False000183165100018316512023-08-012023-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

——————————

FORM 8-K

——————————

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 1, 2023

——————————

| | | | | | | | | | | | | | | | | |

| Shoals Technologies Group, Inc. |

| (Exact name of registrant as specified in its charter) |

——————————

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-39942 | | 85-3774438 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | |

| 1400 Shoals Way | | Portland | | Tennessee | | 37148 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | |

| | (615) | | 451-1400 | | |

| (Registrant’s telephone number, including area code) |

——————————

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.00001 Par Value | | SHLS | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 1, 2023, Shoals Technologies Group, Inc. (the “Company”) issued a press release announcing its financial results for the three months ended June 30, 2023. In the press release, the Company also announced that it would be holding a conference call on August 1, 2023 to discuss its financial results for the the three months ended June 30, 2023. The full text of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference. The transcript of the conference call is attached hereto as Exhibit 99.2 to this Form 8-K.

The information set forth in this Item 2.02, including Exhibit 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Shoals Technologies Group, Inc. |

| | | |

| By: | /s/ Dominic Bardos |

| Name: | | Dominic Bardos |

| Title: | | Chief Financial Officer |

Date: August 1, 2023

Shoals Technologies Group, Inc. Reports Financial Results for Second Quarter 2023

–Record Quarterly Revenue of $119.2 million, up 62% Year-Over-Year –

–System Solutions Revenue Grew 80% Year-Over-Year to $102.1 million, Representing 86% of Second Quarter Revenue –

–Gross Margin Expanded 350 bps Year-Over-Year to 42.4% –

–Signed Landmark 10 Gigawatt Master Supply Agreement with Blattner Company –

–Backlog and Awarded Orders Increased 67% Year-Over-Year to $546.1 million –

PORTLAND, TN. – August 1, 2023 (GLOBE NEWSWIRE) – Shoals Technologies Group, Inc. (“Shoals” or the “Company”) (Nasdaq: SHLS), a leading provider of electrical balance of system (“EBOS”) solutions for solar, battery storage, and electric vehicle charging infrastructure, today announced results for its second quarter ended June 30, 2023.

“Shoals delivered another outstanding performance in the second quarter, setting new Company records for revenue and earnings. Revenue grew 62% year-over-year, while System Solutions revenue increased 80% compared to the year-ago period, as customers continue to partner with and use Shoals for their EBOS needs. This was further illustrated in the quarter when we signed our landmark 10-gigawatt master supply agreement with Blattner,” said Jeff Tolnar, President of Shoals.

Mr. Tolnar added, “Backlog and awarded orders increased 67% year-over-year to a Company record of $546.1 million, reflecting continued robust demand for our products. Demand for our combine-as-you-go solution remained strong, with one new customer converting to our system during the quarter, bringing our total number of Big Lead Assembly (BLA) customers to 43. Quotes, awarded orders and backlog of BLA+ continue to grow as we roll out additional products within the product family and customer adoption increases.”

“Finally, we are very excited to welcome Brandon Moss as Shoals’ new CEO. His industry and leadership experience, proven track record of executing strategic growth plans, and commitment to culture, make him the ideal person to lead Shoals through our next stage of growth. We look forward to working with Brandon to continue our strong momentum and capitalize on our significant market opportunity,” concluded Mr. Tolnar.

Second Quarter 2023 Financial Results

Revenue grew 62%, to $119.2 million, compared to $73.5 million for the prior-year period, driven by higher sales volumes as a result of increased demand for solar EBOS generally and the Company’s combine-as-you-go System Solutions specifically. System Solutions revenue increased 80% compared to the prior-year period, and represented 86% of revenue compared to 77% in the prior-year period.

Gross profit increased 77% to $50.5 million, compared to $28.6 million in the prior-year period. Gross profit as a percentage of revenue grew more than 350 bps to 42.4% compared to 38.9% in the prior-year period, driven primarily by a higher portion of overall revenue coming from the Company’s combine-as-you-go System Solutions, which carry higher margins than the Company’s other products, slightly lower raw materials input costs, increased leverage on fixed costs, and efficiencies gained in operations partially offset by $9.4 million in warranty expense.

