As filed with the U.S. Securities and Exchange

Commission on July 21, 2023

Registration

No. 333-273066

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

AMENDMENT NO.1 TO

FORM

F-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TOP

Financial Group Limited

(Exact

name of registrant as specified in its charter)

| Cayman

Islands |

|

N/A |

|

Not

Applicable |

| (State or other jurisdiction |

|

(Translation of Registrant’s

Name |

|

(I.R.S. Employer |

| of incorporation or organization) |

|

into English) |

|

Identification No.) |

118

Connaught Road West

Room

1101

Hong

Kong

T:

+852-3107-0731

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency

Global Inc.

122

East 42nd Street, 18th Floor

New

York, NY 10168

(Name,

address including zip code, and telephone number, including area code, of agent for service)

Copies

to:

William

S. Rosenstadt, Esq.

Mengyi

“Jason” Ye, Esq.

Yarona

L. Yieh, Esq.

Ortoli

Rosenstadt LLP

366

Madison Avenue, 3rd Floor

New

York, NY 10017

+1-212-588-0022

– telephone

+1-212-826-9307

– facsimile

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement as determined

by the registrant.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

| † | The term “new or revised financial

accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification

after April 5, 2012. |

The

Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

JULY 21, 2023 |

TOP

Financial Group Limited

$300,000,000

Ordinary

Shares

Share

Purchase Contracts

Share

Purchase Units

Warrants

Debt

Securities

Rights

Units

We

may offer, from time to time, in one or more offerings, ordinary shares, share purchase contracts, share purchase units, warrants, debt

securities, rights or units, which we collectively refer to as the “securities”. The aggregate initial offering price of

the securities that we may offer and sell under this prospectus will not exceed $300,000,000.

We

may offer and sell any combination of the securities described in this prospectus in different series, at times, in amounts, at prices

and on terms to be determined at, or prior to, the time of each offering. This prospectus describes the general terms of these securities

and the general manner in which these securities will be offered. We will provide the specific terms of these securities in supplements

to this prospectus. The prospectus supplements will also describe the specific manner in which these securities will be offered and may

also supplement, update or amend information contained in this prospectus. This prospectus may not be used to consummate a sale of securities

unless accompanied by the applicable prospectus supplement. You should read this prospectus and any applicable prospectus supplement

before you invest.

We

may offer and sell the securities from time to time at fixed prices, at market prices, or at negotiated prices, to or through underwriters,

to other purchasers, through agents, or through a combination of these methods. If any underwriters are involved in the sale of any securities

with respect to which this prospectus is being delivered, the names of such underwriters and any applicable commissions or discounts

will be set forth in a prospectus supplement. The offering price of such securities and the net proceeds we expect to receive from such

sale will also be set forth in a prospectus supplement. See “Plan of Distribution” elsewhere in this prospectus for a more

complete description of the ways in which the securities may be sold.

Our ordinary shares are traded on the Nasdaq

Capital Market under the symbol “TOP”. On June 29, 2023, the closing price of our ordinary shares as reported by the Nasdaq

Capital Market was $7.80. During the year immediately prior to the date of this prospectus, the high and low closing prices were US$108.21

and US$3.55 per ordinary share, respectively. We have recently experienced price volatility in our stock. See related risk factors in

the “Risk Factors” section of this prospectus and as set forth in our most recent annual report on Form 20-F.

The

aggregate market value of our outstanding ordinary shares held by non-affiliates or public

float, as of the date of this prospectus, was approximately $87,400,000, which was calculated based on 5,000,000 ordinary

shares held by non-affiliates and the per share price of $17.48, which was the closing price of our ordinary shares on Nasdaq on

May 4, 2023.

Unless

otherwise specified in an applicable prospectus supplement, our share purchase contracts, share purchase units, warrants, debt securities,

rights and units will not be listed on any securities or stock exchange or on any automated dealer quotation system.

This

prospectus may not be used to offer or sell our securities unless accompanied by a prospectus supplement. The information contained or

incorporated in this prospectus or in any prospectus supplement is accurate only as of the date of this prospectus, or such prospectus

supplement, as applicable, regardless of the time of delivery of this prospectus or any sale of our securities.

Investing

in our securities being offered pursuant to this prospectus involves a high degree of risk. You should carefully read and consider the

‘‘Risk Factors’’ section of this prospectus, and risk factors set forth

in our most recent annual report on Form 20-F, in other reports incorporated herein by reference, and in the applicable prospectus

supplement before you make your investment decision.

Neither

the Securities and Exchange Commission, the Cayman Islands Monetary Authority, nor any state securities commission has approved or disapproved

of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2023

TABLE

OF CONTENTS

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement. We have not

authorized any person to provide you with different or additional information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus is not an offer to sell securities, and it is not soliciting an offer to buy

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus

or any prospectus supplement, as well as information we have previously filed with the SEC and incorporated by reference, is accurate

as of the date on the front of those documents only. Our business, financial condition, results of operations and prospects may have

changed since those dates.

ABOUT

THIS PROSPECTUS

This

prospectus is a part of a registration statement that we have filed with the SEC utilizing a “shelf” registration process.

Under this shelf registration process, we may sell any combination of the securities described in this prospectus in one or more offerings

up to an aggregate offering price of $300,000,000.

Each

time we sell securities, we will provide a supplement to this prospectus that contains specific information about the securities being

offered and the specific terms of that offering. The supplement may also add, update or change information contained in this prospectus.

If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the prospectus

supplement.

We

may offer and sell securities to, or through, underwriting syndicates or dealers, through agents or directly to purchasers.

The

prospectus supplement for each offering of securities will describe in detail the plan of distribution for that offering.

In

connection with any offering of securities (unless otherwise specified in a prospectus supplement), the underwriters or agents may over-allot

or effect transactions which stabilize or maintain the market price of the securities offered at a higher level than that which might

exist in the open market. Such transactions, if commenced, may be interrupted or discontinued at any time. See “Plan of Distribution.”

Please

carefully read both this prospectus and any prospectus supplement together with the documents incorporated herein by reference under

“Incorporation of Documents by Reference” and the additional information described below under “Where You Can Get

More Information.”

Prospective

investors should be aware that the acquisition of the securities described herein may have tax consequences. You should read the tax

discussion contained in the applicable prospectus supplement and consult your tax advisor with respect to your own particular circumstances.

You

should rely only on the information contained or incorporated by reference in this prospectus and any prospectus supplement. We have

not authorized anyone to provide you with different information. The distribution or possession of this prospectus in or from certain

jurisdictions may be restricted by law. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy

these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified

to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this prospectus is accurate

only as of the date of this prospectus and any information incorporated by reference is accurate as of the date of the applicable document

incorporated by reference, regardless of the time of delivery of this prospectus or of any sale of the securities. Our business, financial

condition, results of operations and prospects may have changed since those dates.

