Exagen Inc. (Nasdaq: XGN), a leading provider of autoimmune testing

solutions, today reported financial results for the quarter ended

June 30, 2024.

Highlights:

- Recognized record total revenue of

$15.1 million in the second quarter of 2024.

- Delivered gross margin of 60.1% in the second quarter of 2024,

compared to a gross margin of 58.7% in the second quarter of

2023.

- AVISE® CTD trailing twelve-month average selling price (ASP) of

$401, a 25.3% increase over the trailing twelve-month ASP in the

second quarter of 2023.

- Net loss of $3.0 million in the second quarter of 2024, a 40.8%

improvement over the second quarter of 2023.

- Adjusted EBITDA loss of $1.6 million for the second quarter of

2024, a 53.5% improvement over the second quarter of 2023.

- Cash and cash equivalents were $24.5 million as of June 30,

2024.

"It is exciting to report on another successful quarter as we

work to accomplish our goals. We’ve had a very strong start to the

year, outpacing our internal expectations, and we are in the middle

of transforming the company through product enhancements and

continued improvement in our operations. This momentum is a

testament to our team's hard work and dedication to our strategic

initiatives to bring us to profitability. As we head into the

second half of the year, we are confident in our ability to

continue delivering outstanding results and driving sustained

growth. We are again raising our revenue guidance and adjusted

EBITDA expectations for the full year 2024 as a result of the

progress we are making,” said John Aballi, President and Chief

Executive Officer.

Second Quarter

2024 Financial Results

Revenue was $15.1 million in the second quarter of 2024,

compared to $14.1 million in the second quarter of 2023, primarily

due to improved ASP. Gross margin was 60.1% in the second quarter

of 2024, compared to 58.7% in the second quarter of 2023. The

increase in gross margin percentage was driven by an increase in

ASP.

Operating expenses were $17.7 million in the second quarter of

2024, compared with $19.1 million in the second quarter of 2023.

The decrease in operating expenses was a result of lower legal

expenses and lower stock based compensation as a result of

decreases in headcount.

Net loss was $3.0 million for the second quarter of 2024,

compared to a net loss of $5.0 million in the second quarter of

2023.

Adjusted EBITDA loss was $1.6 million for the second quarter of

2024, compared to a $3.4 million loss for the second quarter of

2023. Adjusted EBITDA loss through the first two quarters of 2024

was $3.6 million compared to a $9.6 million loss through the first

two quarters of 2023.

Cash and cash equivalents were $24.5 million as of June 30,

2024 and our accounts receivable balance was $11.7 million.

A reconciliation of non-GAAP adjusted EBITDA to GAAP net loss,

the closest GAAP financial measure, is provided in the financial

schedules that are part of this press release. An explanation of

this non-GAAP financial measures is also included below under the

heading “Use of Non-GAAP Financial Measures (unaudited).”

2024 Guidance

Given our continued improved performance, we are increasing our

guidance for full-year 2024 revenue to at least $57 million and now

believe our adjusted EBITDA loss will be better than $12

million.

Conference Call

A conference call to review second quarter 2024 financial

results and to provide a business update is scheduled for today,

August 5, 2024, at 8:30 AM Eastern Time (5:30 AM Pacific

Time). Interested parties may access the conference call by dialing

(201) 389-0918 (U.S.) or (877) 407-0890 (international).

Additionally, a link to a live webcast of the call will be

available in the Investor Relations section of Exagen's website at

investors.exagen.com.

Participants are asked to join a few minutes prior to the call

to register for the event. A replay of the conference call will be

available until Monday, August 19, 2024, at 11:59 PM Eastern Time

(8:59 PM Pacific Time). Interested parties may access the replay by

dialing (201) 612-7415 (U.S.) or (877) 660-6853 (international)

using passcode 13747595. A link to the replay of the webcast will

also be available in the Investor Relations section of Exagen's

website.

Use of Non-GAAP Financial Measures

(UNAUDITED)

In this release, we use the metrics of adjusted EBITDA, which is

not calculated in accordance with generally accepted accounting

principles in the United States (GAAP) and is a non-GAAP financial

measure. Adjusted EBITDA excludes from net loss interest income

(expense), depreciation and amortization expense, and stock-based

compensation expense.

We use adjusted EBITDA internally because we believe these

metrics provide useful supplemental information in assessing our

operating performance reported in accordance with GAAP. We believe

adjusted EBITDA may enhance an evaluation of our operating

performance because it excludes the impact of prior decisions made

about capital investment, financing, investing and certain expenses

we believe are not indicative of our ongoing performance. However,

this non-GAAP financial measure may be different from non-GAAP

financial measures used by other companies, even when the same or

similarly titled terms are used to identify such measures, limiting

their usefulness for comparative purposes.

