Westamerica Bancorporation Reports Third Quarter 2022 Financial Results

20 Octubre 2022 - 10:00AM

Westamerica Bancorporation (Nasdaq: WABC), parent company of

Westamerica Bank, generated net income for the third quarter 2022

of $34.8 million and diluted earnings per common share ("EPS") of

$1.29, including a life insurance gain equivalent to EPS of $0.03.

Third quarter 2022 net income was 37 percent higher than second

quarter 2022 net income of $25.3 million and EPS of $0.94.

"Westamerica’s third quarter 2022 results benefited from the

Company’s variable-rate bonds, cash and loans, as well as our

valuable deposit base. With 47 percent of average deposits

represented by non-interest bearing checking accounts and limited

reliance on time deposits, the cost of funding our loan and bond

portfolios was 0.03 percent in the third quarter 2022, unchanged

from the prior quarter. Operating expenses were well controlled and

credit quality remained solid,” said Chairman, President and CEO

David Payne. “Third quarter 2022 results generated an annualized

17.1 percent return on average common equity. Shareholders were

paid a $0.42 per common share dividend during the third quarter

2022,” concluded Payne.

Net interest income on a fully-taxable equivalent (FTE) basis

was $60.8 million for the third quarter 2022, compared to $48.0

million for the second quarter 2022. The yield earned on loans and

bonds for the third quarter 2022 was 3.47 percent, up from 2.77

percent for the second quarter 2022. The cost of funding the loan

and bond portfolios was 0.03 percent for both the third quarter and

second quarter of 2022. Variable rate assets at September 30, 2022

included $1.6 billion in collateralized loan obligations for which

interest rates reset quarterly, and $304.1 million in

interest-bearing cash balances for which the interest rate changes

concurrently with Federal Open Market Committee adjustments to the

federal funds rate.

Noninterest income for the third quarter 2022 totaled $11.8

million, including a $923 thousand life insurance gain. Noninterest

income for the second quarter 2022 was $11.3 million.

Noninterest expenses for the third quarter 2022 were $24.8

million compared to $24.6 million for the second quarter 2022.

Westamerica Bancorporation’s wholly owned subsidiary Westamerica

Bank, operates commercial banking and trust offices throughout

Northern and Central California.

Westamerica Bancorporation Web Address:

www.westamerica.com

| For additional information contact: |

|

Westamerica Bancorporation1108 Fifth Avenue, San Rafael, CA

94901Robert A. Thorson – SVP &

Treasurer707-863-6840investments@westamerica.com |

FORWARD-LOOKING INFORMATION:

The following appears in accordance with the Private Securities

Litigation Reform Act of 1995:

This press release may contain forward-looking statements about

the Company, including descriptions of plans or objectives of its

management for future operations, products or services, and

forecasts of its revenues, earnings or other measures of economic

performance. Forward-looking statements can be identified by the

fact that they do not relate strictly to historical or current

facts. They often include the words "believe," "expect,"

"anticipate," "intend," "plan," "estimate," or words of similar

meaning, or future or conditional verbs such as "will," "would,"

"should," "could," or "may."

Forward-looking statements, by their nature, are subject to

risks and uncertainties. A number of factors — many of which are

beyond the Company's control — could cause actual conditions,

events or results to differ significantly from those described in

the forward-looking statements. The Company's most recent reports

filed with the Securities and Exchange Commission, including the

annual report for the year ended December 31, 2021 filed on Form

10-K and quarterly report for the quarter ended June 30, 2022 filed

on Form 10-Q, describe some of these factors, including certain

credit, interest rate, operational, liquidity and market risks

associated with the Company's business and operations. Other

factors described in these reports include changes in business and

economic conditions, competition, fiscal and monetary policies,

disintermediation, cyber security risks, legislation including the

Dodd-Frank Wall Street Reform and Consumer Protection Act of 2011,

the Sarbanes-Oxley Act of 2002 and the Gramm-Leach-Bliley Act of

1999, and mergers and acquisitions.

Forward-looking statements speak only as of the date they are

made. The Company does not undertake to update forward-looking

statements to reflect circumstances or events that occur after the

date forward looking statements are made.