COMMONLY

USED DEFINED TERMS

Unless

otherwise indicated or the context requires otherwise, references in this prospectus to:

| |

● |

“Asian

investors” refers to the Asian population around the globe. |

| |

● |

“China”

or “PRC” refers to the People’s Republic of China, excluding, for the purpose of this annual report only, Taiwan; |

| |

● |

“Controlling

Shareholder” refers to Zhong Yang Holdings (BVI) Limited; |

| |

● |

“HK$”

or “Hong Kong dollars” refers to the legal currency of Hong Kong; |

| |

● |

“HKSFC”

refers to the Securities and Futures Commission of Hong Kong; |

| |

● |

“HKSFO”

refers to the Securities and Futures Ordinance (Cap. 571) of Hong Kong; |

| |

● |

“Hong

Kong” refers to Hong Kong Special Administrative Region of the People’s Republic of China; |

| |

● |

“Operating Subsidiaries”

refers to WIN100 TECH, WIN100 WEALTH, ZYCL and ZYSL; |

| |

● |

“Predecessor Parent

Company” or “ZYHL” refers to Zhong Yang Holdings Limited, a company with limited liability under the laws of Hong

Kong. |

| |

● |

“SEC” refers

to the United States Securities and Exchange Commission; |

| |

● |

“SEHK” refers

to the Stock Exchange of Hong Kong Limited; |

| |

● |

“TFGL”, “TOP”,

the “Company”, “we,” “us,” “or “our” refers to TOP Financial Group Limited,

a Cayman Islands exempted company, and, in the context of describing its operation and business, its subsidiaries; |

| |

● |

“TOP 500” refers

to TOP 500 SEC PTY LTD, a company formed under the laws of Australia; |

| |

● |

“TOP ASSET MANAGEMENT”

refers to TOP ASSET MANAGEMENT PTE.LTD., a company formed under the laws of Singapore; |

| |

● |

“TOP FINANCIAL”

refers to TOP FINANCIAL PTE.LTD., a company formed under the laws of Singapore; |

| |

● |

“US$” or “U.S.

dollars” refers to the legal currency of the United States; |

| |

● |

“WIN100 TECH”

refers to WIN100 TECH Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“WIN100 WEALTH”

refers to WIN100 WEALTH LIMITED, a company incorporated under the laws of the British Virgin Islands; |

| |

● |

“Winrich” refers

to Winrich Finance Limited, a company incorporated under the laws of the Hong Kong; |

| |

● |

“ZYAL BVI”

refers to ZYAL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYCL” refers

to Zhong Yang Capital Limited, a company with limited liability under the laws of Hong Kong. |

| |

● |

“ZYCL BVI”

refers to ZYCL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYFL (BVI)”

refers to ZYFL (BVI) Limited, a company incorporated under the laws of the British Virgin Islands; |

| |

● |

“ZYIL (BVI)”

refers to ZYIL (BVI) Limited, a company incorporated under the laws of the British Virgin Islands; |

| |

● |

“ZYNL (BVI)”

refers to ZYNL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYPL (BVI)”

refers to ZYPL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYSL” refers

to Zhong Yang Securities Limited, a company with limited liability under the laws of Hong Kong. |

| |

● |

“ZYSL (BVI)”

refers to ZYSL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYTL (BVI)”

refers to ZYTL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

| |

● |

“ZYXL (BVI)”

refers to ZYXL (BVI) Limited, a company incorporated under the laws of British Virgin Islands. |

SPECIAL

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements. All statements contained in this prospectus other than statements of historical fact,

including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives

for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to

identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections

about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term

and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks,

uncertainties and assumptions, including the factors described under the section titled “Risk Factors” in this prospectus

and in the documents incorporated by reference herein and under a similar heading in any applicable prospectus supplement. Moreover,

we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management

to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of

these risks, uncertainties and assumptions, the future events and trends discussed in this prospectus may not occur and actual results

could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You

should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking

statements may not be achieved or occur. Although we believe that the expectations reflected in the forward- looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, we undertake

no duty to update any of these forward-looking statements after the date of this prospectus or to conform these statements to actual

results or revised expectations.

PROSPECTUS

SUMMARY

Corporate

History and Structure

The following

diagram illustrates our corporate structure:

Holding

Company Structure

TFGL

is a holding company incorporated in the Cayman Islands with no material operations of its own. We conduct our operations primarily in

Hong Kong through our subsidiaries in Hong Kong. Investors in our ordinary shares are purchasing equity securities of TFGL, the Cayman

Islands holding company, instead of shares of our Operating Subsidiaries in Hong Kong. Investors in our ordinary shares should be aware

that they may never directly hold equity interests in our Operating Subsidiaries.

As

a result of our corporate structure, TFGL’s ability to pay dividends may depend upon dividends paid by our Operating Subsidiaries.

If our existing Operating Subsidiaries or any newly formed ones incur debt on their own behalf in the future, the instruments governing

their debt may restrict their ability to pay dividends to us.

Our

Subsidiaries and Business Functions

ZYSL

(BVI) was formed as the investment holding company of ZYSL under the laws of the British Virgin Islands on August 29, 2019 as part of

the reorganization. It does not engage in any material operation. It is a direct subsidiary of TFGL.

ZYCL

(BVI) was formed as the investment holding company of ZYCL under the laws of the British Virgin Islands on August 29, 2019 as part of

the reorganization. It does not engage in any material operation. It is a direct subsidiary of TFGL.

ZYAL

(BVI) was formed under the laws of the British Virgin Islands on January 7, 2021. It is a holding company and does not engage in any

material operation. It is a direct subsidiary of TFGL.

ZYTL

(BVI) was formed under the laws of the British Virgin Islands on January 12, 2021. It is a holding company and does not engage in any

material operation. It is a direct subsidiary of TFGL.

ZYNL

(BVI) was formed under the laws of the British Virgin Islands on January 20, 2021. It is a holding company and does not engage in any

material operation. It is a direct subsidiary of TFGL.

ZYPL

(BVI) and ZYXL (BVI) were formed under the laws of the British Virgin Islands on July 14, 2022. Each of ZYXL (BVI) and ZYPL (BVI) is

a holding company and does not engage in any material operation and each is a direct subsidiary of TFGL.

ZYFL

(BVI) and ZYIL (BVI) were formed under the laws of the British Virgin Islands on November 11, 2022. Each of ZYFL (BVI) and ZYIL (BVI)

is a holding company and does not engage in any material operation and each is a direct subsidiary of TFGL.

