Red Cat Holdings Reports Financial Results for Fiscal Year Ended April 30, 2024 and Provides Business Update

08 Agosto 2024 - 3:30PM

Red Cat Holdings, Inc. (Nasdaq: RCAT) (“Red Cat” or “Company”), a

drone technology company integrating robotic hardware and software

for military, government, and commercial operations, reports its

financial results for the fiscal year ended April 30, 2024 and

provides a business update

Recent Operational Highlights:

- Certification of Teal 2 as Blue UAS

received from U.S. Department of Defense

- Continued global sales expansion

into Middle East and Latin American markets

- Selected by U.S. Army as finalist

for Short Range Reconnaissance Program of Record

- Launched Red Cat Futures Initiative

Drone Industry Consortium

- Introduced new Family of Low-Cost,

Portable ISR and Precision Strike Systems

- Formed new industry partnerships to

integrate advanced AI and GPS-denied capabilities

Fiscal Year 2024 Financial Highlights:

- Consolidated revenues in fiscal

2024 increased 286% year-over-year to $17.8 million

- Fourth consecutive quarter of

record revenues with $6.3 million in the fourth fiscal quarter

- Completed divesture of Consumer

segment in February 2024

- Over $10.4 million of combined cash

and account receivable balances as of April 30, 2024

- Reduced quarterly cash burn to $1.6

million

“Small Drones have become a crucial tool in modern military

operations, offering new capabilities and changing the dynamics of

warfare,” said Jeff Thompson, Red Cat CEO. “Our singular focus on

addressing this shift and innovation that supports the needs of the

warfighter has spurred rapid growth for us as a business. We

believe that the next six months will be a significant catalyst for

mass production of our Family of Systems as governments across the

globe begin supplying their armed forces with small drones.”

“We are ending the fiscal year in a fundamentally strong

position, reporting solid results that include a year-over-year

consolidated revenue increase of 286 percent to $17.8 million,”

said Leah Lunger, Red Cat CFO. “Our performance reflects Red

Cat's ability to consistently fulfill existing domestic and

international contracts, and we have a robust and growing pipeline

of new orders. Additionally, our pending acquisition of FlightWave

as well as partnerships through the Red Cat Futures Initiative

provide a runway for product diversification, new revenue streams,

and continued financial growth.”

Conference Call Today

CEO Jeff Thompson and CFO Leah Lunger will host an earnings

conference call today (August 8, 2024) at 6:00 p.m. ET to review

financial results and provide an update on corporate developments.

Following management’s formal remarks, there will be a

question-and-answer session.

Interested parties can listen to the conference call by dialing

1-844-413-3977 (within the U.S.) or 1-412-317-1803 (international).

Callers should dial in approximately ten minutes prior to the start

time and ask to be connected to the Red Cat conference call.

Participants can also pre-register for the call using the following

link: https://dpregister.com/sreg/10191533/fd3b347206

The conference call will also be available through a live

webcast that can be accessed at:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=uxH3YdCT

A replay of the webcast will be available until November 8, 2024

and can be accessed through the above link or at

www.redcatholdings.com. A telephonic replay will be available until

August 22, 2024 by calling 1-877-344-7529 (domestic) or

1-412-317-0088 (international) and using access code 5157974.

About Red Cat Holdings, Inc.Red Cat (Nasdaq:

RCAT) is a drone technology company integrating robotic

hardware and software for military, government, and

commercial operations. Red Cat’s solutions are designed

to “Dominate the Night™” and include the

Teal 2, a small unmanned system offering the

highest-resolution thermal imaging in its class. Learn more

at www.redcatholdings.com.