General and administrative expenses were $16.7 million, compared to $13.3 million during the same period in the prior year. This increase was primarily the result of higher non-cash stock-based compensation and planned increases in payroll expense due to higher headcount supporting growth.

Income from operations was $31.6 million, compared to $13.0 million during the same period in the prior year.

Net income increased 159% to $18.9 million compared to $7.3 million during the same period in the prior year. Net income attributable to Shoals grew 330% to $18.9 million compared to $4.4 million during the same period in the prior year. Basic and diluted net income per share was $0.11 compared to basic and diluted net income per share of $0.04 in the prior-year period.

Adjusted EBITDA* increased 96% to $38.7 million compared to $19.8 million for the prior-year period.

Adjusted net income* grew 105% to $24.0 million compared to $11.8 million during the same period in the prior year. Adjusted diluted earnings per share was $0.14 compared to $0.07 in the prior-year period.

* A reconciliation of the Company’s non-GAAP measures to the most closely comparable U.S. generally accepted accounting principles (“GAAP”) measures are found within this release.

Backlog and Awarded Orders

The Company’s backlog and awarded orders as of June 30, 2023 were $546.1 million, representing a 67% increase compared to the same time last year and a 4% sequential increase from March 31, 2023. The increase in backlog and awarded orders reflects continued robust demand for the Company’s solar products, including the recently introduced BLA+.

Backlog represents signed purchase orders or contractual minimum purchase commitments with take-or-pay provisions and awarded orders are orders we are in the process of documenting a contract but for which a contract has not yet been signed.

Full Year 2023 Outlook

Based on current business conditions, business trends and other factors, the Company is maintaining its outlook for the year ending December 31, 2023 as follows:

•Revenue to be in the range of $480 million to $510 million

•Adjusted EBITDA to be in the range of $145 million to $160 million

•Adjusted net income to be in the range of $92 million to $102 million

•Interest expense to be in the range of $22 to $26 million

•Capital expenditures to be in the range of $8 to $12 million

A reconciliation of Adjusted EBITDA and Adjusted net income guidance, which are forward-looking measures that are non-GAAP measures, to the most closely comparable GAAP measures is not provided because we are unable to provide such reconciliation without unreasonable effort. The inability to provide a quantitative reconciliation is due to the uncertainty and inherent difficulty in predicting the occurrence, the financial impact and the periods in which the components of the applicable GAAP measures and non-GAAP adjustments may be recognized. The GAAP measures may include the impact of such items as non-cash share-based compensation, amortization of intangible assets and the tax effect of such items, in addition to other items we have historically excluded from Adjusted EBITDA and Adjusted net income. We expect to continue to exclude these items in future disclosures of these non-GAAP measures and may also exclude other similar items that may arise in the future.

Webcast and Conference Call Information

Company management will host a webcast and conference call on August 1, 2023 at 5:00 p.m. Eastern Time, to discuss the Company’s financial results.

Interested investors and other parties can listen to a webcast of the live conference call by logging onto the Investor Relations section of the Company’s website at https://investors.shoals.com.

The conference call can be accessed live over the phone by dialing 1-855-327-6837 (domestic) or +1-631-891-4304 (international). A telephonic replay will be available approximately two hours after the call by dialing 1-844-512-2921 or for international callers, +1-412-317-6671. The conference ID for the live call and pin number for the replay is 10021930. The telephonic replay will be available until 11:59 p.m. Eastern Time on August 15, 2023.

About Shoals Technologies Group, Inc.

Shoals Technologies Group, Inc. is a leading provider of electrical balance of systems (EBOS) solutions for solar, storage, and electric vehicle charging infrastructure. Since its founding in 1996, the Company has introduced innovative technologies and systems solutions that allow its customers to substantially increase installation efficiency and safety while improving system performance and reliability. Shoals Technologies Group, Inc. is a recognized leader in the renewable energy industry whose solutions are deployed on over 62 GW of solar systems globally. For additional information, please visit: https://www.shoals.com.