ZYSL

was formed in accordance with laws and regulations of Hong Kong on April 22, 2015 with a registered capital of HKD 18,000,000 (approximately

US$2.3 million). ZYSL is a limited liability corporation licensed with HKSFC to carry out regulated activities including Type 1 Dealing

in Securities and Type 2 Dealing in Futures Contracts. It is a direct subsidiary of ZYSL (BVI) and an indirect subsidiary of TFGL.

ZYCL

was established in accordance with laws and regulations of Hong Kong on September 29, 2016 with a registered capital of HKD 5,000,000

(approximately US$0.6 million). ZYCL is a limited liability corporation licensed with the HKSFC to carry out regulated activities Type

4 Advising on Securities, Type 5 Advising on Futures Contracts and Type 9 Asset Management. It is a direct subsidiary of ZYCL (BVI) and

an indirect subsidiary of TFGL.

WIN100

TECH was formed under the laws of the British Virgin Islands on May 14, 2021. WIN100 TECH is a Fintech development and IT support company.

It provides trading solutions for clients trading on the world’s major derivatives and stock exchanges. It is a

direct subsidiary of ZYTL (BVI) and an indirect subsidiary of TFGL.

WIN100

WEALTH was formed under the laws of the British Virgin Islands on July 21, 2021. WIN100 WEALTH borrowed $6 million from TGFL in the form

of intra-company loans and invest such amount in financial products. It is a direct subsidiary of ZYIL (BVI) and an indirect subsidiary

of TFGL.

Winrich

was formed under the laws of Hong Kong on February 24, 2023. It does not engage in any material operation. We plan to apply the Money

Lenders License in Hong Kong through Winrich. It is a direct subsidiary of ZYFL (BVI) and an indirect subsidiary of TFGL.

TOP

500 was formed under the laws of Australia on October 22, 2008. TOP 500 owns an Australian Financial Services License (AFSL: 328866).

It does not have any material operation as of the date of this annual report. We plan to provide financial services in Australia that

includes arranging or providing financial advice on financial products such as derivatives, foreign exchange contracts, stock and bond

issuance etc. through TOP 500. It is a direct subsidiary of ZYAL (BVI) and an indirect subsidiary of TFGL.

TOP

ASSET MANAGEMENT was formed under the laws of Singapore on November 28, 2022. It does not engage in any material operation. We plan to

register with the Monetary Authority of Singapore as a Registered Fund Management Company to carry out Fund Management services. It is

a direct subsidiary of ZYXL (BVI) and an indirect subsidiary of TFGL.

TOP

FINANCIAL was formed under the laws of Singapore on November 28, 2022. It does not engage in any material operation. We plan to acquire

the CMS license from the Monetary Authority of Singapore to carry out regulated activities in Dealing in Capital Market. It is a direct

subsidiary of ZYPL (BVI) and an indirect subsidiary of TFGL.

Name

Change

Effective

July 13, 2022, the Company changed its name from “Zhong Yang Financial Group Limited” to “TOP Financial Group Limited”.

Business

Overview

Our

Operating Subsidiaries operate an online brokerage firm in Hong Kong specializing in the trading of local and overseas equities, futures,

and options products. Our clients primarily reside in Asia and we are currently focusing on expanding our customer base to Southeast

Asian investors. Our trading platforms, which our Operating Subsidiaries license from third parties, enable investors to trade approximately

more than 100 futures products on multiple exchanges around the world including the member exchanges of Chicago Mercantile Exchange (CME),

Hong Kong Futures Exchange (HKFE), The New York Mercantile Exchange (NYMEX), The Chicago Board of Trade (CBOT), The Commodity Exchange

(COMEX), Eurex Exchange (EUREX), ICE Clear Europe Limited (ICEU), Singapore Exchange (SGX), Australia Securities Exchange (ASX), Bursa

Malaysia Derivatives Berhad (BMD), and Osaka Exchange (OSE). Our continuous efforts focusing on offering value-added services and access

to exchanges around the globe, compounded with user friendly experience, have enabled us to become one of the fast-growing online trading

platforms for our clients. Our trading volume of futures contracts was 9.61 million trades in fiscal year 2021, 2.64 million trades in

fiscal year 2022 and 2.97 million trades in fiscal year 2023. Our total registered customer number increased from 247 as of March 31,

2021 to 292 as of March 31, 2022 and further increased to 296 as of March 31, 2023. In fiscal year 2021, we had 49 revenue-generating

accounts in total, including 33 accounts for futures trading and 16 accounts for securities trading. In fiscal year 2022, we had 74 revenue-generating

accounts in total, including 16 accounts for futures trading, 15 accounts for securities trading, 34 accounts for structured notes subscriber

services and 9 accounts for trading solution service. In fiscal year 2023, we had 34 revenue-generating accounts in total, including

12 accounts for futures trading, 12 accounts for securities trading, no account for structured notes subscriber services and 10 accounts

for trading solution service.

Our

Operating Subsidiaries conduct the futures and stock brokerage business through two trading platforms, Esunny for futures trading and

2Go for stock trading, both of which were licensed from third parties and can be easily accessed through our application, or APP, software,

and websites. The two platforms are designed to empower our clients to enjoy a seamless, efficient, and secure trading platform. We offer

our customers comprehensive brokerage and value-added services, including trade order placement and execution, account management, and

customer support. Given the importance of trading systems in our services, we strive to continuously enhance our IT infrastructure.

During

the years ended March 31, 2023, 2022 and 2021, our Operating Subsidiaries provided futures brokerage services and other services (including

stock brokerage, options brokerage, consulting services, currency exchange services, structured note subscriber services, margin financing

services). We generate revenues primarily from brokerage fees we charge clients for executing and/or arranging the trades and transactions

for them. Our revenues for the years ended March 31, 2023, 2022 and 2021 were US$9.7 million, US$7.8 million and US$16.9 million, respectively.

The commissions on futures brokerage accounted for 44.6%, 54.9% and 95.1% of the total revenues for the years ended March 31, 2023, 2022

and 2021, respectively. Starting from the fiscal year 2022, our Operating Subsidiaries commenced trading solution services.

Revenues from the trading solution services accounted for 45.3% and 42.3% of the total revenues for the fiscal year ended March 31, 2023

and 2022. Revenues from the structure note subscription fees accounted for 0%, 9.4% and 0.5% of the total revenues for the fiscal years

ended March 31, 2023, 2022 and 2021, respectively. Our Operating Subsidiaries also provide other financial services including stock brokerage,

options brokerage, consulting services, currency exchange services, and margin financing services to our clients. Revenues generated

from stock brokerage, consulting services, and currency exchange services accounted for 3.0%, 3.6% and 1.6% of total revenues, during

the fiscal years ended March 31, 2023, 2022 and 2021, respectively. We did not generate revenue from options trading services or margin

financing services for the fiscal years 2023, 2022 and 2021. Our top five customers accounted for 43%, 77% and 92% of our total revenues

for the years ended March 31, 2023, 2022 and 2021.

