,000 divided into 300,000,000

shares of a par value of US$0.00166667 each, with an increase of an additional 270,000,000 shares of a par value of US$0.00166667 each.

The Company had 56,273,591,

45,777,318 and 8,967,748 ordinary shares issued and outstanding as of September 28, 2021 and December 31, 2020 and 2019, respectively.

Convertible Note

The material terms and provisions

of the Notes being offered pursuant to this prospectus are summarized below. The Notes are filed as an exhibit to this prospectus and

reference is made thereto for a complete description of such Convertible Note.

The Notes will become due and payable 12 months from the date of closing

and bears an annual interest rate of 6%. The Convertible Note may be converted in full or in part at any time at the option of the holder

into our Ordinary Shares. The Conversion Price is at the lower of (a) $3.675 per share or (b) 90.0% of the lowest daily volume weighted

average price (as reported by Bloomberg) of our Ordinary Shares during the 10 consecutive trading days prior to the conversion date, but

not lower than $1.00 per share. The Conversion Price and the Floor Price are adjustable upon subdivision or combination of our Ordinary

Shares.

The principal and the interest

payable under the Notes will mature twelve months from the issuance date (the “Maturity Date”) unless earlier converted

or redeemed by the Company. At any time before the Maturity Date, the Investor may convert the Notes at its option into ordinary shares

of the Company at the Conversion Price. The Company has the right, but not the obligation, to redeem (“Optional Redemption”)

a portion or all amounts outstanding under the Notes prior to the Maturity Date at a cash redemption price equal to the outstanding Principal

balance to be redeemed, plus the applicable redemption premium, plus accrued and unpaid interest; provided that the trading price of

the Ordinary Shares is less than the Fixed Conversion Price and the Company provides Investor with at least 15 business days’ prior

written notice of its desire to exercise an Optional Redemption. The Investor may convert all or any part of the Notes after receiving