Anthracite Capital, Inc. (NYSE:AHR) (the “Company” or

“Anthracite”) reported net income (loss) available to common

stockholders for the second quarter of 2009 of $(1.39) per share,

compared to $0.38 per share for the same three-month period in

2008. (All currency amounts discussed herein are in thousands,

except share and per share amounts. All per share information is

presented on a diluted basis. Prior year amounts have been restated

or reclassified to conform to the 2009 presentation required by the

retrospective adoption of FSP APB 14-1, Accounting for Convertible

Debt Instruments That May Be Settled in Cash upon Conversion

(Including Partial Cash Settlement) (''FSP APB 14-1'').)

Operating Earnings (defined below) for the second quarters of

2009 and 2008 were $0.07 and $0.22 per share, respectively. Table

1, provided below, reconciles Operating Earnings per share to

diluted net income per share available to common stockholders.

Restructuring of Secured Credit Facilities

During the second quarter of 2009, the Company amended each of

its secured credit facilities with Bank of America, Deutsche Bank

and Morgan Stanley (the “Secured Creditors”). The facilities have

been amended to provide similar terms which, among other things,

extend the maturities of all facilities to September 30, 2010 and

eliminate all mark-to-market provisions. In addition to eliminating

outstanding margin calls and the right to make future margin calls,

existing scheduled amortization payments were replaced with cash

management requirements as described below. The new interest rate

on the facilities is the greater of 30-day LIBOR plus 3.50% or

5.50%.

The Secured Creditors continue to hold the same primary

collateral consisting of U.S. and non-U.S. denominated commercial

real estate loan assets. All cash received from these assets will

first be used to pay interest and then to reduce the respective

lender’s principal balance. The Company has agreed that the

principal balance for each Secured Creditor will be reduced through

this process by an agreed upon amount, measured on a cumulative

basis, at the end of each quarter starting with the period ending

September 30, 2009. If such required reduction is not satisfied,

the Company has 90 days to cure such shortfall or an event of

default would occur.

In addition, the Secured Creditors received a security interest

in all unencumbered assets of the Company as well as a subordinated

second lien on each other’s primary collateral. The cash flows

generated by the bulk of the formerly unencumbered assets will be

deposited monthly into a cash management account that will be

available for use by the Company for its operations pursuant to a

prescribed budget subject to (i) no defaults under the facilities

and (ii) the cure of any outstanding deficiency in the required

reductions of the principal balance of any Secured Creditor. In the

event of an uncured event of default, the cash management account

proceeds must be used to pay down the relevant lender’s debt until

the deficiency has been cured.

The existing financial covenants were modified and apply to the

Company under each facility as follows:

Tangible net worth (as defined in each applicable facility)

cannot fall below $400 million (plus 75% of any equity offering

proceeds) at any quarter end, and cannot fall (with certain

exclusions) by more than 20% in any one quarter or more than 40% in

any four quarter period;

Debt service coverage ratio must (as defined in each applicable

facility) be at least 1.40; and

Total recourse debt to tangible net worth ratio may not exceed

2.5.

The Company also agreed to certain other terms which

establish (i) certain required quarterly operating earnings,

(ii) restrictions or conditions on the incurrence or restructuring

of any indebtedness and the payment of fees and other amounts to

BlackRock Financial Management, Inc. (the “Manager”) and its

affiliates, (iii) limits on acquiring new assets and (iv) required

minimum quarterly operating earnings for each quarter of the

extended term, commencing with the quarter ended June 30, 2009. In

addition, certain definitions, including an event of default, under

each facility were made substantially uniform among the

facilities.

The maturity date for each facility may be further extended to

March 30, 2011 at the discretion of the respective Secured

Creditor. However, if certain conditions are met, the decision by a

lender to not extend may result in such lender losing the benefit

of certain new collateral received under the restructuring.

In addition, the waiver of covenant breach under the Company’s

secured credit facility with Holdco 2 related to the failure of the

Company to repay certain borrowings due under such facility has

been extended through October 22, 2009.

Restructuring of Unsecured Debt

In May and July 2009, the Company restructured a significant

portion of its trust preferred securities and junior subordinated

notes.

Pursuant to an exchange agreement with certain holders of the

Company’s $135 million in trust preferred securities and €50

million junior subordinated notes, the Company issued $168.75

million and €62.5 million principal amount of new junior

subordinated notes in exchange for those securities. The exchanges

closed on May 29, 2009.

The new notes bear a fixed interest rate of 0.75% per year until

the earlier of May 29, 2013 and the date on which the Company’s

senior secured credit facilities with Bank of America, Deutsche

Bank and Morgan Stanley have all been paid in full (the

“Modification Period”). The interest rates on those securities

were, as of the date of the exchanges, 7.50%, 7.73% and 7.77% per

year on the trust preferred securities and EURIBOR plus 2.60% per

year on the junior subordinated notes. After the Modification

Period, the new notes bear interest at the same rates as the

securities for which they were exchanged. The new notes are

contractually senior to the Company’s remaining trust preferred

securities. The new notes otherwise generally have the same terms,

including maturity dates and capital structure priority, as the

securities for which they were exchanged.

