ADC Therapeutics SA (NYSE: ADCT), a commercial-stage global leader

and pioneer in the field of antibody drug conjugates (ADCs), today

reported financial results for the second quarter ended June 30,

2024, and provided operational updates.

“We continue to make progress on multiple fronts, including

reaching a key milestone as ZYNLONTA achieves commercial

profitability in the first half of the year. We are excited about

the potential to further our growth as we move toward expanding

into the second line setting of DLBCL and indolent lymphomas,” said

Ameet Mallik, Chief Executive Officer of ADC Therapeutics.

“Additionally, we have now passed futility analysis with LOTIS-5

and expect to complete enrollment this year, while also planning to

deliver updates on the LOTIS-7 trial and on ADCT-601 targeting AXL.

With our expected cash runway extended into mid-2026, we are well

positioned to execute our strategy and advance multiple

value-generating catalysts before year-end.”

Second Quarter 2024 Operational Updates & Recent

Highlights

- ZYNLONTA: Reached commercial profitability in

the first half of 2024, generating net product sales of $17.0

million in the second quarter of 2024, a 5% decrease as compared to

revenue of $17.8 million in the first quarter of 2024. Demand was

impacted in part by variability in ordering patterns in the second

quarter.

- LOTIS-7: During the second quarter, the

Company announced the completion of dose escalation in LOTIS-7, a

Phase 1b open-label clinical trial evaluating ZYNLONTA in

combination with bispecific antibodies glofitamab or mosunetuzumab

in heavily pre-treated patients with relapsed/refractory B-cell

non-Hodgkin lymphoma (r/r B-NHL). Enrollment in the Part 2 dose

expansion is progressing and completion is expected by year-end. An

update on safety and efficacy in evaluable patients is expected by

year-end, with data on all patients anticipated in the first half

of 2025.

- LOTIS-5: The Phase 3 confirmatory trial for

ZYNLONTA in combination with rituximab in patients with 2L+ diffuse

large B-cell lymphoma (DLBCL). An Independent Data Monitoring

Committee (IDMC) conducted a prespecified interim analysis of

unblinded data and has recommended that the trial continue as

planned without modifications. Enrollment is nearing completion in

the randomized portion of the trial with full enrollment expected

before year-end 2024.

- Investigator-initiated trial in marginal zone lymphoma

(MZL): Partial data from an investigator-initiated Phase 2

clinical trial evaluating ZYNLONTA for the treatment of

relapsed/refractory (r/r) MZL were presented on May 6, 2024 at the

Lymphoma Research Foundation’s 2024 Marginal Zone Lymphoma

Scientific Workshop by the trial’s lead investigator. Initial data

from the first 15 evaluable patients showed 13 achieved a complete

response and 1 achieved a partial response. The multi-center study

is designed to enroll 50 patients. Additional data publications and

presentations at medical congresses are expected in 2024 or

2025.

- Investigator-initiated trial in follicular lymphoma

(FL): The investigator-initiated Phase 2 clinical trial

evaluating ZYNLONTA in combination with rituximab in patients with

relapsed/refractory follicular lymphoma is currently being

conducted at the Sylvester Comprehensive Cancer Center at the

University of Miami Miller School of Medicine. Additional updates

are expected at medical congresses in 2024 or 2025.

- ADCT-601 (targeting AXL): The Phase 1b trial

in ADCT-601 targeting AXL continues enrolling patients in both the

sarcoma and pancreatic cancer arms, optimizing dose and schedule.

We plan to share an initial update from the Phase 1 trial in

patients in the second half of 2024.

- Early-stage pipeline: Progress continues in

the IND-enabling studies for the Company’s PSMA, NaPi2b and

Claudin-6 targeting ADCs. ASCT2 targeting ADC is in drug candidate

selection stage and is still on track to complete this year. The

Company has selected one target to move forward toward IND which we

expect to disclose in 2025.

Second Quarter and First Half 2024

Financial Results

- Cash and cash equivalents: As of June 30,

2024, cash and cash equivalents were $300.1 million, compared to

$278.6 million as of December 31, 2023. In May 2024 the Company

completed an underwritten offering resulting in net proceeds of

approximately $97.4 million, extending the expected cash runway

into mid-2026.

