Xilio Therapeutics, Inc. (Nasdaq: XLO), a clinical-stage

biotechnology company discovering and developing tumor-activated

immuno-oncology therapies for people living with cancer, today

announced pipeline progress and business updates and reported

financial results for the second quarter ended June 30, 2024.

“This quarter, we continued to make meaningful progress

advancing our clinical-stage pipeline toward key data milestones

and potential value drivers anticipated later this year,” said René

Russo, Pharm.D., president and chief executive officer of Xilio.

“We recently initiated enrollment in our Phase 2 trial of XTX101 in

combination with atezolizumab in patients with MSS CRC and our

Phase 1 monotherapy dose expansion for XTX301 in patients with

advanced solid tumors, and we look forward to reporting clinical

data for each of these programs in the fourth quarter. Beyond our

clinical-stage pipeline, we are also advancing multiple

research-stage programs leveraging our tumor-activated approach for

masked immune cell engagers.”

Dr. Russo continued, “I am excited to announce the promotion of

Chris Frankenfield to chief financial officer of Xilio. Chris’

strategic, financial and operational expertise, together with his

collaborative approach and experience building companies, will be

instrumental in advancing our pipeline of novel tumor-activated

immuno-oncology therapies.”

Pipeline and Business

Updates

XTX101: tumor-activated

anti-CTLA-4

XTX101 is an investigational tumor-activated, Fc-enhanced, high

affinity binding anti-CTLA-4 designed to block CTLA-4 and deplete

regulatory T cells when activated (unmasked) in the tumor

microenvironment (TME).

- Xilio today announced the initiation of enrollment in its Phase

2 clinical trial of XTX101 in combination with atezolizumab in

patients with MSS CRC, including patients with and without liver

metastases. The trial will evaluate the safety and efficacy of

XTX101 at 100 mg every six weeks (Q6W) in combination with

atezolizumab at 1200 mg every three weeks (Q3W).

- Xilio expects to report initial Phase 2 data for XTX101 in

combination with atezolizumab in approximately 20 patients with MSS

CRC in the fourth quarter of 2024 and in approximately 20

additional patients (40 patients total) in the first quarter of

2025.

XTX301: tumor-activated, engineered

IL-12

XTX301 is an investigational tumor-activated, engineered IL-12

molecule designed to potently stimulate anti-tumor immunity and

reprogram the TME of poorly immunogenic “cold” tumors towards an

inflamed, or “hot,” state.

- Xilio today announced the initiation of enrollment in Phase 1B

monotherapy dose expansion of its ongoing Phase 1 clinical trial of

XTX301 in patients with advanced solid tumors. In addition,

enrollment in monotherapy dose escalation for XTX301 is ongoing,

with XTX301 currently being evaluated at a dose level of 60 ug/kg

Q6W (preceded by a single priming dose of 15 ug/kg). To date,

XTX301 has been generally well-tolerated, with no dose-limiting

toxicities observed in patients.

- Xilio expects to report safety, pharmacokinetic and

pharmacodynamic data from the ongoing Phase 1 clinical trial for

XTX301 in the fourth quarter of 2024.

Tumor-activated bispecific and immune cell

engager programs

- Xilio is advancing a pipeline of research-stage tumor-activated

bispecifics and immune cell engagers, including tumor-activated

cell engagers and tumor-activated effector-enhanced cell engagers,

leveraging the company’s masking technology.

Corporate

Updates

- Xilio today announced the promotion of Chris Frankenfield to

chief financial officer. Mr. Frankenfield will also continue to

serve in his current role as chief operating officer.

- In June 2024, Xilio announced the appointments of Aoife

Brennan, M.D., and James Shannon, M.D., to its board of

directors.

Second Quarter 2024 Financial

Results

- Cash Position: Cash and cash equivalents

were $74.9 million as of June 30, 2024, compared to $44.7 million

as of December 31, 2023. Cash and cash equivalents as of June 30,

2024 included the $30.0 million upfront payment under the company’s

license agreement with Gilead Sciences, Inc. (Gilead) for XTX301,

approximately $28.1 million in gross proceeds from the sale and

issuance of common stock and prefunded warrants to certain existing

accredited investors and Gilead in private placements and $7.0

million in gross proceeds from the sale and issuance of common

stock under the company’s at-the-market offering program.

- License Revenue: License revenue was $2.4

million for the quarter ended June 30, 2024, which was associated

with revenue recognized under the license agreement and stock

purchase agreement with Gilead. No license revenue was recognized

prior to the quarter ended June 30, 2024.

- Research & Development (R&D)

Expenses: R&D expenses were $11.2 million for the

quarter ended June 30, 2024, compared to $13.2 million for the

quarter ended June 30, 2023. The decrease was primarily driven by

decreased manufacturing activities for XTX301, decreased clinical

development activities for XTX202, decreased spending related to

early-stage programs and indirect research and development costs

and decreased personnel-related costs, partially offset by a $1.0

million development milestone payment to WuXi Biologics (Hong Kong)

Limited under the company’s CTLA-4 monoclonal antibody license

agreement, and increased clinical development activities for XTX101

and XTX301.