The coupons that were due on April 30, 2009 on certain of the

securities being exchanged were satisfied by payments at the new

lower rate of 0.75% per year on the increased principal

amounts.

On July 22, 2009, the Company issued $31,250 aggregate principal

amount of junior unsecured subordinated notes (the “Notes”) in

exchange for $25,000 aggregate liquidation amount of trust

preferred securities of Anthracite Capital Trust I (the "Exchanged

Securities").

The Notes bear a fixed interest rate of 0.75% per year until the

earlier of (i) July 22, 2013 and (ii) the date on which all of the

existing senior secured loans under the Company's senior secured

credit facilities with Bank of America, Deutsche Bank and Morgan

Stanley are fully amortized, including certain deferred

restructuring fees (the "July 22 Modification Period"). After the

July 22 Modification Period, the Notes bear interest at the same

rate as the Exchanged Securities. Interest payments are payable

quarterly, commencing on July 30, 2009. The first interest

payment due on July 30, 2009 under the Notes is for the

interest period from April 30, 2009. All obligations

under the Exchanged Securities, including accrued and unpaid

interest thereunder, were accordingly fully discharged and

satisfied.

The Notes are contractually senior to the Company's remaining

trust preferred securities, and otherwise generally have the same

terms, including maturity date, as the Exchanged Securities.

As a result of the restructuring, during the Modification Period

and the July 22 Modification Period, the Company is subject to

limitations on its ability (i) to pay cash dividends on shares of

its common stock or preferred stock, or redeem, purchase or acquire

any equity interests and (ii) to create, incur, issue or otherwise

become liable for new debt other than trade debt, similar debt

incurred in the ordinary course of business or debt in exchange for

or to provide the funds necessary to repurchase, redeem, refinance

or satisfy the Company's existing secured and senior unsecured

debt. In addition, during such periods, the cure period for a

default in the payment of interest when due is three days.

On May 27, 2009, in a privately negotiated exchange transaction

with a holder of Anthracite’s 11.75% Convertible Senior Notes due

2027, the Company issued 850,000 shares of common stock in exchange

for $4 million principal amount of the notes.

On July 1, 2009, in a privately negotiated exchange transaction

with a holder of Anthracite’s 11.75% Convertible Senior Notes due

2027, the Company issued 900,000 shares of common stock in exchange

for $3 million principal amount of the notes.

On July 29, 2009, the Company issued 1,317,000 shares of its

common stock in exchange for $3,951 aggregate principal amount of

its 11.75% Convertible Senior Notes due 2027 in a privately

negotiated exchange with a holder of such notes.

The Company estimates that the effect of the combined unsecured

restructurings and exchanges will result in cash savings of over

$13 million per year during the period that the lower coupons are

in effect. The Company intends to use cash from these savings for

general corporate purposes and to reduce indebtedness under its

senior secured credit facilities.

Effect of Market Conditions on the Company's Business &

Recent Developments

During 2008 (particularly in the fourth quarter) and 2009,

global economic conditions continued to worsen, resulting in

ongoing disruptions in the credit and capital markets, significant

devaluations of assets and a severe economic downturn globally.

Assets linked to the U.S. and non-U.S. commercial real estate

finance markets have been particularly affected as demand for such

assets has sharply declined and defaults have risen significantly

for CMBS and commercial real estate loans. Available liquidity,

which began to decline during the second half of 2007, became

scarce in 2008 and remains depressed into 2009. Under normal market

conditions, the Company relies on the credit and equity markets for

capital to finance its investments and grow its business. However,

in the current environment, the Company is focused principally on

managing its liquidity.

The recessionary economic conditions and ongoing market

disruptions have had, and the Company expects will continue to

have, an adverse effect on the Company and the commercial real

estate and other assets in which the Company has invested. These

effects include:

