TrustCo Bank Corp NY (

TrustCo, NASDAQ: TRST) today

announced first quarter 2023 net income of $17.7 million or $0.93

diluted earnings per share, compared to net income of $17.1 million

or $0.89 diluted earnings per share for the first quarter 2022.

Average loan growth increased 7.0% or $312.0 million for the first

quarter 2023 over the same period in 2022.

Overview

Chairman, President, and CEO, Robert J.

McCormick said “Our first quarter results, which build upon the

Company’s record year in 2022, demonstrate that TrustCo is a pillar

of strength and a model of stability. The biggest challenge

presented by great performance is maintaining momentum. This

quarter, TrustCo did not just equal last year’s results, but

improved upon them in the key areas of average loan growth, diluted

earnings per share, and net income, among others. That we have been

able to improve upon our performance in the present challenging

environment is a testament to the skill of our bankers and the

soundness of our strategy. Careful expansions of our areas of

operation and mortgage product offerings, resting upon a solid

foundation devoid of risky gimmicks and dangerous concentrations,

position us well for sustained success.”

TrustCo saw deposit balances rebound from the

end of the year with net deposit inflows during the first quarter

of 2023. Loan growth continued in the first quarter 2023 compared

to the prior year first quarter, led by an increase in residential

mortgages. Loan portfolio expansion was funded by a combination of

utilizing a portion of our strong cash balances and by cash flow

from investments and the existing loan portfolio. The Federal

Reserve decision to raise the target Federal Funds rate multiple

times since March 2022 has contributed to our results in the first

quarter 2023, as our cash position and other variable rate products

continue to reprice upward, and are likely to continue to do so to

the extent there are additional rate increases. We also note that

current mortgage rates significantly exceed the yield on our

existing portfolio of mortgages, which, if sustained, should be

positive to net interest margin going forward. TrustCo’s strong

liquidity position continues to allow us to take advantage of

opportunities as they arise.

Details

As discussed, average loans were up $312.0

million or 7.0% in the first quarter 2023 over the same period in

2022. Average residential loans, our primary lending focus, were up

$205.0 million or 5.1%, in the first quarter 2023 over the same

period in 2022. Average commercial loans and home equity lines of

credit also increased $43.9 million or 22.5% and $58.8 million or

25.3%, respectively, over the same period in 2022.

We are now actively retaining deposits which is

evident in the quarter over quarter results. Total deposits as of

March 31, 2023 increased $19.6 million to $5.2 billion from

December 31, 2022. As we move forward, our objective is to continue

to encourage customers to retain these funds in the expanded

product offerings of the Bank through aggressive marketing and

product differentiation. We understood the big inflows of deposits

during the pandemic were temporary and that is why we did not

invest that liquidity into securities or loans, but retained that

liquidity on the balance sheet for when the depositors would start

to absorb the funds. This gave us flexibility to strategically

price deposits while retaining core customers.

Net interest income was $47.0 million for the

first quarter 2023, an increase of $6.9 million or 17.1% compared

to the same period in 2022, driven by solid liquidity, loan growth,

and the recent increases in the Federal Funds target rate. The net

interest margin for the first quarter 2023 was 3.21%, up 55 basis

points from 2.66% in the first quarter of 2022. The yield on

interest earnings assets increased to 3.69%, up 95 basis points

from 2.74% in the first quarter of 2022. At the same time the cost

of interest bearing liabilities only increased to 0.63% in the

first quarter 2023 from 0.10% in the first quarter 2022. The

increase in net interest income of $6.9 million is primarily a

result of our ability to maintain a $576.9 million average cash

balance at the Federal Reserve Bank during the first quarter of

2023 and being able to retain low cost deposit balances at

competitive market rates.

Asset quality remains strong and loan loss

reserve measures are consistent over the past twelve months. The

Company recorded a provision for credit losses of $300 thousand in

the first quarter of 2023, which includes a provision for credit

losses on loans of $600 thousand and a benefit for credit losses on

unfunded commitments of $300 thousand as a result of a

corresponding decrease in unfunded loan commitments. The ratio of

allowance for credit losses on loans to total loans was 0.97% and

1.03% as of March 31, 2023 and 2022, respectively. The allowance

for credit losses on loans was $46.7 million at March 31, 2023,

compared to $46.2 million at March 31, 2022. Nonperforming loans

(NPLs) were $19.2 million at March 31, 2023, compared to $19.4

million at March 31, 2022. NPLs were 0.40% and 0.43% of total loans

at March 31, 2023 and 2022, respectively. The coverage ratio, or

allowance for credit losses on loans to NPLs, was 243.6% at March

31, 2023, compared to 237.8% at March 31, 2022. Nonperforming

assets (NPAs) were $21.0 million at March 31, 2023, compared to

$19.7 million at March 31, 2022.

At March 31, 2023 our equity to asset ratio was

10.17%, compared to 9.44% at March 31, 2022. Book value per share

at March 31, 2023 was $32.31, up 4.7% compared to $30.85 a year

earlier.

A conference call to discuss first quarter 2023

results will be held at 9:00 a.m. Eastern Time on April 25, 2023.

Those wishing to participate in the call may dial toll-free for the

United States at 1-833-470-1428, and for Canada at 1-833-950-0062,

Access code 576267. A replay of the call will be available for

thirty days by dialing toll-free for the United States at

1-866-813-9403, for Canada at 1-226-828-7578, and all other

locations at +44-204-525-0658, Access code 635945. The call will

also be audio webcast at

https://events.q4inc.com/attendee/162588284, and will be available

for one year.

About TrustCo Bank Corp NY

TrustCo Bank Corp NY is a $6.0 billion savings

and loan holding company and through its subsidiary, Trustco Bank,

operated 143 offices in New York, New Jersey, Vermont,

Massachusetts, and Florida at March 31, 2023.

In addition, the Bank’s Financial Services

Department offers a full range of investment services, retirement

planning and trust and estate administration services. The common

shares of TrustCo are traded on the NASDAQ Global Select Market

under the symbol TRST.