Investor Relations Contact

Dhaval Patel

Vice President, Investor Relations

Email: Dhaval.Patel@shoals.com

Forward-Looking Statements

This report contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, technology developments, financing and investment plans, warranty, litigation and liability accruals and estimates of loss or gains, competitive position, industry and regulatory environment, potential growth opportunities and the effects of competition. Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” "seek," “should,” “will,” “would” or similar expressions and the negatives of those terms.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Some of the key factors that could cause actual results to differ from our expectations include, among others, lower than anticipated growth in demand for solar energy projects and EV charging infrastructure; macroeconomic events, including heightened inflation, rises in interest rates and a potential recession; defects or performance problems in our products or their parts, including those manufactured by third parties, and related warranty claims; supply chain challenges, including as a result of additional duties and charges on imports and exports; our failure to, or incurrence of significant costs in order to, obtain, maintain, protect, defend or enforce our intellectual property and other proprietary rights; governmental policies and regulations, and any subsequent changes, which may present technical, regulatory and economic barriers; changes in the United States trade environment; failure to integrate acquired businesses, and delays, disruptions or quality control problems in our manufacturing operations in part due to vendor concentration.

Other risks and uncertainties are described in the section entitled "Item 1A. Risk Factors" of our periodic reports filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2022 and our most recent Quarterly Report on Form 10-Q. Given these uncertainties, you should not place undue reliance on forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this report. You should read this report with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update these forward-looking statements, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Non-GAAP Financial Measures

Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted Earnings per Share (“EPS”)

We define Adjusted EBITDA as net income (loss) plus (i) interest expense, net, (ii) income tax expense, (iii) depreciation expense, (iv) amortization of intangibles, (v) equity-based compensation, and (vi) acquisition-related expenses. We define Adjusted Net Income as net income attributable to Shoals Technologies Group, Inc. plus (i) net income impact from assumed exchange of Class B common stock to Class A common stock as of the beginning of the earliest period presented, (ii) amortization of intangibles, (iii) amortization of deferred financing costs, (iv) equity-based compensation, and (v) acquisition-related expenses, all net of applicable income taxes. We define Adjusted Diluted EPS as Adjusted Net Income divided by the diluted weighted average shares of Class A common stock outstanding for the applicable period, which assumes the exchange of all outstanding Class B common stock for Class A common stock as of the beginning of the earliest period presented.

Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS are intended as supplemental measures of performance that are neither required by, nor presented in accordance with, GAAP. We present Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS because we believe they assist investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. In addition, we use Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS: (i) as factors in evaluating management’s performance when determining incentive compensation; (ii) to evaluate the effectiveness of our business strategies; and (iii) because our credit agreement uses measures similar to Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS to measure our compliance with certain covenants.

Among other limitations, Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS do not reflect our cash expenditures, or future requirements for capital expenditures or

contractual commitments; do not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our ongoing operations; and may be calculated by other companies in our industry differently than we do or not at all, which may limit their usefulness as comparative measures.

Because of these limitations, Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS should not be considered in isolation or as substitutes for performance measures calculated in accordance with GAAP. You should review the reconciliation of net income and net income attributable to Shoals Technologies Group, Inc. to Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted EPS below and not rely on any single financial measure to evaluate our business.

Shoals Technologies Group, Inc.

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except shares and par value)

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 5,860 | | | $ | 8,766 | |

| Accounts receivable, net | 97,099 | | | 50,575 | |

| Unbilled receivables | 21,664 | | | 16,713 | |

| Inventory, net | 68,312 | | | 72,854 | |

| Other current assets | 7,180 | | | 4,632 | |

| Total Current Assets | 200,115 | | | 153,540 | |

| Property, plant and equipment, net | 20,198 | | | 16,870 | |

| Goodwill | 69,941 | | | 69,941 | |

| Other intangible assets, net | 52,542 | | | 56,585 | |

| Deferred tax assets | 470,329 | | | 291,634 | |

| Other assets | 5,695 | | | 6,325 | |

| Total Assets | $ | 818,820 | | | $ | 594,895 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 16,239 | | | $ | 9,481 | |

| Accrued expenses and other | 27,650 | | | 17,882 | |

| Deferred revenue | 31,298 | | | 23,259 | |

| Long-term debt—current portion | 2,000 | | | 2,000 | |

| Total Current Liabilities | 77,187 | | | 52,622 | |

| Revolving line of credit | 20,000 | | | 48,000 | |

| Long-term debt, less current portion | 188,609 | | | 189,063 | |

| Other long-term liabilities | 3,619 | | | 4,221 | |

| Total Liabilities | 289,415 | | | 293,906 | |

| Commitments and Contingencies | | | |

| Stockholders’ Equity | | | |

| Preferred stock, $0.00001 par value - 5,000,000 shares authorized; none issued and outstanding as of June 30, 2023 and December 31, 2022 | — | | | — | |