- Adverse impact on liquidity and

access to capital. The Company's unrestricted cash and cash

equivalents decreased to $2,429 at June 30, 2009 from $9,686 at

December 31, 2008 due to, among other things, amortization payments

under the Company's secured credit facilities and reduced cash flow

from investments. As a result of a continued rise in delinquencies

in commercial real estate loans and CMBS during the second quarter

of 2009, the Company’s cash flow has been materially and adversely

affected. This negative trend has continued into the third quarter

of 2009 and the Company believes this negative trend will continue

into the foreseeable future. The Company is required to make an

interest payment of $4,056 on September 1, 2009 related to its

senior unsecured convertible notes. In addition, pursuant to the

amendments to its secured facilities with Bank of America, Deutsche

Bank and Morgan Stanley which closed in May 2009, the Company is

required to make quarterly payments to reduce the principal

balances under the facilities by certain specified amounts as of

the end of each quarter, commencing for the quarter ended September

30, 2009. The Company’s current projections show that the Company

will not be able to meet the aforementioned principal paydown

requirements for certain secured lenders on September 30, 2009. If

the Company does not satisfy these paydown requirements, the

Company has 90 days to cure such shortfall or an event of default

would occur. However, the Company may not have the liquidity to

cure such shortfall, if it were to occur, while meeting the

Company’s other obligations after September 30, 2009, and the

Company then would not be able to continue as a going concern. The

Company continues to seek ways to refinance or restructure its

unsecured indebtedness, thereby reducing its interest expense and

improving liquidity. These efforts include the debt-for-equity

exchange and junior unsecured subordinated debt restructurings

described above. The Company will endeavor to complete additional

debt-for-equity exchanges to reduce the $4,056 interest payment due

on the convertible notes on September 1, 2009, thereby increasing

the funds available to meet the secured lenders principal paydowns

due by September 30, 2009. No assurance can be given that this

endeavor will be successful. In addition, financings through

collateralized debt obligations (''CDOs''), which the Company

historically utilized, are no longer available.

- Negative operating results. For

the six months ended June 30, 2009 the Company incurred a net loss

of $(89,058) driven primarily by significant net realized and

unrealized losses, the incurrence of a $104,532 provision for loan

losses and a loss from equity investments of $(18,690).

- Change in business objectives

and dividend policy. The Company is currently focused on managing

its liquidity and, unless its liquidity position and market

conditions significantly improve, anticipates no new investment

activity in 2009. In addition, the Company's Board of Directors

(the ''Board of Directors'') anticipates that the Company will only

pay cash dividends on its preferred and common stock to the extent

necessary to maintain its REIT status until the Company's liquidity

position has improved subject to the following restrictions. Under

the junior subordinated indentures the Company entered into on May

29, 2009 and July 22, 2009 in connection with its exchange

agreements with the beneficial owners of certain of the Company’s

TruPS and junior unsecured subordinated notes, until the earlier of

(i) May 29, 2013 for certain junior unsecured subordinated notes

and July 22, 2013 for certain other junior unsecured subordinated

notes and (ii) the date on which all of the existing senior secured

loans under the Company’s secured credit facilities are fully

amortized, including certain deferred restructuring fees, the

Company is prohibited from making payments on its capital stock,

including its common stock, other than (a) with the consent of a

majority of the holders of the notes issued under the indentures or

(b) dividends or distributions reasonably necessary to maintain its

REIT status; provided that such dividends or distributions, (A) to

the extent paid to its common stockholders, are not in excess of

$2.5 million in the aggregate and are in the form of its common

stock to the maximum extent permissible to maintain its REIT status

(the “Permitted Distribution”), and (B) to the extent paid to the

preferred stockholders, are in an amount no greater than that

required to be distributed to such holders in order to make the

Permitted Distribution to its common stockholders.

These effects have led to the following adverse consequences for

the Company:

- Substantial doubt about the

ability to continue as a going concern. The Company's independent

registered public accounting firm issued an opinion on the

Company's December 31, 2008 consolidated financial statements that

stated the consolidated financial statements were prepared assuming

the Company will continue as a going concern and further stated

that the Company's liquidity position, current market conditions

and the uncertainty relating to the outcome of the Company's then

ongoing negotiations with its lenders have raised substantial doubt

about the Company's ability to continue as a going concern. As

noted above under the bullet captioned “Adverse impact on liquidity

and access to capital”, substantial doubt continues to exist about

the Company’s current ability to continue as a going concern.

- Reduction or elimination of

dividends. The Board of Directors did not declare a dividend on the

Company’s common stock and preferred stock for the first and second

quarters of 2009. Due to current market conditions and the

Company’s liquidity position, the Company’s Board of Directors

anticipates the Company will pay cash dividends on its stock only

to the extent necessary to maintain its REIT status, subject to the

following restrictions. As noted above under the bullet captioned

“Change in business objectives and dividend policy”, the Company is

subject to limitations on dividends it may pay on its common and

preferred stock under certain of its junior subordinated notes

indentures. To the extent the Company is required to and permitted

to make distributions to maintain its qualification as a REIT in

2009, the Company may rely upon temporary guidance that was issued

by the Internal Revenue Service (''IRS''), which allows certain

publicly traded REITs to satisfy their net taxable income

distribution requirements during 2009 by distributing up to 90% in

stock, with the remainder distributed in cash. However, the terms

of the Company's preferred stock prohibit the Company from

declaring or paying cash dividends on the common stock unless full

cumulative dividends have been declared and paid on the preferred

stock.

CDO tests

In addition to the covenants under the Company's secured credit

facilities, four of the seven CDOs issued by the Company contain

compliance tests which, if violated, could trigger a diversion of

cash flows from the Company to bondholders of the CDOs. The

Company's three CDOs designated as its high yield (''HY'') series

do not have any compliance tests. The chart below is a summary of

the Company's CDO compliance tests as of June 30, 2009.