- Product Revenues: Net product revenues were

$17.0 million for the second quarter ended June 30, 2024 and $34.9

million for the first six months of 2024 as compared to $19.2

million and $38.2 million for the same periods in 2023. The

quarter-over-quarter decrease is primarily due to lower sales

volume, partially offset by a higher price. The year-to-date

decrease is primarily due to lower sales volumes, as well as higher

gross-to-net deductions primarily due to the discarded drug rebate

accrual partially offset by a higher price.

- Research and Development (R&D) Expense:

R&D expense was $24.3 million and $50.0 million for the three

and six months ended June 30, 2024, respectively. This compares to

R&D expense of $31.3 million and $69.7 million for the same

periods in 2023. The decrease is due primarily to implementation of

productivity initiatives and focused investment in prioritized

development programs.

- Selling and Marketing (S&M) Expense:

S&M expense was $10.7 million and $22.1 million for the three

and six months ended June 30, 2024, respectively. This compares to

S&M expense of $14.5 million and $29.8 million for the same

periods in 2023. The decrease in S&M expense was primarily due

to lower marketing and advertising costs and personnel related

expenses.

- General & Administrative (G&A)

Expense: G&A expense was $10.2 million and $22.3

million for the three and six months ended June 30, 2024,

respectively. This compares to G&A expense of $12.0 million and

$27.5 million for the same periods in 2023. The

quarter-over-quarter decrease in G&A expense was primarily

related to lower legal and audit fees, insurance and IT expenses

while the year-to-date decrease was primarily related to lower

insurance and IT expenses, partially offset by higher legal and

audit fees.

- Net Loss: Net loss for the quarter ended June

30, 2024 was $36.5 million, or a net loss of $0.38 per basic and

diluted share, as compared to net loss of $48.9 million, or a net

loss of $0.60 per basic and diluted share for the same period in

2023. Net loss for the six months ended June 30, 2024 was $83.2

million, or a net loss of $0.93 per basic and diluted share, as

compared to net loss of $108.3 million, or a net loss of $1.33 per

basic and diluted share for the six months ended June 30, 2023. The

decrease is primarily due to lower operating expenses.

- Adjusted Net Loss: Adjusted net loss, which is

a non-GAAP financial measure, was $24.4 million, or an adjusted net

loss of $0.25 per basic and diluted share for the quarter ended

June 30, 2024 as compared to adjusted net loss of $32.1 million, or

$0.39 per basic and diluted share, for the same period in 2023.

Adjusted net loss for the six months ended June 30, 2024 was $55.5

million, or an adjusted net loss of $0.62 per basic and diluted

share, as compared to net loss of $73.9 million, or an adjusted net

loss of $0.91 per basic and diluted share for the six months ended

June 30, 2023. The decrease in adjusted net loss is primarily

attributable to lower operating expenses.

Conference Call Details

ADC Therapeutics management will host a

conference call and live audio webcast to discuss second quarter

2024 financial results and provide a company update today at 8:30

a.m. Eastern Time. To access the conference call, please register

here. Registrants will receive the dial-in number and unique PIN.

It is recommended that you join 10 minutes before the event, though

you may pre-register at any time. A live webcast of the call will

be available under “Events & Presentations” in the Investors

section of the ADC Therapeutics website at ir.adctherapeutics.com.

The archived webcast will be available for 30 days following the

call.

About ZYNLONTA®

ZYNLONTA® is a CD19-directed antibody drug

conjugate (ADC). Once bound to a CD19-expressing cell, ZYNLONTA is

internalized by the cell, where enzymes release a

pyrrolobenzodiazepine (PBD) payload. The potent payload binds to

DNA minor groove with little distortion, remaining less visible to

DNA repair mechanisms. This ultimately results in cell cycle arrest

and tumor cell death.

