Filing pursuant to Rule 425 under the

Securities Act of 1933, as amended

Deemed filed under Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Filer: TLGY Acquisition Corporation

Subject Company: TLGY Acquisition Corporation

Filer’s Commission File Number: 001-41101

Date: August 30, 2023

Proactive Investors Interview

Brian Gordon and Steve Darling

August 28, 2023

The following is a full transcript of an interview made available

at: https://www.proactiveinvestors.com/companies/news/1024725/verde-bioresins-looking-to-team-up-with-tlgy-acquisitions-as-company-looks-to-future-1024725.html

Steve Darling

Hey, welcome back inside our Proactive Newsroom. And joining me now

is Brian Gordon. He is the chairman and COO of Verde Bioresin. And, Brian, it's good to see you. How are you?

Brian Gordon

Yeah, a pleasure meeting. I'm doing great. Thank you very much.

Steve Darling

Awesome. I know you had some really significant news about the company

recently. We'll talk about it in just a second, but maybe give people a bit of background on the company who may not be familiar with

what you do.

Brian Gordon

Sure. So, we make bio based on curbside recyclable and landfill biodegradable

resins, and we do it, you know, initially started the company because we found out that 85% of all plastics go directly into landfills

and only 6% of plastics are ever recycled. So, we felt we can put in a belt and suspenders if it's ever going to be recycled. Our products

will be with regular plastics. If it's not going to be recycled and it ends up in landfill, then we get a highly accelerated landfill

biodegradation effect.

Steve Darling

Yeah! What sort of products are you looking at to do this?

Brian Gordon

So, when you take a look at the overall market, it's about $600 billion

a year. We're focused on about half the market, which is polyethylene and polypropylene, representing $300 Billion a year. And we make

things like blown films for bags. We make thermoforming applications like these trays that you see here in these trays and these trays.

One of the best products that we make, that's a bio-based biodegradable product that we don't know of other products that can achieve

this is this injection molded tube with a life hinge. We also make durable goods like this chain. And then finally, thing that's near

and dear to most people's hearts is, is this. So we make the resin that makes all these products.

Steve Darling

Okay. So, you mentioned that the sort of the industry that the opportunity

that's there with the amount of products that you have. Can you talk a little bit about sort of the strategy that you have behind or are

you going for all of them at once? You are bringing them out one by one? How to how is it going to work going forward?

Brian Gordon

So, we've been working for a while directly with a bunch of national

brands and the largest converters in the industry. We're also we recently announced our partnership with Vinmar International and then

Vinmar Polymers America, one of the largest plastics distributors in the world, to distribute our products as well. So we're rolling it

out both directly and in conjunction with Vinmar. And as a result of that, our sales pipeline today is in excess of 200 million pounds

a year.

Steve Darling

Wow. I mean, just to take out a loan you showed us there earlier is

a major market considering that, you know, governments all around the world are trying to find ways of getting out of that business, so

to speak.

Brian Gordon

That's exactly right. And we make a resin, which is a combination

of about somewhere between eight and twelve different ingredients rather than making a polymer. So, in other words, all of our ingredients

are FDA Title 21 Food contact compliant. And instead of spending hundreds of millions, if not billions of dollars on the hope that our

product will be scalable, we're actually making products today that are being trialed or sold to very large customers.

Steve Darling

Wow. Let's talk about the recent news you had out with TLGY Acquisitions.

It takes the company in in a really interesting direction. Maybe you can sort of talk about how this all came about and where you see

it heading.

Brian Gordon

Yeah. TLGY has a great group of people. They have a [private] equity

background. Their chairman, Jin-Goon Kim, is from TPG and we're thrilled to be working with them, but we're even more interested to raise

the money that we're looking to raise to enable us to accelerate our capacity.

So, in other words, you know, this year we're expecting to get to,

in terms of capacity up to 25 million pounds, but that that money will enable us to get to several hundred million pounds over the next

couple of years.

Steve Darling

Yeah. And lastly, just what's ahead for the company? What would you

like to see in the next six months? What will be the optimal for you?

Brian Gordon

So, if you take a look at our, you know, our 8K or S4, ultimately in

a year or two, we're expecting somewhere between 60 and 80 million in revenue at a 15 to 20% EBITA margin. So, we think it's a really

compelling offering. We know that our customers, you know, are very excited about the products and doing final trials right now, and we

hope to be at capacity very shortly.

Steve Darling

All right, Brian, we'll leave it there. Thanks very much for the update.

Appreciate the time and good to find out a bit more about what you're doing, especially with the way things are going around the world

these days. These kinds of products are what people are looking for. I would think so. Good to see you.

Brian Gordon

Thank you very much, Steve. Pleasure

Steve Darling

All right. There's Brian Gordon. He's the COO and co-founder of Verde

Bioresins.

About TLGY Acquisition Corporation

TLGY Acquisition Corporation is a blank check company sponsored by

TLGY Sponsors LLC, whose business purpose is to effect a merger, share exchange, asset acquisition, stock purchase, reorganization, or

similar business combination with one or more businesses. TLGY was formed to focus on growth companies through long-term,

private equity style value creation in the biopharma and business-to-consumer (B2C) technology sectors.

For additional information, please visit www.tlgyacquisition.com.

