UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of October 2023

Commission File Number: 001-39822

Pharming Group N.V.

(Exact Name of Registrant as Specified in Its Charter)

Darwinweg 24

2333 CR Leiden

The Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Filed as Exhibit 99.1 to this Report on Form 6-K is a press release of Pharming Group N.V., or the Company, dated October 26, 2023.

The information included in this Report on Form 6-K (including Exhibit 99.1 hereto) that is furnished shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. In addition, the information included in this Report on Form 6-K (including Exhibit 99.1 hereto) that is furnished shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference into such filing.

EXHIBIT INDEX

| | | | | | | | |

Exhibit No. | | Description |

| | |

99.1 | | Pharming Group reports third quarter 2023 financial results |

| | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| Pharming Group N.V. |

| | |

| By: | /s/ Sijmen de Vries |

| | | |

| | Name: | Sijmen de Vries |

| | Title: | CEO |

Date: October 26, 2023

Pharming Group reports third quarter 2023 financial results

•Third quarter 2023 revenues increased 23% to US$66.7 million, compared to the third quarter 2022, driven by RUCONEST® revenue and the U.S. commercial launch of Joenja®

•Nine month year to date 2023 revenues increased 9% to US$164.1 million, compared to nine month year to date 2022

•RUCONEST® revenues increased 11% in the third quarter 2023 to US$60.2 million, compared to the third quarter 2022, and increased 18% compared to the second quarter 2023

•RUCONEST® nine month year to date 2023 revenues increased by 2% YoY; on track for low single digit annual revenue growth

•Continued strength in U.S. Joenja® (leniolisib) launch during the third quarter 2023; 63 patients on paid therapy and US$6.5 million revenue

•Overall cash and marketable securities of US$199.2 million at the end of the third quarter 2023, compared to US$194.1 million at the end of the second quarter 2023

Leiden, The Netherlands, October 26, 2023: Pharming Group N.V. (“Pharming” or “the Company”) (Euronext Amsterdam: PHARM/NASDAQ: PHAR) presents its preliminary, unaudited financial report for the three months ended September 30, 2023.

Sijmen de Vries, Chief Executive Officer, commented:

“Pharming delivered a strong third quarter, increasing quarterly revenues to US$66.7 million and putting the Company at US$164.1 million in revenues for the first nine months of the year. The 23% revenue growth seen in the third quarter of 2023, versus the same period last year, was attributable to increased RUCONEST® revenue, coupled with initial Joenja® revenues of US$6.5 million.

To ensure we continue to find new Joenja® patients and grow revenues, Pharming continues to execute a focused U.S. patient finding strategy. Our strategy, which will be ramped up in the fourth quarter of 2023 and into the first quarter of 2024, focuses on early detection and diagnosis of potential APDS patients, genetic testing family members of APDS patients, and expanding the list of genetic variants confirmed to cause APDS.

Looking towards 2024, we continue to progress in our efforts to make Joenja® (leniolisib) available to APDS patients in key global launch markets. Discussions with the EMA are ongoing and we continue to expect a CHMP opinion in the fourth quarter of 2023. In addition, the regulatory submissions filed for leniolisib in Australia, Canada and Israel are progressing as expected, as is the Japanese clinical trial for patients 12 years and older. We also continue to make headway in our pediatric clinical trials with the majority of patients enrolled in the 4 to 11 year old trial, and have initiated recruiting in the second pediatric trial for ages 1 to 6.

The third quarter was an example of Pharming’s strong commercialization acumen as we succeeded in not only finding new Joenja® patients and quickly put them on therapy, but also in our ability to deliver growth for RUCONEST® in the competitive HAE landscape. None of this could have been achieved

without our employees and partners who work tirelessly to bring our global HAE and APDS patients the medicines they need.”

Third quarter highlights

Commercialized assets

RUCONEST® marketed for the treatment of acute HAE attacks

RUCONEST® continued to perform well in the third quarter of 2023, with revenues of US$60.2 million, an 11% increase compared to the third quarter of 2022 and an 18% increase compared to the second quarter of 2023. Revenues for the first nine months of 2023 were US$153.8 million, a 2% increase compared to the same period in 2022. The acceleration of RUCONEST® revenue seen in the second and third quarters puts Pharming firmly on track to achieve our previously indicated outlook for full year 2023 percentage revenue growth in the low single digits.