Forward-Looking Statements All

statements in this news release that are not historical are

forward-looking statements within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as

"anticipate," "intend," "plan," "goal," "seek," "believe,"

"project," "estimate," "expect," "strategy," "future," "likely,"

"may," "should," "will" and similar references to future

development, results or periods. Examples of forward-looking

statements include, among others, statements we make regarding our

expectations for our performance during 2023, including our

expectations regarding the effects of the economic environment on

our financial results, our ability to retain customers and the

amount of customers’ business, including deposit balances, with us,

the impact of the Federal Reserve’s actions regarding interest

rates, the growth of loans and deposits throughout our branch

network, the increase in residential mortgage rates, and our

ability to capitalize on economic changes in the areas in which we

operate. Forward-looking statements are based on management’s

current expectations as well as certain assumptions and estimates

made by, and information available to, management at the time the

statements are made. Such forward-looking statements are subject to

factors and uncertainties that could cause actual results to differ

materially for TrustCo from the views, beliefs and projections

expressed in such statements, and many of the risks and

uncertainties are heightened by or may, in the future, be

heightened by the effects of the COVID-19 pandemic and

macroeconomic or geopolitical concerns related to inflation, rising

interest rates and the war in Ukraine. TrustCo wishes to caution

readers not to place undue reliance on any such forward-looking

statements, which speak only as of the date made. The following

important factors, among others, in some cases have affected and in

the future could affect TrustCo’s actual results and could cause

TrustCo’s actual financial performance to differ materially from

that expressed in any forward-looking statement: changes in

interest rates, including recent and possible future increases

fueled by inflation; inflationary pressures and rising prices;

exposure to credit risk in our lending activities; the sufficiency

of our allowance for credit losses on loans to cover actual loan

losses; our ability to meet the cash flow requirements of our

depositors or borrowers or meet our operating cash needs to fund

corporate expansion and other activities; claims and litigation

pertaining to fiduciary responsibility and lender liability; our

dependency upon the services of the management team; our disclosure

controls and procedures’ ability to prevent or detect errors or

acts of fraud; the adequacy of our business continuity and disaster

recovery plans; the effectiveness of our risk management framework;

the chance of a prolonged economic downturn, especially one

affecting our geographic market area; instability in global

economic conditions and geopolitical matters, as well as volatility

in financial markets; the COVID-19 pandemic; the soundness of other

financial institutions; fluctuations in the trust wealth management

fees we receive as a result of investment performance; the impact

of regulatory capital rules on our growth; changes in laws and

regulations; our compliance with the USA PATRIOT Act, Bank Secrecy

Act, and other laws and regulations that could result in fines or

sanctions; changes in tax laws; limitations on our ability to pay

dividends; TrustCo Realty Corp.’s ability to qualify as a real

estate investment trust; changes in accounting standards;

competition within our market areas; consumers and businesses’ use

of non-banks to complete financial transactions; our reliance on

third-party service providers; the risk of data breaches and

cyber-attacks; the risk of an unauthorized disclosure of sensitive

or confidential client or customer information; the impact of any

expansion by us into new lines of business or new products and

services; the impact of severe weather events and climate change on

us and the communities we serve, including societal responses to

climate change; and other risks and uncertainties under the heading

“Risk Factors” in our most recent annual report on Form 10-K and,

if any, in our subsequent quarterly reports on Form 10-Q or other

securities filings. The forward-looking statements contained in

this news release represent TrustCo management’s judgment as of the

date of this news release. TrustCo disclaims, however, any intent

or obligation to update forward-looking statements, either as a

result of future developments, new information or otherwise, except

as may be required by law.

