true

FY

0001862461

0001862461

2023-01-01

2023-12-31

0001862461

dei:BusinessContactMember

2023-01-01

2023-12-31

0001862461

2023-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

40-F/A

(Amendment

No. 1)

☐ Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

or

☒ Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

| For the fiscal year ended December 31, 2023 |

Commission File Number 001-40442 |

The

Real Brokerage Inc.

(Exact

name of Registrant as specified in its charter)

N/A

(Translation

of Registrant’s name into English (if applicable))

| British Columbia,

Canada |

|

7370 |

|

N/A |

| (Province or other jurisdiction

of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

| incorporation or organization)

|

|

Classification

Code Number) |

|

Identification Number) |

701

Brickell Avenue, 17th

Floor

Miami,

Florida,

33131 USA

(646)

859-2368

(Address

and telephone number of Registrant’s principal executive offices)

Cogency

Global Inc.

122

East 42nd Street, 18th Floor

New

York, NY 10168

1-800-221-0102

(Name,

address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities

registered or to be registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common Shares, no par

value |

|

REAX |

|

The Nasdaq Stock Market

LLC |

Securities

registered pursuant to Section 12(g) of the Act: None

Securities

for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For

annual reports, indicate by check mark the information filed with this Form:

| ☒

Annual information form |

☒

Audited annual financial statements |

Indicate

the number of outstanding shares of each of the registrant’s classes of capital or common stock as of the close of the period covered

by the annual report: 183,605,781 outstanding as of December 31, 2023.

Indicate

by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during

the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject

to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit and post such files). ☒

Yes ☐ No

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

☒

Emerging growth company

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 13(a) of the Exchange Act.

| † |

The term “new or

revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting

Standards Codification after April 5, 2012. |

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

| Auditor Firm ID |

|

Auditor Name |

|

Auditor Location |

| 1197 |

|

Brightman Almagor Zohar & Co |

|

Tel Aviv, Israel |

EXPLANATORY

NOTE

The

Real Brokerage Inc. (the “Company,” “Registrant,” or “Real”) is a “foreign private

issuer” as defined in Rule 3b-4 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is

a Canadian issuer eligible to file its annual report (“Annual Report”) pursuant to Section 13 of the Exchange Act on

Form 40-F pursuant to the multi-jurisdictional disclosure system (the “MJDS”) adopted by the United States Securities

and Exchange Commission (the “SEC”). The Company’s common shares are listed in the United States on the Nasdaq

Capital Market (“NASDAQ”) under the trading symbol “REAX.”

The Company is filing this Amendment No. 1 (this “Amendment”) to its original annual report on Form 40-F

for the year ended December 31, 2023, which was filed with the U.S. Securities and Exchange Commission on March 14, 2024 (the “Original

2023 Annual Report” and together with this Amendment, the “Annual Report”), in order to file Exhibit 97 to the Annual

Report – Policy Regarding Recovery of Erroneously Awarded

Compensation (the “Clawback Policy”). In addition, as required by Rule 12b-15 of the Exchange Act, a new certification by the Registrant’s principal executive officer and principal financial officer

is filed herewith as Exhibits 99.4 and 99.5 to this Amendment, pursuant to Rule 13a-14(a) of the Exchange Act. Because no financial statements

have been included in this Amendment, paragraphs 3, 4 and 5 of the certifications have been omitted. The Registrant is also not including

new certifications under Section 1350 of Chapter 63 of Title 18 of the United States Code (18 U.S.C. 1350) (Section 906 of the Sarbanes-Oxley

Act of 2002), as no financial statements are being filed with this Amendment.

This

Amendment consists of a cover page, this explanatory note, the signature page, the exhibit index, Exhibit 97, Exhibit 99.4, and

Exhibit 99.5. Other than expressly set forth herein, this Amendment does not, and does not purport to, amend or restate any other

information contained in the Original 2023 Annual Report nor does this Amendment reflect any events that have occurred after the

Original 2023 Annual Report was filed.