Cash Flow Triggers CDO I CDO II CDO III

Euro CDO Overcollateralization Current 127.5% 125.9% 118.3% 92.4%

Trigger 115.6% 113.2% 108.9% 116.4% Pass/Fail Pass Pass Pass Fail

Interest Coverage/ Interest

Reinvestment(Euro CDO)

Current 207.9% 229.13% 314.8% 92.4% Trigger 108.0% 117.0% 111.0%

116.4% Pass/Fail Pass Pass Pass Fail Collateral Quality

Tests CDO I CDO II CDO III Euro CDO

Weighted Average Life Test Current N/A N/A N/A 3.51 Trigger N/A N/A

N/A 7.50 Pass/Fail N/A N/A N/A Pass Minimum Weighted Average

Recovery Rate Test Moody's Current N/A N/A N/A 22.8% Trigger N/A

N/A N/A 18.0% Pass/Fail N/A N/A N/A Pass Vector Model Test Fitch

Pass/Fail N/A N/A N/A Fail Weighted Average Rating Factor Test

Moody's Current N/A N/A N/A 2622 Trigger N/A N/A N/A 2740 Pass/Fail

N/A N/A N/A Pass

Because the failures of the Euro CDO’s overcollateralization

tests were not cured by the May 15, 2009 payment date, any cash

flows that remained after the payment of interest to the Class A

and Class B senior notes were utilized to pay down the principal of

the Class A notes. This redirection of cash flows will continue

until the failures of the Class A through Class D

overcollateralization tests are cured.

Additionally, the Euro CDO failed its interest coverage test for

its preferred shares, which are held by the Company. This test is

calculated in the same manner as the Class E overcollateralization

test. Since the Euro CDO's preferred shares are pledged to one of

the Company's secured lenders, the cash flow available to pay down

the lender's outstanding balance will be reduced.

The chart below summarizes the cash flows received from the

fourth quarter 2008 through the second quarter of 2009 from the

Company’s retained CDO bonds.

4Q 2008 1Q 2009 2Q 2009 CDO I $1,615

$1,524 $2,062 CDO II 1,029 652 1,174 CDO III 1,000 617 956

CDO HY1 1,106 1,580 719 CDO HY2 1,756 1,989 1,945 CDO HY3 3,583

4,243 3,074 Euro CDO 3,248 4,503 - Total $13,336

$15,108 $9,930

Commercial Real Estate Loans

The Company recorded a provision for specific loan losses of

$48,629 for the three months ended June 30, 2009. This provision

related to four loans with an aggregate principal balance of

$108,689 and accrued interest of $936. The loans are in various

stages of resolution and due to the estimated reduction in value of

the underlying collateral below the principal balance of the loans,

the Company does not believe the full collectability of the loans

is probable. In addition to these four loans, the Company recorded

a general provision of $15,456 due to the dramatic decline in the

commercial real estate market during the second quarter of 2009 and

the resulting negative impact on the prospects for loan

performance. The general loan loss provision methodology is more

fully described in the Company’s 2008 Annual Report on Form 10-K

for the year ended December 31, 2008.

A summary of the changes in the Company’s reserve for loan

losses is as follows:

General Specific Total Reserve for loan

losses, March 31, 2009 (including accrued interest of $2,310)

$29,254 $191,699 $220,953 Reserve for loan losses-

specific (including accrued interest of $37) - 33,172 33,172

Foreign currency gain - 3,747 3,747 Reserve for loan losses-

general 15,456 - 15,456 Provision for loan loss for

six months ended June 30, 2009 $15,456 $36,919

$52,375 Reserve for loan losses, June 30, 2009 (including accrued

interest of $2,347) $44,710 $228,618 $273,328

The general reserve of $44,710 represents approximately 7% of

the carrying value of the loans against which the Company has not

specifically reserved. The specific reserve of $270,981 represents

approximately 87% of carrying value of ten specific loans.

The chart below summarizes the outstanding principal balance,

carrying value, and loan loss reserves for the commercial real

estate loans held directly by the Company at June 30, 2009.

OutstandingPrincipalBalance

CarryingValue

Loan LossReserve

Net CarryingValue

Retail $300,109 $291,822 $(7,152) $284,670

Office 221,811 218,200 (37,993) 180,207 Multifamily 176,298 176,422

(124,685) 51,737 Various 122,702 119,915 (31,436) 88,479 Storage

73,235 73,116 - 73,116 Land 25,000 25,005 (25,005) - Hotel 14,354

13,592 - 13,592 Industrial 12,636 12,595 - 12,595 Other 4,004

3,954 - 3,954 $950,149 $934,621

$(226,271)* $708,350 General loan loss reserve (44,710) Net

Carrying Value $663,640

* Excludes loan loss reserves of $2,347 related to accrued

interest.

Earnings from Equity Investments

Also included in commercial real estate loans are the Company's

investments in Carbon Capital, Inc. (“Carbon I”) and Carbon Capital

II, Inc. (“Carbon II” and together with Carbon I, the “Carbon

Funds”), which are managed by the Company’s manager. For the

quarters ended June 30, 2009 and 2008, respectively, the Company

recorded losses of $6,565 and $2,566 for the Carbon Funds. The

investment periods for the Carbon Funds have expired and no new

portfolio additions are expected.