| Class A common stock, $0.00001 par value - 1,000,000,000 shares authorized; 169,926,094 and 137,904,663 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | 2 | | | 1 | |

| Class B common stock, $0.00001 par value - 195,000,000 shares authorized; none and 31,419,913 shares issued and outstanding as of June 30, 2023 and December 31, 2022, respectively | — | | | 1 | |

| Additional paid-in capital | 461,705 | | | 256,894 | |

| Accumulated earnings | 67,698 | | | 34,478 | |

| Total stockholders’ equity attributable to Shoals Technologies Group, Inc. | 529,405 | | | 291,374 | |

| Non-controlling interests | — | | | 9,615 | |

| Total stockholders' equity | 529,405 | | | 300,989 | |

| Total Liabilities and Stockholders’ Equity | $ | 818,820 | | | $ | 594,895 | |

Shoals Technologies Group, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 119,208 | | | $ | 73,490 | | | $ | 224,294 | | | $ | 141,466 | |

| Cost of revenue | 68,691 | | | 44,897 | | | 125,520 | | | 86,581 | |

| Gross profit | 50,517 | | | 28,593 | | | 98,774 | | | 54,885 | |

| Operating expenses | | | | | | | |

| General and administrative expenses | 16,723 | | | 13,265 | | | 36,715 | | | 27,184 | |

| Depreciation and amortization | 2,158 | | | 2,344 | | | 4,323 | | | 4,710 | |

| Total operating expenses | 18,881 | | | 15,609 | | | 41,038 | | | 31,894 | |

| Income from operations | 31,636 | | | 12,984 | | | 57,736 | | | 22,991 | |

| Interest expense, net | (6,505) | | | (4,170) | | | (12,501) | | | (8,006) | |

| Income before income taxes | 25,131 | | | 8,814 | | | 45,235 | | | 14,985 | |

| Income tax expense | (6,207) | | | (1,511) | | | (9,328) | | | (3,033) | |

| Net income | 18,924 | | | 7,303 | | | 35,907 | | | 11,952 | |

| Less: net income attributable to non-controlling interests | — | | | 2,901 | | | 2,687 | | | 4,910 | |

| Net income attributable to Shoals Technologies Group, Inc. | $ | 18,924 | | | $ | 4,402 | | | $ | 33,220 | | | $ | 7,042 | |

| | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Earnings per share of Class A common stock: | | | | | | | |

| Basic | $ | 0.11 | | | $ | 0.04 | | | $ | 0.21 | | | $ | 0.06 | |

| Diluted | $ | 0.11 | | | $ | 0.04 | | | $ | 0.21 | | | $ | 0.06 | |

| Weighted average shares of Class A common stock outstanding: | | | | | | | |

| Basic | 169,887 | | | 112,489 | | | 158,213 | | | 112,350 | |

| Diluted | 170,241 | | | 112,616 | | | 158,694 | | | 112,428 | |

Shoals Technologies Group, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| Cash Flows from Operating Activities | | | |

| Net income | $ | 35,907 | | | $ | 11,952 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 5,092 | | | 5,402 | |

| Amortization/write off of deferred financing costs | 692 | | | 684 | |

| Equity-based compensation | 11,968 | | | 7,896 | |

| Provision for credit losses | 296 | | | — | |

| Provision for obsolete or slow-moving inventory | 3,140 | | | 443 | |

| Provision for warranty expense | 9,386 | | | — | |

| Deferred taxes | 8,953 | | | 2,847 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | (46,820) | | | (26,259) | |

| Unbilled receivables | (4,951) | | | (1,047) | |

| Inventory | 1,402 | | | (27,404) | |

| Other assets | (2,064) | | | (2,059) | |

| Accounts payable | 7,014 | | | 4,060 | |

| Accrued expenses and other | (220) | | | 4,713 | |

| Deferred revenue | 8,039 | | | 12,029 | |

| Net Cash Provided by (Used in) Operating Activities | 37,834 | | | (6,743) | |

| Cash Flows from Investing Activities | | | |

| Purchases of property, plant and equipment | (4,377) | | | (2,149) | |

| Net Cash Used in Investing Activities | (4,377) | | | (2,149) | |

| Cash Flows from Financing Activities | | | |

| Distributions to non-controlling interests | (2,628) | | | (4,566) | |

| Employee withholding taxes related to net settled equity awards | (3,576) | | | (1,297) | |