Our

Operating Subsidiaries have achieved substantial growth since the launch of our operation of online brokerage services, as illustrated

by the chart below which sets forth the number of future contracts we have executed from April 1, 2020 to March 31, 2023, organized by

calendar quarter.

The

number of futures contracts executed in each period depends on factors including, but not limited to, economic and political conditions,

market conditions, pricing of futures contracts, and the clients’ risk appetite. By the end of 2019 to the first half of 2020, the

Southeast Asian financial market faced a number of uncertainties such as the COVID-19 pandemic. Trading activities dropped which impacted

our fiscal quarters ended December 31, 2019 and March 31, 2020. The trading activities recover and remain moderately stable from the

fiscal quarter ended on June 30, 2020 to the fiscal quarter ended March 31, 2021. However, the travel restrictions in Hong Kong from

time to time and the economic and financial impact brought about by the COVID-19 pandemic had caused a decrease in our customers’

disposable income and in their willingness to trade and make investments, and therefore had negatively affected our results of operation

since the fiscal quarter ended June 30, 2021. Given the uncertainties surrounding the duration and the impact of the COVID-19 pandemic,

we continue to closely monitor the impact and navigate the significant challenges created by the COVID-19 pandemic.

We

intend to leverage our competitive strengths to sustain and grow our business, namely, to provide our clients with fast and reliable

access to the financial market through our personalized client services and efficient organizational structure. In particular, we plan

to expand our services offering and continue integrating value-added services, including CFD products and services and asset management

services.

Corporate

Information

Our

principal executive offices are located at Flat 1101, 118 Connaught Road West, Hong Kong. Our telephone number at this address is +852

3107 0731. Our registered office in the Cayman Islands is located at the offices of Vistra (Cayman) Limited, P. O. Box 31119 Grand Pavilion,

Hibiscus Way, 802 West Bay Road, Grand Cayman, KY1 - 1205 Cayman Islands. Our agent for service of process in the United States is Cogency

Global Inc. located at 122 East 42nd Street, 18th Floor, New York, NY 10168. Investors should contact us for any

inquiries through the address and telephone number of our principal executive offices. Our website is www. ZYFGL.com. The information

contained on our website is not a part of this prospectus.

The

SEC maintains an internet site at http://www.sec.gov that contains reports, information statements, and other information regarding issuers

that file electronically with the SEC.

Implications

of Being an Emerging Growth Company

We

qualify as and elect to be an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or

the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable

generally to public companies. These provisions include, but not limited to:

| |

● |

Reduced disclosure about

the emerging growth company’s executive compensation arrangements in our periodic reports, proxy statements and registration

statements; and |

| |

● |

an exemption from the auditor

attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of

2002. |

We

will remain an “emerging growth company” until the earliest to occur of (i) the last day of the fiscal year (a) following

the fifth anniversary of the closing of the Business Combination, (b) in which we have total annual gross revenue of at least $1.235 billion

or (c) in which we are deemed to be a large accelerated filer, which means the market value of equity securities held by our non-affiliates

exceeds $700 million as of the last business day of our prior second fiscal quarter, and (ii) the date on which we have issued more

than $1.0 billion in non-convertible debt during the prior three-year period.

Implication

of Being a Foreign Private Issuer

We

are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

| |

● |

we are not required to

provide as many Exchange Act reports or provide periodic and current reports as frequently, as a domestic public company; |

| |

● |

for interim reporting,

we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic

public companies; |

| |

● |

we are not required to

provide the same level of disclosure on certain issues, such as executive compensation; |

| |

● |

we are exempt from provisions

of Regulation FD aimed at preventing issuers from making selective disclosures of material information; |

| |

● |

we are not required to

comply with the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security

registered under the Exchange Act; and |

| |

● |

we are not required to

comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities

and establishing insider liability for profits realized from any “short-swing” trading transaction. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully review the risks and uncertainties described in this section and

under the heading “Risk Factors” contained in any applicable prospectus supplement and under similar headings in our most

recent annual report on Form 20-F as updated by our subsequent filings, some of which are incorporated by reference into this prospectus,

before deciding whether to purchase any of the securities being registered pursuant to the registration statement of which this prospectus

forms a part. Each of the risk factors could adversely affect our business, results of operations, financial condition and cash flows,

as well as adversely affect the value of an investment in our securities, and the occurrence of any of these risks might cause you to

lose all or part of your investment. Additional risks not presently known to us or that we currently believe are immaterial may also

significantly impair our business operations. For more information, see “Where You Can Find Additional Information” and “Incorporation

of Documents by Reference.”

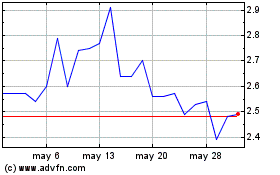

The trading

price of our ordinary shares experienced substantial price fluctuations in April and May 2023. On May 11, 2023 the SEC ordered a 10-day

trading suspension of our ordinary shares. A repeat suspension could occur. Because our ordinary shares has at times been thinly traded,

our ordinary shares may continue to experience price volatility and low liquidity, which could result in substantial losses to investors.

The trading price of our ordinary shares experienced substantial price

fluctuations in April and May 2023, during which time the highest and lowest closing prices were US$108.21 and US$4.53 per ordinary share,

respectively. On May 11, 2023, the SEC ordered a 10-day trading suspension of the Company’s ordinary shares, due to “recent,

unusual, and unexplained market activity raising concerns regarding the adequacy and accuracy of publicly-available information, in light

of disclosures made concerning TOP’s financial condition and scope of operations.” The trading suspension ended on May 26,

2023. In addition, the daily trading volume of our ordinary shares has at times been relatively low. If this continues to occur in the

future, persons buying or selling in relatively small quantities may easily influence the price of our ordinary shares. This low volume

of trades could also cause the price of our ordinary shares to fluctuate greatly, with large percentage changes in price occurring in

any trading day session. Holders of our ordinary shares may also not be able to readily liquidate their investment or may be forced to

sell at depressed prices due to low volume trading. Broad market fluctuations and general economic and political conditions may also adversely

affect the market price of our ordinary shares. As a result of this volatility, investors may experience losses on their investment in

our ordinary shares. Furthermore, the volatility may confuse the public investors of the value of our stock, distort the market perception

of our stock price, our company’s financial performance, public image, and negatively affect the long-term liquidity of our ordinary

shares, regardless of our actual or expected operating performance. A decline in the market price of our ordinary shares also could adversely

affect our ability to issue additional ordinary shares or other securities and our ability to obtain additional financing in the future.