The U.S. market contributed 97% of revenues, while the EU and Rest of World contributed 3% in the third quarter.

In the U.S., we continued to see strength in the third quarter in key leading revenue indicators including new physicians prescribing, active patients, new patients on therapy and vials shipped to patients. For the third quarter in a row we exceed 70 RUCONEST® new patient enrollments. These positive indicators demonstrate the importance of RUCONEST® in treating hereditary angioedema (HAE) attacks and should position us well for the fourth quarter. Furthermore, we continue to see a broad mix of patients using RUCONEST®, with reduced reliance on patients who have highly frequent HAE attacks.

Joenja® (leniolisib) marketed in the U.S. - the first and only approved disease modifying treatment for APDS

The U.S. commercial launch of Joenja®, approved by the US FDA in March 2023 for the treatment of activated phosphoinositide 3-kinase delta (PI3Kδ) syndrome (APDS) in patients 12 years of age and older, continued its strong trajectory in the third quarter.

As of September 30, 2023 we have 76 APDS patients enrolled, of which 63 patients are on paid therapy. All but one of the patients who were on therapy prior to FDA approval under our Expanded Access Program (EAP) or Open Label Extension trial (OLE) have been successfully converted to paid therapy.

Access and reimbursement discussions have been proceeding as previously disclosed. We have seen high approval rates and fast timelines to covered therapy. Pharming’s market access teams have made significant progress working with government and private payors to provide the resources needed by the payors to formulate their policies to ensure access and reimbursement.

APDS patient finding

Based on available literature, Pharming estimates that over 1,500 patients are affected by APDS in our key global launch markets including the U.S., Europe, U.K., Japan, Canada, Australia and Israel.

Pharming has identified over 640 patients in these key global launch markets. Of these 640 patients, approximately 200 are in the U.S. with approximately 75% being 12 years of age or older, the majority of whom are currently eligible for treatment with Joenja®.

Pharming has initiated numerous activities to help diagnose and find APDS patients.

First, we continue to raise awareness of APDS and share new data on leniolisib at medical and scientific conferences worldwide.

Next, we continue to emphasize the importance of genetic testing when APDS is suspected. In addition to our sponsored genetic testing program in the U.S., we have genetic counselors available to provide educational resources to patients both before and after they’ve obtained a genetic test. Moreover, we have partnered with several genetic testing companies allowing outreach to patients whom they have identified as having APDS through their own testing efforts.

Finally, as APDS is an inherited genetic disease, we know that APDS patients may have affected family members. We have initiated a number of programs collaborating with clinicians and patients to aid in reducing the barriers and allowing the appropriate testing in families with APDS.

APDS patient finding - Variant of Uncertain Significance (VUS) resolution

APDS is diagnosed based on clinical symptoms, assessment of immune cell function, and genetic testing. For a patient to receive a definitive APDS diagnosis, a genetic test revealing a disease-causing (pathogenic or likely pathogenic) variant in either the PIK3CD or PIK3R1 genes is required.

Patients with clinical symptoms compatible with APDS frequently receive inconclusive genetic variant test results, i.e. previously unseen variants in the PIK3CD or PIK3R1 genes. It is important to determine if these Variants of Uncertain Significance (VUS) cause APDS.

Pharming has several ongoing initiatives and partnerships to resolve VUSs. We anticipate that these efforts will expand the list of genetic variants that are considered APDS disease causing and lead to more patients being diagnosed with APDS.

Joenja® (leniolisib) strategic highlights - regulatory and clinical updates

Leniolisib for APDS

Pharming made continued progress in the third quarter towards obtaining additional leniolisib regulatory approvals for APDS patients 12 years of age and older and for pediatric patients in key global launch markets.