The U.S. Food and Drug Administration (FDA) and

the European Medicines Agency (EMA) have approved ZYNLONTA

(loncastuximab tesirine-lpyl) for the treatment of adult patients

with relapsed or refractory (r/r) large B-cell lymphoma after two

or more lines of systemic therapy, including diffuse large B-cell

lymphoma (DLBCL) not otherwise specified (NOS), DLBCL arising from

low-grade lymphoma and also high-grade B-cell lymphoma. The trial

included a broad spectrum of heavily pre-treated patients (median

three prior lines of therapy) with difficult-to-treat disease,

including patients who did not respond to first-line therapy,

patients refractory to all prior lines of therapy, patients with

double/triple hit genetics and patients who had stem cell

transplant and CAR-T therapy prior to their treatment with

ZYNLONTA. This indication is approved by the FDA under accelerated

approval and in the European Union under conditional approval based

on overall response rate and continued approval for this indication

may be contingent upon verification and description of clinical

benefit in a confirmatory trial. Please see full prescribing

information including important safety information about ZYNLONTA

at www.ZYNLONTA.com.

ZYNLONTA is also being evaluated as a

therapeutic option in combination studies in other B-cell

malignancies and earlier lines of therapy.

About ADC Therapeutics

ADC Therapeutics (NYSE: ADCT) is a

commercial-stage global leader and pioneer in the field of antibody

drug conjugates (ADCs). The Company is advancing its proprietary

ADC technology to transform the treatment paradigm for patients

with hematologic malignancies and solid tumors.

ADC Therapeutics’ CD19-directed ADC ZYNLONTA

(loncastuximab tesirine-lpyl) received accelerated approval by the

FDA and conditional approval from the European Commission for the

treatment of relapsed or refractory diffuse large B-cell lymphoma

after two or more lines of systemic therapy. ZYNLONTA is also in

development in combination with other agents and in earlier lines

of therapy. In addition to ZYNLONTA, ADC Therapeutics has multiple

ADCs in ongoing clinical and preclinical development.

ADC Therapeutics is based in Lausanne (Biopôle),

Switzerland and has operations in London and New Jersey. For more

information, please visit https://adctherapeutics.com/ and follow

the Company on LinkedIn.

ZYNLONTA® is a registered trademark of ADC Therapeutics SA.

Use of Non-GAAP Financial

Measures

In addition to financial information prepared in

accordance with U.S. Generally Accepted Accounting Principles

(GAAP), this document also contains certain non-GAAP financial

measures based on management’s view of performance including:

- Adjusted total operating

expenses

- Adjusted net loss

- Adjusted net loss per share

Management uses such measures internally when

monitoring and evaluating our operational performance, generating

future operating plans and making strategic decisions regarding the

allocation of capital. We believe that these adjusted financial

measures provide useful information to investors and others in

understanding and evaluating our operating results in the same

manner as our management and facilitate operating performance

comparability across both past and future reporting periods. These

non-GAAP measures have limitations as financial measures and should

be considered in addition to, and not in isolation or as a

substitute for, the information prepared in accordance with GAAP.

When preparing these supplemental non-GAAP measures, management

typically excludes certain GAAP items that management does not

believe are indicative of our ongoing operating performance.

Furthermore, management does not consider these GAAP items to be

normal, recurring cash operating expenses; however, these items may

not meet the GAAP definition of unusual or non-recurring items.

Since non-GAAP financial measures do not have standardized

definitions and meanings, they may differ from the non-GAAP

financial measures used by other companies, which reduces their

usefulness as comparative financial measures. Because of these

limitations, you should consider these adjusted financial measures

alongside other GAAP financial measures.

The following items are excluded from adjusted

total operating expenses:

Shared-Based Compensation Expense: We exclude share-based

compensation expense from our adjusted financial measures because

share-based compensation expense, which is non-cash, fluctuates

from period to period based on factors that are not within our

control, such as our stock price on the dates share-based grants

are issued. Share-based compensation expense has been, and will

continue to be for the foreseeable future, a recurring expense in

our business and an important part of our compensation

strategy.