- General & Administrative (G&A)

Expenses: G&A expenses were $5.8 million for the

quarter ended June 30, 2024, compared to $6.9 million for the

quarter ended June 30, 2023. The decrease was primarily driven by

decreased personnel-related costs, decreased professional and

consulting fees, lower costs related to directors’ and officers’

liability insurance and a reduction in other general and

administrative expenses.

- Net Loss: Net loss was $13.9 million for

the quarter ended June 30, 2024, compared to $19.4 million for the

quarter ended June 30, 2023.

Financial Guidance

Based on its current operating plans, Xilio anticipates that its

existing cash and cash equivalents as of June 30, 2024 will be

sufficient to fund its operating expenses and capital expenditure

requirements into the second quarter of 2025.

About XTX101 (anti-CTLA-4) and the Phase 1/2 Combination

Clinical Trial

XTX101 is an investigational tumor-activated, Fc-enhanced, high

affinity binding anti-CTLA-4 monoclonal antibody designed to block

CTLA-4 and deplete regulatory T cells when activated (unmasked) in

the tumor microenvironment. In the third quarter of 2023, Xilio

entered into a co-funded clinical trial collaboration with Roche to

evaluate XTX101 in combination with atezolizumab (Tecentriq®) in a

multi-center, open-label Phase 1/2 clinical trial. Xilio is

currently evaluating the safety and efficacy of the combination in

a Phase 2 clinical trial in patients with microsatellite stable

colorectal cancer. Please refer to NCT04896697 on

www.clinicaltrials.gov for additional details.

About XTX301 (IL-12) and the Phase 1 Clinical

Trial

XTX301 is an investigational tumor-activated IL-12 designed to

potently stimulate anti-tumor immunity and reprogram the tumor

microenvironment of poorly immunogenic “cold” tumors towards an

inflamed or “hot” state. In March 2024, Xilio entered into an

exclusive license agreement with Gilead Sciences, Inc. for Xilio’s

tumor-activated IL-12 program, including XTX301. Xilio is currently

evaluating the safety and tolerability of XTX301 as a monotherapy

in patients with advanced solid tumors in a first-in-human,

multi-center, open-label Phase 1 clinical trial. Please refer to

NCT05684965 on www.clinicaltrials.gov for additional details.

About Xilio Therapeutics

Xilio Therapeutics is a clinical-stage biotechnology company

discovering and developing tumor-activated immuno-oncology (I-O)

therapies with the goal of significantly improving outcomes for

people living with cancer without the systemic side effects of

current I-O treatments. The company is using its proprietary

platform to advance a pipeline of novel, tumor-activated clinical

and preclinical I-O molecules that are designed to optimize the

therapeutic index by localizing anti-tumor activity within the

tumor microenvironment, including tumor-activated cytokines and

antibodies (including bispecifics) and immune cell engagers

(including tumor-activated cell engagers and tumor-activated

effector-enhanced cell engagers). Learn more by visiting

http://www.xiliotx.com and follow us on LinkedIn (Xilio

Therapeutics, Inc.).

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended, including, without limitation, statements

regarding plans, expectations and anticipated milestones for XTX101

and XTX301, including plans and timing for reporting clinical data

for each of these programs; the potential for Xilio to leverage its

research platform to develop masked immune cell engager molecules;

the potential benefits of any of Xilio’s current or future product

candidates in treating patients as a monotherapy or combination

therapy; Xilio’s estimated cash and cash equivalents and the period

in which Xilio expects to have cash to fund its operations; and

Xilio’s strategy, goals and anticipated financial performance,

milestones, business plans and focus. The words “aim,” “may,”

“will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “believe,” “estimate,” “predict,” “project,” “potential,”

“continue,” “seek,” “target” and similar expressions are intended

to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Any

forward-looking statements in this press release are based on

management’s current expectations and beliefs and are subject to a

number of important risks, uncertainties and other factors that may

cause actual events or results to differ materially from those

expressed or implied by any forward-looking statements contained in

this press release, including, without limitation, general market

conditions; risks and uncertainties related to ongoing and planned

research and development activities, including initiating,

conducting or completing preclinical studies and clinical trials

and the timing and results of such preclinical studies or clinical

trials; the delay of any current or planned preclinical studies or

clinical trials or the development of Xilio’s current or future

product candidates; Xilio’s ability to obtain and maintain

sufficient preclinical and clinical supply of current or future

product candidates; Xilio’s advancement of multiple early-stage

immune cell engager programs, including tumor-activated cell

engagers and tumor-activated effector-enhanced cell engagers;

