Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

11 Octubre 2023 - 4:03PM

Edgar (US Regulatory)

Filed

Pursuant to Rule 433 Under the Securities Act of 1933, as amended

Issuer

Free Writing Prospectus dated October 10, 2023

Relating

to Prospectus Supplement dated October 10, 2023

to

Prospectus dated July 20, 2023

Registration

Statement No. 333-272534

Uranium

Royalty Corp.

Treasury

Offering of Common Shares

October

10, 2023 |

A

final base shelf prospectus and related Canadian preliminary prospectus supplement containing important information relating to securities

described in this document has been filed with the securities regulatory authorities in each of the provinces and territories of

Canada. A copy of the final base shelf prospectus, any amendment to the final base shelf prospectus and any applicable Canadian shelf

prospectus supplement that has been filed, is required to be delivered with this document.

The

issuer has filed a registration statement on Form F-10 (File No. 333-272534) (including a final base shelf prospectus) and a preliminary

prospectus supplement with the United States Securities and Exchange Commission (the “SEC”) for the offering to which

this document relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus

supplement and the other documents that the issuer has filed with the SEC for more complete information about the issuer and this

offering. You may obtain these documents free of charge by visiting the SEC’s website at http://www.sec.gov. Alternatively,

the issuer, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus (as supplemented

by the prospectus supplement) if you request it by contacting BMO Capital Markets Corp., by telephone at (800) 414-3627 or by email

at bmoprospectus@bmo.com.

Copies

of the final base shelf prospectus, registration statement on Form F-10, and the applicable prospectus supplements may be obtained

upon request in Canada by contacting BMO Nesbitt Burns Inc. (“BMO Capital Markets”), Brampton Distribution Centre C/O

The Data Group of Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2 by telephone at 905-791-3151 Ext 4312 or by email at torbramwarehouse@datagroup.ca,

and in the United States by contacting BMO Capital Markets Corp., Attn: Equity Syndicate Department, 151 W 42nd Street,

32nd Floor, New York, NY 10036, or by telephone at (800) 414-3627 or by email at bmoprospectus@bmo.com. You may also get

these documents for free by visiting SEDAR+ at www.sedarplus.caor EDGAR on the SEC website at www.sec.gov.

|

| Terms

and Conditions |

| |

| Issuer: |

Uranium

Royalty Corp. (the “Company”) |

| |

|

| Offering: |

Treasury

offering of 10,205,000 common shares (“Common Shares”) |

| |

|

| Offering

Price: |

U.S.$2.94

per Common Share |

| |

|

| Issue

Amount: |

U.S.$30,002,700

|

| |

|

Over-Allotment

Option: |

The

Company has granted the Underwriters an option, exercisable, in whole or in part, at any time until and including 30 days following

the closing of the Offering, to purchase up to an additional 15% of the Offering at the Offering Price to cover over-allotments,

if any. |

| |

|

| Use

of Proceeds: |

The

net proceeds of the offering will be used primarily to fund future purchases of physical uranium, implement its growth strategy through

future acquisitions of royalties, streams, physical uranium and similar interests, and for other general working capital purposes.

|

| |

|

| Form

of Offering: |

Bought

deal by way of prospectus supplement to be filed in all provinces and territories of Canada, other than Quebec. Registered public

offering in the United States under the multijurisdictional disclosure system. In jurisdictions outside of Canada and the United

States, as approved by the Company, acting reasonably, in accordance with all applicable laws provided that the registration of the

Common Shares in such jurisdiction will not be required, no prospectus, registration statement or similar document is required to

be filed in such jurisdiction and the Company will not be subject to any continuous disclosure requirements in such jurisdiction. |

| |

|

| Listing: |

An

application will be made to list the Common Shares on the TSX Stock Exchange (the “TSX”) and Nasdaq Capital Market (“Nasdaq”).

The existing common shares are listed on the TSX under the symbol “URC” and on Nasdaq under the symbol “UROY”. |

| |

|

| Eligibility: |

Eligible

for RRSPs, RRIFs, RESPs, TFSAs, RDSPs and DPSPs. |

| |

|

| Sole

Bookrunner: |

BMO

Capital Markets |

| |

|

Commission:

|

5.5% |

| |

|

| Closing:

|

On

or about October 17, 2023 |

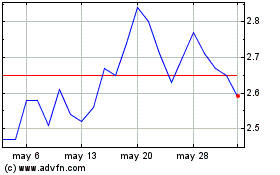

Uranium Royalty (NASDAQ:UROY)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Uranium Royalty (NASDAQ:UROY)

Gráfica de Acción Histórica

De May 2023 a May 2024