EEA and U.K. markets

As part of the review process of the Marketing Authorisation Application (MAA) for leniolisib for patients 12 years of age and older, Pharming submitted its response to the European Medicines Agency’s (EMA) Committee for Human Medicinal Products (CHMP) Day 180 list of outstanding issues in October 2023.

As announced on August 3, 2023, considering the rarity of APDS and the unmet need for the treatment of APDS patients, as part of its review process the CHMP will consult an Ad-hoc Expert Group (AEG) at a closed meeting, also involving Pharming representatives including leniolisib investigators and APDS patients. Under EMA regulations, the CHMP may call an AEG meeting when a medicine is being assessed

that requires input from specialized scientific advisors on matters that may fall outside the expertise of the EMA’s established Scientific Advisory Groups, as is typically the case for rare diseases with few experts.

Pharming continues to anticipate a CHMP opinion in the fourth quarter of 2023, with European Marketing Authorisation following approximately two months later, assuming a positive opinion.

In the U.K., we intend to file the leniolisib dossier with the U.K.’s Medicines and Healthcare products Regulatory Agency (MHRA) within five days of a positive CHMP opinion, which is in line with the current European Commission Decision Reliance Procedure (ECDRP).

Japan

In August, Pharming announced that the first patient has been enrolled in a Phase III clinical trial in Japan evaluating leniolisib for the treatment of activated APDS in adult and pediatric patients 12 years of age and older.

The single-arm, open-label clinical trial will evaluate the safety, tolerability, and efficacy of leniolisib in three patients, 12 years of age and older, who have a confirmed APDS diagnosis. Each patient will receive weight-based dosing up to 70mg of leniolisib twice daily for 12 weeks.

The study’s primary efficacy endpoints and secondary endpoints mirror those used to evaluate the clinical outcomes of the earlier leniolisib APDS trials.

Pharming plans to file an application for the approval of leniolisib with Japan’s Pharmaceuticals and

Medical Devices Agency (PMDA) following completion of the trial. Eligible patients enrolled in the trial will continue to receive the investigational drug for at least one year through an open-label extension trial.

Additional markets - Canada, Australia and Israel

Pharming filed regulatory submissions in Canada and Australia in the third quarter, and Israel in the second quarter. These submissions are progressing as expected and we continue to anticipate regulatory approvals by the second quarter of 2024 for Canada and Australia and an anticipated regulatory approval for Israel in the first half of 2024.

Pediatric clinical development

The majority of patients for our Phase III pediatric clinical trial with leniolisib for the treatment of APDS in patients 4 to 11 years of age have been enrolled. The single-arm, open-label, multinational clinical trial will evaluate the safety, tolerability, and efficacy of leniolisib in 15 children at sites in the U.S., Europe, and Japan.

The second pediatric clinical trial for APDS patients 1 to 6 years of age commenced in the third quarter of 2023. The trial is currently recruiting and we anticipate the first patient will be enrolled in the fourth quarter. The single-arm, open-label, multinational clinical trial will evaluate the safety, tolerability, and efficacy of leniolisib in 15 children at sites in the United States, Europe, and Japan.

Both studies are being conducted as part of Pharming’s Pediatric Investigational Plan for leniolisib as a treatment for APDS in children.

Leniolisib for additional indications (PI3Kδ platform)

As announced in our Joenja® approval conference call on March 27, 2023, we have begun working towards prioritizing other indications where leniolisib has the potential to deliver value for patients. PI3Kδ has been identified as an important factor in a variety of disease states, and leniolisib has demonstrated an attractive, long-term efficacy, safety and tolerability profile in clinical trials conducted in both healthy volunteers and patients. This provides a basis for the investigation and investment in plans for further leniolisib indications. We have already advanced plans for the second indication for leniolisib development, and we are in a dialogue with the FDA on a clinical trial plan. We expect to provide further details later this year.

Pre-Clinical Pipeline

OTL-105

Work is continuing on the preclinical proof of concept studies. We anticipate providing further updates as OTL-105 progresses towards an Investigational New Drug (IND) filing.

