0001060219

false

--12-31

0001060219

2023-08-11

2023-08-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

August 11, 2023

________________________

SALISBURY BANCORP, INC.

(Exact name of registrant as specified

in its charter)

________________________

|

Connecticut

(State of other jurisdiction

of incorporation) |

|

001-14854

(Commission

File Number) |

|

06-1514263

(IRS Employer

Identification No.) |

|

5 Bissell Street, Lakeville, Connecticut

(Address of principal executive offices) |

|

|

06039

(Zip Code)

|

| |

Registrant’s telephone number, including area code: (860) 435-9801 |

|

| |

(Former name or former address, if changed since last report)

________________________ |

|

| |

|

|

|

|

|

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to

Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

| Common Stock, $0.10 par value per share |

SAL |

NASDAQ |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement. |

As previously disclosed, on December

5, 2022, Salisbury Bancorp, Inc. (“Salisbury”) and Salisbury Bank and Trust Company, Salisbury’s subsidiary bank (“Salisbury

Bank”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with NBT Bancorp Inc. (“NBT”)

and NBT Bank, National Association, NBT’s subsidiary bank (“NBT Bank”). The Merger Agreement provided for the acquisition

of Salisbury by NBT through the merger of Salisbury with and into NBT, with NBT being the surviving entity, and the merger of Salisbury

Bank with and into NBT Bank, with NBT Bank being the surviving entity. The Merger Agreement is filed as Exhibit 2.1 to the Current Report

on Form 8-K filed by Salisbury with the Securities and Exchange Commission on December 5, 2022.

On August 9, 2023, Salisbury, Salisbury

Bank, NBT and NBT Bank entered into a First Amendment to Agreement and Plan of Merger (the “Merger Agreement Amendment”) in

accordance with Section 8.02 of the Merger Agreement to, among other matters, (i) correct certain typographical errors in the Merger Agreement,

(ii) clarify that references to “charter and bylaws” of NBT and NBT Bank in the Merger Agreement refer to the Restated

Certificate of Incorporation, as amended, and Amended and Restated Bylaws of NBT and the Articles of Association and Amended and Restated

Bylaws of NBT Bank, respectively, and (iii) clarify that the New Bank Board Member (as defined in the Merger Agreement) shall be appointed

to the board of directors of NBT Bank by the board of directors of NBT Bank in accordance with the Articles of Association and Amended

and Restated Bylaws of NBT Bank.

The

foregoing summary of the Merger Agreement Amendment does not purport to be a complete description and is qualified in its entirety by

the full text of the Merger Agreement Amendment, which is attached hereto as Exhibit 2.2 and is incorporated herein by reference.

| Item 2.01 | Completion

of Acquisition or Disposition of Assets. |

On

August 11, 2023 (the “Closing Date”), NBT completed its acquisition of Salisbury pursuant to the Merger Agreement. Under

the terms of the Merger Agreement, (i) Salisbury merged with and into NBT, with NBT being the surviving entity, and (ii) Salisbury Bank

merged with and into NBT Bank, with NBT Bank being the surviving entity (the “Merger”).

Subject

to the terms and conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each

share of Salisbury common stock was converted into the right to receive 0.7450 shares of NBT common stock, with cash payable in lieu of

any fractional shares.

A copy of Salisbury’s press release dated

August 14, 2023, announcing the completion of the Merger, is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The foregoing description of the Merger and the

Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement,

which is attached as Exhibit 2.1 to the Current Report on Form 8-K filed by Salisbury with the Securities and Exchange Commission on December

5, 2022, and is incorporated by reference herein.

| Item 3.01 | Notice of Delisting. |

On the Closing Date, Salisbury

notified NASDAQ that a certificate of merger had been filed with the Secretary of State of the State of Delaware and the Secretary of

State of the State of Connecticut and requested that NASDAQ (i) suspend trading of Salisbury Common Stock prior to the opening of trading

on August 14, 2023, (ii) withdraw Salisbury Common Stock from listing on NASDAQ prior to the opening of trading on August 14, 2023 and

(iii) file with the Securities and Exchange Commission (the “SEC”) notification on Form 25 of delisting of Salisbury common

stock and of deregistration under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

As a result, Salisbury common stock will no longer be listed on NASDAQ.

NBT, as successor to Salisbury,

intends to file with the SEC a certification on Form 15 requesting the termination of registration of Salisbury common stock under Section

12(g) of the Exchange Act and the suspension of reporting obligations under Sections 13 and 15(d) of the Exchange Act.

The information set forth

in Item 1.01 and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

| Item 3.03 | Material Modification to Rights of Security Holders. |

At the Effective Time, each

holder of a certificate or book-entry share representing any shares of Salisbury common stock ceased to have any rights with respect thereto,

except the right to receive the consideration as described above and subject to the terms and conditions set forth in the Merger Agreement.

The information set forth

in Item 1.01, Item 2.01, Item 3.01, Item 5.01, Item 5.02 and Item 5.03 of this Current Report on Form 8-K is incorporated by reference

into this Item 3.03.

| Item 5.01 | Changes in Control of Registrant. |

On August 11, 2023, Salisbury

was merged with and into NBT pursuant to the Merger Agreement, with NBT as the surviving corporation in the Merger.

The information set forth

in Item 1.01, Item 2.01, Item 3.01, Item 3.03, Item 5.02 and Item 5.03 of this Current Report on Form 8-K is incorporated by reference

into this Item 5.01.

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

At the Effective Time, in

accordance with the terms of the Merger Agreement, Salisbury’s directors and executive officers ceased serving in such capacities.

| Item 5.03 | Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year. |

As

a result of the Merger, at the Effective Time, Salisbury ceased to exist, and the Certificate of Incorporation and the Bylaws of Salisbury

ceased to be in effect by operation of law.

