Additional Proxy Soliciting Materials (definitive) (defa14a)

28 Abril 2023 - 3:55PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | |

Filed by the Registrant x |

Filed by a Party other than the Registrant ¨ |

Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

|

ACCEL ENTERTAINMENT, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Accel Entertainment, Inc.

Supplement to the Proxy Statement for the Annual Meeting of Shareholders to be held on May 4, 2023.

This proxy statement supplement (this “Proxy Supplement”) supplements, updates and amends the definitive proxy statement of Accel Entertainment, Inc. (the “Company”) filed with the Securities and Exchange Commission on March 24, 2023 (the “Proxy Statement”) regarding the annual meeting of shareholders to be held on May 4, 2023 (the “Annual Meeting”).

This Proxy Supplement contains important supplemental information to the Proxy Statement and should be read in conjunction with the Proxy Statement. To the extent that information in this Proxy Supplement differs from, conflicts with, or updates information contained in the Proxy Statement, the information in this Proxy Supplement is more current and shall prevail. The Company is providing you with the following additional information in order to further assist you in voting your shares at the Annual Meeting.

On April 27, 2023, the Company entered into an amendment (the “Amendment”) to the Executive Employment Agreement with the Company’s Chief Executive Officer, Andrew Rubenstein (the “Rubenstein Employment Agreement”). Pursuant to the Amendment, Mr. Rubenstein’s base salary will be increased to $925,000. The

Amendment extends the term of the Rubenstein Employment Agreement to April 27, 2026, unless earlier terminated in accordance with its terms.

In connection with the Amendment, Mr. Rubenstein has been granted a performance-based restricted stock unit representing the opportunity to receive 520,247 shares of the Company’s Class A-1 common stock (the “PSUs”). The PSUs will vest subject to Mr. Rubenstein’s continued employment with the Company through April 27, 2026 (the “Service Condition”) and the achievement of a performance-based vesting condition, whereby one-third of the shares underlying the PSUs will satisfy such performance-based vesting condition if the Company’s volume-weighted average trading price (including reinvestment of dividends) over any 20 trading-day period ending on or prior to April 27, 2026 meets or exceeds the stock price hurdles set forth in the table below (the “Performance Condition”). Each stock price hurdle may be achieved only once during the Measurement Period.

| | | | | | | | | | | |

| Threshold Performance | Target Performance | Maximum Performance |

| Stock Price Hurdle | $12.00 | $12.50 | $13.00 |

In the event of a change in control of the Company, the Performance Condition will be evaluated for a final time based on the per share price implied by the definitive agreement governing such change in control, and the portion of the PSUs for which the Performance Condition has been satisfied will thereafter vest subject only to the Service Condition.

The Service Condition will be deemed satisfied in full in the event of a Qualifying Termination (as defined in the Rubenstein Employment Agreement). The portion of the PSUs, if any, for which the Performance Condition has been satisfied shall vest upon the satisfaction of the Service Condition. Any PSUs for which the Performance Condition has not been satisfied as of the satisfaction of the Service Condition will be forfeited for no consideration.

In addition, Mr. Rubenstein will be prohibited from selling or otherwise disposing of the shares of the Company’s Class A-1 common stock that he is issued in settlement of the PSUs until the earlier of April 27, 2027 and a change in control of the Company. This restriction will not apply to any shares of the Company’s Class A-1 common stock that are sold in connection with a “sell to cover” transaction in order to satisfy tax withholding obligations. In addition, this restriction will lapse if at any time Mr. Rubenstein is no longer providing service to the Company in any capacity (including as an officer, employee, consultant, or member of the Company’s board of directors) and is not the beneficial owner of at least 7,000,000 shares of the Company’s capital stock, as determined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (as such number of shares may be adjusted in the sole discretion of the Company’s board of directors or compensation committee to take into account any stock split, stock dividend, reclassification, or other similar transaction). Additionally, on April 27, 2023, the board of directors of the Company modified the Company’s non-employee director compensation policy to provide that in 2023 and future years, the Company’s Non-Executive Chairman will receive an annual grant of restricted stock units (“RSUs”) with a grant date value of $310,000 that vests annually, in lieu of the cash retainer and annual RSU grant provided to the Company’s other non-employee directors other than the Vice Chairman. Prior to 2023, the Company’s Non-Executive Chairman had waived all of his non-employee director compensation.

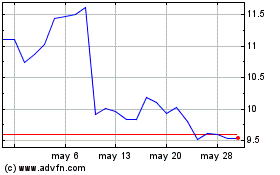

Accel Entertainment (NYSE:ACEL)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

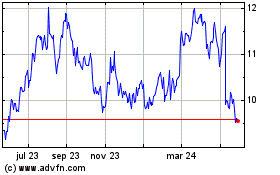

Accel Entertainment (NYSE:ACEL)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024