Forward Looking StatementsThis

press release contains "forward-looking statements" that are

subject to substantial risks and uncertainties. All statements,

other than statements of historical fact, contained in this press

release are forward-looking statements. Forward-looking statements

contained in this press release may be identified by the use of

words such as "anticipate," "believe," "contemplate," "could,"

"estimate," "expect," "intend," "seek," "may," "might," "plan,"

"potential," "predict," "project," "target," "aim," "should,"

"will," "would," or the negative of these words or other similar

expressions, although not all forward-looking statements contain

these words. Forward-looking statements are based on Red Cat

Holdings, Inc.'s current expectations and are subject to inherent

uncertainties, risks and assumptions that are difficult to predict.

Further, certain forward-looking statements are based on

assumptions as to future events that may not prove to be accurate.

These and other risks and uncertainties are described more fully in

the section titled "Risk Factors" in the final prospectus related

to the public offering filed with the Securities and Exchange

Commission. Forward-looking statements contained in this

announcement are made as of this date, and Red Cat Holdings, Inc.

undertakes no duty to update such information except as required

under applicable law.

Contact:

INVESTORS:E-mail: Investors@redcat.red

NEWS MEDIA:Phone: (347)

880-2895Email: peter@indicatemedia.com

|

RED CAT HOLDINGS |

|

Condensed Consolidated Balance Sheets |

|

|

|

|

|

|

| |

|

|

April 30, |

|

|

April 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and marketable securities |