| Payments on term loan facility | (1,000) | | | (1,000) | |

| Proceeds from revolving credit facility | 5,000 | | | 38,000 | |

| Repayments of revolving credit facility | (33,000) | | | (8,000) | |

| Other | (1,159) | | | — | |

| Net Cash Provided by (Used in) Financing Activities | (36,363) | | | 23,137 | |

| Net Increase (Decrease) in Cash, Cash Equivalents and Restricted Cash | (2,906) | | | 14,245 | |

| Cash, Cash Equivalents and Restricted Cash—Beginning of Period | 8,766 | | | 9,557 | |

| Cash, Cash Equivalents and Restricted Cash—End of Period | $ | 5,860 | | | $ | 23,802 | |

Shoals Technologies Group, Inc.

Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted Earnings per Share (“EPS”) (Unaudited)

Reconciliation of Net Income to Adjusted EBITDA (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 18,924 | | | $ | 7,303 | | | $ | 35,907 | | | $ | 11,952 | |

| Interest expense, net | 6,505 | | | 4,170 | | | 12,501 | | | 8,006 | |

| Income tax expense | 6,207 | | | 1,511 | | | 9,328 | | | 3,033 | |

| Depreciation expense | 565 | | | 470 | | | 1,049 | | | 893 | |

| Amortization of intangibles | 2,021 | | | 2,238 | | | 4,043 | | | 4,509 | |

| Equity-based compensation | 4,445 | | | 4,063 | | | 11,968 | | | 7,896 | |

| Acquisition-related expenses | — | | | 12 | | | — | | | 12 | |

| Adjusted EBITDA | $ | 38,667 | | | $ | 19,767 | | | $ | 74,796 | | | $ | 36,301 | |

Reconciliation of Net Income Attributable to Shoals Technologies Group, Inc. to Adjusted Net Income (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income attributable to Shoals Technologies Group, Inc. | $ | 18,924 | | | $ | 4,402 | | | $ | 33,220 | | | $ | 7,042 | |

Net income impact from assumed exchange of Class B common stock to Class A common stock (a) | — | | | 2,901 | | | 2,687 | | | 4,910 | |

Adjustment to the provision for income tax(b) | — | | | (686) | | | (653) | | | (1,159) | |

| Tax effected net income | 18,924 | | | 6,617 | | | 35,254 | | — | | 10,793 | |

| Amortization of intangibles | 2,021 | | | 2,238 | | | 4,043 | | | 4,509 | |

| Amortization of deferred financing costs | 342 | | | 408 | | | 692 | | | 684 | |

| Equity-based compensation | 4,445 | | | 4,063 | | | 11,968 | | | 7,896 | |

| Acquisition-related expenses | — | | | 12 | | | — | | | 12 | |

Tax impact of adjustments (c) | (1,688) | | | (1,588) | | | (4,092) | | | (3,093) | |

| Adjusted Net Income | $ | 24,044 | | | $ | 11,750 | | | $ | 47,865 | | | $ | 20,801 | |

(a) Reflects net income to Class A common stock from assumed exchange of corresponding shares of our Class B common stock held by the Founder and management. There were no shares of Class B common stock outstanding during the three months ended June 30, 2023.

(b) Shoals Technologies Group, Inc. is subject to U.S. Federal income taxes, in addition to state and local taxes with respect to its allocable share of any net taxable income of Shoals Parent LLC. The adjustment to the provision for income tax reflects the effective tax rates below, assuming Shoals Technologies Group, Inc. owned 100% of the units in Shoals Parent LLC for all periods presented.

Shoals Technologies Group, Inc.