SIGNATURES

Pursuant

to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and

has duly caused this Amendment No. 1 to the Annual Report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

THE REAL BROKERAGE INC. |

| |

|

|

| |

By: |

/s/

Tamir Poleg |

| |

Name: |

Tamir Poleg |

| |

Title: |

Chief Executive Officer |

Date:

July 15, 2024

EXHIBIT

INDEX

* Previously filed as an exhibit to the Original 2023 Annual

Report.

** Filed

as an exhibit to this Amendment.

EXHIBIT

97

THE

REAL BROKERAGE INC.

POLICY

REGARDING RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

The

following is the policy of The Real Brokerage Inc. (the “Company”) regarding the recovery of incentive compensation erroneously

awarded (the “Policy”) to Covered Persons as a result of erroneous financial measures that are restated. This policy is intended

to comply with Rule 5608 of the Nasdaq Marketplace Rules (“Rule 5608”) and Securities and Exchange Commission (“SEC”)

Rule 10D-1.

1. The Policy

It

is the policy of the Company that if the Company is required to prepare an accounting restatement due to the material noncompliance of

the Company with any financial reporting requirement under the securities laws, including any required accounting restatement to correct

an error in previously issued financial statements that is material to the previously issued financial statements, or that would result

in a material misstatement if the error were corrected in the current period or left uncorrected in the current period, the Company will

recover reasonably promptly from each Covered Person all Erroneously Awarded Compensation the Covered Person received during the Applicable

Recovery Period due to the error in calculating Financial Reporting Measures that resulted in the restatement.

This

Policy will apply to all Incentive-based compensation received by a person (a) after the person begins service as an Executive Officer

or otherwise is designated by the Committee as a Covered Person (b) who served as an Executive Officer, or otherwise was a Covered Person,

during the performance period for that Incentive-Based Compensation, (c) while the Company has a class of securities listed on the Nasdaq

Stock Market LLC (“Nasdaq”) or any other national securities exchange or a national securities association, and (d) during

the Applicable Recovery Period.

2. Defined Terms

When

used in, or with regard to, this Policy, the following terms will have the meanings given to them in Rule 5608 (with all references to

the issuer being to the Company):

| Executive Officer |

Incentive-Based Compensation |

| Financial

Reporting Measures |

Received |

In

addition, when used in, or with regard to, this Policy, the following terms will have the following meanings:

“Applicable

Recovery Period” means, with respect to a Material Restatement, the three completed fiscal years immediately preceding the

Restatement Date of that Material Restatement (including as a fiscal year any transition period between the last day of the Company’s

previous fiscal year end and the first day of its new fiscal year that comprises a period of between nine and twelve months due to the

Company’s changing its fiscal year within or immediately following the aforementioned three completed fiscal years). The Company’s

obligation to recover Erroneously Awarded Compensation will not be dependent on if or when the restated financial statements are filed.

“Committee”

means the Compensation Committee of the Company’s Board of Directors.

“Covered

Person” means an executive officer of the Company and any other person designated by the Committee to be a Covered Person during

a specified period.

“Erroneously

Awarded Compensation” means, with respect to a Material Restatement, the amount of Incentive-Based Compensation Received by

a Covered Person during the Applicable Recovery Period in excess of the amount that would have been received by that Covered Person if

the Incentive-Based Compensation had been determined based on the restated amounts determined following the Material Restatement, computed

without respect to any taxes paid (i.e. without consideration of any withholding or other taxes paid when the Incentive-Based Compensation

was awarded or issued). If the Incentive- Based Compensation is based on stock price or total shareholder return and the Erroneously

Awarded Compensation is not subject to mathematical recalculation directly from the information in an accounting restatement, it will

be based on a reasonable estimate of the effect of the Material Restatement on the stock price or total shareholder return on which the

Incentive-Based Compensation was received.