The Company's investments in the Carbon Funds were as

follows:

June 30, 2009

December 31, 2008

Carbon I $1,713 $1,713 Carbon II 20,471 39,158

$22,184 $40,871

Carbon II recorded a provision for loan losses of $18,232 for

the three months ended June 30, 2009 which includes a net decrease

of a general provision of $518 and a provision of $18,750 related

to three loans with an aggregate principal balance of $94,600 and

accrued interest of $115. The loans are in various stages of

resolution and due to the estimated fair value of the underlying

collateral being below the principal balance of the loans, Carbon

II does not believe the full collectability of the loans is

probable. The Company incurs its share of Carbon II’s operating

results through its approximately 26% ownership interest in Carbon

II.

Commercial Real Estate Securities

The Company considers CMBS where it maintains the right to

control the foreclosure/workout process on the underlying loans as

controlling class CMBS ("Controlling Class CMBS"). The Company owns

Controlling Class CMBS issued in 1998, 1999 and 2001 through

2007.

The Company did not acquire any additional Controlling Class

CMBS trusts during the second quarter of 2009. At June 30, 2009,

the Company owned 39 Controlling Class CMBS trusts with an

aggregate underlying loan principal balance of $56,308,413.

Delinquencies of 30 days or more on these loans as a percent of

current loan balances were 5.2% at June 30, 2009, compared with

2.53% at March 31, 2009.

The chart below summarizes the par, weighted average coupon,

market value, adjusted purchase price and second quarter 2009

estimated loss assumptions for the Company’s U.S. dollar

denominated Controlling Class CMBS:

Vintage Par

WeightedAverageCoupon

MarketValue

AdjustedPurchasePrice

EstimatedCollateralLosses

1998 $260,667 6.2% $138,216 $155,192

$136,256 1999 7,604 6.9 3,042 7,374 13,989 2001 34,790 6.1

15,762 28,649 13,610 2002 2,300 5.7 1,177 2,266 20,428 2003 78,209

4.9 20,643 48,615 36,628 2004 75,445 5.1 9,939 29,164 196,498 2005

213,329 5.0 13,642 72,352 353,214 2006 455,187 5.2 24,794 65,883

395,274 2007 677,412 5.2 41,210 86,528

1,105,611 Total $1,804,943 5.3% $268,425

$496,023 $2,271,508

During the three months ended June 30, 2009, no securities in

the Company’s Controlling Class CMBS were upgraded and fifteen

securities in four Controlling Class CMBS were downgraded.

Additionally, at least one rating agency upgraded five of the

Company’s non-Controlling Class commercial real estate securities

and downgraded eleven.

Summary of Commercial Real Estate Assets

A summary of the Company’s commercial real estate assets with

estimated fair values in local currencies and U.S. dollars at June

30, 2009 is as follows:

Commercial Real Estate

Securities(2)

Commercial Real Estate Loans

(1)

Commercial Real Estate

Equity

Commercial Mortgage

Loan Pools

Total Commercial Real Estate

Assets

Total Commercial Real Estate

Assets (USD)

% of Total

USD $727,531 $218,815 - $946,070

$1,892,416 $1,892,416 77.1% GBP £2,729 £43,610 - -

£46,339 76,314 3.1% EUR €18,078 €294,141 - - €312,219 437,935 17.8%

CAD C$56,710 C$6,269 - - C$62,979 54,229

2.2%

JPY ¥819,116 - - - ¥819,116 8,490

0.3%

CHF - CHF 23,843 - - CHF 23,843 21,924

0.9%

INR - - Rs 447,539 - Rs 447,539

9,350

0.4%

General loan loss reserve - (44,710) - -

(44,710) (44,710) (1.8) Total USD Equivalent

$814,703 $685,824 $9,350 $946,070

$2,455,948 $2,455,948

100.0%

(1)

Includes the Company's investments

in the Carbon Capital Funds of $22,184 at June 30, 2009.

(2)

Includes the Company's investment

in AHR JV of $320 at June 30, 2009.

As of January 2009, the Company substantially reduced the use of

various currency instruments to hedge the capital portion of its

foreign currency risk. The Company reduced the use of such

instruments in an effort to avoid cash outlays caused by the

requirement to mark these instruments to market. The Company has

been primarily focused on preserving cash to pay down secured

lenders and maintaining these hedges creates unpredictable cash

flows as currency values move in relation to each other.

Net realized and unrealized gain (loss)

Upon the adoption of SFAS No. 159, The Fair Value Option for

Financial Assets and Financial Liabilities ("FAS 159") on January

1, 2008, the Company elected to have the changes in the estimated

fair value of its trading securities (formerly classified as

available-for-sale) and long-term liabilities recorded in earnings.

The loss of $60,593 for the three months ended June 30, 2009 was

comprised of realized gains of $13,822, unrealized gains on

securities held-for-trading of $20,777 offset by unrealized losses

on liabilities of $81,320 and an unrealized gain on swaps

classified as held-for-trading of $21,384. During the second

quarter of 2009, the value of the Company’s long-term liabilities

increased by more than the offsetting increase in the value of its

swaps and CMBS securities.

