Filing pursuant to Rule 425 under the

Securities Act of 1933, as amended

Deemed filed under Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Filer: TLGY Acquisition Corporation

Subject Company: TLGY Acquisition Corporation

Filer’s Commission File Number: 001-41101

Date: September 13, 2023

SPAC

Insider Podcast – September 13, 2023

Nick Clayton, Melina Haddad, Brian Gordan and

Jin-Goon Kim

The following is a full transcript of an interview made available

at: https://www.spacinsider.com/news/spacinsider/podcast-verde-bioresins-brian-gordon-tlgy-jin-goon-kim

Nick Clayton

Hello and welcome to another SPAC Insider podcast where we bring an

independent eye in interviewing the targets of SPAC transactions and their SPAC partners. Sustainable materials are starting to take a

bite out of the share of single use plastics in circulation but replacing the full $600 billion plastics market is going to take more

innovation and much more capital.

I'm

Nick Clayton, and this week my colleague Melina Haddad and I speak with Brian Gordon, President and COO of Verde Bioresins, and

Jin-Goon Kim, Chairman and CEO of TLGY Acquisition Corp. The two announced a $433 billion combination in June. Brian explains why he believes

Verde is closer to scaling up a viable plastics replacement than many of its competitors. While Jin-Goon explains how TLGY designed this

transaction to be accountable to private equity style benchmarks and be attractive to SPAC investors through the De-SPAC process. Take

a listen.

Nick Clayton

So, Brian, you know, when we talk about creating sustainable replacements

for plastic products, just how big of a market are we talking about? And at what point will sustainable plastics be making up a major

part of market share?

Brian Gordon

Today, the overall market for plastics in general is about $600 billion

a year. The segment that we focus on is $300 billion a year, which represents polyethylene and polypropylene. When you take a look at

sustainable plastics like bioplastics, some of which are biodegradable, some of which aren't, they represent less than 2% of the overall

market. So, while it's not a huge amount in terms of overall percentage, in terms of dollars, it is quite large. You know, in excess of

$10 billion a year. But our products are geared towards renewable and sustainable products as a replacement for traditional plastics rather

than just a replacement for other bioplastics.

Nick Clayton

Got it. And, you know, Jin-Goon, you and your team at TLGY brought

really diverse expertise to your target search. So, I'm just interested in as you're looking at the market, what were some of the

major factors that drew you towards Verde and the sustainable materials sector?

Jin-Goon Kim

That's a great question. So, we are really private equity in our DNA

and the way that we conduct our business. And we looked at over 50 to 100 deals, depending on what you count as deals that we looked at.

And we decided that Verde is probably the best thing that we could back in this market for a number of reasons. But typically, as a private

equity, we'll be looking at this – we are looking at really the long term returns on our investment horizons.

Nobody can tell what's going to happen within the next six months,

but over the next three to five years we are looking for what we call the unicorns in the making – so, what I call also the diamonds

in the rough. My expertise, if you look at my background at TPG and also as a transformational CEO, I would find these great companies

that are at the cusp of becoming multibillion or in some cases; in the case of Li Ning, for example, we brought it from $700 million to

$30 billion [in market cap].

So, we are able to find those companies and really help them grow.

So that [selection of Verde] is really driven by that investment thesis. And often the way we look at this versus the macro – like

Brian said, it’s a $600 billion macro, which is going to be replaced at some point because of regulatory and other issues that is

pushing everybody to think about stopping the plastic pollution and really replacing it with a sustainable alternative. We looked at what

is it that is going to allow someone to actually go after the market? And Brian will talk a little more about this – but it is something

that really meets all the requirements – all the of the industry [requirements]. For example, it has to be scalable; it has to have

all of the applicational requirements that are met; it has to be cost effective and it also has to have some of the qualities of what

we call the drop in, which is, it has to be able to go right into the infrastructure that's already there as opposed to replace completely

what’s in the plants that have already been created for the $600 billion market.