WESTAMERICA BANCORPORATIONFINANCIAL HIGHLIGHTSSeptember

30, 2022

| 1. Net

Income Summary. |

|

|

|

|

| |

|

(in thousands except per-share amounts) |

| |

|

|

|

% |

|

| |

|

Q3'2022 |

Q3'2021 |

Change |

Q2'2022 |

| |

|

|

|

|

|

|

|

Net Interest and Fee Income (FTE) |

$ |

60,780 |

|

$ |

43,952 |

|

38.3 |

% |

$ |

48,033 |

|

| |

Provision for Credit

Losses |

|

- |

|

|

- |

|

n/m |

|

|

- |

|

| |

Noninterest

Income |

|

11,818 |

|

|

11,282 |

|

4.8 |

% |

|

11,264 |

|

| |

Noninterest

Expense |

|

24,767 |

|

|

24,697 |

|

0.3 |

% |

|

24,629 |

|

| |

Income Before Taxes

(FTE) |

|

47,831 |

|

|

30,537 |

|

56.6 |

% |

|

34,668 |

|

| |

Income Tax Provision

(FTE) |

|

13,071 |

|

|

8,474 |

|

54.2 |

% |

|

9,354 |

|

| |

Net

Income |

$ |

34,760 |

|

$ |

22,063 |

|

57.5 |

% |

$ |

25,314 |

|

| |

|

|

|

|

|

| |

Average Common Shares

Outstanding |

|

26,906 |

|

|

26,866 |

|

0.1 |

% |

|

26,889 |

|

| |

Diluted Average Common

Shares |

|

26,916 |

|

|

26,875 |

|

0.2 |

% |

|

26,901 |

|

| |

|

|

|

|

|

| |

Operating

Ratios: |

|

|

|

|

| |

Basic Earnings Per Common Share |

$ |

1.29 |

|

$ |

0.82 |

|

57.3 |

% |

$ |

0.94 |

|

| |

Diluted Earnings Per Common Share |

|

1.29 |

|

|

0.82 |

|

57.3 |

% |

|

0.94 |

|

| |

Return On Assets (a) |

|

1.85 |

% |

|

1.22 |

% |

|

|

1.37 |

% |

| |

Return On Common Equity (a) |

|

17.1 |

% |

|

11.6 |

% |

|

|

12.9 |

% |

| |

Net Interest Margin (FTE) (a) |

|

3.44 |

% |

|

2.60 |

% |

|

|

2.74 |

% |

| |

Efficiency Ratio (FTE) |

|

34.1 |

% |

|

44.7 |

% |

|

|

41.5 |

% |

| |

|

|

|

|

|

| |

Dividends Paid Per

Common Share |

$ |

0.42 |

|

$ |

0.41 |

|

2.4 |

% |

$ |

0.42 |

|

| |

Common Dividend Payout

Ratio |

|

33 |

% |

|

50 |

% |

|

|

45 |

% |

| |

|

|

|

|

|

| |

|

|

|

% |

|

| |

|

9/30'22YTD |

9/30'21YTD |

Change |

|

| |

|

|

|

|

|

| |

Net Interest and Fee

Income (FTE) |

$ |

152,620 |

|

$ |

131,034 |

|

16.5 |

% |

|

| |

Provision for Credit

Losses |

|

- |

|

|

- |

|

n/m |

|

|

| |

Noninterest Income

(1) |

|

34,658 |

|

|

32,503 |

|

6.6 |

% |

|

| |

Noninterest

Expense |

|

74,271 |

|

|

73,894 |

|

0.5 |

% |

|

| |

Income Before Taxes

(FTE) |

|

113,007 |

|

|

89,643 |

|

26.1 |

% |

|

| |

Income Tax Provision

(FTE) |

|

30,317 |

|

|

24,854 |

|

22.0 |

% |

|

| |

Net

Income |

$ |

82,690 |

|

$ |

64,789 |

|

27.6 |

% |

|

| |

|

|

|

|

|

| |

Average Common Shares

Outstanding |

|

26,889 |

|

|

26,851 |

|

0.1 |

% |

|

| |

Diluted Average Common

Shares |

|

26,901 |

|

|

26,868 |

|

0.1 |

% |

|

| |

|

|

|

|

|

| |

Operating

Ratios: |

|

|

|

|

| |

Basic Earnings Per Common Share |

$ |

3.08 |

|

$ |

2.41 |

|

27.8 |

% |

|

| |

Diluted Earnings Per Common Share |

|

3.07 |

|

|

2.41 |

|

27.4 |

% |

|

| |

Return On Assets (a) |

|

1.49 |

% |

|

1.25 |

% |

|

|

| |

Return On Common Equity (a) |

|

14.0 |

% |

|

11.6 |

% |

|

|

| |

Net Interest Margin (FTE) (a) |

|

2.90 |

% |

|

2.67 |

% |

|

|

| |

Efficiency Ratio (FTE) |

|

39.7 |

% |

|

45.2 |

% |

|

|

| |

|

|

|

|

|

| |

Dividends Paid Per

Common Share |

$ |

1.26 |

|

$ |

1.23 |

|

2.4 |

% |

|

| |

Common Dividend Payout

Ratio |

|

41 |

% |

|

51 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

| 2. Net

Interest Income. |

|

|

|

|

| |

|

(dollars in thousands) |

| |

|

|

|

% |

|

| |

|

Q3'2022 |

Q3'2021 |

Change |

Q2'2022 |

| |

|

|

|

|

|

|

|

Interest and Fee Income (FTE) |

$ |

61,267 |

|

$ |

44,444 |

|

37.9 |

% |

$ |

48,516 |

|

| |

Interest

Expense |

|

487 |

|

|

492 |

|

-1.0 |

% |

|

483 |

|

| |

Net Interest and Fee

Income (FTE) |

$ |

60,780 |

|

$ |

43,952 |

|

38.3 |

% |

$ |

48,033 |

|

| |

|

|

|

|

|

| |

Average Earning

Assets |

$ |

7,041,313 |

|

$ |

6,754,281 |

|

4.2 |

% |

$ |

7,000,862 |

|

| |

Average

Interest-Bearing Liabilities |

|

3,520,083 |

|

|

3,370,840 |

|

4.4 |

% |

|

3,549,140 |

|

| |

|

|

|

|

|

| |

Yield on Earning

Assets (FTE) (a) |

|

3.47 |

% |

|

2.63 |

% |

|

|

2.77 |

% |

| |

Cost of Funds

(a) |

|

0.03 |

% |

|

0.03 |

% |

|

|

0.03 |

% |

| |

Net Interest Margin

(FTE) (a) |

|

3.44 |

% |

|

2.60 |

% |

|

|

2.74 |

% |

| |

Interest

Expense/Interest-Bearing Liabilities (a) |

|

0.05 |

% |

|

0.06 |

% |

|

|

0.05 |

% |

| |

Net Interest Spread

(FTE) (a) |

|

3.42 |

% |

|

2.57 |

% |

|

|

2.72 |

% |

| |

|

|

|

|

|

| |

|

|

|

% |

|

| |

|

9/30'22YTD |

9/30'21YTD |

Change |

|

| |

|

|

|

|

|

| |

Interest and Fee

Income (FTE) |

$ |

154,070 |

|

$ |

132,485 |

|

16.3 |

% |

|

| |

Interest

Expense |

|

1,450 |

|

|

1,451 |

|

-0.1 |

% |

|

| |

Net Interest and Fee

Income (FTE) |

$ |

152,620 |

|

$ |

131,034 |

|

16.5 |

% |

|

| |

|

|

|

|

|

| |

Average Earning

Assets |

$ |

7,013,627 |

|

$ |

6,535,949 |

|

7.3 |

% |

|

| |

Average

Interest-Bearing Liabilities |

|

3,538,361 |

|

|

3,267,311 |

|

8.3 |

% |

|

| |

|

|

|

|

|

| |

Yield on Earning

Assets (FTE) (a) |

|

2.93 |

% |

|

2.70 |

% |

