Vaxxinity, Inc. (Nasdaq: VAXX), a U.S. company pioneering the

development of a new class of medicines, today reported financial

results for the second quarter ended June 30, 2023, and provided a

corporate update.

“Vaxxinity has broken new ground in the first half of 2023. Now

in three independent programs, UB-311, UB-312, and UB-313, we have

demonstrated proof of technology and our ability to safely induce

antibodies in subjects through active immunization. Importantly, we

also demonstrated target engagement of toxic forms of

alpha-synuclein, a pathology underlying Parkinson’s disease, with

UB-312. This is our first clear proof of mechanism of action in

patients, showing that UB-312-induced antibodies clearly bind to

the target and slow alpha-synuclein aggregation. We expect this to

have positive read-through to our Alzheimer’s and other chronic

disease programs. In other words, the platform is doing what we

designed it to do,” said Mei Mei Hu, CEO of Vaxxinity.

“Our Phase 1 trial of VXX-401, our anti-PCSK9 candidate for high

cholesterol, is now fully enrolled, with a read-out expected by

early 2024. Imagine expanding the addressable patient population

for PCSK9 immunotherapies by multiple orders of magnitude,

potentially over 1,000x, and delivering life-saving medicine to the

world at a fraction of the cost. That is our vision for VXX-401 and

the potential power of active immunotherapies,” added Mei Mei.

“Additionally, we are eager to welcome Peter Powchik to our

leadership team in October as EVP, Global Scientific Director.

Peter brings decades of experience overseeing the development and

licensure of seven biologic drugs throughout his prior position at

Regeneron, including an anti-PCSK9 antibody, and is excited to be

part of what we’re calling ‘the next biologic revolution.’”

Second Quarter 2023 and Recent Updates

UB-312 in Parkinson’s disease (PD) and other

synucleinopathies

- UB-312 targets toxic forms of

aggregated alpha-synuclein (aSyn) in the brain.

- Met primary endpoints of the Phase 1

trial, with Part B showing UB-312 was immunogenic and generally

well-tolerated in patients with early PD.

- Demonstrated target engagement of

aggregated aSyn in cerebrospinal fluid (CSF) of patients with PD,

and slowing of aSyn seeding and aggregation in CSF of patients with

PD in multiple target engagement assays conducted with support from

with The Michael J. Fox Foundation (MJFF).

- These data show proof of mechanism

of action in patients and validate Vaxxinity platform’s ability to

selectively target aggregated, toxic forms of neurodegenerative

proteins.

UB-313 in migraine

- UB-313 targets calcitonin

gene-related peptide (CGRP) to prevent migraines.

- Interim results from ongoing Phase 1

trial show UB-313 was generally well-tolerated and immunogenic in

healthy volunteers.

- All subjects who received three

doses of UB-313 (31 out of 31) developed anti-CGRP antibodies.

- Serum antibody titers were lower

than expected, however, and due to this lower immunogenicity,

UB-313 will not meet secondary objective of capsaicin-induced

dermal blood flow inhibition; for instance, titers induced by

UB-313 were on average over 100 times lower than those observed in

UB-312 in healthy volunteers.

- We believe this was the result of a

suboptimal drug product made by a new contract manufacturer, and we

have identified the necessary steps to manufacture a more

immunogenic product consistent with prior lots and the known

immunogenic potential of our platform candidates.

- In April 2023, JC Dodart, Senior

Vice President of Research, delivered an Emerging Science

Presentation on UB-313 preclinical data at the American Academy of

Neurology Annual Meeting in Boston titled “UB-313, an

Investigational CGRP Vaccine for the Prevention of Migraine.”

VXX-401 in hypercholesterolemia

- VXX-401 targets proprotein

convertase subtilisin/kexin type 9 (PCSK9) to reduce low-density

lipoprotein (LDL) cholesterol.

- The ongoing Phase 1 trial of VXX-401

is fully enrolled.

- The company is on track to report

topline Phase 1 data in early 2024.

UB-612 COVID-19 booster

- UB-612 employs a peptide-protein

subunit approach to neutralizing the ancestral SARS-CoV-2 virus and

its variants.

- Regulatory authorities in the UK and

Australia are reviewing Vaxxinity’s application for

conditional/provisional marketing authorization of UB-612 under

their established work share agreement. If successful, this

submission lays the groundwork for regulatory filings and the

commercialization of UB-612 in other countries, including low- and

middle-income countries.