This non-GAAP financial measure is not meant to be considered in

isolation or used as a substitute for net loss reported in

accordance with GAAP, should be considered in conjunction with our

financial information presented in accordance with GAAP, has no

standardized meaning prescribed by GAAP, is unaudited, and is not

prepared under any comprehensive set of accounting rules or

principles. In addition, from time to time in the future, there may

be other items that we may exclude for purposes of these non-GAAP

financial measures, and we may in the future cease to exclude items

that we have historically excluded for purposes of these non-GAAP

financial measures. Likewise, we may determine to modify the nature

of adjustments to arrive at these non-GAAP financial measures.

Because of the non-standardized definitions of non-GAAP financial

measures, the non-GAAP financial measure as used by us in this

press release and the accompanying reconciliation table have limits

in their usefulness to investors and may be calculated differently

from, and therefore may not be directly comparable to, similarly

titled measures used by other companies. Accordingly, investors

should not place undue reliance on non-GAAP financial measures.

About Exagen

Exagen is a leading provider of autoimmune testing and its

purpose as an organization is to provide clarity in autoimmune

disease decision making with the goal of improving patients’

clinical outcomes. Exagen is located in San Diego County,

California.

For more information, please visit Exagen.com or follow

@ExagenInc on X (formally known as Twitter).

Forward Looking Statements

Exagen cautions you that statements contained in this press

release regarding matters that are not historical facts are

forward-looking statements. These statements are based on Exagen’s

current beliefs and expectations. Such forward-looking statements

include, but are not limited to, statements regarding: Exagen’s

goals, strategies and ambitions; potential future financial and

business performance; the potential utility and effectiveness of

Exagen’s services and testing solutions; updates to be made to

AVISE® CTD; potential shareholder value and growth and 2024

guidance. The inclusion of forward-looking statements should not be

regarded as a representation by Exagen that any of its plans will

be achieved. Actual results may differ from those set forth in this

press release due to the risks and uncertainties inherent in

Exagen’s business, including, without limitation: delays in

reimbursement and coverage decisions from Medicare and third-party

payors and in interactions with regulatory authorities, and delays

in ongoing and planned clinical trials involving its tests; changes

in laws and regulations related to Exagen’s regulatory

requirements; Exagen’s commercial success depends upon attaining

and maintaining significant market acceptance of its testing

products among rheumatologists, patients, third-party payors and

others in the medical community; Exagen’s ability to successfully

execute on its business strategies; third-party payors not

providing coverage and adequate reimbursement for Exagen’s testing

products, including Exagen’s ability to collect on funds due;

Exagen’s ability to obtain and maintain intellectual property

protection for its testing products; regulatory developments

affecting Exagen’s business; and other risks described in Exagen’s

prior press releases and Exagen’s filings with the Securities and

Exchange Commission (“SEC”), including under the heading “Risk

Factors” in Exagen’s Annual Report on Form 10-K for the year ended

December 31, 2023, filed with the SEC on March 18, 2024, its

Quarterly Report on Form 10-Q for the quarter ended June 30, 2024,

filed with the SEC on August 5, 2024 and any subsequent filings

with the SEC. You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

hereof, and Exagen undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist

after the date hereof. All forward-looking statements are qualified

in their entirety by this cautionary statement, which is made under

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995.