|

|

| |

Cost of Funds

(a) |

|

0.03 |

% |

|

0.03 |

% |

|

|

| |

Net Interest Margin

(FTE) (a) |

|

2.90 |

% |

|

2.67 |

% |

|

|

| |

Interest

Expense/Interest-Bearing Liabilities (a) |

|

0.05 |

% |

|

0.06 |

% |

|

|

| |

Net Interest Spread

(FTE) (a) |

|

2.88 |

% |

|

2.64 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

| 3. Loans

& Other Earning Assets. |

|

|

|

|

| |

|

(average volume, dollars in thousands) |

| |

|

|

|

% |

|

| |

|

Q3'2022 |

Q3'2021 |

Change |

Q2'2022 |

| |

|

|

|

|

|

|

|

Total Assets |

$ |

7,472,304 |

|

$ |

7,158,462 |

|

4.4 |

% |

$ |

7,420,069 |

|

| |

Total Earning

Assets |

|

7,041,313 |

|

|

6,754,281 |

|

4.2 |

% |

|

7,000,862 |

|

| |

Total

Loans |

|

989,033 |

|

|

1,176,114 |

|

-15.9 |

% |

|

1,009,633 |

|

| |

Total Commercial Loans |

|

190,325 |

|

|

333,327 |

|

-42.9 |

% |

|

202,585 |

|

| |

Paycheck Protection Program (PPP) Loans |

|

10,453 |

|

|

144,641 |

|

-92.8 |

% |

|

20,997 |

|

| |

Commercial Loans |

|

179,872 |

|

|

188,686 |

|

-4.7 |

% |

|

181,588 |

|

| |

Commercial RE Loans |

|

494,717 |

|

|

543,429 |

|

-9.0 |

% |

|

508,003 |

|

| |

Consumer Loans |

|

303,991 |

|

|

299,358 |

|

1.5 |

% |

|

299,045 |

|

| |

Total Investment

Securities |

|

5,552,588 |

|

|

4,615,540 |

|

20.3 |

% |

|

5,008,929 |

|

| |

Debt Securities Available For Sale |

|

4,845,055 |

|

|

4,235,141 |

|

14.4 |

% |

|

4,721,083 |

|

| |

Debt Securities Held To Maturity |

|

707,533 |

|

|

380,399 |

|

86.0 |

% |

|

287,846 |

|

| |

Total Interest-Bearing

Cash |

|

499,692 |

|

|

962,627 |

|

-48.1 |

% |

|

982,300 |

|

| |

|

|

|

|

|

| |

Loans/Deposits |

|

15.2 |

% |

|

18.9 |

% |

|

|

15.7 |

% |

| |

|

|

|

|

|

| |

|

|

|

% |

|

| |

|

9/30'22YTD |

9/30'21YTD |

Change |

|

| |

|

|

|

|

|

| |

Total

Assets |

$ |

7,433,140 |

|

$ |

6,939,636 |

|

7.1 |

% |

|

| |

Total Earning

Assets |

|

7,013,627 |

|

|

6,535,949 |

|

7.3 |

% |

|

| |

Total

Loans |

|

1,009,314 |

|

|

1,227,971 |

|

-17.8 |

% |

|

| |

Total Commercial Loans |

|

200,206 |

|

|

380,638 |

|

-47.4 |

% |

|

| |

PPP Loans |

|

22,347 |

|

|

180,214 |

|

-87.6 |

% |

|

| |

Commercial Loans |

|

177,859 |

|

|

200,424 |

|

-11.3 |

% |

|

| |

Commercial RE Loans |

|

508,812 |

|

|

549,639 |

|

-7.4 |

% |

|

| |

Consumer Loans |

|

300,296 |

|

|

297,694 |

|

0.9 |

% |

|

| |

Total Investment

Securities |

|

5,172,003 |

|

|

4,484,084 |

|

15.3 |

% |

|

| |

Debt Securities Available For Sale |

|

4,741,400 |

|

|

4,046,289 |

|

17.2 |

% |

|

| |

Debt Securities Held To Maturity |

|

430,603 |

|

|

437,795 |

|

-1.6 |

% |

|

| |

Total Interest-Bearing

Cash |

|

832,310 |

|

|

823,894 |

|

1.0 |

% |

|

| |

|

|

|

|

|

| |

Loans/Deposits |

|

15.7 |

% |

|

20.4 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

| 4.

Deposits, Other Interest-Bearing Liabilities &

Equity. |

|

|

| |

|

(average volume, dollars in thousands) |

| |

|

|

|

% |

|

| |

|

Q3'2022 |

Q3'2021 |

Change |

Q2'2022 |

| |

|

|

|

|

|

|

|

Total Deposits |

$ |

6,495,051 |

|

$ |

6,223,500 |

|

4.4 |

% |

$ |

6,424,202 |

|

| |

Noninterest Demand |

|

3,058,662 |

|

|

2,960,207 |

|

3.3 |

% |

|

2,998,360 |

|

| |

Interest-Bearing Transaction |

|

1,308,310 |

|

|

1,246,667 |

|

4.9 |

% |

|

1,298,665 |

|

| |

Savings |

|

1,989,275 |

|

|

1,864,401 |

|

6.7 |

% |

|

1,985,325 |

|

| |

Time greater than $100K |

|

62,014 |

|

|

68,811 |

|

-9.9 |

% |

|

63,790 |

|

| |

Time less than $100K |

|

76,790 |

|

|

83,414 |

|

-7.9 |

% |

|

78,062 |

|

| |

Total Short-Term

Borrowings |

|

83,694 |

|

|

107,547 |

|

-22.2 |

% |

|

123,298 |

|

| |

Shareholders'

Equity |

|

807,428 |

|

|

755,682 |

|

6.8 |

% |

|

788,078 |

|

| |

|

|

|

|

|

| |

Demand

Deposits/ |

|

|

|

|

| |

Total Deposits |

|

47.1 |

% |

|

47.6 |

% |

|

|

46.7 |

% |

| |

Transaction &

Savings |

|

|

|

|

| |

Deposits / Total Deposits |

|

97.9 |

% |

|

97.6 |

% |

|

|

97.8 |

% |

| |

|

|

|

|

|

| |

|

|

|

% |

|

| |

|

9/30'22YTD |

9/30'21YTD |

Change |

|

| |

|

|

|

|

|

| |

Total

Deposits |

$ |

6,437,943 |

|

$ |

6,017,175 |

|

7.0 |

% |

|

| |

Noninterest Demand |

|

3,020,892 |

|

|

2,854,936 |

|

5.8 |

% |

|

| |

Interest-Bearing Transaction |

|

1,290,850 |

|

|

1,195,762 |

|

8.0 |

% |

|

| |

Savings |

|

1,984,931 |

|

|

1,811,711 |

|

9.6 |

% |

|

| |

Time greater than $100K |

|

63,318 |

|

|

70,258 |

|

-9.9 |

% |

|

| |

Time less than $100K |

|

77,952 |

|

|

84,508 |

|

-7.8 |

% |

|

| |

Total Short-Term

Borrowings |

|

121,310 |

|

|

105,001 |

|

15.5 |

% |

|

| |

Other Borrowed

Funds |

|

- |

|

|

71 |

|

n/m |

|

|

| |

Shareholders'

Equity |

|

790,691 |

|

|

745,382 |

|

6.1 |

% |

|

| |

|

|

|

|

|

| |

Demand

Deposits/ |

|

|

|

|

| |

Total Deposits |

|

46.9 |

% |

|

47.4 |

% |

|

|

| |

Transaction &

Savings |

|

|

|

|

| |

Deposits / Total Deposits |

|

97.8 |

% |

|

97.4 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

| 5.