No assurance can be given that an active market in our ordinary shares will develop or be sustained. If an active market does not develop,

holders of our ordinary shares may be unable to readily sell the shares they hold or may not be able to sell their shares at all.

The sale of a substantial amount of our

ordinary shares and/or securities that are exercisable or convertible into out ordinary shares could adversely affect the prevailing

market price of our ordinary shares.

We are registering

the sale of ordinary shares and other securities with an aggregate offering price of $300,000,000 and may issue ordinary shares or other

equity or debt securities that are exercisable or convertible into ordinary shares pursuant to this prospectus or the applicable prospectus

supplement. Furthermore, in the future, we may issue additional ordinary shares or other securities in connection with financing, equity

incentive plans, strategic business acquisition, or otherwise. Sales of substantial amounts of our ordinary shares in the public market,

or the perception that such sales might occur, could result in substantial dilution to our existing shareholders and could

adversely affect the market price of our ordinary shares.

CAPITALIZATION AND INDEBTNESS

Our capitalization will be set forth in the

applicable prospectus supplement or in a report on Form 6-K subsequently furnished to the SEC and specifically incorporated

by reference into this prospectus.

DILUTION

If required, we will set forth in a prospectus

supplement the following information regarding any material dilution of the equity interests of investors purchasing securities in an

offering under this prospectus:

| |

● |

the net tangible book value per share of our equity securities before and after the offering; |

| |

● |

the amount of the increase in such net tangible book value per share attributable to the cash payments made by purchasers in the offering; and |

| |

● |

the amount of the immediate dilution from the public offering price which will be absorbed by such purchasers. |

USE OF PROCEEDS

We

intend to use the net proceeds from the sale of securities we offer as indicated in the applicable prospectus supplement, information

incorporated by reference, or free writing prospectus.

DESCRIPTION OF ORDINARY SHARES

TOP Financial Group Ltd is

an exempted company incorporated under the Companies Act (Revised) of the Cayman Islands, as amended (the “Cayman Islands

Companies Act”). As of the date of this prospectus, we are authorized to issue 150,000,000 ordinary shares of $0.001 par value per

share. As of June 30, 2023, there are 35,007,233 ordinary shares issued and outstanding.

The following are summaries of the material provisions

of our amended and restated memorandum and articles of association and the Cayman Islands Companies Act, insofar as they relate to the

material terms of our ordinary shares. Copies of our amended and restated memorandum and articles of association are filed as exhibits

to the most recent annual report on Form 20-F, which is incorporated by reference in this prospectus.

General

As of the date of this prospectus, under our amended

and restated memorandum of association, we are authorized to issue 150,000,000 ordinary shares of $0.001 par value per share. As

of June 30, 2023, there are 35,007,233 ordinary shares issued and outstanding.

Each ordinary share in the Company confers upon

the shareholder:

| |

● |

the right to one vote at a meeting of the shareholders of the Company or on any resolution of shareholders; |

| |

● |

the right to an equal share in any dividend paid by the Company; and |

| |

● |

the right to an equal share in the distribution of the surplus assets of the Company on its liquidation. |

Distributions

The holders of our ordinary shares are entitled

to such dividends or other distributions as may be recommended by the board and authorized by shareholders subject to the Cayman Islands

Companies Act and our amended and restated memorandum and articles of association.

Shareholders’ voting rights

At each general meeting, each shareholder who

is present in person or by proxy (or, in the case of a shareholder being a corporation, by its duly authorized representative) will have

one (1) vote for each Ordinary Share.

An ordinary resolution

to be passed by the shareholders requires the affirmative vote of a simple majority of the votes attached to the Ordinary Shares cast

by those shareholders entitled to vote who are present in person or by proxy (or, in the case of corporations, by their duly authorized

representatives) at a general meeting, while a special resolution requires the affirmative vote of a majority of not less than two-thirds of

the votes attached to the Ordinary Shares cast by those shareholders who are present in person or by proxy (or, in the case of corporations,

by their duly authorized representatives) at a general meeting. Both ordinary resolutions and special resolutions may also be passed by

a unanimous written resolution signed by all the shareholders of our company, as permitted by the Companies Act and our amended and restated

memorandum and articles of association. A special resolution will be required for important matters such as a change of name or making

changes to our amended and restated memorandum and articles of association.

Election of directors

We may appoint directors by a resolution of shareholders

passed by a simple majority of the votes or by resolution of the directors.

Meetings of shareholders

The directors may convene a meeting of shareholders

whenever they think necessary or desirable. We must provide notice counting from the date service is deemed to take place, stating the

place, the day and the hour of the general meeting and, in the case of special business, the general nature of that business, to such

persons who are entitled to receive such notices from the Company. Our board of directors must convene a general meeting upon the written

requisition of one or more shareholders entitled to attend and vote at general meeting of the Company holding not less than 10% of the

paid up voting share capital of the Company in respect to the matter for which the meeting is requested.

No business may be transacted at any general meeting

unless a quorum is present at the time the meeting proceeds to business. One or more shareholders present in person or by proxy holding

in aggregate at least a majority of the paid up voting share capital of the Company shall be a quorum. If, within half an hour from the

time appointed for the meeting, a quorum is not present, the meeting, if convened upon the requisition of shareholders, shall be dissolved.

In any other case, it shall stand adjourned to the same day in the next week, at the same time and place and if, at the adjourned meeting,

a quorum is not present within half an hour from the time appointed for the meeting, the shareholders present and entitled to vote shall

be a quorum. At every meeting, the shareholders present shall choose someone of their number to be the chairman.

A corporation that is a shareholder shall be deemed

for the purpose of our amended and restated memorandum and articles of association to be present at a general meeting in person if represented

by its duly authorized representative. This duly authorized representative shall be entitled to exercise the same powers on behalf of

the corporation which he represents as that corporation could exercise if it were our individual shareholder.

Meeting of directors

The business of our company is managed by the

directors. Our directors are free to meet at such times and in such manner and places within or outside the Cayman Islands as the directors

determine to be necessary or desirable. The quorum necessary for the transaction of the business of the directors may be fixed by the

directors, and unless so fixed, if there be more than two directors shall be two, and if there are two or less Directors shall be one.

An action that may be taken by the directors at a meeting may also be taken by a resolution of directors consented to in writing by all

of the directors.

Pre-emptive rights

There are no pre-emptive rights applicable to

the issue by us of new shares under either Cayman Islands law or our amended and restated memorandum and articles of association.

Transfer of ordinary shares

Subject to the restrictions in our amended and

restated memorandum and articles of association and applicable securities laws, any of our shareholders may transfer all or any of his

or her ordinary shares by written instrument of transfer signed by the transferor and containing the name of the transferee. Our board

of directors may resolve by resolution to refuse or delay the registration of the transfer of any ordinary share without giving any reason.