interim or preliminary preclinical or clinical data or results,

which may not be replicated in or predictive of future preclinical

or clinical data or results; Xilio’s ability to successfully

demonstrate the safety and efficacy of its product candidates and

gain approval of its product candidates on a timely basis, if at

all; results from preclinical studies or clinical trials for

Xilio’s product candidates, which may not support further

development of such product candidates; actions of regulatory

agencies, which may affect the initiation, timing and progress of

current or future clinical trials; Xilio’s ability to obtain,

maintain and enforce patent and other intellectual property

protection for current or future product candidates; Xilio’s

ability to obtain and maintain sufficient cash resources to fund

its operations; the impact of international trade policies on

Xilio’s business, including U.S. and China trade policies; Xilio’s

ability to maintain its clinical trial collaboration with Roche to

develop XTX101 in combination with atezolizumab; and Xilio’s

ability to maintain its license agreement with Gilead to develop

and commercialize XTX301. These and other risks and uncertainties

are described in greater detail in the sections entitled “Risk

Factor Summary” and “Risk Factors” in Xilio’s filings with the U.S.

Securities and Exchange Commission (SEC), including Xilio’s most

recent Quarterly Report on Form 10-Q and any other filings that

Xilio has made or may make with the SEC in the future. Any

forward-looking statements contained in this press release

represent Xilio’s views only as of the date hereof and should not

be relied upon as representing its views as of any subsequent date.

Except as required by law, Xilio explicitly disclaims any

obligation to update any forward-looking statements.

This press release contains hyperlinks to information that is

not deemed to be incorporated by reference in this press

release.

TECENTRIQ is a registered trademark of Genentech USA, Inc., a

member of the Roche Group.

Contacts:

|

Investors:Melissa ForstArgot PartnersXilio@argotpartners.com |

Media:Dan Budwick1ABdan@1abmedia.com |

|

XILIO THERAPEUTICS, INC.Condensed

Consolidated Balance Sheets(In

thousands)(Unaudited) |

|

|

|

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

| |

|

2024 |

|

2023 |

| Assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

74,949 |

|

$ |

44,704 |

|

Other assets |

|

|

14,924 |

|

|

16,222 |

|

Total assets |

|

|

89,873 |

|

|

60,926 |

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

Deferred revenue |

|

|

36,767 |

|

|

— |

|

Other liabilities |

|

|

19,690 |

|

|

24,099 |

|

Total liabilities |

|

|

56,457 |

|

|

24,099 |

|

Stockholders’ equity |

|

|

33,416 |

|

|

36,827 |

|

Total liabilities and stockholders’ equity |

|

|

89,873 |

|

|

60,926 |

|

XILIO THERAPEUTICS, INC.Condensed

Consolidated Statements of Operations and Comprehensive

Loss(In thousands, except share and per share

data)(Unaudited) |

| |

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

License revenue |

|

$ |

2,357 |

|

|

$ |

— |

|

|

$ |

2,357 |

|

|

$ |

— |

|

| Operating expenses (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

11,216 |

|

|

|

13,218 |

|

|

|

21,616 |

|

|

|

29,349 |

|

|

General and administrative |

|

|

5,815 |

|

|

|

6,898 |

|

|

|

11,954 |

|

|

|

14,293 |

|

|

Restructuring |

|

|

30 |

|

|

|

— |

|

|

|

978 |

|

|

|

— |

|

|

Total operating expenses |

|

|

17,061 |

|

|

|

20,116 |

|

|

|

34,548 |

|

|

|

43,462 |

|

|

Loss from operations |

|

|

(14,704 |

) |

|

|

(20,116 |

) |

|

|

(32,191 |

) |

|

|

(43,642 |

) |

| Other income, net |

|

|

779 |

|

|

|

761 |

|

|

|

1,063 |

|

|

|

1,641 |

|

| Net loss and comprehensive

loss |

|

$ |

(13,925 |

) |

|

$ |

(19,355 |

) |

|

$ |

(31,128 |

) |

|

$ |

(42,001 |

) |

| Net loss per share, basic and

diluted |

|

$ |

(0.24 |

) |

|

$ |

(0.70 |

) |

|

$ |

(0.73 |

) |

|

$ |

(1.53 |

) |

| Weighted average common shares

outstanding, basic and diluted |

|

|

57,760,178 |

|

|

|

27,468,668 |

|

|

|

42,836,381 |

|

|

|

27,451,058 |

|

(1) Operating expenses include the following amounts

of non-cash stock-based compensation expense:

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2024 |

|

2023 |

|

2024 |

|

|

2023 |

|

Research and development expense |

|

$ |

385 |

|

$ |

549 |

|

$ |

891 |

|

$ |

1,122 |

| General and administrative

expense |

|

|

1,126 |

|

|

1,251 |

|

|

2,453 |

|

|

2,469 |

|

Total stock-based compensation expense |

|

$ |

1,511 |

|

$ |

1,800 |

|

$ |

3,344 |

|

$ |

3,591 |

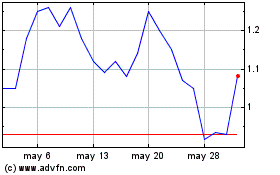

Xilio Therapeutics (NASDAQ:XLO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Xilio Therapeutics (NASDAQ:XLO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024