Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

13 Abril 2023 - 3:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2023

Commission File Number: 001-41407

TOP

FINANCIAL GROUP LIMITED

(Translation

of registrant’s name into English)

118 Connaught Road West

Room 1101

Hong Kong

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

As previously disclosed on a report of foreign private issuer on Form

6-K of TOP Financial Group Limited (the “Company”) filed with the U.S. Securities and Exchange Commission on September 1,

2022, on August 31, 2022, the Company and ZYAL (BVI) Limited (“ZYAL”), a subsidiary of the Company, entered into a Share

Purchase Agreement (the “Agreement”) with TOP 500 SEC PTY LTD (the “Target”) and the sole shareholder of the

Target (“Seller”). Seller is a company controlled by Junli Yang, the Chairwoman of the Board of Directors of the Company.

The Agreement was negotiated at arm’s length and has been approved by the Board of Directors of the Company.

The Target is a brokerage

firm in Australia that owns an Australian Financial Services License (AFSL: 328866). The Target provides financial services in Australia

that includes arranging or providing financial advice on financial products such as derivatives, foreign exchange contracts, stock and

bond issuance etc.

Pursuant to the Agreement,

the Seller agreed to sell, convey, assign, transfer and deliver to ZYAL, and ZYAL agreed to purchase from Seller, 100% of the equity interest

in the Target for a total purchase price of $700,000, $200,000 of which has been paid by the Company upon signing of the Agreement and

the remaining $500,000 shall be paid by the Company at closing. The closing of the transaction is conditioned upon completion of due diligence

reviews of the Target and any required regulatory approvals.

On April 12, 2023, the

parties to the Agreement completed the acquisition of the Target and therefore the Target became a subsidiary of ZYAL.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: April 13, 2023 |

TOP FINANCIAL GROUP LIMITED |

| |

|

|

| |

By: |

/s/ Ka Fai Yuen |

| |

Name: |

Ka Fai Yuen |

| |

Title: |

Chief Executive Officer |

2

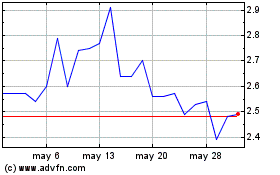

TOP Financial (NASDAQ:TOP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

TOP Financial (NASDAQ:TOP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024