| TRUSTCO

BANK CORP NY |

|

GLENVILLE, NY |

| |

| FINANCIAL

HIGHLIGHTS |

| |

| (dollars

in thousands, except per share data) |

|

(Unaudited) |

| |

Three months ended |

|

|

3/31/2023 |

|

|

12/31/2022 |

|

|

|

3/31/2022 |

|

| Summary of operations |

|

|

|

|

|

|

|

|

Net interest income |

$ |

46,965 |

|

|

$ |

49,186 |

|

|

$ |

40,096 |

|

|

Provision (Credit) for credit losses |

|

300 |

|

|

|

50 |

|

|

|

(200 |

) |

|

Noninterest income |

|

4,669 |

|

|

|

4,775 |

|

|

|

5,183 |

|

|

Noninterest expense |

|

27,679 |

|

|

|

26,405 |

|

|

|

22,765 |

|

|

Net income |

|

17,746 |

|

|

|

20,910 |

|

|

|

17,089 |

|

| |

|

|

|

|

|

|

|

| Per share |

|

|

|

|

|

|

|

|

Net income per share: |

|

|

|

|

|

|

|

|

- Basic |

$ |

0.93 |

|

|

$ |

1.10 |

|

|

$ |

0.89 |

|

|

- Diluted |

|

0.93 |

|

|

|

1.10 |

|

|

|

0.89 |

|

|

Cash dividends |

|

0.360 |

|

|

|

0.360 |

|

|

|

0.350 |

|

|

Book value at period end |

|

32.31 |

|

|

|

31.54 |

|

|

|

30.85 |

|

|

Market price at period end |

|

31.94 |

|

|

|

37.59 |

|

|

|

31.93 |

|

| |

|

|

|

|

|

|

|

| At period end |

|

|

|

|

|

|

|

|

Full time equivalent employees |

|

776 |

|

|

|

750 |

|

|

|

769 |

|

|

Full service banking offices |

|

143 |

|

|

|

143 |

|

|

|

144 |

|

| |

|

|

|

|

|

|

|

| Performance ratios |

|

|

|

|

|

|

|

|

Return on average assets |

|

1.20 |

% |

|

|

1.38 |

% |

|

|

1.12 |

% |

|

Return on average equity |

|

11.84 |

|

|

|

13.91 |

|

|

|

11.60 |

|

|

Efficiency ratio (1) |

|

53.17 |

|

|

|

48.75 |

|

|

|

50.55 |

|

|

Net interest spread |

|

3.06 |

|

|

|

3.28 |

|

|

|

2.63 |

|

|

Net interest margin |

|

3.21 |

|

|

|

3.34 |

|

|

|

2.66 |

|

|

Dividend payout ratio |

|

38.59 |

|

|

|

32.81 |

|

|

|

39.36 |

|

| |

|

|

|

|

|

|

|

| Capital ratios at period

end |

|

|

|

|

|

|

|

|

Consolidated equity to assets |

|

10.17 |

% |

|

|

10.00 |

% |

|

|

9.44 |

% |

|

Consolidated tangible equity to tangible assets (2) |

|

10.16 |

% |

|

|

9.99 |

% |

|

|

9.43 |

% |

| |

|

|

|

|

|

|

|

| Asset quality analysis at

period end |

|

|

|

|

|

|

|

|

Nonperforming loans to total loans |

|

0.40 |

% |

|

|

0.37 |

% |

|

|

0.43 |

% |

|

Nonperforming assets to total assets |

|

0.35 |

|

|

|

0.33 |

|

|

|

0.31 |

|

|

Allowance for credit losses on loans to total loans |

|

0.97 |

|

|

|

0.97 |

|

|

|

1.03 |

|

|

Coverage ratio (3) |

2.4x |

|

|

2.6x |

|

|

|

2.4x |

|

|

|

|

|

|

|

|

|

|

(1) Non-GAAP measure; calculated as noninterest expense

(excluding ORE income/expense) divided by taxable equivalent

net interest income plus noninterest income. See Non-GAAP Financial

Measures Reconciliation.(2) Non-GAAP measure; calculated as total

shareholders' equity less $553 of intangible assets divided by

total assets less $553 of intangible assets. See Non-GAAP

Financial Measures Reconciliation.(3) Calculated as allowance for

credit losses on loans divided by total nonperforming loans.