“Material

Restatement” means an accounting restatement of previously issued financial statements of the Company due to the Company’s

material noncompliance with a financial requirement under the securities laws.

“Restatement

Date” means, with respect to a Material Restatement, the earlier of (i) the date the Company’s Board, a Committee of

the Company’s Board, or the officer or officers of the Company authorized to take such action if Board action is not required,

concludes, or reasonably should have concluded, that the Company is required to prepare the Material Restatement, or (ii) the date a

court, regulator or other legally authorized body, directs the Company to prepare the Material Restatement.

3. Exception to Policy

The

Company may elect not to seek to recover Erroneously Awarded Compensation from a Covered Person if the Committee determines that recovery

would be impractical and one or more of the following conditions is met: (i) the direct expense paid to a third party for assistance

in enforcing this Policy would exceed the amount to be recovered, and the Company has made a reasonable attempt to recover the Erroneously

Awarded Compensation, documented such reasonable attempt to recover, and provided that documentation to Nasdaq (ii) recovery would cause

the Company to violate a law of Canada or a province of Canada that was adopted prior to November 28, 2022, and the Company obtains,

and provides to Nasdaq, an opinion of Canadian counsel acceptable to Nasdaq that recovery would result in a violation of a law of Canada

or a province of Canada, or (iii) recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly

available to employees of the Company, to fail to meet the requirements of 26 U.S.C. 401(a)(13) or 26 U.S.C. 411(a) and regulations thereunder.

4. No Indemnification

The

Company is prohibited from indemnifying any Covered Person or former Covered Person against the loss of Erroneously Awarded Compensation.

No Covered Person will be entitled to indemnification from the Company or any of its subsidiaries for any costs of defending against

a claim by the Company for Erroneously Received Compensation.

5. Enforcement of Policy

The

Committee will determine the steps the Company should take to recover Erroneously Awarded Compensation, provided that the Committee will

not determine not to proceed against a Covered Person who received Erroneously Paid Compensation, unless it has received written advice

from counsel to the effect that it is more likely than not that if the Company attempts to recover Erroneously Awarded Compensation,

the effort will not result in a material net recovery by the Company (whether because of doubts regarding the Company’s right to

recover the Erroneously Awarded Compensation or because of doubts about the Covered Person’s financial ability to return the Erroneously

Awarded Compensation).

No

Covered Person will be entitled to indemnification from the Company or any of its subsidiaries for any costs of defending against a claim

by the Company for Erroneously Received Compensation.

6. Rights against Covered Persons

Every

employee of the Company or any of its subsidiaries who is, or becomes, a Covered Person, will be deemed by accepting Incentive-Based

Compensation to agree that that Incentive-Based Compensation is received, and will be held by the Covered Person, subject to this Policy,

and that this Policy may be enforced to recover Erroneously Awarded Compensation from the Covered Person.

7. Administration and Interpretation

The

Committee will be responsible for all decisions regarding the application and interpretation of this Policy. However, in interpreting

this Policy, the Committee will do so in a manner that is, to the fullest extent practicable, consistent with SEC Rule 10D-1 and Rule

5608 of the Nasdaq Marketplace Rules.

8. Maintaining Records

The

Company will be responsible for maintaining documentation of the determination of the reasonable estimate as detailed under the definition

of “Erroneously Awarded Compensation” and provide such documentation to Nasdaq.

The

Company will also be responsible for filing all disclosures with respect to such recovery policy in accordance with the requirements

of the Federal securities laws, including the disclosure required by the applicable SEC filings.

9. Review

The

Committee shall be responsible for administering this Policy. The Committee shall review this Policy periodically and recommend appropriate

changes to the Board of Directors of the Company.