Adjusted EBITDA, Adjusted Net Income and Adjusted Diluted Earnings per Share (“EPS”) (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Statutory U.S. Federal income tax rate | 21.0 | % | | 21.0 | % | | 21.0 | % | | 21.0 | % |

| Permanent adjustments | 0.5 | % | | 0.1 | % | | 0.4 | % | | 0.1 | % |

| State and local taxes (net of federal benefit) | 3.3 | % | | 2.5 | % | | 3.1 | % | | 2.5 | % |

| Effective income tax rate for Adjusted Net Income | 24.8 | % | | 23.6 | % | | 24.5 | % | | 23.6 | % |

(c) Represents the estimated tax impact of all Adjusted Net Income add-backs, excluding those which represent permanent differences between book versus tax.

Reconciliation of Diluted Weighted Average Shares Outstanding to Adjusted Diluted Weighted Average Shares Outstanding (in thousands, except per share):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Diluted weighted average shares of Class A common stock outstanding, excluding Class B common stock | 170,241 | | | 112,616 | | | 158,694 | | | 112,428 | |

| Assumed exchange of Class B common stock to Class A common stock | — | | | 54,635 | | | 11,491 | | | 54,585 | |

| Adjusted diluted weighted average shares outstanding | 170,241 | | | 167,251 | | | 170,185 | | | 167,013 | |

| | | | | | | |

| Adjusted Net Income | $ | 24,044 | | | $ | 11,750 | | | $ | 47,865 | | | $ | 20,801 | |

| Adjusted Diluted EPS | $ | 0.14 | | | $ | 0.07 | | | $ | 0.28 | | | $ | 0.12 | |

Exhibit 99.2

Shoals Technologies Group, Inc.

2Q23 Earnings Conference Call Script

August 1, 2023

Good afternoon, and welcome to Shoals Technologies Group Second Quarter 2023 Earnings Conference Call. Today's call is being recorded, and we have allocated one hour for prepared remarks and Q&A. At this time, I would like to turn the conference over to Mehgan Peetz, Chief Legal Officer for Shoals Technologies Group. Thank you. You may begin.

| | |

| Mehgan Peetz, CLO, Shoals Technologies Group, Inc. |

Thank you, operator and thank you everyone for joining us today. Hosting the call with me are CEO Brandon Moss, President Jeff Tolnar, CFO Dominic Bardos, and VP of Investor Relations Dhaval Patel.

On this call, management will be making projections or other forward-looking statements based on current expectations and assumptions, which are subject to risks and uncertainties. As you listen and consider these comments, you should understand that these statements, including the guidance regarding full year 2023, are not guarantees of performance or results. Actual results could differ materially from our forward-looking statements if any of our assumptions are incorrect or because of other factors. These factors include, among other things, the risk factors described in our filings with the Securities and Exchange Commission, as well as economic and market circumstances, decreased demand for our products, policy and regulatory changes, industry conditions, current macroeconomic events, defects or performance problems in our products or their parts, including those manufactured by third parties, and related warranty and product liability claims, supply chain disruptions and availability and price of our components and materials.

Although we may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized. We caution that any forward-looking statement included in this discussion is made as of the date of this discussion and do not undertake any duty to update any forward-looking statements.

Exhibit 99.2

Shoals Technologies Group, Inc.

2Q23 Earnings Conference Call Script

August 1, 2023

Today's presentation also includes references to non-GAAP financial measures. You should refer to the information contained in the company's second quarter press release for definitional information and reconciliations of historical non-GAAP measures to the comparable financial measures.

With that, let me turn the call over to Shoals’ new CEO Brandon Moss.

| | |

| Brandon Moss, CEO, Shoals Technologies Group, Inc. |

Thank you very much, Mehgan, and good afternoon, everyone. I am excited to join you this afternoon for my first earnings call as Shoals’ CEO. I want to thank everyone on the team for being so welcoming, helpful and open.

Prior to taking the position here, I was most recently at Southwire Company. Southwire, as many of you may know, is a global leader in the wire and cable space. My last position there was president of Tools, Components and Assembled Solutions Business. During my tenure, we built an adjacent product strategy into a large business supporting three product platforms with domestic and international manufacturing, as well as a global supply chain.

I have always admired Shoals for its innovative and entrepreneurial approach to creating simple solutions and a terrific value proposition. Over the past few weeks here, I have become even more impressed with the company as I have met with the team. I appreciate the mission-driven culture at Shoals. Our employees have immense dedication, to each other, the company, the community, and to enabling the green energy transition. I think you will recognize this in our recently released 2022 ESG report.

