First Quarter Highlights

- Interest income of $15.7 million; net interest income of $1.6

million

- Net loss attributable to common stockholders of $(74.3)

million

- Operating loss of $(4.8) million or $(0.16) per common

share

- Earnings per share ("EPS") per basic common share was a loss of

$(2.41) of which $(0.50) per basic common share relates to the

accrual of the manager termination fee

- Taxable loss of $(0.67) per share attributable to common

stockholders after payment of dividends on our previously issued

preferred stock

- Book value per common share of $6.87 at March 31, 2024

- Collected total cash of $80.9 million from loan payments, sales

of loans, sales of real estate owned ("REO") properties and

collections from investments on debt securities and beneficial

interests

- As of March 31, 2024, held $100.1 million of cash and cash

equivalents; average daily cash balance for the quarter was $65.3

million

- As of March 31, 2024, approximately 84.4% of our portfolio

(based on unpaid principal balance ("UPB") at the time of

acquisition) made at least 12 out of the last 12 payments

Great Ajax Corp. (NYSE: AJX), a Maryland corporation that is a

real estate investment trust ("REIT"), announces its results of

operations for the quarter ended March 31, 2024. We focus primarily

on acquiring, investing in and managing a portfolio of

re-performing mortgage loans ("RPLs") and non-performing loans

("NPLs") secured by single-family residences and commercial

properties. In addition to our continued focus on RPLs and NPLs, we

also originate and acquire small-balance commercial loans ("SBC

loans") secured by multi-family retail/residential and mixed use

properties.

Selected Financial Results

(Unaudited)

($ in thousands except per share

amounts)

For the three months

ended

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

March 31, 2023

Loan interest income

$

11,823

$

12,420

$

12,696

$

12,929

$

13,281

Earnings from debt securities and

beneficial interests(1)

$

2,956

$

4,289

$

4,218

$

4,480

$

4,569

Other interest income

$

959

$

948

$

965

$

931

$

606

Interest expense

$

(14,106

)

$

(14,484

)

$

(14,838

)

$

(15,039

)

$

(14,925

)

Net interest income

$

1,632

$

3,173

$

3,041

$

3,301

$

3,531

Net (increase)/decrease in the net present

value of expected credit losses

$

(4,230

)

$

(11,294

)

$

(330

)

$

2,866

$

621

Other income, income/(loss) from equity

method investments, loss on joint venture refinancing on beneficial

interests and mark to market loss on mortgage loans held-for-sale,

net

$

(46,783

)

$

(8,132

)

$

(1,658

)

$

(8,581

)

$

(3,612

)

Total (loss)/revenue, net(2)

$

(49,381

)

$

(16,253

)

$

1,053

$

(2,414

)

$

540

Consolidated net loss

$

(73,992

)

$

(22,614

)

$

(5,517

)

$

(11,462

)

$

(7,364

)

Net loss per basic share

$

(2.41

)

$

(0.86

)

$

(0.25

)

$

(0.51

)

$

(0.34

)

Average equity(3)

$

280,714

$

321,327

$

316,814

$

324,089

$

337,206

Average total assets

$

1,311,767

$

1,358,027

$

1,384,285

$

1,424,524

$

1,463,529

Average daily cash balance

$

65,293

$

55,195

$

53,211

$

43,609

$

50,916

Average carrying value of RPLs

$

858,253

$

882,071

$

892,367

$

886,072

$

882,018

Average carrying value of NPLs

$

11,974

$

42,050

$

50,439

$

68,459

$

86,494

Average carrying value of SBC loans

$

28,116

$

8,560

$

8,349

$

10,876

$

12,159

Average carrying value of debt securities

and beneficial interests

$

319,053

$

338,572

$

346,601

$

382,502

$

401,240

Average asset backed debt balance

$

779,768

$

800,050

$

834,507

$

870,595

$

897,279

____________________________________________________________

(1)

Interest income on investment in debt

securities and beneficial interests issued by our joint ventures is

net of servicing fees.

(2)

Total loss/revenue includes net interest

income, loss from equity method investments, loss on joint venture

refinancing on beneficial interests and other loss/income.

(3)

Average equity includes the effect of an

aggregate of $34.6 million of preferred stock for December 31,

2023, September 30, 2023, June 30, 2023 and March 31, 2023.