Winding up

If we are wound up and the assets available for

distribution among our shareholders are more than sufficient to repay the whole of the paid up capital at the commencement of the winding

up, the excess shall be distributable among those shareholders in proportion to the capital paid up at the commencement of the winding

up on the shares held by them respectively. If we are wound up and the assets available for distribution among the shareholders as such

are insufficient to repay the whole of the paid up capital, such assets shall be distributed so that, as nearly as may be, the losses

shall be borne by the shareholders in proportion to the capital paid up at the commencement of the winding up on the shares held by them,

respectively. If we are wound up, the liquidator may with the sanction of a special resolution and any other sanction required by the

Companies Act, divide among our shareholders in specie or kind the whole or any part of our assets (whether they shall consist of property

of the same kind or not), and may, for such purpose, set such value as the liquidator deems fair upon any property to be divided and may

determine how such division shall be carried out as between the shareholders or different classes of shareholders.

The liquidator may also vest the whole or any

part of these assets in trusts for the benefit of the shareholders as the liquidator shall think fit, but so that no shareholder will

be compelled to accept any assets, shares or other securities upon which there is a liability.

Calls on ordinary shares and forfeiture of

ordinary shares

Our board of directors may from time to time make

calls upon shareholders for any amounts unpaid on their Ordinary Shares in a notice served to such shareholders at least one month prior

to the specified time of payment. The Ordinary Shares that have been called upon and remain unpaid are subject to forfeiture.

Redemption, Repurchase and Surrender of Ordinary

Shares

We may issue shares on terms that such shares

are subject to redemption, at our option, on such terms and in such manner as may be determined, before the issue of such shares, by our

board of directors or by an ordinary resolution of our shareholders. The Companies Act and our amended and restated memorandum and

articles of association permits us to purchase our own shares, subject to certain restrictions and requirements. Subject to the Companies

Act, our amended and restated memorandum and articles of association and to any applicable requirements imposed from time to time by the

Nasdaq, the U.S. Securities and Exchange Commission, or by any other recognized stock exchange on which our securities are listed, we

may purchase our own shares (including any redeemable shares) on such terms and in such manner as been approved by the directors or by

an ordinary resolution of our shareholders. Under the Companies Act, the repurchase of any share may be paid out of our Company’s

profits, or out of the share premium account, or out of the proceeds of a fresh issue of shares made for the purpose of such repurchase,

or out of capital. If the repurchase proceeds are paid out of our Company’s capital, our Company must, immediately following such

payment, be able to pay its debts as they fall due in the ordinary course of business. In addition, under the Companies Act, no such share

may be repurchased (1) unless it is fully paid up, and (2) if such repurchase would result in there being no shares outstanding other

than shares held as treasury shares. The repurchase of shares may be effected in such manner and upon such terms as may be authorized

by or pursuant to the Company’s articles of association. If the articles do not authorize the manner and terms of the purchase,

a company shall not repurchase any of its own shares unless the manner and terms of purchase have first been authorized by a resolution

of the company. In addition, under the Companies Act and our amended and restated memorandum and articles of association, our Company

may accept the surrender of any fully paid share for no consideration unless, as a result of the surrender, the surrender would result

in there being no shares outstanding (other than shares held as treasury shares).

Variations of Rights of Shares

If at any time, our share capital is divided into

different classes of shares, all or any of the rights attached to any class of our shares may (unless otherwise provided by the

terms of issue of the shares of that class) be varied with the consent in writing of the holders of two-thirds of the issued shares of

that class or with the sanction of a resolution passed by at least a two-thirds majority of holders of shares of that class as may be

present in person or by proxy at a separate general meeting of the holders of shares of that class.

Inspection of books and records

Holders of our ordinary shares will have no general

right under Cayman Islands law to inspect or obtain copies of our list of shareholders or our corporate records. However, we will provide

our shareholders with annual audited financial statements. See “Where You Can Find Additional Information.”

Rights of non-resident or foreign shareholders

There are no limitations imposed by our amended

and restated memorandum and articles of association on the rights of non-resident or foreign shareholders to hold or exercise voting rights

on our shares. In addition, there are no provisions in our amended and restated memorandum and articles of association governing the ownership

threshold above which shareholder ownership must be disclosed.

Issuance of additional ordinary shares

Our amended and restated memorandum and articles

of association authorizes our board of directors to issue additional ordinary shares from authorized but unissued shares, to the extent

available, from time to time as our board of directors shall determine.

Listing

Our ordinary shares are listed on the Nasdaq Capital

Market under the symbol “TOP”. On June 29, 2023, the last reported sale price per share for our ordinary shares on the Nasdaq

Capital Market as reported was $7.80.

Transfer Agent and Registrar

The transfer agent and registrar for our ordinary

shares is Securities Transfer Corporation, 2901 N Dallas Parkway, Suite 380,

Plano, Texas 75093.

DESCRIPTION OF WARRANTS

The following description, together with the additional

information we may include in any applicable prospectus supplements, summarizes the material terms and provisions of the warrants that

we may offer under this prospectus and the related warrant agreements and warrant certificates. While the terms summarized below will

apply generally to any warrants that we may offer under this prospectus, we will describe the particular terms of any series of warrants

that we may offer in more detail in the applicable prospectus supplement. If we indicate in the prospectus supplement, the terms of any

warrants offered under that prospectus supplement may differ from the terms described below. However, no prospectus supplement shall fundamentally

change the terms that are set forth in this prospectus or offer a security that is not registered and described in this prospectus at

the time of its effectiveness. Specific warrant agreements will contain additional important terms and provisions and will be incorporated

by reference as an exhibit to the registration statement that includes this prospectus or as an exhibit to a report filed under the Exchange

Act.

General

We may issue warrants that entitle the holder

to purchase ordinary shares, debt securities or any combination thereof. We may issue warrants independently or together with ordinary

shares, debt securities or any combination thereof, and the warrants may be attached to or separate from these securities.