|

CONSOLIDATED STATEMENTS OF INCOME |

| |

|

|

|

|

|

|

|

|

|

| (dollars in thousands,

except per share data) |

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| |

Three months ended |

|

|

|

3/31/2023 |

|

|

|

12/31/2022 |

|

|

|

9/30/2022 |

|

|

|

6/30/2022 |

|

|

|

3/31/2022 |

|

| Interest and dividend

income: |

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

$ |

44,272 |

|

|

$ |

42,711 |

|

|

$ |

40,896 |

|

|

$ |

39,604 |

|

|

$ |

39,003 |

|

|

Interest and dividends on securities available for sale: |

|

|

|

|

|

|

|

|

|

|

U. S. government sponsored enterprises |

|

692 |

|

|

|

693 |

|

|

|

479 |

|

|

|

147 |

|

|

|

86 |

|

|

State and political subdivisions |

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

|

|

1 |

|

|

Mortgage-backed securities and collateralized mortgage obligations

- residential |

|

1,585 |

|

|

|

1,606 |

|

|

|

1,617 |

|

|

|

1,367 |

|

|

|

1,087 |

|

|

Corporate bonds |

|

521 |

|

|

|

523 |

|

|

|

526 |

|

|

|

522 |

|

|

|

233 |

|

|

Small Business Administration - guaranteed participation

securities |

|

117 |

|

|

|

124 |

|

|

|

133 |

|

|

|

140 |

|

|

|

154 |

|

|

Other securities |

|

2 |

|

|

|

2 |

|

|

|

3 |

|

|

|

2 |

|

|

|

2 |

|

|

Total interest and dividends on securities available for sale |

|

2,917 |

|

|

|

2,948 |

|

|

|

2,759 |

|

|

|

2,178 |

|

|

|

1,563 |

|

| |

|

|

|

|

|

|

|

|

|

| Interest on held to maturity

securities: |

|

|

|

|

|

|

|

|

|

|

Mortgage-backed securities and collateralized mortgage obligations

- residential |

|

78 |

|

|

|

81 |

|

|

|

85 |

|

|

|

87 |

|

|

|

90 |

|

| Total interest on held to

maturity securities |

|

78 |

|

|

|

81 |

|

|

|

85 |

|

|

|

87 |

|

|

|

90 |

|

| |

|

|

|

|

|

|

|

|

|

| Federal Home Loan Bank

stock |

|

110 |

|

|

|

98 |

|

|

|

80 |

|

|

|

65 |

|

|

|

62 |

|

| |

|

|

|

|

|

|

|

|

|

| Interest on federal funds sold

and other short-term investments |

|

6,555 |

|

|

|

6,246 |

|

|

|

5,221 |

|

|

|

2,253 |

|

|

|

572 |

|

| Total interest income |

|

53,932 |

|

|

|

52,084 |

|

|

|

49,041 |

|

|

|

44,187 |

|

|

|

41,290 |

|

| |

|

|

|

|

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

Interest on deposits: |

|

|

|

|

|

|

|

|

|

|

Interest-bearing checking |

|

66 |

|

|

|

61 |

|

|

|

43 |

|

|

|

42 |

|

|

|

44 |

|

|

Savings |

|

530 |

|

|

|

401 |

|

|

|

200 |

|

|

|

163 |

|

|

|

156 |

|

|

Money market deposit accounts |

|

814 |

|

|

|

389 |

|

|

|

237 |

|

|

|

210 |

|

|

|

214 |

|

|

Time deposits |

|

5,272 |

|

|

|

1,839 |

|

|

|

646 |

|

|

|

536 |

|

|

|

546 |

|

|

Interest on short-term borrowings |

|

285 |

|

|

|

208 |

|

|

|

122 |

|

|

|

176 |

|

|

|

234 |

|

|

Total interest expense |

|

6,967 |

|

|

|

2,898 |

|

|

|

1,248 |

|

|

|

1,127 |

|

|

|

1,194 |

|

| |

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

46,965 |

|

|

|

49,186 |

|

|

|

47,793 |

|

|

|

43,060 |

|

|

|

40,096 |

|

| |

|

|

|

|

|

|

|

|

|

|

Less: Provision (Credit) for credit losses |

|

300 |

|

|

|

50 |

|

|

|

300 |

|

|

|

(491 |

) |

|

|

(200 |

) |

|

Net interest income after provision for loan losses |

|

46,665 |

|

|

|

49,136 |

|

|

|

47,493 |

|

|

|

43,551 |

|

|

|

40,296 |

|

| |

|

|

|

|

|

|

|

|

|

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

Trustco Financial Services income |

|

1,774 |

|

|

|

1,773 |

|

|

|

1,435 |

|

|

|

1,996 |

|

|

|

1,833 |

|

|

Fees for services to customers |

|

2,648 |

|

|

|

2,783 |

|

|

|

2,705 |

|

|

|

2,658 |

|

|

|

2,801 |

|

|

Other |

|

247 |

|

|

|

219 |

|

|

|

246 |

|

|

|

262 |

|

|

|

549 |

|

|

Total noninterest income |

|

4,669 |

|

|

|

4,775 |

|

|

|

4,386 |

|

|

|

4,916 |

|

|

|

5,183 |

|

| |

|

|

|

|

|

|

|

|

|

| Noninterest expenses: |

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

13,283 |

|

|

|

13,067 |

|

|

|

12,134 |

|

|

|

11,464 |

|

|

|

9,239 |

|

|

Net occupancy expense |

|

4,598 |

|

|

|

4,261 |

|

|

|

4,483 |

|

|

|

4,254 |

|

|

|

4,529 |

|

|

Equipment expense |

|

1,962 |

|

|

|

1,700 |

|

|

|

1,532 |

|

|

|

1,667 |

|

|

|

1,588 |

|

|

Professional services |

|

1,607 |

|

|

|

1,251 |

|

|

|

1,375 |

|

|

|

1,484 |

|

|

|

1,467 |

|

|

Outsourced services |

|

2,296 |

|

|

|

2,102 |

|

|

|

2,328 |

|

|

|

2,500 |

|

|

|

2,280 |

|

|

Advertising expense |

|

390 |

|

|

|

532 |

|

|

|

508 |

|

|

|

389 |

|

|

|

617 |

|

|

FDIC and other insurance |

|

1,052 |

|

|

|

770 |

|

|

|

773 |

|

|

|

804 |

|

|

|

812 |

|

|

Other real estate expense, net |

|

225 |

|

|

|

101 |

|

|

|

124 |

|

|

|

74 |

|

|

|

11 |

|

|

Other |

|

2,266 |

|

|

|

2,621 |

|

|

|

2,887 |

|

|

|

2,369 |

|

|

|

2,222 |

|

|

Total noninterest expenses |

|

27,679 |

|

|

|

26,405 |

|

|

|

26,144 |

|

|

|

25,005 |

|

|

|

22,765 |

|

| |

|

|

|

|

|

|

|

|

|

| Income before taxes |

|

23,655 |

|

|

|

27,506 |

|

|

|

25,735 |

|

|

|

23,462 |

|

|

|

22,714 |

|

| Income taxes |

|

5,909 |

|

|

|

6,596 |

|

|

|

6,371 |

|

|

|

5,591 |

|

|

|

5,625 |

|

| |

|

|

|

|

|

|

|

|

|

| Net income |

$ |

17,746 |

|

|

$ |

20,910 |

|

|

$ |

19,364 |

|

|

$ |

17,871 |

|

|

$ |

17,089 |

|

| |

|

|

|

|

|

|

|

|

|

| Net income per common

share: |

|

|

|

|

|

|

|

|

|

|

- Basic |

$ |

0.93 |

|

|

$ |

1.10 |

|

|

$ |

1.01 |

|

|

$ |

0.93 |

|

|

$ |

0.89 |

|

| |

|

|

|

|

|

|

|

|

|

|

- Diluted |

|

0.93 |

|

|

|

1.10 |

|

|

|

1.01 |

|

|

|

0.93 |

|

|

|

0.89 |

|

| |

|

|

|

|

|

|

|

|

|

| Average basic shares (in

thousands) |

|

19,024 |

|

|

|

19,045 |

|

|

|

19,111 |

|

|

|

19,153 |

|

|

|

19,209 |

|

| Average diluted shares (in

thousands) |

|

19,028 |

|

|

|

19,050 |

|

|

|

19,112 |

|

|

|

19,153 |

|

|

|

19,210 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION |

| |

| (dollars

in thousands) |

|

(Unaudited) |

|

|

|

3/31/2023 |