Organizational highlights

At the Extraordinary General Meeting of Shareholders held on September 25, 2023, shareholders approved the appointment of Dr. Richard Peters as a Non-Executive Director for a period of four years. As a result, Dr. Peters succeeded Mr. Paul Sekhri as Chair of the Board of Directors with immediate effect.

On September 1, Pharming welcomed Dr. Alexander Breidenbach, MBA, as Chief Business Officer (CBO). Dr. Breidenbach will lead the development and execution of Pharming’s growth strategy and its future plans.

Financial Summary

| | | | | | | | | | | | | | |

| Amounts in US$m except per share data | 3Q 2023 | 3Q 2022 | 9M 2023 | 9M 2022 |

| | | | |

| Income Statement | | | | |

| Revenue - RUCONEST® | 60.2 | 54.2 | 153.8 | 151.0 |

| Revenue - Joenja® | 6.5 | 0.0 | 10.3 | 0.0 |

| Total Revenues | 66.7 | 54.2 | 164.1 | 151.0 |

| Cost of sales | (8.3) | (2.3) | (18.1) | (11.3) |

| Gross profit | 58.4 | 51.9 | 146.0 | 139.7 |

| Other income | 0.3 | 0.6 | 22.8 | 15.6 |

| Research and development | (20.8) | (12.3) | (57.3) | (41.6) |

| General and administrative | (10.9) | (12.0) | (31.9) | (28.5) |

| Marketing and sales | (25.1) | (20.4) | (86.1) | (56.8) |

| Operating profit (loss) | 1.9 | 7.8 | (6.5) | 28.4 |

| Other finance income | 1.2 | 2.8 | 2.1 | 9.3 |

| Other finance expenses | 0.7 | (1.2) | (4.6) | (4.0) |

| Share of net profits in associates using the equity method | (0.5) | (0.1) | (1.0) | (0.6) |

| Profit (loss) before tax | 3.3 | 9.3 | (10.0) | 33.1 |

| Income tax credit (expense) | 0.2 | (0.2) | 2.6 | (4.8) |

| Profit (loss) for the period | 3.5 | 9.1 | (7.4) | 28.3 |

| Share Information | | | | |

| Basic earnings per share (US$) | 0.005 | 0.014 | (0.011) | 0.043 |

| Diluted earnings per share (US$) | 0.005 | 0.013 | (0.011) | 0.040 |

| | | | | | | | |

| Amounts in US$m | September 30, 2023 | December 31, 2022 |

| | |

| Balance Sheet | | |

| Cash and cash equivalents, restricted cash and marketable securities | 199.2 | 208.7 |

| Current assets | 291.7 | 277.5 |

| Total assets | 436.5 | 425.8 |

| Current liabilities | 68.1 | 59.7 |

| Equity | 209.9 | 204.6 |

Financial highlights

Third quarter 2023

Revenues in the third quarter of 2023 increased to US$66.7 million compared to US$54.2 million in the third quarter of 2022 and US$54.9 million in the second quarter of 2023. This was driven by U.S. Joenja® revenues of US$6.5 million in the third quarter of 2023. Next to that, RUCONEST® net sales increased

11% compared to the same period last year and increased 18% compared to the second quarter of 2023. Joenja® revenues increased in the third quarter by 72% compared to the previous quarter.

Gross profit in the third quarter increased by US$6.5 million compared the third quarter of 2022. This was driven by an increase in revenues, which was partly offset by the prior year’s favorable FX tailwind and the current years’ increased RUCONEST® production costs, as well as royalty payments to Novartis on Joenja® sales.

Operating expenses increased by US$12.0 million in the third quarter compared to last year. This was driven by higher research and development expenses and higher marketing and sales expenses. These were both mainly related to Joenja®.

In the third quarter of 2023, an operating profit of US$1.9 million was realized.

Nine months 2023

Revenues for the first nine months of 2023 were US$164.1 million, a 9% increase compared to the first nine months of 2022 (US$151.0 million), which was driven by 2% net sales growth of RUCONEST® and US$10.3 million in Joenja® sales subsequent to the FDA approval in March 2023.