|

$ |

6,067,169 |

|

|

$ |

15,987,687 |

|

|

Accounts receivable, net |

|

|

4,361,090 |

|

|

|

719,862 |

|

|

Inventory, including deposits |

|

|

8,610,125 |

|

|

|

9,280,073 |

|

|

Intangible assets including goodwill, net |

|

|

12,882,939 |

|

|

|

23,905,947 |

|

|

Equity method investee |

|

|

5,142,500 |

|

|

|

— |

|

|

Note receivable |

|

|

4,000,000 |

|

|

|

— |

|

|

Other |

|

|

7,473,789 |

|

|

|

5,458,207 |

|

|

Assets of discontinued operations |

|

|

— |

|

|

|

5,391,552 |

|

| |

|

|

|

|

|

|

| TOTAL

ASSETS |

|

$ |

48,537,612 |

|

|

$ |

60,743,328 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

2,703,922 |

|

|

$ |

1,957,975 |

|

|

Debt obligations |

|

|

751,570 |

|

|

|

1,323,707 |

|

|

Operating lease liabilities |

|

|

1,517,590 |

|

|

|

1,641,390 |

|

|

Liabilities of discontinued operations |

|

|

— |

|

|

|

1,052,315 |

|

|

Total liabilities |

|

|

4,973,082 |

|

|

|

5,975,387 |

|

| |

|

|

|

|

|

|

|

Stockholders’ capital |

|

|

124,690,641 |

|

|

|

112,707,161 |

|

|

Accumulated deficit/comprehensive loss |

|

|

(81,126,111 |

) |

|

|

(57,939,220 |

) |

|

Total stockholders' equity |

|

|

43,564,530 |

|

|

|

54,767,941 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

$ |

48,537,612 |

|

|

$ |

60,743,328 |

|

| |

|

|

|

|

|

|

|

Condensed Consolidated Statements of

Operations |

| |

| |

|

Year

ended |

|

April 30, |

| |

|

2024 |

|

2023 |

|

Revenues |

|

$ |

17,836,382 |

|

|

$ |

4,620,834 |

|

| |

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

|

14,155,836 |

|

|

|

5,455,145 |

|

| |

|

|

|

|

|

|

|

|

| Gross profit (loss) |

|

|

3,680,546 |

|

|

|

(834,311 |

) |

| |

|

|

|

|

|

|

|

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

5,896,037 |

|

|

|

5,595,281 |

|

|

Sales and marketing |

|

|

4,568,617 |

|

|

|

3,731,776 |

|

|

General and administrative |

|

|

10,679,105 |

|

|

|

12,383,470 |

|

|

Impairment loss |

|

|

412,999 |

|

|

|

2,826,918 |

|

|

Total operating expenses |

|

|

21,556,758 |

|

|

|

24,537,445 |

|

| Operating loss |

|

|

(17,876,212 |

) |

|

|

(25,371,756 |

) |

|

|

|

|

|

|

|

|

|

|

| Other expense |

|

|

3,650,484 |

|

|

|

1,004,887 |

|

| |

|

|

|

|

|

|

|

|

| Net loss from continuing

operations |

|

|

(21,526,696 |

) |

|

|

(26,376,643 |

) |

| |

|

|

|

|

|

|

|

|

| Loss from discontinued

operations |

|

|

(2,525,933 |

) |

|

|

(1,730,386 |

) |

|

Net loss |

|

$ |

(24,052,629 |

) |

|

$ |

(28,107,029 |

) |

| |

|

|

|

|

|

|

|

|

| Loss per share - basic and

diluted |

|

$ |

(0.40 |

) |

|

$ |

(0.52 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding - basic and diluted |

|

|

60,118,675 |

|

|

|

53,860,199 |

|

| |

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Cash

Flows |

|

|

|

|

|

|

|

|

|

|

Year ended April 30, |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

| Cash Flows from Operating

Activities |

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

|

$ |

(21,526,696 |

) |

|

$ |

(26,376,643 |

) |

|

Non-cash expenses |

|

|

8,512,449 |

|

|

|

7,784,364 |

|

|

Changes in operating assets and liabilities |

|

|

(4,672,816 |

) |

|

|

(5,721,395 |

) |

| Net cash used in operating

activities |

|

|

(17,687,063 |

) |

|

|

(24,313,674 |

) |

|

|

|

|

|

|

|

|

|

|

| Cash Flows from Investing

Activities |

|

|

|

|

|

|

|

|

|

Proceeds from sale of marketable securities |

|

|

12,826,217 |

|

|

|

32,290,448 |

|

|

Other |

|

|

740,861 |

|

|

|

(2,700,213 |

) |

| Net cash provided by investing

activities |

|

|

13,567,078 |

|

|

|

29,590,235 |

|

|

|

|

|

|

|

|

|

|

|

| Cash Flows from Financing

Activities |

|

|

|

|

|

|

|

|

|

Payments of debt obligations, net |

|

|

(572,137 |

) |

|

|

(633,550 |

) |

|

Payments related to employee equity transactions |

|

|

(30,599 |

) |

|

|

(581,775 |

) |

|

Proceeds from issuance of common stock, net |

|

|

8,404,812 |

|

|

|

— |

|

| Net cash provided by (used in)

financing activities |

|

|

7,802,076 |

|

|

|

(1,215,325 |

) |

|

|

|

|

|

|

|

|

|

|

| Net cash used in discontinued

operations |

|

|

(875,227 |

) |

|

|

(4,885,746 |

) |

| |

|

|

|

|

|

|

|

|

| Net increase (decrease) in

Cash |

|

|

2,806,864 |

|

|

|

(824,510 |

) |

| Cash, beginning of period |

|

|

3,260,305 |

|

|

|

4,084,815 |

|

| Cash, end of period |

|

|

6,067,169 |

|

|

|

3,260,305 |

|

| Less: Cash of discontinued

operations |

|

|

— |

|

|

|

(86,656 |

) |

| Cash of continuing operations,

end of period |

|

|

6,067,169 |

|

|

|

3,173,649 |

|

| Marketable securities |

|

|

— |

|

|

|

12,814,038 |

|

| Cash of continuing operations

and marketable securities |

|

$ |

6,067,169 |

|

|

$ |

15,987,687 |

|

| |

|

|

|

|

|

|

|

|

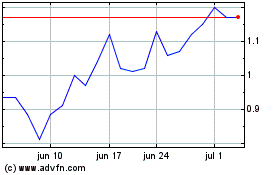

Red Cat (NASDAQ:RCAT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Red Cat (NASDAQ:RCAT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024