|

|

|

12/31/2022 |

|

|

|

9/30/2022 |

|

|

|

6/30/2022 |

|

|

|

3/31/2022 |

|

| ASSETS: |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

$ |

47,595 |

|

|

$ |

43,429 |

|

|

$ |

46,236 |

|

|

$ |

46,611 |

|

|

$ |

47,526 |

|

| Federal funds sold and other

short term investments |

|

589,389 |

|

|

|

607,170 |

|

|

|

795,028 |

|

|

|

999,573 |

|

|

|

1,225,022 |

|

|

Total cash and cash equivalents |

|

636,984 |

|

|

|

650,599 |

|

|

|

841,264 |

|

|

|

1,046,184 |

|

|

|

1,272,548 |

|

| |

|

|

|

|

|

|

|

|

|

| Securities available for

sale: |

|

|

|

|

|

|

|

|

|

|

U. S. government sponsored enterprises |

|

119,132 |

|

|

|

118,187 |

|

|

|

102,779 |

|

|

|

101,100 |

|

|

|

62,059 |

|

|

States and political subdivisions |

|

34 |

|

|

|

34 |

|

|

|

41 |

|

|

|

41 |

|

|

|

41 |

|

|

Mortgage-backed securities and collateralized mortgage obligations

- residential |

|

255,556 |

|

|

|

260,316 |

|

|

|

261,242 |

|

|

|

287,450 |

|

|

|

244,045 |

|

|

Small Business Administration - guaranteed participation

securities |

|

19,821 |

|

|

|

20,977 |

|

|

|

22,498 |

|

|

|

25,428 |

|

|

|

28,086 |

|

|

Corporate bonds |

|

81,464 |

|

|

|

81,346 |

|

|

|

81,002 |

|

|

|

87,740 |

|

|

|

74,089 |

|

|

Other securities |

|

652 |

|

|

|

653 |

|

|

|

657 |

|

|

|

656 |

|

|

|

671 |

|

|

Total securities available for sale |

|

476,659 |

|

|

|

481,513 |

|

|

|

468,219 |

|

|

|

502,415 |

|

|

|

408,991 |

|

| |

|

|

|

|

|

|

|

|

|

| Held to maturity

securities: |

|

|

|

|

|

|

|

|

|

|

Mortgage-backed securities and collateralized mortgage

obligations-residential |

|

7,382 |

|

|

|

7,707 |

|

|

|

8,091 |

|

|

|

8,544 |

|

|

|

9,183 |

|

|

Total held to maturity securities |

|

7,382 |

|

|

|

7,707 |

|

|

|

8,091 |

|

|

|

8,544 |

|

|

|

9,183 |

|

| |

|

|

|

|

|

|

|

|

|

| Federal Reserve Bank and

Federal Home Loan Bank stock |

|

5,797 |

|

|

|

5,797 |

|

|

|

5,797 |

|

|

|

5,797 |

|

|

|

5,604 |

|

| |

|

|

|

|

|

|

|

|

|

| Loans: |

|

|

|

|

|

|

|

|

|

|

Commercial |

|

246,307 |

|

|

|

231,011 |

|

|

|

217,120 |

|

|

|

199,886 |

|

|

|

192,408 |

|

|

Residential mortgage loans |

|

4,241,459 |

|

|

|

4,203,451 |

|

|

|

4,132,365 |

|

|

|

4,076,657 |

|

|

|

4,026,434 |

|

|

Home equity line of credit |

|

296,490 |

|

|

|

286,432 |

|

|

|

269,341 |

|

|

|

253,758 |

|

|

|

236,117 |

|

|

Installment loans |

|

15,326 |

|

|

|

12,307 |

|

|

|

10,665 |

|

|

|

10,258 |

|

|

|

9,395 |

|

| Loans, net of deferred net

costs |

|

4,799,582 |

|

|

|

4,733,201 |

|

|

|

4,629,491 |

|

|

|

4,540,559 |

|

|

|

4,464,354 |

|

| |

|

|

|

|

|

|

|

|

|

| Less: Allowance for credit

losses on loans |

|

46,685 |

|

|

|

46,032 |

|

|

|

45,517 |

|

|

|

45,285 |

|

|

|

46,178 |

|

|

Net loans |

|

4,752,897 |

|

|

|

4,687,169 |

|

|

|

4,583,974 |

|

|

|

4,495,274 |

|

|

|

4,418,176 |

|

| |

|

|

|

|

|

|

|

|

|

| Bank premises and equipment,

net |

|

32,305 |

|

|

|

32,556 |

|

|

|

31,931 |

|

|

|

32,381 |

|

|

|

32,644 |

|

| Operating lease right-of-use

assets |

|

43,478 |

|

|

|

44,727 |

|

|

|

45,733 |

|

|

|

47,343 |

|

|

|

48,569 |

|

| Other assets |

|

90,306 |

|

|

|

89,984 |

|

|

|

94,485 |

|

|

|

88,853 |

|

|

|

86,158 |

|

| |

|

|

|

|

|

|

|

|

|

|

Total assets |

$ |

6,045,808 |

|

|

$ |

6,000,052 |

|

|

$ |

6,079,494 |

|

|

$ |

6,226,791 |

|

|

$ |

6,281,873 |

|

| |

|

|

|

|

|

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

Demand |

$ |

806,075 |

|

|

$ |

838,147 |

|

|

$ |

859,829 |

|

|

$ |

851,573 |

|

|

$ |

835,281 |

|

|

Interest-bearing checking |

|

1,124,785 |

|

|

|

1,183,321 |

|

|

|

1,188,790 |

|

|

|

1,208,159 |

|

|

|

1,225,093 |

|

|

Savings accounts |

|

1,400,887 |

|

|

|

1,521,473 |

|

|

|

1,562,564 |

|

|

|

1,577,034 |

|

|

|

1,553,152 |

|

|

Money market deposit accounts |

|

600,410 |

|

|

|

621,106 |

|

|

|

716,319 |

|

|

|

760,338 |

|

|

|

796,275 |

|

|

Time deposits |

|

1,280,301 |

|

|

|

1,028,763 |

|

|

|

954,352 |

|

|

|

999,737 |

|

|

|

940,215 |

|

|

Total deposits |

|

5,212,458 |

|

|

|

5,192,810 |

|

|

|

5,281,854 |

|

|

|

5,396,841 |

|

|

|

5,350,016 |

|

| |

|

|

|

|

|

|

|

|

|

| Short-term borrowings |

|

134,293 |

|

|

|

122,700 |

|

|

|

124,932 |

|

|

|

147,282 |

|

|

|

248,371 |

|

| Operating lease

liabilities |

|

47,643 |

|

|

|

48,980 |

|

|

|

50,077 |

|

|

|

51,777 |

|

|

|

53,094 |

|

| Accrued expenses and other

liabilities |

|

36,711 |

|

|

|

35,575 |

|

|

|

33,625 |

|

|

|

36,259 |

|

|

|

37,497 |

|

| |

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

5,431,105 |

|

|

|

5,400,065 |

|

|

|

5,490,488 |

|

|

|

5,632,159 |

|

|

|

5,688,978 |

|

| |

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS'

EQUITY: |

|

|

|

|

|

|

|

|

|

| Capital stock |

|

20,058 |

|

|

|

20,058 |

|

|

|

20,046 |

|

|

|

20,046 |

|

|

|

20,046 |

|

| Surplus |

|

257,078 |

|

|

|

257,078 |

|

|

|

256,661 |

|

|

|

256,661 |

|

|

|

256,661 |

|

| Undivided profits |

|

404,728 |

|

|

|

393,831 |

|

|

|

379,769 |

|

|

|

367,100 |

|

|

|

355,948 |

|

| Accumulated other

comprehensive loss, net of tax |

|

(23,375 |

) |

|

|

(27,194 |

) |

|

|

(25,209 |

) |

|

|

(9,422 |

) |

|

|

(2,369 |

) |

| Treasury stock at cost |

|

(43,786 |

) |

|

|

(43,786 |

) |

|

|

(42,261 |

) |

|

|

(39,753 |

) |

|

|

(37,391 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

614,703 |

|

|

|

599,987 |

|

|

|

589,006 |

|

|

|

594,632 |

|

|

|

592,895 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

6,045,808 |

|

|

$ |

6,000,052 |

|

|

$ |

6,079,494 |

|

|

$ |

6,226,791 |

|

|

$ |

6,281,873 |

|

| |

|

|

|

|

|

|

|

|

|

| Outstanding shares (in

thousands) |

|

19,024 |

|

|

|

19,024 |

|

|

|

19,052 |

|

|

|

19,127 |

|

|

|

19,202 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONPERFORMING ASSETS |