For the quarter ended March 31, 2024, we had a GAAP consolidated

net loss attributable to common stockholders of $(74.3) million or

$(2.41) per common share after preferred dividends of which $15.5

million or $(0.50) per common share relates to the accrual of the

manager termination fee. Operating loss, a non-GAAP financial

measure that adjusts GAAP earnings by removing gains and losses as

well as certain other non-core income and expenses and preferred

dividends, was $(4.8) million or $(0.16) per common share. We

consider Operating loss/income to provide a useful measure for

comparing the results of our ongoing operations over multiple

quarters. For a reconciliation of Operating loss to consolidated

net loss available to common stockholders, please refer to Appendix

B.

Our net interest income for the quarter ended March 31, 2024,

excluding any adjustment for expected credit losses was $1.6

million, a decrease of $1.5 million over the prior quarter. Gross

interest income decreased $1.9 million as a result of slightly

lower average balances on our mortgage, debt security and

beneficial interest portfolios. We also adjusted our yields on our

beneficial interests based on lower expected redemption proceeds as

described below. Our interest expense for the quarter ended March

31, 2024 decreased $0.4 million compared to the prior quarter

primarily as a result of a decrease in our average balance of

interest bearing debt. The carrying value of our interest earning

assets declined $140.9 million during the quarter ended March 31,

2024 due to the loan sales, debt security and beneficial interest

redemption and the recording of a mark to market loss on loans

reclassified to held-for-sale.

We generally acquire loans and beneficial interests at a

discount and record an allowance for expected credit losses at

acquisition. We update the allowance quarterly based on actual cash

flow results and changing cash flow expectations in accordance with

the current expected credit losses accounting standard, otherwise

known as CECL. During the quarter ended March 31, 2024, we recorded

a $3.1 million write-down on our beneficial interests. We expect to

redeem several of our joint ventures during 2024 and adjusted our

cash flow projections to reflect lower projected sale prices of the

underlying collateral on the expected redemption dates due to

longer durations of the underlying loans as interest rate

reductions appear increasingly less certain during calendar year

2024. Based on the revised collateral sales prices, the expected

liquidation proceeds on the sale of the underlying loans would not

be sufficient to redeem the beneficial interests in full. Because

CECL compares projected cash flows to contractual cash flows to

determine "credit" losses, the write-down is reflected as a credit

loss and not as a mark to market adjustment. Other than extended

duration, the performance of the underlying loans has remained

unchanged.

During the quarter ended March 31, 2024, we recorded a $1.1

million increase in expected credit losses on our mortgage loan

portfolio held-for-investment. The impairment is a result of

updating our cash flow projections to extend the duration of the

mortgage loans. The underlying loan performance has not changed.

The remaining portfolio classified as held for investment are

primarily loans in our rated securitization trusts.

During the quarter ended March 31, 2024, our debt securities and

the majority of our beneficial interests in Ajax Mortgage Loan

Trust 2020-C and Ajax Mortgage Loan Trust 2020-D joint ventures

were redeemed. At redemption the debt securities were redeemed at

par and the beneficial interests paid down by approximately 82%.

The remaining assets in the trust are expected to pay down the

remaining beneficial interests.

Beginning in October 2023, we have been engaged in sales of

certain significant pools of loans in expectation of the repayment

of our outstanding convertible notes. Such loan sales necessitate

moving loans to held-for-sale and marking the loans to the lower of

cost or market when we determine that the loans will be sold.

During the quarter ended March 31, 2024, we moved loans with UPB of

$421.6 million to held-for-sale and recorded a $47.3 million mark

to market loss after taking into account the repayment of advances

to our servicer. These loan sales went under contract in March and

April. Two trades closed in April 2023 with the remainder expected

to close in May 2024. See "Recent Events" below for more detail.

Additionally, during the quarter ended March 31, 2024, we closed

the sale of loans with UPB of $58.9 million that were classified as

held-for-sale. These loans were moved to held-for-sale at December

31, 2023 and we recorded a mark to market loss of $8.6 million at

December 31, 2023. At the sale date, we recorded an incremental

loss of $0.4 million.

Our expenses increased on a quarter over quarter basis by $17.4

million primarily due to the approximately $15.5 million accrual of

the termination fee paid to our manager. As described in the Rithm

transaction documents, we provided a termination notice to our

manager on February 26, 2024. Our management contract provides that

the manager is entitled to receive a termination fee equal to two

times the sum of the last twelve months’ management fee. The

termination fee will be paid in shares of our common stock, the

price of which was fixed at $4.87 per share as of February 26,

2024, the earlier of the first day after the transaction closes,

which is subject to shareholder approval, or August 26, 2024.