Gross profit for the first nine months of 2023 increased by US$6.3 million, or 5%, to US$146.0 million. This increase was driven by a growth in revenues, which was partly offset by increased production costs for RUCONEST® and royalty expenses for Joenja®.

Operating loss for the first nine months of 2023 amounted to US$6.5 million as compared to an Operating profit of US$28.4 million in the same period last year. This was mainly due to a US$48.4 million increase in operating expenses when compared with the first nine months of 2022. Of that, US$10.5 million is related to milestone payments for Joenja® in the second quarter of 2023. A further US$17.4 million expense increase is directly related to leniolisib in the form of increased R&D spend, marketing costs, market access costs and the commencement of the amortization of acquired rights. An increase of US$17.1 million is related to an increase in payroll expenses, which was in large part driven by the expansion of the organization, resulting from the preparations for launch and further commercialization of leniolisib. The remainder of the increase relates to general costs of US$2.3 million and incidental cost relating to the discontinuation of the Pompe disease program of US$0.9 million.

Net result for the first nine months of 2023 was negative US$7.4 million, compared to US$28.3 million profit in the same period last year. This was driven by a decreased operating result of US$34.9 million, as well as a negative impact of net finance gains and losses of US$7.9 million when compared to the first nine months of 2022. These were mainly due to favorable EUR/USD exchange rate developments last year. This was partly offset by US$1.7 million interest income from AAA rated treasury certificates, which was further offset by an income tax credit of US$2.6 million, whereas in the same period last year an income tax expense of US$4.8 million was recorded.

Cash and cash equivalents, together with restricted cash and marketable securities, decreased from US$208.7 million at the end of 2022, to US$199.2 million at the end of the third quarter 2023.

Outlook

For the financial year of 2023:

•On track for low single digit growth in annual revenues from RUCONEST®.

•We anticipate the CHMP to issue their opinion for leniolisib in 4Q 2023. Subject to a positive opinion, Marketing Authorisation in Europe is expected ~2 months later, followed by commercial launches in individual EU countries.

•We intend to submit an ECDRP filing for leniolisib with the U.K. MHRA shortly after a positive CHMP opinion, with approval expected several months later.

•Pharming will continue to allocate resources to accelerate future growth. Investments in launch preparations, commercialization and focused clinical developments for leniolisib including to support pediatric and key market approvals, as well as for the development of leniolisib in additional indications. These investments will continue to impact profit throughout 2023. Our current cash on hand, including the continued cash flows from RUCONEST® and Joenja® sales, are expected to be sufficient to fund these investments.

•Further details on our plans to develop leniolisib in additional indications to be provided in 4Q 2023.

•Investments and continued focus on in-licensing or acquisitions of mid to late-stage opportunities in rare diseases. Financing, if required, would come via a combination of our strong balance sheet and access to capital markets.

No further specific financial guidance for 2023 is provided.

Additional information

Presentation

The conference call presentation is available on the Pharming.com website from 07:30 CEST.

Conference Call

The conference call will begin at 13:30 CEST/07:30 EDT. A transcript will be made available on the Pharming.com website in the days following the call.

Please note, the Company will only take questions from dial-in attendees.

Webcast link:

https://edge.media-server.com/mmc/p/599pzbd7

Conference call dial-in details:

https://register.vevent.com/register/BIb15561b07c01418199d56096c5c3c8f9

Additional information on how to register for the conference call/webcast can be found on the Pharming.com website.

For further public information, contact:

Pharming Group N.V., Leiden, The Netherlands

Michael Levitan, VP Investor Relations & Corporate Communications

T: +1 (908) 705 1696

Heather Robertson, Investor Relations & Corporate Communications Manager

E: investor@pharming.com

FTI Consulting, London, UK

Victoria Foster Mitchell/Alex Shaw

T: +44 203 727 1000

LifeSpring Life Sciences Communication, Amsterdam, The Netherlands

Leon Melens

T: +31 6 53 81 64 27

E: pharming@lifespring.nl

About Pharming Group N.V.