Before we move on today, I want to take a moment to recognize Jeff Tolnar, who has helped guide the organization by serving as Interim CEO since March. I look forward to working with Jeff in his role as President.

As Shoals moves to its next chapter, I am honored to lead the company and partner with the extraordinary team whose hard work has delivered fantastic growth.

And with that, I’ll turn it over to Jeff.

Exhibit 99.2

Shoals Technologies Group, Inc.

2Q23 Earnings Conference Call Script

August 1, 2023

| | |

| Jeff Tolnar, President, Shoals Technologies Group, Inc. |

Thanks, Brandon. We are very excited to have you on board.

Shoals had another outstanding quarter and I would like to thank our employees, partners, and customers for their support and contributions to our success. I’m especially grateful to the Shoals team for supporting me over the last several months in my role as interim CEO. I’m now excited to turn the reins over to Brandon, who I know will do a great job leading the company in its next phase of growth.

I’ll start with some key highlights from our second quarter results, followed by an update on new product introductions and other growth initiatives, and an overview of the Blattner Master Supply Agreement. I’ll then review current solar market conditions before turning it over to Dominic, who will discuss our financial results in more detail for the second quarter.

Shoals set new records for revenue, adjusted EBITDA and adjusted net income in the second quarter. Compared to the prior-year period, second quarter revenue grew 62%, driven by increased demand for domestic solar EBOS generally and our combine-as-you-go System Solutions specifically.

Second quarter gross margin grew 350 basis points to 42.4% and adjusted EBITDA margin expanded 550 basis points to 32.4%. The margin growth we achieved in the second quarter was driven by a higher mix of System Solutions revenue, continued leverage on fixed costs, and enhanced operating efficiency resulting from the operational initiatives implemented earlier this year.

Demand for Shoals products remains very strong and we ended the quarter with record backlog and awarded orders of $546.1 million, an increase of 67% year-over-year.

System Solutions revenue grew 80% compared to a year ago, reflecting strong growth in U.S. utility scale solar demand and continued share gains by our products. During the quarter, we converted one additional customer to our combine-as-you-go system, bringing the total number of BLA customers to 43, with an additional 14 in transition.

Exhibit 99.2

Shoals Technologies Group, Inc.

2Q23 Earnings Conference Call Script

August 1, 2023

We are progressing as planned with new product introductions for 2023. In the second quarter we began shipping our BLA+ system solution and recorded first revenues on schedule. Quotes for our BLA+ system continue to grow after our global commercial launch earlier this year.

We recently announced the commercial launch of Snapshot I-V, formerly known as IV Curve Trace.

Snapshot I-V is an ecosystem of products that integrate seamlessly into solar asset management systems. The solution remotely monitors the health and performance of PV modules at a very granular level over the life of the system.

I am very excited about Snapshot I-V. The technology has applications in existing solar fields in addition to our typical market of new deployments.

Moving on to other products, we remain on track to commercially launch high capacity plug-n-play harnesses and connectors in the second half of 2023.

In battery energy storage, we continued to ship and fulfill the 1-GWDC BESS project EV Solutions is gaining further traction in the market with some very exciting projects deployed, others awarded and a continued launch of new products to build out the portfolio.

I’m excited to say that our international revenue, backlog and awarded orders continues to grow. To fulfill our international demand, we are exploring international production options.

Now I would like to discuss the landmark 10-gigawatt MSA signed with Blattner Company, which we announced in the second quarter. We are very excited about the agreement, which ensures mutual needs are met. For Shoals, the MSA further strengthens project visibility, enabling us to optimize capital allocation and invest to best support our customers and their needs. At the same time, Blattner benefits from surety of supply which allows better project planning to ensure timelines are met. I want to clarify that a majority of the agreement was already reflected in backlog and awarded orders at the time of the announcement. Additional projects were added in the second quarter and the balance will be added as projects are won by the customer. The most compelling reward of this

Exhibit 99.2

Shoals Technologies Group, Inc.

2Q23 Earnings Conference Call Script

August 1, 2023

agreement reflects a strengthening of our relationship with this very important customer.

Turning to the solar market backdrop, conditions remain favorable for the industry as a whole and for Shoals specifically. Project visibility continues to be strong, supported by quoting activity and order flow.