| |

|

|

|

|

|

| (dollars

in thousands) |

|

(Unaudited) |

|

|

|

3/31/2023 |

|

|

12/31/2022 |

|

|

9/30/2022 |

|

|

6/30/2022 |

|

|

3/31/2022 |

|

| Nonperforming

Assets |

|

|

|

|

|

| |

|

|

|

|

|

| New York and other

states* |

|

|

|

|

|

| Loans in nonaccrual

status: |

|

|

|

|

|

|

Commercial |

$ |

560 |

|

$ |

219 |

|

$ |

179 |

|

$ |

203 |

|

$ |

187 |

|

|

Real estate mortgage - 1 to 4 family |

|

15,722 |

|

|

14,949 |

|

|

16,295 |

|

|

16,259 |

|

|

17,065 |

|

|

Installment |

|

59 |

|

|

23 |

|

|

29 |

|

|

40 |

|

|

33 |

|

| Total non-accrual loans |

|

16,341 |

|

|

15,191 |

|

|

16,503 |

|

|

16,502 |

|

|

17,285 |

|

| Other nonperforming real

estate mortgages - 1 to 4 family |

|

8 |

|

|

10 |

|

|

12 |

|

|

14 |

|

|

16 |

|

| Total nonperforming loans |

|

16,349 |

|

|

15,201 |

|

|

16,515 |

|

|

16,516 |

|

|

17,301 |

|

| Other real estate owned |

|

1,869 |

|

|

2,061 |

|

|

682 |

|

|

644 |

|

|

269 |

|

| Total nonperforming

assets |

$ |

18,218 |

|

$ |

17,262 |

|

$ |

17,197 |

|

$ |

17,160 |

|

$ |

17,570 |

|

| |

|

|

|

|

|

| Florida |

|

|

|

|

|

| Loans in nonaccrual

status: |

|

|

|

|

|

|

Commercial |

$ |

314 |

|

$ |

314 |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

|

Real estate mortgage - 1 to 4 family |

|

2,437 |

|

|

1,895 |

|

|

2,104 |

|

|

2,192 |

|

|

2,109 |

|

|

Installment |

|

62 |

|

|

83 |

|

|

65 |

|

|

5 |

|

|

8 |

|

| Total non-accrual loans |

|

2,813 |

|

|

2,292 |

|

|

2,169 |

|

|

2,197 |

|

|

2,117 |

|

| Other nonperforming real

estate mortgages - 1 to 4 family |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Total nonperforming loans |

|

2,813 |

|

|

2,292 |

|

|

2,169 |

|

|

2,197 |

|

|

2,117 |

|

| Other real estate owned |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Total nonperforming

assets |

$ |

2,813 |

|

$ |

2,292 |

|

$ |

2,169 |

|

$ |

2,197 |

|

$ |

2,117 |

|

| |

|

|

|

|

|

| Total |

|

|

|

|

|

| Loans in nonaccrual

status: |

|

|

|

|

|

|

Commercial |

$ |

874 |

|

$ |

533 |

|

$ |

179 |

|

$ |

203 |

|

$ |

187 |

|

|

Real estate mortgage - 1 to 4 family |

|

18,159 |

|

|

16,844 |

|

|

18,399 |

|

|

18,451 |

|

|

19,174 |

|

|

Installment |

|

121 |

|

|

106 |

|

|

94 |

|

|

45 |

|

|

41 |

|

| Total non-accrual loans |

|

19,154 |

|

|

17,483 |

|

|

18,672 |

|

|

18,699 |

|

|

19,402 |

|

| Other nonperforming real

estate mortgages - 1 to 4 family |

|

8 |

|

|

10 |

|

|

12 |

|

|

14 |

|

|

16 |

|

| Total nonperforming loans |

|

19,162 |

|

|

17,493 |

|

|

18,684 |

|

|

18,713 |

|

|

19,418 |

|

| Other real estate owned |

|

1,869 |

|

|

2,061 |

|

|

682 |

|

|

644 |

|

|

269 |

|

| Total nonperforming

assets |

$ |

21,031 |

|

$ |

19,554 |

|

$ |

19,366 |

|

$ |

19,357 |

|

$ |

19,687 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Quarterly Net

(Recoveries) Chargeoffs |

|

|

|

|

|

|

|

|

|

|

|

|

|

New York and other states* |

|

|

|

|

|

|

Commercial |

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

36 |

|

|

Real estate mortgage - 1 to 4 family |

|

(53 |

) |

|

(46 |

) |

|

(164 |

) |

|

(119 |

) |

|

(97 |

) |

|

Installment |

|

(6 |

) |

|

31 |

|

|

34 |

|

|

12 |

|

|

3 |

|

|

Total net (recoveries) chargeoffs |

$ |

(59 |

) |

$ |

(15 |

) |

$ |

(130 |

) |

$ |

(107 |

) |

$ |

(58 |

) |

| |

|

|

|

|

|

|

Florida |

|

|

|

|

|

|

Commercial |

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

|

Real estate mortgage - 1 to 4 family |

|

(25 |

) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

Installment |

|

31 |

|

|

- |

|

|

(2 |

) |

|

- |

|

|

- |

|

|

Total net (recoveries) chargeoffs |

$ |

6 |

|

$ |

- |

|

$ |

(2 |

) |

$ |

- |

|

$ |

- |

|

| |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Commercial |

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

- |

|

$ |

36 |

|

|

Real estate mortgage - 1 to 4 family |

|

(78 |

) |

|

(46 |

) |

|

(164 |

) |

|

(119 |

) |

|

(97 |

) |

|

Installment |

|

25 |

|

|

31 |

|

|

32 |

|

|

12 |

|

|

3 |

|

|

Total net (recoveries) chargeoffs |

$ |

(53 |

) |

$ |

(15 |

) |

$ |

(132 |

) |

$ |

(107 |

) |

$ |

(58 |

) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Asset Quality

Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

| Total nonperforming loans

(1) |

$ |

19,162 |

|

$ |

17,493 |

|

$ |

18,684 |

|

$ |

18,713 |

|

$ |

19,418 |

|

| Total nonperforming assets

(1) |

|

21,031 |

|

|

19,554 |

|

|

19,366 |

|

|

19,357 |

|

|

19,687 |

|

| Total net (recoveries)