Interest Yields Earned & Rates Paid. |

|

|

|

| |

|

(dollars in thousands) |

| |

|

Q3'2022 |

| |

|

Average |

Income/ |

Yield (a) / |

| |

|

Volume |

Expense |

Rate (a) |

| |

Interest & Fee

Income Earned |

|

|

|

|

|

Total Earning Assets (FTE) |

$ |

7,041,313 |

$ |

61,267 |

3.47 |

% |

| |

Total Loans (FTE) |

|

989,033 |

|

12,298 |

4.93 |

% |

| |

Total Commercial Loans (FTE) |

|

190,325 |

|

2,843 |

5.93 |

% |

| |

PPP Loans |

|

10,453 |

|

533 |

20.24 |

% |

| |

Commercial Loans (FTE) |

|

179,872 |

|

2,310 |

5.10 |

% |

| |

Commercial RE Loans |

|

494,717 |

|

5,821 |

4.67 |

% |

| |

Consumer Loans |

|

303,991 |

|

3,634 |

4.74 |

% |

| |

Total Investments (FTE) |

|

5,552,588 |

|

46,227 |

3.33 |

% |

| |

Total Debt Securities Available For Sale

(FTE) |

|

4,845,055 |

|

39,388 |

3.22 |

% |

| |

Corporate Securities |

|

2,518,870 |

|

17,404 |

2.76 |

% |

| |

Collateralized Loan Obligations |

|

1,600,611 |

|

16,355 |

4.00 |

% |

| |

Agency Mortgage Backed Securities |

|

336,392 |

|

2,001 |

2.38 |

% |

| |

Securities of U.S. Government

sponsored entities |

|

288,538 |

|

2,604 |

3.61 |

% |

| |

Obligations of States and

Political Subdivisions (FTE) |

|

86,357 |

|

660 |

3.06 |

% |

| |

Other Debt Securities Available For Sale

(FTE) |

|

14,287 |

|

364 |

10.18 |

% |

| |

Total Debt Securities Held To Maturity (FTE) |

|

707,533 |

|

6,839 |

3.87 |

% |

| |

Agency Mortgage Backed Securities |

|

117,606 |

|

586 |

1.99 |

% |

| |

Corporate Securities |

|

477,881 |

|

5,230 |

4.38 |

% |

| |

Obligations of States and

Political Subdivisions (FTE) |

|

112,046 |

|

1,023 |

3.65 |

% |

| |

Total Interest-Bearing Cash |

|

499,692 |

|

2,742 |

2.15 |

% |

| |

|

|

|

|

| |

Interest Expense

Paid |

|

|

|

| |

Total Earning Assets |

|

7,041,313 |

|

487 |

0.03 |

% |

| |

Total Interest-Bearing Liabilities |

|

3,520,083 |

|

487 |

0.05 |

% |

| |

Total Interest-Bearing Deposits |

|

3,436,389 |

|

470 |

0.05 |

% |

| |

Interest-Bearing Transaction |

|

1,308,310 |

|

94 |

0.03 |

% |

| |

Savings |

|

1,989,275 |

|

290 |

0.06 |

% |

| |

Time less than $100K |

|

76,790 |

|

47 |

0.24 |

% |

| |

Time greater than $100K |

|

62,014 |

|

39 |

0.25 |

% |

| |

Total Short-Term Borrowings |

|

83,694 |

|

17 |

0.08 |

% |

| |

|

|

|

|

| |

Net Interest Income

and Margin (FTE) |

|

$ |

60,780 |

3.44 |

% |

| |

|

|

|

|

| |

|

Q3'2021 |

| |

|

Average |

Income/ |

Yield (a) / |

| |

|

Volume |

Expense |

Rate (a) |

| |

Interest & Fee

Income Earned |

|

|

|

| |

Total Earning Assets (FTE) |

$ |

6,754,281 |

$ |

44,444 |

2.63 |

% |

| |

Total Loans (FTE) |

|

1,176,114 |

|

14,893 |

5.02 |

% |

| |

Total Commercial Loans (FTE) |

|

333,327 |

|

3,866 |

4.60 |

% |

| |

PPP Loans |

|

144,641 |

|

1,865 |

5.12 |

% |

| |

Commercial Loans (FTE) |

|

188,686 |

|

2,001 |

4.21 |

% |

| |

Commercial RE Loans |

|

543,429 |

|

7,457 |

5.44 |

% |

| |

Consumer Loans |

|

299,358 |

|

3,570 |

4.73 |

% |

| |

Total Investments (FTE) |

|

4,615,540 |

|

29,182 |

2.53 |

% |

| |

Total Debt Securities Available For Sale

(FTE) |

|

4,235,141 |

|

26,736 |

2.51 |

% |

| |

Corporate Securities |

|

2,506,856 |

|

17,974 |

2.87 |

% |

| |

Collateralized Loan Obligations |

|

1,148,445 |

|

5,631 |

1.92 |

% |

| |

Agency Mortgage Backed Securities |

|

470,250 |

|

2,022 |

1.72 |

% |

| |

Obligations of States and

Political Subdivisions (FTE) |

|

95,229 |

|

747 |

3.14 |

% |

| |

Other Debt Securities Available For Sale

(FTE) |

|

14,361 |

|

362 |

10.09 |

% |

| |

Total Debt Securities Held To Maturity (FTE) |

|

380,399 |

|

2,446 |

2.57 |

% |

| |

Agency Mortgage Backed Securities |

|

178,381 |

|

753 |

1.69 |

% |

| |

Obligations of States and

Political Subdivisions (FTE) |

|

202,018 |

|

1,693 |

3.35 |

% |

| |

Total Interest-Bearing Cash |

|

962,627 |

|

369 |

0.15 |

% |

| |

|

|

|

|

| |

Interest Expense

Paid |

|

|

|

| |

Total Earning Assets |

|

6,754,281 |

|

492 |

0.03 |

% |

| |

Total Interest-Bearing Liabilities |

|

3,370,840 |

|

492 |

0.06 |

% |

| |

Total Interest-Bearing Deposits |

|

3,263,293 |

|

473 |

0.06 |

% |

| |

Interest-Bearing Transaction |

|

1,246,667 |

|

101 |

0.03 |

% |

| |

Savings |

|

1,864,401 |

|

272 |

0.06 |

% |

| |

Time less than $100K |

|

83,414 |

|

42 |

0.20 |

% |

| |

Time greater than $100K |

|

68,811 |

|

58 |

0.33 |

% |

| |

Total Short-Term Borrowings |

|

107,547 |

|

19 |

0.07 |

% |

| |

|

|

|

|

| |

Net Interest Income

and Margin (FTE) |

|

$ |

43,952 |

2.60 |

% |

| |

|

|

|

|

|

|

| 6.