So as a private equity [in our approach], we actually went in with

industry experts – in particular, we have a former GE Plastics executive who is very deep into this bioplastics world – and

we have done field due diligence, and we've also talked to customers, and we've also talked to their main partners in the distribution

and really came to realize that this solution that they are presenting to the market is one of the viable and the first replacements for

the overall plastics market, we will be able to take it from up 2% market share today to something that is much bigger.

Melina Haddad

Great. And can you walk us through where you are in the process of

developing PolyEarthylene and what are some of the major milestones that you've already gotten over? And about how far out are you from

getting it into products on shelves?

Brian Gordon

Sure. So, Verde Bioresins makes a bio based, for the most part, curbside

recyclable and landfill biodegradable product under the brand name PolyEarthylene. It's a resin that's used to produce a number of products.

So, our focus has been on the replacement of polyethylene and polypropylene based products. To give you a sense, we've worked with some

of the largest converters in the industry.

So, in other words, a lot of bio polymer companies can make a single

product, but making 100,000 or a million products, you really need to scale that and show that your products are economically feasible,

show that your products can be dropped into existing manufacturing equipment. And that's what we've achieved. So, for example, the extrusion

sheets have been extruded at companies that make over 500 million pounds of extruded sheet a year, and they've been converted into thermoform

at a company that produces over 100 million pounds of thermoform a year.

So that was our verification that, yes, the products work and they

work in volume capacity. Ultimately, things that we're very excited about are we can not only make single use products, but we can also

make durable goods out of PolyEarthylene. And we've been working on everything from injection molding to blow molding, blown film and

thermoforming. And we have several other products that will be coming out in the near future. We have over $250 million worth of sales

pipeline in process, and that's growing every week. And so, we're working with some of the largest multinationals in the world to roll

out PolyEarthylene and give them an economically feasible, renewable, and sustainable solution.

Jin-Goon Kim

A lot of people think about commercialization and scalability as an

issue in this industry because this is a very exciting industry, a lot of investments and attention has been given over the last five

to 10 years, but it really hasn't really picked up because of those issues. I just want to make sure that we're being very clear in communicating

that we're not an R&D company. What this [Verde] is, is really just using all of the existing infrastructure, all of the commercially

available building blocks and ingredients and not trying to create new polymers, which are the building block chemicals. But it is really

trying to make what is already there into a biodegradable resin. So, because it is a resin company, it doesn't require all of the complicated

R&D and commercialization scalability. As Brian just talked about, what he's doing is not trying to create his own trial manufacturing

in the hope to scale that when somebody buys large quantities, [but] he's going straight to people that are producing today 100 million

pounds of stuff and, in their facility, he's just letting them make it. The whole scalability issue, the ready for shelf issue, all of

those problems go away when you're working with a solution at the very end of the supply chain.

Melina Haddad – 8:41

And so just going off of that, how does PolyEarthylene compared to

some of the other bio resin products coming to market on both price and capabilities?

Brian Gordon

We support all bio resins. We think that there’s a place for

them in the industry. But most bio resins today, they’ve taken years to develop because they’re developing a polymer, they’ve

taken [years], if not decades, they've taken hundreds of millions, if not a billion-dollars plus to develop the capital and the infrastructure

in order to scale, if they can ever scale. And they have some other downfalls – pitfalls, let's say – that they tend to be

brittle, and they tend to be temperature sensitive. So, ultimately, and then the last aspect to that is a lot of those products you need

to take your entire conversion, your entire warehouse that makes a product and convert it into new equipment – the entire warehouse

to make those products. So here we've come with a product that is not temperature sensitive, it's a true replacement for traditional plastic.

You can just drop it into existing manufacturing. And our price point is somewhere in the $1.80 range right now, eventually going significantly

lower than that. But at even our current price point, we're significantly lower than other bioplastics. We're even half the price, if

not less than some of them on the market today.

Melina Haddad

Got it. And so, are there any applications for PolyEarthylene that

particularly excels over the competition and any that you likely wouldn't pursue for it?

Brian Gordon

Yeah. So, in terms of durable goods production, our products are all

shelf stable, so they biodegrade when introduced to a microbe rich environment like a landfill. So ultimately, our products are shelf

stable. We can create durable goods that most bioplastics companies can't. We can create life hinges, which we haven't seen in bio based

biodegradable products yet. And then we can also compete in the single use products.