chargeoffs (2) |

|

(53 |

) |

|

(15 |

) |

|

(132 |

) |

|

(107 |

) |

|

(58 |

) |

| |

|

|

|

|

|

| Allowance for credit losses on

loans (1) |

|

46,685 |

|

|

46,032 |

|

|

45,517 |

|

|

45,285 |

|

|

46,178 |

|

| |

|

|

|

|

|

| Nonperforming loans to total

loans |

|

0.40 |

% |

|

0.37 |

% |

|

0.40 |

% |

|

0.41 |

% |

|

0.43 |

% |

| Nonperforming assets to total

assets |

|

0.35 |

% |

|

0.33 |

% |

|

0.32 |

% |

|

0.31 |

% |

|

0.31 |

% |

| Allowance for credit losses on

loans to total loans |

|

0.97 |

% |

|

0.97 |

% |

|

0.98 |

% |

|

1.00 |

% |

|

1.03 |

% |

| Coverage ratio (1) |

|

243.6 |

% |

|

263.1 |

% |

|

243.6 |

% |

|

242.0 |

% |

|

237.8 |

% |

| Annualized net (recoveries)

chargeoffs to average loans (2) |

|

0.00 |

% |

|

0.00 |

% |

|

-0.01 |

% |

|

-0.01 |

% |

|

-0.01 |

% |

| Allowance for credit losses on

loans to annualized net (recoveries) chargeoffs (2) |

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

N/A |

|

|

|

* Includes New York, New Jersey, Vermont and Massachusetts.(1)

At period-end(2) For the three-month period ended

|

DISTRIBUTION OF ASSETS, LIABILITIES AND SHAREHOLDERS'

EQUITY - |

| INTEREST

RATES AND INTEREST DIFFERENTIAL |

| |

| (dollars in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

Three months ended |

|

Three months ended |

| |

March 31, 2023 |

|

March 31, 2022 |

| |

|

Average |

|

|

|

Interest |

|

Average |

|

|

|

Average |

|

|

|

Interest |

|

Average |

|

| |

|

Balance |

|

|

|

|

|

Rate |

|

|

|

Balance |

|

|

|

|

|

Rate |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Securities available for

sale: |

|

|

|

|

|

|

|

|

|

|

|

|

U. S. government sponsored enterprises |

$ |

120,692 |

|

|

$ |

692 |

|

2.29 |

% |

|

$ |

61,755 |

|

|

$ |

86 |

|

0.55 |

% |

|

Mortgage backed securities and collateralized mortgage obligations

- residential |

|

287,046 |

|

|

|

1,585 |

|

2.20 |

|

|

|

261,124 |

|

|

|

1,087 |

|

1.67 |

|

|

State and political subdivisions |

|

34 |

|

|

|

- |

|

6.74 |

|

|

|

41 |

|

|

|

1 |

|

6.73 |

|

|

Corporate bonds |

|

85,578 |

|

|

|

521 |

|

2.43 |

|

|

|

52,977 |

|

|

|

233 |

|

1.76 |

|

|

Small Business Administration - guaranteed participation

securities |

|

22,129 |

|

|

|

117 |

|

2.12 |

|

|

|

29,871 |

|

|

|

154 |

|

2.06 |

|

|

Other |

|

686 |

|

|

|

2 |

|

1.17 |

|

|

|

686 |

|

|

|

2 |

|

1.17 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total securities available for sale |

|

516,165 |

|

|

|

2,917 |

|

2.26 |

|

|

|

406,454 |

|

|

|

1,563 |

|

1.54 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Federal funds sold and other

short-term Investments |

|

576,931 |

|

|

|

6,555 |

|

4.61 |

|

|

|

1,187,201 |

|

|

|

572 |

|

0.20 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Held to maturity

securities: |

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage backed securities and collateralized mortgage obligations

- residential |

|

7,542 |

|

|

|

78 |

|

4.14 |

|

|

|

9,541 |

|

|

|

90 |

|

3.79 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total held to maturity securities |

|

7,542 |

|

|

|

78 |

|

4.14 |

|

|

|

9,541 |

|

|

|

90 |

|

3.79 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Federal Home Loan Bank

stock |

|

5,797 |

|

|

|

110 |

|

7.59 |

|

|

|

5,604 |

|

|

|

62 |

|

4.43 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Commercial loans |

|

238,870 |

|

|

|

3,024 |

|

5.06 |

|

|

|

194,989 |

|

|

|

2,525 |

|

5.18 |

|

| Residential mortgage

loans |

|

4,212,878 |

|

|

|

36,913 |

|

3.50 |

|

|

|

4,007,886 |

|

|

|

34,197 |

|

3.42 |

|

| Home equity lines of

credit |

|

291,326 |

|

|

|

4,119 |

|

5.73 |

|

|

|

232,535 |

|

|

|

2,125 |

|

3.71 |

|

| Installment loans |

|

13,323 |

|

|

|

216 |

|

6.56 |

|

|

|

8,974 |

|

|

|

156 |

|

7.03 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Loans, net of unearned

income |

|

4,756,397 |

|

|

|

44,272 |

|

3.73 |

|

|

|

4,444,384 |

|

|

|

39,003 |

|

3.52 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total interest earning assets |

|

5,862,832 |

|

|

$ |

53,932 |

|

3.69 |

|

|

|

6,053,184 |

|

|

$ |

41,290 |

|

2.74 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses on

loans |

|

(46,290 |

) |

|

|

|

|

|

|

(46,759 |

) |

|

|

|

|

| Cash & non-interest

earning assets |

|

175,097 |

|

|

|

|

|

|

|

207,308 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

5,991,639 |

|

|

|

|

|

|

$ |

6,213,733 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and shareholders'

equity |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest bearing checking accounts |

$ |

1,133,383 |

|

|

$ |

66 |

|

0.02 |

% |

|

$ |

1,191,496 |

|

|

$ |

44 |

|

0.01 |

% |

|

Money market accounts |

|

600,855 |

|

|

|

814 |

|

0.55 |

|

|

|

791,689 |

|

|

|

214 |

|

0.11 |

|

|

Savings |

|

1,456,242 |

|

|

|

530 |

|

0.15 |

|

|

|

1,527,975 |

|

|

|

156 |

|

0.04 |

|

|

Time deposits |

|

1,160,969 |

|

|

|

5,272 |

|

1.84 |

|

|

|

964,158 |

|

|

|

546 |

|

0.23 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total interest bearing deposits |

|

4,351,449 |

|

|

|

6,682 |

|

0.62 |

|

|

|

4,475,318 |

|

|

|

960 |

|

0.09 |

|

| Short-term borrowings |

|

131,867 |

|

|

|

285 |

|

0.88 |

|

|

|

248,535 |

|

|

|

234 |

|

0.38 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Total interest bearing liabilities |