Contact:Ryan DouglasExagen Inc.ir@exagen.com

760.560.1525

|

Exagen Inc.Unaudited Condensed Statements

of Operations(in thousands, except share and per

share data) |

| |

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

Revenue |

|

$ |

15,064 |

|

|

$ |

14,137 |

|

|

$ |

29,479 |

|

|

$ |

25,367 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Costs of revenue |

|

|

6,008 |

|

|

|

5,836 |

|

|

|

11,825 |

|

|

|

11,762 |

|

|

Selling, general and administrative expenses |

|

|

10,464 |

|

|

|

11,953 |

|

|

|

21,006 |

|

|

|

23,837 |

|

|

Research and development expenses |

|

|

1,179 |

|

|

|

1,263 |

|

|

|

2,238 |

|

|

|

2,389 |

|

|

Total operating expenses |

|

|

17,651 |

|

|

|

19,052 |

|

|

|

35,069 |

|

|

|

37,988 |

|

| Loss

from operations |

|

|

(2,587 |

) |

|

|

(4,915 |

) |

|

|

(5,590 |

) |

|

|

(12,621 |

) |

| Interest

expense |

|

|

(560 |

) |

|

|

(574 |

) |

|

|

(1,109 |

) |

|

|

(1,212 |

) |

| Interest

income |

|

|

181 |

|

|

|

476 |

|

|

|

373 |

|

|

|

1,132 |

|

| Net

loss |

|

$ |

(2,966 |

) |

|

$ |

(5,013 |

) |

|

$ |

(6,326 |

) |

|

$ |

(12,701 |

) |

| Net loss

per share, basic and diluted |

|

$ |

(0.16 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.35 |

) |

|

$ |

(0.72 |

) |

|

Weighted-average number of shares used to compute net loss per

share, basic and diluted |

|

|

18,178,185 |

|

|

|

17,655,483 |

|

|

|

18,061,312 |

|

|

|

17,591,478 |

|

|

Exagen Inc.Unaudited Condensed Balance

Sheets(in thousands, except share and per share

data) |

| |

| |

|

June 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

24,479 |

|

|

$ |

36,493 |

|

|

Accounts receivable, net |

|

|

11,703 |

|

|

|

6,551 |

|

|

Prepaid expenses and other current assets |

|

|

4,612 |

|

|

|

4,797 |

|

|

Total current assets |

|

|

40,794 |

|

|

|

47,841 |

|

| Property and equipment,

net |

|

|

5,147 |

|

|

|

5,201 |

|

| Operating lease right-of-use

assets |

|

|

2,853 |

|

|

|

3,286 |

|

| Other assets |

|

|

513 |

|

|

|

616 |

|

|

Total assets |

|

$ |

49,307 |

|

|

$ |

56,944 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

2,330 |

|

|

$ |

3,131 |

|

|

Accrued and other current liabilities |

|

|

5,658 |

|

|

|

7,531 |

|

|

Operating lease liabilities |

|

|

1,035 |

|

|

|

976 |

|

|

Borrowings-current portion |

|

|

423 |

|

|

|

264 |

|

|

Total current liabilities |

|

|

9,446 |

|

|

|

11,902 |

|

| Borrowings-non-current

portion, net of discounts and debt issuance costs |

|

|

19,830 |

|

|

|

19,231 |

|

| Non-current operating lease

liabilities |

|

|

2,227 |

|

|

|

2,760 |

|

| Other non-current

liabilities |

|

|

219 |

|

|

|

357 |

|

|

Total liabilities |

|

|

31,722 |

|

|

|

34,250 |

|

| Commitments and contingencies

(Note 5) |

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized, no

shares issued or outstanding as of June 30, 2024 and December

31, 2023 |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 200,000,000 shares authorized as of

June 30, 2024 and December 31, 2023; 17,381,575 and 17,045,954

shares issued and outstanding as of June 30, 2024 and December

31, 2023, respectively |

|

|

17 |

|

|

|

17 |

|

|

Additional paid-in capital |

|

|

303,110 |

|

|

|

301,893 |

|

|

Accumulated deficit |

|

|

(285,542 |

) |

|

|

(279,216 |

) |

|

Total stockholders' equity |

|

|

17,585 |

|

|

|

22,694 |

|

| Total liabilities and

stockholders' equity |

|

$ |

49,307 |

|

|

$ |

56,944 |

|

|

Exagen Inc.Reconciliation of Non-GAAP

Financial Measures (UNAUDITED) |

|

|

|

The table below presents the reconciliation of adjusted EBITDA,

which is a non-GAAP financial measure. See "Use of Non-GAAP

Financial Measures (UNAUDITED)" above for further information

regarding the Company's use of non-GAAP financial measures. |

| |

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| (in thousands) |

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

| Net

loss |

|

$ |

(2,966 |

) |

|

$ |

(5,013 |

) |

|

$ |

(6,326 |

) |

|

$ |

(12,701 |

) |

|

Other (Income) Expense |

|

|

(181 |

) |

|

|

(476 |

) |

|

|

(373 |

) |

|

|

(1,132 |

) |

|

Interest Expense |

|

|

560 |

|

|

|

574 |

|

|

|

1,109 |

|

|

|

1,212 |

|

|

Income tax expense (benefit) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Depreciation and amortization expense |

|

|

429 |

|

|

|

503 |

|

|

|

887 |

|

|

|

1,056 |

|

|

Stock-based compensation expense |

|

|

560 |

|

|

|

979 |

|

|

|

1,113 |

|

|

|

1,963 |

|

| Adjusted

EBITDA (Non-GAAP) |

|

$ |

(1,598 |

) |

|

$ |

(3,433 |

) |

|

$ |

(3,590 |

) |

|

$ |

(9,602 |

) |

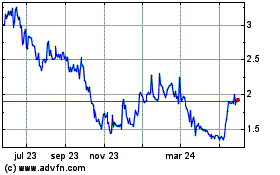

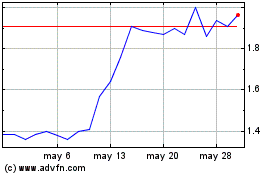

Exagen (NASDAQ:XGN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Exagen (NASDAQ:XGN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024