About Verde Bioresins, Inc.

Verde Bioresins, Inc. is a full-service bioplastics company that specializes

in sustainable product innovation and the manufacturing of proprietary biopolymer resins, providing comprehensive design and development

solutions for companies seeking alternatives to conventional plastics.

For additional information, please visit www.verdebioresins.com.

Forward-Looking Statements

This communication includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the

Exchange Act that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from

those expected and projected. All statements, other than statements of historical fact included in this communication regarding TLGY and

the Company’s financial position, business strategy and the plans and objectives of management for future operations, are forward-looking

statements. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,”

“seek” and variations and similar words and expressions are intended to identify such forward-looking statements.

Forward-looking statements are predictions, projections and other statements

about future events that are based on current expectations and assumptions and, as a result, are neither promises nor guarantees, but

involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements, including

but not limited to: (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which may adversely

affect the price of TLGY’s securities; (ii) the risk that the proposed business combination may not be completed by TLGY’s

business combination deadline and the potential failure to obtain an extension of the business combination deadline sought by TLGY; (iii)

the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval of the proposed

business combination by the shareholders of TLGY; (iv) the effect of the announcement or pendency of the proposed business combination

on the Company’s business relationships, performance, and business generally; (v) risks that the proposed business combination disrupts

current plans of the Company and potential difficulties in the Company employee retention as a result of the proposed business combination;

(vi) the outcome of any legal proceedings that may be instituted against TLGY or the Company related to the agreement and plan of merger

or the proposed business combination; (vii) the ability to maintain the listing of TLGY’s securities on Nasdaq; (viii) the price

of TLGY’s securities, including volatility resulting from changes in the competitive and highly regulated industries in which the

Company operates, variations in performance across competitors, changes in laws and regulations affecting the Company’s business

and changes in the combined capital structure; and (ix) the ability to implement and realize upon business plans, forecasts, and other

expectations after the completion of the proposed business combination, and identify and realize additional opportunities. The foregoing

list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described

in TLGY’s final proxy statement/prospectus to be contained in the Form S-4 registration statement, including those under “Risk

Factors” therein, TLGY’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed by TLGY from

time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and

results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date

they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and TLGY and the Company assume no obligation

and, except as required by law, do not intend to update or revise these forward-looking statements, whether as a result of new information,

future events, or otherwise. Neither TLGY nor the Company gives any assurance that either TLGY or the Company will achieve its expectations.

Additional Information and Where to Find It / Non-Solicitation

In connection with the proposed business combination, the Company

will become wholly-owned subsidiary of TLGY and TLGY will be renamed to Verde Bioresins, Corp. as of the closing of the proposed business

combination. TLGY filed with the SEC the Registration Statement, including a preliminary proxy statement/prospectus of TLGY, in connection

with the proposed business combination. After the Registration Statement is declared effective, TLGY will mail a definitive proxy statement/prospectus

and other relevant documents to its shareholders. TLGY’s shareholders and other interested persons are advised to read, when available,

the preliminary proxy statement/prospectus, and amendments thereto, and the definitive proxy statement/prospectus in connection with

TLGY’s solicitation of proxies for its shareholders’ meeting to be held to approve the proposed business combination because

the proxy statement/prospectus will contain important information about TLGY, Verde and the proposed business combination. The definitive

proxy statement/prospectus will be mailed to shareholders of TLGY as of a record date to be established for voting on the proposed business

combination. Shareholders will also be able to obtain copies of the Registration Statement, each preliminary proxy statement/prospectus

and the definitive proxy statement/prospectus, without charge, once available, at the SEC’s website at www.sec.gov.

In addition, the documents filed by TLGY may be obtained free of charge from TLGY at www.tlgyacquisition.com.

Participants in Solicitation

TLGY, the Company and their respective directors, executive officers

and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies

of TLGY’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed

information regarding the names, affiliations and interests of TLGY’s directors and executive officers in TLGY’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 21, 2023. Information regarding the

persons who may, under SEC rules, be deemed participants in the solicitation of proxies of TLGY’s shareholders in connection with

the proposed business combination will be set forth in the proxy statement/prospectus for the proposed business combination when available.

Information concerning the interests of TLGY’s participants in the solicitation, which may, in some cases, be different than those

of TLGY’s equity holders generally, will be set forth in the proxy statement/prospectus relating to the proposed business combination

when it becomes available.

No Offer or Solicitation

This communication is not a proxy statement or solicitation of a proxy,

consent or authorization with respect to any securities or in respect of the potential business combination and shall not constitute an

offer to sell or a solicitation of an offer to buy the securities of TLGY, the Company or the combined company, nor shall there be any

sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act.

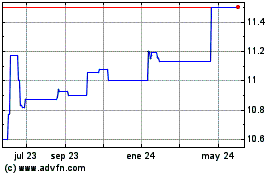

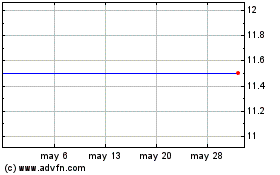

TLGY Acquisition (NASDAQ:TLGYU)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

TLGY Acquisition (NASDAQ:TLGYU)

Gráfica de Acción Histórica

De May 2023 a May 2024