Because we own an equity investment in our Manager, 19.8% of the

termination fee, or $3.1 million, was recognized as income in

Income/(loss) from equity method investments for a net financial

statement impact of $12.4 million.

We recorded $0.4 million in impairment on our REO held-for-sale

portfolio in other expense for the quarter ended March 31, 2024. We

sold two properties in the first quarter and recorded a net gain of

$8 thousand in other income. Six properties were added to REO

held-for-sale through foreclosures.

During the quarter ended March 31, 2024, we recorded the fair

value of the warrants issued to Rithm under the Credit Agreement.

The fair value of $2.7 million was recorded in Accrued expenses and

other liabilities with an offset to deferred issuance costs in

Prepaid expenses and other assets. As of March 31, 2024, we

recorded a mark to market gain of $0.7 million on the warrants and

$0.7 million of amortization on the deferred issuance costs. As of

March 31, 2024, the warrants had a carrying value of $2.1

million.

For the quarter ended March 31, 2023, we transferred certain

securities from AFS to HTM in compliance with the European Union

risk retention requirement, which was a non-cash transaction and

recorded at fair value. On the date of transfer, accumulated other

comprehensive income ("AOCI") included unrealized losses of $10.9

million for these securities. This amount is being amortized out of

AOCI over the remaining life of the respective securities, and has

no net impact on interest income. For both the quarters ended March

31, 2024 and December 31, 2023, we recorded $0.8 million in

amortization.

During the three months ended March 31, 2024, no shares were

sold under our At-the-Market program.

During the three months ended March 31, 2024, we acquired the

remaining 424,949 shares of our outstanding 7.25% Series A

Fixed-to-Floating Rate Preferred Stock and 1,135,590 shares of our

outstanding 5.00% Series B Fixed-to-Floating Rate Preferred Stock

and the associated warrants in exchange for newly issued shares of

our common stock. Of the 12,046,218 shares, 9,464,524 shares of our

common stock were issued during the three months ended March 31,

2024 and the remaining 2,581,694 shares of our common stock will

only be issued following the approval of a majority of our

stockholders during our 2024 annual and special meeting of

stockholders. We recorded a $12.6 million liability to account for

the shares payable to the preferred holders. Subsequent to

shareholder approval, common shares will be issued to satisfy the

liability resulting in a $12.6 million increase in equity.

We ended the quarter with a GAAP book value of $6.87 per common

share, compared to a book value per common share of $9.99 for the

quarter ended December 31, 2023. The decrease in book value is

driven primarily by the GAAP net loss for the period, including the

mark to market loss recorded when we moved loans to held for sale,

the increase in the number of our outstanding common shares during

the quarter, and dividends paid, partially offset by the recovery

of a portion of the mark to market loss in debt securities recorded

on the balance sheet through AOCI, and the amortization of the

unrealized loss on debt securities transferred to HTM.

Our taxable loss for the quarter ended March 31, 2024 was

$(0.67) per share of net income available to common stockholders,

compared to $(0.03) per share of taxable net loss available to

common stockholders for the quarter ended December 31, 2023.

Additionally, we recorded income tax expense of $0.9 million

primarily due to the income from our Manager recognized in our

Taxable REIT subsidiary.

We collected $80.9 million of cash during the first quarter as a

result of loan payments, loan payoffs, sales of REO, and cash

collections on our securities portfolio to end the quarter with

$100.1 million in cash and cash equivalents.

The following table provides an overview of our portfolio at

March 31, 2024 ($ in thousands)(1):

No. of loans

4,720

Weighted average coupon

4.54

%

Total UPB(2)

$

882,050

Weighted average LTV(6)

52.2

%

Interest-bearing balance

$

805,459

Weighted average remaining term

(months)

284

Deferred balance(3)

$

76,591

No. of first liens

4,677

Market value of collateral(4)

$

2,028,883

No. of second liens

43

Current purchase price/total UPB

81.4

%

No. of REO held-for-sale

24

Current purchase price/market value of

collateral

40.2

%

Market value of REO held-for-sale(7)

$

5,778

RPLs

91.9

%

Carrying value of debt securities and

beneficial interests in trusts

$

284,535

NPLs

7.4

%

Loans with 12 for 12 payments as an

approximate percentage of acquisition UPB(8)

84.4

%

SBC loans(5)

0.7

%

Loans with 24 for 24 payments as an

approximate percentage of acquisition UPB(9)

81.2

%

____________________________________________________________

(1)

Includes 2,109 loans that were classified

from Mortgage loans held-for investment, net to Mortgage loans

held-for-sale, net with a total UPB of $421.6 million and a

carrying value of $411.8 million.