Book Value Per Share

The chart below is a comparison of book value per share at June

30, 2009 and December 31, 2008.

6/30/2009 12/31/2008 Total

Stockholders' Equity $504,676 $572,131* Less: Series C

Preferred Stock Liquidation Value (57,500) (57,500) Series D

Preferred Stock Liquidation Value (86,250) (86,250) Common

Equity $360,926 $428,381 Common Shares Outstanding 79,658,431

78,371,715 Book Value per Share $4.53 $5.46

* On January 1, 2009, the Company adopted FSP APB 14-1, which

superseded FAS 159 with respect to the Company’s fair valuing its

convertible debt and decreased the Company’s GAAP book value by

$45,361, or $0.58 per share. The impact of adopting FSP APB 14-1 is

outlined in the Company's Quarterly Report on Form 10-Q filing for

the quarter ended June 30, 2009.

Reconciliation of Operating Earnings (Deficit) to Net Income

(Loss) Available to Common Stockholders (Table 1)

The table below reconciles Operating Earnings with diluted net

income available to common stockholders:

Three Months EndedJune 30,

Six Months EndedJune 30,

2009 2008 2009 2008 Operating earnings

available to common stockholders $0.07 $0.22 $0.14

$0.58 Net realized and change in unrealized gain (loss)

(0.67) 0.16 0.10 1.07 Incentive fees attributable to other gains -

- - (0.13) Dedesignation of derivative instruments (0.10) - (0.10)

- Net foreign currency gain (loss) and hedge ineffectiveness (0.08)

- 0.06 (0.11) Provision for loan loss (0.61) - (1.33)

(0.32) Diluted net income available to common stockholders

($1.39) $0.38 ($1.13) $1.09

The Company considers its Operating Earnings to be net income

after operating expenses, income taxes and preferred dividends but

before net realized and change in unrealized gain (loss), incentive

fees attributable to other income (loss), dedesignation of

derivative instruments, net foreign currency gain (loss), hedge

ineffectiveness and provision for loan losses. The Company believes

Operating Earnings to be an effective indicator of the Company’s

profitability and financial performance over time. Operating

Earnings can and will fluctuate based on changes in asset levels,

funding rates, available reinvestment rates and expected losses on

credit sensitive positions.

This release, including the reconciliation of Operating Earnings

with net income available to common stockholders, is also available

on the News section of the Company’s website at

www.anthracitecapital.com.

Earnings Conference Call

The Company will host a conference call on August 11, 2009 at

9:00 a.m. (Eastern Time). The conference call will be available

live via telephone. Members of the public who are interested in

participating in Anthracite’s second quarter earnings

teleconference should dial, from the U.S., (800) 374-0176, or from

outside the U.S., (706) 679-4634, shortly before 9:00 a.m. and

reference the Anthracite Teleconference Call (number 24015717).

Please note that the teleconference call will be available for

replay beginning at 1:00 p.m. on Tuesday, August 11, 2009, and

ending at midnight on Tuesday, August 18, 2009. To access the

replay, callers from the U.S. should dial (800) 642-1687 and

callers from outside the U.S. should dial (706) 645-9291 and enter

conference identification number 24015717.

About Anthracite

Anthracite Capital, Inc. is a specialty finance company

focused on investments in high yield commercial real estate loans

and related securities. Anthracite is externally managed by

BlackRock Financial Management, Inc., which is a subsidiary of

BlackRock, Inc. (“BlackRock”) (NYSE:BLK), one of the largest

publicly traded investment management firms in the United States

with approximately $1.373 trillion in global assets under

management at June 30, 2009. BlackRock Realty Advisors, Inc.,

another subsidiary of BlackRock, provides real estate equity and

other real estate-related products and services in a variety of

strategies to meet the needs of institutional investors.

Forward-Looking Statements

This release, and other statements that Anthracite may make, may

contain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, with respect to

Anthracite’s future financial or business performance, strategies

or expectations. Forward-looking statements are typically

identified by words or phrases such as “trend,” “potential,”

“opportunity,” “pipeline,” “believe,” “comfortable,” “expect,”

“anticipate,” “current,” “intention,” “estimate,” “position,”

“assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,”

“seek,” “achieve,” and similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “may”

or similar expressions.