Pharming Group N.V. (Euronext Amsterdam: PHARM/Nasdaq: PHAR) is a global biopharmaceutical company dedicated to transforming the lives of patients with rare, debilitating, and life-threatening diseases. Pharming is commercializing and developing an innovative portfolio of protein replacement therapies and precision medicines, including small molecules, biologics, and gene therapies that are in early to late-stage development. Pharming is headquartered in Leiden, Netherlands, and has employees around the globe who serve patients in over 30 markets in North America, Europe, the Middle East, Africa, and Asia-Pacific. For more information, visit www.pharming.com and find us on LinkedIn.

Auditor’s involvement

The Condensed Consolidated Interim Financial Statements have not been audited by the Company’s statutory auditor.

Risk profile

The risks outlined in the 2022 Annual Report continued to apply in the first nine months of 2023 and are expected to apply for the rest of the financial year. We continue to closely monitor the key risks and opportunities, and will respond appropriately to any emerging risk.

Related party transactions

There are no material changes in the nature, scope, and (relative) scale in this reporting period

compared to last year.

Forward-looking Statements

This press release may contain forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance, or events to differ materially from those expressed or implied in these statements. These forward-looking statements are identified by their use of terms and phrases such as “aim”, “ambition”, ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’, ‘‘estimate’’, ‘‘expect’’, ‘‘goals’’, ‘‘intend’’, ‘‘may’’, “milestones”, ‘‘objectives’’, ‘‘outlook’’, ‘‘plan’’, ‘‘probably’’, ‘‘project’’, ‘‘risks’’, “schedule”, ‘‘seek’’, ‘‘should’’, ‘‘target’’, ‘‘will’’ and similar terms and phrases. Examples of forward-looking statements may include statements with respect to timing and progress of Pharming's preclinical studies and clinical trials of its product candidates, Pharming's clinical and commercial prospects, and Pharming's expectations regarding its projected working capital requirements and cash resources, which statements are subject to a number of risks, uncertainties and assumptions, including, but not limited to the scope, progress and expansion of Pharming's clinical trials and ramifications for the cost thereof; and clinical, scientific, regulatory and

technical developments. In light of these risks and uncertainties, and other risks and uncertainties that are described in Pharming's 2022 Annual Report and the Annual Report on Form 20-F for the year ended December 31, 2022, filed with the U.S. Securities and Exchange Commission, the events and circumstances discussed in such forward-looking statements may not occur, and Pharming's actual results could differ materially and adversely from those anticipated or implied thereby. All forward-looking statements contained in this press release are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Any forward-looking statements speak only as of the date of this press release and are based on information available to Pharming as of the date of this release. Pharming does not undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information.

Inside Information

This press release relates to the disclosure of information that qualifies, or may have qualified, as inside information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Pharming Group N.V.

Condensed Consolidated Interim Financial Statements in US Dollars (unaudited)

For the period ended September 30, 2023

•Condensed consolidated interim statement of profit and loss

•Condensed consolidated interim statement of comprehensive income

•Condensed consolidated interim balance sheet

•Condensed consolidated interim statement of changes in equity

•Condensed consolidated interim statement of cash flow

| | | | | | | | |

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF PROFIT AND LOSS | |

| For the 9-month period ended 30 September | | |

| | |

| Amounts in US$ ‘000 | 9M 2023 | 9M 2022 |

| Revenues | 164,099 | 151,001 |

| Costs of sales | (18,094) | (11,288) |

| Gross profit | 146,005 | 139,712 |

| Other income | 22,811 | 15,602 |

| Research and development | (57,287) | (41,639) |

| General and administrative | (31,849) | (28,446) |

| Marketing and sales | (86,136) | (56,819) |

| Other Operating Costs | (175,272) | (126,904) |

| Operating profit (loss) | (6,456) | 28,410 |

| Other finance income | 2,050 | 9,297 |

| Other finance expenses | (4,621) | (3,978) |

| Finance cost net | (2,571) | 5,319 |

| Share of net profits in associates using the equity method | (954) | (660) |

| Profit (loss) before tax | (9,981) | 33,069 |

| Income tax credit (expense) | 2,556 | (4,765) |

| Profit (loss) for the period | (7,425) | 28,304 |

| Basic earnings per share (US$) | (0.011) | 0.043 |

| Fully-diluted earnings per share (US$) | (0.011) | 0.040 |

| | | | | | | | |

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF COMPREHENSIVE INCOME | |

| For the 9-month period ended 30 September | | |

| | |

| Amounts in US$ ‘000 | 9M 2023 | 9M 2022 |

| Profit (loss) for the period | (7,425) | 28,304 |

| Currency translation differences | (2,079) | (26,313) |

| Items that may be subsequently reclassified to profit or loss | (2,079) | (26,313) |