(2)

Our loan portfolio consists of fixed rate

(59.7% of UPB), ARM (6.0% of UPB) and Hybrid ARM (34.3% of UPB)

mortgage loans.

(3)

Amounts that have been deferred in

connection with a loan modification on which interest does not

accrue. These amounts generally become payable at maturity.

(4)

As of the reporting date.

(5)

SBC loans includes both purchased and

originated loans.

(6)

UPB as of March 31, 2024 divided by market

value of collateral and weighted by the UPB of the loan.

(7)

Market value of other REO is the estimated

expected gross proceeds from the sale of the REO less estimated

costs to sell, including repayment of servicer advances.

(8)

Loans that have made at least 12 of the

last 12 payments, or for which the full dollar amount to cover at

least 12 payments has been made in the last 12 months.

(9)

Loans that have made at least 24 of the

last 24 payments, or for which the full dollar amount to cover at

least 24 payments has been made in the last 24 months.

Recent Events

Our board declared a cash dividend of $0.06 per share to be paid

on May 30, 2024 to stockholders of record as of May 15, 2024.

On April 30, 2024, we repaid our 2024 Convertible Notes at

maturity, for an aggregate amount of $103.5 million, and 15 days of

accrued interest.

During April 2024, we called the Senior notes and the Class B

bond in our Ajax Mortgage Loan Trust 2021-B ("2021-B"). We sold

underlying loans with a total UPB of $92.2 million and moved the

majority of the remaining loans to our repurchase line of credit.

The estimated $10.1 million loss realized on the loans was accrued

at March 31, 2024. We received net cash proceeds on the redemption

in the amount of $6.5 million and are under contract, subject to

due diligence, to sell the majority of the remaining loans in

2021-B and from our repurchase lines of credit in May 2024. The

loans have a total UPB of $180.6 million and we expect to generate

$47.1 million in cash after repayment of any associated debt. The

estimated $21.8 million expected loss on these loans sales was

accrued at March 31, 2024.

Also, during April 2024, we sold loans from our repurchase lines

of credit with a total UPB of $124.8 million. We received net cash

proceeds from these loan sales in the amount of $20.1 million after

repaying the associated debt. The estimated $13.6 million loss

realized on the loan sales was accrued at March 31, 2024.

About Great Ajax Corp.

Great Ajax Corp. is a Maryland corporation that is a REIT, that

focuses primarily on acquiring, investing in and managing RPLs and

NPLs secured by single-family residences and commercial properties.

In addition to our continued focus on RPLs and NPLs, we also

originate and acquire SBC loans secured by multi-family

retail/residential and mixed use properties. We are externally

managed by Thetis Asset Management LLC, an affiliated entity. Our

mortgage loans and other real estate assets are serviced by Gregory

Funding LLC, an affiliated entity. We have elected to be taxed as a

REIT under the Internal Revenue Code.

Forward-Looking Statements

This press release contains certain forward-looking statements.

Words such as “believes,” “intends,” “expects,” “projects,”

“anticipates,” and “future” or similar expressions are intended to

identify forward-looking statements. These forward-looking

statements are subject to the inherent uncertainties in predicting

future results and conditions, many of which are beyond our

control, including, without limitation the risk factors and other

matters set forth in our Annual Report on Form 10-K for the period

ended December 31, 2023 filed with the Securities and Exchange

Commission (the “SEC”) on February 28, 2024 and our Definitive

Proxy Statement filed with the SEC on April 10, 2024. We undertake

no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as may be required by law.