The following items are excluded from adjusted net loss and

adjusted net loss per share:

Shared-Based Compensation Expense: We exclude

share-based compensation expense from our adjusted financial

measures because share-based compensation expense, which is

non-cash, fluctuates from period to period based on factors that

are not within our control, such as our stock price on the dates

share-based grants are issued. Share-based compensation expense has

been, and will continue to be for the foreseeable future, a

recurring expense in our business and an important part of our

compensation strategy.

Certain Other Items: We exclude certain other

significant items that we believe do not represent the performance

of our business, from our adjusted financial measures. Such items

are evaluated by management on an individual basis based on both

quantitative and qualitative aspects of their nature. While not

all-inclusive, examples of certain other significant items excluded

from our adjusted financial measures would be: changes in the fair

value of warrant obligations and the effective interest expense

associated with the senior secured term loan facility and the

effective interest expense and cumulative catch-up adjustments

associated with the deferred royalty obligation under the royalty

purchase agreement with HealthCare Royalty Partners.

See the attached Reconciliation of GAAP Measures

to Non-GAAP Measures for explanations of the amounts excluded and

included to arrive at the non-GAAP financial measures.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. In some cases you can identify

forward-looking statements by terminology such as “may”, “will”,

“should”, “would”, “expect”, “intend”, “plan”, “anticipate”,

“believe”, “estimate”, “predict”, “potential”, “seem”, “seek”,

“future”, “continue”, or “appear” or the negative of these terms or

similar expressions, although not all forward-looking statements

contain these identifying words. Forward-looking statements are

subject to certain risks and uncertainties that can cause actual

results to differ materially from those described. Factors that may

cause such differences include, but are not limited to: the

expected cash runway into mid-2026 the Company’s ability to grow

ZYNLONTA® revenue in the United States; the ability of our partners

to commercialize ZYNLONTA® in foreign markets, the timing and

amount of future revenue and payments to us from such partnerships

and their ability to obtain regulatory approval for ZYNLONTA® in

foreign jurisdictions; the timing and results of the Company’s or

its partners’ research and development projects or clinical trials

including LOTIS 5 and 7, ADCT 601 and 602 as well as early research

in certain solid tumors with different targets, linkers and

payloads; the timing and results of investigator-initiated trials

including those studying FL and MZL and the potential regulatory

and/or compendia strategy and the future opportunity; the timing

and outcome of regulatory submissions for the Company’s products or

product candidates; actions by the FDA or foreign regulatory

authorities; projected revenue and expenses; the Company’s

indebtedness, including Healthcare Royalty Management and Blue Owl

and Oaktree facilities, and the restrictions imposed on the

Company’s activities by such indebtedness, the ability to comply

with the terms of the various agreements and repay such

indebtedness and the significant cash required to service such

indebtedness; and the Company’s ability to obtain financial and

other resources for its research, development, clinical, and

commercial activities. Additional information concerning these and

other factors that may cause actual results to differ materially

from those anticipated in the forward-looking statements is

contained in the “Risk Factors” section of the Company's Annual

Report on Form 10-K and in the Company's other periodic and current

reports and filings with the U.S. Securities and Exchange

Commission. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results,

performance, achievements or prospects to be materially different

from any future results, performance, achievements or prospects

expressed in or implied by such forward-looking statements. The

Company cautions investors not to place undue reliance on the

forward-looking statements contained in this document.

ADC Therapeutics

SACondensed Consolidated Statements of Operation

(Unaudited)(in thousands, except for share and per

share data)

| |

|

For the Three Months Ended June 30, |

|

For the Six Months Ended June 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Revenue |