Now I’ll take a moment to provide a brief update on the patent infringement complaints filed by Shoals in May with the U.S. International Trade Commission, or ITC. The ITC accepted our initial complaints in June and we most recently announced the issuance of a third key patent within our group of already filed claims.

I would like to take a moment to say it was an honor to serve as interim CEO while the Board searched for the ideal candidate to lead Shoals in its next phase of growth. Having worked alongside Brandon for the last few weeks, I can say he is that person and I am excited about what we can achieve under his leadership in the coming years.

I'll now turn it over to Dominic who will discuss second quarter 2023 financial results.

| | |

| Dominic Bardos, CFO, Shoals Technologies Group, Inc. |

Thanks, Jeff, and good afternoon to everyone on the call.

Second quarter revenue grew 62% versus the prior-year period to $119.2 million. Similar to prior quarters, our higher sales volume was primarily driven by strong demand for our combine-as-you-go EBOS System Solutions, which comprised 86% of our revenue versus 77% in the prior year period.

Gross profit increased 77% to $50.5 million, compared to $28.6 million in the prior-year period. Gross profit as a percentage of net revenue grew 350 bps to 42.4% compared to 38.9% in the prior-year period. The increase was driven primarily by a higher proportion of revenue from the Company’s combine-as-you-go System Solutions, which carry a higher margin than our other products, slightly lower raw materials input costs, increased leverage on fixed costs and efficiencies gained in operations. These gains were partially offset by a $9.4 million charge for

Exhibit 99.2

Shoals Technologies Group, Inc.

2Q23 Earnings Conference Call Script

August 1, 2023

warranty expense predominantly due to a previously disclosed wire issue with a supplier. We recorded a non-cash charge in the second quarter to remediate known issues. We have not booked any offsetting recovery from the supplier.

Second quarter general and administrative expenses were $16.7 million, compared to $13.3 million during the same period in the prior year. The year-over-year increase in general and administrative expenses was primarily related to increased wages and related taxes due to increased employee headcount to support our growth initiatives and requirements for being a public company.

Net income was $18.9 million in the second quarter compared to $7.3 million in the prior-year period.

Adjusted EBITDA increased 96% to $38.7 million compared to $19.8 million in the prior-year period. Adjusted EBITDA margin increased 550 basis points year-over-year to 32.4%, reflecting the impact of higher gross margins and leverage on G&A expense.

Adjusted net income grew 105% to $24.0 million in the second quarter compared to $11.8 million in the prior-year period.

During the quarter we generated cash from operations of nearly $27.9 million. In the quarter, we used excess cash to pay down $25.0 million of the revolver. We will continue to prioritize growing the business and driving shareholder value.

As of June 30, 2023, we had $546.1 million dollars in backlog and awarded orders, an increase of 67% year-over-year, reflecting continued robust demand for our products.

Turning now to our full year outlook. Based on current market conditions and input from our customers, we continue to expect:

•Revenues to be in the range of $480 million to $510 million

•Adjusted EBITDA to be in the range of $145 million to $160 million

•Adjusted net income to be in the range of $92 million to $102 million

•Interest expense to be in the range of $22 million to $26 million

•Capital expenditures for the full year in the range of $8 million to $12 million

Exhibit 99.2

Shoals Technologies Group, Inc.

2Q23 Earnings Conference Call Script

August 1, 2023

Now back to Brandon for closing remarks.

| | |

| Brandon Moss, CEO, Shoals Technologies Group, Inc. |

Thanks, Dominic. I would like to close by thanking all of our customers for their confidence in Shoals, our employees for enabling us to effectively serve our customers, and our shareholders for their continuous support.

And with that, thank you everyone, I appreciate your time today. We will now open the line for questions.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

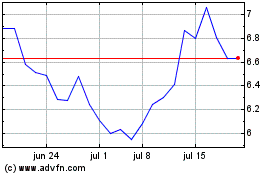

Shoals Technologies (NASDAQ:SHLS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

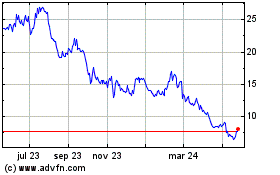

Shoals Technologies (NASDAQ:SHLS)

Gráfica de Acción Histórica

De May 2023 a May 2024