GREAT AJAX CORP. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Dollars in thousands except

per share amounts)

Three months ended

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

INCOME

Interest income

$

15,738

$

17,657

$

17,879

$

18,340

Interest expense

(14,106

)

(14,484

)

(14,838

)

(15,039

)

Net interest income

1,632

3,173

3,041

3,301

Net (increase)/decrease in the net present

value of expected credit losses

(4,230

)

(11,294

)

(330

)

2,866

Net interest (loss)/income after the

impact of changes in the net present value of expected credit

losses

(2,598

)

(8,121

)

2,711

6,167

Income/(loss) from equity method

investments

521

(317

)

(628

)

(265

)

Loss on joint venture refinancing on

beneficial interests

—

—

(1,215

)

(8,814

)

Mark to market loss on mortgage loans

held-for-sale, net

(47,307

)

(8,559

)

—

—

Other income

3

744

185

498

Total (loss)/revenue, net

(49,381

)

(16,253

)

1,053

(2,414

)

EXPENSE

Related party expense - loan servicing

fees

1,734

1,773

1,809

1,827

Related party expense - management fee

17,459

2,000

1,940

2,001

Professional fees

705

623

611

989

Fair value adjustment on put option

liability and warrants

1,353

490

540

1,839

Other expense

2,445

1,406

1,754

2,211

Total expense

23,696

6,292

6,654

8,867

Loss on debt extinguishment

—

—

16

—

Loss before provision for income taxes

(73,077

)

(22,545

)

(5,617

)

(11,281

)

Provision for income taxes (benefit)

915

69

(100

)

181

Consolidated net loss

(73,992

)

(22,614

)

(5,517

)

(11,462

)

Less: consolidated net (loss)/income

attributable to non-controlling interests

(14

)

35

25

24

Consolidated net loss attributable to the

Company

(73,978

)

(22,649

)

(5,542

)

(11,486

)

Less: dividends on preferred stock

341

548

547

548

Consolidated net loss attributable to

common stockholders

$

(74,319

)

$

(23,197

)

$

(6,089

)

$

(12,034

)

Basic loss per common share

$

(2.41

)

$

(0.86

)

$

(0.25

)

$

(0.51

)

Diluted loss per common share

$

(2.41

)

$

(0.86

)

$

(0.25

)

$

(0.51

)

Weighted average shares – basic

30,700,278

26,931,750

24,001,702

23,250,725

Weighted average shares – diluted

30,893,391

26,931,750

24,244,147

23,565,351

GREAT AJAX CORP. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands except

per share amounts)

March 31, 2024

December 31, 2023

ASSETS

Cash and cash equivalents

$

100,054

$

52,834

Mortgage loans held-for-sale, net(1)

368,288

55,718

Mortgage loans held-for-investment,

net(1,2)

438,698

864,551

Real estate owned properties, net(3)

5,191

3,785

Investments in securities

available-for-sale(4)

125,126

131,558

Investments in securities

held-to-maturity(5)

54,085

59,691

Investments in beneficial interests(6)

88,577

104,162

Receivable from servicer

4,240

7,307

Investments in affiliates

28,300

28,000

Prepaid expenses and other assets

31,896

28,685

Total assets

$

1,244,455

$

1,336,291

LIABILITIES AND

EQUITY

Liabilities:

Secured borrowings, net(1,7)

$

399,699

$

411,212

Borrowings under repurchase

transactions

354,039

375,745

Convertible senior notes(7)

103,516

103,516

Notes payable, net(7)

107,059

106,844

Management fee payable

1,951

1,998

Warrant liability

2,054

16,644

Accrued expenses and other liabilities

19,901

9,437

Total liabilities

988,219

1,025,396

Equity:

Preferred stock $0.01 par value,

25,000,000 shares authorized

Series A 7.25% Fixed-to-Floating Rate

Cumulative Redeemable, $25.00 liquidation preference per share,

135,930 shares issued and zero outstanding at March 31, 2024 and

424,949 shares issued and outstanding at December 31, 2023(8)

—

9,411

Series B 5.00% Fixed-to-Floating Rate

Cumulative Redeemable, $25.00 liquidation preference per share,

363,245 shares issued and zero outstanding at March 31, 2024 and

1,135,590 shares issued and outstanding at December 31, 2023(8)

—

25,143

Common stock $0.01 par value; 125,000,000

shares authorized, 36,992,019 shares issued and outstanding at

March 31, 2024 and 27,460,161 shares issued and outstanding at

December 31, 2023

380

285

Additional paid-in capital

408,732

352,060

Treasury stock

(9,557

)

(9,557

)

Retained deficit

(132,400

)

(54,382

)

Accumulated other comprehensive loss

(12,858

)

(14,027

)

Equity attributable to stockholders

254,297

308,933

Non-controlling interests(9)