The information set forth

in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.03.

On August 14, 2023, Salisbury

issued a press release announcing the completion of the Merger. A copy of the press release is incorporated herein by reference

as Exhibit 99.1.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

Exhibit

Number |

|

Description |

| |

|

| 2.1 |

|

Agreement

and Plan of Merger, dated as of December 5, 2022, by and among NBT Bancorp Inc., NBT Bank, National Association, Salisbury Bancorp,

Inc. and Salisbury Bank and Trust Company (incorporated by reference to Exhibit 2.1 to Salisbury Bancorp, Inc.’s Current Report

on Form 8-K filed on December 5, 2022)* |

| |

|

|

| 2.2 |

|

First

Amendment to Agreement and Plan of Merger, dated as of August 9, 2023, by and among NBT Bancorp Inc., NBT Bank, National Association,

Salisbury Bancorp, Inc. and Salisbury Bank and Trust Company |

| |

|

|

| 99.1 |

|

Press

Release of Salisbury Bancorp, Inc., dated August 14, 2023, announcing completion of the Merger |

| |

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

* Schedules and exhibits

have been omitted pursuant to Item 601(a)(5) of Regulation S-K. NBT Bancorp Inc. agrees to furnish supplementally to the SEC a copy of

any omitted schedule or exhibit upon request by the SEC.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

|

|

|

|

|

| |

|

|

|

SALISBURY BANCORP, INC. |

| |

|

|

|

|

| August 14, 2023 |

|

|

| |

|

|

|

By: |

|

/s/ Richard

J. Cantele, Jr. |

| |

|

|

|

|

|

Richard J. Cantele, Jr.

President and Chief Executive Officer |

| |

|

|

|

|

|

|

Exhibit 2.2

Exhibit 99.1

NEWS RELEASE

Contact:

Rick Cantele, President and Chief Executive Officer

Salisbury Bancorp, Inc.

5 Bissell Street

Lakeville, CT 06039

860.435.9801

rcantele@salisburybank.com

FOR IMMEDIATE RELEASE

Salisbury

banCORP, INC. COMPLETES MERGER WITH NBT BANCORP INC.

Lakeville, Connecticut, August 14, 2023 / GlobeNewswire…Salisbury

Bancorp, Inc. (“Salisbury”), (NASDAQ Capital Market: “SAL”), the holding company for Salisbury Bank and Trust

Company (“Salisbury Bank”), announced that it completed its merger with and into NBT Bancorp Inc. (“NBT”) (NASDAQ:

NBTB) (the “Merger”) on August 11, 2023.

Salisbury’s

President and Chief Executive Officer, Richard J. Cantele, Jr., stated, “We are excited about the consummation of our strategic

merger with NBT. We believe Salisbury shareholders will benefit from the additional scale and expanded suite of products and services

offered by NBT. I am extremely proud of the employees of Salisbury Bank who have worked diligently over the years to provide outstanding

service to our customers and to give back to our communities. I am also grateful to our many customers for allowing us to partner and

grow with them. I am confident that our customers will experience the same level of service from NBT.”

Background

Salisbury

Bancorp, Inc. is the parent company of Salisbury Bank and Trust Company, a Connecticut chartered commercial bank serving the communities

of northwestern Connecticut and proximate communities in New York and Massachusetts, since 1848, through full service branches in Canaan,

Lakeville, Salisbury and Sharon, Connecticut; Great Barrington, South Egremont and Sheffield, Massachusetts; and Dover Plains, Fishkill,

Millerton, Newburgh, New Paltz, and Poughkeepsie, New York.

Forward Looking Statements

This communication contains forward-looking statements

as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about Salisbury and their industry

involve substantial risks and uncertainties. Statements other than statements of current or historical fact, including statements regarding

Salisbury’s future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, and the impact

of any laws or regulations applicable to Salisbury, are forward-looking statements. Words such as “anticipates,” “believes,”

“estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,”

“may,” “will,” “should” and other similar expressions are intended to identify these forward-looking

statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results.

Among the risks and uncertainties that could

cause actual results to differ from those described in the forward-looking statements include, but are not limited to the following: (1)

the businesses of NBT and Salisbury may not be combined successfully, or such combination may take longer to accomplish than expected;

(2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer

loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected;

(4) the possibility that NBT may be unable to achieve expected synergies and operating efficiencies in the merger within the expected

timeframes or at all or to successfully integrate Salisbury’s operations and those of NBT; (5) such integration may be more difficult,

time consuming or costly than expected; (6) revenues following the proposed transaction may be lower than expected; (7) NBT’s success

in executing its business plan and strategy and managing the risks involved in the foregoing; (8) the dilution caused by NBT’s issuance

of additional shares of its capital stock in connection with the proposed transaction; (9) changes in general economic conditions, including

changes in market interest rates and changes in monetary and fiscal policies of the federal government; (10) legislative and regulatory

changes; and (11) uncertainty as to the extent of the duration, scope, and impacts of the COVID-19 pandemic on NBT. Further

information about these and other relevant risks and uncertainties may be found in Salisbury’s and NBT’s respective Annual

Reports on Form 10-K for the fiscal year ended December 31, 2022 and in subsequent filings with the SEC.

Forward-looking statements speak only as of the date

they are made. Salisbury does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions

which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances

after the date of such statements. You are cautioned not to place undue reliance on these forward-looking statements.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

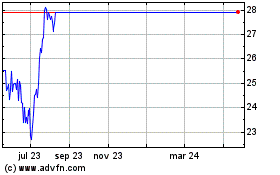

Salisbury Bancorp (NASDAQ:SAL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Salisbury Bancorp (NASDAQ:SAL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025