We will describe in the applicable prospectus

supplement the terms of the series of warrants, including:

| |

● |

the offering price and aggregate number of warrants offered; |

| |

● |

the currency for which the warrants may be purchased, if not United States dollars; |

| |

● |

if applicable, the designation and terms of the securities with which the warrants are issued and the number of warrants issued with each such security or each principal amount of such security; |

| |

● |

if applicable, the date on and after which the warrants and the related securities will be separately transferable; |

| |

● |

in the case of warrants to purchase ordinary shares, the number of

ordinary shares purchasable upon the exercise of one warrant and the price at which these shares may be purchased upon such exercise; |

| |

|

|

| |

● |

in the case of warrants to purchase debt securities, the principal amount of debt securities purchasable upon exercise of one warrant and the price at, and currency, if not United States dollars, in which, this principal amount of debt securities may be purchased upon such exercise; |

| |

● |

the effect of any merger, consolidation, sale or other disposition of our business on the warrant agreement and the warrants; |

| |

|

|

| |

● |

the term of any rights to redeem or call the warrants; |

| |

|

|

| |

● |

any provisions for changes to or adjustments in the exercise price or number of securities issuable upon exercise of the warrants; |

| |

● |

the dates on which the right to exercise the warrants will commence and expire; |

| |

● |

the manner in which the warrant agreement and warrants may be modified; |

| |

● |

federal income tax consequences of holding or exercising the warrants; |

| |

● |

the terms of the securities issuable upon exercise of the warrants; and |

| |

● |

any other specific terms, preferences, rights or limitations of or restrictions on the warrants. |

Before exercising their warrants, holders of warrants

will not have any of the rights of holders of the securities purchasable upon such exercise, including:

|

● |

in the case of warrants to purchase debt securities, the right to receive payments of principal of, or premium, if any, or interest on, the debt securities purchasable upon exercise or to enforce covenants in the applicable indenture; or |

| |

● |

in the case of warrants to purchase our ordinary shares, the right to receive dividends, if any, or, payments upon our liquidation, dissolution or winding up or to exercise voting rights, if any. |

Exercise of Warrants

Each warrant will entitle the holder to purchase

the securities that we specify in the applicable prospectus supplement at the exercise price that we describe in the applicable prospectus

supplement. Unless we otherwise specify in the applicable prospectus supplement, holders of the warrants may exercise the warrants at

any time up to the specified time on the expiration date that we set forth in the applicable prospectus supplement. After the close of

business on the expiration date, unexercised warrants will become void.

Holders of the warrants may exercise the warrants

by delivering the warrant certificate representing the warrants to be exercised together with specified information, and paying the required

amount to the warrant agent in immediately available funds, as provided in the applicable prospectus supplement. We will set forth on

the reverse side of the warrant certificate and in the applicable prospectus supplement the information that the holder of the warrant

will be required to deliver to the warrant agent.

Upon receipt of the required payment and the warrant

certificate properly completed and duly executed at the corporate trust office of the warrant agent or any other office indicated in the

applicable prospectus supplement, we will issue and deliver the securities purchasable upon such exercise. If fewer than all of the warrants

represented by the warrant certificate are exercised, then we will issue a new warrant certificate for the remaining amount of warrants.

If we so indicate in the applicable prospectus supplement, holders of the warrants may surrender securities as all or part of the exercise

price for warrants.

Enforceability of Rights by Holders of Warrants

Each warrant agent will act solely as our agent

under the applicable warrant agreement and will not assume any obligation or relationship of agency or trust with any holder of any warrant.

A single bank or trust company may act as warrant agent for more than one issue of warrants. A warrant agent will have no duty or responsibility

in case of any default by us under the applicable warrant agreement or warrant, including any duty or responsibility to initiate any proceedings

at law or otherwise, or to make any demand upon us. Any holder of a warrant may, without the consent of the related warrant agent or the

holder of any other warrant, enforce by appropriate legal action its right to exercise, and receive the securities purchasable upon exercise

of, its warrants.

Warrant Agreement Will Not Be Qualified Under

Trust Indenture Act

No warrant agreement will be qualified as an indenture,

and no warrant agent will be required to qualify as a trustee, under the Trust Indenture Act. Therefore, holders of warrants issued under

a warrant agreement will not have the protection of the Trust Indenture Act with respect to their warrants.

Modification of the Warrant Agreement

The warrant agreements may permit us and the warrant

agent, if any, without the consent of the warrant holders, to supplement or amend the agreement in the following circumstances:

| |

● |

to correct or supplement any provision which may be defective or inconsistent with any other provisions; or |

| |

● |

to add new provisions regarding matters or questions that we and the warrant agent may deem necessary or desirable and which do not adversely affect the interests of the warrant holders. |

DESCRIPTION OF DEBT SECURITIES

As used in this prospectus, debt securities

mean the debentures, notes, bonds and other evidences of indebtedness, which may or may not be converted into our ordinary shares, that

we may issue from time to time. The debt securities may be either secured or unsecured and will either be senior debt securities or subordinated

debt securities. The debt securities may be issued under one or more separate indentures between us and a trustee to be specified in

an accompanying prospectus supplement. Senior debt securities will be issued under a new senior indenture. Subordinated debt securities

will be issued under a subordinated indenture. Together, the senior indentures and the subordinated indentures are sometimes referred

to in this prospectus as the indentures. This prospectus, together with the applicable prospectus supplement, will describe the terms

of a particular series of debt securities.

The statements and descriptions in this prospectus

or in any prospectus supplement regarding provisions of the indentures and debt securities are summaries thereof, do not purport to be

complete and are subject to, and are qualified in their entirety by reference to, all of the provisions of the indentures (and any amendments

or supplements we may enter into from time to time which are permitted under each indenture) and the debt securities, including the definitions

therein of certain terms.

General

Unless otherwise specified in a prospectus supplement,

the debt securities will be direct unsecured obligations of TOP Financial Group Limited. The senior debt securities will rank equally

with any of our other senior and unsubordinated debt. The subordinated debt securities will be subordinate and junior in right of payment

to any senior indebtedness.

Unless otherwise specified in a prospectus supplement,

the indentures do not limit the aggregate principal amount of debt securities that we may issue and provide that we may issue debt securities

from time to time at par or at a discount, and in the case of the new indentures, if any, in one or more series, with the same or various

maturities. Unless indicated in a prospectus supplement, we may issue additional debt securities of a particular series without the consent

of the holders of the debt securities of such series outstanding at the time of the issuance. Any such additional debt securities, together

with all other outstanding debt securities of that series, will constitute a single series of debt securities under the applicable indenture.