1,939

1,962

Total equity

256,236

310,895

Total liabilities and equity

$

1,244,455

$

1,336,291

____________________________________________________________

(1)

Mortgage loans held-for-sale, net and

mortgage loans held-for-investment, net include $623.2 million and

$628.6 million of loans at March 31, 2024 and December 31, 2023,

respectively, transferred to securitization trusts that are

variable interest entities (“VIEs”); these loans can only be used

to settle obligations of the VIEs. Secured borrowings consist of

notes issued by VIEs that can only be settled with the assets and

cash flows of the VIEs. The creditors do not have recourse to the

primary beneficiary (Great Ajax Corp.). Mortgage loans

held-for-investment, net include $0.4 million and $3.4 million of

allowance for expected credit losses at March 31, 2024 and December

31, 2023, respectively.

(2)

As of March 31, 2024 and December 31,

2023, balances for Mortgage loans held-for-investment, net include

$0.2 million and $0.6 million, respectively, from a 50.0% owned

joint venture, which we consolidate under U.S. GAAP.

(3)

Real estate owned properties, net, are

presented net of valuation allowances of $1.6 million and $1.2

million at March 31, 2024 and December 31, 2023, respectively.

(4)

Investments in securities AFS are

presented at fair value. As of March 31, 2024, Investments in

securities AFS include an amortized cost basis of $132.8 million

and a net unrealized loss of $7.7 million. As of December 31, 2023,

Investments in securities AFS include an amortized cost basis of

$139.6 million and net unrealized loss of $8.0 million.

(5)

On January 1, 2023, we transferred certain

of our Investments in securities AFS to HTM due to European risk

retention regulations. As of March 31, 2024, Investments in

securities HTM includes an allowance for expected credit losses of

zero and remaining discount of $5.2 million related to the

unamortized unrealized loss in AOCI.

(6)

Investments in beneficial interests

includes allowance for expected credit losses of $9.1 million and

$6.9 million at March 31, 2024 and December 31, 2023,

respectively.

(7)

Secured borrowings, net are presented net

of deferred issuance costs of $2.8 million at March 31, 2024 and

$3.1 million at December 31, 2023. Convertible senior notes are

presented net of deferred issuance costs of zero at both March 31,

2024 and December 31, 2023. Notes payable, net are presented net of

deferred issuance costs and discount of $2.9 million at March 31,

2024 and $3.2 million at December 31, 2023.

(8)

The preferred shares issued but not

outstanding are the preferred shares that were not redeemed with

common stock and are pending approval by a vote of our

shareholders. The obligation to redeem these shares is currently

recorded as $12.6 million in Accrued expenses and other liabilities

on our consolidated balance sheets at March 31, 2024.

(9)

As of March 31, 2024, non-controlling

interests includes $0.8 million from a 50.0% owned joint venture,

$1.0 million from a 53.1% owned subsidiary and $0.1 million from a

99.9% owned subsidiary which we consolidate. As of December 31,

2023, non-controlling interests includes $0.8 million from a 50.0%

owned joint venture, $1.0 million from a 53.1% owned subsidiary and

$0.1 million from a 99.9% owned subsidiary which we consolidate

under U.S. GAAP.

Appendix A - Earnings per

share

The following table sets forth the

components of basic and diluted EPS ($ in thousands, except per

share):

Three months ended

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

Income

(Numerator)

Shares

(Denominator)

Per Share

Amount

Income

(Numerator)

Shares

(Denominator)

Per Share

Amount

Income

(Numerator)

Shares

(Denominator)

Per Share

Amount

Income

(Numerator)

Shares

(Denominator)

Per Share

Amount

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

Basic EPS

Consolidated net loss attributable to

common stockholders

$

(74,319

)

30,700,278

$

(23,197

)

26,931,750

$

(6,089

)

24,001,702

$

(12,034

)

23,250,725

Allocation of loss to participating

restricted shares

465

—

164

—

62

—

161

—

Consolidated net loss attributable to

unrestricted common stockholders

$

(73,854

)

30,700,278

$

(2.41

)

$

(23,033

)

26,931,750

$

(0.86

)

$

(6,027

)

24,001,702

$

(0.25

)

$

(11,873

)

23,250,725

$

(0.51

)

Effect of dilutive

securities(1,2)

Restricted stock grants and director fee

shares(3)

(465

)

193,113

—

—

(62

)

242,445

(161

)

314,626

Diluted EPS

Consolidated net loss attributable to

common stockholders and dilutive securities

$

(74,319

)

30,893,391

$

(2.41

)

$

(23,033

)

26,931,750

$

(0.86

)

$

(6,089

)

24,244,147

$

(0.25

)

$

(12,034

)

23,565,351

$

(0.51

)

____________________________________________________________

(1)

Our outstanding warrants and the effect of

the interest expense and assumed conversion of shares from

convertible notes would have an anti-dilutive effect on diluted

earnings per share for all periods shown and have not been included

in the calculation.