So ultimately, we're working on things like foams and coatings that

are not currently in the PolyEarthylene catalog but will be shortly. So, we’re not really going after the bioplastics market; we’re

going after the traditional plastics market. So we're a little more expensive [than traditional plastics]. But ultimately, we believe

that the brands and ownership care about sustainability and renewable products, and it's time for them to start stepping up. And based

on our discussions with all these companies and the testing that's going on right now of PolyEarthylene products, we believe that they

will make that commitment.

Nick Clayton

Right. And you've also established some strategic relationships with

Braskem and Vinmar. Can you talk a little bit about how those partnerships are helping you with your go to market strategy?

Brian Gordon

So Braskem has been wonderful to us. We are currently purchasing product

from them and will continue to, and they've committed to support us as we grow. They understand the forecasts and are working to provide

us with materials that we need in order to ensure that we can meet that goal on a going forward basis.

Vinmar has also been a truly exceptional partner as well. They are

international. They are in 110 markets worldwide. They have 55 offices globally. And I believe that we're the only product of this kind

in their portfolio today. We started launching with them in Vinmar Polymers America to meet demand for North America. And ultimately,

we expect to work on projects with them worldwide.

Nick Clayton

Great. And are there any areas where you feel like additional strategic

relationships might help fill any gaps in what you're trying to do right now?

Brian Gordon

We have great partnerships today. We could always use additional support

both in terms of supply of raw materials as well as distribution long term. But ultimately, we're very happy where we are today. We believe

that we're in a good position to be able to execute our plan, but we would like to look for more and different bio-based materials and

we expect to work with both Braskem and other partners to provide us with the ability to go beyond hundreds of millions of pounds and

into a really impactful percentage of the plastics market worldwide in the long term.

Melina Haddad

Great. And what kind of regulatory constraints do developers of new

bio resin products face? And on the other end, are there any government policies incentivizing this work that you've been benefiting from

thus far?

Brian Gordon

So, in terms of regulations, what we've looked to do is, one of the

commitments that we made from the beginning was to ensure that all the products that we place into our PolyEarthylene resins are FDA Title

21 food contact compliant so that we don't run into issues with food because ultimately packaging and the food industry is a large part

of our overall product.

Unless we're talking about making an electrostatic dissipative tray

for the semiconductor or electronics industry or a bag that's anti-static or electrostatic dissipative, all of our materials are FDA Title

21 food contact compliant. And that really gets us to a good place overall with compliance. We're starting to evaluate our options in

terms of the USDA BioPreferred Program, which is something that could be important to us in the long run. I think most of the incentives

are geared towards companies making liquids like fuels, etc., but we hope that that changes and opens up the market to us in the

future.

Jin-Goon Kim

In addition to the direct incentives, obviously the biggest benefit

from regulatory pressures and it's obviously something that everybody knows about, is that governments and companies have very strong

intent to fight against both the harm and impact of traditional plastics, as well as all the polluting impact that is obviously everywhere

that you see. And [recycling], as well as compostability is a limited solution; it doesn't really solve most of the $600 billion of plastics

that's out there. So, there's a lot of regulation that is right now pushing to solve that problem.

Melina Haddad

Right. And so, I'm curious to hear how much prices fluctuate on

the raw materials that you use as input.

Brian Gordon

Prices, like with all commodities, prices can fluctuate and due to

an extent. Fortunately for us, some of our vendors that are strategic hedge and, as we expand, we will look at establishing hedging options

to enable us to protect our costs. But ultimately our margins are good right now and we expect them to grow over time as we scale.

Nick Clayton

Right and so just moving over to the deal, kind of a question for both

of you really is just, you know, what made on your case, Brian, Verde decide that now is the right time for it to go public. And from

the SPAC perspective, sort of what was the point of what you saw as being the evidence of a real inflection point here? And also, Brian, I

guess when you were looking at your options, what made the SPAC route stand out to you?