- In April 2023, Vaxxinity delivered

two presentations about UB-612 to the World Vaccine Congress in

Washington, D.C.:

- “Vaccine Supply and Access: Lessons

Learned and the Way Forward (a Fireside Chat with Sarah Despres)”

featuring Vaxxinity CEO Mei Mei Hu

- “Success in Boosting the Immunity by

Vaxxinity’s UB-612 Compared to the mRNA, Adenovirus and Inactivated

COVID-19 Vaccine Platforms” featuring Alexander Rumyantsev, M.D.,

Ph.D., Therapeutic Area Head for Infectious Diseases at

Vaxxinity

Second Quarter 2023 Financial Results

As of June 30, 2023, Vaxxinity had $56.1

million of highly liquid assets, including $37.1 million of cash

and cash equivalents, $18.8 million of short-term investments, and

$0.2 million of restricted cash, compared to $87.9 million as of

December 31, 2022.

Comparison of three months ended June 30, 2023

to three months ended June 30, 2022

Research and development expenses were $8.3

million and $10.7 million for the three months ended June 30,

2023 and 2022, respectively.

The $2.4 million decrease in research and

development expenses was primarily due to decreases in costs

related to our UB-612 COVID-19 vaccine program, UB-312 PD program

and VXX-301 anti-tau program totaling $1.7 million and decreases in

personnel and consulting costs totaling $1.1 million, partially

offset by increases in our VXX-401 hypercholesterolemia program

totaling $0.3 million.

General and administrative expenses were $6.1

million and $6.6 million for the three months ended June 30, 2023

and 2022, respectively.

The $0.5 million decrease was primarily due to a

decrease in director and officer insurance expense of $0.6 million

and decreases in personnel costs and travel expenses, partially

offset by an increase in stock-based compensation of $0.6

million.

Net loss for the three months ended June 30, 2023 was $14.0

million or $0.11 per share compared to $17.3 million or $0.14 per

share for the three months ended June 30, 2022.

About VaxxinityVaxxinity, Inc. is a

purpose-driven biotechnology company committed to democratizing

healthcare across the globe. The company is pioneering a new class

of synthetic, peptide-based immunotherapeutic vaccines aimed at

disrupting the existing treatment paradigm for chronic disease,

increasingly dominated by monoclonal antibodies, which suffer from

prohibitive costs and cumbersome administration. The company’s

proprietary technology platform has enabled the innovation of novel

pipeline candidates designed to bring the efficiency of vaccines to

the treatment of chronic diseases, including Alzheimer’s,

Parkinson’s, migraine, and hypercholesterolemia. The technology is

also implemented as part of a COVID-19 vaccine program. Vaxxinity

has optimized its pipeline to achieve a potentially historic,

global impact on human health.

For more information about Vaxxinity, Inc., visit

http://www.vaxxinity.com and follow us on social media

@vaxxinity.

Forward-looking StatementsThis press release

includes forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. The use of

certain words, including "believe," "may," "continue," "advancing,"