|

4,483,316 |

|

|

$ |

6,967 |

|

0.63 |

|

|

|

4,723,853 |

|

|

$ |

1,194 |

|

0.10 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Demand deposits |

|

816,565 |

|

|

|

|

|

|

|

808,695 |

|

|

|

|

|

| Other liabilities |

|

84,092 |

|

|

|

|

|

|

|

83,633 |

|

|

|

|

|

| Shareholders' equity |

|

607,666 |

|

|

|

|

|

|

|

597,552 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and

shareholders' equity |

$ |

5,991,639 |

|

|

|

|

|

|

$ |

6,213,733 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net interest income, GAAP and

tax equivalent |

|

|

$ |

46,965 |

|

|

|

|

|

|

$ |

40,096 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net interest spread, GAAP and

tax equivalent |

|

|

|

3.06 |

% |

|

|

|

|

2.63 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin (net

interest income to total interest earning assets) GAAP and tax

equivalent |

|

|

|

3.21 |

% |

|

|

|

|

2.66 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Tax equivalent adjustment |

|

|

|

- |

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income |

|

|

$ |

46,965 |

|

|

|

|

|

|

$ |

40,096 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

Reconciliation

Tangible equity as a percentage of tangible

assets at period end is a non-GAAP financial measure derived from

GAAP-based amounts. We calculate tangible equity and tangible

assets by excluding the balance of intangible assets from total

shareholders’ equity and total assets, respectively. We calculate

tangible equity as a percentage of tangible assets at period end by

dividing tangible equity by tangible assets at period end. We

believe that this is consistent with the treatment by bank

regulatory agencies, which exclude intangible assets from the

calculation of risk-based capital ratios. Additionally, we believe

that this measure is important to many investors in the marketplace

who are interested in relative changes from period to period in

equity and total assets, each exclusive of changes in intangible

assets.

The efficiency ratio is a non-GAAP measure of

expense control relative to revenue from net interest income and

non-interest fee income. We calculate the efficiency ratio by

dividing total noninterest expenses as determined under GAAP,

excluding other real estate expense, net, by net interest income

(fully taxable equivalent) and total noninterest income as

determined under GAAP, excluding non-routine items from this

calculation. We believe that this provides a reasonable measure of

primary banking expenses relative to primary banking revenue.

Additionally, we believe this measure is important to investors

looking for a measure of efficiency in our productivity measured by

the amount of revenue generated for each dollar spent.

We believe that these non-GAAP financial

measures provide information that is important to investors and

that is useful in understanding our financial results. Our

management internally assesses our performance based, in part, on

these measures. However, these non-GAAP financial measures are

supplemental and not a substitute for an analysis based on GAAP

measures. As other companies may use different calculations for

these measures, this presentation may not be comparable to other

similarly titled measures reported by other companies. A

reconciliation of the non-GAAP measures of tangible equity as a

percentage of tangible assets, and efficiency ratio to the most

directly comparable GAAP measures is set forth below.

| NON-GAAP FINANCIAL

MEASURES RECONCILIATION |

|

|

|

| |

|

|

|

| (dollars in thousands) |

|

|

|

| (Unaudited) |

|

|

|

|

|

|

3/31/2023 |

|

|

12/31/2022 |

|

|

3/31/2022 |

|

| Tangible Equity to

Tangible Assets |

|

|

|

| Total Assets (GAAP) |

$ |

6,045,808 |

|

$ |

6,000,052 |

|

$ |

6,281,873 |

|

| Less: Intangible assets |

|

553 |

|

|

553 |

|

|

553 |

|

|

Tangible assets (Non-GAAP) |

$ |

6,045,255 |

|

$ |

5,999,499 |

|

$ |

6,281,320 |

|

| |

|

|

|

| Equity (GAAP) |

$ |

614,703 |

|

$ |

599,987 |

|

$ |

592,895 |

|

| Less: Intangible assets |

|

553 |

|

|

553 |

|

|

553 |

|

|

Tangible equity (Non-GAAP) |

$ |

614,150 |

|

$ |

599,434 |

|

$ |

592,342 |

|

| Tangible Equity to Tangible

Assets (Non-GAAP) |

|

10.16 |

% |

|

9.99 |

% |

|

9.43 |

% |

| Equity to Assets (GAAP) |

|

10.17 |

% |

|

10.00 |

% |

|

9.44 |

% |

|

|

|

|

|

| |

Three months ended |

| Efficiency

Ratio |

|

3/31/2023 |

|

|

12/31/2022 |

|

|

3/31/2022 |

|

|

|

|

|

|

| Net interest income (fully

taxable equivalent) (Non-GAAP) |

$ |

46,965 |

|

$ |

49,187 |

|

$ |

40,096 |

|

| Non-interest income

(GAAP) |

|

4,669 |

|

|

4,775 |

|

|

5,183 |

|

| Less: Net gain on sale of

building |

|

- |

|

|

- |

|

|

268 |

|

|

Revenue used for efficiency ratio (Non-GAAP) |

$ |

51,634 |

|

$ |

53,962 |

|

$ |

45,011 |

|

|

|

|

|

|

| Total noninterest expense

(GAAP) |

$ |

27,679 |

|

$ |

26,405 |

|

$ |

22,765 |

|

| Less: Other real estate

(income) expense, net |

|

225 |

|

|

101 |

|

|

11 |

|

|

Expense used for efficiency ratio (Non-GAAP) |

$ |

27,454 |

|

$ |

26,304 |

|

$ |

22,754 |

|

|

|

|

|

|

| Efficiency Ratio |

|

53.17 |

% |

|

48.75 |

% |

|

50.55 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Subsidiary: Trustco Bank |

|

|

|

|

|

Contact: |

|

Robert LeonardExecutive Vice President(518) 381-3693 |

|

|

|

|

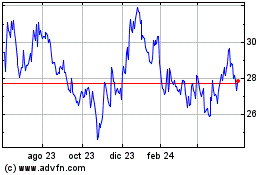

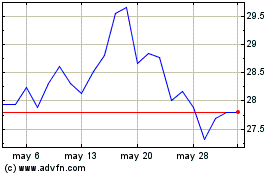

TrustCo Bank Corporation... (NASDAQ:TRST)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

TrustCo Bank Corporation... (NASDAQ:TRST)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024