Brian Gordon

For Verde, we were very impressed by the TLGY team led by Jin-Goon

and their backgrounds and what they've done in the past and their dedication to getting this SPAC public and getting a commitment to us

to achieve what we need in order to grow our business. The reason for us to go the public route was primarily to achieve the funding that

we need in today's market, which will enable us to grow to hundreds of millions of pounds in our Midwest facility. That's the focus of

those funds. So, it'll enable us to scale quickly and aggressively and to take Verde to the next level.

Jin-Goon Kim

On the second part of your question – in my previous life as

a part of the investment committee at TPG, we’ve looked at many, many deals. And also, we obviously, we naturally as an investor

looking at a lot of the other angel and other investment opportunities just by being in that investment and deal world, you get to understand

what are the businesses that are going to make it and what are the businesses that just won’t get there.

Like I said, you know, we looked at the technology and what it takes

to replace traditional plastics and you're almost like trying to replace water. So, plastics is one of the most scalable, the low cost,

most well developed and low margin efficient ecosystem that you have out there. It is like water, and if you want to replace water, you

better have something that is better in terms of its functionality, the cost, the scalability, all the supporting infrastructures and

all that. And all the solutions out there – they may be a great VC story where you're getting the first early round funding, but

how are they ever become a replacement for traditional plastic? You really think about it, you say there's just very little chance that

these things are going to scale or that people are going to be willing to pay four or five times in order to get these things to be massively

deployed, or to change out their plants, right – all of the things they're using right now, the entire ecosystem with billions and

billions of dollars of plant rehaul just so that you can try out other product.

Nick Clayton

Yeah, it’s really interesting. And, you know, and looking at

it also as you’re discussing there some of the long term viability of some companies in this space from a kind of a private investment

perspective, looking at the range of De-SPACs we’ve seen over the past few years, the public markets have also been hard on a lot

of new technology and growth companies, but sustainable materials De-SPACs have actually been more resilient than I would say, like a

lot of the FinTech’s and EV companies that we’ve seen go public through SPAC. So, I mean, just what did you see in kind

of watching the public markets’ reaction to some of these companies hitting the market? And how did that play into your evaluation

of it as a target?

Jin-Goon Kim

Yeah. So, in our 8-K investor presentation, we detail out the way that

we thought about valuation. And the model that we created is a private equity model where we're trying to get everybody to win –

all the shareholders. So, for example, what we've done along with target Verde is that we put a lot of our economics in the future so

that only when the shareholders who are investing in the public market – the PIPE or common – do very well to the tune of

35% IRR, that's 35% every year for three to four years, then [a] big part of the economics will actually come to play. So, this is created

in a way that is really a win-win.

So, if you look at the way that we valued the company, you're absolutely

right. Even in this terrible market, you see that there's a lot of support for companies in the sustainability space, mainly because the

whole world is focused on solving this problem. It has to get resolved. There's a big demand, right? And the TAM is massive. We're talking

about $600 billion market potential and there really isn't a viable solution. So, people are hoping that somebody, one of these guys will

make it. But if you look at their economics, those other public companies are losing a lot of money. Our economic, unit-economics –

that is one of the things that we really focus on as a private equity investor – we say, what is unit-economics, what is the cash

flow profile, why is this a good business? Those are the things that we really look at deeply. And you look at some of these other public

companies – losing like 50% negative EBITDA, for example, right? So that's not great as a business. These are things that maybe

people are not paying as much attention, but despite that, despite all that, they're still getting a pretty good, you know, pretty good

valuation even in this market. So why is that? Because of the massive potential.

Nick Clayton

Yeah, I'm really glad you mentioned you know, the way that the

structure of this deal puts a lot of the value into an earnout that's, you know, conditional, which is interesting. But also, the transaction

has an interesting mechanism for TLGY shareholders as well in terms of the incentives involving the warrants and sort of a Tontine structure.

Could you touch upon that a little bit? And then what some of the upside is for investors in the SPAC?