(2)

The effect of the amortization of put

option on our diluted EPS calculation for all periods shown would

have been anti-dilutive and has been removed from the

calculation.

(3)

The effect of restricted stock grants and

manager and director fee shares on our diluted EPS calculation for

the three months ended December 31, 2023 would have been

anti-dilutive and has been removed from the calculation.

Appendix B - Reconciliation of

Operating loss to Consolidated net loss available to common

stockholders

(Dollars in thousands except

per share amounts)

Three months ended

March 31, 2024

December 31, 2023

September 30, 2023

June 30, 2023

(Unaudited)

(Unaudited)

(Unaudited)

(Unaudited)

INCOME

Interest income

$

15,738

$

17,657

$

17,879

$

18,340

Interest expense

(14,106

)

(14,484

)

(14,838

)

(15,039

)

Net interest income

1,632

3,173

3,041

3,301

Other (loss)/income

(740

)

745

558

498

Total revenue, net

892

3,918

3,599

3,799

EXPENSE

Related party expense - loan servicing

fees

1,734

1,773

1,809

1,827

Related party expense - management

fees

1,953

2,000

1,940

2,001

Professional fees

705

623

611

989

Other expense

1,306

1,356

1,505

1,526

Total expense

5,698

5,752

5,865

6,343

Consolidated operating loss

$

(4,806

)

$

(1,834

)

$

(2,266

)

$

(2,544

)

Basic operating loss per common share

$

(0.16

)

$

(0.07

)

$

(0.09

)

$

(0.11

)

Diluted operating loss per common

share

$

(0.16

)

$

(0.07

)

$

(0.09

)

$

(0.11

)

Reconciliation to GAAP net loss

Consolidated operating loss

$

(4,806

)

$

(1,834

)

$

(2,266

)

$

(2,544

)

Mark to market loss on joint venture

refinancing

—

—

(1,215

)

(8,814

)

Mark to market loss on mortgage loans

held-for-sale, net

(47,307

)

(8,559

)

—

—

Management termination fee

(15,506

)

—

—

—

Realized loss on sale of securities

—

—

(373

)

—

Net (increase)/decrease in the net present

value of expected credit losses

(4,230

)

(11,294

)

(330

)

2,866

Fair value adjustment on put option

liability and warrants

(1,353

)

(490

)

(540

)

(1,839

)

Other adjustments

125

(368

)

(893

)

(950

)

Loss before provision for income taxes

(73,077

)

(22,545

)

(5,617

)

(11,281

)

Provision for income taxes (benefit)

915

69

(100

)

181

Consolidated net loss/(income)

attributable to non-controlling interest

14

(35

)

(25

)

(24

)

Consolidated net loss attributable to the

Company

(73,978

)

(22,649

)

(5,542

)

(11,486

)

Dividends on preferred stock

(341

)

(548

)

(547

)

(548

)

Consolidated net loss attributable to

common stockholders

$

(74,319

)

$

(23,197

)

$

(6,089

)

$

(12,034

)

Basic loss per common share

$

(2.41

)

$

(0.86

)

$

(0.25

)

$

(0.51

)

Diluted loss per common share

$

(2.41

)

$

(0.86

)

$

(0.25

)

$

(0.51

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240503798797/en/

Lawrence Mendelsohn Chief Executive Officer Or Mary Doyle Chief

Financial Officer Mary.Doyle@aspencapital.com 503-444-4224

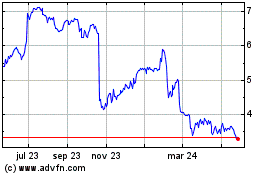

Great Ajax (NYSE:AJX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

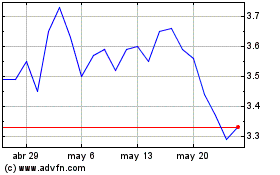

Great Ajax (NYSE:AJX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024