Noninterest Income. |

|

|

|

|

| |

|

(dollars in thousands except per-share

amounts) |

| |

|

|

|

% |

|

| |

|

Q3'2022 |

Q3'2021 |

Change |

Q2'2022 |

| |

|

|

|

|

|

|

|

Service Charges on Deposits |

$ |

3,737 |

|

$ |

3,578 |

|

4.4 |

% |

$ |

3,687 |

|

| |

Merchant Processing

Services |

|

2,925 |

|

|

3,159 |

|

-7.4 |

% |

|

3,374 |

|

| |

Debit Card

Fees |

|

1,594 |

|

|

1,740 |

|

-8.4 |

% |

|

1,709 |

|

| |

Trust

Fees |

|

810 |

|

|

839 |

|

-3.5 |

% |

|

809 |

|

| |

ATM Processing

Fees |

|

594 |

|

|

573 |

|

3.7 |

% |

|

469 |

|

| |

Other Service

Fees |

|

463 |

|

|

475 |

|

-2.6 |

% |

|

480 |

|

| |

Financial Services

Commissions |

|

79 |

|

|

95 |

|

-16.8 |

% |

|

118 |

|

| |

Life Insurance

Gains |

|

923 |

|

|

- |

|

n/m |

|

|

- |

|

| |

Other Noninterest

Income |

|

693 |

|

|

823 |

|

-15.8 |

% |

|

618 |

|

| |

Total Noninterest

Income |

$ |

11,818 |

|

$ |

11,282 |

|

4.8 |

% |

$ |

11,264 |

|

| |

|

|

|

|

|

| |

Total Revenue (FTE) |

$ |

72,598 |

|

$ |

55,234 |

|

31.4 |

% |

$ |

59,297 |

|

| |

Noninterest Income/Revenue (FTE) |

|

16.3 |

% |

|

20.4 |

% |

|

|

19.0 |

% |

| |

Service Charges/Avg. Deposits (a) |

|

0.23 |

% |

|

0.23 |

% |

|

|

0.23 |

% |

| |

Total Revenue (FTE) Per Avg. Common Share

(a) |

$ |

10.70 |

|

$ |

8.16 |

|

31.2 |

% |

$ |

8.85 |

|

| |

|

|

|

|

|

| |

|

|

|

% |

|

| |

|

9/30'22YTD |

9/30'21YTD |

Change |

|

| |

|

|

|

|

|

| |

Service Charges on

Deposits |

$ |

11,006 |

|

$ |

10,117 |

|

8.8 |

% |

|

| |

Merchant Processing

Services |

|

8,922 |

|

|

8,998 |

|

-0.8 |

% |

|

| |

Debit Card Fees

(1) |

|

6,175 |

|

|

5,132 |

|

20.3 |

% |

|

| |

Trust

Fees |

|

2,462 |

|

|

2,467 |

|

-0.2 |

% |

|

| |

ATM Processing

Fees |

|

1,514 |

|

|

1,792 |

|

-15.5 |

% |

|

| |

Other Service

Fees |

|

1,392 |

|

|

1,435 |

|

-3.0 |

% |

|

| |

Financial Services

Commissions |

|

314 |

|

|

260 |

|

20.8 |

% |

|

| |

Life Insurance

Gains |

|

923 |

|

|

- |

|

n/m |

|

|

| |

Securities

Gains |

|

- |

|

|

34 |

|

n/m |

|

|

| |

Other Noninterest

Income |

|

1,950 |

|

|

2,268 |

|

-14.0 |

% |

|

| |

Total Noninterest

Income |

$ |

34,658 |

|

$ |

32,503 |

|

6.6 |

% |

|

| |

|

|

|

|

|

| |

Total Revenue (FTE) |

$ |

187,278 |

|

$ |

163,537 |

|

14.5 |

% |

|

| |

Noninterest Income/Revenue (FTE) |

|

18.5 |

% |

|

19.9 |

% |

|

|

| |

Service Charges/Avg. Deposits (a) |

|

0.23 |

% |

|

0.22 |

% |

|

|

| |

Total Revenue (FTE) Per Avg./Common Share (a) |

$ |

9.31 |

|

$ |

8.14 |

|

14.4 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

| 7.

Noninterest Expense. |

|

|

|

|

| |

|

(dollars in thousands) |

| |

|

|

|

% |

|

| |

|

Q3'2022 |

Q3'2021 |

Change |

Q2'2022 |

| |

|

|

|

|

|

|

|

Salaries & Benefits |

$ |

11,311 |

|

$ |

11,813 |

|

-4.2 |

% |

$ |

11,412 |

|

| |

Occupancy and

Equipment |

|

5,064 |

|

|

4,759 |

|

6.4 |

% |

|

4,856 |

|

| |

Outsourced Data

Processing |

|

2,434 |

|

|

2,429 |

|

0.2 |

% |

|

2,423 |

|

| |

Limited Partnership

Operating Losses |

|

1,431 |

|

|

620 |

|

130.8 |

% |

|

1,431 |

|

| |

Professional

Fees |

|

582 |

|

|

724 |

|

-19.6 |

% |

|

736 |

|

| |

Courier

Service |

|

671 |

|

|

534 |

|

25.7 |

% |

|

661 |

|

| |

Other Noninterest

Expense |

|

3,274 |

|

|

3,818 |

|

-14.2 |

% |

|

3,110 |

|

| |

Total Noninterest

Expense |

$ |

24,767 |

|

$ |

24,697 |

|

0.3 |

% |

$ |

24,629 |

|

| |

|

|

|

|

|

| |

Noninterest

Expense/Avg. Earning Assets (a) |

|

1.40 |

% |

|

1.45 |

% |

|

|

1.41 |

% |

| |

Noninterest

Expense/Revenues (FTE) |

|

34.1 |

% |

|

44.7 |

% |

|

|

41.5 |

% |

| |

|

|

|

|

|

| |

|

|

|

% |

|

| |

|

9/30'22YTD |

9/30'21YTD |

Change |

|

| |

|

|

|

|

|

| |

Salaries &

Benefits |

$ |

34,643 |

|

$ |

36,575 |

|

-5.3 |

% |

|

| |

Occupancy and

Equipment |

|

14,666 |

|

|

14,447 |

|

1.5 |

% |

|

| |

Outsourced Data

Processing |

|

7,294 |

|

|

7,244 |

|

0.7 |

% |

|

| |

Limited Partnership

Operating Losses |

|

4,293 |

|

|

1,820 |

|

135.9 |

% |

|

| |

Professional

Fees |

|

2,054 |

|

|

2,496 |

|

-17.7 |

% |

|

| |

Courier

Service |

|

1,914 |

|

|

1,605 |

|

19.3 |

% |

|

| |

Other Noninterest

Expense |

|

9,407 |

|

|

9,707 |

|

-3.1 |

% |

|

| |

Total Noninterest

Expense |

$ |

74,271 |

|

$ |

73,894 |

|

0.5 |

% |

|

| |

|

|

|

|

|

| |

Noninterest

Expense/Avg. Earning Assets (a) |

|

1.42 |

% |

|

1.51 |

% |

|

|

| |

Noninterest

Expense/Revenues (FTE) |

|

39.7 |

% |

|

45.2 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

| 8.

Allowance for Credit Losses. |

|

|

|

|

| |

|

(dollars in thousands) |

| |

|

|

|

% |

|

| |

|

Q3'2022 |

Q3'2021 |

Change |

Q2'2022 |

| |

|

|

|

|

|

|

|

Average Total Loans |

$ |

989,033 |

|

$ |

1,176,114 |

|

-15.9 |

% |

$ |

1,009,633 |

|

| |

|

|

|

|

|

| |

Beginning of Period

Allowance for Credit Losses on Loans (ACLL) |

$ |

22,313 |

|

$ |

23,737 |

|

-6.0 |

% |

$ |

22,925 |

|

| |

Provision for Credit

Losses |

|

- |

|

|

2 |

|

n/m |

|

|

- |

|

| |

Net ACLL (Losses)

Recoveries |

|

(1,095 |

) |

|

143 |

|

n/m |

|

|

(612 |

) |

| |

End of Period

ACLL |

$ |

21,218 |

|

$ |

23,882 |

|

-11.2 |

% |

$ |

22,313 |

|

| |

Gross ACLL Recoveries

/ Gross ACLL Losses |

|

43 |

% |

|

115 |

% |

|

|

57 |

% |

| |

Net ACLL Losses

(Recoveries) / Avg. Total Loans (a)

|

|

0.44 |

% |

|

(0.05 |

%) |

|

|

0.24 |

% |

| |

|

|

|

|

|

| |

|

|

|

% |

|

| |

|

9/30'22YTD |

9/30'21YTD |

Change |

|

| |

|

|

|

|

|

| |

Average Total

Loans |

$ |

1,009,314 |

|

$ |

1,227,971 |

|

-17.8 |

% |

|

| |

|

|

|

|

|

| |

Beginning of Period

ACLL |

$ |

23,514 |

|

$ |

23,854 |

|

-1.4 |

% |

|

| |

Provision for Credit

Losses |

|

- |

|

|

2 |

|

n/m |

|

|

| |

Net ACLL (Losses)