Jin-Goon Kim

Sure. I think we're very different in the way that we look at the SPAC

world. I mean, SPAC is a very difficult instrument, it’s very complex, and it’s a blank sheet of paper – it’s

whatever you make out of it. And a lot of people walk into this thinking that it's an easy business where you basically make a fee and

you don't really have to do much. It's actually not true. For a long, long time, the SPAC world has remained very small and about 60%

of the SPACs actually didn't make it work because, if they didn't have the right deal and if they didn't have the right kind of valuation,

they actually didn’t work. This was pre-2019. This has always been the case.

So, all these things have told us that SPAC has to be a highly complex

instrument and it needs to have a differentiated business model. So that's what we created. So, [among] all the things that we have done,

we said, okay, redemption will be a problem unless you create a naturally adjusting mechanism that in a sense gives the people who are

not redeeming the benefit, not the people who participate in IPO, so a big part of the IPO benefit is actually reserved and not given

until those people who don't redeem stay. So, what happens is you have a massive pool of warrants that actually gets given to only the

people that don't redeem, which becomes a massive upside. But we also allow that to be converted into common because a lot of the people

who are participating in the SPAC world – they don't understand the investment returns. So, they may not actually value warrants.

So, they like to have something that trades in the market at a better price. So, five to one ratio of exchange allows you to either bet

on the investment or just bet on the public price. So, what they trade at – in a way, the simple way to look at it and it's all

in the 8-K investment presentation – is that we have six million shares of warrant that could become 1.2 million shares of common

that is given to however many investors are left in the end, right, after redemption.

So, if there was a 90% redemption, you'll get downside protected to

what, four bucks, right? So, your cost basis actually goes out to below four. But at the same time, if the price were to run, then you

have a 2.5 x return. So, if the price were to go to $30, your return is actually 2.5 times more than that. And there really isn't any

instrument that achieves both the downside case and an upside case without diluting and issuing more economics, because [in our case]

everything is already paid off at IPO – we're using all the things that we paid for upfront to benefit and make sure that we have

rewards for the people who don’t redeem. So, it's a very unique instrument and it is really thinking about – as in any deal

we do in a complex transformational deals in private equity – is that you try to solve a problem with the structure. So, the problem

that you want to solve here is, in a high redemption environment, how do you create an instrument that actually works to encourage people

to stay so that people could invest before De-SPAC as opposed to today, the biggest issue we have right now is that even if the deal is

great, nobody wants to invest before De-SPAC because they think that it's going to all go down and they're just going to wait until the

De-SPAC is finished because the price would get reset and they will almost always be able to invest at a lower price. So, with our structure,

we're giving them the reason to invest before De-SPAC.

Melina Haddad

And just going off of that, you mentioned in your announcement materials

that you plan to put together a PIPE for this transaction before close and already have commitments from Humanitario. So, I'm interested

to hear how those continued fundraising efforts are going and about how much does Verde need to hit its near-term goals.

Jin-Goon Kim

Yeah, so one of the reasons we decided to back Verde in this market

is because Verde is such a great unit-economics business that early on, they're going to get to a very quickly a cash flow positive, and

an operating margin positive business. In fact, in our work we talk about year two when they can actually achieve that.

To get there, they really only need about $15- $20 million. They already

have the capacity, but they need some more capital as an operating company to be able to actually continue to grow. But they need $55

million in order to deliver on a plan that is much, much bigger than that. Obviously, we're talking about a number that is much bigger

than what we have disclosed. So, that's about how much money they need. So, we are talking to mainly the strategics who understand this

business, including some of the partners that we're working with. We expect them to be quite interested in coming to the PIPE, along with

investors who are fundamental investors who would want to back a company like this and participate in their exciting journey. So that

is the effort that we're making right now and hopefully with that, be able to raise a lot of the capital that we really need in addition

to the structure that we just created, which hopefully will also give us significantly more capital so that Verde could deliver on their

plan.

Nick Clayton

And looking forward beyond the De-SPAC, you know, what are some of

the major milestones that you think investors should be keeping an eye on in terms of news with Verde as it continues to progress in its

plans in the coming years.