"will" and similar expressions, are intended to identify

forward-looking statements. Forward-looking statements include

statements, other than statements of historical fact, regarding,

among other things: the plans for, or progress, scope, initiation,

duration, enrollment, results or timing for availability of results

of, development of any of Vaxxinity’s product candidates or

programs, including timing of the data readouts of UB-313 and

VXX-401, and completion of the Phase 3 trial of UB-612; the target

indication(s) for development or approval, the size, design,

population, location, conduct, cost, objective, enrollment,

duration or endpoints of any clinical trial, or the timing for

initiation or completion of or availability or reporting of results

from any clinical trial; the potential future regulatory

authorization or approval and commercialization of Vaxxinity’s

product candidates; the potential benefits or competitive position

of any Vaxxinity product candidate or program or the commercial

opportunity in any target indication; and Vaxxinity’s plans,

expectations or future operations, financial position, revenues,

costs or expenses. These forward-looking statements involve

substantial risks and uncertainties, including statements that are

based on the current expectations and assumptions of Vaxxinity’s

management about the development of a new class of

immunotherapeutic vaccines and the innovation and efficacy of

Vaxxinity’s product candidates. Various important factors could

cause actual results or events to differ materially from those that

may be expressed or implied by our forward-looking statements,

including, but not limited to: whether UB-311, UB-312, UB-313,

VXX-401, UB-612 or any other current or future product candidate of

Vaxxinity will be approved or authorized by any regulatory agency

for the indications that Vaxxinity targets; any potential negative

impacts of the COVID-19 pandemic, including on manufacturing,

supply, conduct or initiation of clinical trials, or other aspects

of Vaxxinity’s business; Vaxxinity’s product candidates may not be

successful or clinical development may take longer and be more

costly than anticipated; product candidates that appeared promising

in earlier research and clinical trials may not demonstrate safety

or efficacy in larger-scale or later clinical trials or in clinical

trials for other indications; the timing for initiation or

completion of, or for availability of data from, clinical trials

for UB-311, UB-312, UB-313, VXX-401 or UB-612, and the outcomes of

such trials; Vaxxinity’s reliance on collaborative partners and

other third parties for development of its product candidates;

Vaxxinity’s ability to obtain coverage, pricing or reimbursement

for any approved products and acceptance from patients and

physicians for any approved indications; delays or other challenges

in the recruitment of patients for, or the conduct of, Vaxxinity’s

clinical trials; challenges associated with supply and

manufacturing activities; and Vaxxinity’s accounting policies.

These and other important factors to be considered in connection

with forward-looking statements are described in the "Risk Factors"

section of Vaxxinity’s Annual Report on Form 10-K filed with the

U.S. Securities and Exchange Commission on March 27, 2023. The

forward-looking statements are made as of this date and Vaxxinity

does not undertake any obligation to update any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

|

|

|

VAXXINITY, INC. |

|

Statement of Operations |

|

(In thousands, except number of shares and per share

amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

8,345 |

|

|

|

10,664 |

|

|

|

19,769 |

|

|

|

22,142 |

|

|

General and administrative |

|

6,082 |

|

|

|

6,560 |

|

|

|

13,422 |

|

|

|

13,246 |

|

|

Total operating expenses |

|

14,427 |

|

|

|

17,224 |

|

|

|

33,191 |

|

|

|

35,388 |

|

|

Loss from operations |

|

(14,427 |

) |

|

|

(17,224 |

) |

|

|

(33,191 |

) |

|

|

(35,388 |

) |

|

Other (income) expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other expense |

|

146 |

|

|

|

105 |

|

|

|

338 |

|

|

|

210 |

|

|

Interest and other income |

|

(578 |

) |

|

|

(75 |

) |

|

|

(1,145 |

) |

|

|

(80 |

) |

|

(Gain) loss on foreign currecny transactions, net |

|

(18 |

) |

|

|

(2 |

) |

|

|

14 |

|

|

|

(3 |

) |

|

Total other (income) expense, net |

|

(449 |

) |

|

|

28 |

|

|

|

(793 |

) |

|

|

127 |

|

|

Net loss |

$ |

(13,977 |

) |

|

$ |

(17,252 |

) |

|

$ |

(32,398 |

) |

|

$ |

(35,515 |

) |

|

Net loss per share, basic and diluted |

$ |

(0.11 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.28 |

) |

|

Weighted average common shares outstanding, basic and diluted |

|

126,481,497 |

|

|

|

125,948,595 |

|

|

|

126,272,546 |

|

|

|

125,829,764 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VAXXINITY, INC. |

|

Selected Balance Sheet Data |

|

(in Thousands) |

|

|

|

|

|

|

|

|

|

| |

June 30 |

|

December 31, |

| |

|

2023 |

|

|

|

2022 |

|

|

Cash and cash equivalents |

$ |

37,058 |

|

|

$ |

33,475 |

|

|

Short term investments |

|

18,790 |

|

|

|

53,352 |

|

|

Restricted cash |

|

205 |

|

|

|

1,095 |

|

|

Total assets |

|

71,367 |

|

|

|

106,399 |

|

|

Total liabilities |

|

36,355 |

|

|

|

44,222 |

|

|

Total stockholder's equity (deficit) |

|

35,012 |

|

|

|

62,177 |

|

|

|

|

|

|

|

|

|

|

Investor ContactMark

Joinnidesir@vaxxinity.com

Press ContactJon Yumedia@vaxxinity.com

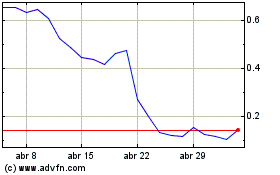

Vaxxinity (NASDAQ:VAXX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Vaxxinity (NASDAQ:VAXX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024