Recoveries |

|

(2,296 |

) |

|

26 |

|

n/m |

|

|

| |

End of Period

ACLL |

$ |

21,218 |

|

$ |

23,882 |

|

-11.2 |

% |

|

| |

Gross ACLL Recoveries

/ Gross ACLL Losses |

|

49 |

% |

|

101 |

% |

|

|

| |

Net ACLL Losses

(Recoveries) / Avg. Total Loans (a)

|

|

0.30 |

% |

|

0.00 |

% |

|

|

| |

|

|

|

|

|

| |

|

(dollars in thousands) |

| |

|

|

|

% |

|

| |

|

9/30/22 |

9/30/21 |

Change |

6/30/22 |

| |

Allowance for Credit

Losses on Loans |

$ |

21,218 |

|

$ |

23,882 |

|

-11.2 |

% |

$ |

22,313 |

|

| |

Allowance for Credit

Losses on HTM Securities |

|

7 |

|

|

7 |

|

0.0 |

% |

|

7 |

|

| |

Total Allowance for Credit Losses |

$ |

21,225 |

|

$ |

23,889 |

|

-11.2 |

% |

$ |

22,320 |

|

| |

|

|

|

|

|

| |

Allowance for Unfunded

Credit Commitments |

$ |

201 |

|

$ |

101 |

|

99.3 |

% |

$ |

201 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 9. Credit

Quality. |

|

|

|

|

| |

|

(dollars in thousands) |

| |

|

|

|

% |

|

| |

|

9/30/22 |

9/30/21 |

Change |

6/30/22 |

| |

Nonperforming

Loans: |

|

|

|

|

|

|

Nonperforming Nonaccrual |

$ |

131 |

|

$ |

801 |

|

-83.6 |

% |

$ |

12 |

|

| |

Performing Nonaccrual |

|

66 |

|

|

436 |

|

-84.9 |

% |

|

235 |

|

| |

Total Nonaccrual Loans |

|

197 |

|

|

1,237 |

|

-84.1 |

% |

|

247 |

|

| |

90+ Days Past Due Accruing Loans |

|

769 |

|

|

537 |

|

43.2 |

% |

|

614 |

|

| |

Total Nonperforming Loans |

$ |

966 |

|

$ |

1,774 |

|

-45.5 |

% |

$ |

861 |

|

| |

|

|

|

|

|

| |

Total Loans

Outstanding |

$ |

979,033 |

|

$ |

1,132,472 |

|

-13.5 |

% |

$ |

999,768 |

|

| |

|

|

|

|

|

| |

Total

Assets |

|

7,177,025 |

|

|

7,403,573 |

|

-3.1 |

% |

|

7,222,405 |

|

| |

|

|

|

|

|

| |

Loans: |

|

|

|

|

| |

Allowance for Credit Losses on Loans |

$ |

21,218 |

|

$ |

23,882 |

|

-11.2 |

% |

$ |

22,313 |

|

| |

Allowance for Credit Losses on Loans / Loans |

|

2.17 |

% |

|

2.11 |

% |

|

|

2.23 |

% |

| |

Nonperforming

Loans/Total Loans |

|

0.10 |

% |

|

0.16 |

% |

|

|

0.09 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| 10.

Capital. |

|

|

|

|

| |

|

(in thousands, except per-share amounts) |

| |

|

|

|

% |

|

| |

|

9/30/22 |

9/30/21 |

Change |

6/30/22 |

| |

|

|

|

|

|

|

|

Shareholders' Equity |

$ |

538,988 |

|

$ |

837,953 |

|

-35.7 |

% |

$ |

617,126 |

|

| |

Total

Assets |

|

7,177,025 |

|

|

7,403,573 |

|

-3.1 |

% |

|

7,222,405 |

|

| |

Shareholders'

Equity/Total Assets |

|

7.51 |

% |

|

11.32 |

% |

|

|

8.54 |

% |

| |

Shareholders'

Equity/Total Loans |

|

55.05 |

% |

|

73.99 |

% |

|

|

61.73 |

% |

| |

Tangible Common Equity

Ratio |

|

5.91 |

% |

|

9.83 |

% |

|

|

6.97 |

% |

| |

Common Shares

Outstanding |

|

26,911 |

|

|

26,866 |

|

0.2 |

% |

|

26,896 |

|

| |

Common Equity Per

Share |

$ |

20.03 |

|

$ |

31.19 |

|

-35.8 |

% |

$ |

22.94 |

|

| |

Market Value Per

Common Share |

|

52.29 |

|

|

56.26 |

|

-7.1 |

% |

|

55.66 |

|

| |

|

|

|

|

|

| |

|

(shares in thousands) |

| |

|

|

|

% |

|

| |

|

Q3'2022 |

Q3'2021 |

Change |

Q2'2022 |

| |

Share Repurchase

Programs: |

|

|

|

|

| |

Total Shares Repurchased |

|

- |

|

|

- |

|

n/m |

|

|

- |

|

| |

Average Repurchase Price |

$ |

- |

|

$ |

- |

|

n/m |

|

$ |

- |

|

| |

Net Shares Issued |

|

(15 |

) |

|

(1 |

) |

n/m |

|

|

(13 |

) |

| |

|

|

|

|

|

| |

|

|

|

% |

|

| |

|

9/30'22YTD |

9/30'21YTD |

Change |

|

| |

|

|

|

|

|

| |

Total Shares Repurchased |

|

3 |

|

|

4 |

|

n/m |

|

|

| |

Average Repurchase Price |

$ |

58.66 |

|

$ |

61.09 |

|

n/m |

|

|

| |

Net Shares Issued |

|

(45 |

) |

|

(59 |

) |

n/m |

|

|

| |

|

|

|

|

|

|

|

|

|

| 11.