Anthracite cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and Anthracite assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

In addition to factors previously disclosed in Anthracite’s SEC

reports and those identified elsewhere in this release, the

following factors, among others, could cause actual results to

differ materially from forward-looking statements or historical

performance: (1) the introduction, withdrawal, success and timing

of business initiatives and strategies; (2) changes in political,

economic or industry conditions, the interest rate environment,

financial and capital markets or otherwise, which could result in

changes in the value of the Company's assets and liabilities,

including net realized and unrealized gains or losses, and could

adversely affect the Company's operating results; (3) the Company's

ability to meet its liquidity requirements to continue to fund its

business operations, including its ability to renew its existing

facilities or obtain replacement financing, to meet amortization

payments under the facilities and to service debt; (4) the amount

and timing of any future margin calls and their impact on the

Company's financial condition and liquidity; (5) the Company's

ability to obtain amendments and waivers in the event that a lender

terminates a facility before the maturity date or debt obligations

are accelerated due to a covenant breach or otherwise; (6) the

relative and absolute investment performance and operations of

BlackRock Financial Management, Inc. (the ''Manager''), the

Company's Manager; (7) the impact of increased competition; (8) the

impact of future acquisitions or divestitures; (9) the unfavorable

resolution of legal proceedings; (10) the impact of legislative and

regulatory actions and reforms and regulatory, supervisory or

enforcement actions of government agencies relating to the Company

or the Manager; (11) terrorist activities and international

hostilities, which may adversely affect the general economy,

domestic and global financial and capital markets, specific

industries, and the Company; (12) the ability of the Manager to

attract and retain highly talented professionals; (13) fluctuations

in foreign currency exchange rates; (14) the impact of changes to

tax legislation and, generally, the tax position of the Company;

and (15) as a result of its liquidity position, current market

conditions and the uncertainty relating to its ability to meet

covenants in restructured agreements, substantial doubt about the

Company's ability to continue as a going concern.

Anthracite’s Annual Report on Form 10-K for the year ended

December 31, 2008 and Anthracite’s subsequent filings with the SEC,

accessible on the SEC's website at www.sec.gov, identify additional

factors that can affect forward-looking statements.

To learn more about Anthracite, visit our website at

www.anthracitecapital.com. The information contained on the

Company’s website is not a part of this release.

Anthracite Capital, Inc. and

Subsidiaries

Consolidated Statements of

Financial Condition (Unaudited)

(dollar amounts in

thousands)

June 30, 2009

December 31, 2008

ASSETS Cash and cash equivalents $2,429 $9,686

Restricted cash equivalents 32,266 23,982 RMBS 15 787 Commercial

mortgage loan pools $946,070 $1,022,105 Commercial real estate

securities 814,704 935,963 Commercial real estate loans, (net of

loan loss reserve of $270,981 and $165,928 in 2008) 685,824 823,777

Commercial real estate 9,350 9,350 Total commercial

real estate 2,455,948 2,791,195 Derivative instruments, at

estimated fair value 206,125 929,632 Other assets (includes $255

and $384 at estimated fair value in 2009 and 2008) 51,874 73,766

Total Assets $2,748,657 $3,829,048

LIABILITIES AND

STOCKHOLDERS' EQUITY Liabilities: Short-term borrowings:

Secured by pledge of RMBS $- $- Secured by pledge of commercial

real estate securities 233,506 308,123 Secured by pledge of

commercial mortgage loan pools 4,584 4,584 Secured by pledge of

commercial real estate loans 165,021 167,625 Total short-term

borrowings 403,111 $480,332 Long-term borrowings: Collateralized

debt obligations (at estimated fair value) 434,718 564,661 Secured

by pledge of commercial mortgage loan pools 924,445 999,804 Senior

unsecured notes (at estimated fair value) 15,015 18,411 Junior

unsecured notes (at estimated fair value) 4,094 5,726

Junior subordinated notes to

subsidiary trust issuing preferred securities (at estimated fair

value)

10,628 12,643 Convertible senior unsecured notes 69,192 72,000

Total long-term borrowings 1,458,092 1,673,245 Total borrowings

1,861,203 2,153,577 Distributions payable - 3,019 Derivative

instruments, at estimated fair value 279,438 1,018,927 Other

liabilities 56,866 34,920 Total Liabilities 2,197,507 3,210,443 12%

Series E-1 Cumulative Convertible Redeemable Preferred Stock,

liquidation preference $23,375 23,237 23,237 12% Series E-2

Cumulative Convertible Redeemable Preferred Stock, liquidation

preference $23,375 23,237 23,237 Stockholders' Equity:

Preferred Stock, 100,000,000 shares authorized; 9.375% Series C

Preferred Stock, liquidation preference $57,500 55,435 55,435 8.25%

Series D Preferred Stock, liquidation preference $86,250 83,259

83,259 Common Stock, par value $0.001 per share; 400,000,000 shares

authorized;

79,658,431 and 78,371,715 shares

issued and outstanding in 2009 and 2008

80 78 Additional paid-in capital 798,572 797,372 Distributions in

excess of earnings (413,121) (331,613) Accumulated other

comprehensive loss (19,549) (32,400) Total Stockholders’ Equity

504,676 572,131 Total Liabilities and Stockholders' Equity

$2,748,657 $3,829,048

Anthracite Capital, Inc. and

Subsidiaries

Consolidated Statements of

Operations (Unaudited)

(in thousands, except per share

data)

For the Three Months Ended

June 30,

For the Six Months Ended

June 30,

2009 2008 2009 2008

Operating Portfolio

Income: Commercial real estate securities

$44,384 $50,588 $94,135 $102,798 Commercial mortgage loan pools

9,974 12,801 20,347 25,666 Commercial real estate loans 13,375

23,100 29,266 46,831 Loss from equity investments (6,565) (2,566)