| Fair value remeasurement investments | 419 | (573) |

| Items that shall not be subsequently reclassified to profit or loss | 419 | (573) |

| Other comprehensive income (loss), net of tax | (1,660) | (26,886) |

| Total comprehensive income (loss) for the period | (9,085) | 1,418 |

| | | | | | | | |

| CONDENSED CONSOLIDATED INTERIM BALANCE SHEET | | |

| As at September 30 | | |

| Amounts in US$ ‘000 | September 30, 2023 | December 31, 2022 |

| Non-current assets | | |

| Intangible assets | 69,849 | 75,121 |

| Property, plant and equipment | 9,648 | 10,392 |

| Right-of-use assets | 27,834 | 28,753 |

| Long-term prepayments | 88 | 228 |

| Deferred tax assets | 26,608 | 22,973 |

| Investments accounted for using the equity method | 1,541 | 2,501 |

| Investment in equity instruments designated as at FVTOCI | 949 | 403 |

| Investment in debt instruments designated as at FVTPL | 6,749 | 6,827 |

| Restricted cash | 1,464 | 1,099 |

| Total non-current assets | 144,730 | 148,297 |

| Current assets | | |

| Inventories | 53,439 | 42,326 |

| Trade and other receivables | 40,521 | 27,619 |

| Restricted cash | 212 | 213 |

| Marketable securities | 142,912 | — |

| Cash and cash equivalents | 54,653 | 207,342 |

| Total current assets | 291,737 | 277,500 |

| Total assets | 436,467 | 425,797 |

| | |

| Equity | | |

| Share capital | 7,650 | 7,509 |

| Share premium | 475,983 | 462,297 |

| Legal reserves | (10,915) | (8,737) |

| Accumulated deficit | (262,776) | (256,431) |

| Shareholders’ equity | 209,942 | 204,638 |

| Non-current liabilities | | |

| Convertible bonds | 129,733 | 131,618 |

| Lease liabilities | 28,734 | 29,843 |

| Total non-current liabilities | 158,467 | 161,461 |

| | |

| Current liabilities | | |

| Convertible bonds | 1,748 | 1,768 |

| Trade and other payables | 62,540 | 54,465 |

| Lease liabilities | 3,770 | 3,465 |

| Total current liabilities | 68,058 | 59,698 |

| Total equity and liabilities | 436,467 | 425,797 |

| | |

| CONDENSED CONSOLIDATED INTERIM STATEMENT CHANGES IN EQUITY |

| For the 9-month period ended September 30 |

| | | | | | | | | | | | | | | | | |

| Amounts in $ ‘000 | Share capital | Share premium | Other

reserves | Accumulated deficit | Total equity |

| Balance at January 1, 2022 | 7,429 | | 455,254 | | 3,400 | | (273,167) | | 192,916 | |

| Profit (loss) for the period | — | | — | | — | | 28,304 | | 28,304 | |

| Other comprehensive income (loss) for the period | — | | — | | (27,546) | | 660 | | (26,886) | |

| Total comprehensive income (loss) for the period | — | | — | | (27,546) | | 28,964 | | 1,418 | |

| Legal reserves | — | | — | | — | | — | | — | |

| Income Tax expense from excess tax deductions related to Share-based payments | — | | — | | — | | 273 | | 273 | |

| Share-based compensation | — | | — | | — | | 4,522 | | 4,522 | |

| Options exercised /LTIP shares issued | 53 | | 4,196 | | — | | (3,124) | | 1,125 | |