Period-End Balance Sheets. |

|

|

|

|

| |

|

(unaudited, dollars in thousands) |

| |

|

|

|

% |

|

| |

|

9/30/22 |

9/30/21 |

Change |

6/30/22 |

| |

Assets: |

|

|

|

|

|

|

Cash and Due from Banks |

$ |

413,665 |

|

$ |

1,011,048 |

|

-59.1 |

% |

$ |

753,293 |

|

| |

|

|

|

|

|

| |

Debt Securities Available For Sale: |

|

|

|

|

| |

Corporate Securities |

|

2,138,508 |

|

|

2,668,389 |

|

-19.9 |

% |

|

2,296,853 |

|

| |

Collateralized Loan Obligations |

|

1,587,622 |

|

|

1,379,533 |

|

15.1 |

% |

|

1,601,333 |

|

| |

Agency Mortgage Backed Securities |

|

296,689 |

|

|

458,053 |

|

-35.2 |

% |

|

331,425 |

|

| |

Securities of U.S. Government

sponsored entities |

|

272,525 |

|

|

- |

|

n/m |

|

|

290,725 |

|

| |

Obligations of States and

Political Subdivisions |

|

80,987 |

|

|

96,603 |

|

-16.2 |

% |

|

86,676 |

|

| |

Other Debt Securities Available For Sale |

|

- |

|

|

128 |

|

n/m |

|

|

102 |

|

| |

Total Debt Securities Available For Sale |

|

4,376,331 |

|

|

4,602,706 |

|

-4.9 |

% |

|

4,607,114 |

|

| |

|

|

|

|

|

| |

Debt Securities Held To Maturity: |

|

|

|

|

| |

Agency Mortgage Backed Securities |

|

112,371 |

|

|

166,955 |

|

-32.7 |

% |

|

121,810 |

|

| |

Corporate Securities |

|

720,154 |

|

|

- |

|

n/m |

|

|

181,316 |

|

| |

Obligations of States and

Political Subdivisions (2) |

|

103,742 |

|

|

189,151 |

|

-45.2 |

% |

|

139,228 |

|

| |

Total Debt Securities Held To Maturity (2) |

|

936,267 |

|

|

356,106 |

|

162.9 |

% |

|

442,354 |

|

| |

|

|

|

|

|

| |

Loans |

|

979,033 |

|

|

1,132,472 |

|

-13.5 |

% |

|

999,768 |

|

| |

Allowance For Credit Losses on Loans |

|

(21,218 |

) |

|

(23,882 |

) |

-11.2 |

% |

|

(22,313 |

) |

| |

Total Loans, net |

|

957,815 |

|

|

1,108,590 |

|

-13.6 |

% |

|

977,455 |

|

| |

|

|

|

|

|

| |

Premises and Equipment, net |

|

29,756 |

|

|

31,603 |

|

-5.8 |

% |

|

30,309 |

|

| |

Identifiable Intangibles, net |

|

644 |

|

|

900 |

|

-28.4 |

% |

|

707 |

|

| |

Goodwill |

|

121,673 |

|

|

121,673 |

|

0.0 |

% |

|

121,673 |

|

| |

Other Assets |

|

340,874 |

|

|

170,947 |

|

99.4 |

% |

|

289,500 |

|

| |

|

|

|

|

|

| |

Total

Assets |

$ |

7,177,025 |

|

$ |

7,403,573 |

|

-3.1 |

% |

$ |

7,222,405 |

|

| |

|

|

|

|

|

| |

Liabilities and

Shareholders' Equity: |

|

|

|

|

| |

Deposits: |

|

|

|

|

| |

Noninterest-Bearing |

$ |

3,069,907 |

|

$ |

2,988,329 |

|

2.7 |

% |

$ |

2,987,725 |

|

| |

Interest-Bearing Transaction |

|

1,338,855 |

|

|

1,257,460 |

|

6.5 |

% |

|

1,303,700 |

|

| |

Savings |

|

1,949,711 |

|

|

1,894,290 |

|

2.9 |

% |

|

1,983,713 |

|

| |

Time |

|

136,783 |

|

|

148,882 |

|

-8.1 |

% |

|

140,453 |

|

| |

Total Deposits |

|

6,495,256 |

|

|

6,288,961 |

|

3.3 |

% |

|

6,415,591 |

|

| |

|

|

|

|

|

| |

Short-Term Borrowed Funds |

|

76,886 |

|

|

119,102 |

|

-35.4 |

% |

|

118,167 |

|

| |

Other Liabilities |

|

65,895 |

|

|

157,557 |

|

-58.2 |

% |

|

71,521 |

|

| |

Total

Liabilities |

|

6,638,037 |

|

|

6,565,620 |

|

1.1 |

% |

|

6,605,279 |

|

| |

|

|

|

|

|

| |

Shareholders'

Equity: |

|

|

|

|

| |

Common Equity: |

|

|

|

|

| |

Paid-In Capital |

|

474,732 |

|

|

470,711 |

|

0.9 |

% |

|

473,555 |

|

| |

Accumulated Other Comprehensive (Loss)

Income |

|

(290,797 |

) |

|

71,284 |

|

n/m |

|

|

(188,025 |

) |

| |

Retained Earnings |

|

355,053 |

|

|

295,958 |

|

20.0 |

% |

|

331,596 |

|

| |

Total Shareholders'