|

|

|

|

|

|

|

|

| Product revenues, net |

|

$ |

17,030 |

|

$ |

19,197 |

|

$ |

34,878 |

|

$ |

38,150 |

| License revenues and

royalties |

|

380 |

|

86 |

|

585 |

|

125 |

| Total revenue,

net |

|

17,410 |

|

19,283 |

|

35,463 |

|

38,275 |

| Operating expense |

|

|

|

|

|

|

|

|

|

Cost of product sales |

|

(1,217) |

|

(1,132) |

|

(3,727) |

|

(1,105) |

|

Research and development |

|

(24,295) |

|

(31,342) |

|

(50,030) |

|

(69,717) |

|

Selling and marketing |

|

(10,701) |

|

(14,456) |

|

(22,091) |

|

(29,807) |

|

General and administrative |

|

(10,238) |

|

(12,002) |

|

(22,269) |

|

(27,505) |

| Total operating expense |

|

(46,451) |

|

(58,932) |

|

(98,117) |

|

(128,134) |

| Loss from

operations |

|

(29,041) |

|

(39,649) |

|

(62,654) |

|

(89,859) |

| |

|

|

|

|

|

|

|

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

Interest income |

|

3,253 |

|

2,372 |

|

6,201 |

|

4,547 |

|

Interest expense |

|

(12,679) |

|

(10,309) |

|

(25,175) |

|

(20,600) |

|

Other, net |

|

2,754 |

|

(5,067) |

|

159 |

|

(4,234) |

| Total other expense, net |

|

(6,672) |

|

(13,004) |

|

(18,815) |

|

(20,287) |

| Loss before income

taxes |

|

(35,713) |

|

(52,653) |

|

(81,469) |

|

(110,146) |

|

Income tax (expense) benefit |

|

(234) |

|

4,498 |

|

(397) |

|

3,980 |

| Loss before equity in

net losses of joint venture |

|

(35,947) |

|

(48,155) |

|

(81,866) |

|

(106,166) |

|

Equity in net losses of joint venture |

|

(597) |

|

(767) |

|

(1,284) |

|

(2,130) |

| Net loss |

|

$ |

(36,544) |

|

$ |

(48,922) |

|

$ |

(83,150) |

|

$ |

(108,296) |

| |

|

|

|

|

|

|

|

|

| Net loss per

share |

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.38) |

|

$ |

(0.60) |

|

$ |

(0.93) |

|

$ |

(1.33) |

|

Weighted average shares outstanding, basic and diluted |

|

95,691,245 |

|

81,471,127 |

|

89,121,783 |

|

81,140,287 |

|

|

|

|

|

|

|

|

|

|

ADC Therapeutics

SACondensed Consolidated Balance Sheet

(Unaudited)(in thousands)

|

|

|

June 30, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

|

| Current

assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

300,119 |

|

$ |

278,598 |

|

Accounts receivable, net |

|

22,868 |

|

25,182 |

|

Inventory |

|

15,191 |

|

16,177 |

|

Prepaid expenses and other current assets |

|

17,181 |

|

16,334 |

| Total current

assets |

|

355,359 |

|

336,291 |

| Non-current

assets |

|

|

|

|

|

Property and equipment, net |

|

5,483 |

|

5,622 |

|

Operating lease right-of-use assets |

|

9,685 |

|

10,511 |

|

Interest in joint venture |

|

260 |

|

1,647 |

|

Other long-term assets |

|

992 |

|

711 |

| Total

assets |

|

$ |

371,779 |

|

$ |

354,782 |

| |

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

|

| Current

liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

10,708 |

|

$ |

15,569 |

|

Accrued expenses and other current liabilities |

|

46,924 |

|

52,101 |

| Total current

liabilities |

|

57,632 |

|

67,670 |

| |

|

|

|

|

|

Deferred royalty obligation, long-term |

|

316,211 |

|

303,572 |

|

Senior secured term loans |

|

113,673 |

|

112,730 |

|

Operating lease liabilities, long-term |

|

9,309 |

|

10,180 |

|

Other long-term liabilities |

|

6,624 |

|

8,879 |

| Total

liabilities |

|

503,449 |

|

503,031 |

| |

|

|

|

|

| Total shareholders’

equity (deficit) |

|

(131,670) |

|

(148,249) |

| |

|

|

|

|

| Total liabilities and

shareholders’ equity (deficit) |

|

$ |

371,779 |

|

$ |

354,782 |

| |

|

|

|

|

|

|

ADC Therapeutics SA

Reconciliation of GAAP Measures to

Non-GAAP Measures (Unaudited)(in thousands, except

for share and per share data)