| Total transactions with owners, recognized directly in equity | 53 | | 4,196 | | — | | 1,671 | | 5,920 | |

| Balance at September 30, 2022 | 7,482 | | 459,450 | | (24,146) | | (242,532) | | 200,254 | |

| | | | | |

| Balance at January 1, 2023 | 7,509 | | 462,297 | | (8,737) | | (256,431) | | 204,638 | |

| Profit (loss) for the period | — | | — | | — | | (7,425) | | (7,425) | |

| Other comprehensive income (loss) for the period | — | | — | | (1,660) | | — | | (1,660) | |

| Total comprehensive income (loss) for the period | — | | — | | (1,660) | | (7,425) | | (9,085) | |

| Legal reserves | — | | — | | (518) | | 518 | | — | |

| Income Tax expense from excess tax deductions related to Share-based payments | — | | — | | — | | 574 | | 574 | |

| Share-based compensation | — | | — | | — | | 5,935 | | 5,935 | |

| Options exercised / LTIP shares Issued | 141 | | 13,686 | | — | | (5,947) | | 7,880 | |

| Total transactions with owners, recognized directly in equity | 141 | | 13,686 | | (518) | | 1,080 | | 14,389 | |

| Balance at September 30, 2023 | 7,650 | | 475,983 | | (10,915) | | (262,776) | | 209,942 | |

| | | | | | | | |

| CONDENSED CONSOLIDATED INTERIM STATEMENT OF CASH FLOWS | |

| For the 9-month period ended 30 September | | |

| | |

| Amounts in $’000 | 9M 2023 | 9M 2022 |

|

| Profit before tax | (9,981) | 33,069 |

| | |

| Adjustments to reconcile net profit (loss) to net cash used in operating activities: | | |

| Depreciation, amortization, impairment | 8,370 | 6,216 |

| Equity settled share based payments | 5,935 | 4,522 |

| Gain on disposal of investment in associate | — | (12,382) |

| Gain on disposal from PRV sale | (21,080) | — |

| Other finance income | (2,050) | (9,296) |

| Other finance expense | 4,621 | 3,978 |

| Share of net profits in associates using the equity method | 954 | 660 |

| Other | (1,130) | — |

| Operating cash flows before changes in working capital | (14,361) | 26,767 |

| | |

| Changes in working capital: | | |

| Inventories | (11,113) | (6,196) |

| Trade and other receivables | (12,902) | 1,155 |

| Payables and other current liabilities | 8,075 | 272 |

| Restricted Cash | 363 | 169 |

| Total changes in working capital | (15,577) | (4,600) |

| | |

| Interest received (paid) | 1,059 | 31 |

| Income taxes paid (received) | — | (4,975) |

| | |

| Net cash flows generated from (used in) operating activities | (28,879) | 17,223 |

| | |

| Capital expenditure for property, plant and equipment | (1,133) | (1,071) |

| Proceeds on PRV sale | 21,080 | — |

| Investment intangible assets | 23 | (591) |

| Investment in associate | — | 7,384 |

| Purchases of marketable securities | (231,901) | — |

| Proceeds from sale of marketable securities | 86,451 | — |

| | |

| Net cash flows used in investing activities | (125,480) | 5,722 |

| | |

| Payment of lease liabilities | (3,847) | (2,385) |

| Interests on loans and leases | (4,052) | (3,999) |

| Settlement of share based compensation awards | 7,880 | 1,124 |

| | |

| Net cash flows generated from (used in) financing activities | (19) | (5,260) |

| | |

| Increase (decrease) of cash | (154,378) | 17,685 |

| Exchange rate effects | 1,689 | (20,906) |

| Cash and cash equivalents at the start of the period | 207,342 | 191,924 |

| | |

| Total cash and cash equivalents at the end of the period | 54,653 | 188,703 |

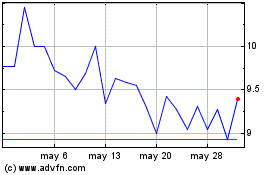

Pharming Group NV (NASDAQ:PHAR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Pharming Group NV (NASDAQ:PHAR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025