Equity |

|

538,988 |

|

|

837,953 |

|

-35.7 |

% |

|

617,126 |

|

| |

|

|

|

|

|

| |

Total Liabilities and

Shareholders' Equity |

$ |

7,177,025 |

|

$ |

7,403,573 |

|

-3.1 |

% |

$ |

7,222,405 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 12. Income

Statements. |

|

|

|

|

| |

|

(unaudited, in thousands except per-share

amounts) |

| |

|

|

|

% |

|

| |

|

Q3'2022 |

Q3'2021 |

Change |

Q2'2022 |

| |

Interest & Fee

Income: |

|

|

|

|

|

|

Loans |

$ |

12,208 |

$ |

14,789 |

-17.5 |

% |

$ |

12,331 |

| |

Equity Securities |

|

127 |

|

109 |

16.5 |

% |

|

129 |

| |

Debt Securities Available For Sale |

|

39,100 |

|

26,452 |

47.8 |

% |

|

31,764 |

| |

Debt Securities Held To Maturity |

|

6,625 |

|

2,091 |

216.9 |

% |

|

1,771 |

| |

Interest-Bearing Cash |

|

2,742 |

|

369 |

643.1 |

% |

|

2,002 |

| |

Total Interest &

Fee Income |

|

60,802 |

|

43,810 |

38.8 |

% |

|

47,997 |

| |

|

|

|

|

|

| |

Interest

Expense: |

|

|

|

|

| |

Transaction Deposits |

|

94 |

|

101 |

-6.9 |

% |

|

91 |

| |

Savings Deposits |

|

290 |

|

272 |

6.6 |

% |

|

288 |

| |

Time Deposits |

|

86 |

|

100 |

-14.0 |

% |

|

82 |

| |

Short-Term Borrowed Funds |

|

17 |

|

19 |

-10.5 |

% |

|

22 |

| |

Total Interest

Expense |

|

487 |

|

492 |

-1.0 |

% |

|

483 |

| |

|

|

|

|

|

| |

Net Interest

Income |

|

60,315 |

|

43,318 |

39.2 |

% |

|

47,514 |

| |

|

|

|

|

|

| |

Provision for Credit

Losses |

|

- |

|

- |

n/m |

|

|

- |

| |

|

|

|

|

|

| |

Noninterest

Income: |

|

|

|

|

| |

Service Charges |

|

3,737 |

|

3,578 |

4.4 |

% |

|

3,687 |

| |

Merchant Processing Services |

|

2,925 |

|

3,159 |

-7.4 |

% |

|

3,374 |

| |

Debit Card Fees |

|

1,594 |

|

1,740 |

-8.4 |

% |

|

1,709 |

| |

Trust Fees |

|

810 |

|

839 |

-3.5 |

% |

|

809 |

| |

ATM Processing Fees |

|

594 |

|

573 |

3.7 |

% |

|

469 |

| |

Other Service Fees |

|

463 |

|

475 |

-2.6 |

% |

|

480 |

| |

Financial Services Commissions |

|

79 |

|

95 |

-16.8 |

% |

|

118 |

| |

Life Insurance Gains |

|

923 |

|

- |

n/m |

|

|

- |

| |

Other Noninterest Income |

|

693 |

|

823 |

-15.8 |

% |

|

618 |

| |

Total Noninterest

Income |

|

11,818 |

|

11,282 |

4.8 |

% |

|

11,264 |

| |

|

|

|

|

|

| |

Noninterest

Expense: |

|

|

|

|

| |

Salaries and Benefits |

|

11,311 |

|

11,813 |

-4.2 |

% |

|

11,412 |

| |

Occupancy and Equipment |

|

5,064 |

|

4,759 |

6.4 |

% |

|

4,856 |

| |

Outsourced Data Processing |

|

2,434 |

|

2,429 |

0.2 |

% |

|

2,423 |

| |

Limited Partnership Operating Losses |

|

1,431 |

|

620 |

130.8 |

% |

|

1,431 |

| |

Professional Fees |

|

582 |

|

724 |

-19.6 |

% |

|

736 |

| |

Courier Service |

|

671 |

|

534 |

25.7 |

% |

|

661 |

| |

Other Noninterest Expense |

|

3,274 |

|

3,818 |

-14.2 |

% |

|

3,110 |

| |

Total Noninterest

Expense |

|

24,767 |

|

24,697 |

0.3 |

% |

|

24,629 |

| |

|

|

|

|

|

| |

Income Before Income

Taxes |

|

47,366 |

|

29,903 |

58.4 |

% |

|

34,149 |

| |

Income Tax

Provision |

|

12,606 |

|

7,840 |

60.8 |

% |

|

8,835 |

| |

Net

Income |

$ |

34,760 |

$ |

22,063 |

57.5 |

% |

$ |

25,314 |

| |

|

|

|

|

|

| |

Average Common Shares

Outstanding |

|

26,906 |

|

26,866 |

0.1 |

% |

|

26,889 |

| |

Diluted Common Shares

Outstanding |

|

26,916 |

|

26,875 |

0.2 |

% |

|

26,901 |

| |

|

|

|

|

|

| |

Per Common Share

Data: |

|

|

|

|

| |

Basic Earnings |

$ |

1.29 |

$ |

0.82 |

57.3 |

% |

$ |

0.94 |

| |

Diluted Earnings |

|

1.29 |

|

0.82 |

57.3 |

% |

|

0.94 |

| |

Dividends Paid |

|

0.42 |

|

0.41 |

2.4 |

% |

|

0.42 |

| |

|

|

|

|

|

| |

|

|

|

% |

|

| |

|

9/30'22YTD |

9/30'21YTD |

Change |

|

| |

Interest & Fee

Income: |

|

|

|

|

| |

Loans |

$ |

37,481 |

$ |

44,434 |

-15.6 |

% |

|

| |

Equity Securities |

|

384 |

|

329 |

16.7 |

% |

|

| |

Debt Securities Available For Sale |

|

99,430 |

|

77,822 |

27.8 |

% |

|

| |

Debt Securities Held To Maturity |

|

10,040 |

|

7,051 |

42.4 |

% |

|

| |

Interest-Bearing Cash |

|

5,223 |

|

766 |

581.9 |

% |

|

| |

Total Interest &

Fee Income |

|

152,558 |

|

130,402 |

17.0 |

% |

|

| |

|

|

|

|

|

| |

Interest

Expense: |

|

|

|

|

| |

Transaction Deposits |

|

273 |

|

283 |

-3.5 |

% |

|

| |

Savings Deposits |

|

861 |

|

785 |

9.7 |

% |

|

| |

Time Deposits |

|

249 |

|

330 |

-24.5 |

% |

|

| |

Short-Term Borrowed Funds |

|

67 |

|

53 |

26.4 |

% |

|

| |

Total Interest

Expense |

|

1,450 |

|

1,451 |

-0.1 |

% |

|

| |

|

|

|

|

|

| |

Net Interest

Income |

|

151,108 |

|

128,951 |

17.2 |

% |

|

| |

|

|

|

|

|

| |

Provision for Credit

Losses |

|

- |

|

- |

n/m |

|

|

| |

|

|

|

|

|

| |

Noninterest

Income: |

|

|

|

|

| |

Service Charges |

|

11,006 |

|

10,117 |

8.8 |

% |

|

| |

Merchant Processing Services |

|

8,922 |

|

8,998 |

-0.8 |

% |

|

| |

Debit Card Fees (1) |

|

6,175 |

|

5,132 |

20.3 |

% |

|

| |

Trust Fees |

|

2,462 |

|

2,467 |

-0.2 |

% |

|

| |

ATM Processing Fees |

|

1,514 |

|

1,792 |

-15.5 |

% |

|

| |

Other Service Fees |

|

1,392 |

|

1,435 |

-3.0 |

% |

|

| |

Financial Services Commissions |

|

314 |

|

260 |

20.8 |

% |

|

| |

Life Insurance Gains |

|

923 |

|

- |

n/m |

|

|

| |

Securities Gains |

|

- |

|

34 |

n/m |

|

|

| |

Other Operating |

|

1,950 |

|

2,268 |

-14.0 |

% |

|

| |

Total Noninterest

Income |

|

34,658 |

|

32,503 |

6.6 |

% |

|

| |

|

|

|

|

|

| |

Noninterest

Expense: |

|

|

|

|

| |

Salaries and Benefits |

|

34,643 |

|

36,575 |

-5.3 |

% |

|

| |

Occupancy and Equipment |

|

14,666 |

|

14,447 |

1.5 |

% |

|

| |

Outsourced Data Processing |

|

7,294 |

|

7,244 |

0.7 |

% |

|

| |

Limited Partnership Operating Losses |

|

4,293 |

|

1,820 |

135.9 |

% |

|

| |

Professional Fees |

|

2,054 |

|

2,496 |

-17.7 |

% |

|

| |

Courier Service |

|

1,914 |

|

1,605 |

19.3 |

% |

|

| |

Other Operating |

|

9,407 |

|

9,707 |

-3.1 |

% |

|

| |

Total Noninterest

Expense |

|

74,271 |

|

73,894 |

0.5 |

% |

|

| |

|

|

|

|

|

| |

Income Before Income

Taxes |

|

111,495 |

|

87,560 |

27.3 |

% |

|

| |

Income Tax

Provision |

|

28,805 |

|

22,771 |

26.5 |

% |

|

| |

Net

Income |

$ |

82,690 |

$ |

64,789 |

27.6 |

% |

|

| |

|

|

|

|

|

| |

Average Common Shares

Outstanding |

|

26,889 |

|

26,851 |

0.1 |

% |

|

| |

Diluted Common Shares

Outstanding |

|

26,901 |

|

26,868 |

0.1 |

% |

|

| |

|

|

|

|

|

| |

Per Common Share

Data: |

|

|

|

|

| |

Basic Earnings |

$ |

3.08 |

$ |

2.41 |

27.8 |

% |

|

| |

Diluted Earnings |

|

3.07 |

|

2.41 |

27.4 |

% |

|

| |

Dividends Paid |

|

1.26 |

|

1.23 |

2.4 |

% |

|

| |

|

|

|

|

|

|

|

|

Footnotes and Abbreviations:

|

(1) The Company received a $1.2 million reconciling payment

from a payments network in the first quarter 2022. |

|

|

|

(2) Debt Securities Held To Maturity and Obligations of

States and Political Subdivisions are net of related reserve for

expected credit losses of $7 thousand at September 30, 2022, June

30, 2022 and September 30, 2021. |

|

|

|

(FTE) Fully Taxable Equivalent. The Company presents its

net interest margin and net interest income on a FTE basis using

the current statutory federal tax rate. Management believes the FTE

basis is valuable to the reader because the Company’s loan and

investment securities portfolios contain a relatively large portion

of municipal loans and securities that are federally tax exempt.

The Company’s tax exempt loans and securities composition may not

be similar to that of other banks, therefore in order to reflect

the impact of the federally tax exempt loans and securities on the

net interest margin and net interest income for comparability with

other banks, the Company presents its net interest margin and net

interest income on a FTE basis. |

|

|

|

(a) Annualized |

|

|

|

Certain amounts in prior periods have been reclassified to

conform to the current presentation. |

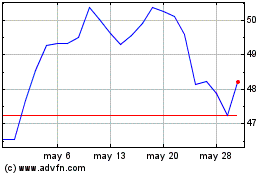

Westamerica Bancorporation (NASDAQ:WABC)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Westamerica Bancorporation (NASDAQ:WABC)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024