TOP Financial Group Limited (the "Company") (NASDAQ: TOP), a

fast-growing online brokerage firm located in Hong Kong

specializing in the trading of local and foreign equities, futures,

options products and other financial services, today announced the

preliminary results for the six months ended September 30, 2022.

The Company cautioned that these financial

results have not been audited or reviewed by the Company’s

independent registered public accounting firm and may have

discrepancies in connection with further reviews by the independent

registered public accounting firm of the Company.

Six Months Ended September

30,

2022 Operational and

Financial Highlights :

- Total revenues were US$5.2 million,

representing an increase of 63% from US$3.2 million for the six

months ended September 30, 2021

- Net profit was US$2.5 million,

representing an increase of 178% compared with net income of US$0.9

million for the six months ended September 30, 2021.

- Total number of total registered

customers were 304, representing an increase of 4.8% from 290 as of

September 30, 2021.

Mr. Ka Fai Yuen, CEO of the Company commented:

“We are encouraged by our strong revenue and net profit growths in

the first half of fiscal 2022, as we benefit from both our

outstanding execution capabilities and the soundness of our

business strategies. With the launch of our new business initiative

and our continuous efforts in expanding our customer base, we are

confident that our business momentum will continue and expect the

significant increase in our revenue and net profit in 2023.”

Business Outlook

According to our strong revenue and net profit

growth in the first half of fiscal 2022 and the forecast we made at

the beginning of 2022, for the fiscal year ended March 31, 2023,

the Company expects total revenues to be between US$9.75 million to

US$10.53 million, representing year-over-year growth of 25% to 35%.

For the six months ended September 30, 2023, the Company expects

total revenues to be between US$6.5 million to US$7 million,

representing year-over-year growth of 25% to 35%. This forecast

reflects the Company’s current and preliminary views on the market

and operational conditions, which are subject to change.

About TOP Financial

Group

Founded in Hong Kong, the Company, through its

operating subsidiaries, operates online brokerage platforms

specializing in the trading of local and foreign equities, futures,

and options products.

The trading platforms, which the operating

subsidiaries license from third parties enable its investors to

trade on renowned stock and futures exchanges around the world,

including the Chicago Mercantile Exchange (“CME”), Hong Kong

Futures Exchange (“HKFE”), The New York Mercantile Exchange

(“NYMEX”), The Chicago Board of Trade (“CBOT”), The Commodity

Exchange (“COMEX”), Eurex Exchange (“EUREX”), ICE Clear Europe

Limited (“ICEU”), Singapore Exchange (“SGX”), Australia Securities

Exchange (“ASX”), Bursa Malaysia Derivatives Berhad (“BMD”), and

Osaka Exchange (OSE). The operating subsidiaries are licensed with

the Securities and Futures Commission of Hong Kong ("HKSFC”) to

carry out type 1 (dealing in securities), type 2 (dealing in

futures contracts) regulated activities, and are licensed with the

HKSFC to carry out type 4 (advising on securities), type 5

(advising on futures contracts), and type 9 (asset management)

regulated activities in Hong Kong. TOP is also in the process of

completing its acquisition of Australia licensed company TOP 500

Sec Pty Ltd, which will provide dealing services in derivatives and

foreign exchange contracts, and financial product advices for

derivatives, foreign exchange contracts, debentures, stocks or

bonds in the near future.For more information, please visit

http://www.zyfgl.com/.

Exchange Rate Information

TFGL is a holding company with operations

conducted in Hong Kong through its operating subsidiaries in Hong

Kong, using Hong Kong dollars. This announcement contains

translations of Hong Kong dollars into US. dollars (“US$”) at a

specified rates solely for the convenience of the reader. Unless

otherwise noted The conversion of Hong Kong dollars into U.S.

dollars are based on the exchange rates set forth in the H.10

statistical release of the Board of Governors of the Federal

Reserve System. All translations from Hong Kong dollars to U.S.

dollars and from U.S. dollars to Hong Kong dollars in this

announcement were made at a year-end spot rate of HK$7.8325 to

US$1.00 or an average rate of HK$7.7844 to US$1.00. On March 31,

2020, the year-end spot rate and average rate for Hong Kong dollars

were, respectively, HK$7.7513 to US$1.00 and HK$7.8167 to US$1.00.

On September 30, 2021, the period-end exchange rate and average

rate for Hong Kong dollars were, HK$7.7850 to US$1.00 and HK$7.7718

to US$1.00, respectively.

Forward-Looking Statement

This press release contains forward-looking

statements as defined by the Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements

concerning plans, objectives, goals, strategies, future events or

performance, and underlying assumptions and other statements that

are other than statements of historical facts. When the Company

uses words such as "may, "will, "intend," "should," "believe,"

"expect," "anticipate," "project," "estimate" or similar

expressions that do not relate solely to historical matters, it is

making forward-looking statements. Forward-looking statements are

not guarantees of future performance and involve risks and

uncertainties that may cause the actual results to differ

materially from the Company's expectations discussed in the

forward-looking statements. These statements are subject to

uncertainties and risks including, but not limited to, the

uncertainties related to market conditions and the completion of

the initial public offering on the anticipated terms or at all, and

other factors discussed in the “Risk Factors” section of the

registration statement filed with the SEC. For these reasons, among

others, investors are cautioned not to place undue reliance upon

any forward-looking statements in this press release. Additional

factors are discussed in the Company's filings with the SEC, which

are available for review at www.sec.gov. The Company undertakes no

obligation to publicly revise these forward-looking statements to

reflect events or circumstances that arise after the date

hereof.

For more information, please contact:

The Company:

IR DepartmentEmail: IR@zyzq.com.hk

Investor Relations:

EverGreen Consulting Inc.

Ms. Hana Yin, Managing Partner

Email: IR@changqingconsulting.com

Phone: +1 949-416-8888 (from U.S.)

+86 185-0119-2929 (from China)

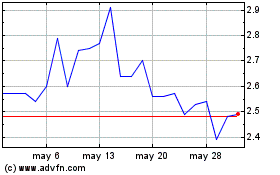

TOP Financial (NASDAQ:TOP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

TOP Financial (NASDAQ:TOP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024