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

(in thousands) |

2024 |

|

2023 |

|

Change |

|

% Change |

|

2024 |

|

2023 |

|

Change |

|

% Change |

| Total operating

expense |

(46,451) |

|

(58,932) |

|

12,481 |

|

(21)% |

|

$ |

(98,117) |

|

$ |

(128,134) |

|

$ |

30,017 |

|

(23)% |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share-based compensation

expense (i) |

1,988 |

|

1,118 |

|

870 |

|

78% |

|

2,146 |

|

9,192 |

|

(7,046) |

|

(77)% |

| Adjusted total

operating expenses |

(44,463) |

|

(57,814) |

|

13,351 |

|

(23)% |

|

$ |

(95,971) |

|

$ |

(118,942) |

|

$ |

22,971 |

|

(19)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

in thousands (except for share and per share

data) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net loss |

$ |

(36,544) |

|

$ |

(48,922) |

|

$ |

(83,150) |

|

$ |

(108,296) |

|

Adjustments: |

|

|

|

|

|

|

|

| Share-based compensation

expense (i) |

1,988 |

|

1,118 |

|

2,146 |

|

9,192 |

| Deerfield warrants obligation,

change in fair value (income) expense (ii) |

(2,230) |

|

(20) |

|

838 |

|

(636) |

| Effective interest expense on

senior secured term loan facility (iii) |

4,413 |

|

4,480 |

|

8,816 |

|

9,020 |

| Deferred royalty obligation

interest expense (iv) |

8,266 |

|

5,829 |

|

16,359 |

|

11,575 |

| Deferred royalty obligation

cumulative catch-up adjustment (income) expense (iv) |

(263) |

|

5,417 |

|

(526) |

|

5,288 |

| Adjusted net

loss |

$ |

(24,370) |

|

$ |

(32,098) |

|

$ |

(55,517) |

|

$ |

(73,857) |

| |

|

|

|

|

|

|

|

| Net loss per share, basic and

diluted |

$ |

(0.38) |

|

$ |

(0.60) |

|

$ |

(0.93) |

|

$ |

(1.33) |

| Adjustment to net loss per

share, basic and diluted |

0.13 |

|

0.21 |

|

0.31 |

|

0.42 |

| Adjusted net loss per

share, basic and diluted |

$ |

(0.25) |

|

$ |

(0.39) |

|

$ |

(0.62) |

|

$ |

(0.91) |

| Weighted average shares

outstanding, basic and diluted |

95,691,245 |

|

81,471,127 |

|

89,121,783 |

|

81,140,287 |

(i) Share-based compensation expense represents the cost of

equity awards issued to our directors, management and employees.

The fair value of awards is computed at the time the award is

granted and is recognized over the requisite service period less

actual forfeitures by a charge to the statement of operations and a

corresponding increase in additional paid-in capital within equity.

These accounting entries have no cash impact.

(ii) Change in the fair value of the Deerfield warrant

obligation results from the valuation at the end of each accounting

period. There are several inputs to these valuations, but those

most likely to result in significant changes to the valuations are

changes in the value of the underlying instrument (i.e., changes in

the price of our common shares) and changes in expected volatility

in that price. These accounting entries have no cash impact.

(iii) Effective interest expense on senior secured term loans

relates to the increase in the value of our loans in accordance

with the amortized cost method.

(iv) Deferred royalty obligation interest expense relates to the

accretion expense on our deferred royalty obligation pursuant to

the royalty purchase agreement with HCR and cumulative catch-up

adjustments related to changes in the expected payments to HCR

based on a periodic assessment of our underlying revenue

projections.

CONTACTS:

|

InvestorsMarcy GrahamADC

TherapeuticsMarcy.Graham@adctherapeutics.com+1 650-667-6450 |

Media:Nicole RileyADC

TherapeuticsNicole.Riley@adctherapeutics.com+1 862-926-9040 |

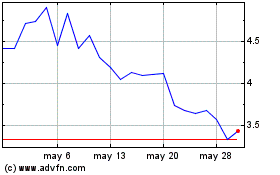

ADC Therapeutics (NYSE:ADCT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

ADC Therapeutics (NYSE:ADCT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025