Jin-Goon Kim

So, before De-SPAC, we expect some major announcements to come out

around their customer acquisitions and other partnerships and other market expansion opportunities and achievements. And then, of course,

one of the biggest things that will happen after the De-SPAC is a continuous growth of that and how we are actually changing the game,

right, by allowing the traditional plastics to finally have a viable solution to replace itself so that the world could become a much

less polluting place. But Brian, why don't you share some of your short-term and long-term milestones?

Brian Gordon

Yeah, I mean, from an economic perspective, obviously the significant

revenue that we're looking at achieving in year two plus the positive EBITDA margins at, by year two, I believe are in the 15%- 20%

EBITDA range. Those are exciting to us. From a more fundamental perspective, our goal from a research and development standpoint, manufacturing,

is developing greater biodegradation, applications, moving from landfill biodegradation to marine biodegradation, significantly reducing

our costs overall so that we can pass on those savings to our customers and get closer and closer to parity with traditional plastics.

And then, of course, I touched on before, implementing additional types of PolyEarthylene, one to replace coatings on paper to make

that biodegradable, and another to replace foam, which is a huge challenge. And we're getting very close to that.

Melina Haddad

And so overall, what do you see as the most exciting thing coming out

of this sustainable materials space that maybe not enough people are talking about right now?

Brian Gordon

For me, having renewable and sustainable products are very important.

But having products that can be curbside recycled under your curbs, you put them in your in your backyard, you know, trash and recycling

container. You move your recycling container to the front of your house, and it gets picked up. If any products are recycled in that container,

then ours would be recycled with it. That's huge. Second part is 85% of all plastics in the U.S. end up in a landfill. And that's why

our focus is on landfill biodegradation rather than some of the other focuses right now. Because at the end of the day, that's where it's

going.

Jin-Goon Kim

And for me, I think there was a study, I can’t remember

exactly where it came from, but at least in countries like Korea or Japan, a lot of that has been taken care of. But if you go to places

like Southeast Asia, what happens is, is that there's a huge amount of those plastics waste that's being pumped into the ocean. I mean, I

saw some data which says a big part of the global ocean polluting comes from countries like that. And so, if you think about it, the only

solution where it's cost effective for countries like that with a lot of population that are very poor, per capita, you know – how

do you get them to actually solve this problem and participate in this? The only solution is biodegradability, natural biodegradability.

There is no other way that you're going to make sure that those things don't end up in the oceans. And what happens is that those things

don’t break down. They become microplastics, and then they're going to end up in your body and in our body and all our children's

bodies, and everything that we eat, right? It is going to go everywhere in the world. And this is something we have to fix. And I think

the only way that it’s going to get fixed is to do a truly biodegradable product that replaces the traditional plastics, and they

have to be biodegradable in the natural environment.

About TLGY Acquisition Corporation

TLGY Acquisition Corporation is a blank check company sponsored by

TLGY Sponsors LLC, whose business purpose is to effect a merger, share exchange, asset acquisition, stock purchase, reorganization, or

similar business combination with one or more businesses. TLGY was formed to focus on growth companies through long-term,

private equity style value creation in the biopharma and business-to-consumer (B2C) technology sectors.

For additional information, please visit www.tlgyacquisition.com.

About Verde Bioresins, Inc.

Verde Bioresins, Inc. is a full-service bioplastics company that

specializes in sustainable product innovation and the manufacturing of proprietary biopolymer resins, providing comprehensive design and

development solutions for companies seeking alternatives to conventional plastics.

For additional information, please visit www.verdebioresins.com.

Forward-Looking Statements

This communication includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E

of the Exchange Act that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially

from those expected and projected. All statements, other than statements of historical fact included in this communication regarding TLGY

and the Company’s financial position, business strategy and the plans and objectives of management for future operations, are forward-looking

statements. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,”

“seek” and variations and similar words and expressions are intended to identify such forward-looking statements.