Each prospectus supplement will describe the terms

relating to the specific series of debt securities being offered. These terms will include some or all of the following:

| |

● |

the title of the debt securities and whether they are subordinated debt securities or senior debt securities; |

| |

● |

any limit on the aggregate principal amount of the debt securities; |

| |

● |

the ability to issue additional debt securities of the same series; |

| |

● |

the price or prices at which we will sell the debt securities; |

| |

● |

the maturity date or dates of the debt securities on which principal will be payable; |

| |

● |

the rate or rates of interest, if any, which may be fixed or variable, at which the debt securities will bear interest, or the method of determining such rate or rates, if any; |

| |

● |

the date or dates from which any interest will accrue or the method by which such date or dates will be determined; |

| |

● |

the conversion price at which the debt securities may be converted; |

| |

● |

the date on which the right to convert the debt securities will commence and the date on which the right will expire; |

| |

● |

if applicable, the minimum or maximum amount of debt securities that may be converted at any one time; |

| |

● |

the right, if any, to extend the interest payment periods and the duration of any such deferral period, including the maximum consecutive period during which interest payment periods may be extended; |

| |

● |

whether the amount of payments of principal of (and premium, if any) or interest on the debt securities may be determined with reference to any index, formula or other method, such as one or more currencies, commodities, equity indices or other indices, and the manner of determining the amount of such payments; |

| |

● |

the dates on which we will pay interest on the debt securities and the regular record date for determining who is entitled to the interest payable on any interest payment date; |

| |

● |

the place or places where the principal of (and premium, if any) and interest on the debt securities will be payable, where any securities may be surrendered for registration of transfer, exchange or conversion, as applicable, and notices and demands may be delivered to or upon us pursuant to the indenture; |

| |

● |

if we possess the option to do so, the periods within which and the prices at which we may redeem the debt securities, in whole or in part, pursuant to optional redemption provisions, and the other terms and conditions of any such provisions; |

| |

● |

our obligation, if any, to redeem, repay or purchase debt securities by making periodic payments to a sinking fund or through an analogous provision or at the option of holders of the debt securities, and the period or periods within which and the price or prices at which we will redeem, repay or purchase the debt securities, in whole or in part, pursuant to such obligation, and the other terms and conditions of such obligation; |

| |

● |

the denominations in which the debt securities will

be issued, if other than denominations of $1,000 and integral multiples of $1,000; |

| |

● |

the portion, or methods of determining the portion, of the principal amount of the debt securities which we must pay upon the acceleration of the maturity of the debt securities in connection with an event of default (as described below), if other than the full principal amount; |

| |

● |

the currency, currencies or currency unit in which we will pay the principal of (and premium, if any) or interest, if any, on the debt securities, if not United States dollars; |

| |

● |

provisions, if any, granting special rights to holders of the debt securities upon the occurrence of specified events; |

| |

● |

any deletions from, modifications of or additions to the events of default or our covenants with respect to the applicable series of debt securities, and whether or not such events of default or covenants are consistent with those contained in the applicable indenture; |

| |

● |

any limitation on our ability to incur debt, redeem shares, sell our assets or other restrictions; |

| |

● |

the application, if any, of the terms of the indenture relating to defeasance and covenant defeasance (which terms are described below) to the debt securities; |

| |

● |

whether the subordination provisions summarized below or different subordination provisions will apply to the debt securities; |

| |

● |

the terms, if any, upon which the holders may convert or exchange the debt securities into or for our ordinary shares or other securities or property; |

| |

● |

whether any of the debt securities will be issued in global form and, if so, the terms and conditions upon which global debt securities may be exchanged for certificated debt securities; |

| |

● |

any change in the right of the trustee or the requisite holders of debt securities to declare the principal amount thereof due and payable because of an event of default; |

| |

● |

the depository for global or certificated debt securities; |

| |

● |

any special tax implications of the debt securities; |

| |

● |

any foreign tax consequences applicable to the debt securities, including any debt securities denominated and made payable, as described in the prospectus supplements, in foreign currencies, or units based on or related to foreign currencies; |

| |

● |

any trustees, authenticating or paying agents, transfer agents or registrars, or other agents with respect to the debt securities; |

| |

● |

any other terms of the debt securities not inconsistent with the provisions of the indentures, as amended or supplemented; |

| |

● |

to whom any interest on any debt security shall be payable, if other than the person in whose name the security is registered, on the record date for such interest, the extent to which, or the manner in which, any interest payable on a temporary global debt security will be paid if other than in the manner provided in the applicable indenture; |

| |

● |

if the principal of or any premium or interest on any debt securities of the series is to be payable in one or more currencies or currency units other than as stated, the currency, currencies or currency units in which it shall be paid and the periods within and terms and conditions upon which such election is to be made and the amounts payable (or the manner in which such amount shall be determined); |

| |

● |

the portion of the principal amount of any securities of the series which shall be payable upon declaration of acceleration of the maturity of the debt securities pursuant to the applicable indenture if other than the entire principal amount; and |

| |

● |

if the principal amount payable at the stated maturity of any debt security of the series will not be determinable as of any one or more dates prior to the stated maturity, the amount which shall be deemed to be the principal amount of such securities as of any such date for any purpose, including the principal amount thereof which shall be due and payable upon any maturity other than the stated maturity or which shall be deemed to be outstanding as of any date prior to the stated maturity (or, in any such case, the manner in which such amount deemed to be the principal amount shall be determined). |

Unless otherwise specified in the applicable prospectus

supplement, the debt securities will not be listed on any securities exchange and will be issued in fully-registered form without coupons.

Debt securities may be sold at a substantial discount

below their stated principal amount, bearing no interest or interest at a rate which at the time of issuance is below market rates. The

applicable prospectus supplement will describe the federal income tax consequences and special considerations applicable to any such debt

securities. The debt securities may also be issued as indexed securities or securities denominated in foreign currencies, currency units

or composite currencies, as described in more detail in the prospectus supplement relating to any of the particular debt securities. The

prospectus supplement relating to specific debt securities will also describe any special considerations and certain additional tax considerations

applicable to such debt securities.

Conversion of Debt Securities

The debt securities may entitle the holder

to purchase, in exchange for the extinguishment of debt, an amount of securities at a conversion price that will be stated in the debt

securities. If such debt securities are convertible, unless otherwise specified in a prospectus supplement, the debt securities will

be convertible at any time up to the close of business on the expiration date set forth in the terms of such debt securities. After the

close of business on the expiration date, the debt securities not converted will be paid in accordance with their terms.

Subordination

The prospectus supplement relating to any offering

of subordinated debt securities will describe the specific subordination provisions. However, unless otherwise noted in the prospectus

supplement, subordinated debt securities will be subordinate and junior in right of payment to any existing senior indebtedness.

Unless otherwise specified in the applicable prospectus

supplement, under the subordinated indenture, “senior indebtedness” means all amounts due on obligations in connection with

any of the following, whether outstanding at the date of execution of the subordinated indenture, or thereafter incurred or created:

| |

● |

the principal of (and premium, if any) and interest due on our indebtedness for borrowed money and indebtedness evidenced by bonds, notes, debentures or similar instruments or letters of credit (or reimbursement agreements in respect thereof); |

| |

● |

all of our capital lease obligations or attributable debt (as defined in the indentures) in respect of sale and leaseback transactions; |

| |

● |

all obligations representing the balance deferred and unpaid of the purchase price of any property or services, which purchase price is due more than six months after the date of placing such property in service or taking delivery and title thereto, except any such balance that constitutes an accrued expense or trade payable or any similar obligation to trade creditors; |

| |

● |