(18,690) (557) RMBS 9 16 70 76 Cash and cash equivalents 236

918 427 1,982 Total Income 61,413 84,857

125,555 176,796 Expenses: Interest expense:

Short-term borrowings 6,212 9,295 13,421 19,911 Collateralized debt

obligations 20,280 25,228 41,847 51,149 Commercial mortgage loan

pools 9,988 12,183 20,295 24,391 Senior unsecured notes 3,105 3,016

6,191 6,074 Convertible senior notes 2,716 2,851 5,586 5,627 Junior

unsecured notes 897 1,442 1,743 2,769 Junior subordinated notes

(506) 3,328 2,838 6,595 General and administrative expense 6,640

1,866 8,966 3,682 Management fee 1,953 2,961 4,084 6,236 Incentive

fee - 1,334 - 1,963 Incentive fee – stock based 62 645

305 1,044 Total Expenses 51,347 64,149

105,276 129,441 Income from the Operating Portfolio 10,066

20,708 20,279 47,355

Other income

(loss): Net realized and change in unrealized gain (loss)

(52,753) 13,365 7,667 83,848 Incentive fee attributable to other

gains - - - (9,916) Dedesignation of derivative instruments (7,840)

- (7,840) - Provision for loan loss (48,629) - (104,532) (25,190)

Foreign currency gain (loss) (6,428) (2,145) 4,362 (10,186) Hedge

ineffectiveness - 1,382 64 1,304 Total other

income (loss) (115,650) 12,602 (100,279)

39,860 Net Income (loss) (105,584) 33,310

(80,000) 87,215 Dividends on preferred stock (4,529)

(5,083) (9,058) (8,209) Net Income (Loss) available

to Common Stockholders $(110,113) $28,227 $(89,058)

$79,006 Operating Earnings: Income from the Operating

Portfolio $10,066 $20,708 $20,279 $47,355 Dividends on preferred

stock (4,529) (5,083) (9,058) (8,209) Net

Operating Earnings $5,537 $15,625 $11,221

$39,146 Operating Earnings available to Common Stockholders

per share: Basic $0.07 $0.23 $0.14 $0.59 Diluted $0.07 $0.22 $0.14

$0.58 Net Income (loss) available to Common Stockholders per

share: Basic $(1.39) $0.41 $(1.13) $1.19 Diluted $(1.39) $0.38

$(1.13) $1.09 Weighted average number of shares

outstanding: Basic 79,050,446 69,458,370 78,712,956 66,437,973

Diluted 79,050,446 85,846,376 78,712,956 78,340,316 Dividend

declared per share of Common Stock $- $0.31 $- $0.61

NET INCOME (LOSS) AVAILABLE TO

COMMON STOCKHOLDERS PER SHARE *

(in thousands, except share and

per share data)

For the Three MonthsEnded June 30, For the Six

MonthsEnded June 30, 2009** 2008 2009** 2008

Numerator: Numerator for basic earnings per share

$(110,133) $28,227 $(89,059) $79,006 Interest expense on

convertible senior notes - 2,370 - 4,683 Dividends on Series E

convertible preferred stock - 1,929 - 1,929

Numerator for diluted earnings per share $(110,133) $32,526

$(89,059) $85,618 Denominator:

Denominator for basic earnings per

share— weighted average common shares outstanding

79,050,446 69,458,370 78,712,956 66,437,973 Assumed conversion of

convertible senior notes - 7,416,680 - 7,416,680

Assumed conversion of Series E

convertible preferred stock

- 8,604,781 - 4,302,390

Dilutive effect of stock based

incentive fee

- 366,545 - 183,273

Denominator for diluted earnings

per share— weighted average common shares outstanding and common

stock equivalents outstanding

79,050,446 85,846,376 78,712,956 78,340,316

Basic net income (loss) per

weighted average common share:

$(1.39) $0.41 $(1.13) $1.19

Diluted net income (loss) per

weighted average common share and common share equivalents:

$(1.39) $0.38 $(1.13) $1.09 *

Convertible senior notes and Series E convertible preferred stock

were anti-dilutive for 2009. ** The Company elected not to declare

any of the specified dividends on its three series of preferred

stock during 2009. For the three and six months ended June 30,

2009, $4,529 and $7,550 of preferred dividends were in arrears.

These dividends in arrears are included as part of dividends on

preferred stock on the consolidated statements of operations since

they represent a claim on earnings superior to common stockholders.

These dividends in arrears have not been accrued as dividends

payable since they have not been declared.

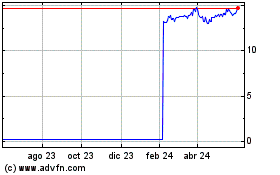

American Healthcare REIT (NYSE:AHR)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

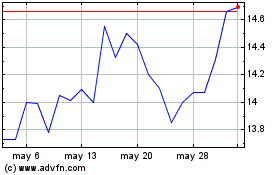

American Healthcare REIT (NYSE:AHR)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024