Forward-looking statements are predictions, projections and other statements

about future events that are based on current expectations and assumptions and, as a result, are neither promises nor guarantees, but

involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements, including

but not limited to: (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which

may adversely affect the price of TLGY’s securities; (ii) the risk that the proposed business combination may not be completed

by TLGY’s business combination deadline and the potential failure to obtain an extension of the business combination deadline sought

by TLGY; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval

of the proposed business combination by the shareholders of TLGY; (iv) the effect of the announcement or pendency of the proposed

business combination on the Company’s business relationships, performance, and business generally; (v) risks that the proposed

business combination disrupts current plans of the Company and potential difficulties in the Company employee retention as a result of

the proposed business combination; (vi) the outcome of any legal proceedings that may be instituted against TLGY or the Company related

to the agreement and plan of merger or the proposed business combination; (vii) the ability to maintain the listing of TLGY’s

securities on Nasdaq; (viii) the price of TLGY’s securities, including volatility resulting from changes in the competitive

and highly regulated industries in which the Company operates, variations in performance across competitors, changes in laws and regulations

affecting the Company’s business and changes in the combined capital structure; and (ix) the ability to implement and realize

upon business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize

additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the

other risks and uncertainties described in TLGY’s final proxy statement/prospectus to be contained in the Form S-4 registration

statement, including those under “Risk Factors” therein, TLGY’s Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q and other documents filed by TLGY from time to time with the SEC. These filings identify and address other important risks

and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and TLGY and the Company assume no obligation and, except as required by law, do not intend to update or revise these forward-looking

statements, whether as a result of new information, future events, or otherwise. Neither TLGY nor the Company gives any assurance that

either TLGY or the Company will achieve its expectations.

Additional Information and Where to Find It / Non-Solicitation

In

connection with the proposed business combination, the Company will become wholly-owned subsidiary of TLGY and TLGY will be renamed to

Verde Bioresins, Corp. as of the closing of the proposed business combination. TLGY filed with the SEC the Registration Statement,

including a preliminary proxy statement/prospectus of TLGY, in connection with the proposed business combination. After the Registration

Statement is declared effective, TLGY will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders.

TLGY’s shareholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus,

and amendments thereto, and the definitive proxy statement/prospectus in connection with TLGY’s solicitation of proxies for its

shareholders’ meeting to be held to approve the proposed business combination because the proxy statement/prospectus will contain

important information about TLGY, Verde and the proposed business combination. The definitive proxy statement/prospectus will be mailed

to shareholders of TLGY as of a record date to be established for voting on the proposed business combination. Shareholders will also

be able to obtain copies of the Registration Statement, each preliminary proxy statement/prospectus and the definitive proxy statement/prospectus,

without charge, once available, at the SEC’s website at www.sec.gov. In addition, the documents filed by TLGY

may be obtained free of charge from TLGY at www.tlgyacquisition.com.

Participants in Solicitation

TLGY, the Company and their respective directors, executive officers

and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies

of TLGY’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed

information regarding the names, affiliations and interests of TLGY’s directors and executive officers in TLGY’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 21, 2023. Information

regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of TLGY’s shareholders in

connection with the proposed business combination will be set forth in the proxy statement/prospectus for the proposed business combination

when available. Information concerning the interests of TLGY’s participants in the solicitation, which may, in some cases, be different

than those of TLGY’s equity holders generally, will be set forth in the proxy statement/prospectus relating to the proposed business

combination when it becomes available.

No Offer or Solicitation

This communication is not a proxy statement or solicitation of a proxy,

consent or authorization with respect to any securities or in respect of the potential business combination and shall not constitute an

offer to sell or a solicitation of an offer to buy the securities of TLGY, the Company or the combined company, nor shall there be any

sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act.

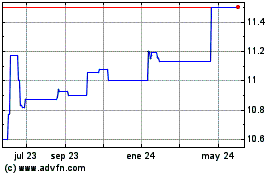

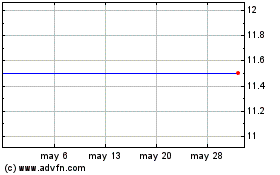

TLGY Acquisition (NASDAQ:TLGYU)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

TLGY Acquisition (NASDAQ:TLGYU)

Gráfica de Acción Histórica

De May 2023 a May 2024