Approved

by the Board of Directors on August 8, 2023

EXHIBIT

99.4

CERTIFICATION

I,

Tamir Poleg, Chief Executive Officer of The Real Brokerage Inc., certify that:

| 1. |

I have reviewed this Amendment No. 1 to the Annual Report on Form 40-F

of The Real Brokerage Inc.; and |

| |

|

| 2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the

period covered by this report. |

Date: July 15, 2024

| By: |

/s/

Tamir Poleg |

|

| Name: |

Tamir

Poleg |

|

| Title: |

Chief

Executive Officer |

|

EXHIBIT

99.5

CERTIFICATION

I,

Michelle Ressler, Chief Financial Officer of The Real Brokerage Inc., certify that:

| 1. |

I have reviewed this Amendment No. 1 to the Annual Report on Form 40-F

of The Real Brokerage Inc.; and |

| |

|

| 2. |

Based on my knowledge, this report does not contain any untrue statement

of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such

statements were made, not misleading with respect to the period covered by this report. |

Date:

July 15, 2024

| By: |

/s/

Michelle Ressler |

|

| Name: |

Michelle

Ressler |

|

| Title: |

Chief

Financial Officer |

|

v3.24.2

Cover

|

12 Months Ended |

|

Dec. 31, 2023

shares

|

|---|

| Entity Addresses [Line Items] |

|

| Document Type |

40-F/A

|

| Amendment Flag |

true

|

| Amendment Description |

The

Real Brokerage Inc. (the “Company,” “Registrant,” or “Real”) is a “foreign private

issuer” as defined in Rule 3b-4 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is

a Canadian issuer eligible to file its annual report (“Annual Report”) pursuant to Section 13 of the Exchange Act on

Form 40-F pursuant to the multi-jurisdictional disclosure system (the “MJDS”) adopted by the United States Securities

and Exchange Commission (the “SEC”). The Company’s common shares are listed in the United States on the Nasdaq

Capital Market (“NASDAQ”) under the trading symbol “REAX.”

|

| Document Registration Statement |

false

|

| Document Annual Report |

true

|

| Document Period End Date |

Dec. 31, 2023

|

| Document Fiscal Period Focus |

FY

|

| Document Fiscal Year Focus |

2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-40442

|

| Entity Registrant Name |

The

Real Brokerage Inc.

|

| Entity Central Index Key |

0001862461

|

| Entity Incorporation, State or Country Code |

Z4

|

| Entity Address, Address Line One |

701

Brickell Avenue

|

| Entity Address, Address Line Two |

17th

Floor

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Country |

US

|

| Entity Address, Postal Zip Code |

33131

|

| City Area Code |

(646)

|

| Local Phone Number |

859-2368

|

| Title of 12(b) Security |

Common Shares, no par

value

|

| Trading Symbol |

REAX

|

| Security Exchange Name |

NASDAQ

|

| Annual Information Form |

true

|

| Audited Annual Financial Statements |

true

|

| Entity Current Reporting Status |

Yes

|

| Entity Interactive Data Current |

Yes

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Common Stock, Shares Outstanding |

183,605,781

|

| ICFR Auditor Attestation Flag |

false

|

| Document Financial Statement Error Correction [Flag] |

false

|

| Auditor Firm ID |

1197

|

| Auditor Name |

Brightman Almagor Zohar & Co

|

| Auditor Location |

Tel Aviv, Israel

|

| Business Contact [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

122

East 42nd Street, 18th Floor

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10168

|

| City Area Code |

1-800

|

| Local Phone Number |

221-0102

|

| Contact Personnel Name |

Cogency

Global Inc.

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag with value true on a form if it is an annual report containing audited financial statements. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditedAnnualFinancialStatements |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a registration statement. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

| Name: |

dei_DocumentRegistrationStatement |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

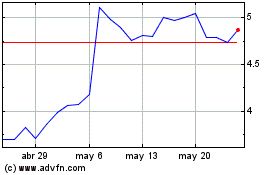

Real Brokerage (NASDAQ:REAX)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Real Brokerage (NASDAQ:REAX)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024